SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d) (1))

|

|

|

|

|

¨

|

Definitive Information Statement

|

|

WORLD MEDIA & TECHNOLOGY CORP.

|

|

(Name of Registrant as Specified In Its Charter

)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No Fee Required

|

|

|

|

|

¨

|

Fee Computed on table below per Exchange Act Rules

14c-5(g) and 0-11

.

|

|

|

|

|

|

|

1.

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4.

|

Proposed aggregate offering price:

|

|

|

|

|

|

|

5.

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box is any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1.

|

Amount previously paid:

|

|

|

|

|

|

|

2.

|

Form, schedule, or registration statement number:

|

|

|

|

|

|

|

3.

|

Filing party:

|

|

|

|

|

|

|

4.

|

Date filed:

|

WORLD MEDIA & TECHNOLOGY CORP.

600 Brickell Ave., Suite 1775

Miami, FL 33131

To the Stockholders of World Media & Technology Corp.:

On April 20, 2016, our Board of Directors adopted a resolution to amend our Articles of Incorporation which will

alter our authorized share capital to authorize the issuance of up to Ten Thousand (10,000) shares of preferred stock, par value of $0.001 per share (the "Preferred Shares"), for which the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of the Preferred Shares

. Such action is described in more detail in the attached Information Statement.

On or about April 21, 2016, the holders of approximately 96% of our common stock approved the Amendment by written consent.

This Information Statement is being sent to you for informational purposes only. We are not asking for a proxy or vote on any of the matters described therein. However, we encourage you to read the Information Statement carefully.

Sincerely,

|

|

/s/ Fabio Galdi

|

|

|

|

Fabio Galdi

|

|

|

|

Chief Executive Officer

|

|

Miami, Florida

April 22, 2016

WORLD MEDIA & TECHNOLOGY CORP.

600 Brickell Ave., Suite 1775

Miami, FL 33131

INFORMATION STATEMENT

AND

NOTICE OF ACTION TAKEN WITHOUT A MEETING

This Information Statement and Notice of Action Taken Without a Meeting is being furnished by the Board of Directors (the "Board") of World Media & Technology Corp. (the "Company," "we", "our" or "us") to the holders of our common stock, $0.001 par value per share (the "common stock") at April 21, 2016 (the "Record Date") in connection with the filing of the Amendment to the Articles of Incorporation (the "Amendment"), in the form attached hereto as Annex A, which will

alter our authorized share capital to authorize the issuance of up to Ten Thousand (10,000) shares of preferred stock, par value of $0.001 per share (the "Preferred Shares"), for which the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of the Preferred Shares

.

Pursuant to Section 78.320 of the Nevada Revised Statutes (the "NRS"), any action that may be taken at any annual or special meeting of the stockholders may be taken without a meeting, without prior notice and without a vote, if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Under federal law these proposals may not be effected until at least twenty (20) days after this Information Statement has first been sent to our stockholders, at which time, we intend to file the Amendment with the Nevada Secretary of State.

Our Board obtained the required approval for the Amendment by means of a written consent of stockholders effective on or about April 21, 2016. A meeting to approve the Amendment is therefore unnecessary, and our Board decided to forego the expense of having one.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being mailed on or about April 22, 2016, to the holders of our outstanding common stock as of the Record Date.

ABOUT THE INFORMATION STATEMENT

GENERAL

The Company will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of the Company's common stock.

The Company will only deliver one Information Statement to multiple security holders sharing an address unless the Company has received contrary instructions from one or more of the security holders. Upon written or oral request, the Company will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address:

World Media & Technology Corp.

600 Brickell Ave., Suite 1775

Miami, FL 33131

Phone:(

347) 717-4966

WHAT IS THE PURPOSE OF THE INFORMATION STATEMENT?

This information statement is being furnished to you pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), to notify the Company's stockholders as of the close of business on the Record Date of the approval of the Amendment. Five stockholder holding 96% of the Company's outstanding common stock have consented to the Amendment pursuant to a written consent effective on April 21, 2016.

WHO IS ENTITLED TO NOTICE?

