A.M. Best has upgraded the financial strength rating

(FSR) to A (Excellent) from A- (Excellent) and the issuer credit

ratings (ICR) to “a” from “a-” for Maiden Reinsurance Ltd.

and its reinsured affiliate, Maiden Reinsurance North America,

Inc. (headquartered in Mount Laurel, NJ) (collectively referred

to as Maiden Re). The companies are subsidiaries of Maiden

Holdings, Ltd. (Maiden Holdings) [NASDAQ:MHLD] All companies

are headquartered in Hamilton, Bermuda, unless otherwise specified.

A.M. Best also has upgraded the ICRs to “bbb” from “bbb-” for

Maiden Holdings and its subsidiary, Maiden Holdings North

America, Ltd. (MHNA) (Delaware), whose debt is fully and

unconditionally guaranteed by Maiden Holdings. The issue and

indicative issue ratings of Maiden Holdings and MHNA also have been

upgraded. The outlooks have been revised to stable from positive.

(See below for a detailed listing of companies and ratings.)

The rating upgrades reflect Maiden Re’s consistently profitable

underwriting and operating performance within its niche market

segments. Returns have improved in recent years, as the company’s

growing book of business has generated results in-line with

historical levels and as Maiden Holdings has successfully lowered

its financing costs. Maiden Re’s business primarily consists of

proportional reinsurance in working layers, which affords it a

greater ability to price due to the relatively low severity but

higher frequency of the losses it assumes.

This produces greater accuracy in pricing and reserving. The

results also benefit from limited exposure to shock losses,

although its combined ratio therefore, has not benefited from the

relatively benign catastrophe environment in recent years. The

ratings also acknowledge Maiden Re’s strong risk-adjusted

capitalization, due, in part, to capital contributions from its

ultimate parent, Maiden Holdings, and the operational benefits that

Maiden Re derives as a quota share partner with a related party,

AmTrust International Insurance, Ltd. (AII), the Bermuda

reinsurance subsidiary of AmTrust Financial Services, Inc.

(AmTrust).

Partially offsetting these positive rating factors is the

continued execution risk Maiden Holdings faces in achieving its

business plans given the continuing competitive environment in its

core reinsurance markets and its client concentration, as the AII

business accounted for approximately 70% of the group’s 2015 total

net premiums written. In addition, the 2015 results of the

Diversified Reinsurance segment deteriorated from prior years,

driven by adverse development of loss reserves associated with its

commercial auto book. The favorable results of the AII business

offset the impact, and the group posted favorable underwriting

results overall, demonstrating the benefits derived from the

relationship with AII.

Maiden Holdings’ adjusted debt-to-total capital, excluding

accumulated other comprehensive income (AOCI) of 27.1% and adjusted

debt-to-total tangible capital (excluding AOCI) of 28.4% at June

30, 2016, was within A.M. Best’s guidelines. Financial leverage

will decline following the mandatory conversion of the company’s

Series A preference shares to common equity in September 2016.

Interest coverage also is within A.M. Best’s tolerances, although

modestly below expectations for the rating level.

Although A.M. Best does not expect positive rating actions in

the near term, they could take place in the mid-to-long term if

Maiden Re’s underwriting and operating results consistently

outperform higher-rated peers while maintaining similar or better

levels of risk-adjusted capital. Negative rating actions could

result from deterioration in the group’s operating or underwriting

performance; from a change in the group’s relationship with its

largest client, AmTrust; or from deterioration in the financial

condition of the group’s ultimate parent, Maiden Holdings.

The FSR has been upgraded to A (Excellent) from A- (Excellent)

and the ICRs have been upgraded to “a” from “a-” for Maiden

Reinsurance Ltd. and Maiden Reinsurance North America,

Inc.

The ICRs have been upgraded to “bbb” from “bbb-”for Maiden

Holdings, Ltd. and Maiden Holdings North America,

Ltd.

The following issue ratings have been upgraded:

Maiden Holdings, Ltd.—

-- to “bbb” from “bbb-” on $110 million 6.625% senior unsecured

notes, due 2046

-- to “bb+” from “bb” on $165 million 7.25% preferred stock

-- to “bb+” from “bb” on $165 million 7.125% preferred

non-cumulative stock

-- to “bb+” from “bb” on $150 million 8.25% preferred stock

Maiden Holdings North America, Ltd.—

-- to “bbb” from “bbb-” on $100 million 8.0% senior unsecured

notes, due 2042

-- to “bbb” from “bbb-” on $152.5 million 7.75% senior unsecured

notes, due 2043

The following indicative issue ratings have been upgraded:

Maiden Holdings, Ltd.—

-- to “bbb” from “bbb-“ on senior unsecured debt

-- to “bbb-” from “bb+” on subordinated debt

-- to “bb+” from “bb” on preferred stock

Maiden Holdings North America, Ltd.—

-- to “bbb” from “bbb-” on senior unsecured debt

-- to “bbb-” from “bb+” on senior subordinated debt

-- to “bb+” from “bb” on junior subordinated debt

This press release relates to rating(s) that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office

responsible for issuing each of the individual ratings

referenced in this release, please see A.M. Best’s Recent

Rating Activity web page.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2016 by A.M. Best Rating

Services, Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160901006565/en/

A.M. BestJennifer Marshall, +1 908 439 2200, ext.

5327Assistant Vice

Presidentjennifer.marshall@ambest.comorChristopher Sharkey,

+1 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorMichael

Lagomarsino, CFA, FRM, +1 908 439 2200, ext. 5810Vice

Presidentmichael.lagomarsino@ambest.comorJim Peavy, +1

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

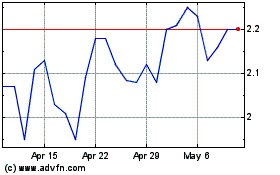

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

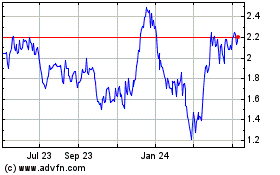

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Apr 2023 to Apr 2024