As filed with the Securities and Exchange Commission on

February 23, 2016

Registration No.

333-209463

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-7

REGISTRATION

STATEMENT UNDER

THE SECURITIES ACT OF 1933

NAUTILUS MINERALS INC.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada |

1000 |

Not Applicable |

(Province or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

incorporation or organization) |

Classification Code Number) |

Identification Number)

|

Level 3, 33 Park Road

Milton, Queensland 4064

Australia

Telephone Number: + 61-7-3318-5555

(Address and telephone number of Registrant’s principal executive

offices)

Puglisi & Associates

850 Library Avenue, Suite

204

Newark, DE 19711

Telephone: 302-738-6680

(Name, address and telephone number of agent for service in the

United States)

Copies to:

Corey Dean |

Herbert I. Ono |

DuMoulin Black LLP |

McMillan LLP |

10th Floor – 595 Howe St

|

Suite 1500 – 1055 West Georgia Street

|

Vancouver, British Columbia |

Vancouver, British Columbia |

Canada V6C 2T5 |

Canada V6E 4N7 |

Tel: (604) 687-1224 |

Tel: (604) 691-7493

|

Approximate date of commencement of proposed sale of the

securities to the public:

As soon as practicable after the filing of the next amendment

to this registration statement.

1

This registration statement and any amendment thereto shall

become effective upon filing with the Commission in accordance with Rule

467(a).

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to the home jurisdiction’s

shelf prospectus offering procedures, check the following box:[ ]

|

If, as a result of stock splits, stock dividends or

similar transactions, the number of securities purported to be

registered on this registration statement changes, the provisions of Rule

416 shall apply to this registration statement.

|

II-2

PART I

INFORMATION REQUIRED TO BE SENT TO SHAREHOLDERS

I-1

IF YOU ARE A REGISTERED SHAREHOLDER AND RESIDENT IN AN

ELIGIBLE JURISDICTION OR A PRE-APPROVED JURISDICTION, YOUR RIGHTS CERTIFICATE IS

ENCLOSED. PLEASE READ THIS MATERIAL CAREFULLY AS YOU ARE REQUIRED TO MAKE A

DECISION PRIOR TO 2:00 P.M. (VANCOUVER TIME) ON APRIL 6, 2016.

No securities regulatory authority has expressed an opinion

about these securities and it is an offence to claim otherwise. This short form

prospectus constitutes a public offering of these securities only in those

jurisdictions where they may be lawfully offered for sale and therein only by

persons permitted to sell such securities.

Information has been incorporated by reference in this

short form prospectus from documents filed with securities commissions or

similar authorities in Canada. Copies of the documents incorporated

herein by reference may be obtained on request without charge from the Company

Secretary of Nautilus Minerals Inc. at Level 3, 33 Park Road, PO Box 1213,

Milton, Queensland, Australia 4064 (Telephone +61-73318-5555) or 10th Floor, 595

Howe Street, Vancouver, British Columbia, V6C 2T5 (Telephone 604-687-1224) and

are also available electronically at www.sedar.com.

With respect to the United Kingdom, this short form

prospectus is being made to and directed at and the securities being offered

hereunder are only available to: (i) persons outside the United Kingdom; or (ii)

persons in the United Kingdom who are: (a) a "qualified investor" within the

meaning of Section 86(7) of the United Kingdom Financial Services and Markets

Act 2000, as amended ("FSMA"), acting as principal or in

circumstances where Section 86(2) FSMA applies; and (b) also: (1) within the

categories of persons referred to in Article 19 (investment professionals) or

Article 49 (high net worth companies, unincorporated associations, etc.) of the

United Kingdom Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005 (the "Financial Promotion Order"); or (2) are

otherwise lawfully permitted to receive them (all such persons together being

referred to as "relevant persons"). The securities being

offered hereunder are only available to, and any invitation, offer or agreement

to subscribe, purchase or otherwise acquire such securities will be engaged in

only with, relevant persons. Any person who is not a relevant person should not

act or rely on this document or any of its contents. This document contains no

offer of transferable securities to the public in the United Kingdom within the

meaning of sections 85(1) and 102B FSMA. This document is not a prospectus for

the purposes of Section 85(1) FSMA. Accordingly, this document has not been

examined or approved as a prospectus by the United Kingdom Financial Conduct

Authority (the "FCA") under Section 87A FSMA or by the

London Stock Exchange and has not been filed with the FCA pursuant to the rules

published by the FCA implementing the Prospectus Directive (2003/71/EC) (the

"United Kingdom Prospectus Rules") nor has it been approved

by a person authorized under FSMA, for the purposes of Section 21 FSMA.

SHORT FORM PROSPECTUS

| Rights Offering |

February 23, 2016 |

NAUTILUS MINERALS INC.

$103,000,000

OFFERING OF RIGHTS TO SUBSCRIBE FOR UP TO 686,666,666 COMMON SHARES

AT A PRICE OF $0.15 PER

COMMON SHARE

Nautilus Minerals Inc. (the "Company" or

"Nautilus") is distributing (the "Offering") to the holders of its

outstanding common shares (the "Common Shares") of record

("Shareholders") at the close of business (Vancouver time) on March 1, 2016

(the "Record Date") one right (the "Right") for each Common Share

held which will entitle the Shareholders to subscribe for up to an aggregate of

686,666,666 Common Shares for gross proceeds to the Company of up to approximately

$103,000,000.

The Rights are evidenced by transferable certificates in

registered form (the "Rights Certificates"). Each Shareholder is entitled

to one Right for each Common Share held on the Record Date. For each Right held,

the holder thereof is entitled to purchase 1.541329 Common Shares (the "Basic Subscription Privilege") at a price

of $0.15 per Common Share (the "Subscription Price") prior to 2:00 p.m.

(Vancouver time) (the "Expiry Time") on April 6, 2016 (the "Expiry

Date"). No fractional Common Shares will be issued. RIGHTS NOT EXERCISED BEFORE THE EXPIRY TIME WILL BE VOID AND OF NO VALUE.

Shareholders who exercise in full the Basic Subscription Privilege for their

Rights are also entitled to subscribe for additional Common Shares (the

"Additional Shares"), if available, pursuant to an additional

subscription privilege (the "Additional Subscription Privilege"). See

"Description of Offered Securities — Additional Subscription Privilege". Any

subscription for Common Shares will be irrevocable once submitted.

- ii -

| |

Subscription Price

|

Proceeds to the

Company(2) |

| Per Common Share |

$0.15 |

$0.15 |

| Total Offering(1) |

$103,000,000 |

$103,000,000 |

| (1) |

Assuming exercise in full of all of the Rights issued

under the Offering. |

| (2) |

Before deducting the expenses of the Offering, estimated

to be approximately $450,000. |

Pursuant to the requirements of the Toronto Stock Exchange

("TSX"), completion of the Offering is not subject to raising a minimum amount

of proceeds. The Company has not entered into a standby commitment with any

person or company in respect of the Offering. This means that the Company could

complete this Offering after raising only a small proportion of the Offering

amount set out in the table above. See "Use of Proceeds".

This prospectus qualifies the distribution of the Rights as

well as the Common Shares issuable upon exercise of the Rights in each province

of Canada (other than Quebec). This prospectus also covers the offer and sale of

the Common Shares issuable upon exercise of the Rights within the United States

under the U.S. Securities Act of 1933, as amended (the "U.S. Securities

Act"). The provinces of Canada (other than Quebec) and the United States are

collectively referred to in this prospectus as the "Eligible

Jurisdictions". Notwithstanding registration under the U.S. Securities Act,

the securities or blue sky laws of certain states (including California, Ohio,

Arizona, Arkansas, Iowa, Minnesota and Wisconsin) may not permit the Company to

offer Rights and/or Common Shares in such states, or to certain persons in those

states, or may otherwise limit the Company's ability to do so, and as a result

the Company will treat those states as Ineligible Jurisdictions (as defined

below) under the Offering.

