EmergingGrowth.com Reports On The Value Of A Subscriber To App Co. Focus on Friendable, Inc. Also Terra Tech Corp., Orbital T

May 19 2016 - 8:00AM

InvestorsHub NewsWire

Miami, FL -- May 19, 2016 -- InvestorsHub

NewsWire – EmergingGrowth.com, a leading independent small cap

media portal with an extensive history of providing unparalleled

content for the Emerging Growth markets and companies, reports on

the Value of a User to an App company with focus on Friendable Inc.

(OTC: Pink: FDBL), Also - Terra Tech Corp. (OTCQX:

TRTC), Orbital

Tracking Corp. (OTCQB: TRKK), and Integra Gold Corp. OTCQX:

ICGQF).

Friendable Inc. (OTC Pink:

FDBL)

Friendable Inc. is the mobile-social network

focused on the future, rather than sharing the past, where it's all

about having location specific and nearby opportunities to connect

with others. The Friendable brand represents a friends first

approach and takes all the pressure off for its users, making it

simple to make new connections, create meet up style events or

simply tell others what you are "Friendable for."

On April 19, Friendable, Inc. (OTC

Pink: FDBL) announced that its Friendable app had surpassed the 1

million downloads milestone and in addition, at that time, there

were 708,760 registered users which gave great validation to the

widespread acceptance of the Friendable App and its brand.

This came in just days after the company announced a 558% increase

in new downloads over the previous months of January and February

2016.

FDBL, was contacted by the Kluger

Agency (TKA) who had worked on many successful strategic

relationships with companies like PlentyOfFish.com and Tinder.

Earlier this year, Friendable, Inc. entered into an agreement to

retain TKA to identify and secure relationships with music

celebrities as well as integrate the Friendable App into music

videos with Major A-List recording artists.

As a result, the Friendable app

was featured in the new Jennifer Lopez music video “Ain’t Your

Mama”. You can see the video here: http://emerginggrowth.com/2016/05/06/friendablel-app-featured-in-jennifer-lopez-new-aint-your-mama-video/

In addition to the Friendable App being

exposed to JLo’s 35 million Twitter, 45

million Facebook and 44 million Instagram followers, in the “Ain’t

Your Mama” video, the Friendable name has also been featured along

with JLo's in online articles seen on Page Six, Spin, Yahoo, and

Fox News.

Friendable

has been announcing their explosive download and new user data

following the end of the month and we are excited to see how Jlo

has affected its users to date.

TKA

specializes in working with clients to partner products with

celebrities like Jennifer Lopez, Lady Gaga, Britney

Spears, Flo Rida, Eminem, Christina Aguilera, Alicia Keys, and

Meghan Trainor, elevating brands to unparalleled

results.

Celebrity recording artist Redfoo shot out on

Instagram just a few days ago, “Yea Babies, meet me on Friendable.

Great app for getting ahold of me and the Party Rock Crew” https://www.instagram.com/p/BFWyzA_izMX/

Downloads in the US and Canada are up

substantially and the Friendable App is Climbing. The

Friendable App spiked to the 3rd most downloaded app

against all paid (Apple App Store) social networking apps in

Canada, and 57th in the US.

The

Company has also seen a dramatic increase in its free app user

session times (time spent in app) over previous months and shows a

100% increase internally. Industry standard is approximately 35

seconds on iOS social networking apps. Friendable's current user

base consistently topped 1 minute for the month of May

2016. (Source: Flurry)

As we

see TKA introduce more celebrities to get on the Friendable

bandwagon, we expect the Friendable uses to grow

exponentially.

So, what

is the value of a user?

Here are

some recent examples of valuations placed on other relationship

based platforms and apps.

OKCupid.com

Founded by four students at

Harvard University founded OKCupid.com (Originally TheSpark.com) In

1999. In February 2011, Match.com announced that it had acquired

OKCupid.com for $50 million in cash. At the time, OKCupid had

3.5 million users or a $14.00 per user valuation.

Tinder.com

Tinder app, founded in 2012 was

valued by Merrill Lynch at 1.35 billion in July of 2015 following

the increase in its majority stake by in 2014. This was based

on 50 million users at a $27 per user valuation. However,

Merrill added that this estimate was below the $33 and $42 per user

that Facebook paid for Instagram and WhatsApp

respectively.

Story continued here:

http://emerginggrowth.com/2016/05/18/whats-a-user-worth-focus-on-friendable-inc-otc-pink-fdbl/

Terra Tech Corp. (OTCQX:

TRTC)

Shares of marijuana company, Terra Tech Corp.

(OTCQX: TRTC) were down as much as 10% in the early hours of

trading on May 18, 2016. Within the first hour of trading, nearly

1.8 million shares have changed hands or around $400,000 in dollar

volume.

The declines in Terra Tech Corp. (OTCQX: TRTC)

come after the company reported first quarter earnings last week on

May 12th, that were overall strong. The marijuana

company reportedly generated $1.5 million in revenues during the

first quarter 2016, versus $763,000 in total revenue during the

first quarter in 2015. However, gross margins saw a hefty drop from

29% in Q1 2015 to 9% in Q1 2016. The drop in gross margins was

blamed on higher research and development costs regarding Terra

Tech Corp. (OTCQX: TRTC)’s marijuana concentrate

initiatives.

