![[F424B3SUPPLEMENTPROSPECTU002.GIF]](http://content.edgar-online.com/edgar_conv_img/2016/05/24/0001551163-16-000433_F424B3SUPPLEMENTPROSPECTU002.GIF)

SANGUI BIOTECH INTERNATIONAL, INC.

Prospectus Supplement No. 5

(to the Prospectus dated August 7, 2015)

This Prospectus Supplement No. 5, dated May 23, 2016, contains information that supplements

and updates our Prospectus dated August 10, 2015, Prospectus Supplement No. 1 dated August 14, 2015, Prospectus Supplement No. 2 dated October 5, 2015, Prospectus Supplement No. 3 dated November 23, 2015, and Prospectus Supplement No. 4 dated February 24, 2016. Since it contains only the most recent developments, this supplement should be read in conjunction with such prospectus.

This prospectus relates to the offer and resale of up to 30,000,000 shares of Sangui Biotech International, Inc. (

“

Sangui

”

or the

“

Company

”

) common stock, no par value per share, by the selling security holder, Tarpon Bay Partners, LLC, a Florida limited liability company (

“

Tarpon

”

). All of such shares represent shares that Tarpon has agreed to purchase if put to it by us pursuant to the terms of the Equity Purchase Agreement we entered into with them on May 11, 2015, subject to the volume limitations and other limitations in the Equity Purchase Agreement. Subject to the terms and conditions of the Equity Purchase Agreement, we have the right to

“

put,

”

or sell, up to $5,000,000 worth of shares of our common stock to Tarpon.

Periodic

Report on Form 10-

Q

Attached hereto and incorporated by reference herein is our

Periodic

Report on

Form 10-

Q

for the period ended

March

31

, 201

6

, which we filed with the Securities and Exchange Commission on

May

23

, 2016

.

The information set forth in the attached Periodic Report supplements and amends the information contained

in the Prospectus.

This Prospectus Supplement No.

5

should be read in conjunction with, and delivered with, the Prospectus and all and Prospectus Supplements and is qualified by reference to the Prospectus except to the extent that the information in this Prospectus Supplement No.

5

supersedes the information contained in the Prospectus or Prospectus Supplements.

Unregistered Sale of Equity Securities and Use of Proceeds

On January 5, 2016, the Company issued 2,000,114 shares of its common stock in consideration of the conversion of $24,001 of principal and interest on the unsecured note payable for $50,000 dated May 11, 2015 made in favor of Tarpon Bay Partners, LLC. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

In January 2016, the Company sold 3,410,000 shares of its common stock for cash to three individuals at an average price of $0.016 per share for a total cash raise of $55,104. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

In February 2016, the Company sold 2,000,000 shares of its common stock for cash to one individual at an average price of $0.015 per share for a total cash raise of $29,590. No underwriters were used. The securities were

sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

Subsequent to the period covered by this report, the Company sold 6,151,000 shares of its common stock for cash to two individuals and one of its directors at an average price of $0.016 per share for a total cash raise of $96,500. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

Investing in our common stock involves a high degree of risk.

See

“

Risk Factors

”

beginning on page 4 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that the Prospectus or this Prospectus Supplement No. 5 is truthful or complete. A representation to the contrary is a criminal offense.

The date of this Prospectus Supplement No. 5 is May 23, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended:

March 31, 2016

Commission file number: 0-21271

SANGUI BIOTECH INTERNATIONAL, INC.

(Exact name of Registrant as specified in Its Charter)

|

|

|

Colorado

|

84-1330732

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

Alfred-Herrhausen-Str. 44, 58455 Witten, Germany

(Address of Principal Executive Offices)

011-49-2302-915-204

(Registrant's Telephone Number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“

large accelerated filer,

”

“

accelerated filer

”

and

“

smaller reporting company

”

in Rule 12b-2 of the Exchange Act.

|

|

|

Large Accelerated Filer [ ]

|

Accelerated Filer [ ]

|

|

|

|

|

Non-Accelerated Filer [ ]

|

Smaller Reporting Company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of May 23, 2016, there were 165,372,503 shares of the issuer's Common Stock, no par value, issued and outstanding.

SANGUI BIOTECH INTERNATIONAL, INC.

Quarterly Report on Form 10-Q

For the Quarterly Period Ended March 31, 2016

INDEX

|

|

|

|

PART I

–

FINANCIAL INFORMATION

|

|

|

Item 1

|

Consolidated Financial Statements.........................................................................................................

|

1

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations ................

|

11

|

|

Item 3.

|

Quantitative and Qualitative Disclosure About Market Risk ................................................................

|

15

|

|

Item 4.

|

Controls and Procedures ........................................................................................................................

|

15

|

|

PART II

–

OTHER INFORMATION

|

|

|

Item 1.

|

Legal Proceedings.................................................................................................................................

|

16

|

|

Item 1A.

|

Risk Factors...........................................................................................................................................

|

16

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds ..............................................................

|

16

|

|

Item 3.

|

Defaults Upon Senior Securities ...........................................................................................................

|

16

|

|

Item 5.

|

Other Information..................................................................................................................................

|

16

|

|

Item 6.

|

Exhibits..................................................................................................................................................

|

17

|

ii

PART I - FINANCIAL INFORMATION

Item 1 - Consolidated Financial Statements

The accompanying unaudited consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q pursuant to the rules and regulations of the Securities and Exchange Commission and, therefore, do not include all information and footnotes necessary for a complete presentation of our financial position, results of operations, cash flows, and stockholders' deficit in conformity with generally accepted accounting principles in the United States of America. In the opinion of management, all adjustments considered necessary for a fair presentation of the consolidated results of operations and financial position have been included and all such adjustments are of a normal recurring nature.

