As filed with the Securities and Exchange Commission on April

13, 2016

Registration No.

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SPHERE 3D CORP.

(Exact name of

registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name

into English)

|

Ontario, Canada

|

240 Matheson Blvd. East

|

98-1220792

|

|

(State or other jurisdiction of

|

Mississauga, Ontario L4Z 1X1

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

(858) 571-5555

|

Identification No.)

|

(Address and telephone number of

Registrant’s

principal executive offices)

Eric L. Kelly

Chief Executive Officer

9112 Spectrum Center Boulevard

San Diego, California

92123

(858) 571-5555

(Name, address, and telephone number

of agent for service)

Copy to:

Warren T. Lazarow, Esq.

Paul L. Sieben, Esq.

O’Melveny & Myers LLP

2765 Sand Hill Road

Menlo Park, California 94025

(650) 473-2600

Approximate date of commencement of proposed sale to the

public:

From time to time after the effective date of this registration

statement.

If the only securities being

registered on this form are being offered pursuant to dividend or interest

reinvestment plans, please check the following box. [ ]

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933 check the following box.

[X]

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. [ ]

If this Form is a registration

statement pursuant to General Instruction I.C. or a post-effective amendment

thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. [ ]

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.C.

filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

CALCULATION OF REGISTRATION FEE

|

|

|

Proposed

|

Proposed

|

|

|

|

Amount

|

maximum

|

maximum

|

|

|

Title of each class of

|

to be

|

offering price

|

aggregate

|

Amount of

|

|

securities to be registered

|

registered(1)

|

per unit(2)

|

offering price(2)

|

registration

fee

|

|

Secondary Shares

|

|

|

|

|

|

Common Shares, no

par value per share

|

7,287,679

|

$1.27

|

$9,255,353

|

$932

|

|

(1)

|

This registration statement shall also cover any

additional common shares that become issuable by reason of any stock

dividend, stock split or other similar transaction effected without the

receipt of consideration that results in an increase in the number of the

outstanding common shares of the registrant. This registration statement

relates to the resale of common shares previously issued to the selling

shareholders or issuable upon exercise of warrants previously issued to

the

selling shareholders.

|

|

|

|

|

(2)

|

Estimated solely for the purpose of calculating the

amount of registration fee pursuant to Rule 457(c) under the Securities

Act. The proposed maximum offering price per share and proposed maximum

aggregate offering price are based upon the average of the high $1.30

and low $1.23 sales prices of the registrant’s common shares on The Nasdaq Global Market on April

12, 2016. The registrant is not selling any

common shares in this offering and, therefore, will not receive any

proceeds from this offering.

|

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay

its effective date until the registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until this registration statement shall become effective on such

date as the Securities and Exchange Commission, acting pursuant to said Section

8(a), may determine.

The information in this prospectus is

not complete and may be changed. The selling shareholders may not sell these

securities pursuant to this prospectus until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not

an offer to sell these securities, and the selling shareholders are not

soliciting offers to buy these securities in any state where the offer or sale

of these securities is not permitted.

SUBJECT TO COMPLETION, DATED April 13,

2016

PROSPECTUS

7,287,679 Common Shares

This prospectus relates to the resale or

other disposition by certain selling shareholders identified in this prospectus,

or their transferees, of up to an aggregate of 7,287,679 common shares issued or

issuable upon the exercise of warrants issued to the selling shareholders. Of

the common shares to which this prospectus relates, 3,031,249 common shares have

been issued through the partial exercise of a warrant, with an exercise price of

$1.22 per common share, issued pursuant to a warrant exchange agreement, dated

March 25, 2016, between us and a selling shareholder, and 4,167,967 common

shares remain issuable upon exercise of the same warrant. The remaining 88,463

common shares to which this prospectus relates are issuable pursuant to a

warrant with an exercise price of $2.06 per common share, issued as compensation

to Ladenburg Thalmann & Co. Inc. for acting as our placement agent in connection

with our December equity financing.

The selling shareholders may,

from time to time, sell, transfer, or otherwise dispose of any or all of their

common shares on any stock exchange, market or trading facility on which the

shares are traded or in private transactions. These dispositions may be at fixed

prices, at prevailing market prices at the time of sale, at prices related to

the prevailing market price, at varying prices determined at the time of sale,

or at negotiated prices. See “Plan of Distribution” for additional information.

We are not offering any common

shares for sale under this prospectus, and we will not receive any of the

proceeds from the sale or other disposition of the common shares covered hereby.

However, we will receive the exercise price of any warrants exercised for cash.

Our common shares are traded on The

Nasdaq Global Market under the symbol “ANY”. On April 8, 2016, the last reported

sale price for our common shares on Nasdaq was $1.32 per share.

We will pay the expenses related

to the registration of the common shares covered by this prospectus. The selling

shareholders will pay any commissions and selling expenses they may incur.

Our business and an investment

in our securities involve significant risks. You should read the section

entitled "

Risk

Factors

" on page 6 of

this prospectus and the risk factors incorporated by reference into this

prospectus as described in that section before investing in our securities.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or

disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a

registration statement on Form F-3 that we filed with the Securities and

Exchange Commission using a “shelf” registration or continuous offering process.

You should read this prospectus,

the information and documents incorporated by reference, and the additional

information described under the heading “Where You Can Find Additional

Information” below carefully because these documents contain important

information you should consider when making your investment decision. Whenever

we make reference in this prospectus to any of our contracts, agreements or

other documents, the references are not necessarily complete and you should

refer to the exhibits attached to the registration statement or the documents

incorporated by reference for copies of the actual contract, agreements or other

document. See “Where You Can Find More Information” and “Information

Incorporated by Reference.”

You should rely only on the

information provided in this prospectus and the information and documents

incorporated by reference into this prospectus. We have not, and the selling

shareholders have not, authorized anyone to provide you with different

information. This prospectus is not an offer to sell these securities, and the

selling shareholders are not soliciting offers to buy these securities, in any

state where the offer or sale of these securities is not permitted. The

information contained in this prospectus is accurate only as of the date of this

prospectus, regardless of the time of delivery of this prospectus or of any sale

of common shares. You should not assume that the information contained in this

prospectus is accurate as of any date other than the date on the front cover of

this prospectus, or that the information contained in any document incorporated

by reference is accurate as of any date other than the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus

or any sale of a security.