Story Continued here:

http://emerginggrowth.com/2016/05/18/terra-tech-corp-otc-trtc-sheds-as-much-as-10-in-early-trading/

Orbital Tracking Corp

(OTCQB: TRKK)

With an average dollar volume of only about

$30,000 per day, and a 97% decline over the past 5 months, Orbital

Tracking Corp (OTCQB: TRKK) was quick to get moving on the

announcement of its profitable first quarter for

2016.

Upon the announcement that for the first

quarter ended March 31, 2016, consolidated revenues increased by

62% to approximately $1,295,264 as compared to $799,698 reported

for the quarter ended March 31, 2015.

Comparable revenue increased 35.8% and 204.9%

for the Company’s wholly owned subsidiaries, GTC and Orbital Satcom

Corp., for the three months ended March 30, 2016. Total sales for

GTC were $922,223 for the three months ended March 31, 2016 as

compared to $679,112 for the three months ended March 31, 2015, an

increase of $243,111 or 35.8%. Total sales for Orbital Satcom Corp.

were $367,771 for the three months ended March 31, 2016 as compared

to $120,586 for the three months ended March 31, 2015, an increase

of $247,185 or 205%.

Results in the quarter were driven by the

addition of new international marketplaces, continued growth across

all geographies and the addition of increasing recurring revenue

derived from a 33.1% increase in monthly contract customers versus

the year ago period. Sales in the quarter at the Company’s

third-party e-commerce sites increased by 63.5% in the UK, by 21.4%

in the EU and by 5.0% in the US.

Net income for the quarter ended March 31,

2016 was approximately $59,946 as compared to a net loss of

approximately $421,982 in the comparable quarter of 2015.

Comprehensive income was $61,985 for the quarter, as the Company

recorded a gain for foreign currency translation adjustments for

the three months ended March 31, 2016 of $2,039, as compared to a

comprehensive loss of $422,466, for the three months ended March

31, 2015.

Orbital’s stock traded up 63% on about $75,000

in dollar volume on the announcement with follow up on Tuesday to

the tune of 244% gains on just under $2 million in dollar

volume.

Story continued here:

http://emerginggrowth.com/2016/05/18/after-a-five-month-97-decline-orbital-tracking-corp-otcqb-trkk-sees-the-light-at-the-end-of-the-tunnel/

Integra Gold Corp. (OTCQX:

ICGQF)

Integra Gold Corp. (OTCQX: ICGQF) is seeing

heavy volume in the first hour of trading on May 18th,

pushing shares lower by nearly 5%. Around 420,000 shares have

exchanged hands early today, or around $235,000 in dollar

volume.

The junior gold exploring and mining company

mostly operates in Canada through the Lamaque Gold Project and

Triangle, where Integra Gold Corp. (OTCQX: ICGQF) has five active

drills. The gold company released an update on May 12, 2016 shows

the company is continuing to find massive deposits as the drilling

phase progresses. Integra Gold Corp. (OTCQX: ICGQF) began drilling

on the Triangle and Lamaque Gold Project in September 2015. The

following is a summary of the exploration results recently

announced:

2015/2016 Exploration

Summary

A total of 93,592 m in 203 drill holes was

completed at Lamaque in 2015 of which 59,753 m in 104 drill holes

was conducted at Triangle. In 2016 a total of 65,000 m in 159 drill

holes have thus far been completed at Lamaque South. Drilling is

ongoing at Lamaque with 5 drill rigs currently in

operation.

Story continued here:

http://emerginggrowth.com/2016/05/18/shares-of-integra-gold-corp-otcqx-icgqf-fall-5-on-heavy-volume-in-early-trading/

Emerging

Growth has launched a new page dedicated to Caveat Emptor

Status. You can view it here:

http://emerginggrowth.com/caveat-emptor-status-changes/

About

EmergingGrowth.com

EmergingGrowth.com is a leading independent

small cap media portal with an extensive history of providing

unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a

niche in identifying companies that can be overlooked by the

markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging

Growth info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our Parent Company, we also have the

ability to facilitate road shows to present your products and

services to the most influential investment banks in the

space.

Disclaimer

All

information contained herein as well as on the EmergingGrowth.com

website is obtained from sources believed to be reliable but not

guaranteed to be accurate or all-inclusive. All material is for

informational purposes only, is only the opinion of

EmergingGrowth.com and should not be construed as an offer or

solicitation to buy or sell securities. The information

may include certain forward-looking statements, which may be

affected by unforeseen circumstances and / or certain

risks. EmergingGrowth.com may either hold a stock

position in or have been compensated by or for a company or

companies discussed in this article. EmergingGrowth.com does not

have a stock position in any securities discussed in this

article. Please view our full disclosure which can be found

here, http://www.emerginggrowth.com/disclosure-3325/.

Please

consult an investment professional before investing in anything

viewed within. When EmergingGrowth.com is long shares it will sell

those shares. In addition, please make sure you read and understand

the Terms of Use, Privacy Policy and the Disclosure posted on the

EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: EmergingGrowth1@gmail.com

SOURCE: EmergingGrowth.com –

www.EmergingGrowth.com

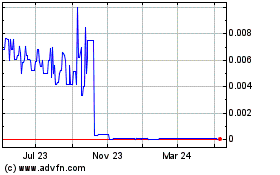

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Apr 2024 to May 2024

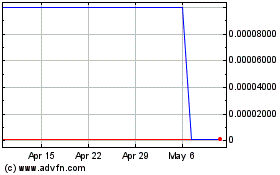

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From May 2023 to May 2024