The Rights distributed under this prospectus and the Common Shares issuable upon the exercise of the Rights will be listed on the TSX. The Common Shares currently outstanding are listed and posted for trading on the TSX under the symbol "NUS" and are quoted on the OTCQX International (Nasdaq International Designation) under the symbol "NUSMF". On February 22, 2016, the closing price for the Common Shares on the TSX was $0.24 per share and on the OTCQX International was US$0.185 per share.

The Rights are fully transferable into and within the Eligible

Jurisdictions in Canada by the holders thereof. The Rights may not be transferred to any person within the

United States. Holders of Common Shares in the United States who receive Rights

may transfer or resell them only in transactions outside of the United States in

accordance with Regulation S under the U.S. Securities Act, which generally will

permit the resale of the Rights through the facilities of the TSX.

Computershare Investor Services Inc. (the "Subscription

Agent"), at its principal office in the City of Vancouver, British Columbia

(the "Subscription Office"), is the subscription agent for this Offering.

See "Description of Offered Securities — Subscription and Transfer Agent".

For Common Shares held through a securities broker or dealer,

bank or trust company or other participant (a "CDS Participant") in the

book based system administered by CDS Clearing and Depository Services Inc.

("CDS"), a subscriber in an Eligible Jurisdiction or an Approved Eligible

Holder (as defined herein) may subscribe for Common Shares by instructing the

CDS Participant holding the subscriber's Rights to exercise all or a specified

number of such Rights and forwarding the Subscription Price for each Common

Share subscribed for to such CDS Participant in accordance with the terms of

this Offering. A subscriber wishing to subscribe for Additional Shares pursuant to the Additional

Subscription Privilege must forward its request to the CDS Participant that

holds the subscriber's Rights prior to the Expiry Time on the Expiry Date, along

with payment for the number of Additional Shares requested. Any excess funds

will be returned by mail or credited to the subscriber's account with its CDS

Participant without interest or deduction. Subscriptions for Common Shares made

through a CDS Participant will be irrevocable and subscribers will be unable to

withdraw their subscriptions for Common Shares once submitted. See "Description

of Offered Securities — Rights Certificate — Common Shares Held Through CDS".

- iii -

For Common Shares held in registered form, a Rights Certificate

evidencing the number of Rights to which a holder is entitled will be mailed

with a copy of this prospectus to each registered Shareholder as of the close of

business on the Record Date. In order to exercise the Rights represented by the

Rights Certificate, the holder of Rights must complete and deliver the Rights

Certificate to the Subscription Agent in the manner and upon the terms set out

in this prospectus. All exercises of Rights are irrevocable once submitted. See

"Description of Offered Securities — Rights Certificate — Common Shares Held in

Registered Form".

If a Shareholder does not exercise, or sells or otherwise

transfers, its Rights, then such Shareholder's current percentage ownership in

the Company will be diluted as a result of the exercise of Rights by other

Shareholders.

This prospectus qualifies the distribution of the Rights as

well as the Common Shares issuable upon exercise of the Rights in the Eligible

Jurisdictions. The Rights as well as the Common Shares issuable upon exercise of

the Rights are not being distributed or offered to Shareholders in any

jurisdiction other than the Eligible Jurisdictions (an "Ineligible

Jurisdiction") and, except under the circumstances described herein, Rights

may not be exercised by or on behalf of a holder of Rights resident in an

Ineligible Jurisdiction (an "Ineligible Holder"). This prospectus is not,

and under no circumstances is to be construed as, an offering of any Rights or

Common Shares for sale in any Ineligible Jurisdiction or a solicitation therein

of an offer to buy any securities. Rights Certificates will not be sent to

Shareholders with addresses of record in any Ineligible Jurisdiction, other than

Pre-Approved Jurisdictions (as defined herein). Instead, such Ineligible Holders

will be sent a letter advising them that their Rights Certificates will be held

by the Subscription Agent, who will hold such Rights as agent for the benefit of

all such Ineligible Holders. See "Description of Offered Securities — Ineligible

Holders".

No underwriter has been involved in the preparation of this

prospectus or performed any review of the contents of this prospectus.

There are risks associated with an investment in the Common

Shares. See "Risk Factors" for a discussion of factors that should be considered

by prospective investors and their advisors in assessing the appropriateness of

an investment in the Common Shares.

The Company's two largest shareholders, MB Holding Company LLC,

which, together with its affiliates (collectively, "MB"), holds

approximately 28% of the outstanding Common Shares, and Metalloinvest Holding

(Cyprus) Limited, which, together with its affiliates (collectively,

"Metallo"), holds approximately 21% of the outstanding Common Shares,

have each indicated to the board of directors of the Company their present

intention to participate in the Offering by exercising all or a portion of their

Basic Subscription Privilege, but they will determine the extent of their

participation in the contexts of the market and there can be no assurance that

either MB or Metallo will exercise their Basic Subscription Privilege. The

Company believes that insiders of the Company, including MB and Metallo, will be

issued Rights to purchase approximately 331,794,574 Common Shares, representing approximately 50% of the Offering. See

"Intention of Insiders to Exercise Rights".

All calculations of outstanding Common Shares in this

prospectus exclude outstanding Common Shares that have been issued under, and

remain subject to the restrictions of, the Company's Share Loan Plan. See

"Description of Share Capital – Loan Shares".

- iv -

The Company's head office in Canada is located at Suite 1400,

400 Burrard Street, Vancouver, British Columbia, V6C 3A6. The Company also has a

project and operations office located at Level 3, 33 Park Road, Milton,

Queensland, Australia 4064, PO Box 1213. The Company's registered and records

office is located at 10th Floor, 595 Howe Street, Vancouver, British Columbia,

V6C 2T5. The Company also has a corporate office located at Suite 1702, 141

Adelaide Street West, Toronto, Ontario M5H 3L5.

The persons signing the Company's certificate page for this

prospectus, the balance of the Company's directors and certain persons for whom

the Company is required to file a consent in connection herewith, reside outside

of Canada. See "Enforcement of Judgments Against Foreign Persons".

We are permitted to prepare this prospectus in accordance

with Canadian disclosure requirements, which are different from those of the

United States. We prepare our financial statements in accordance with

International Financial Reporting Standards as issued by the International

Accounting Standards Board, and they may be subject to Canadian auditing and

auditor independence standards. They may not be comparable to financial

statements of United States companies.

Owning the securities may subject you to tax consequences

both in the United States and Canada. This prospectus or any applicable

prospectus supplement may not describe these tax consequences fully. See

"Certain U.S. Federal Income Tax Considerations". You should read the tax

discussion in any applicable prospectus supplement.

Your ability to enforce civil liabilities under the United

States federal securities laws may be affected adversely because we are existing

under the laws of British Columbia, some or all of our officers and directors

may be residents of a country other than the United States, some or all of the

experts named in this prospectus may be residents of a country other than the

United States, and all of our assets are located outside the United

States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE "SEC"). NOR HAS THE

SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENCE.

TABLE OF CONTENTS

- 2 -

ABOUT THIS PROSPECTUS

In this prospectus, "Nautilus", the "Company",

"we", "us" and "our" refer collectively to Nautilus

Minerals Inc. and each of its material subsidiaries, unless the context

otherwise requires.

