Conference Call and Webcast Today at 4:30

p.m. ET

- Royalty revenue from

paritaprevir-containing regimens was $13.0 million

- Cash and marketable securities

totaled $245.6 million at March 31, 2016

Enanta Pharmaceuticals, Inc., (NASDAQ:ENTA), a research and

development-focused biotechnology company dedicated to creating

small molecule drugs for viral infections and liver diseases, today

reported financial results for its fiscal second quarter ended

March 31, 2016.

Enanta’s cash, cash equivalents and short-term and long-term

marketable securities totaled $245.6 million at March 31, 2016.

This compares to a total of $209.4 million in such accounts at

September 30, 2015. Enanta expects that its current cash, cash

equivalents and marketable securities will be sufficient to meet

the anticipated cash requirements of its existing business for the

foreseeable future.

Fiscal Second Quarter Ended March 31, 2016 Financial

Results

Revenue for the three months ended March 31, 2016 was $13.0

million, compared to $57.4 million for the three months ended March

31, 2015. For the six months ended March 31, 2016, revenue was

$61.4 million compared to revenue of $134.9 million for the same

period in 2015. The decrease in revenue in the 2016 periods was due

primarily to the fact that revenue in the comparable periods in

2015 included the $50.0 million milestone payment earned in January

2015 for the European commercialization regulatory approval of

VIEKIRAX™, and the six-month period in 2015 also included the $75.0

million milestone earned in December 2014 for the approval of

VIEKIRA PAK® in the United States. The revenue decrease for the six

month period due to the decrease in milestone payments was

partially offset by higher royalties earned during the first half

of fiscal 2016 from contractually specified portions of AbbVie’s

worldwide net sales of HCV regimens containing paritaprevir. Enanta

began earning royalties from AbbVie upon its HCV product launch in

Enanta’s first fiscal quarter of 2015. Enanta’s milestone payments,

royalties and other payments received from collaborations have

varied significantly from period to period, and are expected to

continue to do so.

Research and development expenses totaled $9.1 million for the

three months ended March 31, 2016, compared to $5.4 million for the

three months ended March 31, 2015. For the six months ended March

31, 2016, research and development expenses were $18.2 million,

compared to $9.9 million for the same period in 2015. The increase

in the three and six month periods was primarily due to increased

pre-clinical and clinical costs associated with Enanta’s

wholly-owned R&D programs in NASH, RSV, HBV and HCV

cyclophilin.

General and administrative expenses totaled $4.4 million for the

three months ended March 31, 2016, compared to $3.4 million for the

three months ended March 31, 2015. For the six months ended March

31, 2016, general and administrative expenses were $8.2 million

compared to $6.2 million for the same period in 2015. The increase

in the three and six month periods primarily reflects increases in

stock-based compensation expense driven by increased headcount and

additional equity grants.

Income tax expense for the three months ended March 31, 2016 was

$1.6 million compared to $20.0 million for the corresponding period

in 2015. During the three months ended March 31, 2016, Enanta

increased its estimate of its annual effective tax rate for fiscal

2016, which resulted in an income tax provision despite a pre-tax

loss for the quarter. Income tax expense for the six months ended

March 31, 2016 was $11.3 million compared to $48.5 million for the

corresponding period in 2015, representing annual effective tax

rates of 31.5% and 40.7%, respectively, for those periods. For the

six months ended March 31, 2016, Enanta’s effective tax rate was

lower than that in the comparable period of 2015 primarily due to

lower state income taxes and higher federal research and

development tax credits, which are factored into the annual

effective tax rate.

Net loss for the three months ended March 31, 2016 was $1.6

million, or ($0.09) per diluted common share, compared to net

income of $28.8 million or $1.49 per diluted common share, for the

corresponding period in 2015. Net income for the six months ended

March 31, 2016 was $24.5 million, or $1.28 per diluted common

share, compared to net income of $70.8 million or $3.67 per diluted

common share, for the corresponding period in 2015.

“Enanta remains in a strong financial position and continues to

receive royalties from paritaprevir-containing regimens marketed

globally,” commented Jay R. Luly, Ph.D., President and Chief

Executive Officer. “These ongoing royalties and our strong cash

balance will continue to support our wholly-owned programs,

including our cyclophilin candidate, EDP-494, currently in phase 1

development, and our NASH candidate, EDP-305, which is expected to

begin phase 1 clinical development in the second half of calendar

2016.”