Our unaudited condensed consolidated balance sheet as of March 31, 2016 and the audited balance sheet as of June 30, 2015, our unaudited condensed consolidated statements of operations for the three and nine month periods ended March 31, 2016, and 2015, and our unaudited condensed consolidated statements of cash flows for the nine month periods ended March 31, 2016, and 2015 are attached hereto and incorporated herein by this reference.

|

|

|

|

|

|

|

|

|

|

SANGUI BIOTECH INTERNATIONAL, INC.

|

|

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

|

|

June 30,

|

|

|

|

|

|

2016

|

|

2015

|

|

CURRENT ASSETS

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

$

|

51,786

|

|

$

|

17,672

|

|

|

Prepaid expenses and other assets

|

|

41,546

|

|

|

37,325

|

|

|

Tax refunds receivable

|

|

-

|

|

|

16,647

|

|

|

Accounts receivable, net

|

|

10,798

|

|

|

455

|

|

|

Deferred Finance Costs

|

|

35,160

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

139,290

|

|

|

122,099

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, Net

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

$

|

139,290

|

|

$

|

122,099

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

$

|

185,375

|

|

$

|

142,787

|

|

|

Related party payables

|

|

29,398

|

|

|

121,637

|

|

|

Convertible notes payable - net of discount

|

|

-

|

|

|

50,000

|

|

|

Notes payable

|

|

|

37,509

|

|

|

36,569

|

|

|

Note payable - related party

|

|

110,940

|

|

|

110,940

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

363,222

|

|

|

461,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, no par value; 10,000,000 shares

|

|

|

|

|

|

|

|

authorized, -0- shares issued and outstanding

|

|

-

|

|

|

-

|

|

|

Common stock, no par value; 250,000,000 shares

|

|

|

|

|

|

|

|

authorized, 159,221,503 and 148,103,056 shares issued and

|

|

|

|

|

|

|

|

158,036,771 and 146,918,314 shares outstanding, respectively

|

|

32,281,561

|

|

|

31,932,726

|

|

|

Additional paid-in capital

|

|

4,667,156

|

|

|

4,621,430

|

|

|

Treasury stock

|

|

|

(339,387)

|

|

|

(339,387)

|

|

|

Accumulated other comprehensive income

|

|

256,317

|

|

|

169,589

|

|

|

Accumulated deficit

|

|

(36,504,100)

|

|

|

(36,160,646)

|

|

|

Total Sangui Biotech International, Inc's stockholder's deficit

|

|

361,547

|

|

|

223,712

|

|

|

Non-controlling interest

|

|

(585,479)

|

|

|

(563,546)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity (Deficit)

|

|

(223,932)

|

|

|

(339,834)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$

|

139,290

|

|

$

|

122,099

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANGUI BIOTECH INTERNATIONAL, INC.

|

|

Consolidated Statements of Operations

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

|

|

For the Nine Months Ended

|

|

|

|

|

|

March 31,

|

|

March 31,

|

|

|

|

|

|

2016

|

|

2015

|

|

2016

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

|

$

|

10,149

|

|

$

|

11,654

|

|

$

|

37,005

|

|

$

|

116,560

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES

|

|

|

43

|

|

|

91

|

|

|

272

|

|

|

489

|

|

GROSS MARGIN

|

|

|

10,106

|

|

|

11,563

|

|

|

36,733

|

|

|

116,071

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,701

|

|

|

36,450

|

|

|

37,208

|

|

|

171,427

|

|

|

General and administrative

|

|

|

79,925

|

|

|

169,552

|

|

|

320,635

|

|

|

520,830

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses

|

|

|

81,626

|

|

|

206,002

|

|

|

357,843

|

|

|

692,257

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

|

(71,520)

|

|

|

(194,439)

|

|

|

(321,110)

|

|

|

(576,186)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on change in derivative liability

|

|

|

25,117

|

|

|

-

|

|

|

28,057

|

|

|

-

|

|

|

Amortization of debt discount

|

|

|

(47,294)

|

|

|

-

|

|

|

(50,000)

|

|

|

-

|

|

|

Interest expense

|

|

|

(13,098)

|

|

|

(1,127)

|

|

|

(29,425)

|

|

|

(2,938)

|

|

|

Other income

|

|

|

-

|

|

|

36

|

|

|

7,091

|

|

|

36

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income (Expense)

|

|

|

(35,275)

|

|

|

(1,091)

|

|

|

(44,277)

|

|

|

(2,902)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes and non-controlling interest

|

|

|

(106,795)

|

|

|

(195,530)

|

|

|

(365,387)

|

|

|

(579,088)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS BEFORE NON-CONTROLLING INTEREST

|

|

|

(106,795)

|

|

|

(195,530)

|

|

|

(365,387)

|

|

|

(579,088)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net loss attributable to non-controlling interest

|

|

|

(3,280)

|

|

|

(14,176)

|

|

|

(21,933)

|

|

|

(41,806)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS

|

|

$

|

(103,795)

|

|

$

|

(181,354)

|

|

$

|

(343,454)

|

|

$

|

(537,282)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME (LOSS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