In this prospectus, unless

otherwise indicated or the context otherwise requires, references to “Sphere,”

“we,” “company,” “us,” or “our” refer to Sphere 3D Corp. and its consolidated

subsidiaries, and references to “selling shareholders” refer to those

shareholders listed herein under “Selling Shareholders,” and their transferees.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are subject to the

informational requirements of the Securities Exchange Act of 1934, as amended,

applicable to foreign private issuers. We anticipate filing with the SEC, within

three months after the end of each fiscal year, an Annual Report on Form 40-F

containing financial statements audited by an independent accounting firm. We

also file with the SEC Reports of Foreign Private Issuer on Form 6-K and other

information with the SEC as required by the Exchange Act. We, as a “foreign

private issuer,” are exempt from the rules under the Exchange Act prescribing

certain disclosure and procedural requirements for proxy solicitations, and our

officers, directors and principal shareholders are exempt from the reporting and

“short-swing” profit recovery provisions contained in Section 16 of the Exchange

Act, with respect to their purchases and sales of shares. In addition, we are

not required to file annual, quarterly and current reports and financial

statements with the SEC as frequently or as promptly as U.S. companies whose

securities are registered under the Exchange Act. You can find, copy and inspect

information we file with the SEC (including exhibits to such documents) at the

SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You

may obtain additional information about the Public Reference Room by calling the

SEC at 1-800-SEC-0330. In addition, the SEC maintains a site on the Internet at

http://www.sec.gov which contains reports and other information that we file

electronically with the SEC. You may also review such reports and other

documents we file with the SEC on our website at http://www.sphere3d.com.

Information included on our website is not a part of this prospectus. This

prospectus is part of a registration statement that we filed with the SEC. The

registration statement contains more information than this prospectus regarding

our common shares and us, including exhibits.

- 1 -

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating by

reference” information into this prospectus. This means that we are disclosing

important information to you by referring you to another document that has been

separately filed with or furnished to the SEC. The information incorporated by

reference is considered to be part of this prospectus, and certain information

that we later file with or furnish to the SEC will automatically update and

supersede the information contained in documents earlier filed with or furnished

to the SEC or contained in this prospectus. The following documents filed with

or furnished to the SEC are incorporated herein by reference:

|

|

•

|

Our Annual Report on Form 40-F (File No. 001-36532) filed

with the SEC on March 30, 2016;

|

|

|

|

|

|

|

•

|

The description of our common shares contained in our

Registration Statement on Form 8-A (File No. 001- 36532) filed with the

Commission on July 7, 2014 pursuant to Section 12 of the Exchange Act, and

any other amendment or report filed for the purpose of updating such

description;

|

|

|

|

|

|

|

•

|

The audited consolidated balance sheets of our company

and subsidiaries as of December 31, 2013, and the related audited

consolidated statements of operations, equity and comprehensive income

(loss), and cash flows and the notes to the financial statements related thereto for the year ended December 31, 2013

contained in our Annual Report on Form 40-F (File No. 001-36532) filed

with the SEC on March 31, 2015;

|

|

|

|

|

|

|

•

|

The consolidated audited balance sheets of Overland Storage, Inc. and

subsidiaries as of June 30, 2014 and 2013, and the related audited

consolidated statements of operations, equity and comprehensive income

(loss), and cash flows for the fiscal years ended June 30, 2014 and 2013;

the audited consolidated balance sheets of Tandberg Data S.à r.l. and

subsidiaries as of December 31, 2013 and 2012, and the related audited

consolidated statements of operations, equity and comprehensive income

(loss), and cash flows for the years ended December 31, 2013 and 2012; the

unaudited pro forma condensed combined financial information of our

company, the Overland companies and the Tandberg companies giving effect

to the acquisition of the Overland companies and derived from the

historical consolidated financial statements and notes thereto of our

companies; the description of the terms of our merger with Overland

Storage, Inc., together with Annex A; and the description of the rights of

our shareholders, each contained in our Registration Statement on Form F-4

(File No. 333- 197569) filed with the SEC on July 23, 2014, as

subsequently amended;

|

|

|

|

|

|

|

•

|

Our Report of Foreign Private Issuer on Form 6-K (File

No. 001-36532) furnished to the SEC on April 7, 2016; and

|

|

|

|

|

|

|

•

|

All Annual Reports on Form 40-F and all Reports of

Foreign Private Issuer on Form 6-K (or portions thereof) that indicate

that they are being incorporated by reference into this registration

statement and that we file with the SEC on or after the date on which the

registration statement is first filed with the SEC until the termination

or completion of the offering under this prospectus.

|

Unless otherwise identified,

documents or information deemed to have been furnished and not filed in

accordance with SEC rules shall not be deemed incorporated by reference into

this registration statement. We may incorporate future Reports of Foreign

Private Issuer on Form 6-K (or portions thereof) that we furnish subsequent to

the date of this prospectus by indicating in such Form 6-K (or portions thereof)

that they are being incorporated by reference into this prospectus.

Any statement contained herein or

in a document, all or a portion of which is incorporated or deemed to be

incorporated by reference herein, shall be deemed to be modified or superseded

for purposes of this registration statement to the extent that a statement

contained herein or in any other subsequently filed document which also is or is

deemed to be incorporated by reference herein modifies or supersedes such

statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or amended, to constitute a part of this registration

statement.

You may obtain copies, without

charge, of documents incorporated by reference in this prospectus, by requesting

them in writing or by telephone from us as follows:

Sphere 3D Corp.

240 Matheson Blvd. East

Mississauga,

Ontario L4Z 1X1

Attention: Investor Relations

(800) 729-8725

Exhibits to the filings will not

be sent unless those exhibits have been specifically incorporated by reference

in this prospectus.

- 2 -

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this

prospectus, any prospectus supplement and the documents we incorporate by

reference in this prospectus or any prospectus supplement constitute

forward-looking information that involves risks and uncertainties. This

forward-looking information includes, but is not limited to, statements with

respect to management’s expectations regarding our future growth and business

plans, business planning process, results of operations, uses of cash,

performance, and business prospects. This forward-looking information may also

include other statements that are predictive in nature, or that depend upon or

refer to future events or conditions. Statements with the words “could”,

“expects”, “may”, “will”, “anticipates”, “assumes”, “intends”, “plans”,

“believes”, “estimates”, “guidance” and similar expressions are intended to

identify statements containing forward-looking information, although not all

forward-looking statements include such words. In addition, any statements that

refer to expectations, projections or other characterizations of future events

or circumstances contain forward-looking information. Statements containing

forward-looking information are not historical facts but instead represent

management’s expectations, estimates and projections regarding future events.

Although management believes the

expectations reflected in such forward-looking statements are reasonable,

forward- looking statements are based on the opinions, assumptions and estimates

of management at the date the statements are made, and are subject to a variety

of risks and uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the forward-looking

statements. These factors include, but are not limited to: our limited operating

history; our ability to manage growth; our ability to integrate the businesses

of Overland Storage, Inc. and V3 Systems, Inc.; the impact of competition; the

investment in technological innovation; any defects in components or design of

our products; the retention or maintenance of key personnel; the possibility of

significant fluctuations in operating results; currency fluctuations; our

ability to maintain business relationships; financial, political or economic

conditions; financing risks; future acquisitions; our ability to protect our

intellectual property; third party intellectual property rights; volatility in

the market price for our common shares; our compliance with financial reporting

and other requirements as a public company; conflicts of interests; future sales

of our common shares by our directors, officers and other shareholders; dilution

and future sales of common shares; acquisition-related risks and other factors

described under the heading “Risk Factors”.

