UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of March, 2016

Commission File Number 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

Vertigo Naos Building, 6,

Rue Eugene Ruppert,

L-2453, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒

Form 40-F

☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐

No

☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

ANNUAL GENERAL MEETING OF SHAREHOLDERS

This report contains a copy of the registrant’s notice and agenda for its Annual General Meeting of Shareholders to be held on April 20, 2016, together with a copy of the form of proxy to be solicited by the registrant.

The attachment contains forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s forward-looking statements are based on the registrant’s current expectations, assumptions, estimates and projections about the registrant and its industry. These forward-looking statements can be identified by words or phrases such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “is/are likely to,” “may,” “plan,” “should,” “would,” or other similar expressions.

The forward-looking statements included in the attached relate to, among others: (i) the registrant’s business prospects and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the laws, regulations and governmental policies governing the registrant’s business, including limitations on ownership of farmland by foreign entities in certain jurisdictions in which the registrant operate, environmental laws and regulations; (iv) the implementation of the registrant’s business strategy, including its development of the Ivinhema mill and other current projects; (v) the registrant’s plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the implementation of the registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the registrant’s relationships with customers; (viii) the competitive nature of the industries in which the registrant operates; (ix) the cost and availability of financing; (x) future demand for the commodities the registrant produces; (xi) international prices for commodities; (xii) the condition of the registrant’s land holdings; (xiii) the development of the logistics and infrastructure for transportation of the registrant’s products in the countries where it operates; (xiv) the performance of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions with the United States Securities and Exchange Commission.

These forward-looking statements involve various risks and uncertainties. Although the registrant believes that its expectations expressed in these forward-looking statements are reasonable, its expectations may turn out to be incorrect. The registrant’s actual results could be materially different from its expectations. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in the attached might not occur, and the registrant’s future results and its performance may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The forward-looking statements made in the attached relate only to events or information as of the date on which the statements are made in the attached. The registrant undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Adecoagro S.A.

|

|

|

|

|

|

|

By

|

/s/ Carlos A. Boero Hughes

|

|

|

Name:

|

Carlos A. Boero Hughes

|

|

|

Title:

|

Chief Financial Officer and

Chief Accounting Officer

|

Date: March 24, 2016

Adecoagro S.A.

Société Anonyme

Vertigo Naos Building

6, Rue Eugène Ruppert

L - 2453 Luxembourg

R.C.S. Luxembourg: B 153.681

(the “

Company

”

)

Convening Notice to the

Annual General Meeting of Shareholders (the “

AGM

”)

to be held on April 20, 2016 at 4.pm (CET) and

Extraordinary General Meeting of Shareholders (the “

EGM

”)

to be held on April 20, 2016, right thereafter the AGM

at Vertigo Naos Building, 6 Rue Eugène Ruppert, L - 2453 Luxembourg

Dear Shareholders,

The Board of Directors of Adecoagro S.A. (the “

Board

”) is pleased to invite you to attend the Annual General Meeting of Shareholders of Adecoagro S.A. to be held on April 20, 2016 at 4.pm (CET) at the registered office of the Company in Luxembourg and the Extraordinary General Meeting of Shareholders of Adecoagro S.A. to be held on April 20, 2016 right thereafter the AGM at the registered office of the Company in Luxembourg, with the following agendas:

A. Agenda for the Annual General Meeting of Shareholders

|

1.

|

Approval of the Consolidated Financial Statements as of and for the years ended December 31, 2015, 2014, and 2013.

|

The Board of Directors of the Company recommends a vote FOR approval of the Company’s consolidated financial statements as of December 31, 2015, 2014 and 2013, after due consideration of the reports from each of the Board and the independent auditor on such consolidated financial statements. The consolidated balance sheets of the Company and its subsidiaries and the related consolidated income statements, consolidated statements of changes in shareholders’ equity, consolidated cash flow statements and the notes to such consolidated financial statements, the report from the independent auditor on such consolidated financial statements and management’s discussion and analysis on the Company’s results of operations and financial condition are included in the Company’s 2015 annual report, a copy of which is available on Company’s website at

www.adecoagro.com

. Copies of the Company’s 2015 annual report are also available free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

|

2.

|

Approval of the Company’s annual accounts as of December 31, 2015.

|

The Board recommends a vote FOR approval of the Company’s annual accounts as of December 31, 2015, after due consideration of the Board’s management report and the report from the independent auditor on such annual accounts. These documents are included in the Company’s 2015 annual report, a copy of which is available on our website at

www.adecoagro.com

. Copies of the Company’s 2015 annual report are also available free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

|

3.