Each outstanding share of common stock as of record on the close of business on the Record Date, which is April 21, 2016, will be entitled to notice of the approval of the Amendment. Under the NRS, all the activities requiring stockholders approval may be taken by obtaining the written consent and approval of more than 50% of the holders of voting stock in lieu of a meeting of the stockholders. No action by the minority stockholders in connection with the Amendment is required.

WHAT CONSTITUTES THE VOTING SHARES OF THE COMPANY?

The voting power entitled to vote on the proposals consists of the vote of the holders of a majority of the voting power of the common stock, each of whom is entitled to one vote per share. As of the record date, 28,581,000 shares of common stock were issued and outstanding.

WHAT VOTE IS REQUIRED TO APPROVE THE PROPOSALS?

The affirmative vote of a majority of the shares of our common stock outstanding on the Record Date is required for approval of the Amendment. The approval of such majority was obtained pursuant to a written consent effective on April 21, 2016.

OUTSTANDING SHARES AND VOTING RIGHTS

As of the Record Date, the Company's authorized capitalization consisted of 75,000,000 shares of common stock, of which 28,581,000 shares were issued and outstanding. Holders of common stock of the Company have no preemptive rights to acquire or subscribe to any of the additional shares of common stock. The following five stockholders (holding the indicated number of shares) have voted in favor of the proposal:

|

Holder

|

|

Number of

Shares

|

|

|

Percentage of

Outstanding

|

|

|

Fabio Galdi

|

|

|

22,048,157

|

|

|

|

77.1

|

%

|

|

Anch Holdings Ltd.

|

|

|

2,017,168

|

|

|

|

7.1

|

%

|

|

Power Clouds, Inc.

|

|

|

1,282,211

|

|

|

|

4.5

|

%

|

|

Power Clouds Holdings Pte. Ltd.

|

|

|

1,083,333

|

|

|

|

3.8

|

%

|

|

Roberto Forlani

|

|

|

1,083,333

|

|

|

|

3.8

|

%

|

|

|

|

|

27,514,202

|

|

|

|

96.3

|

%

|

Pursuant to Rule 14c-2 under the Exchange Act, the Amendment will not be effected until a date at least twenty (20) days after the date on which this Information Statement has been mailed to the stockholders. The Amendment will become effective with the Secretary of State of the State of Nevada on the close of business on May 12, 2016. The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the common stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material. This Information Statement will serve as written notice to stockholders pursuant to the NRS.

SECURITY OWNERSHIP OF DIRECTORS, MANAGEMENT AND PRINCIPAL STOCKHOLDERS

As of the Record Date, 28,581,000 shares of common stock were issued and outstanding and no shares of our preferred stock are issued or outstanding. Only holders of record of our voting stock at the close of business on the Record Date were entitled to participate in the written consent of Company stockholders. Each share of common stock was entitled to one (1) vote for each share of common stock held by such shareholder.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the Record Date, 28,581,000 shares of common stock were outstanding and no shares of preferred stock were outstanding. The following table sets forth, as of such date, information with respect to shares beneficially owned by:

* each person who is known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock;

* each of our directors;

* each of our named executive officers; and all of our directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 of the Exchange Act. Under this rule, shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option) within 60 days of the date of this table. In computing the percentage ownership of any person, the amount of shares includes the amount of shares beneficially owned by the person by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person does not necessarily reflect the person's actual voting power. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Unless otherwise indicated, the business address of the individuals and entities listed is

600 Brickell Ave., Suite 1775, Miami, FL 33131

.

|

Name and Address of Shareholder

|

|

Shares of Common

Stock Beneficially

Owned

|

|

|

Total

Percentage of

Voting Power

|

|

|

5% or More Shareholders:

|

|

|

|

|

|

|

|

Anch Holdings Ltd.