You should rely only on the information contained in this

prospectus. We have not authorized anyone to provide you with information

different from that contained in this prospectus. We are offering the Rights,

and offering to sell and seeking offers to buy the Common Shares, only in

jurisdictions where, and to persons to whom, offers and sales are lawfully

permitted. The information contained in this prospectus is accurate only as of

the date of this prospectus, regardless of the time of delivery of this

prospectus or of any sale of the Rights or Common Shares. You should bear in

mind that although the information contained in this prospectus is accurate as

of any date on the front of such documents, such information may also be

amended, supplemented or updated by the subsequent filing of additional

documents deemed by law to be or otherwise incorporated by reference into this

prospectus and by any subsequently filed prospectus amendments.

Unless stated otherwise or the context otherwise requires, all

references to dollar amounts in this prospectus are references to Canadian

Dollars. The Company prepares its annual financial statements, including those

incorporated herein by reference, in accordance with International Financial

Reporting Standards ("IFRS"), as issued by the International Accounting

Standards Board, and its interim financial statements, including those

incorporated herein by reference, in accordance with International Accounting

Standard 34, Interim Financial Reporting. As a result, the Company's financial

statements may not be comparable to financial statements of United States

companies that report in accordance to United States Generally Accepted

Accounting Principles ("U.S. GAAP"). The Company presents its financial

statements in United States dollars.

CANADIAN MINERAL DISCLOSURE STANDARDS

This prospectus has been prepared in accordance with the

requirements of securities laws in effect in Canada, which differ from the

requirements of United States securities laws. In Canada, an issuer is required

to provide technical information with respect to mineralization, including

reserves and resources, if any, on its mineral exploration properties in

accordance with Canadian requirements, which differ significantly from the

requirements of the United States Securities and Exchange Commission (the

"SEC") applicable to registration statements and reports filed by United

States companies pursuant to the 1933 Act or the United States Securities

Exchange Act of 1934, as amended (the "Exchange Act"). As such,

information contained or incorporated by reference in this prospectus concerning

descriptions of mineralization under Canadian standards may not be comparable to

similar information made public by United States companies subject to the

reporting and disclosure requirements of the SEC.

Mineral resource estimates included in this prospectus and in

any document incorporated by reference herein or therein have been prepared in

accordance with National Instrument 43-101 - Standards of Disclosure for Mineral

Projects ("NI 43-101") and the Canadian Institute of Mining and

Metallurgy Classification System, as required by Canadian securities regulatory

authorities. In particular, this prospectus and any document incorporated by

reference herein, include the terms "measured mineral resource", "indicated

mineral resource" and "inferred mineral resource." While these terms are

recognized and required by Canadian regulations (under NI 43-101), the SEC does

not recognize them. In addition, a document incorporated by reference in this

prospectus includes disclosure of "contained ounces" of mineralization. Although

such disclosure is permitted under Canadian regulations, the SEC only permits

issuers to report mineralization as in place tonnage and grade without reference

to unit measures.

The definitions of proven and probable reserves used in NI

43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry

Guide 7 (under the Exchange Act), as interpreted by the staff of the SEC, mineralization may not be classified as a "reserve"

for United States reporting purposes unless the determination has been made that

the mineralization could be economically and legally produced or extracted at

the time the reserve determination is made. Among other things, all necessary

permits would be required to be in hand or issuance imminent in order to

classify mineralized material as reserves under the SEC standards.

- 3 -

United States investors are cautioned not to assume that any

part or all of the mineral deposits identified as a "measured mineral resource",

"indicated mineral resource" or "inferred mineral resource" will ever be

converted to reserves as defined in NI 43-101 or SEC Industry Guide 7. Further,

"inferred mineral resources" have a great amount of uncertainty as to their

existence and economic and legal feasibility. It cannot be assumed that all or

any part of an inferred mineral resource will ever be upgraded to a higher

category. Under Canadian rules, estimates of "inferred mineral resources" may

not form the basis of feasibility or other economic studies. U.S. investors are

cautioned not to assume that part or all of an inferred mineral resource exists,

or is economically or legally mineable.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference

herein contain "forward-looking statements" or "forward-looking information"

within the meaning of applicable securities legislation (together,

"forward-looking statements"), which include all statements other than

statements of historical fact. These forward-looking statements are made as of

the date of this prospectus or, in the case of documents incorporated by

reference herein, as of the date of such documents and, except as required under

applicable securities legislation, the Company does not intend, and does not

assume any obligation, to update these forward-looking statements.

Capitalized terms used and not defined herein are defined in

the AIF (as defined in "Documents Incorporated by Reference" below).

Forward-looking statements include, but are not limited to, statements with respect to the future price of copper, gold and other metals; the estimation of mineral resources; the realization of mineral resource estimates; plans for establishing or expanding mineral resource estimates on the Projects; the construction and delivery of the PSV (also referred to in this prospectus as the "Production Support Vessel"); the fulfillment of the obligations under the Tongling Sales Agreement and the timing and sustainability of such arrangements; costs and timing of the development of the Seafloor Production System; the Company's SMS prospects (including Solwara 1) and new deposits; success of exploration and development activities; permitting time lines; currency fluctuations; requirements for additional capital; government regulation of exploration operations; the Company's financial position; business strategy; plans and objectives of management for future operations; the design and performance of the PSV and SPTs (also referred to in this prospectus as the "Seafloor Production Tools"); and the procurement of the PSV. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk of failure to obtain required equity or debt funding; the risk that material assumptions listed in the paragraph below will not be borne out; changes in project parameters as plans continue to be refined; any additional permitting or licensing requirements associated with any modifications to the scope of the Solwara 1 Project; future prices of copper, gold and other metals being lower than expected; the over-arching risk that the Company will not commence production of mineralized material; possible variations in resources, grade or recovery rates; the risk of failure to conclude the investigation into the cyber-attack, the inability to reach agreement with MAC as to the deposit under the vessel charter agreement, the insolvency of MAC or the applicable shipyard and other events which may cause a delay to the delivery of the PSV; the risk that the obligations under the Tongling Sales Agreement are not fulfilled; late delivery of the PSV and SPTs or other equipment; variations in the cost of the PSV and SPTs or other equipment; variations in exchange rates; the failure to obtain regulatory approval for financings; changes in the cost of fuel and other inflationary factors; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities.

- 4 -

Other risks are discussed in this prospectus under "Risk

Factors".

Such forward-looking statements are current only as at the date

on which they are stated to be made and are based on numerous material

assumptions (that management believes were reasonable at the time they are made)

regarding the Company's present and future business strategies and the

environment in which the Company will operate in the future, including the

Company's continued compliance with regulatory requirements and the estimated

costs and availability of funding for the continued development of the Seafloor

Production System. The Company has also assumed that market fundamentals will

result in sustained copper and gold demand and prices; that the proposed

development of its Seafloor Production System will be viable operationally and

economically and proceed as expected; and that any additional financing needed

will be available on reasonable terms. With respect to the arrangement with MAC,

the Company is assuming that the parties will observe their obligations, that

the investigation into the cyber-attack will reach a timely conclusion and that

MAC and the Company can agree how to proceed in relation to the payment of the

deposit under the vessel charter agreement. Other assumptions are discussed

throughout the AIF and, in particular, under the heading "Risk Factors" in the

AIF, and under "Critical Accounting Estimates and Judgments" and "Critical

Accounting Estimates" in the management's discussion and analysis incorporated

herein by reference.

