Filed Pursuant to

Rule 424(b)(3)

Registration File

No. 333-212808

PROSPECTUS

AQUA

METALS, INC.

4,431,205 Shares

of

Common Stock Offered

by Selling Stockholders

The selling stockholders

identified in this prospectus may from time to time sell up to 4,431,205 shares of common stock. These shares were issued in private

placement transactions consummated with the selling stockholders on May 24, 2016. We will not receive any proceeds from the sale,

if any, of common stock by any selling stockholder. The selling stockholders will pay any underwriting discounts and commissions

and transfer taxes incurred by the selling stockholder in disposing of the shares of common stock.

The selling stockholders

may offer these securities in amounts, at prices and on terms determined at the time of offering. The securities may be sold directly

to you, through agents, or through underwriters and dealers.

Our common stock is

listed on The NASDAQ Capital Market under the symbol “AQMS”. On July 29, 2016, the last reported sale price of our

common stock on The NASDAQ Capital Market was $9.31 per share.

Investing in these

securities involves significant risks. See “Risk Factors” included in any accompanying prospectus supplement and in

the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before

deciding to purchase these securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is August 15, 2016

TABLE OF CONTENTS

ABOUT THIS

PROSPECTUS

This prospectus is

part of a registration statement that we filed with the Securities and Exchange Commission, which we refer to as the “SEC,”

utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholders may from

time to time sell up to 4,431,205 shares of our common stock described in this prospectus in one or more secondary offerings.

This prospectus provides

you with a general description of the securities the selling stockholders may offer. From time to time, we may provide one or more

prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also

add, update or change information contained in this prospectus. You should read both this prospectus and any accompanying prospectus

supplement together with the additional information described under the heading “Where You Can Find More Information”

beginning on page 11 of this prospectus.

We have not authorized

anyone to provide you with information different from that contained in or incorporated by reference in this prospectus, any accompanying

prospectus supplement or in any related free writing prospectus filed by us with the SEC. We do not take any responsibility for,

and cannot provide any assurance as to the reliability of, any information other than the information contained or incorporated

by reference in this prospectus, any accompanying prospectus supplement or in any related free writing prospectus filed by us with

the SEC. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an

offer to buy any securities other than the securities described in the accompanying prospectus supplement or an offer to sell or

the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should

assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and

any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of

operations and prospects may have changed materially since those dates.

Unless the context

otherwise indicates, references in this prospectus to “we,” “our” and “us” refer, collectively,

to Aqua Metals, Inc., a Delaware corporation and its subsidiaries.

ABOUT AQUA

METALS, INC.

We are engaged in

the business of recycling lead through a novel, proprietary and patent-pending process that we developed and named “AquaRefining”.

Lead is a globally traded commodity with a worldwide market value in excess of $20 billion. Lead acid batteries, or LABs, are the

primary use of all lead produced in the world. Because the chemical properties of lead allow it to be recycled and reused indefinitely,

LABs are also the primary source of all lead production. As such, LABs are almost 100% recycled for purposes of capturing the lead

contained therein for re-use. We believe that our proprietary AquaRefining process will provide for the recycling of LABs and the

production of a pure grade lead with a significantly lower cost of production, and with fewer environmental and regulatory issues,

than conventional methods of lead production.

In recent years, many

lead mines have become exhausted and recycled lead has become increasingly important to LAB production. Recycled lead surpassed

mined lead in the 1990s and now represents more than 50% of the lead content in new LABs. Whether it is produced from lead ore

or recycled LABs, lead has historically been produced by smelting. Smelting is a high-temperature, endothermic chemical reduction,

making it inefficient, energy intensive and often a highly pollutive process. As a consequence of its environmental and health

issues, lead smelting has become increasingly regulated in developed countries. In the US, regulatory non-compliance has forced

the closure of large high-capacity lead smelters in Vernon, California, Frisco, Texas and Herculaneum, Missouri over the last three

years. Herculaneum was the last remaining primary lead-mine operation (i.e., smelting lead from ore) in the US, though secondary

lead smelters that process recycled lead continue to operate in the US. In response, there has been an expansion of LAB smelting

capacity in Mexico and other less regulated countries. The resulting transportation of used LABs from where they originate in the

US to smelters in Mexico, the Philippines and elsewhere is an increasingly significant logistical and global environmental cost.