|

Allocation of results for the year ended December 31, 2015.

|

Notwithstanding the net gain of US$18,375,000 on a consolidated basis, the statutory

solus

accounts of the Company under Luxembourg GAAP show a loss of US$2,319,447 on a standalone basis. The Board acknowledges such loss and recommends a vote FOR the carry forward of such loss.

|

4.

|

Vote on discharge (

quitus

) of the members of the Board of Directors for the proper exercise of their mandate during the year ended December 31, 2015.

|

In accordance with applicable Luxembourg law and regulations, it is proposed that, upon approval of the Company’s annual accounts as of December 31, 2015, all who were members of the Board during the year 2015, be discharged from any liability in connection with the management of the Company’s affairs during such year.

The Board recommends a vote FOR the discharge (

quitus

) of the members of the Board of Directors for the proper exercise of their mandate during the year ended December 31, 2015.

|

5.

|

Approval of compensation of members of the Board of Directors for year 2015.

|

The compensation of the Company’s directors is approved annually at the ordinary general shareholders’ meeting.

The Board informs that the overall compensation actually allocated to the members of the Board for the fiscal year 2015 was higher than the compensation approved at the Annual General Meeting of Shareholders held on April 15, 2015. The compensation to the members of the Board for fiscal year 2015 was US$450,000 and a grant of restricted units of up to an aggregate amount of 46,400 units under the Adecoagro’s Amended and Restated Restricted Share and Restricted Stock Unit Plan, as amended, allocated as follows:

|

Name

|

Cash US$

|

Restricted Units

|

|

Abbas Farouq Zuaiter

|

70,000

|

5,800

|

|

Alan Leland Boyce

|

70,000

|

5,800

|

|

Plínio Musetti

|

70,000

|

5,800

|

|

Andrés Velasco Brañes

|

70,000

|

5,800

|

|

Mark Schachter

|

50,000

|

5,800

|

|

Marcelo Vieira (**) (***)

|

|

|

|

Guillaume van der Linden (*)

|

70,000

|

5,800

|

|

Mariano Bosch (**)

|

|

|

|

Daniel C. González

|

50,000

|

5,800

|

|

Dwight Anderson (**)

|

|

5,800

|

|

Walter Marcelo Sánchez (**)

|

|

|

(*) Mr. Guillaume van der Linden was allocated an additional USD20,000 from the cash compensation approved for fiscal year 2015 at the Annual General Meeting of Shareholders held on April 15, 2015.

(**) Mr. Dwight Anderson declined and therefore did not receive his fees in cash, and Mr. Mariano Bosch, Mr. Marcelo Vieira and Mr. Walter Marcelo Sánchez declined and therefore did not receive their fees neither in cash nor in restricted units.

(***) Adecoagro Vale do Ivinhema S.A., a Brazilian subsidiary of the Company, executed an Advisory Services Agreement on November 18, 2014 with Mirante Consultoria Ltda, an affiliate of Mr. Marcelo Vieira, for a term of 12 months and extended for 4 more months. As consideration for the provision of the advisory services under the agreement, Adecoagro Vale do Ivinhema S.A. will pay Mirante Consultoría Ltda. R$59,463 per month, which is equal to an aggregate amount of R$951,408 for the term of the agreement.

The Board recommends a vote FOR the proposed compensation of directors for year 2015.

|

6.

|

Approval of compensation of members of the Board of Directors for year 2016.

|

The compensation of the Company’s directors is approved annually at the ordinary general shareholders’ meeting.

The proposed aggregate compensation to our directors for fiscal year 2016 amounts to up to US$550,000 and a grant of restricted units of up to an aggregate amount of 35,883 units under the Adecoagro’s Amended and Restated Restricted Share and Restricted Stock Unit Plan, as amended, allocated as follows:

|

Name

|

Cash US$

|

Restricted Units

|

|

Abbas Farouq Zuaiter

|

70,000

|

3,987

|

|

Alan Leland Boyce

|

70,000

|

3,987

|

|

Plínio Musetti

|

70,000

|

3,987

|

|

Andrés Velasco Brañes

|

70,000

|

3,987

|

|

Mark Schachter

|

50,000

|

3,987

|

|

Marcelo Vieira

|

50,000

|

3,987

|

|

Guillaume van der Linden

|

70,000

|

3,987

|

|

Mariano Bosch (*)

|

|

|

|

Daniel González

|

50,000

|

3,987

|

|

Dwight Anderson

|

50,000

|

3,987

|

|

Walter Marcelo Sánchez (*)

|

|

|

(*) Mr. Mariano Bosch and Mr. Walter Marcelo Sánchez declined and therefore will not receive their fees neither in cash nor in restricted units.