(156,583)

|

|

|

13,354

|

|

|

86,728

|

|

|

40,150

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Comprehensive Income

|

|

|

(156,583)

|

|

|

13,354

|

|

|

86,728

|

|

|

40,150

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS)

|

|

$

|

(263,378)

|

|

$

|

(182,176)

|

|

$

|

(278,659)

|

|

$

|

(538,938)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED LOSS PER SHARE

|

|

$

|

(0.00)

|

|

$

|

(0.00)

|

|

$

|

(0.00)

|

|

$

|

(0.00)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED WEIGHTED AVERAGE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF SHARES OUTSTANDING

|

|

|

157,102,910

|

|

|

144,803,490

|

|

|

152,184,386

|

|

|

143,975,360

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

|

|

|

|

|

|

|

|

|

|

|

SANGUI BIOTECH INTERNATIONAL, INC.

|

|

Consolidated Statements of Cash Flows

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

2016

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(365,387)

|

|

$

|

(579,088)

|

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

|

|

used by operating activities:

|

|

|

|

|

|

|

|

|

Gain on change in derivative liability

|

|

(52,707)

|

|

|

-

|

|

|

|

Amortization of deferred finance fees

|

|

14,840

|

|

|

-

|

|

|

|

Derivative expense

|

|

24,650

|

|

|

|

|

|

|

Common stock issued for services

|

|

-

|

|

|

36,422

|

|

|

|

Forgivenes of liabilities due to Company Director

|

|

23,181

|

|

|

-

|

|

|

|

Amortization of debt discount

|

|

50,000

|

|

|

-

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

Trade accounts receivable

|

|

(17,254)

|

|

|

(16,987)

|

|

|

|

Prepaid expenses and other current assets

|

|

(4,438)

|

|

|

32,044

|

|

|

|

Tax refunds receivable

|

|

16,557

|

|

|

21,522

|

|

|

|

Accounts payable and accrued expenses

|

|

47,738

|

|

|

41,559

|

|

|

|

Related parties accounts payable

|

|

(92,050)

|

|

|

18,971

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Operating Activities

|

|

(354,870)

|

|

|

(445,557)

|

|

|

|

|

|

|

.

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

Collection of notes receivable, related parties

|

|

-

|

|

|

30,883

|

|

|

|

Proceeds from sale of interest in joint venture

|

|

6,897

|

|

|

-

|

|

|

|

|

Net Cash Used in Investing Activities

|

|

6,897

|

|

|

30,883

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

Payments on convertible notes payable

|

|

(26,300)

|

|

|

-

|

|

|

|

Common stock issued for cash

|

|

321,860

|

|

|

291,883

|

|

|

|

Proceeds from notes payable- related party

|

|

-

|

|

|

108,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

295,560

|

|

|

400,383

|

|

|

|

|

|

|

|

|

|

|

|

EFFECTS OF EXCHANGE RATES

|

|

86,527

|

|

|

23,941

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE IN CASH

|

|

34,114

|

|

|

9,650

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

17,672

|

|

|

98,148

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH AT END OF PERIOD

|

$

|

51,786

|

|

$

|

107,798

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF

|

|

|

|

|

|

|

|

CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

|

$

|

-

|

|

$

|

2,568

|

|

|

|

Income Taxes

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

NON CASH INVESTING AND FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

Debt Discount on convertible note and related derivative

|

$

|

50,000

|

|

$

|

-

|

|

|

|

Conversion of debt and accrued interest into common stock

|

$

|

26,974

|

|

$

|

-

|

|

|

|

Change in derivative due to conversion

|

$

|

21,943

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

|

4

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

NOTE 1 - BASIS OF PRESENTATION

The accompanying consolidated financial statements have been prepared without audit in accordance with accounting principles generally accepted in the United States of America for interim financial information. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations. The unaudited consolidated financial statements and notes should, therefore, be read in conjunction with the consolidated financial statements and notes thereto in the Company's Form 10-K for the year ended June 30, 2015. In the opinion of management, all adjustments (consisting of normal and recurring adjustments) considered necessary for a fair presentation, have been included. The results of operations for the three and nine months ended March 31, 2016 are not necessarily indicative of the results that may be expected for the full fiscal year ending June 30, 2016.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Sangui Biotech International, Inc., incorporated in Colorado in 1995, and its subsidiary, Sangui BioTech GmbH (Sangui GmbH). Sangui GmbH, which is headquartered in Witten, Germany, is engaged in the development of artificial oxygen carriers (external applications of hemoglobin, blood substitutes and blood additives) as well as in the development, marketing and sales of cosmetics and wound management products.

Consolidation

The consolidated financial statements include the accounts of Sangui BioTech International, Inc. and its ninety percent owned subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Foreign Currency Translation

Assets and liabilities of the Company's foreign operations are translated into U.S. dollars at period-end exchange rates. Net exchange gains or losses resulting from such translation are excluded from net loss but are included in comprehensive income (loss) and accumulated in a separate component of stockholders' equity. Income and expenses are translated at weighted average exchange rates for the period.

Exchanges rates used for the preparation of the consolidated balance sheet as of March 31, 2016 and June 30, 2015 and our unaudited consolidated statements of operations for the nine month periods ended March 31, 2016 and 2015, were calculated as follows:

|

|

|

as of March 31, 2016

|

USD 1 : EUR 0.907213

|

|

as of June 30, 2015

|

USD 1 : EUR 0.9014

|

|

July 1 through March 31, 2016

|

USD 1 : EUR 0.883353

|

|

July 1 through March 31, 2015

|

USD 1 : EUR 0.7765

|

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Risk and Uncertainties

The Company's line of future pharmaceutical products (artificial oxygen carriers or blood substitute and additives) and medical products (wound dressings and other wound management products) being developed by Sangui GmbH, are deemed as medical devices or biologics, and as such are governed by the Federal Food and Drug and Cosmetics Act and by the regulations of state agencies and various foreign government agencies. The pharmaceutical, under development in Germany, will be subject to more stringent regulatory requirements, because they are in vivo products for humans. The Company and its subsidiaries have no experience in obtaining regulatory clearance on these types of products. Therefore, the Company will be subject to the risks of delays in obtaining or failing to obtain regulatory clearance.