Dundrum, Dublin 14

Ireland

|

|

|

2,017,168

|

|

|

|

7.1

|

%

|

|

Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Fabio Galdi (1)

Chief Executive Officer, Corp. Sec. and Director

|

|

|

24,413,701

|

|

|

|

85.4

|

%

|

|

Alfonso Galdi

Chief Financial Officer, Director

|

|

|

0

|

|

|

|

-

|

|

|

Alessandro Senatore

Director

|

|

|

0

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

All Officers & Directors as a Group (3 Total)

|

|

|

24,413,701

|

|

|

|

85.4

|

%

|

____________________

|

(1)

|

Fabio Galdi owns 22,048,157 shares directly, and beneficially owns 1,282,211 shares held by Power Clouds Inc., indirectly through his dispositive voting and investment control of Power Clouds Inc., and 1,083,333 shares held by Power Clouds Holdings Pte. Ltd indirectly through his dispositive voting and investment control of Power Clouds Holdings Pte. Ltd.

|

ACTION 1 -- APPROVAL OF AMENDED ARTICLES OF INCORPORATION TO

AUTHORIZE THE ISSUANCE OF UP TO 10,000 SHARES OF PREFERRED STOCK

Effective on April 21, 2016, five stockholders holding 96% of the voting power of the Company's issued and outstanding common stock executed a written consent in lieu of meeting authorizing our stockholders to

approve an amendment to our Articles of Incorporation for the alteration of our authorized share capital to authorize the issuance of up to Ten Thousand (10,000) shares of preferred stock, par value of $0.001 per share (the "Preferred Shares"), for which the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of the Preferred Shares.

PURPOSE OF AMENDMENT

Our Amended Articles of Incorporation (the "Articles") currently authorize the issuance of 75,000,000 shares of common stock, $0.001 par value, and no shares of preferred stock. On April 20, 2016 our board of directors approved, subject to receiving the approval of a majority of the shareholders of our common stock, an amendment to our Articles to authorize the issuance of up to 10,000 shares of preferred stock in the capital of our corporation, for which the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of the shares of preferred stock.

The general purpose and effect of the amendment to our corporation's Articles is authorize the Preferred Shares, which will enhance our Corporation's ability to finance the development and operation of our business.

Our board of directors approved the amendment to our corporation's Articles to authorize the Preferred Shares so that such shares will be available for issuance for general corporate purposes, including financing activities, without the requirement of further action by our shareholders. Potential uses of the Preferred Shares may include public or private offerings, conversions of convertible securities, issuance of options pursuant to employee benefit plans, acquisition transactions and other general corporate purposes. Allowing for the ability to issue the Preferred Shares will give us greater flexibility and will allow us to issue such shares in most cases without the expense of delay of seeking shareholder approval. Our Company is at all times investigating additional sources of financing which our board of directors believes will be in our best interests and in the best interests of our shareholders. We do not currently have any agreements for any transaction that would require the issuance of common or Preferred Shares. Our common shares carry no pre-emptive rights to purchase additional shares. The adoption of the amendment to our Articles of Incorporation will not of itself cause any changes in our capital accounts.

The amendment to our corporation's Articles to authorize the Preferred Shares will not have any immediate effect on the rights of existing shareholders. However, our board of directors will have the authority to issue the Preferred Shares without requiring future shareholders' approval of such issuances, except as may be required by applicable law or exchange regulations. To the extent that Preferred Shares are issued in the future, they will decrease the existing shareholders' percentage equity ownership and, depending upon the terms and price at which they are issued, could be dilutive to the existing shareholders.

The subsequent issuance of such shares could have the effect of delaying or preventing a change in control of our Company without further action by the shareholders. Shares of authorized and unissued Preferred Stock could be issued (within limits imposed by applicable law) in one or more transactions. Any such issuance of additional stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of common stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain control of our company.

Our board of directors may authorize and issue classes of Preferred Shares that have rights that are preferential to our common stock. Such rights may include:

|

|

·

|

the payment of dividends in preference and priority to any dividends on our common stock;

|

|

|

|

|

|

|

·

|

preference to any distributions upon any liquidation, dissolution or winding up of our company;

|

|

|

|

|

|

|

·

|

voting rights that may rank equally to, or in priority over, our common stock;

|

|

|

|

|

|

|

·

|

mandatory redemption by the company in certain circumstances, for amounts that may exceed the purchase price of the Preferred Shares;

|

|

|

|

|

|

|

·

|

conversion provisions for the conversion of the Preferred Shares into common stock;

|

|

|

|

|

|

|

·

|

pre-emptive or first refusal rights in regards to future issuances of common stock or Preferred Shares by the Company; or

|

|

|

|

|

|

|

·

|

rights that restrict our Company from undertaking certain corporate actions without the approval of the holders of the Preferred Shares.

|

We do not have any provisions in our Articles, bylaws, or employment or credit agreements to which we are party that have anti-takeover consequences. We do not currently have any plans to adopt anti-takeover provisions or enter into any arrangements or understandings that would have anti-takeover consequences. In certain circumstances, our management may issue additional shares to resist a third party takeover transaction, even if done at an above market premium and favoured by a majority of independent shareholders.