In addition, if any of the

assumptions or estimates made by management prove to be incorrect, actual

results and developments are likely to differ, and may differ materially, from

those expressed or implied by the forward-looking information. Accordingly,

investors are cautioned not to place undue reliance on such statements.

All of this forward-looking

information is qualified by these cautionary statements. Statements containing

forward-looking information are made only as of the date of such document. We

expressly disclaim any obligation to update or alter statements containing any

forward-looking information, or the factors or assumptions underlying them,

whether as a result of new information, future events or otherwise, except as

required by law.

- 3 -

PROSPECTUS SUMMARY

The following is only a summary

and therefore does not contain all of the information you should consider before

investing in our securities. We urge you to read this entire prospectus,

including the matters discussed under “Risk Factors” and the risk factors

incorporated by reference into this prospectus as described in that section, and

the more detailed consolidated financial statements, notes to the consolidated

financial statements and other information incorporated by reference from our

other filings with the SEC.

Our Company

We are a virtualization

technology and data management solutions provider with a portfolio of products

that address the complete data continuum. We enable the integration of virtual

applications, virtual desktops, and storage into workflow, and allow

organizations to deploy a combination of public, private or hybrid cloud

strategies. We achieve this through the sale of solutions that are derived from

our primary product groups: disk systems, virtualization, and data management

and storage.

We have a global presence and

maintain offices in multiple locations. Executive offices and our primary

operations are conducted from our San Jose and San Diego, California locations.

Our main office is located at 9112 Spectrum Center Blvd., San Diego, CA 92123.

Our virtualization product development is primarily done from its research and

development center near Toronto, Canada. Our European headquarters are located

in Germany. We maintain additional offices in Singapore, Japan, and the United

Kingdom.

We were incorporated on May 2,

2007 under the Business Corporations Act (Ontario) as “T.B. Mining Ventures

Inc.”. Our registered office is located at 240 Matheson Blvd. East Mississauga,

Ontario L4Z 1X1 and our main telephone number is (858) 571-5555. Our Internet

address is

http://www.sphere3d.com

. Except for the documents referred to

under “Where You Can Find Additional Information” which are specifically

incorporated by reference into this prospectus, information contained on our

website or that can be accessed through our website does not constitute a part

of this prospectus. We have included our website address only as an interactive

textual reference and do not intend it to be an active link to our website.

The Offering

Common shares offered by the selling

shareholders,

including common shares issuable upon exercise of the

warrants:

|

7,287,679

|

|

|

|

|

Common shares to be outstanding after the offering:

|

53,325,969

(1)

|

|

|

|

|

Nasdaq Global Market symbol:

|

ANY

|

|

|

|

|

Use of proceeds:

|

To the extent that we have received or will receive

additional cash upon exercise of the warrants, we currently expect to use

that cash for general corporate purposes. See “Use of Proceeds” beginning

on page 10.

|

|

|

|

|

Risk factors:

|

See “Risk Factors” beginning on page 7 and the risk

factors incorporated by reference into this prospectus as described in

that section, and the other information included in this prospectus or

incorporated by reference for a discussion of factors you should consider

before making an investment decision

|

|

(1)

|

The number of common shares shown to be outstanding is

based on the number of common shares outstanding as of April 6, 2016,

and excludes as of such date:

|

- 4 -

|

|

•

|

3,587,396 common shares subject to outstanding options

having a weighted-average exercise price of $2.41 per share;

|

|

|

•

|

2,068,652 common shares reserved for issuance in

connection with future awards under our 2015 Performance Incentive Plan

and 5,277,857 restricted share units outstanding and unreleased under the

plan;

|

|

|

•

|

2,000,000 common shares reserved for future sale under

our Employee Stock Purchase Plan; and

|

|

|

•

|

7,258,856 common shares issuable pursuant to outstanding warrants having

a weighted-average exercise price of $2.96 per share, including warrants

to purchase up to, in aggregate, 800,000 common shares issued on February

19, 2015, March 6, 2015, March 20, 2015 and December 2015 to FBC Holdings

S.à r.l. in connection with draws on our Revolving Credit Agreement with

FBC (with each such warrant’s exercise price being determined by reference

to 110% of the closing price for our common shares on The NASDAQ Global

Market on the last complete trading day immediately prior to issuance) and

a warrant to purchase up to, in aggregate, 500,000 common shares issued on

February 26, 2016 in connection with the amendment to our 8% Senior

Secured Convertible Debenture with FBC (with each such warrant's exercise

price being determined by reference to 110% of the closing price for our

common shares on the NASDAQ Global Market on the last complete trading day

immediately prior to issuance).

|

Unless otherwise indicated, this prospectus supplement reflects

and assumes no exercise of our outstanding warrants or options to purchase

common shares described above.

- 5 -

Recent Developments

Warrant Exchange Agreement

A portion of the shares offered under this

prospectus were issued or are issuable pursuant to the terms of a warrant for

the purchase of up to, in aggregate, 7,199,216 common shares, no par value,

issued in connection with a warrant exchange agreement entered into with the

selling shareholder on March 25, 2016 in a privately negotiated exchange under

Section 3(a)(9) of the Securities Act of 1933, as amended, in exchange for the

surrender and cancellation of previously outstanding warrants for the purchase

of up to, in aggregate, 3,031,249 common shares. The previously outstanding

warrants were issued pursuant to (i) that certain Purchase Agreement, dated as

of May 13, 2015, by and between the Company and the Holder, (ii) that certain

Purchase Agreement, dated as of August 10, 2015, by and between the Company and

the Holder, and (iii) that certain Subscription Agreement, dated as of September

22, 2015, by and between the Company and the Holder. The terms of the new

warrant are substantially similar to the previously outstanding warrants except

(i) in the case of the existing warrants issued pursuant to the May 2015

purchase agreement, the exercise price has changed from $4.00 per common share

to $1.22 per common share, (ii) in the case of the existing warrants issued

pursuant to the August 2015 purchase agreement and the September 2015

subscription agreement, the exercise price has changed from $2.33 per common

share to $1.22 per common share, and (iii) the expiry date has changed from

various dates between May 18, 2020 and September 22, 2020 to April 14, 2016.