Development Program and Business Review

- In April, new data on Enanta’s second

protease inhibitor, ABT-493, co-formulated in combination with

AbbVie’s NS5A inhibitor ABT-530, was presented at The Liver Meeting

in Barcelona, Spain. Selected data from the SURVEYOR 1 and 2

studies demonstrated:

- 97-98 percent SVR12 with eight weeks of

treatment in genotypes 1, 2 or 3 HCV patients without

cirrhosis;

- 100 percent SVR12 with 12 weeks of

treatment in difficult-to-treat genotype 3 patients with

compensated cirrhosis (Child-Pugh A) new to therapy; and

- 100 percent SVR12 with 12 weeks of

treatment in genotypes 4, 5 or 6 patients without cirrhosis;

eight-week treatment duration is also being investigated in these

genotypes in this ongoing study.

- A phase 1 clinical trial of EDP-494,

Enanta’s cyclophilin inhibitor targeted to treat RAVs, DAA failures

and other hard to treat populations, is ongoing and Enanta plans to

initiate a proof-of-concept study next quarter.

- In April, Enanta Pharmaceuticals

announced that the U.S. FDA had approved AbbVie’s supplemental New

Drug Application for use of VIEKIRA PAK® without ribavirin in

genotype 1b chronic hepatitis C patients with compensated cirrhosis

(Child Pugh-A), which followed earlier approval in the European

Union of AbbVie’s VIEKIRAX® + EXVIERA® for similar genotype 1b

patients.

- Enanta is on track to initiate a phase

1 clinical trial in the second half of calendar 2016 with EDP-305,

Enanta’s wholly-owned Farnesoid X Receptor (FXR) agonist candidate

for non-alcoholic steatohepatitis (NASH) and Primary Biliary

Cholangitis (PBC).

Upcoming Events and Presentations

- June 7-10, 2016 - Jefferies 2016

Healthcare Conference, New York

- June 21-22, 2016 - JMP Securities Life

Sciences Conference, New York

- Enanta plans to issue its fiscal third

quarter financial results press release, and hold a conference call

regarding those results, during the week of August 8, 2016.

Conference Call and Webcast Information

Enanta will host a conference call and webcast today at 4:30

p.m. Eastern time. To participate in the live conference call,

please dial (855) 840-0595 in the U.S. or (518) 444-4814 for

international callers. A replay of the conference call will be

available starting at approximately 7:30 p.m. Eastern time on May

9, 2016, through 11:59 p.m. Eastern time on May 13, 2016 by dialing

(855) 859-2056 from the U.S. or (404) 537-3406 for international

callers. The passcode for both the live call and the replay is

99296308. A live audio webcast of the call and replay can be

accessed by visiting the “Calendar of Events” section on the

“Investors” page of Enanta’s website at www.enanta.com.

About Enanta

Enanta Pharmaceuticals is a research and development-focused

biotechnology company that uses its robust chemistry-driven

approach and drug discovery capabilities to create small molecule

drugs for viral infections and liver diseases. Enanta’s research

and development is currently focused on four disease targets:

Hepatitis C Virus (HCV), Hepatitis B Virus (HBV), Non-alcoholic

Steatohepatitis (NASH) and Respiratory Syncytial Virus (RSV).

Enanta has developed novel protease inhibitors and NS5A

inhibitors that are members of the direct-acting-antiviral (DAA)

inhibitor classes designed for use against the hepatitis C virus

(HCV). Enanta’s protease inhibitors, developed through its

collaboration with AbbVie, include paritaprevir, which is contained

in AbbVie’s marketed DAA regimens for HCV, and ABT-493, Enanta’s

second protease inhibitor, which AbbVie is developing in phase 3

studies in combination with ABT-530, AbbVie’s NS5A inhibitor.

Enanta has also discovered a cyclophilin inhibitor, EDP-494, a

novel, host-targeting mechanism for HCV, which is now in phase 1

clinical development, and EDP-305, an FXR agonist, which Enanta

plans to advance into clinical development for NASH later in 2016.

Please visit www.enanta.com for more information on Enanta’s

programs and pipeline.

Forward Looking Statements Disclaimer

This press release contains forward-looking statements,

including statements with respect to the prospects for future

royalties on sales of AbbVie’s HCV treatment regimens containing

paritaprevir, the prospects for AbbVie’s development and regulatory

approval of a new regimen containing ABT-493, the prospects for

further clinical development of Enanta’s cyclophilin inhibitor for

the treatment of HCV, the prospects for advancing EDP-305 for the

treatment of NASH into clinical trials, the prospects for

advancement of another program in HBV or RSV, and the projected

sufficiency of Enanta’s cash-equivalent resources and marketable

securities. Statements that are not historical facts are based on

management’s current expectations, estimates, forecasts and

projections about Enanta’s business and the industry in which it

operates and management’s beliefs and assumptions. The statements

contained in this release are not guarantees of future performance

and involve certain risks, uncertainties and assumptions, which are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed in such forward-looking

