Ingersoll-Rand Releases Downbeat Forecast

July 27 2016 - 10:18AM

Dow Jones News

By Austen Hufford

Ingersoll-Rand on Wednesday said profit and revenue grew in the

latest quarter, but the climate-control company said global

industrial weakness continues and released a downbeat profit

forecast.

Shares fell 3.9% to $65.53 in morning trading and are down 0.2%

in the last three months.

The diversified industrial manufacturer said there continue to

be "broad-based" challenges across end industrial markets, but that

the global trend toward energy efficiency, sustainability and the

safe transport of perishables continues.

The company forecast annual revenue to increase between 1% to 2%

and adjusted earnings per share to be between $4 and $4.10, raising

the low end by 5 cents. Analysts had expected adjusted earnings per

share of $4.09.

For the current quarter, the company expects $1.25 to $1.30 in

adjusted earnings per share, compared with analysts' expectations

of $1.29. It expects revenue growth of about 2%.

Over all for the second quarter, Ingersoll-Rand posted a profit

of $747.6 million, or $2.86 a share, up from $78.9 million, or 29

cents a share a year prior. The prior year had a large income-tax

charge. Excluding the tax charge and other items, earnings were

$1.38 a share.

Revenue climbed 2.4% to $3.69 billion.

Analysts surveyed by Thomson Reuters forecast adjusted per-share

earnings of $1.30 on revenue of $3.7 billion.

In the latest quarter, sales in the company's climate division,

which makes heating and air conditioning systems, rose 4.2% to

$2.93 billion. In its smaller industrial division, which makes

compressed-air systems, power tools and golf carts, sales fell 4%

to $753.4 million.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 27, 2016 10:03 ET (14:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

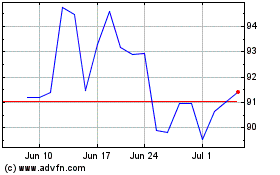

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

From Sep 2023 to Sep 2024