Although the Company has attempted to identify important

factors that could cause actual results to differ materially, the assumptions

made may not prove to be correct or there may be unknown risks, uncertainties

and other important factors beyond the Company's control that could cause the

actual results, performance or achievements of the Company to be materially

different from future results, performance or achievements expressed or implied

by such forward-looking statements. Except as may be required by applicable

laws, the Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward-looking statements contained

herein to reflect any change in the Company's expectations with regard thereto

or any change in events, conditions or circumstances on which any such

statements are based.

CURRENCY AND EXCHANGE RATE INFORMATION

This prospectus contains references to United States dollars

and Canadian dollars. All dollar amounts referenced, unless otherwise indicated,

are expressed in Canadian dollars. References to "$" or "C$" are

to Canadian dollars and references to "US$" are to U.S. dollars.

The closing, high, low and average exchange rates for the

United States dollar in terms of Canadian dollars for each of the three years

ended December 31, 2015, December 31, 2014, and December 31, 2013 as reported by

the Bank of Canada, were as follows:

- 5 -

| |

|

Year Ended December 31 |

|

| |

2015 |

2014 |

2013 |

| |

(C$) |

(C$) |

(C$) |

| Closing(1) |

1.3840 |

1.1601 |

1.0636 |

| High(1) |

1.3990 |

1.1643 |

1.0697 |

| Low(1) |

1.1728 |

1.0614 |

0.9839 |

| Average(2) |

1.2787 |

1.1045 |

1.0299 |

| |

(1) |

The exchange rates are nominal quotations (not buying or

selling rates) of the daily noon exchange rates published by the Bank of

Canada and are intended for statistical purposes. |

| |

(2) |

Calculated as an average of the daily noon rates for each

period. |

On February 22, 2016, the Bank of Canada noon rate of exchange

was C$1.00 = US$0.7307 or US$1.00 = C$1.3685.

The financial statements of the Company incorporated by

reference herein are reported in United States dollars and have been prepared in

accordance with IFRS.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this

prospectus from documents filed with securities commissions and similar

authorities in Canada. Copies of the documents incorporated herein by

reference may be obtained upon request without charge from Company Secretary of

Nautilus Minerals Inc. at Level 3, 33 Park Road, PO Box 1213, Milton,

Queensland, Australia 4064 (Telephone +61-73318-5555) or 10th Floor, 595 Howe

Street, Vancouver, British Columbia, V6C 2T5 (Telephone 604-687-1224) and are

also available electronically at www.sedar.com.

The following documents of Nautilus, filed with securities

commissions and similar authorities in Canada, are specifically incorporated by

reference into, and form an integral part of, this prospectus:

| 1) |

Annual Information Form dated March 30, 2015 and filed on

SEDAR on March 31, 2015 (the "AIF"); |

| |

|

| 2) |

Audited consolidated financial statements for the years

ended December 31, 2014 and December 31, 2013, together with the notes

thereto and the auditors' report thereon, filed on SEDAR on March 31,

2015; |

| |

|

| 3) |

Management's Discussion & Analysis for the years

ended December 31, 2014 and December 31, 2013 and filed on SEDAR on March

31, 2015 (the "Annual MD&A"); |

| |

|

| 4) |

Unaudited consolidated financial statements for the three

and nine month periods ended September 30, 2015 and September 30, 2014,

together with the notes thereto, filed on SEDAR on November 9,

2015; |

| |

|

| 5) |

Management's Discussion & Analysis for the nine

months ended September 30, 2015, filed on SEDAR on November 9, 2015 (the

"Interim MD&A"); |

| |

|

| 6) |

Material Change Report dated February 11, 2016 and filed on SEDAR on February 11, 2016, with respect to the announcement of the Offering and the filing of the preliminary prospectus;

|

| |

|

| 7) |

Material Change Report dated December 16, 2015 and filed on SEDAR on December 16, 2015, with respect to the Company entering into a new agreement with Tongling Nonferrous Metals Co. Ltd. ("Tongling") for the sale of material extracted from the Company's Solwara 1 Project (the "Tongling Sales Agreement"); |

- 6 -

| 8) |

Material Change Report dated May 7, 2015 and filed on SEDAR on May 7, 2015, with respect to a change of directors of the Company; |

| |

|

| 9) |

Material Change Report dated February 4, 2015 and filed on SEDAR on February 4, 2015, with respect to the pre-payment of the charterer's guarantee relating to the construction of the Production Support Vessel; and |

| |

|

| 10) |

Management Information Circular dated May 7, 2015 and filed on SEDAR on May 19, 2015 prepared in connection with Nautilus' annual meeting of shareholders held on June 16, 2015 (the "AGM Circular"). |

Any documents of the Company of the type described in section

11.1 of Form 44-101F1 – Short Form Prospectus filed by the Company with any

securities regulatory authorities after the date of this prospectus and prior to

the termination of this distribution will be deemed to be incorporated by

reference into this prospectus.

Any statement contained in this prospectus or in a document

incorporated or deemed to be incorporated by reference herein will be deemed to

be modified or superseded, for purposes of this prospectus, to the extent that a

statement contained in this prospectus or in any other subsequently filed

document which also is, or is deemed to be, incorporated by reference herein

modifies or supersedes such statement. The modifying or superseding statement

need not state that it has modified or superseded a prior statement or include

any other information set forth in the document that it modifies or supersedes.

The making of a modifying or superseding statement will not be deemed an

admission for any purposes that the modified or superseded statement, when made,

constituted a misrepresentation, an untrue statement of a material fact or an

omission to state a material fact that is required to be stated or that is

necessary to make a statement not misleading in light of the circumstances in

which it was made. Any statement so modified or superseded will not, except as

so modified or superseded, be deemed to constitute a part of this prospectus.

MARKETING MATERIALS

Any "template version" of any "marketing materials" (as such

terms are defined under applicable Canadian securities laws) that are prepared

in connection with the Offering are not part of this prospectus to the extent

that the contents of the template version of the marketing materials have been

modified or superseded by a statement contained in this prospectus. Any template

version of any marketing materials that has been, or will be, filed on SEDAR

(www.sedar.com) before the termination of the distribution under the Offering

(including any amendments to, or an amended version of, any template version of

any marketing materials) is deemed to be incorporated by reference into this

prospectus.

SUMMARY OF RIGHTS OFFERING

The following is a summary of the principal features of the

Offering and should be read in conjunction with, and is qualified in its

entirety by, the more detailed information and financial data and statements

contained elsewhere or incorporated by reference in this prospectus. Certain

terms used in this summary and in the prospectus are defined elsewhere herein.