AquaRefining uses

an aqueous solvent and a novel electro-chemical process to produce pure lead (i.e., higher than 99.99% purity). We believe that

AquaRefining can significantly reduce production costs as compared with alternative methods of producing pure lead. This cost reduction

is partly because our novel electro-chemical process requires less energy than the endothermic high temperature (1700°F) chemical

reduction that is at the core of smelting. It is also partly because our process does not generate toxic high temperature dust

and gas, or the lead containing slag and dross that are unavoidable byproducts of smelting, and which require capital and energy

intensive processes to meet environmental compliance. We also have the potential to locate multiple smaller recycling facilities

in areas closer to the source of used LABs, thereby reducing transport costs and supply chain bottlenecks. AquaRefining is a water-based

ambient temperature process. On this basis, we believe that it significantly reduces environmental emissions, health concerns and

permitting needs as compared with lead smelting. We believe that the combined advantages offered by AquaRefining represent a potential

step change in lead recycling technology, one that can deliver advantages in economics, footprint and logistics while greatly reducing

the environmental impact of lead recycling.

The modular nature

of AquaRefining makes it possible to start LAB recycling at a much smaller scale than is possible with smelters, thereby significantly

reducing the investment risk associated with building a lead production facility. Our plan is to actively explore distributed recycling

in the US by establishing our own initial recycling operation near Reno, Nevada. This plan is based on our belief that Reno has

become a significant hub of the West Coast’s LAB distribution infrastructure and yet is very poorly served by the LAB recycling

industry. From our initial recycling facility near Reno, we intend to expand first throughout the US and then overseas. We will

seek to own our own recycling facilities but will also evaluate joint ventures, licensing and direct sales.

Our principal executive

offices are located at 1010 Atlantic Avenue, Alameda, California 94501, and our telephone number is (510) 479-7635.

RISK FACTORS

Investing in our securities

involves significant risks. You should carefully consider the risks and uncertainties described in this prospectus and any accompanying

prospectus supplement, including the risk factors in our most recent Annual Report on Form 10-K, any subsequently filed Quarterly

Report on Form 10-Q or Current Report on Form 8-K,

together with all of the other information

appearing in or incorporated by reference into this prospectus and any applicable prospectus supplement

, before making an

investment decision pursuant to this prospectus and any accompanying prospectus supplement relating to a specific offering.

Our business, financial

condition and results of operations could be materially and adversely affected by any or all of these risks or by additional risks

and uncertainties not presently known to us or that we currently deem immaterial that may adversely affect us in the future.

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains,

and any accompanying prospectus supplement will contain, forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation

Reform Act of 1993. Also, documents that we incorporate by reference into this prospectus, including documents that we subsequently

file with the Commission, will contain forward-looking statements. Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical matters. You can generally identify forward-looking statements

as statements containing the words "may," "will," "could," "should," "expect,"

"anticipate," "intend," "estimate," "believe," "project," "plan," "assume"

or other similar expressions, or negatives of those expressions, although not all forward-looking statements contain these identifying

words. All statements contained or incorporated by reference in this prospectus and any prospectus supplement regarding our business

strategy, future operations, projected financial position, potential strategic transactions, proposed participation or casino projects,

projected sales growth, estimated future revenues, cash flows and profitability, projected costs, potential outcome of litigation,

potential sources of additional capital, future prospects, future economic conditions, the future of our industry and results that

might be obtained by pursuing management's current plans and objectives are forward-looking statements.

You should not place

undue reliance on our forward-looking statements because the matters they describe are subject to certain risks, uncertainties

and assumptions that are difficult to predict. Our forward-looking statements are based on the information currently available

to us and speak only as of the date on the cover of this prospectus, the date of any prospectus supplement, or, in the case of

forward-looking statements incorporated by reference, the date of the filing that includes the statement. Over time, our actual

results, performance or achievements may differ from those expressed or implied by our forward-looking statements, and such difference

might be significant and materially adverse to our security holders. Except as required by law, we undertake no obligation to update

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

We have identified

some of the important factors that could cause future events to differ from our current expectations and they are described in

this prospectus and supplements to this prospectus under the caption "Risk Factors," as well as in our most recent Annual

Report on Form 10-K, including under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations," and in other documents that we may file with the Commission, all of which you should

review carefully. Please consider our forward-looking statements in light of those risks as you read this prospectus and any prospectus

supplement.

USE OF PROCEEDS

We

will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. The selling stockholders

will receive all the proceeds from this offering, if any.

