Spectrum ASA: Amendments to the bank facilities

July 01 2016 - 2:15AM

Spectrum ASA ("Spectrum") has yesterday afternoon

entered into an agreement to amend the amortization schedule on the

company's term loan facility. With the new repayment schedule the

term loan is amortized USD 10 million in 2Q 2016, USD 10 million in

3Q 2016 and USD 15 million in 1Q 2017 vs. previous amortization

schedule of USD 15 million in 2Q 2016 and USD 20 million in 3Q

2016.

In addition, Spectrum has obtained a waiver for the NIBD/EBITDA -

MC capex covenant for 2Q 2016.

Based on preliminary figures for 2Q 2016, Management expects to

report a cash balance of approximately USD15 million after the 2Q

2016 term loan payment of USD 10 million.

CEO Rune Eng comments:

"Oil companies continued to be very selective on spending in 2Q

2016 in spite of the increased oil price. Even though there are

signs of increasing activity in the market, it's still too early to

draw a positive conclusion. The updated amortization schedule gives

Spectrum increased flexibility and headroom even if the markets

remain subdued."

Spectrum will report the 2(nd) quarter 2016 financial results on

the 12(th) of August 2016.

For further information, please contact:

Henning Olset, CFO

Mobile: +47 92 26 69 48

E-mail: henning.olset@spectrumasa.com

Rune Eng, CEO

Mobile: +47 91 57 08 45

E-mail: rune.eng@spectrumasa.com

This information is subject

of the disclosure requirements acc. to §5-12 vphl (Norwegian

Securities Trading Act)

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Spectrum ASA via Globenewswire

HUG#2024451

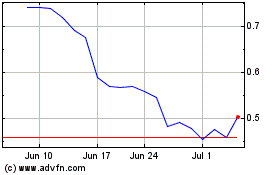

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Sep 2023 to Sep 2024