| Issuer |

Nautilus Minerals Inc. |

| The Offering. |

The Offering consists of Rights to subscribe for up to

approximately 686,666,666 Common Shares. |

- 7 -

| Eligible Jurisdictions |

All provinces of Canada (other than Quebec) and the

United States. Notwithstanding registration under the U.S. Securities Act,

the securities or blue sky laws of certain states (including California,

Ohio, Arizona, Arkansas, Iowa, Minnesota and Wisconsin) may not permit the

Company to offer Rights and/or Common Shares in such states, or to certain

persons in those states, or may otherwise limit the Company's ability to

do so, and as a result the Company will treat those states as Ineligible

Jurisdictions under the Offering. The Company will only offer Rights in

states where, and to such persons to whom, it is legally permitted to do

so. |

| Pre-Approved Jurisdictions |

The Commonwealth of Australia, New Zealand, the Republic

of Cyprus, the British Virgin Islands, France and Oman. |

| Record Date |

March 1, 2016 |

| Commencement Date |

March 7, 2016 |

| Expiry Date |

April 6, 2016 |

| Expiry Time |

2:00 p.m. (Vancouver time) on the Expiry Date. Rights not

exercised at or before the Expiry Time will be void and have no value. |

| Subscription Price |

$0.15 per Common Share. |

| Standby Commitment |

There is no standby commitment. |

| Maximum Net Proceeds |

Approximately $102,550,000, after deducting the estimated expenses

of the Offering of approximately $450,000, and assuming exercise in full

of the Rights. |

| Use of Proceeds |

The Company intends to use the net proceeds of the

Offering to advance the construction and development of the Company's

Seafloor Production System (as defined in the AIF) and for general working

capital requirements. See "Use of Proceeds". |

Basic Subscription

Privilege |

Each Right entitles the holder thereof to subscribe for

1.541329 Common Shares upon payment of the Subscription Price per Common Share. No

fractional Common Shares will be issued. Where the exercise of Rights

would appear to entitle a holder of Rights to receive fractional Common

Shares, the holder's entitlement will be reduced to the next lowest whole

number of Common Shares. See "Description of Offered Securities — Basic

Subscription Privilege". |

Additional

Subscription

Privilege |

Holders of Rights who exercise in full the Basic

Subscription Privilege for their Rights are also entitled to subscribe pro

rata for additional Common Shares, if any, not otherwise purchased

pursuant to the Basic Subscription Privilege. See "Description of Offered

Securities — Additional Subscription Privilege". |

| Exercise of Rights |

For all Shareholders whose Common Shares are held in

registered form with an address of record in an Eligible Jurisdiction or a

Pre-Approved Jurisdiction, a Rights Certificate representing the total

number of Rights to which such Shareholder is entitled as at the Record

Date will be mailed with a copy of this prospectus to each such

Shareholder. In order to exercise the Rights represented by the Rights

Certificate, such holder of Rights must complete and deliver the Rights

Certificate in accordance with the instructions set out under "Description

of Offered Securities — How to Complete the Rights Certificate". For

Common Shares held through a CDS Participant, a subscriber in an Eligible

Jurisdiction or a Pre-Approved Jurisdiction may subscribe for Common

Shares by instructing the CDS Participant holding the subscriber's Rights

to exercise all or a specified number of such Rights and forwarding the

Subscription Price for each Common Share subscribed for in accordance with

the terms of this Offering to such CDS Participant. |

- 8 -

Holders in Ineligible

Jurisdictions |

This Offering is made in all of the Eligible

Jurisdictions. No subscription under the Basic Subscription Privilege nor

under the Additional Subscription Privilege will be accepted from any

person, or such person's agent, who appears to be, or who the Company has

reason to believe is, an Ineligible Holder, except that the Company may

accept subscriptions in certain circumstances from persons in such

jurisdictions if the Company determines that such offering to and

subscription by such person or agent is lawful and in compliance with all

securities and other laws applicable in the jurisdiction where such person

or agent is resident (each, an "Approved Eligible Holder").

The Company is treating Shareholders of record on the Record Date in the

Commonwealth of Australia, New Zealand, Cyprus, the British Virgin

Islands, France and Oman (the "Pre-Approved Jurisdictions") as

Approved Eligible Holders. No Rights Certificates will be mailed to

Ineligible Holders (other than to Shareholders in Pre-Approved

Jurisdictions) and Ineligible Holders (other than Shareholders in Pre-

Approved Jurisdictions) will not be permitted to exercise their Rights.

Registered holders of Common Shares who have not received Rights

Certificates but are resident in an Eligible Jurisdiction or a

Pre-Approved Jurisdiction or wish to be recognized as Approved Eligible

Holders should contact the Subscription Agent at the earliest possible

time. Rights of Ineligible Holders will be held by the Subscription Agent

until 5:00 p.m. (Vancouver time) on March 29, 2016 in order to provide

the beneficial holders outside the Eligible Jurisdictions and Pre-Approved

Jurisdictions an opportunity to claim the Rights Certificate by satisfying

the Company that the exercise of their Rights will not be in violation of

the laws of the applicable jurisdiction. After such time, the Subscription

Agent will attempt to sell the Rights of such registered Ineligible

Holders on such date or dates and at such price or prices as the

Subscription Agent will determine in its sole discretion.

Holders of Rights who reside outside of the Eligible Jurisdictions and

any persons (including any CDS Participants) who have a contractual or

legal obligation to forward this document to a jurisdiction outside the

Eligible Jurisdictions should read the section entitled "Description of

Offered Securities – Ineligible Holders". |

| Listing and Trading |

The Rights and the Common Shares issuable upon exercise of the Rights will be listed on the TSX. |

| Risk Factors |

An investment in Common Shares is subject to a

number of risk factors. See "Risk Factors". |

United

States

Transfer Restrictions |

The Rights may be transferred or resold only in

transactions outside of the United States in accordance with Regulation S

under the U.S. Securities Act, which generally will permit the resale of

the Rights through the facilities of the TSX. See "Description of Offered

Securities – U.S. Shareholders". |

- 9 -

SUMMARY DESCRIPTION OF BUSINESS

Summary

Nautilus is a company existing under the Business

Corporations Act (British Columbia). Nautilus' current notice of articles

were filed on SEDAR (www.sedar.com) on August 13, 2015 and its current articles

were filed on July 24, 2013. See also "Corporate Structure" in the AIF.

Nautilus is a seafloor resource exploration and development

company and the first publicly listed company to commercially explore the ocean

floor for copper, gold, silver and zinc rich seafloor massive sulphide deposits

and for manganese, nickel, copper and cobalt nodule deposits. Nautilus holds

tenement licences and exploration applications in various locations in the

western and central Pacific Ocean and is establishing a pipeline of prospects

for development. The Company's goal is to develop a seafloor production system

that can be used to extract resources from its seafloor prospects.

Nautilus' seafloor production system, once developed, has the

potential to open a new frontier of resource development as land-based mineral

deposits continue to be depleted and the cost of development and extraction

continue to rise and grades continue to fall.

Nautilus has completed an independent NI 43-101 resource

estimate for its Solwara 1 Project, where the Company plans to first deploy and

test its seafloor production system. The Company has received both the mining

lease and environmental permit for its Solwara 1 Project from the State of PNG.

The Company's 85% interest in the Solwara 1 Project is held through a joint

venture (the "Solwara 1 JV") with Eda Kopa (Solwara) Limited as the nominee of the Independent State

of Papua New Guinea (the "State Nominee"), whose 15% interest is fully

funded up to first production. In December 2015 the State Nominee elected not to

exercise its option to take up to a further 15% interest in the Solwara 1

Project.

Nautilus has also released, through one of its 100% owned

subsidiaries, Tonga Offshore Mining Limited, an independent NI 43-101 resource

estimate in respect of its Clarion-Clipperton Fracture Zone polymetallic nodule

project, located within the Central Pacific Ocean.

Recent Developments

New Offtake Agreement for Solwara 1 Project

On December 11, 2015, the Company announced it had entered into

a new agreement with Tongling Nonferrous Metals Group Co. Ltd

("Tongling") for the sale of material extracted from the Company's

Solwara 1 Project. Following a series of detailed negotiations focused on

achieving a mutually beneficial and workable arrangement, the parties finalized

the terms of the new take or pay agreement, referred to as the Master Ores Sales

and Processing Agreement (the "MOSPA"), which replaces the terms of the

previous binding heads of agreement dated April 21, 2012 between the parties

(the "HOA"). The MOSPA was filed under the Company's profile on the SEDAR

website (www.sedar.com).

