UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): February 12, 2016

ATVRockN

(Exact

name of registrant as specified in its charter)

| |

|

|

| Nevada |

000-54739 |

27-4594495 |

| (State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

| of Incorporation) |

|

Identification No.) |

1420 London Road, Suite 100

Duluth, MN 55805

(Address

of Principal Executive Officers)

Registrant's

telephone number, including area code: (218) 728-8553

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

[_] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Completion

of Acquisition or Disposition of Assets

On February 12, 2016, ATVRockN completed the purchase of

the assets and business of US Centrifuge Systems, LLC, an Indiana limited liability company (“US Centrifuge”). ATVRockN

purchased these assets from Dilling Investment Group, LLC. The purchase price is $962,000, with the purchase agreement calling

for $100,000 paid upon execution of the agreement, and the balance of $862,000 to be paid on or before May 1, 2016. ATVRockN obtained

the initial $100,000 payment via an asset based loan guaranteed by Dr. Hal B. Heyer, MD., Chairman of ATVRockN’s board of

directors.

Item 5.02 Departure of Director or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(b) On February 12, 2016, Hal B. Heyer, MD resigned as Chief

Executive Officer. Dr. Heyer will remain the Chairman of the Board of Directors.

On February 12, 2016, the board of directors appointed

Tim Moody to serve as the Company’s Chief Executive Officer. Mr Moody’s business experience is as follows:

Mr. Moody is currently President,

CEO and Managing Principal of Moody Capital Solutions, Inc. a boutique investment banking firm located in the metro Atlanta area

registered with the SEC and a member of FINRA. The company specializes in raising capital for micro cap – small cap public

companies and has successfully raised over 200 million dollars over the past 9 years. Mr. Moody has been a securities professional

for 28 years and holds a series 7, 63, 79 and the general securities principals 24 and the municipal principals 53 licenses. Mr.

Moody is also a managing partner in US Food Fund LLC, a hedge fund that specializes in providing disaster relief in the US and

in certain foreign countries.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

99.1. Purchase Agreement

2

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this current report on Form 8-K to be signed on its behalf

by the undersigned Chairman hereunto duly authorized.

| |

|

| Date: February 16, 2016 |

ATVRockN |

| |

|

| |

|

| |

/s/ Tim Moody |

| |

Tim Moody

Chief Executive Officer |

| |

|

Exhibit 99.1

ATVRockN

1420 London Road, Suite 100

Duluth, MN 55805

February 2, 2016

Dilling Investment Group, LLC

111 East Mildred Street

Logansport IN 46947

Attention: Mr. Richard Dilling, President and Mr. Jeff Secrist

CFO

Re: Proposal to Purchase Certain Assets of US Centrifuge

Systems, LLC

Gentlemen:

This letter (this "Letter")

is intended to summarize the principal terms of a proposal being considered by ATVRoc1cN ("Buyer") regarding its possible

acquisition of certain of the assets and certain specified liabilities of US Centrifuge Systems, LLC ("Seller"). The

possible acquisition is referred to as the "Transaction" and Buyer, Seller and Seller's owner Dilling Group Inc. ("Dilling")

are referred to collectively as the "Parties."

| 1. | Acquisition of Assets and Purchase Price. |

| (a) | Subject to the satisfaction of the conditions described in this Letter, at the closing of the |

Transaction Buyer would acquire the

assets set forth on Schedule A (the "Assets") and the liabilities set forth on Schedule B, free and clear of all encumbrances,

at the purchase price set forth in Section 1(b). Buyer shall not assume the liabilities set forth on Schedule C.

| (b) | The purchase price for the Assets would be $1,064,500 cash (the "Cash Purchase Price"), |

payable as follows:

| (i) | $100,000 in immediately available funds, non-refundable, paid in cash at the closing of the Transaction,

scheduled for 2-12-2016; |

| (ii) | $882,000 cash payment 90 days from closing date. |

| (iii) | $82,500 representing the final 50 percent of the Apple re-purchase program funded by Dilling Investment

Group payable in 12 month installments |

| (iv) | Net AR (Open collectable AR less open trade AP) balance, amount to be mutually agreed to between

Buyer and Seller at closing, payable in 12 month installments per (iii) schedule. Open trade AP to not include the 2nd half as

stated in (iii) |

| (c) | Buyer has calculated the Purchase Price on the basis of information currently known to |

Buyer and on the basis of the following assumptions:

| (i) | Current Inventory (WIP and Perpetual) value as of 12-31-2015 |

| (ii) | Current Machinery/Equipment, vehicles and office equipment per 12-31-2015 |

| (iii) | Accumulated Depreciation per Blue and Co fixed asset ledger as of 12-31-2015 |

| (iv) | Net AR balance (AR balance minus AP Trade Liability at closing). |

| 2. | Proposed Definitive Agreement. As soon as reasonably practicable after the execution of this |

Letter, the Parties shall commence to

negotiate a definitive purchase agreement (the "Definitive Agreement") relating to Buyer's acquisition of the Assets.