SELLING

STOCKHOLDERS

Interstate Placement

On May 18, 2016, we entered into (i) a stock

purchase agreement with Interstate Emerging Investments, LLC ( “Interstate”) that provided for the sale of 702,247

shares of our common stock at a price of $7.12 per share for gross proceeds of approximately $5,000,000, and (ii) a credit agreement

with Interstate pursuant to which Interstate loaned us $5,000,000 in consideration for our issuance of a convertible term note

in the original principal amount of $5,000,000, which is convertible into shares of our common stock at a conversion price of $7.12

per share, and pursuant to which we also issued to Interstate two common stock purchase warrants, including:

|

|

·

|

a warrant to purchase 702,247 shares of our common stock, at an exercise price of $7.12 per share, that is exercisable upon

grant and expires on May 24, 2018; and

|

|

|

·

|

a warrant to purchase 1,605,131 shares of our common stock, at an exercise price of $9.00 per share, that is exercisable commencing

November 24, 2016 and expires on May 24, 2019.

|

The stock purchase agreement includes customary

representations, warranties, and covenants Interstate and us, and an indemnity from us in favor of Interstate. In connection with

the above transactions, we entered into an investor rights agreement, dated May 18, 2016, with Interstate, pursuant to which

we agreed to register for resale by Interstate the shares of common stock purchased by Interstate and the shares of common stock

issuable upon exercise of the warrants and the convertible term note issued to the selling stockholder. The investor rights agreement

also provides for “piggyback” registration rights. We committed to file the registration statement upon demand from

Interstate at any time after August 1, 2016. The investor rights agreement provides for liquidated damages upon the occurrence

of certain events, including our failure to file the registration statement within twenty days after we provide notice of receipt

of the demand to file the registration statement (which notice must be sent within five business days of receipt of the demand).

The amount of liquidated damages payable to an investor would be 1.5% of the aggregate amount invested by Interstate for each 30-day

period, or pro rata portion thereof, during which the default continues. The Interstate shares are included in the registration

statement of which this prospectus is a part with the SEC pursuant to the “piggyback” registration rights of the investor

rights agreement.

National Securities Placement

On May 18, 2016, we entered into a stock

purchase agreement and a registration rights agreement with 26 accredited investors pursuant to which we issued and sold to the

investors 719,333 shares of our common stock at a price of $7.12 per share for the gross proceeds of $5,121,651. National Securities

Corporation acted as placement agent for the private placement and received sales commission in the amount of six percent (6%)

of the gross proceeds, or a total of $307,299 in commissions from us. In addition, we reimbursed National Securities for its out-of-pocket

expenses and legal fees in the aggregate amount of $32,645.

The stock purchase agreement includes customary

representations, warranties, and covenants by the investors and us, and an indemnity from us in favor of the investors. Pursuant

to the terms of the registration rights agreement, we agreed to cause a resale registration statement covering the common shares

to be filed by August 1, 2016. The registration rights agreement also provides that we must make certain payments as liquidated

damages to the investors if we fail to timely file the registration statement or if Rule 144 under the Securities Act should become

unavailable for the resale of the common shares. The private placement closed on May 24, 2016. We filed the registration statement

of which this prospectus is a part with the SEC pursuant to the registration rights agreement.

Selling Stockholder Table

The following table sets forth for each

selling stockholder the stockholder’s name, the number and percentage of shares of common stock beneficially owned as of

July 29, 2016, the maximum number of shares of common stock that may be offered pursuant to this prospectus and the number and

percentage of shares of common stock that would be beneficially owned after the sale of the maximum number of shares of common

stock, and is based upon information provided to us by the selling stockholders for use in this prospectus. The information presented

in the table is based on 15,574,225 shares of our common stock outstanding on July 29, 2016.

Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Unless

otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and investment

power with respect to all shares beneficially owned, subject to community property laws where applicable. For purposes of the

table below, shares of common stock issuable pursuant to Interstate within the next 60 days pursuant to the convertible term

note and the warrants held by Interstate within the next 60 days are deemed to be outstanding and to be beneficially owned by

Interstate but are not treated as outstanding for the purpose of computing the percentage ownership of any other selling

stockholder. Except as otherwise disclosed herein, the selling stockholders, to our knowledge, have not had a material

relationship with us during the three years immediately prior to the date of this prospectus.