Compared to the HOA, the terms of the MOSPA offer significant

cost savings and reduced business risk to Nautilus, while giving Tongling the

freedom to process the Solwara 1 material in a manner intended to optimize its

return. The MOSPA has simplified the arrangements between the parties in many

respects and it now operates as a more conventional material sales agreement

where Tongling will pay Nautilus for a fixed proportion of copper, gold and

silver in the mineralized material.

The copper payment will be for 95% of recoverable copper as

determined by locked cycle testwork on samples of shipments. The gold payment is

fixed at 50% of the contained gold in the mineralized material which represents

a premium payment for gold compared to the HOA. Payment for silver is fixed at

30% of contained silver in the mineralized material. The Asian

international copper concentrate benchmark will still be used as the basis for

smelter treatment and refining charges related to the recoverable copper.

- 10 -

From Tongling's perspective, the MOSPA offers greater

flexibility over the design and operation of a concentrator to be built

specifically for the processing of Solwara 1 material. The construction of the

concentrator will initially be financed by Tongling, with these costs recovered

through a fixed plant capital fee payable by Nautilus monthly over the term of

the MOSPA. Nautilus shall provide Tongling with a bank guarantee covering 50% of

the concentrator capital cost. Tongling now has the exclusive right to market or

process any pyrite concentrates produced from the Solwara 1 material, whereas

under the HOA the parties were to jointly market any pyrite concentrates sharing

any profit on a 50/50 basis.

For further details refer to the Company's material change

report dated December 16, 2015.

Equipment Storage and Wet Testing Contracts

On January 18, 2016, the Company announced that it had signed

agreements with United Engineering Services LLC ("UES") to provide

support services associated with wet testing the Company's seafloor production

equipment and storing the equipment as it is delivered from various suppliers

prior to integration onto the Production Support Vessel.

The first of the equipment to be tested will be the three

Seafloor Production Tools (SPTs). The SPTs are due for delivery from

the Soil Machine Dynamics facility in Newcastle upon Tyne in the first half of

2016. Each machine is undergoing rigorous commissioning and factory acceptance

testing which has been conducted in dry conditions on land. Once delivered, the

SPTs will undergo extensive wet testing at Duqm Port in Oman which is designed

to provide a submerged demonstration of the fully assembled SPTs and will

involve submerged testing of control systems operations and feedback, hydraulic

functions, collection system functions and survey and visualization systems.

On completion of the wet testing, the SPTs will be stored at

UES facilities in Duqm, Oman for preservation and maintenance until integration

on the Production Support Vessel which is expected to occur in 2017.

UES is a wholly-owned subsidiary of MB, which holds, directly

or indirectly, approximately 28% of the outstanding Common Shares and has two

nominee directors sitting on the Company's board (Dr. Mohammed Al Barwani and

Tariq Al Barwani). Accordingly, the support services and equipment storage

contracts with UES constitute a "related party transaction" of the Company under

Multilateral Instrument 61-101 Protection of Minority Security Holders

in Special Transactions ("MI 61-101").

The board of directors of the Company, excluding the two

interested directors, unanimously approved the contracts with UES, and

determined that the transaction is exempt from the formal valuation and minority

shareholder approval requirements of MI 61-101 in reliance on the exemptions set

forth in sections 5.5(a) and 5.7(1)(a) of MI 61-101, on the basis that, at the

time the transaction was agreed to, neither the fair market value of the subject

matter of, nor the fair market value of the consideration for, the transaction

exceeds 25% of the Company's market capitalization.

Delivery of SPTs

On February 1, 2016 the Company announced that the Solwara 1 JV had taken delivery of the three SPTs from Soil Machine Dynamics Limited's facility in Newcastle upon Tyne. The three SPTs are being transported to Oman, where they are scheduled to undergo extensive wet testing at Duqm Port.

Assembly and Testing of SSLP

On February 4, 2016 the Company announced that the Solwara 1 JV was advised that factory acceptance testing on the Subsea Slurry Lift Pump ("SSLP") had commenced at the GE Oil & Gas manufacturing facility in Houston, USA. The SSLP is a key element in the Solwara 1 JV's seafloor production system. The SSLP and riser system is designed to transfer the mineralized material as slurry from the deep ocean up onto the Production Support Vessel, where the mineralized solids are removed. The return water is then filtered to 8 microns, and transferred back down to the pump via the auxiliary riser pipes where it is released back into the same environment from which it originally came.

- 11 -

INTENTION OF INSIDERS TO EXERCISE RIGHTS

The Company's two largest shareholders, MB and Metallo, have

each indicated to the board of directors of the Company their present intention

to participate in the Offering by exercising all or a portion of their Basic

Subscription Privilege, but they will determine the extent of their

participation in the contexts of the market and there can be no assurance that

either MB or Metallo will exercise their Basic Subscription Privilege. The

Company believes that insiders of the Company, including MB and Metallo, will be

issued Rights to purchase approximately 331,794,574 Common Shares, representing

approximately 50% of the Offering.

MB currently owns 122,316,260 Common Shares, representing

approximately 28% of the outstanding Common Shares. If no Rights are exercised

by persons other than MB and MB fully exercises its Basic Subscription

Privilege, then following the Closing MB could own up to approximately

310,845,859 Common Shares, representing up to approximately 50% of the issued

and outstanding Common Shares.

Metallo currently owns 90,668,516 Common Shares, representing

approximately 21% of the outstanding Common Shares. If no Rights are exercised

by persons other than Metallo and Metallo fully exercises its Basic Subscription

Privilege, then following the Closing Metallo could own up to 230,418,529 Common

Shares, representing up to approximately 40% of the issued and outstanding

Common Shares.

The Company has determined that each of MB and Metallo is an

Approved Eligible Holder.

RISK FACTORS

An investment in the Common Shares is highly speculative due to

the nature of the Company's involvement in the exploration and development of

undersea mineral resources. A prospective purchaser of Common Shares should

carefully consider the information and risks faced by the Company described in

this prospectus and the documents incorporated by reference including, without

limitation, the risk factors set out under the heading "Risk Factors" in each of

the AIF, the Annual MD&A and Interim MD&A incorporated by reference in

this prospectus. Such risks may not be the only risks facing the Company;

additional risks not currently known may also impair the Company's business

prospects and operations.

The Company's Seafloor Production System is Untested and May

Not be Economically Viable

The machines, equipment and systems comprising the Company's

proposed Seafloor Production System, including the sub-sea mining equipment and

the Production Support Vessel, are in the process of being designed and

constructed and have not been completed or tested and may not be technically

feasible, may not perform the tasks designed for, may prove uneconomic,

unreliable or may not be delivered on a timely basis.

The majority of exploration companies fail to ever locate an

economic deposit and given that no economic seafloor massive sulphide (SMS)

deposit has ever been proven, such risks are especially significant to the

Company. The model for SMS deposits has never been tested by closed spaced

drilling and/or production for the purpose of establishing resource tonnage at

economic grades. SMS deposits have never been mined and there is a risk that

mining and sulphide material recovery methods and equipment may not be able to

be developed to allow for economic development of SMS deposits.

The Company has not completed and does not intend to complete a

preliminary economic assessment, pre-feasibility study or feasibility study

before completing the construction and first deployment of the Seafloor

Production System at the Company's Solwara 1 Project. Management considers the

Company's best interests would be served by first testing the operational

viability of the Seafloor Production System at the Solwara 1 Project. There is

significant risk with this approach, and no assurance can be given that the

Seafloor Production System, if fully funded and completed for deployment at the

Solwara 1 Project, will successfully demonstrate that seafloor resource

development is commercially viable.

