By Mark DeCambre and Sara Sjolin, MarketWatch

ADP employment report shows a gain of 177,000 in August

U.S. stocks on Wednesday morning traded lower, following a

report of monthly private-sector employment that came in slightly

better than Wall Street expectations, potentially adding more

reasons for the Federal Reserve to follow through with talk of

lifting interest rates.

The U.S. economy added 177,000 private-sector jobs in August

(http://www.marketwatch.com/story/private-sector-adds-177000-jobs-in-august-adp-2016-08-31),

compared with average estimates from economists polled by

MarketWatch of 175,000. And, the prior month's private-payroll

report was raised to 194,000 from 179,000.

The ADP data have arguably worked as a precursor for the more

closely watched nonfarm-payrolls report out on Friday, but it

hasn't always been an accurate gauge.

The Dow Jones Industrial Average gave up 40 points, or 0.2%, at

18,412, dragged lower by a 1% decline in shares of DuPont & Co.

(DD). The S&P 500 index fell 4 points, or 0.2%, to 2,171, with

financial shares one of the few sectors in positive territory.

Meanwhile, the Nasdaq Composite Index declined 8 points, or

0.2%, at 5,215.

"U.S. [stock-market] index futures have eased back a little on

the back of the slightly stronger-than-expected ADP data. This has

raised the prospects we will see a stronger official employment

report on Friday, which could then lead to an earlier rate rise

from the Fed," said Fawad Razaqzada, technical analyst at

Forex.com.

The dollar gained

(http://www.marketwatch.com/story/dollar-holds-steady-as-investors-sit-tight-ahead-of-jobs-data-2016-08-31)slightly

against the yen and was up 0.2%, as measured by the ICE U.S. Dollar

Index , after the ADP data.

Read: Friday could be an important turning point for the dollar

(http://www.marketwatch.com/story/friday-could-be-an-important-turning-point-for-the-dollar-2016-08-30)

Some analysts said the report did little to change the narrative

or raise expectations for a rate increase in September.

"The U.S. market has been limited so far as [the ADP report is]

not enough of a surprise to change Fed expectations for September,"

Colin Cieszynski, chief market strategist at CMC Markets.

Separately, the Chicago purchasing managers index for August

fell 4 points to 51.5 from the previous month.

Wednesday's action comes after similar small moves on Tuesday

(http://www.marketwatch.com/story/wall-street-faces-choppy-day-as-traders-wait-for-rate-clues-2016-08-30),

when investors weighed comments from Fed Vice Chairman Stanley

Fischer about the timing of the next policy move. The S&P 500

closed down 0.2%, while the Dow industrials ended off 0.3%.

Looking ahead, investors will be focused on the Friday

nonfarm-payrolls report, which has been one of the most crucial

pieces of data the policy-setting Federal Open Market Committee

looks at to the determine the timing and pace of rate hikes.

Economic news: A reading on pending-homes sales for July, out at

10 a.m. Eastern.

In Fed news, Boston Fed President Eric Rosengren and Chicago Fed

President Charles Evans both appeared at an event in Shanghai,

China, and showed both sides of the Fed debate

(http://www.marketwatch.com/story/feds-rosengren-and-evans-typify-diverging-stances-on-interest-rates-2016-08-31)

over raising interest rates.

Rosengren said the Fed is close to achieving its employment and

inflation target, while Evans hinted he was in no rush to tighten

policy.

Movers and shakers: Shares of Palo Alto Networks Inc.(PANW)

dropped in 7% after the cybersecurity firm late Tuesday provided a

downbeat outlook for the current quarter

(http://www.marketwatch.com/story/palo-alto-networks-revenue-expenses-surge-2016-08-30-174855517).

AeroVironment Inc.(AVAV) tanked 16% after the drone maker said

revenue slumped 23%

(http://www.marketwatch.com/story/aerovironment-revenue-falls-on-weak-drone-sales-2016-08-30)

in the latest quarter.

H&R Block Inc.(HRB) lost 7% following weaker-than-expected

results

(http://www.marketwatch.com/story/hr-block-sees-losses-widen-in-latest-quarter-2016-08-30-174855545)

out late Tuesday.

U.S.-listed shares of Deutsche Bank AG(DBK.XE) gained 3.5% after

a report the German lender was considering a merger with rival

Commerzbank AG

(http://www.marketwatch.com/story/deutsche-bank-explored-merger-with-commerzbank-report-2016-08-31)(CBK.XE).

Deutsche Bank chief executive John Cryan, however, shot down the

idea of a merger

(http://www.marketwatch.com/story/deutsche-bank-commerzbank-merger-not-an-option-2016-08-31),

saying he's looking to make the bank smaller.

Cisco Systems Inc.(CSCO) shares could also be active after the

tech major late Tuesday said it would buy ContainerX Inc

(http://www.marketwatch.com/story/cisco-to-buy-software-container-startup-containerx-2016-08-30).,

an 18-month-old startup that manages software containers for

corporate customers. Shares fell 0.4%.

After the market closes, Salesforce.com Inc.(CRM) will report

earnings.

Read:Salesforce earnings may be subdued ahead of big Dreamforce

party

(http://www.marketwatch.com/story/salesforce-earnings-may-be-subdued-ahead-of-big-dreamforce-party-2016-08-30)

Other markets: Crude oil inched lower on Wednesday, but was

still on track for an 11% gain for August, which would be its

largest monthly advance since April.

Gold futures turned firmly lower as the dollar traded up after

the ADP print.

Stocks in Asia closed mixed

(http://www.marketwatch.com/story/japan-shares-rise-on-yen-weakness-other-asia-stocks-drop-2016-08-31),

while European markets struggled for direction

(http://www.marketwatch.com/story/european-stocks-get-a-lift-from-german-banks-2016-08-31).

(END) Dow Jones Newswires

August 31, 2016 09:52 ET (13:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

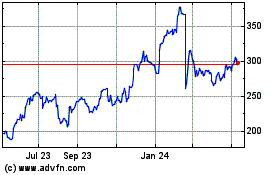

Palo Alto Networks (NASDAQ:PANW)

Historical Stock Chart

From Mar 2024 to Apr 2024

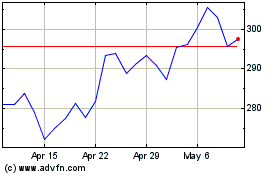

Palo Alto Networks (NASDAQ:PANW)

Historical Stock Chart

From Apr 2023 to Apr 2024