Pursuant to the terms of the convertible

term note and the warrants held by Interstate, the maximum number of shares that may be acquired by Interstate upon any exercise

of the warrants or the conversion of the convertible term note is limited to the extent necessary to ensure that, following such

exercise, the total number of shares of common stock then beneficially owned by the stockholder and its affiliates and any other

persons whose beneficial ownership of common stock would be aggregated with the selling stockholder for purposes of Section 13(d)

of the Exchange Act, does not exceed 19.99%.

We do not know when or in what amounts any

of the selling stockholders may offer its shares for sale. Because each of the selling stockholders may offer all, some or none

of its shares pursuant to this prospectus, no definitive estimate can be provided as to the number of shares that will be held,

or percentage of shares beneficially owned, by any selling stockholder after completion of any offerings pursuant to this prospectus.

|

|

|

Shares Beneficially Owned

Prior to the Offering

|

|

|

Maximum

Number of

Shares to be

|

|

|

Shares Beneficially Owned

After the Sale of the

Maximum Number of Shares

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

|

|

|

Sold Hereunder

|

|

|

Number

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interstate Emerging Investments, LLC

(1)

|

|

|

3,711,872

|

|

|

|

19.9

|

%

|

|

|

3,711,872

|

|

|

|

—

|

|

|

|

—

|

|

|

Ace Core Convictions Ltd.

(2)

|

|

|

54,000

|

|

|

|

*

|

|

|

|

14,000

|

|

|

|

40,000

|

|

|

|

*

|

|

|

Andrew Schwartzberg

|

|

|

5,000

|

|

|

|

*

|

|

|

|

5,000

|

|

|

|

—

|

|

|

|

—

|

|

|

BDS Assurance Company, Inc.

(3)

|

|

|

35,000

|

|

|

|

*

|

|

|

|

35,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Benjamin L. Padnos

|

|

|

175,000

|

|

|

|

1.1

|

%

|

|

|

10,000

|

|

|

|

165,000

|

|

|

|

1.1

|

%

|

|

Blue Earth Fund, L.P.

(4)

|

|

|

178,338

|

|

|

|

1.1

|

%

|

|

|

16,000

|

|

|

|

162,338

|

|

|

|

1.0

|

%

|

|

Brian Weitman

|

|

|

25,914

|

|

|

|

*

|

|

|

|

5,000

|

|

|

|

20,914

|

|

|

|

*

|

|

|

Connective Capital Emerging Energy QP, LP

(5)

|

|

|

92,317

|

|

|

|

*

|

|

|

|

38,632

|

|

|

|

53,685

|

|

|

|

*

|

|

|

Connective Capital I Master Fund, Ltd.

(5)

|

|

|

79,610

|

|

|

|

*

|

|

|

|

31,368

|

|

|

|

48,242

|

|

|

|

*

|

|

|

Conrad Group Inc. Defined Benefit Plan

(4)

|

|

|

14,000

|

|

|

|

*

|

|

|

|

14,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Crispin Capital Management LLC

(6)

|

|

|

4,000

|

|

|

|

*

|

|

|

|

4,000

|

|

|

|

—

|

|

|

|

—

|

|

|

David R. Wilmerding

|

|

|

156,716

|

|

|

|

1.0

|

%

|

|

|

12,000

|

|

|

|

144,716

|

|

|

|

*

|

|

|

Erick E. Richardson

|

|

|

24,333

|

|

|

|

*

|

|

|

|

14,333

|

|

|

|

10,000

|

|

|

|

*

|

|

|

FLMM, Ltd.

(7)

|

|

|

5,000

|

|

|

|

*

|

|

|

|

5,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Jeffrey S. Padnos & Margaret M. Pados JTWROS

|

|

|

85,000

|

|

|

|

*

|

|

|

|

10,000

|

|

|

|

75,000

|

|

|

|

*

|

|

|

JMR Capital, Ltd.

(7)

|

|

|

5,000

|

|

|

|

*

|

|

|

|

5,000

|

|

|

|

—

|

|

|

|

—

|

|

|

John O. Wirtz Trust Under Agreement dated Feb. 26, 1988

(8)

|

|

|

7,000

|

|

|

|

*

|

|

|

|

7,000

|

|

|

|

—

|

|

|

|

—

|

|

|

MTC Educational Trust

(6)

|

|

|

165,550

|

|

|

|

1.1

|

%

|

|

|

9,000

|

|

|

|

156,550

|

|

|

|

1.0

|

%

|

|

Park City Capital Offshore Master, Ltd.

