Flowers Foods Earnings Down Slightly as Sales Rise

August 10 2016 - 10:00PM

Dow Jones News

Flowers Foods Inc. said its second-quarter profit fell 1.2% as

soft demand and increased promotional activity prompted the company

to lower its 2016 guidance.

The maker of Wonder bread, Tastykake and Nature's Own baked

goods also launched an operational review called "Project

Centennial" to look into enhancing revenue growth, streamlining

operations and investing to strengthen its competitive

position.

Shares fell 4% to $15.50 in after-hours trading.

Like other established food makers facing threats from younger

brands, Flowers has diversified by acquiring companies focused on

natural ingredients. General Mills Inc. bought Annie's Inc., while

Campbell Soup Co. purchased Bolthouse Farms.

Flowers has found some success with 2015 deals for Dave's Killer

Bread, for $275 million, and Alpine Valley Bread Co., for $120

million. The company said Wednesday that said strong demand for

those products offset lower sales in its core markets.

Breaking out its 5.2% total sales increase, the company said

acquisitions contributed 5.6% as pricing/mix decreased 0.5% and

volume rose 0.1%.

Earlier Wednesday, Flowers disclosed that it faces a federal

inquiry into its labor practices. It didn't detail the specific

labor issues involved. The company was previously sued by delivery

drivers in several states who allege they were misclassified as

independent contractors.

Flowers expects earnings of 90 cents to 95 cents a share for the

year, excluding a second-quarter pension plan settlement loss of 2

cents a share. In May, it projected earnings of $1 to $1.06 a

share.

Flowers projects sales of $3.93 billion to $3.986 billion for

the year, compared with prior guidance of $3.986 billion to $4.08

billion.

For the quarter ended June 30, Flowers reported a profit of

$51.2 million, or 24 cents a share, compared with $51.8 million, or

24 cents a share, a year earlier. Earnings excluding items were 26

cents a share.

Sales rose to $935 million from $888.8 million.

Analysts surveyed by Thomson Reuters had projected a profit of

26 cents a share on $949 million in revenue.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

August 10, 2016 21:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

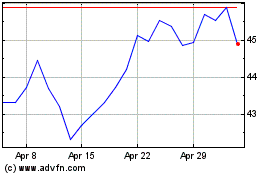

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

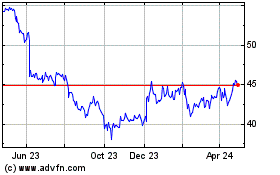

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Apr 2023 to Apr 2024