Current Report Filing (8-k)

July 27 2016 - 2:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 1, 2016

MAGELLAN GOLD CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

Nevada

|

_

333-174287

|

27-3566922

|

|

(State or other jurisdiction

of incorporation)

|

Commission File

Number

|

(I.R.S. Employer Identification number)

|

2010A Harbison Drive # 312, Vacaville, CA 95687

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code:

(707) 884-3766

______________________________________________________

(Former name or former address, if changed since last report)

|

|

|

___

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

___

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

___

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

___

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

ITEM 1.01

ENTRY INTO MATERIAL DEFINITIVE AGREEMENTS

ITEM 3.02

UNREGISTERED SALE OF EQUITY SECURITIES

On July 1, 2016 Magellan Gold Corporation (the “Company”) signed an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, Gulf+Western Industries, Inc. a Nevada corporation and majority-owned subsidiary of the Company (“G+W”), and Magellan Merger Sub, Inc., a Nevada corporation and wholly-owned acquisition subsidiary of the Company (“Merger Sub”).

Pursuant to the Merger Agreement, Merger Sub merged with and into G+W with G+W as the surviving corporation (the “Merger”).

Articles of Merger were filed with and accepted by the Nevada Secretary of State on July 15, 2016.

The Merger is intended to qualify as a tax-free reorganization pursuant to Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). A copy of the Merger Agreement is filed as Exhibit 10.1 hereto.

Under the terms of the Merger,

shares of G+W Common Stock issued and outstanding immediately prior to the Effective Time of the Merger, excluding any such shares currently held by Company, were converted into the right to receive 8,623,957 shares of Common Stock of Magellan, $.001 par value per share (the "Magellan Common Stock"). Those shares are owned exclusively by W. Pierce Carson, the Company’s President.

Following and giving effect to the Merger, the minority interest in G+W was eliminated and G+W became a wholly-owned subsidiary of the Company.

ITEM 9.01:

FINANCIAL STATEMENTS AND EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

Item

|

Title

|

|

|

|

|

|

|

10.1

|

Agreement and Plan of Merger

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

Magellan Gold Corporation

|

|

|

|

|

Date:

July 27, 2016

|

By:

/s/ W. Pierce Carson

W. Pierce Card, President

|

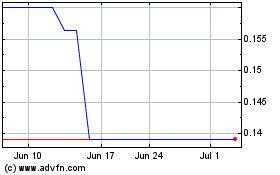

Magellan Gold (PK) (USOTC:MAGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

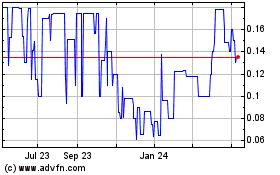

Magellan Gold (PK) (USOTC:MAGE)

Historical Stock Chart

From Apr 2023 to Apr 2024