Shareholder approval for the Amendments to our Articles was obtained by written consent of 5 shareholders owning 27,514,202 shares of our common stock, which represented 96% on April 21, 2016. The creation of the Preferred Shares will not become effective until not less than twenty (20) days after this Information Statement is first mailed to shareholders of our common stock and until the appropriate filings have been made with the Nevada Secretary of State.

DISSENTERS' RIGHTS OF APPRAISAL

Pursuant to the NRS, no stockholder that objects to the Amendment will have any right to receive from us the fair value of his, her or its shares. The NRS provides that any provision of our Articles of Incorporation may be amended by approval of the Board and the affirmative written consent of the holders of a majority of the voting power of the outstanding shares entitled to vote thereon; provided that, any amendment that would adversely affect the rights of the holders of any class or series of capital stock must be approved by the holders of a majority of the shares of such class or series. The Amendment will be adopted by the holders of a majority of the shares entitled to vote thereon.

ADDITIONAL INFORMATION

The Company is subject to the informational filing requirements of the Exchange Act and, in accordance therewith, is required to file periodic reports, proxy statements and other information with the SEC relating to its business, financial condition and other matters. Such reports, proxy statements and other information can be inspected and copied at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549-0213. Information regarding the public reference facilities may be obtained from the SEC by telephoning 1-800-SEC-0330. The Company's filings are also available to the public on the SEC's website (www.sec.gov). Copies of such materials may also be obtained by mail from the Office of Investor Education and Advocacy of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates.

By Order of the Board of Directors,

|

|

/s/ Fabio Galdi

|

|

|

|

Fabio Galdi

|

|

|

|

Chief Executive Officer

|

|

Miami, Florida

April 22, 2016

ANNEX A

Certificate of Amendment to Articles of Incorporation For Nevada Profit Corporations (Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock

1. Name of Corporation: WORLD MEDIA & TECHNOLOGY CORP.

2. The articles have been changed as follows: Article III is amended to the following:

Capital Stock. The aggregate number of shares which this Corporation shall have authority to issue is: Seventy Five Million (75,000,000) shares of $0.001 par value each, which shares shall be designated "Common Stock"; and Ten Thousand (10,000) shares of $0.001 par value each, which shares shall be designated "Preferred Stock", and which may be issued in one or more series at the discretion of the Board of Directors. The Board of Directors is hereby vested with authority to fix by resolution or resolutions the designations and the power, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, including without limitation, the dividend rate, conversion or exchange rights, redemption price and liquidation preference, of any series of shares of Preferred Stock and to fix the number of shares constituting any such series, and to increase or decrease the number of shares of any such series (but not below the number of shares thereof then outstanding). In case the number of shares of any such series shall be so decreased, the shares constituting such decrease shall resume the status which they had prior to the adoption of the resolution or resolutions originally fixing the number of shares of such series. All shares of any one series shall be alike in every particular except as otherwise provided by these Articles of Incorporation or the Nevada Business Corporation Act.

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation have voted in favor of the amendment is: 96%.

4. Effective date and time of filing: _______________________

5. Signature

10

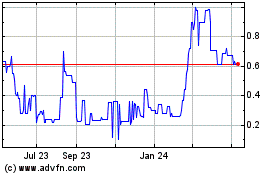

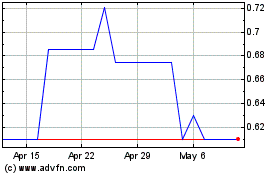

Helo (PK) (USOTC:HLOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Helo (PK) (USOTC:HLOC)

Historical Stock Chart

From Apr 2023 to Apr 2024