In addition, the Company's existing mineral resources will not

be sufficient to economically operate the Seafloor Production System. In order

to demonstrate the economic viability of the Seafloor Production System, the

Company will need to locate and classify significant new mineral resources or

mineral reserves on its existing or new tenements, and there can be no

assurance that the Company will be able to do so. The Company's only SMS

resources comprise the inferred and indicated mineral resources at the Solwara 1

Project and an inferred resource at Solwara 12, 25 km to the northwest of

Solwara 1, and no other SMS deposit has even been sufficiently sampled or

drilled to determine a resource, and there is a risk that techniques and

equipment may not be suitable or cannot be developed to allow further resources

to be determined. There is a risk of poor recovery from such drilling, making it

difficult to accurately quantify tonnage and grade of identified SMS deposits.

It is possible that if a new deposit is located it will be unable to be treated

as a mineral resource or mineral reserve according to the definitions of a

mineral resource and mineral reserve under NI 43-101.

- 12 -

Dilution and Control of the Company

If a Shareholder does not exercise all of its Rights pursuant

to the Basic Subscription Privilege, the Shareholder's current percentage

ownership in the Company will be diluted by the issuance of Common Shares upon

the exercise of Rights by other Shareholders.

No Minimum

Pursuant to TSX requirements, completion of the Offering is not

subject to raising a minimum amount of proceeds. This means that the Company

could complete the Offering after raising only a small portion of the gross

proceeds. See "Use of Proceeds".

Trading Market for Rights

Although the Company expects that the Rights will be listed on

the TSX, the Company cannot provide any assurance that an active or any trading

market in the Rights will develop or that Rights can be sold on the TSX at any

time.

Negative Cash Flow

The Company has no producing mines and has no source of

operating cash flow other than through equity, joint ventures and/or debt

financing. As such, it has and it is expected to continue to have negative

operating cash flow. To the extent the Company has negative cash flow in future

periods, the Company may use a portion of its general working capital to fund

such negative cash flow.

Discretion in the Use of Proceeds

Management will have broad discretion concerning the use of the

proceeds of the Offering as well as the timing of their expenditures. As a

result, an investor will be relying on the judgment of management for the

application of the net proceeds of the Offering. While the Company intends to

use the net proceeds as described under "Use of Proceeds", future results from

the Company's operations, external events or other sound business reasons may

make it desirable for the Company to re-allocate some or all of the net

proceeds. Management may use the net proceeds of the Offering in ways that an

investor may not consider desirable. The results and the effectiveness of the

application of the proceeds are uncertain. If the proceeds are not applied

effectively, the Company's results of operations may suffer.

No Underwriter

There is no underwriter for the Offering. Accordingly, there

has not been an independent "due diligence" review of matters covered by this

prospectus, such as would customarily be conducted by an underwriter if one had

been involved in this Offering.

- 13 -

Exercises of Rights Irrevocable

Subject to certain statutory withdrawal and rescission rights

available to holders in Canada, if the Common Share trading price declines below

the Subscription Price, resulting in a loss of some or all of the holder's

subscription payment, holders may not revoke or change the exercise of Rights

after they send in their subscription forms and payment.

Subscription Price Not Necessarily Indication of Value

The Subscription Price does not necessarily bear any

relationship to the book value of the Company's assets, past operations, losses,

financial condition or any other established criteria for value. Holders of

Rights should not consider the Subscription Price to be an indication of the

Company's value and the Common Shares may trade at prices above or below the

Subscription Price.

Responsibilities of Holders of Rights

Holders of Rights who wish to purchase Common Shares in the

Offering must act promptly to ensure that all required forms and payments are

actually received by the Subscription Agent or the CDS Participant holding the

subscriber's Rights in sufficient time prior to the Expiry Time on the Expiry

Date. If a holder of Rights fails to complete and sign the required subscription

forms, sends an incorrect payment amount or otherwise fails to follow the

subscription procedures that apply to the transaction in question, the

Subscription Agent or CDS Participant, as the case may be, may, depending on the

circumstances, reject a subscription or accept it to the extent of the payment

received. None of the Company, the Subscription Agent or CDS Participant

undertakes to contact a holder of Rights concerning, or attempt to correct, an

incomplete or incorrect payment or subscription form. The Board of Directors of

the Company has the sole discretion to determine whether a subscription properly

follows subscription procedures.

USE OF PROCEEDS

Pursuant to TSX requirements, completion of the Offering is not

subject to raising a minimum amount of proceeds. The estimated net proceeds to

be received by the Company from the Offering, after deducting the estimated

expenses of the Offering of approximately $450,000, are set forth in the table

below based on various thresholds which are provided for illustrative purposes:

|

Assuming 15% of Offering |

Assuming 50% of Offering |

Assuming Maximum Offering |

| Estimated Net Proceeds |

$15,000,000 |

$51,050,000 |

$102,550,000 |

The Company plans to use the net proceeds from the Offering, together with the Company's existing cash reserves, to advance the development of the Company's Seafloor Production System (as defined in the AIF) and for general working capital requirements. As at February 15, 2016, the Company had approximately US$50 million in cash and cash equivalents.

The table below sets forth the significant contracts in place as at the date of this prospectus relating to the construction of certain equipment forming part of the Company's Seafloor Production System and the outstanding value of such contracts as at February 15, 2016.

- 14 -

| Significant Contracts |

Outstanding contract value as at

February 15, 2016 (US$ millions) |

| Seafloor Production Tools |

17.5 |

| Riser and ancillary equipment |

11.5 |

| Subsea Slurry Lift Pump |

20.0 |

| Total: |

49.0 |

Refer to "Overview of Business – Products, Services and

Components" in the AIF for a summary description of all of the equipment and

systems associated with the Company's Seafloor Production System, including the

equipment noted above and the Production Support Vessel.

15% Raised

Assuming 15% of the maximum gross proceeds of the Offering is

raised, the Company expects that 100% of the net proceeds, along with the

Company’s existing cash reserves, will be applied towards the outstanding

contract values noted above following the closing of the Offering in order to

advance the development of the Company's Seafloor Production System, with the

balance of the Company's available funds used toward project management and

general working capital requirements. If this level of proceeds is raised, the

Company expects that such proceeds will enable the Company to achieve the

following business objectives or milestones in relation to advancing the

development of the Company's Seafloor Production System:

|

Component of the Seafloor

Production

System |

Business Objective or Milestone |

Anticipated Date |

|

Seafloor Production Tools |

Completion of commissioning and delivery of the Seafloor

Production Tools by the manufacturer and delivery to Duqm Port, Oman for

storage |

By the end of March 2016 |

|

Riser and ancillary equipment |

Completion and delivery by the manufacturer of the Riser and ancillary equipment under existing contracts |

By the end of December 2016 |

|

Subsea Slurry Lift Pump |

Completion of equipment assembly, commissioning and delivery by the manufacturer to Duqm Port, Oman for storage |

By the end of July 2016 |

The Company would need additional funding to enable it to

complete the construction and development of the entire Seafloor Production

System and a failure to obtain such funding as required would likely result in a

delay to the Company's anticipated timetable for the start of seafloor

operations in the first quarter of 2018.

50% Raised

Assuming 50% of the maximum gross proceeds of the Offering is

raised, the Company expects that approximately 100% of the net proceeds, along

with the Company's existing cash reserves, will be applied towards the

outstanding contract values noted above following the closing of the Offering,

with part of the balance of the Company's available funds used towards the

design and fabrication of the dewatering plant in order to advance the

development of the Company's Seafloor Production System. The remaining balance

of the available funds would be applied toward project management and general

working capital requirements. If this level of proceeds is raised, the Company

expects that such proceeds will enable the Company to achieve the business objectives or milestones noted

in the table immediately above, as well as the purchase of equipment for the

fabrication of the dewatering plant by the manufacturer by the anticipated date

of the end of June 2017.