(9)

|

|

|

18,000

|

|

|

|

*

|

|

|

|

18,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Peter A. Appel

|

|

|

40,000

|

|

|

|

*

|

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Special Situations Cayman Fund, LP

(10)

|

|

|

202,905

|

|

|

|

1.3

|

%

|

|

|

24,720

|

|

|

|

178,185

|

|

|

|

1.1

|

%

|

|

Special Situations Fund III QP, LP

(10)

|

|

|

621,498

|

|

|

|

4.0

|

%

|

|

|

75,718

|

|

|

|

545,780

|

|

|

|

3.5

|

%

|

|

Special Situations Technology Fund II, LP

(10)

|

|

|

358,280

|

|

|

|

2.3

|

%

|

|

|

43,650

|

|

|

|

314,630

|

|

|

|

2.0

|

%

|

|

|

|

Shares Beneficially Owned

Prior to the Offering

|

|

|

Maximum

Number of

Shares to be

|

|

|

Shares Beneficially Owned

After the Sale of the

Maximum Number of Shares

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage

|

|

|

Sold Hereunder

|

|

|

Number

|

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special Situations Technology Fund, LP

(10)

|

|

|

89,567

|

|

|

|

*

|

|

|

|

10,912

|

|

|

|

78,655

|

|

|

|

*

|

|

|

The Jeffrey L. Feinberg Personal Trust

(11)

|

|

|

1,331,102

|

|

|

|

8.5

|

%

|

|

|

175,000

|

|

|

|

1,156,102

|

|

|

|

7.4

|

%

|

|

Valley High Partners, LP

(12)

|

|

|

56,000

|

|

|

|

*

|

|

|

|

56,000

|

|

|

|

—

|

|

|

|

—

|

|

|

Wirtz Manufacturing Co., Inc.

(8)

|

|

|

40,000

|

|

|

|

*

|

|

|

|

40,000

|

|

|

|

—

|

|

|

|

—

|

|

|

|

*

|

Represents beneficial ownership of less than one percent.

|

|

|

(1)

|

Consists of (i) 702,247 shares of common stock, (ii) 2,307,378 shares of common stock that may

be acquired from us upon exercise of warrants, and (iii) 702,247 shares of common stock that may be acquired from us upon conversion

of a convertible term note. Interstate Batteries, Inc. is the sole member of the selling stockholder and, as such, exercises voting

and investment authority over the shares beneficially owned by this selling stockholder.

|

|

|

(2)

|

Sanjiv Garg exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(3)

|

Bradley Dale Streelman exercises voting and investment authority over the shares held by this selling

stockholder.

|

|

|

(4)

|

Brett Conrad exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(5)

|

Robert Romero exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(6)

|

Michael T. Cahill exercises voting and investment authority over the shares held by this selling

stockholder.

|

|

|

(7)

|

Per-Magnus Andersson exercises voting and investment authority over the shares held by this selling

stockholder.

|

|

|

(8)

|

John O. Wirtz exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(9)

|

Michael J. Fox exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(10)

|

Adam Stettner exercises voting and investment authority over the shares held by this selling stockholder.

|

|

|

(11)

|

Jeffrey L. Feinberg exercises voting and investment authority over the shares held by this selling

stockholder.

|

|

|

(12)

|

Malcolm Fairbairn exercises voting and investment authority over the shares held by this selling

stockholder.

|

PLAN OF

DISTRIBUTION

The selling stockholders,

which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests

in shares of common stock received after the date of this prospectus from a selling stockholders as a gift, pledge, partnership

distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose (collectively, “dispositions”)

of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility

on which the shares are traded or in private transactions. The selling stockholders may sell all or a portion of the shares beneficially

owned and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. These dispositions

may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying

prices determined at the time of sale, or at negotiated prices.

The selling stockholders

may use any one or more of the following methods when selling or disposing of shares or interests therein:

|

|

·

|

underwritten transactions on any national securities exchange or

quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions otherwise than on these exchanges or systems or in

the over-the-counter market;

|

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer

solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the

shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer

for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable

exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales effected after the date the registration statement of

which this Prospectus is a part is declared effective by the SEC;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions,

whether through an options exchange or otherwise;

|

|

|

·

|

broker-dealers may agree with the selling stockholders to sell a

specified number of such shares at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted by applicable law.

|

The selling stockholders

may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if

they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other

successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of

common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling

beneficial owners for purposes of this prospectus.

