UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14f-1

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

_______________________________________________

Protect Pharmaceutical Corporation.

(Name of Registrant as Specified in its Charter)

|

|

|

|

Nevada

|

000-54001

|

27-1877179

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

2681 Parleys Way

Suite 204

Salt Lake City, UT 84109

|

|

(Address of principal executive office)

|

|

|

(801) 322-3401

|

|

(Registrant

’

s telephone number)

|

_______________________________________________

September 9, 2016

Protect Pharmaceutical Corporation

2681 Parleys Way

Suite 204

Salt Lake City, UT 84109

INFORMATION STATEMENT PURSUANT TO SECTION 14(f)

OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND RULE 14f-1 PROMULGATED THEREUNDER

NOTICE OF CHANGE IN MAJORITY OF THE BOARD OF DIRECTORS

September 9, 2016

INTRODUCTION

This Information Statement is being furnished to stockholders of record as of September 9, 2016 (the

“

Record Date

”

) of the outstanding shares of common stock, par value $0.001 per share (

“

Common Stock

”

), of Protect Pharmaceutical Corporation, a Nevada corporation (

“

we

”

,

“

us

”

,

“

our

”

or the

“

Company

”

), pursuant to Section 14(f) of the Securities Exchange Act of 1934, as amended (the

“

Exchange Act

”

), and Rule 14f-1 promulgated thereunder (

“

Rule 14f-1

”

). Section 14(f) of the Exchange Act and Rule 14f-1 require the mailing to our stockholders of record of the information set forth in this Information Statement in connection with an anticipated change in majority control of our Board of Directors (the

“

Board

”

) other than at a meeting of our stockholders. Pursuant to Rule 14f-1, such change in majority control of the Board may not occur earlier than ten days after the later of the date of the filing of this Information Statement with the Securities and Exchange Commission (the

“

SEC

”

) or the date on which we mail this Information Statement to holders of record of our Common Stock on the Record Date. Accordingly, the change in a majority of our directors pursuant to the Agreement (as defined herein) will not occur until at least 10 days following the mailing of this Information Statement. This Information Statement will be mailed on or about September 9, 2016 to our stockholders of record on the Record Date.

Effective September 9, 2016, Deworth Williams, the principal stockholder of the Company (

“

Williams

”

), entered into a Stock Purchase Agreement (the

“

Agreement

”

), as amended (the

“

Amended Agreement

”

), dated, August 30, 2016,, with Taylor Group Holdings, LLC (the

“

Buyer

”

), a Florida Limited Liability Company, pursuant to which, among other things, Williams agreed to sell to the Buyer, and the Buyer agreed to purchase from Williams, a total of 937,063 shares of Common Stock owned of record and beneficially by Williams (the

“

Purchased Shares

”

). On September 9, 2016, (the

“

Closing

”

or

“

Closing Date

”

), Williams sold, assigned and conveyed the Purchased Shares to the Buyer for an aggregate purchase price of $260,000, or approximately $0.2774626679 per share. The Purchased Shares represented approximately 84.3% of the Company

’

s issued and outstanding shares of Common Stock as of the Record Date. In connection with the transactions contemplated by the Agreement, the Board appointed Una Taylor and Theodore Faison to fill vacancies on the Company

’

s Board of

Directors, except that such appointments will not become effective until at least 10 days following the mailing of this Information Statement.

THIS INFORMATION STATEMENT IS REQUIRED BY SECTION 14(F) OF THE SECURITIES EXCHANGE ACT AND RULE 14F-1 PROMULGATED THEREUNDER SOLELY IN CONNECTION WITH THE ANTICIPATED CHANGE IN MAJORITY CONTROL OF THE BOARD.

NO VOTE OR OTHER ACTION BY OUR STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

PROXIES ARE NOT BEING SOLICITED AND YOU ARE REQUESTED NOT TO SEND US A PROXY. YOU SHOULD READ THIS INFORMATION STATEMENT CAREFULLY, BUT ARE NOT REQUIRED OR REQUESTED TO TAKE ANY ACTION IN CONNECTION WITH THIS INFORMATION STATEMENT.

Change In Control; Directors and Executive Officers

Consummation of the purchase and sale of the Purchased Shares on the Closing Date pursuant to the Agreement effected a change of control of the Company, as the Buyer, using personal funds, acquired an aggregate of 937,063 shares, or approximately 84.3% of the Company

’

s 1,111,461 shares of Common Stock outstanding as of the Record Date . Currently, the Buyer is the Company

’

s majority, and controlling, stockholder. In connection with the transactions contemplated by the Agreement, the Board appointed Una Taylor and Theodore Faison to fill vacancies on the Company

’

s Board of Directors, except that such appointments will not become effective until at least 10 days following the mailing of this Information Statement. On the Closing Date, the Board appointed Ms. Taylor as President, effective as of the Closing Date. The Agreement further provides that Mr. Williams will resign as an officer and director of the Company promptly after signing the Company