- 15 -

The Company would need to secure additional funding to enable

it to complete the construction and development of the entire Seafloor

Production System and a failure to obtain such funding as required would likely

result in a delay to the Company's anticipated timetable for the start of

seafloor operations in the first quarter of 2018.

Maximum Offering

If the maximum Offering amount is raised, the Company expects

that approximately 100% of the net proceeds, along with the Company’s existing

cash reserves, will be applied to the outstanding contract values noted above

following the closing of the Offering, with part of the balance of the Company's

available funds used for the fabrication of the dewatering plant and wet testing

the Seafloor Production Tools and Subsea Slurry Lift Pump in order to advance

the development of the Company's Seafloor Production System. The remaining

balance of the available funds would be applied toward project management and

general working capital requirements. If this level of proceeds is raised, the

Company expects that such proceeds will enable the Company to achieve the

following business objectives or milestones in relation to advancing the

development of the Company's Seafloor Production System:

|

Component of the Seafloor

Production

System |

Business Objective or Milestone |

Anticipated Date |

|

Seafloor Production Tools |

Completion of commissioning and delivery of the Seafloor

Production Tools by the manufacturer and delivery to Duqm Port, Oman for

storage |

By the end of March 2016 |

|

Initial wet testing of the Seafloor Production Tools |

By the end of October 2016 |

|

Riser and ancillary equipment |

Completion and delivery by the manufacturer of the Riser

and ancillary equipment under existing contracts |

By the end of December 2016 |

| Award of further contracts, completion and delivery by the manufacturer of remaining ancillary equipment |

By the end of December 2017 |

|

Subsea Slurry Lift Pump |

Completion of equipment assembly, commissioning and delivery by the manufacturer to Duqm Port, Oman for storage |

By the end of July 2016 |

|

Initial wet testing of the Subsea Slurry Lift Pump |

By the end of December 2016 |

|

Dewatering Plant |

Completion of fabrication of the dewatering plant by the

manufacturer |

By the end of June 2017 |

The anticipated dates disclosed in the two tables above are

based on management's estimates as at the date of this prospectus, and delays by

the equipment manufacturers, equipment breakdowns or failures and other

unanticipated events could result in such dates being delayed, in some cases

significantly. See also "Risk Factors – Discretion in the Use of Proceeds" in

this prospectus.

- 16 -

Completion and Funding for the Construction and Development of entire Seafloor Production System

Set forth below is a summary of the principal remaining steps required to complete the construction and development of the entire Seafloor Production System for initial deployment and testing operations at the Company's Solwara 1 Project, which is scheduled to occur during the first quarter of 2018 based on the Company's current project timetable and subject to additional funding required. These steps are in addition to the business objectives or milestones described in the table immediately above.

| 1. |

Acquisition of remotely operated vehicles to support seafloor operations; |

| |

|

| 2. |

Design and build of stockpile frame for the underwater stockpile hoses; |

| |

|

| 3. |

Integration of the Seafloor Production Tools, Subsea Slurry Lift Pump, Riser and other ancillary equipment (collectively, the "Seafloor Production Equipment") onto the Production Support Vessel; |

| |

|

| 4. |

Completion of sea trials of the Production Support Vessel and any integrated Seafloor Production Equipment; |

| |

|

| 5. |

Delivery of the Production Support Vessel, with integrated Seafloor Production Equipment, by the owner, Marine Assets Corporation, to the Company; |

| |

|

| 6. |

Mobilisation of the Production Support Vessel and seafloor operations team to the Solwara 1 Project site; and |

| |

|

| 7. |

Construction of a concentrator by Tongling pursuant to the Tongling Sales Agreement. |

Nautilus will need to raise additional equity, debt and/or joint venture partner funding in excess of the maximum Offering amount in order to fund its costs associated with completion of the steps listed above. Nautilus currently anticipates that its costs associated with such steps, including project management, will be in the range of approximately US$125 million to US$175 million. This is a rough approximation and is subject to change as the development of the Seafloor Production System progresses, based on, among other things, final design specifications, negotiation of additional contracts, consideration of various financing alternatives and prevailing market conditions.

There can be no assurance that Nautilus will be able to secure, on terms acceptable to Nautilus or at all, the additional funding required to complete the Seafloor Production System and commence seafloor operations. See "Risk Factors – Exploration, Development and Operating Risks – Financial resources" and "Risk Factors – Exploration, Development and Operating Risks – Future funding requirements and risk" in the AIF. See also "Risk Factors" in this prospectus.

See also the disclosure in the AIF titled "Overview of Business

– Nautilus' Strategy" and "Overview of Business – Development Plan for Bismarck

Sea Prospects".

Nautilus has not yet achieved positive operating cash

flow. It is anticipated that a majority or all of the net proceeds of the

Offering will be used to fund negative cash flow from operating activities.

PRIOR SALES

The following table sets forth for the 12 month period prior to

the date of this prospectus details of the price at which securities have been

issued or are to be issued by the Company, the number of securities issued at

that price and the date on which the securities were issued:

| Date of Issue |

Type of

Securities

|

No. of Common

Shares

|

Issue or Exercise

Price

per Security |

Reason for Issue |

| 18 June 2015 |

Common Shares |

400,000 |

$0.45 |

Issue under Share Loan

Plan(1)

|

| 19 June 2015 |

Stock Options |

1,800,000 |

$0.45 |

Grant of Stock Options |

| 24 July 2015 |

Common Shares |

40,000 |

$0.24 |

Purchase of Loan

Shares(2)

|

| (1) |

See "Description of Share Capital – Share Loan

Plan". |

| (2) |

The outstanding loan in respect of these shares was

repaid by the plan participant, and accordingly the shares were released

by the trustee to the participant without any further restrictions under

the Share Loan Plan, all pursuant to the terms of the Share Loan

Plan. |

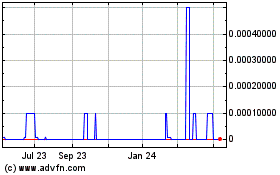

TRADING PRICE AND VOLUME

The following table sets forth for the 12 month period prior to

the date of this prospectus details of the trading prices and volume on a

monthly basis of the Common Shares traded through the facilities of the TSX:

- 17 -

| Period |

High |

Low |

Volume |

| 2015 |

|

|

|

| February |

0.55 |

0.39 |

1,166,932 |

| March |

0.55 |

0.43 |

628,839 |

| April |

0.51 |

0.46 |

975,003 |

| May |

0.49 |

0.435 |

487,416 |

| June |

0.49 |

0.435 |

688,035 |

| July |

0.47 |

0.365 |

1,485,940 |

| August |

0.41 |

0.33 |

811,215 |

| September |

0.40 |

0.27 |

1,331,700 |

| October |

0.35 |

0.235 |

1,953,454 |

| November |

0.345 |

0.255 |

1,835,461 |

| December |

0.34 |

0.27 |

1,131,502 |

| 2016 |

• |

• |

• |

| January |

0.32 |

0.26 |

942,527 |

In addition, the Common Shares were quoted under the symbol "NUSMF" on OTCQX International effective as at April 27, 2012, and effective December 9, 2015 the Company became a member of the Nasdaq International Designation program.

CONSOLIDATED CAPITALIZATION