However, pursuant to the terms of the warrant exchange agreement, because the

selling shareholder exercised the new warrant for the purchase of 3,031,249

common shares before April 14, 2016, the expiry date for the balance of the

unexercised portion of the new warrant became March 25, 2021. We received $3.7

million in proceeds from the selling shareholder’s partial exercise of the

warrant on March 25, 2016.

Debt Financing

Overland Storage, Inc., a

California corporation (“Overland”) and wholly owned subsidiary of our company,

Tandberg Data GmbH, a limited liability company organized under the laws of

Germany and wholly owned subsidiary of our company (“Tandberg” and, together

with Overland, collectively the “Borrowers”), and Opus Bank, a California

commercial bank, as Lender (“Lender”), have entered into a Credit Agreement,

dated as of April 6, 2016 (the “Credit Agreement”). Pursuant to the terms of the

Credit Agreement, the Lender will provide the Borrowers a $10 Million revolving

credit facility and Overland $10 Million term loan facility. The revolving

credit facility will mature on April 6, 2018, and the term loan facility will

mature the earlier of the maturity date in the Debenture (as defined below) or

April 6, 2020. Further, as a condition of the extension of credit to the

Borrowers under the Credit Agreement, we agreed to issue to the Lender a warrant

for the purchase of up to 1,541,768 common shares at an exercise price of $1.30

per common share.

We also entered into a Second

Amendment, dated April 6, 2016, (the “Second Amendment”) to our existing 8% Senior Secured Convertible

Debenture, dated December 1, 2014, issued to FBC Holdings S.a r.l. (the

“Debenture”), pursuant to which, among other things, the Debenture has been

amended to provide an additional loan of $5,000,000 under the Debenture (the

“Additional Loan”) and to make certain other amendments provided therein. The

proceeds of the Additional Loan were used to pay off a portion of the

outstanding obligations under the Revolving Credit Agreement referred to below.

In connection with the

transactions contemplated by the Credit Agreement and the Second Amendment, we

and the Borrowers have repaid all outstanding obligations under the Amended and

Restated Loan and Security Agreement, dated as of March 19, 2014, by and among

the Borrowers and Silicon Valley Bank, as amended, and all outstanding

obligations under the Revolving Credit Agreement, dated as of July 10, 2015, by

and among the Company, the subsidiaries of the Company party thereto and FBC

Holdings S.à r.l., and such Amended and Restated Loan and Security Agreement and

the Revolving Credit Agreement have been terminated.

- 6 -

RISK FACTORS

An investment in our

securities involves a high degree of risk. In addition to the other information

included in this prospectus, you should carefully consider the risk factors set

forth in our most recent Annual Report on Form 40-F on file with the SEC, which

is incorporated by reference into this prospectus, as well as the following risk

factors, which supplement or augment the risk factors set forth in our Annual

Report on Form 40-F. Before making an investment decision, you should carefully

consider these risks as well as other information we include or incorporate by

reference in this prospectus and the accompanying prospectus supplement. The

risks and uncertainties not presently known to us or that we currently deem

immaterial may also materially harm our business, operating results and

financial condition and could result in a complete loss of your investment.

Risks Related to our Business

If we are unable to generate sufficient cash from

operations or raise additional financing, we may be unable to fund our

operations.

We require sufficient cash from

operations together with cash from debt, equity or equity based financing,

including financing from this offering, to fund our operations as currently

conducted. Our available cash and cash equivalents was $8.7 million and our

outstanding indebtedness was $36.9 million as of December 31, 2015. Cash

forecasts and capital requirements are subject to change as a result of a

variety of risks and uncertainties. Cash from operations can change as a result

of a variety of factors including changes in sales levels, unexpected increases

in product costs, increases in operating costs, and changes to the historical

timing of collecting accounts receivable. In addition, we expect to continue to

need to raise debt, equity and equity-linked financing in the near future, but

such financing may not be available on favorable terms on a timely basis or at

all. If we are unable to generate sufficient cash from operations or financing

sources, we may be forced to make further reductions in spending, extend payment

terms with suppliers, liquidate assets where possible and/or curtail, suspend or

cease planned programs or operations generally or possibly seek bankruptcy

protection, which would have a material adverse effect on our business, results

of operations, financial position and liquidity.

Our cash and other sources of liquidity may not be

adequate to fund our operations for the next 12 months. If we raise additional

funding through sales of equity or equity-based securities, your shares will be

diluted. If we need additional funding for operations and we are unable to raise

it, we may be forced to liquidate assets and/or curtail or cease operations.

We have projected that cash on

hand, available borrowings under our credit facility may not be sufficient to

allow us to continue operations for the next 12 months. Significant changes from

our current forecasts, including, but not limited to: (i) shortfalls from

projected sales levels, (ii) unexpected increases in product costs, (iii)

increases in operating costs, (iv) changes to the historical timing of

collecting accounts receivable and/or (v) failure to secure additional capital

under our credit facility or to secure additional debt or equity financing could

have a material adverse impact on our ability to operate our business or to

access the level of funding necessary to continue operations at current levels.

If any of these events occur, we may be forced to make further reductions in

spending, extend payment terms with suppliers, liquidate assets where possible

and/or suspend or curtail planned programs. Any of these actions could

materially harm our business, and/or results of operations and future prospects.

We may seek debt, equity, or

equity-based financing when market conditions permit. Such financing may not be

available on favorable terms, or at all. If we need additional funding for

operations and are unable to raise it through debt or equity financings, we may

be forced to liquidate assets and/or curtail or cease operations. If we raise

additional funds by selling additional shares of our capital stock, or

securities convertible into shares of our capital stock, the ownership interest

of our existing shareholders will be diluted. The amount of dilution could be

increased by the issuance of warrants or securities with other dilutive

characteristics, such as anti-dilution clauses or price resets.

Our credit facility contains restrictions and

requirements on our operations, including financial covenants. We have in the

past failed to comply with financial covenants in certain of our loan documents,

and similar defaults in the future could adversely affect our financial

condition and our ability to meet our payment obligations on our

indebtedness.

We have obtained external funding

for our business through a Credit Agreement with Opus Bank. This Credit

Agreement contains restrictions on the amount of debt we may incur and other

restrictions and requirements on our operations. We have in the past defaulted

under financial covenants in our previous loan documents, which was waived by

our previous lender. Upon the occurrence of certain events of default under our

current credit facility, our lender may elect to declare all amounts outstanding

to be immediately due and payable and terminate all commitments to extend

further credit. In the event of such acceleration or if we are unable to

otherwise maintain compliance with covenants set forth in these arrangements or

if these arrangements are otherwise terminated for any reason, it could have a

material adverse effect on our ability to access the level of funding necessary

to continue operations at current levels. If any of these events occur,

management may be forced to make reductions in spending, extend payment terms

with suppliers, liquidate assets where possible, and/or suspend or curtail

planned programs. Any of these actions could materially harm our business,

results of operations and future prospects.