statements. Important factors and risks that may affect actual

results include: Enanta’s revenues in the short-term are dependent

upon the success of AbbVie’s continuing commercialization efforts

for its HCV treatment regimens containing paritaprevir; Enanta’s

longer term revenues will be dependent upon the success of AbbVie’s

planned clinical development and commercialization of its

investigational regimen containing ABT-493; regulatory actions

affecting any approval of an HCV treatment regimen containing

ABT-493; competitive pricing, market acceptance and reimbursement

rates of AbbVie’s treatment regimens containing paritaprevir or

ABT-493 compared to competitive HCV products on the market and

product candidates of other companies under development; the

discovery and development risks of early stage discovery efforts in

new disease areas such as HBV, NASH and RSV; potential competition

from the development efforts of others in those new disease areas,

as well as HCV; Enanta’s lack of clinical development experience;

Enanta’s need to attract and retain senior management and key

scientific personnel; Enanta’s need to obtain and maintain patent

protection for its product candidates and avoid potential

infringement of the intellectual property rights of others; and

other risk factors described or referred to in “Risk Factors” in

Enanta’s most recent Form 10-K for the fiscal year ended September

30, 2015 and other periodic reports filed more recently with the

Securities and Exchange Commission. Enanta cautions investors not

to place undue reliance on the forward-looking statements contained

in this release. These statements speak only as of the date of this

release, and Enanta undertakes no obligation to update or revise

these statements, except as may be required by law.

ENANTA PHARMACEUTICALS, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except

per share amounts) Three Months Ended

Six Months Ended March 31, March 31,

2016 2015

2016 2015 Revenue

$ 13,004 $ 57,367 $ 61,449 $ 134,865 Operating expenses Research

and development 9,143 5,368 18,176 9,887 General and administrative

4,426 3,438 8,244

6,207 Total operating expenses 13,569

8,806 26,420 16,094 Income

(loss) from operations (565 ) 48,561 35,029 118,771 Other income,

net 472 210 801

511 Income (loss) before income taxes (93 ) 48,771 35,830

119,282 Income tax expense (1,552 ) (20,018 )

(11,286 ) (48,520 ) Net income (loss) $ (1,645 ) $ 28,753

$ 24,544 $ 70,762 Net income (loss) per share

Basic $ (0.09 ) $ 1.54 $ 1.30 $ 3.80 Diluted $ (0.09 ) $ 1.49 $

1.28 $ 3.67 Weighted average common shares outstanding Basic 18,921

18,680 18,848 18,641 Diluted 18,921 19,269 19,225 19,276

ENANTA PHARMACEUTICALS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands)

March 31, September 30, 2016

2015 Assets Current assets Cash and cash equivalents

$ 56,360 $ 21,726 Short-term marketable securities 164,062 123,479

Accounts receivable 13,004 15,289 Unbilled receivables - 433

Deferred tax assets 1,581 1,447 Prepaid expenses and other current

assets 7,658 8,267 Total current assets 242,665

170,641 Property and equipment, net 7,691 5,886 Long-term

marketable securities 25,224 64,238 Deferred tax assets 5,407 4,640

Restricted cash 608 608 Total assets $ 281,595 $

246,013 Liabilities and Stockholders' Equity Current liabilities

Accounts payable $ 2,572 $ 1,543 Accrued expenses and other current

liabilities 2,632 3,962 Income taxes payable 6,784

1,199 Total current liabilities 11,988 6,704 Warrant liability

1,223 1,276 Series 1 nonconvertible preferred stock 156 163 Other

long-term liabilities 1,813 1,713 Total liabilities

15,180 9,856 Total stockholders' equity

266,415 236,157 Total liabilities and stockholders' equity $

281,595 $ 246,013

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160509006487/en/

Investor ContactEnanta Pharmaceuticals, Inc.Carol Miceli,

617-607-0710cmiceli@enanta.comorMedia ContactMacDougall

Biomedical CommunicationsKari Watson,

781-235-3060kwatson@macbiocom.com

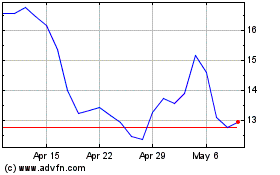

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

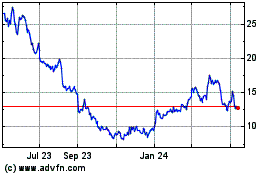

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Apr 2023 to Apr 2024