Going Concern

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern, which contemplates, among other things, the realization of assets and satisfaction of liabilities in the normal course of business. The Company has accumulated deficit of $36,504,100 as of March 31, 2016. The Company incurred a net loss applicable to common stockholders of $343,454 during the nine months ended March 31, 2016 and used cash in operating activities of $354,869 during the three months ended March 31, 2016. These conditions raise substantial doubt about the Company's ability to continue as a going concern. The Company expects to continue to incur significant capital expenses in pursuing its business plan to market its products and expand its product line, while obtaining additional financing through stock offerings or other feasible financing alternatives. In order for the Company to continue its operations at its existing levels, the Company will require significant additional funds over the next twelve months. Therefore, the Company is dependent on funds raised through equity or debt offerings. Additional financing may not be available on terms favorable to the Company, or at all. If these funds are not available the Company may not be able to execute its business plan or take advantage of business opportunities. The ability of the Company to obtain such additional financing and to achieve its operating goals is uncertain. In the event that the Company does not obtain additional capital, is not able to collect its outstanding receivables or is not able to increase cash flow through the increase of sales, there is a substantial doubt of its being able to continue as a going concern. The accompanying condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Cash and Cash Equivalents

The Company maintains its cash in bank accounts in Germany. Cash and cash equivalents include time deposits for which the Company has no requirements for compensating balances. The Company has not experienced any losses in its uninsured bank accounts. At December 31, the Company had no cash equivalents.

Derivative Liabilities

ASC 815 generally provides three criteria that, if met, require companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments. These three criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under otherwise applicable generally accepted accounting principles with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument subject to the requirements of ASC 815. ASC 815 also provides an exception to this rule when the host instrument is deemed to be conventional, as described.

The Company assessed the classification of its derivative financial instruments as of March 31, 2015, which consist of convertible instruments and rights to shares of the Company

’

s common stock, and determined that such derivatives meet the criteria for liability classification under ASC 815.

The Company accounts for convertible instruments (when it has determined that the embedded conversion options should not be bifurcated from their host instruments) in accordance with professional standards when

“

Accounting for Convertible Securities with Beneficial Conversion Features,

”

as those professional standards pertain to

“

Certain Convertible Instruments.

”

Accordingly, the Company records, when necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in debt instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective conversion price embedded in the note. Debt discounts under these arrangements are amortized over the term of the related debt to their earliest date of redemption.

Research and Development

Research and development costs are charged to operations as they are incurred. Legal fees and other direct costs incurred in obtaining and protecting patents are expensed as incurred.

Revenue Recognition

Product sales revenue is recognized when the sales amount is determined, shipment of goods to the customer has occurred and collection is reasonably assured. Product is shipped FOB origination. Product royalty revenue is recognized when the licensee has reported the product sales to the Company. Product royalty revenue is calculated based upon the contractual percentage of reported sales.

Basic and Diluted Earnings (Loss) Per Common Share

Basic earnings (loss) per common share is computed by dividing income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period of computation. Diluted earnings (loss) per share give effect to all potential dilutive common shares outstanding during the period of compensation. The computation of diluted earnings (loss) per share does not assume conversion, exercise or contingent exercise of securities that would have an antidilutive effect on earnings. As of March 31, 2016, the Company had no potentially dilutive securities that would affect the loss per share if they were to be dilutive.

Comprehensive Income (Loss)

Total comprehensive income (loss) represents the net change in stockholders' equity during a period from sources other than transactions with stockholders and as such, includes net earnings (loss). For the Company, the components of other comprehensive income (loss) are the changes in the cumulative foreign currency translation adjustments and unrealized gains (losses) on marketable securities and are recorded as components of stockholders' equity.

5

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

NOTE 3 - COMMITMENTS AND CONTINGENCIES

Litigation

The Company may, from time to time, be involved in various legal disputes resulting from the ordinary course of operating its business. Management is currently not able to predict the outcome of any such cases. However, management believes that the amount of ultimate liability, if any, with respect to such actions will not have a material effect on the Company's financial position or results of operations.

Indemnities and Guarantees

During the normal course of business, the Company has made certain indemnities and guarantees under which it may be required to make payments in relation to certain transactions. These indemnities include certain agreements with the Company's officers, under which the Company may be required to indemnify such person for liabilities arising out of their employment relationship. The duration of these indemnities and guarantees varies and, in certain cases, is indefinite. The majority of these indemnities and guarantees do not provide for any limitation of the maximum potential future payments the Company could be obligated to make. Historically, the Company has not been obligated to make significant payments for these obligations and no liabilities have been recorded for these indemnities and guarantees in the accompanying consolidated balance sheet.

NOTE 4

–

NOTE PAYABLE, RELATED PARTIES

On March 6, 2015, the Company entered into a note payable with a shareholder for $110,940. The note payable accrues interest at 5 percent per annum, is due on March 31, 2016 and is unsecured.