The Board recommends a vote FOR the proposed compensation of directors for year 2016.

|

7.

|

Appointment of PricewaterhouseCoopers Société Coopérative,

réviseur d’entreprises agréé

as auditor of the Company for a period ending at the general meeting approving the annual accounts for the year ending December 31, 2016.

|

The Board recommends a vote FOR the re-appointment of PricewaterhouseCoopers

Société Coopérative, réviseur d’entreprises agréé

as auditor of the Company for a term ending for a period ending at the general meeting approving the annual accounts for the year ending December 31, 2016.

|

8.

|

Election of the following members of the Board of Directors: (i) Mr. Alan Leland Boyce and Mr. Andrés Velasco Brañes for a term of three (3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2019; and (ii) Mr. Marcelo Vieira and Mr. Walter Marcelo Sanchez for a term of one (1) year each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2017.

|

The Directors are appointed by the General Meeting of Shareholders for a period of up to three (3) years; provided however the Directors shall be elected on a staggered basis, with one third (1/3) of the Directors being elected each year and provided further that such three year term may be exceeded by a period up to the annual general meeting held following the third anniversary of the appointment. The Directors shall be eligible for re-election indefinitely.

The Board recommends a vote FOR the re-election of Mr. Alan Leland Boyce and Mr. Andrés Velasco Brañes, each as member of the Board, for a term of three (3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2019; and the re-election of Mr. Marcelo Vieira and Mr. Walter Marcelo Sánchez, for a term of one (1) year each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2017.

Set forth below is a summary biographical information of each of the candidates:

Alan Leland Boyce. Mr. Boyce is a co-founder of Adecoagro and has been a member of the Company’s board of directors since 2002. Mr. Boyce is co-founder and Chairman of Materra LLC, a diversified farming company based in California and Arizona. Mr Boyce is CEO of Westlands Solar Farms, LLC, a developer of utility scale solar PV projects in California. Since 1985, Mr. Boyce has served as the Chief Financial Officer of Boyce Land Co. Inc., a farmland management company that runs 10 farmland limited partnerships in the U.S. Mr. Boyce formerly served as the director of special situations at Soros from 1999 to 2007, where he managed an asset portfolio of the Quantum Fund and had principal operational responsibilities for the bulk of the fund’s investments in South America. Mr. Boyce also served as managing director in charge of fixed-income arbitrage at Bankers Trust from 1986 to 1999, as senior managing director for investment strategy at Countrywide Financial from 2007 to 2008, and worked at the U.S. Federal Reserve Board from 1982 to 1984. He graduated with a degree in Economics from Pomona College, and has a Masters in Business Administration from Stanford University. Mr. Boyce is an American citizen.

Andres Velasco Brañes. Mr. Velasco has been a member of the Company’s board of directors since 2011. Mr. Velasco was the Minister of Finance of Chile between March 2006 and March 2010, and was also the president of the Latin American and Caribbean Economic Association from 2005 to 2007. Prior to entering the government sector, Mr. Velasco was Sumitomo-FASID Professor of Development and International Finance at Harvard University’s John F. Kennedy School of Government, an appointment he had held since 2000. From 1993 to 2000, he was Assistant and then Associate Professor of Economics and the director of the Center for Latin American and Caribbean Studies at New York University. During 1988 to 1989, he was Assistant Professor at Columbia University. Currently Mr. Velasco serves as Professor of Professional Practice at Columbia University. He also performs consulting services on various economic matters rendering economic advice to an array of clients, including certain of our shareholders. Mr. Velasco holds a Ph.D. in economics from Columbia University and was a postdoctoral fellow in political economy at Harvard University and the Massachusetts Institute of Technology. He received an B.A. in economics and philosophy and an M.A. in international relations from Yale University. Mr. Velasco is a Chilean citizen.

Marcelo Vieira. Mr. Vieira was the Director of Ethanol, Sugar & Energy operations of Adecoagro from 2005 to 2014. He is currently a member of the Board of União da Indústria de Cana-de-Açúcar (“UNICA”) and is a Vice President of Sociedade Rural Brasileira, coordinating its Sustainability area. He has managed agricultural and agribusiness company for over 40 years, including Usina Monte Alegre, Alfenas Agricola and Alfenas Café. Mr.Vieira holds a degree in Mechanical Engineering from PUC University in Río de Janeiro, Brazil, and a graduate degree in Food Industry Management and Marketing from University of London’s Imperial College. Mr. Vieira is a Brazilian citizen.