’

s: (i) Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016; (ii) Current Report on Form 8-K disclosing the terms of the change in control transactions; and (iii) federal tax returns for all tax years ending on or before the Closing date. The Board and the Company

’

s officers consist of the following persons, except that the appointments of the following persons to the Board will not become effective until at least 10 days following the mailing of this Information Statement:

|

|

|

|

Name

|

Age

|

Position

|

|

Una Taylor

95 Merrick Way, 3rd Floor

Coral Gables, Florida 33134

|

40

|

Director and President

|

|

Theodore Faison

5645 Northborough Drive

Sacramento, CA 95835

|

40

|

Director

|

3

Each of the directors will serve until the next annual meeting of stockholders of the Company and until such director

’

s successor is elected and qualified or until such director

’

s earlier death, resignation or removal. The following is information concerning the business backgrounds of each of Ms. Taylor and Mr. Faison, as well as our only current director, Mr. Geoff Williams.

Una Taylor

. Ms. Taylor has been the Founder and CEO of Renewable Energy Supplies LLC, a Florida limited liability company for the last seven years. Renewable Energy Supplies LLC was founded in 2010 as an Alternative Energy Company with the goal of bringing renewable, non-polluting power to homes and businesses in the Caribbean region. Six years later, Renewable Energy continues to deliver the best products, training and support needed to its growing customer base. Renewable Energy supplies re-sellers, contractors, integrators, and installers with reliable products and the training they need to design, install and maintain renewable energy systems. Ms. Taylor also serves as a director of World Cup of Sales Inc. (an online cash prize sales tournament for college students that help startups launch their products) and served as its first Chief Product Officer.

Theodore Faison

. Mr. Faison has been Co-Founder, Strategy Officer, and Board Chairman at World Cup of Sales, a product market fit and sales platform geared towards startup companies and product launches, since December 2015. Since March 2003, he has been an employee of IBM. His specific recent employment with IBM includes being a Rational Channel Sales Manager, from 2011 to 2013, a member of the IBM North America Software Partner Representative & Ecosystem Development team from 2013 to 2015, the Worldwide Trusteer Advanced Fraud Protection Channel Sales Leader from January 2015 to January 2016 and since January 2016 being responsible for Strategic Embedded Solution Partnerships for IBM Analytics. He has more than 15 years in software sales, channel sales, and business development, having personally delivered consulting, training, and sales interactions to over 1,000 customers (of all sizes and spanning many industry verticals). His leadership experience include leading a global channel sales team, building a channel ecosystem for a $2B IBM Security acquisition (Trusteer), and managing some of the industry's largest software channel resellers.

Geoff Williams

. Mr. Williams has served as a director since February, 2012, and, until the Closing Date, Mr. Williams had also served as our chief executive officer and president. He is also presently serving as acting principal financial and accounting officer. From 1994 to the present, Mr. Williams has been a representative of Williams Investments Company, a Salt Lake City, Utah financial consulting firm involved in facilitating mergers, acquisitions, business consolidations and financings. Mr. Williams attended the University of Utah and California Institute of the Arts. Mr. Williams is currently a director, President and C.E.O. of Westgate Acquisitions Corp. and, until he resigned in February 2010, he was a director, President and C.E.O. of Greyhound Commissary, Inc., now known as Tanke Biosciences Corp. Mr. Williams was also a director of U.S. Rare Earths, Inc. from November 2011 to August 2012.

Voting Securities of the Company

As of the Record Date, there were 1,111,461 shares of Common Stock of the Company issued and outstanding. Each share of Common Stock entitles the holder thereof to one vote on each matter that may come before a meeting of the stockholders.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information as of the Record Date with respect to the beneficial ownership of Common Stock by (i) each person known by us to be the beneficial owner of more than 5% of our outstanding Common Stock currently, (ii) our current directors, (iii) each person who will become a director on or after the tenth day following our mailing of this Information Statement, (iv) each of our current named executive officers and (v) all of our current executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated by footnote and subject to community property laws, where applicable, to our knowledge the persons named in the table below have sole voting and investment power with respect to all shares of Common Stock that are shown as beneficially owned by them. In computing the number of shares of Common Stock owned by a person and the percentage ownership of that person, any such shares subject to options and warrants held by that person that are exercisable as of the Record Date or that will become exercisable within 60 days thereafter are deemed outstanding for purposes of that person

’

s percentage ownership but not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, the mailing address of each individual is c/o Protect Pharmaceutical Corporation, 2681 Parleys Way, Suite 204, Salt Lake City, UT 84109.