- 7 -

Risks Related to Our Common Shares and this Offering

Our share price has been volatile and your investment in

our common shares could decrease in value.

The market price for securities

of technology companies, including ours, historically has been highly volatile,

and the market from time to time has experienced significant price and volume

fluctuations that are unrelated to the operating performance of such companies.

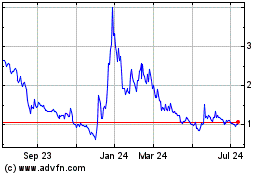

For example, during the 12-month period ended March 31, 2016, our closing share

price on The NASDAQ Global Market has ranged from a low of $1.15 to a high of

$5.71. Fluctuations in the market price or liquidity of our common shares may

harm the value of your investment in our common shares. You may not be able to

resell your common shares at or above the price you pay for those shares due to

fluctuations in the market price caused by changes in our operating performance

or prospects and other factors, including, among others:

|

|

•

|

actual or anticipated fluctuations in our

operating results or future prospects;

|

|

|

|

|

|

|

•

|

our announcements or our competitors’

announcements of new products;

|

|

|

|

|

|

|

•

|

public reaction to our press releases, our

other public announcements and our filings with the SEC;

|

|

|

|

|

|

|

•

|

strategic actions by us or our competitors;

|

|

|

|

|

|

|

•

|

changes in financial markets or general

economic conditions;

|

|

|

|

|

|

|

•

|

our ability to raise additional capital as

needed;

|

|

|

|

|

|

|

•

|

developments regarding our patents or

proprietary rights or those of our competitors; and

|

|

|

|

|

|

|

•

|

changes in stock market analyst recommendations

or earnings estimates regarding our common shares, other comparable

companies or our industry generally.

|

Future sales of our common shares or securities

convertible into common shares by us could result in a decline in the trading

price of our common shares and the dilution of the ownership interest of our

existing shareholders.

We may sell securities in the

public or private equity markets if and when conditions are favorable, even if

we do not have an immediate need for additional capital at that time. Sales of

substantial amounts of common shares or securities convertible into common

shares, or the perception that such sales could occur, could adversely affect

the prevailing market price of our common shares and our ability to raise

capital. We may issue additional common shares in future financing transactions

or as incentive compensation for our executive management and other key

personnel, consultants and advisors. Issuing any equity securities would be

dilutive to the equity interests represented by our then-outstanding common

shares. The market price for our common shares could decrease as the market

takes into account the dilutive effect of any of these issuances.

Sales of shares issuable upon exercise of outstanding

warrants, the conversion of outstanding convertible debt, or the effectiveness

of our registration statement may cause the market price of our shares to

decline.

We have warrants outstanding for the

purchase of up to 11,515,286 common shares, including warrants to purchase the

common shares covered by this prospectus, and our 8% Senior Secured Convertible

Debenture is convertible to common shares at a conversion price of $3.00 per

common share. Additionally, we are in the process of registering with the SEC

the common shares issued or issuable upon exercise of warrants for resale, and

upon the effectiveness of the registration statement for these shares, they may

be freely sold in the open market. The sale of our common shares upon exercise

of our outstanding warrants, the conversion of the debenture into common shares,

or the sale of a significant amount of the common shares issued or issuable upon

exercise of the warrants in the open market, or the perception that these sales

may occur, could cause the market price of our common shares to decline or

become highly volatile.

Future sales of our securities under certain

circumstances may trigger price-protection provisions in outstanding warrants,

which would dilute your investment and could result in a decline in the trading

price of our common shares.

In connection with our registered direct

offering in December 2015, we issued a warrant exercisable to purchase up to

1,500,000 common shares that contains certain price protection provisions. If

we, at any time while these warrants are outstanding, effect certain variable

rate transactions and the issue price, conversion price or exercise price per

share applicable thereto is less than the exercise price then in effect for the

warrants, then the exercise price of the warrants will be reduced to equal such

price. Further, if as of the 180 day anniversary from November 30, 2015, the

quotient of (x) the sum of the volume weighted average price of our common

shares for each trading day during the five consecutive trading days ending and

including the trading day immediately preceding such date, divided by (y) five

is less than the current exercise price of $2.50 per common share, the exercise

price of the warrants will be adjusted to such price. The triggering of these

price protection provisions or the potential adjustment to the exercise price of

this warrant, together with its exercise for the purchase of 1,500,000 common

shares, could cause the market price of our common shares to decline or become

highly volatile.

- 8 -

We may have to pay liquidated damages to our investors,

which will increase our negative cash flows.

Under the terms of our

registration rights agreements entered into with certain investors in connection

with private placements of our securities in May, June, and August 2015 and in

connection with the warrant exchange agreement we entered into with a selling

shareholder, if we fail to comply with certain provisions set forth in these

agreements, including covenants requiring that we maintain the effectiveness of

the registration statements registering these securities, then we will be

required to pay liquidated damages to our investors. There can be no assurance

that the registration statements will remain effective for the time periods

necessary to avoid payment of liquidated damages. If we are required to pay our

investors liquidated damages, this could materially harm our business and future

prospects.

We do not expect to pay cash dividends on our common

shares for the foreseeable future.

We have never paid cash dividends

on our common shares and do not anticipate that any cash dividends will be paid

on the common shares for the foreseeable future. The payment of any cash

dividend by us will be at the discretion of our board of directors and will

depend on, among other things, our earnings, capital, regulatory requirements

and financial condition.

We may not be able to maintain our listing on the NASDAQ

Global Market. If our common stock is delisted from NASDAQ, our business,

financial condition, results of operations and stock price would be adversely

affected, and the liquidity of our stock and our ability to obtain financing

could be impaired.

Maintaining the listing of our

common stock on the NASDAQ Global Market requires that we comply with certain

listing requirements. If our common stock ceases to be listed for trading on

NASDAQ for any reason, it may harm our stock price, increase the volatility of

our stock price, decrease the level of trading activity and make it more

difficult for investors to buy or sell shares of our common stock. Our failure

to maintain a listing on NASDAQ may constitute an event of default under our

outstanding indebtedness as well as any future indebtedness, which could

accelerate the maturity date of such debt or trigger other obligations. In

addition, certain institutional investors that are not permitted to own

securities of non-listed companies may be required to sell their shares, which would adversely affect the trading price of our common stock. If we are not

listed on NASDAQ, we will be limited in our ability to raise additional capital

we may need.

- 9 -

USE OF PROCEEDS

To the extent that we have

received or will receive additional cash upon exercise of the warrants, we

currently expect to use that cash for general corporate purposes. These purposes

may include repayment of debt, working capital needs, capital expenditures,

acquisitions and any other general corporate purpose.