NOTE 5

–

CONVERTIBLE NOTE PAYABLE

On May 11, 2015, the Company entered into an unsecured note payable for $50,000 (related to the Equity Purchase Agreement or

“

EPA

”

disclosed in Note 6) due on November 30, 2015 with interest accruing at 10% annually. The note payable was entered into as consideration to the investor for execution of the EPA. Accordingly, the Company recorded $50,000 to Deferred financing costs which will be amortized ratably over the period ending March 31, 2016. . As no equity was sold under the EPA as of June 30, 2015, no amortization of the Deferred financing costs was recorded during the year.

During the period ended March 31, 2016, the Company amortized $14,840 of the deferred financing costs.

On December 9, 2015, the Company agreed to change the terms of the note representing the deferred financing costs, making the note convertible and extending the repayment of the note as due on or before December 31, 2016. The repayment is subject to the convertible features of the note. The creditor has a conversion option allowing it to choose to receive repayment of the stated principal and interest (10% per annum) either in cash or, at the creditor

’

s option, in the Company

’

s restricted common stock. If paid in cash the principal repayment is $50,000.

On December 14, 2015, the Company issued 165,144 shares of common stock valued at $2,973 to pay the accrued interest on the note as interest expense. The change to a convertible note was treated as effective on December 9, 2015 and the value of the stock to be issued was included as accrued expense and interest was charged $4,954 during the quarter, based upon the trading value of the common stock at the date issued.

6

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

NOTE 5

–

CONVERTIBLE NOTE PAYABLE (CONTINUED)

In connection with the change in the status of the note, it was treated as a convertible note following extinguishment accounting. The Company identified embedded derivatives related to the Convertible Promissory Note entered into as of December 9, 2015. These embedded derivatives included certain conversion features, including a variable exercise price calculated by taking 60% the average of the 5 lowest days

’

closing bid prices in the 20 days leading up to conversion. The accounting treatment of derivative financial instruments requires that the Company record the fair value of the derivatives as of the inception date of the Convertible Promissory Note provisions and to adjust the fair value as of each subsequent balance sheet date. The fair value of the embedded derivative was determined using the Black-Scholes Model based on the following assumptions:

|

|

|

|

|

|

Dividend yield:

|

|

|

0

|

%

|

|

Volatility

|

|

|

157.93

|

%

|

|

Risk free rate:

|

|

|

0.49

|

%

|

The initial fair value of the derivative liability was $74,650, of which $50,000 was recorded as a debt discount against the $50,000 Convertible Promissory Note and $24,650 was recorded as derivative expense. On January 5, 2016, $23,700 in principal and $301 in accrued interest was converted into 2,000,114 shares of common stock. In March 2016, the Company repaid the remaining principal of $26,300 and additional interest of $9,820.

As a result of these transactions, the Company recognized a gain on fair value of derivative of $52,707, amortization expense of $50,000, initial derivative expense of $24,650 and additional paid-in capital of $21,943 during the period ending March 31, 2016.

NOTE 6

–

CAPITAL STOCK

Preferred Stock

–

The Company is authorized to issue 10,000,000 shares of preferred stock. No preferred stock has been issued so far. The authorized preferred shares are non-voting and the Board of Directors has not designated any liquidation value or dividend rates.

Common Stock

–

The Company is authorized to issue 250,000,000 shares of no par value common stock. The holders of the Company's common stock are entitled to one vote for each share held of record on all matters to be voted on by those stockholders.

On May 11, 2015, the Company entered into an equity purchase agreement (the

“

EPA

”

) with an unrelated investor (

“

the Investor

”

). The EPA is a put option contract wherein, at the Company

’

s sole discretion, up to $5,000,000 of common stock may be sold to the Investor for a period of 3 years ending May 2018. Under the terms of the EPA, the Company issued 208,333 shares pursuant to a put notice for $10,000 during the period ending September 30, 2015 (no shares during the year ended June 30, 2015). The put notice yielded $1,500 in cash against 37,037 of the 208,333 shares. In addition to these 37,037 shares, concurrent with the extension of the related $50,000 Convertible Promissory Note (see Note 5), the investor converted $2,973 in accrued interest into 165,144 shares leaving 6,152 shares held by the investor that are receivable by the Company.

During the nine months ended March 31, 2016, the Company sold 8,947,037 shares of its common stock for $321,860 in cash proceeds to five individuals and a Company director at an average price of $0.034 per share.

See Note 5 for common shares issued in conversion of convertible notes payable and accrued interest.

NOTE 7- INVESTMENT IN JOINT VENTURE AND NOTE PAYABLE

During the nine months ended March 31, 2016, the Company sold its interest in the Sastomed joint venture, for 6,250 Euros, resulting in a gain recorded in Other Income. The sale of the joint venture terminated the relationship with Sastomed. Accordingly, the note payable of $37,509, which was previously recorded as a related party note payable, is now classified as non-related party note payable. The note payable accrues interest at 4% annum and is due June 8, 2016.

NOTE 8

–

SUBSEQUENT EVENTS

Subsequent to March 31, 2016, the Company sold 6,151,000 shares of its common stock for approximately $96,500 in cash proceeds to two individuals and a Company director at an average price of $0.016 per share.

In accordance with ASC 855-10, the Company

’

s management has reviewed all material events and there are no additional material subsequent events to report.

