Current Report Filing (8-k)

September 08 2016 - 3:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

September 2, 2016

|

Lucas Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

450 Gears Road, Suite 860

Houston,

Texas 77067

|

|

(Address of principal executive offices, including zip code)

|

|

(713) 528-1881

|

|

(Registrant’s telephone number, including

area code)

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 3.02. Unregistered Sales of

Equity Securities.

On September 2, 2016, Lucas Energy, Inc. (the

“Company”) issued and sold 53 shares of its Series C redeemable convertible preferred stock (the “Series C Stock”)

and a warrant (the “Second Warrant”) to purchase 1,111,112 shares of its common stock in an initial closing (the “Initial

Closing”) pursuant to the stock purchase agreement (the “Stock Purchase Agreement”) that it had entered into

with an accredited institutional investor (the “Investor”) on April 6, 2016. The terms of the Series C Stock, the Second

Warrant and the Stock Purchase Agreement were previously reported in the Company’s Current Report on Form 8-K filed with

the Securities and Exchange Commission on April 7, 2016.

The sale and issuance of the securities described

herein have been determined to be exempt from registration under the Securities Act of 1933 in reliance on Sections 3(a)(9) and

4(a)(2) of the Securities Act of 1933, as amended, Rule 506 of Regulation D promulgated thereunder and Regulation S promulgated

thereunder, as transactions by an issuer not involving a public offering. The Investor has represented that it is an accredited

investor, as that term is defined in Regulation D, it is not a U.S. Person, and it is acquiring the securities for its own account.

The Company received gross proceeds of $500,000 from the sale and issuance of the 53 shares of Series C Stock and, as previously

disclosed, will pay placement agent fees of $47,500 for services rendered in connection with the Initial Closing.

Item 9.01. Financial Statements and Exhibits.

(a) Not Applicable.

(b) Not Applicable.

(c) Not Applicable.

(d) Exhibits.

4.1

Common Stock Purchase Second Warrant

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

LUCAS ENERGY, INC.

|

|

|

|

|

|

|

|

|

|

Dated: September 8, 2016

|

By:

|

/s/ Anthony C. Schnur

|

|

|

|

Anthony C. Schnur, Chief Executive Officer

|

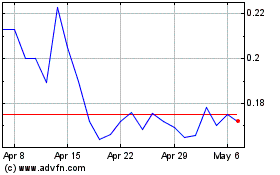

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024