SELLING SHAREHOLDER

We have prepared this prospectus to allow

the selling shareholders or their donees, pledgees, transferees or other

successors in interest to sell or otherwise dispose of, from time to time, up to

an aggregate of 7,287,679 common shares issued or issuable upon exercise of the

warrant issued pursuant to the exchange agreement dated March 25, 2016 and the

warrant issued as compensation to Ladenburg Thalmann & Co. Inc. for acting as

our placement agent in connection with our December equity financing. The table

below presents information regarding the selling shareholder, the common shares

beneficially owned prior to the private placement offering and the common shares

that they may sell or otherwise dispose of from time to time under this

prospectus.

We do not know when or in what amounts the

selling shareholder may sell or otherwise dispose of the common shares covered

hereby. The selling shareholder might not sell any or all of the shares covered

by this prospectus or may sell or dispose of some or all of the shares other

than pursuant to this prospectus. Because the selling shareholder may not sell

or otherwise dispose of some or all of the shares covered by this prospectus and

because there are currently no agreements, arrangements or understandings with

respect to the sale or other disposition of any of the shares, we cannot

estimate the number of the shares that will be held by the selling shareholder

after completion of the offering. However, for purposes of this table, we have

assumed that all of the common shares covered by this prospectus will be sold by

the selling shareholder.

|

|

|

Beneficial

Ownership

(1)

|

|

|

|

|

Number of

|

|

|

Percent

|

|

|

|

|

|

Number of

|

|

|

Percent

|

|

|

|

|

Shares

|

|

|

of

|

|

|

|

|

|

Shares

|

|

|

of

|

|

|

|

|

Beneficially

|

|

|

Class

|

|

|

Number of

|

|

|

Beneficially

|

|

|

Class

|

|

|

|

|

Owned Prior

|

|

|

Prior

|

|

|

Shares

|

|

|

Owned

|

|

|

After

|

|

|

Name of Selling

|

|

to the

|

|

|

to the

|

|

|

Offered

|

|

|

After this

|

|

|

this

|

|

|

Shareholder

(2)

|

|

Offering

|

|

|

Offering

|

|

|

Hereby

(3)

|

|

|

Offering

|

|

|

Offering

|

|

|

MacFarlane Family Ventures LLC

(4)

|

|

9,554,830

(5)

|

|

|

17.9%

|

|

|

7,199,216

|

|

|

2,355,614

|

|

|

4.4%

|

|

|

Ladenburg Thalmann & Co. Inc.

(6)

|

|

88,463

|

|

|

*

|

|

|

88,463

|

|

|

—

|

|

|

*

|

|

* Less than 1.0%.

|

(1)

|

Beneficial ownership is determined in accordance with

Section 13(d) of the Exchange Act and generally includes voting and

investment power with respect to securities and including any securities

that grant the selling shareholder the right to acquire common shares

within 60 days of April 6, 2016. Percentage ownership is based on an

aggregation of the 49,069,539 common shares issued and outstanding as of

April 6, 2016 and assumes issuance of the remaining common shares issuable

upon exercise of the warrant issued pursuant to the exchange agreement

dated March 25, 2016 and the warrant issued as compensation to Ladenburg

Thalmann & Co. Inc. for acting as our placement agent in connection with

our December equity financing. This amount totals 53,325,969 common

shares.

|

|

|

|

|

(2)

|

Unless otherwise indicated, this table is based on

information supplied to us by the selling shareholders and our records.

|

|

|

|

|

(3)

|

7,199,216 common shares offered pursuant to this

prospectus were issued or are issuable pursuant to the warrant issued to

the selling shareholder in connection with the warrant exchange agreement

we entered into with the selling shareholder on March 25, 2016. The

remaining 88,463 common shares offered pursuant to this prospectus are

issuable pursuant to a warrant with an exercise price of $2.06 per common

share, issued as compensation to Ladenburg Thalmann & Co. Inc. for acting

as our placement agent in connection with our December equity financing.

|

|

|

|

|

(4)

|

Mr. Victor B. MacFarlane has voting and investment power

with respect to the common shares held by this selling shareholder. The

address for this selling shareholder is: 201 Spear Street 14th Floor, San

Francisco, California 94105.

|

|

|

|

|

(5)

|

Consists of a warrant currently exercisable for 4,167,967 common shares

and 5,386,863 common shares held directly by MacFarlane Family Ventures

LLC.

|

|

|

|

|

(6)

|

Ladenberg Thalmann & Co. Inc. is a registered broker-dealer and a wholly-owned subsidiary of Ladenburg Thalmann Financial Services Inc. The address for this selling

shareholder is: 4400 Biscayne Blvd., Miami, Florida 33137.

|

- 10 -

PLAN OF DISTRIBUTION

We are registering the common

shares issued or issuable upon exercise of the warrants to permit the resale of the common

shares by the selling shareholders. We will not receive any of the proceeds from

the sale by the selling shareholders of the common shares. We will bear all fees

and expenses incident to our obligation to register the common shares.

The selling shareholders, which

as used herein includes donees, pledgees, transferees or other

successors-in-interest selling common shares or interests in common shares

received after the date of this prospectus from a selling shareholder as a gift,

pledge, partnership distribution or other transfer, may, from time to time,

sell, transfer or otherwise dispose of any or all of their common shares or

interests in common shares on any stock exchange, market or trading facility on

which the shares are traded or in private transactions. These dispositions may

be at fixed prices, at prevailing market prices at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time

of sale, or at negotiated prices.

The selling shareholders may use

any one or more of the following methods when disposing of shares or interests

therein:

|

|

•

|

ordinary brokerage transactions and transactions in which

the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

•

|

block trades in which the broker-dealer will attempt to

sell the shares as agent, but may position and resell a portion of the

block as principal to facilitate the transaction;

|

|

|

|

|

|

|

•

|

purchases by a broker-dealer as principal and resale by

the broker-dealer for its account;

|

|

|

|

|

|

|

•

|

an exchange distribution in accordance with the rules of

the applicable exchange;

|

|

|

|

|

|

|

•

|

privately negotiated transactions;

|

|

|

|

|

|

|

•

|

short sales effected after the date the registration

statement of which this prospectus is a part is declared effective by the

SEC;

|

|

|

|

|

|

|

•

|

through the writing or settlement of options or other

hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

•

|

broker-dealers may agree with the selling shareholders to

sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

|

|

|

|

•

|

any other method permitted by applicable law.

|

If the selling shareholders

effect such transactions by selling common shares to or through underwriters,

broker-dealers or agents, such underwriters, broker-dealers or agents may

receive commissions in the form of discounts, concessions or commissions from

the selling shareholders or commissions from purchasers of the common shares for

whom they may act as agent or to whom they may sell as principal (which

discounts, concessions or commissions as to particular underwriters,

broker-dealers or agents may be in excess of those customary in the types of

transactions involved). The selling shareholders may, from time to time, pledge

or grant a security interest in some or all of the common shares owned by them

and, if they default in the performance of their secured obligations, the

pledgees or secured parties may offer and sell the common shares, from time to

time, under this prospectus, or under an amendment to this prospectus under Rule

424(b)(3) or other applicable provision of the Securities Act amending the list

of selling shareholders to include the pledgee, transferee or other successors

in interest as selling shareholders under this prospectus. The selling

shareholders also may transfer the common shares in other circumstances, in

which case the transferees, pledgees or other successors in interest will be the

selling beneficial owners for purposes of this prospectus.