In connection with

the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions

they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out

their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling

stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation

of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares

offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The aggregate proceeds

to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less

discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents

from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents.

We will not receive any of the proceeds from this offering.

We will pay all expenses

of the registration of the shares, including, without limitation, SEC filing fees and expenses of compliance with state securities

or “blue sky” laws; provided, however, that the selling stockholders will pay all underwriting discounts and selling

commissions, if any.

The selling stockholders

also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of

1933, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders

and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be deemed

to be "underwriters" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions

or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. "Underwriters"

within the meaning of Section 2(11) of the Securities Act are subject to the prospectus delivery requirements of the Securities

Act.

There can be no assurance

that any selling stockholder will sell any or all of the shares registered pursuant to the registration statement of which this

prospectus forms a part.

To the extent required,

the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer

will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

In order to comply

with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered

or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the

selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the

market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make

copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the

purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer

that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under

the Securities Act.

We have agreed to indemnify

the selling stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating

to the registration of the shares offered by this prospectus.

We have agreed with

the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier

of (1) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration

statement or (2) the date on which all of the shares are sold without restriction pursuant to Rule 144 of the Securities Act.

LEGAL

MATTERS

The validity of the

issuance of the common stock offered by this prospectus has been passed upon for us by Greenberg Traurig, LLP, Irvine, California.

EXPERTS

The financial statements

incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2015 have been so

incorporated in reliance on the report of Armanino LLP, an independent registered public accounting firm, given on the authority

of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and current reports and other information with the SEC. You may read and copy any document we file at the SEC's Public Reference

Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the public reference

room by calling the SEC at 1-800-SEC-0330. Our filings with the SEC also are available from the SEC's internet site at http://www.sec.gov,

which contains reports, proxy and information statements, and other information regarding issuers that file electronically.

This prospectus is

part of a registration statement that we filed with the SEC. As permitted by SEC rules, this prospectus and any accompanying prospectus

supplement that we may file, which form a part of the registration statement, do not contain all of the information that is included

in the registration statement. The registration statement contains more information regarding us and our securities,

including certain exhibits. You can obtain a copy of the registration statement from the SEC at the address listed above or from

the SEC’s website.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The SEC permits us

to “incorporate by reference” the information and reports we file with it. This means that we can disclose important

information to you by referring to another document. The information that we incorporate by reference is considered to be part

of this prospectus, and later information that we file with the SEC automatically updates and supersedes this information. We incorporate

by reference the documents listed below, except to the extent information in those documents is different from the information

contained in this prospectus, and all future documents filed with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange

Act (other than the portions thereof deemed to be furnished to the SEC pursuant to Item 9 or Item 12) until we terminate the offering

of these securities:

|

|

·

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on

March 28, 2016;

|

|

|

·

|

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, which was filed on May 19,

2016;

|

|

|

·

|

Our Current Reports on Form 8-K, which were filed on March 25, 2016 and May 24, 2016;

|

|

|

·

|

The description of our common stock in our Form 8-A12B, which was filed on July 24, 2015, and any

amendments or reports filed for the purpose of updating this description; and

|

|

|

·

|

All documents we file with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act

after the date of this prospectus and prior to the termination of this offering made by way of this prospectus.

|

To the extent that

any statement in this prospectus is inconsistent with any statement that is incorporated by reference and that was made on or before

the date of this prospectus, the statement in this prospectus shall supersede such incorporated statement. The incorporated statement

shall not be deemed, except as modified or superseded, to constitute a part of this prospectus or the registration statement. Statements

contained in this prospectus as to the contents of any contract or other document are not necessarily complete and, in each instance,

we refer you to the copy of each contract or document filed as an exhibit to our various filings made with the SEC.

You may request a copy

of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Aqua Metals, Inc.

Attn: Investor Relations

1010 Atlantic Avenue

Alameda, California 94501

(510) 479-7635

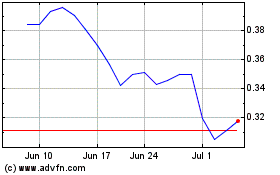

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

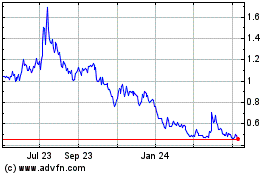

Aqua Metals (NASDAQ:AQMS)

Historical Stock Chart

From Apr 2023 to Apr 2024