Walter Marcelo Sanchez. Mr. Sanchez has been a member of the Company’s board of directions since April, 2014. Mr. Sanchez is a co-founder of Adecoagro and our Chief Commercial Officer for all operations in Argentina, Brazil and Uruguay and a member of Adecoagro’s Senior Management since 2002. He coordinates the Commercial Committee and is responsible for the trading of all commodities produced by Adecoagro. Mr. Sanchez has over 25 years of experience in agricultural business trading and market development. Mr. Sanchez has a degree in Agricultural and Livestock Engineering from the University of Mar del Plata. Mr. Sánchez is an Argentine citizen.

B. Agenda for the Extraordinary General Meeting of Shareholders

|

1.

|

Renewal of the authorized un-issued share capital of the Company of three billion US Dollars (USD3,000,000,000) consisting in two billion (2,000,000,000) shares, each with a nominal value of one US Dollars and fifty cents (USD1.5).

|

The Board of Directors of the Company recommends a vote

FOR

the approval of the renewal of the authorized un-issued share capital of the Company of three billion US Dollars (USD3,000,000,000) consisting in two billion (2,000,000,000) shares, each with a nominal value of one US Dollars and fifty cents (USD1.5); renewal of the waiver of and agreement to the suppression or restriction of any pre-emptive right or preferential subscription right, renewal of the authorization granted to the board of directors of the Company (the “Board of Directors”) to proceed to the issue of shares (or any securities or rights exchangeable for, convertible into, or giving subscription or like rights to, shares) within the authorized (unissued) share capital against contributions in cash, in kind or by way of incorporation of available premium or reserves or otherwise pursuant to the terms and conditions determined by the Board of Directors or its delegate(s) (including issue price or any terms or circumstances) while waiving, suppressing or limiting any pre-emptive subscription rights as provided for under Luxembourg law (and any related procedure) in the case of issues of shares within the authorized (unissued) share capital; acknowledgement and approval of the report of the Board of Directors made in accordance with article 32-3 (5) of the law of 10th August 1915 on commercial companies (as amended) (the “Law”) regarding pre-emptive or subscription rights and the related waivers and authorizations; determination of validity of the renewed authorized (unissued) share capital and related waiver and authorization to the Board of Directors for a period starting on the day of the present meeting and ending on the 5th anniversary of the day of the publication of the minutes of the present meeting in the Mémorial.

|

2.

|

Renewal of the authorization granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to purchase, acquire, receive or hold shares in the Company.

|

The Board of Directors of the Company recommends a vote

FOR

the approval of the renewal of the authorization under article 49-2 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to from time to time purchase, acquire, receive or hold shares in the Company up to twenty per cent (20 %) of the issued share capital, on such terms as referred to below and as shall further be determined by the Board of Directors of the Company, such authorization being granted for another period of 5 years. Acquisitions may be made in any manner including without limitation, by tender or other offer(s), buyback program(s), over the stock exchange or in privately negotiated transactions or in any other manner as determined by the Board of Directors (including derivative transactions or transactions having the same or similar economic effect than an acquisition). In the case of acquisitions for value:

|

(i)

|

in the case of acquisitions other than in the circumstances set forth under (ii), for a net purchase price being (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the closing price, as reported by the New York City edition of the Wall Street Journal, or, if not reported therein, any other authoritative source to be selected by the Board of Directors of the Company (the “Closing Price”), over the ten (10) trading days preceding the date of the purchase (or as the case may be the date of the commitment to the transaction);

|

|

(ii)

|

in case of a tender offer (or if deemed appropriate by the Board of Directors, a buyback program),

|

|

|

a.

|

in case of a formal offer being published, for a set net purchase price or a purchase price range, each time within the following parameters: (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over the ten (10) trading days preceding the publication date, provided however that if the stock exchange price during the offer period fluctuates by more than 10 %, the Board of Directors may adjust the offer price or range to such fluctuations;

|

|

|

b.

|

in case a public request for sell offers is made, a price range may be set (and revised by the Board of Directors as deemed appropriate) provided that acquisitions may be made at a price which is no less than (x) fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over a period determined by the Board of Directors provided that such period may not start more than five (5) trading days before the sell offer start date of the relevant offer and may not end after the last day of the relevant sell offer period.

|

|

3.

|

Approval of consequential amendment of article 5.1.1 of the articles of association of the Company, as follows:

|

“5.1.1.