7

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

Item 2 - Management's Discussion And Analysis Of Financial Condition And Results Of Operations

Forward-looking Statements

The following discussion of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the related notes thereto included elsewhere in this quarterly report. Some of the information in this quarterly report contains forward-looking statements, including statements related to anticipated operating results, margins, growth, financial resources, capital requirements, adequacy of the Company's financial resources, trends in spending on research and development, the development of new markets, the development, regulatory approval, manufacture, distribution, and commercial acceptance of new products, and future product development efforts. Investors are cautioned that forward-looking statements involve risks and uncertainties, which may affect our business and prospects, including but not limited to, the Company's expected need for additional funding and the uncertainty of receiving the additional funding, changes in economic and market conditions, acceptance of our products by the health care and reimbursement communities, new development of competitive products and treatments, administrative and regulatory approval and related considerations, health care legislation and regulation, and other factors discussed in our filings with the Securities and Exchange Commission.

GENERAL

Our mission is the development of novel and proprietary pharmaceutical, medical and cosmetic products. We develop our products through our German subsidiary, Sangui GmbH. Currently, we are seeking to market and sell our products through partnerships with industry partners worldwide.

Our focus has been the development of oxygen carriers capable of providing oxygen transport in humans in the event of acute and/or chronic lack of oxygen due to arterial occlusion, anemia or blood loss whether due to surgery, trauma, or other causes, as well as in the case of chronic wounds. We have thus far focused our development and commercialization efforts on such artificial oxygen carriers by reproducing and synthesizing polymers out of native hemoglobin of defined molecular sizes. In addition, we have developed external applications of oxygen transporters in the medical and cosmetic fields in the form of sprays for the healing of chronic wounds and of gels and emulsions for the regeneration of the skin. A wound dressing that shows outstanding properties in the support of wound healing, is distributed by SastoMed GmbH, a former joint venture company in which we held a share of 25%, as global licensee under the Granulox brand name. Effective End of second quarter of our fiscal year 2016 we sold this stake to SanderStrohmann GmbH, the co-shareholder.

SanguiBioTech GmbH holds distribution rights for our Chitoskin wound pads for the European Union and various other countries. A European patent has been granted for the production and use of improved Chitoskin wound pads.

Our current key business focuses are: (a) selling our existing cosmetics and wound management products by way of licensing through distribution partners, or by way of direct sale, to end users; (b) identifying additional industrial and distribution partners for our patents, production techniques, and products; and, (c) obtaining the additional certifications on our products in development.

Artificial Oxygen Carriers

SanguiBioTech GmbH develops several products based on polymers of purified natural porcine hemoglobin with oxygen carrying abilities that are similar to native hemoglobin. These are (1) oxygen carrying blood additives and (2) oxygen carrying blood volume substitutes.

During the first quarter of our 2013 financial year the European Patent Office granted a patent based on Sangui

’

s application (01 945 245)

“

Mammalian hemoglobin compatible with blood plasma, cross-linked and conjugated with polyalkylene oxides as artificial medical oxygen carriers, production and use thereof

”

.

During the third quarter of our 2013 financial year the company had a feasibility study prepared by external experts inquiring into market potentials and further preclinical and clinical development requirements. The study

8

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

came to the conclusion that an approval of Sangui's hemoglobin hyperpolymers as a blood additive appears possible, expedient and promising.

During the fourth quarter of our 2014 financial year the company filed a patent application aimed at significantly expanding the protection of our hemoglobin formulations. It will encompass a greater array of ischemic conditions of the human body, for instance in the case of severe dysfunctions of the lung.

During the first quarter of our 2015 financial year, we began together with Excellence Cluster Cardio-Pulmonary System (ECCPS) and TransMIT Gesellschaft für Technologietransfer mbH (TransMIT) to investigate therapeutic approaches to treating septic shock and acute respiratory distress syndrome (ARDS). The approach adopted here by Sangui, ECCPS and TransMIT presupposes that self-perpetuating septic shock, that has so far been highly resistant to treatment, can be interrupted by Sangui's artificial haemoglobin-based oxygen carrier, which would ultimately lower mortality rates. The preclinical trials commenced at ECCPS investigate the effect of various haemoglobin preparations on the oxygen supply of a number of organs in septic shock models and ARDS.

Also during the first quarter we were notified that the period for objection against European Patent EP 2550973,Wound Spray

“

) elapsed without any objection being raised. The patent, therefore, has become effective and legally binding.

During the second quarter of our 2015 financial year the first phase of preclinical trials was concluded successfully. It could be demonstrated that applying an oxygen-carrying liquid (the hemoglobin hyperpolymer formulation SBT102) in the abdomen did significantly improve the oxygen supply to the intestines. The restoration of intestinal oxygenation will have an impact on tissue integrity and ultimately on patient survival.

During the third quarter of our 2015 financial year the preclinical trials were concluded successfully, the final results did fully confirm the interim results obtained in the second quarter.

After the end of the first quarter of our 2016 financial year the Company decided to reduce research and development activities for this product range as one element of a comprehensive cost containment program.

According to regulatory requirements, all drugs must complete preclinical and clinical trials before approval (e.g. Federal Drug Administration approval) and market launch. The Company

’

s management believes that the European and FDA approval process will take at a minimum several years to complete.

9

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

Nano Formulations for the Regeneration of the Skin

Healthy skin is supplied with oxygen both from the inside as well as through diffusion from the outside. A lack of oxygen will cause degenerative alterations, ranging from premature aging, to surface damage, and even as extensive as causing open wounds. The cause for the lack of oxygen may be a part of the normal aging process, but it may also be caused by burns, radiation, trauma, or a medical condition. Impairment of the blood flow, for example caused by diabetes mellitus or by chronic venous insufficiency, can also lead to insufficient oxygen supply and the resulting skin damage.