|

|

|

|

|

|

Name and Address of

Beneficial Owner

|

Title of Class

|

Amount and Nature of Beneficial Ownership

|

|

Percent of Class

|

|

Current Directors and Executive Officers

|

|

|

|

|

|

Geoff Williams

2681 East Parleys Way, Suite 204

Salt Lake City, UT 84109

|

Common Stock

|

2,286

|

Direct

|

0.21%

|

|

Directors and Executive Officers

–

after Closing Date

|

|

|

|

|

|

Una Taylor

95 Merrick Way, 3rd Floor

Coral Gables, Florida 33134

|

Common Stock

|

937,063*

|

Direct

|

84.3%

|

|

Theodore Faison

5645 Northborough Drive

Sacramento, CA 95835

|

Common Stock

|

-0-

|

|

0%

|

|

5

% Stockholders

|

|

|

|

|

|

Taylor Group Holdings, LLC

95 Merrick Way

Coral Gables, Florida 33134

Edward F. Cowle

70 Garth Road, Apt. 4A

Scarsdale, NY 10583

|

Common Stock

Common Stock

|

937,063

105,750

|

Direct

Direct

|

84.3%

9.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All current directors and officers as a group (3 person)

|

Common stock

|

939,349*

|

|

84.5%

|

*Una Taylor is the control person of Taylor Group Holdings, LLC

Certain Relationships and Related Party Transactions

Except as set forth in the Agreement, there are no transactions since the beginning of our last fiscal year, or any currently proposed transaction, that would require disclosure pursuant to Item 404(a) of Regulation S-K.

Legal Proceedings

The Company is not aware of any legal proceedings in which any director, officer, or any owner of record or beneficial owner of more than 5% of any class of voting securities of the Company, or any affiliate of any such director, officer, affiliate of the Company, or security holder, or any person who will become a director upon completion of the transactions contemplated by the Agreement is a party, or any information that any such person is adverse to the Company or has a material interest adverse to the Company.

Compensation of Directors and Executive Officers and Other Matters

There are presently no plans or commitments with regard to such compensation or remuneration. The Company has no employee benefit plans or other compensation plans.

The Board of Directors will not adopt a procedure for stockholders to send communications to the Board of Directors until it has considered and reviewed the merits of several possible alternative communications procedures. The Company has no policy and does not presently intend to consider director candidates for election to the Board of Directors recommended by security holders, although that policy may be reconsidered in the future.

Compliance with Section 16(a) of the Securities Act of 1934

Section 16(a) of the Exchange Act requires the Company

’

s directors, executive officers and persons who own more than 10% of a registered class of the Company

’

s equity securities to file with the SEC initial reports of ownership and reports to changes in ownership of common stock and other equity securities of the Company. Officers and directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. To the Company

’

s knowledge, based solely on a review of copies of such reports furnished to the Company during and/or with respect to the year ended December 31, 2015, the Company is not aware of any late or delinquent filings required under Section 16(a) of the Exchange Act in respect of Common Stock or other equity securities of the Company.

CORPORATE GOVERNANCE

The Board of Directors

As set forth in our Articles of Incorporation and Bylaws, all directors of the Company hold office until the next annual meeting of stockholders or until their successors have been duly elected and qualified. Other than as disclosed in this Information Statement, to the knowledge of the Company, are no agreements with respect to the election of directors. The Company

’

s executive officers serve at the discretion of the Board.

We do not believe that any current director qualifies as an

“

independent director

”

under the Nasdaq Stock Market

’

s listing standards, and that neither Ms. Taylor nor Mr. Faison will qualify as

“

independent directors

”

when they join the Board on the Schedule 14f-1 Information Statement Effective Date. Our Common Stock is traded on the OTC Pink Market under the symbol

“

PRTT

”

. The OTC Pink electronic trading platform does not maintain any standards regarding the

“

independence

”

of the directors for our Board and we do not believe we are subject to the requirements of any national securities exchange or an inter-dealer quotation system with respect to the need to have any and/or a majority of our directors be independent.

Board of Directors

’

Meetings

During the fiscal year ending December 31, 2015, the Board held one (1) meeting, which was held in person and attended by all of the directors.

7

Board Committees

Our Board has not established any Board committees.

Code of Ethics

The Board has not adopted a Code of Ethics and Business Conduct.

WHERE YOU CAN FIND MORE INFORMATION

The Company is required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read, without charge, and copy, at prescribed rates, all or any portion of any reports, statements or other information in the files at the public reference room at the SEC

’

s principal office at 100 F Street NE, Washington, D.C., 20549. You may request copies of these documents, for a copying fee, by writing to the SEC. You may call the SEC at 1-800-SEC-0330 for further information on the operation of its public reference room. The Company

’

s filings will also be available to you on the SEC

’

s Internet website at http://www.sec.gov.

September 9, 2016

PROTECT PHARMACEUTECAL CORPORATION, A Nevada corporation

By:

/s/ Una Taylor

Una Taylor, President

9

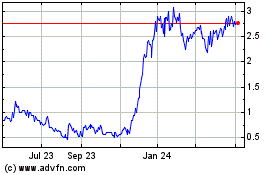

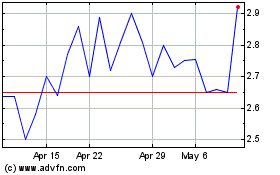

Protect Pharmaceutical (PK) (USOTC:PRTT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Protect Pharmaceutical (PK) (USOTC:PRTT)

Historical Stock Chart

From Apr 2023 to Apr 2024