The Company has an authorized share capital of three billion US Dollars (USD3,000,000,000), including the issued share capital, represented by two billion (2,000,000,000) shares, each with a nominal value of one US Dollar and fifty cents (USD1.5). The Company’s share capital (and any authorization granted to the Board of Directors in relation thereto) shall be valid from 20

th

April 2016 and until the fifth anniversary of publication in the Mémorial of the deed of the Extraordinary General Shareholder’s Meeting held on 20

th

April 2016. The Board of Directors, or any delegate(s) duly appointed by the Board of Directors, may from time to time issue shares within the limits of the authorized share capital against contributions in cash, contributions in kind or by way of incorporation of available reserves at such times and on such terms and conditions, including the issue price, as the Board of Directors or its delegate(s) may in its or their discretion resolve and the General Shareholder’s Meeting waived and has authorized the Board of Directors to waive, suppress or limit, any pre-emptive subscription rights of shareholders provided for by law to the extent it deems such waiver, suppression or limitation advisable for any issue or issues of shares within the authorized share capital.”

The Board of Directors of the Company recommends a vote

FOR

the approval of the amendment of article 5.1.1 of the articles of association of the Company, as set forth above.

***************

Each of the items to be voted on the AGM will be passed by a simple majority of the votes validly cast, irrespective of the number of Shares represented.

Quorum for EGM shall be at least one half of the issued share capital of the Company. If said quorum is not present, a second meeting may be convened at which there shall be no quorum requirement. Each of the items to be voted on the EGM will be passed by a two thirds (2/3) majority of the votes validly cast.

Any shareholder who holds one or more shares(s) of the Company on March 3, 2016 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person or vote by proxy. Shareholders who have sold their Shares between the Record Date and the date of the meetings cannot attend the meetings or vote by proxy. In case of breach of such prohibition, criminal sanctions may apply.

Holders who have withdrawn their shares from DTC between April 8, 2016 and the date of the meetings should contact the Company in advance of the date of the meetings at 6, Rue Eugène Ruppert, L-2453 Luxembourg, or at Av. Fondo de la Legua 936, B1640EDO | Martínez, Pcia de Buenos Aires, Argentina, to make separate arrangements to be able to attend the meetings or vote by proxy.

Attached to this notice is a proxy card which you will need to complete in order to vote your Shares by proxy. Proxy cards must be received by the tabulation agent no later than 3:00 p.m. New York City Time on April 18, 2016 in order for such votes to count.

Please consult the Company’s website as to the procedures for attending the meetings or to be represented by way of proxy. A copy of this notice is also available on the Company’s website.

Copies of the Consolidated Financial Statements as of and for the years ended December 31, 2015, 2014, and 2013 of the Company and the Company’s annual accounts as of December 31, 2015 together with the Company’s 2015 annual report, relevant management and audit reports are available on the Company’s website www.adecoagro.com and may also be obtained free of charge at the Company’s registered office in Luxembourg.

Yours faithfully

The Board of Directors

Procedures for Attending the meetings and Voting by Proxy

Any shareholder who holds one or more shares(s) of the Company on March 3, 2016 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person, through their duly appointed attorneys or vote by proxy. Attorneys must properly evidence their powers to represent a shareholder by a valid power-of-attorney which should be filed no later than April 18, 2016 at the address indicated below.

In the case of Shares owned by a corporation or any other legal entity, individuals representing such entity who wish to attend the meetings in person and vote at the meetings on behalf of such entity, must present evidence of their authority to attend and vote at the meetings, by means of a proper document (such as a general or special power-of-attorney) issued by the respective entity. A copy of such power of attorney or other proper document should be filed not later than April 18, 2016, at any of the addresses indicated below.

Address for filing powers-of-attorney:

Adecoagro S.A.

Vertigo Naos Building,

6 Rue Eugène Ruppert,

L – 2453, Luxembourg

Attention: Emilio Gnecco

To vote by proxy, holders of Shares will need to complete proxy cards. Proxy cards must be received by the tabulation agent at the return address indicated on the proxy cards, Computershare Shareowner Services LLC, P.O. Box 43101, Providence, RI 02940, no later than 3:00 p.m. New York City Time on April 18, 2016 in order for such votes to count.

If you hold your shares through a brokerage account, please contact your broker to receive information regarding how you may vote your shares.

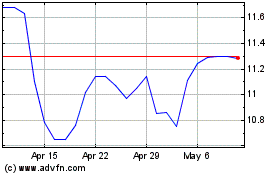

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Sep 2023 to Sep 2024