Sales of this series have remained at a low level throughout the first nine months of our 2016 fiscal year. During the first quarter of the 2016 fiscal year we decided to decrease our operations in this particular segment and to abandon the patent protection for this range of products.

Chitoskin Wound Pads

Usually, normal (

“

primary

”

) wounds tend to heal over a couple of days without leaving scars following a certain sequence of phases. Burns and certain diseases impede the normal wound healing process, resulting in large, hardly healing (

“

secondary

”

) wounds which only close by growing new tissue from the bottom. Wound dressings serve to safeguard the wound with its highly sensitive new granulation tissue from mechanical damage as well as from infection. Using the natural polymer chitosan, Sangui

’

s Chitoskin wound dressings show outstanding properties in supporting wound healing.

It is the strategy of the company to find industry partners ready to acquire or license this product range as a whole.

Hemospray Wound Spray

SanguiBioTech GmbH has developed a novel medical technology supporting the healing of chronic wounds. Lack of oxygen supply to the cells in the wound ground is the main reason why those wounds lose their genuine healing power. Based on its concept of artificial oxygen carriers, our wound spray product bridges the watery wound surface and permits an enhanced afflux of oxygen to the wound ground.

In December 2010, SanguiBioTech GmbH established SastoMed GmbH, a joint venture company with SanderStrothmann GmbH of Georgsmarienhütte, Germany. SanguiBioTech GmbH has granted SastoMed GmbH global distribution rights. SastoMed GmbH started to distribute the product in Germany after having obtained the CE mark authorizing the distribution of the wound spray in the countries of the European Union in April 2012.

In August, 2012, Sangui BioTech GmbH and SastoMed GmbH cordially adjusted the existing sales strategy. In consideration of corresponding contributions the existing licensing contract was partially complemented resulting in the following conditions: As licensor SanguiBioTech GmbH is awarded a fixed licensing fee as a percentage of each and every external revenues incurred by SastoMed from sales of the Granulox product (based on SastoMed selling prices). The percentage ranges in the uppermost zone of what is usually granted in the pharmaceutical and medical products industries. In addition and complementing this basic agreement the percentage will be permanently increased by one fourth of the current rate as soon as cumulated sales revenues at SastoMed will have exceeded the total of

€

50,000,000.

Since December 2013, international distribution outside Germany was initiated in collaboration with local partners in more than 40 countries in Europe and Latin American.

SastoMed GmbH at the end of the first quarter of fiscal 2016 informed the Company and its shareholders that the market entry phase for the product will last longer than expected and could extend into the Company's 2018 fiscal year.

FINANCIAL POSITION

During the nine months ended March 31, 2016, our total assets increased $17,191 from $122,099 at June 30, 2015 to $139,290 at March 31, 2016. An increase in the cash on hand from June 30 2015, to March 31, 2016, of $34,114 was primarily responsible for the increase in the total assets.

We funded our operations primarily through our existing cash reserves and cash received from the issuance of shares of common stock. Our stockholders

’

equity (deficit) decreased by $115,902 from ($339,834) at June 30, 2015 to ($223,932) at March 31, 2016. The primary factor behind this was due to the issuance of stock for cash for $321,860, as well as an increase in accumulated other comprehensive income due to movements in the foreign exchange rate.

RESULTS OF OPERATIONS

For the three-month and the nine- month periods ended March 31, 2016 and 2015:

REVENUES

–

Revenues reported were $10,149 and $11,654 for the three months ended March 31, 2016 and 2015 respectively. For the nine months ended March 31, 2016 and 2015 revenues were $37,005 and $116,560. Revenues decreased by $1,505 and $79,555 for the three and nine months ended March 31, 2016. The decrease by $79,555 from the revenues in the comparable period of our 2015 financial year can be traced back to a decrease in royalties from the licensing agreement with SastoMed GmbH. Included in the revenues of the first nine months of our 2015 financial year were license fees on one single large order. Cost of sales in the third quarter were $43 and $91 for the three months ended March 31, 2016 and 2015 respectively. Cost of sales for the nine months amounted to $272 compared to $489 for the years ended 2016 and 2015.

RESEARCH AND DEVELOPMENT

–

Research and development expenses decreased by $34,749 to $1,701 from $36,450 for the three month periods ending March 31, 2016 and 2015. Research and development expenses decreased $134,219 to approximately $37,208 in the first three quarters of our 2016 financial year from approximately $171,427 in the comparable period of the previous year. This decrease is mainly attributed to lower R&D expenses after the conclusion of the animal tests of our hemoglobin hyperpolymers.

GENERAL AND ADMINISTRATIVE and PROFESSIONAL FEES

–

For the three months ended March 31, 2016 and 2015 the combined general and administrative expenses and professional fees decreased by $80,627 to $79,925 from $169,552. Accumulated general and administrative expenses and professional fees decreased $200,195 to approximately $320,635 in the nine months ended March 31, 2016, from approximately $520,830 in the respective period of the previous year.

DEPRECIATION AND AMORTIZATION

–

Deferred financing costs were amortized during the three and nine months ended March 31, 2016. Deferred financing costs for the three month period ended March 31, 2016 and 2015 were $4,155 and $0. For the nine months ended March 31, 2016 and 2015 costs were $12,557 and $0, respectively.

INTEREST EXPENSE - Interest expenses for the three month period ended March 31, 2016 and 2015 were $13,098 and $1,127, an increase of $11,971 For the nine months ended March 31, 2016 and 2015, interest expense increased by $26,487to $29,425 from $2,938.