In connection with the sale of

our common shares or interests therein, the selling shareholders may enter into

hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the common shares in the course of hedging

the positions they assume. The selling shareholders may also sell shares of our

common shares short and deliver these securities to close out their short

positions, or loan or pledge the common shares to broker-dealers that in turn

may sell these securities. The selling shareholders may also enter into option

or other transactions with broker-dealers or other financial institutions or the

creation of one or more derivative securities which require the delivery to such

broker-dealer or other financial institution of shares offered by this

prospectus, which shares such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such

transaction).

The aggregate proceeds to the

selling shareholders from the sale of the common shares offered by them will be

the aggregate purchase price of the common shares less aggregate discounts or

commissions, if any. Each of the selling shareholders reserves the right to accept and, together with their agents from time to

time, to reject, in whole or in part, any proposed purchase of common shares to

be made directly or through agents. We will not receive any of the proceeds from

this offering. Upon any exercise of the warrants by payment of cash, however, we

will receive the exercise price of the warrants.

- 11 -

The selling shareholders also

may resell all or a portion of the shares in open market transactions in

reliance upon Rule 144 under the Securities Act, provided that they meet the

criteria and conform to the requirements of that rule.

The selling shareholders and any

underwriters, broker-dealers or agents that participate in the sale of the

common shares or interests therein may be, “underwriters” within the meaning of

Section 2(11) of the Securities Act. Any discounts, commissions, concessions or

profit they earn on any resale of the shares may be underwriting discounts and

commissions under the Securities Act. Selling shareholders who are

“underwriters” within the meaning of Section 2(11) of the Securities Act will be

subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the

common shares to be sold, the names of the selling shareholders, the respective

purchase prices and public offering prices, the names of any agents, dealer or

underwriter, any applicable commissions or discounts with respect to a

particular offer will be set forth in an accompanying prospectus supplement or,

if appropriate, a post-effective amendment to the registration statement that

includes this prospectus.

In order to comply with the

securities laws of some states, if applicable, the common shares may be sold in

these jurisdictions only through registered or licensed brokers or dealers. In

addition, in some states the common shares may not be sold unless it has been

registered or qualified for sale or an exemption from registration or

qualification requirements is available and is complied with.

We have advised the selling

shareholders that the anti-manipulation rules of Regulation M under the Exchange

Act may apply to sales of shares in the market and to the activities of the

selling shareholders and their affiliates. In addition, to the extent applicable

we will make copies of this prospectus (as it may be supplemented or amended

from time to time) available to the selling shareholders for the purpose of

satisfying the prospectus delivery requirements of the Securities Act. The

selling shareholders may indemnify any broker-dealer that participates in

transactions involving the sale of the shares against certain liabilities,

including liabilities arising under the Securities Act.

We have agreed to indemnify the

selling shareholders against liabilities, including liabilities under the

Securities Act and state securities laws, relating to the registration of the

shares offered by this prospectus.

We have agreed with one of the selling

shareholders to keep the registration statement of which this prospectus

constitutes a part effective until the earlier of (1) such time as all of the

shares covered by this prospectus have been disposed of pursuant to and in

accordance with the registration statement or (2) the date on which the shares

may be sold without restriction pursuant to Rule 144 of the Securities Act

without the Company being in compliance with the reporting requirements set

forth under Rule 144(d)(1)(i).

- 12 -

CAPITALIZATION

The following table sets forth our cash

and cash-equivalents and our capitalization as of December 31, 2015 on an actual

basis.(1) The table below does not present our capitalization on an as-adjusted

basis to give effect to the issuance and sale of the 7,199,216 common shares

issued or issuable upon exercise of the warrant issued on March 25, 2016 or the

88,463 common shares issuable upon exercise of the warrant issued as

compensation to Ladenburg Thalmann & Co. Inc. for acting as our placement agent

in connection with our December equity financing. The holders of the warrants

are not obligated to exercise them for the purchase of our common shares, and as

a result, there can be no assurance that the holders will exercise the warrants.

In addition, the table below does not reflect our recent debt financing

completed on April 6, 2016, pursuant to which we repaid the outstanding debt

under our Revolving Credit Agreement and Amended and Restated Loan and Security

Agreement. Our new lender has provided certain of our subsidiaries a $10 Million

revolving credit facility and a $10 Million term loan facility. In addition, on

April 6, 2016, we

amended our Convertible Debenture to provide an additional loan of $5 Million.

You should read the information

in the following table in conjunction with our consolidated financial statements

and the related notes and the section entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” contained in our

Annual Report on Form 40-F for the year ended December 31, 2015 filed with the

SEC and incorporated by reference in this prospectus supplement and the

accompanying prospectus.

|

(In thousands, except per share

information)

|

|

As of December 31,

2015

|

|

|

Cash and cash equivalents

|

$

|

8,661

|

|

|

Revolving Credit Agreement

|

$

|

10,000

|

|

|

Amended and Restated Loan and

Security Agreement

|

$

|

7,391

|

|

|

Convertible Debenture (Long-Term)

|

$

|

19,500

|

|

|

Stockholders’ equity

|

|

|

|

Common

shares, no par value per share; unlimited shares authorized, 45,198

thousand

shares issued and outstanding

|

$

|

136,058

|

|

|

Accumulated deficit

|

|

(66,783

|

)

|

|

Accumulated Other Comprehensive

Loss

|

|

(1,135

|

)

|

|

Total shareholders’ equity

|

$

|

68,140

|

|

(1)

Subsequent to December 31, 2015, an aggregate of

3,870,825 common shares were issued pursuant to (i) restricted share issuance releases,

(ii) the subscription agreements we entered into with investors on December 15,

2015, and (iii) warrant exercises, including the partial exercise of the warrant

issued to MacFarlane Family Ventures LLC for the purchase of 3,031,249 common shares.

- 13 -

PRICE RANGE OF OUR SHARES

On December 28, 2012, our common

shares commenced trading on the TSX Venture Exchange under the symbol “ANY”. On

July 8, 2014, our common shares commenced trading on the Nasdaq Global Market

under the symbol “ANY”. On December 10, 2014, we voluntarily delisted our common

shares from the TSXV.

