Report of Foreign Issuer (6-k)

June 09 2016 - 5:32PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2016

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

YPF Sociedad An

ó

nima

TABLE OF CONTENTS

ITEM

1 Translation of letter to the Buenos Aires Stock Exchange dated June 9, 2016

TRANSLATION

Autonomous City of Buenos Aires, June 9, 2016

To the

Bolsa de Comercio de Buenos Aires

(Buenos Aires Stock Exchange)

Dear Sirs:

The purpose of this letter is to comply with the requirements of Article 23, Section 3 of the Buenos Aires Stock Exchange Regulations.

The Board of Directors decided to pay a dividend in cash of 2.26 Argentine pesos per share with no distinction among the classes of the Company's stock. Such dividend shall be made available to all shareholders on July 7, 2016, or on any subsequent date due to the application of the rules governing the jurisdictions where the Company's shares are listed. The exchange rate to be used for payment of the ADRs shall be that of the United States dollar in the free exchange market –selling rate– at the close of the business date prior to the date the dividends shall be made available in the Republic of Argentina.

Additionally, please be informed that from the amount to be paid as a dividend, there will be a deduction – if applicable – for the amount paid by the Company for the Personal Asset Tax (according to the unnumbered article after article 25 of Law 23,966, as amended), corresponding to the 2015 fiscal year. In addition, as a result of changes introduced during 2013 to the Income Tax Law, a 10% one-time income tax withholding has been put in place on dividends and profits distributed by the entities mentioned in subsection a), paragraphs 1, 2, 3, 6 and 7 and subsection b), of article 69 of the Income Tax Law, thus please be informed that we will proceed to withhold that amount for individuals residing in the country and foreign beneficiaries.

In the case of ADRs, for operational reasons, the tax will be withheld for all holders, and a system on our website (www.ypf.com) will be made available on the day following the payment date, in order to request a refund, in cases where such tax does not apply.

Yours faithfully,

Diego Celaá

Market Relations Officer

YPF S.A.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

YPF Sociedad Anónima

|

|

|

Date: June 9, 2016

|

By:

|

/s/

Diego Celaá

|

|

|

|

Name:

Title:

|

Diego Celaá

Market Relations Officer

|

|

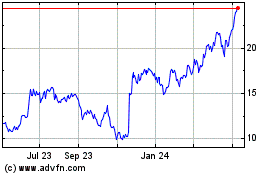

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

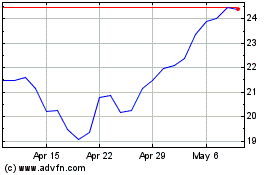

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024