NET LOSS - As a result of the above factors, $

343,454

compared to $

537,282

for the three months ended March 31, 2016 and 2015 respectively. The loss per share for both periods was $(0.00). Our consolidated net loss before non-controlling interest was $365,387, or $(0.00) per common share, for the nine months ended March 31, 2016, compared to $579,088, or $(0.00) per common share, during the comparable period in our 2015 financial year.

LIQUIDITY AND CAPITAL RESOURCES

For the nine months ended March 31, 2016, net cash used in operating activities decreased $90,687 to $354,870, compared to $445,557

used

in the previous year. Major components of the decrease in the cash used included a decrease in the net loss from $(579,088) to $(365,387) from 2015 to 2016.

We had a working capital deficit of approximately $223,932 at March 31, 2016, a decrease of approximately $115,962 from June 30, 2015.

At March 31, 2016, a significant part of our current assets consist of unamortized deferred finance costs of $35,160. At March 31, 2016 compared to June 30, 2015, we had cash of $51,786 compared to $17,672, prepaid expenses of $41,546 compared to $37,325 and accounts receivable of $10,798 compared $455. We will need substantial additional funding to fulfill our business plan and we intend to explore financing sources for our future development activities. No assurance can be given that these efforts will be successful.

Item 3 - Quantitative and Qualitative Disclosures about Market Risk

We are a smaller reporting company as defined by § 229.10(f)(1) and are not required to provide the information under this item.

Item 4 - Controls and Procedures

Disclosure Controls and Procedures

As of the date of the end of the period covered by this report, our Chief Executive Officer and Chief Financial Officer conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as required by Exchange Act Rule 13a-15. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified by the SEC

’

s rules and forms.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC

’

s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer and our Chief Financial Officer, to allow timely decisions regarding required disclosure.

10

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

Changes in Internal Control Over Financial Reporting

There has been no change in our internal control over financial reporting that occurred during our last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

The term

“

internal control over financial reporting

”

is defined as a process designed by, or under the supervision of, the registrant

’

s principal executive and principal financial officers, or persons performing similar functions, and effected by the registrant

’

s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

(a)

11

SANGUI BIOTECH INTERNATIONAL, INC.

Notes to the Condensed Consolidated Financial Statements

March 31, 2016 and June 30, 2015

(Unaudited)

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the registrant;

(b)

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the registrant are being made only in accordance with authorizations of management and directors of the registrant; and

(c)

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the registrant

’

s assets that could have a material effect on the financial statements.

PART II - OTHER INFORMATION

Item 1 - Legal Proceedings

The Company is not aware of pending claims or assessments which may have a material adverse impact on the Company

’

s financial position or results of operations.

Item 1a - Risk Factors

We are a smaller reporting company and are not required to provide the information under this item.

Item 2 - Unregistered Sales of Equity Securities and Use Of Proceeds

On January 5, 2016, the Company issued 2,000,114 shares of its common stock in consideration of the conversion of $24,001 of principal and interest on the unsecured note payable for $50,000 dated May 11, 2015 made in favor of Tarpon Bay Partners, LLC. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

In January 2016, the Company sold 3,410,000 shares of its common stock for cash to three individuals at an average price of $0.016 per share for a total cash raise of $55,104. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

In February 2016, the Company sold 2,000,000 shares of its common stock for cash to one individual at an average price of $0.015 per share for a total cash raise of $29,590. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

Subsequent to the period covered by this report, the Company sold 6,151,000 shares of its common stock for cash to two individuals and one of its directors at an average price of $0.016 per share for a total cash raise of $96,500. No underwriters were used. The securities were sold pursuant to an exemption from registration provided by Regulation S and Section 4(2) of the Securities Act of 1933. The certificate representing the shares contained a restricted legend.

Item 3 - Defaults Upon Senior Securities

None.

Item 5 - Other Information

None.

Item 6

–

Exhibits

1.

Financial Statements.

The unaudited condensed consolidated Balance Sheet of Sangui Biotech International, Inc. as of March 31, 2016 and the audited balance sheet as of June 30, 2015, the unaudited condensed consolidated Statements of Operations for the three and nine month periods ended March 31, 2016 and 2015, and the unaudited condensed consolidated Statements of Cash Flows for the three and nine month periods ended March 31, 2016 and 2015, together with the notes thereto, are included in this Quarterly Report on Form 10-Q.

2.

Exhibits

. The following exhibits are either filed as a part hereof or are incorporated by reference. Exhibit numbers correspond to the numbering system in Item 601 of Regulation S-K.

Exhibit

Number Description of Exhibit

|

|

|

31.01

|

Certification of CEO Pursuant to Rule 13a-14(a) and 15d-14(a), filed herewith

|

|

31.02

|

Certification of principal financial officer Pursuant to Rule 13a-14(a) and 15d-14(a), filed herewith

|

|

32.01

|

Certification Pursuant to Section 1350 of Title 18 of the United States Code, filed herewith

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

SANGUI BIOTECH INTERNATIONAL, INC.

Dated: May 23, 2016

/s/ Thomas Striepe

By: Thomas Striepe

Chief Executive Officer

12

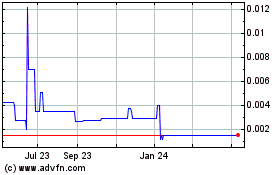

Sangui Biotech (CE) (USOTC:SGBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sangui Biotech (CE) (USOTC:SGBI)

Historical Stock Chart

From Apr 2023 to Apr 2024