The tables below set forth, for

the periods indicated, the per share high and low closing sales prices for our

common shares as reported on the Nasdaq and the TSXV. TSXV closing prices of our

common shares are presented in Canadian dollars, and the Nasdaq closing prices

of our common shares are presented in U.S. dollars.

TSXV:

|

|

|

ANY shares

TSXV

|

|

|

|

|

(in C$)

|

|

|

|

|

High

|

|

|

Low

|

|

|

Annual Information for

2012, 2013, 2014

|

|

|

|

|

|

|

|

2012 (from December

28, 2012)

|

|

0.80

|

|

|

0.74

|

|

|

2013

|

|

6.56

|

|

|

0.45

|

|

|

2014 (through

December 10, 2014)

|

|

11.15

|

|

|

5.45

|

|

|

Quarterly information for the past two fiscal years

and subsequent quarters:

|

|

|

|

|

|

|

|

2013,

quarter ended

|

|

|

|

|

|

|

|

December 31

|

|

6.56

|

|

|

2.70

|

|

|

September 30

|

|

2.88

|

|

|

0.50

|

|

|

June

30

|

|

0.73

|

|

|

0.45

|

|

|

March 31

|

|

0.85

|

|

|

0.53

|

|

|

2014,

quarter ended

|

|

|

|

|

|

|

|

December 31

(through December 10, 2014)

|

|

10.84

|

|

|

5.90

|

|

|

September 30

|

|

11.15

|

|

|

6.70

|

|

|

June 30

|

|

10.84

|

|

|

6.75

|

|

|

March

31

|

|

8.49

|

|

|

5.45

|

|

NASDAQ:

|

|

|

ANY shares

NASDAQ

|

|

|

|

|

(in

US$)

|

|

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

Annual information for

2014

|

|

|

|

|

|

|

|

2014

(from July 8, 2014)

|

|

10.00

|

|

|

5.21

|

|

|

2014, quarter ended

|

|

|

|

|

|

|

|

December 31

|

|

9.50

|

|

|

5.21

|

|

|

September 30 (from July 8, 2014)

|

|

10.00

|

|

|

6.15

|

|

|

2015, quarter ended

|

|

|

|

|

|

|

|

December 31

|

|

3.35

|

|

|

1.33

|

|

|

September 30

|

|

5.71

|

|

|

1.99

|

|

|

June 30

|

|

5.17

|

|

|

3.14

|

|

|

March 31

|

|

7.13

|

|

|

3.47

|

|

|

2016, quarter ended

|

|

|

|

|

|

|

|

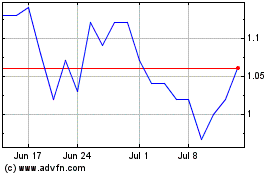

June 30 (through April 12, 2016)

|

|

1.34

|

|

|

1.05

|

|

|

March 31

|

|

1.97

|

|

|

1.15

|

|

|

Monthly information for

the most recent six months

|

|

|

|

|

|

|

|

October 2015

|

|

3.36

|

|

|

2.05

|

|

|

November 2015

|

|

2.75

|

|

|

1.79

|

|

|

December 2015

|

|

1.83

|

|

|

1.33

|

|

|

January 2016

|

|

1.46

|

|

|

1.15

|

|

|

February 2016

|

|

1.84

|

|

|

1.26

|

|

|

March 2016

|

|

1.97

|

|

|

1.24

|

|

|

April 2016 (through April 12, 2016)

|

|

1.34

|

|

|

1.05

|

|

Fluctuations in the exchange rate

between the Canadian dollar and the U.S. dollar will affect any comparisons of

our common shares traded on the TSXV and our common shares traded on the Nasdaq.

- 14 -

ENFORCEABILITY OF CIVIL LIABILITIES AGAINST FOREIGN

PERSONS

We are a corporation governed by

the Business Corporations Act (Ontario) and by the applicable federal laws of

Canada. Certain of our directors and officers and some of the experts named in

this prospectus reside outside the United States and a majority of their assets

are located outside the United States. It may not be possible for you to effect

service of process within the United States on these persons. Furthermore, it

may not be possible for you to enforce against us or them, in the United States,

judgments obtained in United States courts, because a significant portion of our

assets and the assets of these persons are located outside the United States.

We have been advised that there

are strong defenses that can be raised as to the enforceability, in original

actions in Canadian courts, of liabilities based on the United States federal

securities laws or “blue sky” laws of any state within the United States and to

the enforceability in Canadian courts of judgments of United States courts

obtained in actions based on the civil liability provisions of the United States

federal securities laws or any such state securities or blue sky laws such that

the enforcement in Canada of such liabilities and judgments is not certain.

Therefore, it may not be possible to enforce those judgments against us, our

directors and officers and some of the experts named in this prospectus.

OFFERING EXPENSES

The following table lists the

costs and expenses payable by us in connection with the sale of the common

shares covered by this prospectus other than any sales commissions or discounts,

which expenses will be paid by the selling shareholders. The estimates do not

include expenses related to offerings of particular securities. Each prospectus

supplement describing an offering of securities will reflect the estimated

expenses related to the offering of securities under that prospectus supplement.

All amounts shown are estimates except for the SEC registration fee.

|

|

SEC registration fee

|

$

|

932

|

|

|

|

Legal fees and expenses

|

|

30,000

|

|

|

|

Accounting fees and expenses

|

|

5,000

|

|

|

|

Miscellaneous expenses

|

|

5,000

|

|

|

|

Total

|

$

|

40,932

|

|

- 15 -

SHARE CAPITAL

As of April 6, 2016, 49,069,539 common

shares were issued and outstanding, all of which have been duly approved and are

registered on our books. Our articles of amalgamation permit the issuance of an

unlimited number of common shares. All of the outstanding common shares are

fully paid and non-assessable. Within the past five years, more than 10% of our

capital stock has been paid for with assets other than cash.

Our articles of amalgamation,

bylaws, and Registration Statement on Form 8-A describe the rights attached to

our common shares more fully. These documents are filed as exhibits to the

registration statement of which this prospectus forms a part or are incorporated

by reference. See the section entitled “Where You Can Find Additional

Information” on page 1.

Nasdaq Stock Market Marketplace

Rules permit Nasdaq-listed companies that are foreign private issuers to follow

home country practices in lieu of the corporate governance provisions specified

by the Nasdaq with limited exceptions. While we intend to comply with most of

these rules, we plan to follow home country rules with respect to shareholder

approval requirements for the issuance of securities in lieu of following

Nasdaq's shareholder approval requirements under Nasdaq Listing Rule 5635. Other

than with respect to certain actions, including consummation of amalgamations

(mergers), plans of arrangement, and certain related party transactions, the