The Definitive Agreement would include the terms summarized in thjs Letter and such other representations, warranties, conditions,

covenants, indemnities and other terms that are customary for transactions of this kind and are not inconsistent with this Letter.

The Parties shall also commence to negotiate ancillary agreements, including a bill of sale and an assignment and assumption agreement.

| 3. | Conditions. Buyer's obligation to close the proposed Transaction will be subject to customary |

conditions, including:

| (a) | Buyer's satisfactory completion of due diligence; |

| (b) | the Board of Directors of Buyer and the Board of Directors and shareholders of Seller approving

the Transaction; |

| (c) | the Parties' execution of the Definitive Agreement and the ancillary agreements; |

| (d) | and there being no material adverse change in the business, results of operations, prospects, condition (financial or otherwise)

or assets of the Seller. |

| 4. | Termination. This letter will automatically terminate and be of no further force and effect upon |

the earlier of (1) execution of the

Definitive Agreement by Buyer and Seller, (ii) mutual agreement of Buyer and Seller; and (iii) , 2016. Notwithstanding anything

in the previous sentence, sections 5, 6 and 8 shall survive the termination of this Letter and the termination of this Letter shall

not affect any rights any Party has with respect to the breach of this Letter by another Party prior to such termination.

| 5. | GOVERNING LAW. This Letter (including the attached schedules) shall be deemed for all |

purposes to be entered into in the State

of Indiana and shall be governed by, and construed and enforced in accordance with, the laws of the State of Indiana. Each party

hereto submits to the exclusive] urisdietion of the federal and state courts sitting in the County of Marion, State of Indiana

in connection with any action, suit or proceeding related to this Letter or the matters contemplated hereby, and irrevocably and

unconditionally waives any objectionto the laying of such venue of any such action, suit or proceeding brought in any such court

and any claim that any such action, suit or proceeding has been brought in an inconvenient forum.

| 6. | Confidentiality. This existence of this Letter (including the attached schedules) and the terms and |

conditions hereof and thereof shall

be treated as strictly confidential and shall not be disclosed, directly or indirectly, to any person or entity except (i) to the

parties' respective officers, directors, affiliates, managers, employees, agents, counsel, accountants, financial advisors, consultants

and other representatives that need to review such terms for the purpose of evaluating, negotiating or finalizing the Transaction

or any other matter in connection therewith, (ii) as may be required by law, including securities laws, or, in the event any party

is served with legal process seeking disclosure, disclosure pursuant to such legal process if such party first has notified the

other party in writing of such legal process and has cooperated with the other party to the fullest

2

extent possible in seeking to prevent

the disclosure, (i11) in connection with the exercise of any remedies hereunder or any suit action or proceeding relating to this

Letter or the enforcement of rights hereunder or (iv) upon prior written consent of each other Party (to be given in such party's

sole discretion)..

| 7. | No Third Party Beneficiaries. Except as specifically set forth or referred to herein, nothing herein |

is intended or shall be construed to

confer upon any person or entity other than the Parties and their successors or assigns, any rights or remedies under or by reason

of this Letter.

| 8. | Expenses. The Parties will each pay their own transaction expenses in connection with this

Letter, |

including the fees and expenses of investment bankers and

other advisors, incurred in connection with the proposed Transaction.

| 9. | No Binding Agreement. This Letter reflects the intention of the Parties, but for the avoidance of |

doubt neither this Letter nor its acceptance

shall give rise to any legally binding or enforceable obligation on any Party, except with regard to paragraphs 4 through 10 hereof.

No contract or agreement providing for any transaction involving the Business shall be deemed to exist between Seller and Buyer

and any of its affiliates unless and until a final definitive agreement has been executed and delivered.

| 10. | Miscellaneous. This Letter may be executed in counterparts, each of which shall be deemed to be |

an original, but all of winch together

shall constitute one agreement, The headings of the various sections of this Letter have been inserted for reference only and shall

not be deemed to be a part of this Letter.

[SIGNATURE PAGE FOLLOWS]

3

If you are in agreement with the

terms set forth above and desire to proceed with the proposed Transaction on that basis, please sign this Letter in the space provided

below.

Very truly yours,

ATVRockN

By: /s/ Tim Moody

Name: Tim Moody

Title: President

Agreed to and accepted:

Dilling Investment Group, LLC

By: /s/ Richard Dilling

Name: Richard Dilling

Title: President

US Centrifuge Systems, LLC

By: /s/ Steve Wallace

Name: Steve Wallace

Title: President

4

Schedule A

Purchased Assets

1. 6 Apple centrifuge machines

2. Rights to execute the bill of sale agreement with Apple

for the remaining 18 A560 Units in Mesa AZ

3. 12131 Balance Sheet -Perpetual Inventory

4. 12/31 Balance Sheet - WIP Inventory

5. Machinery and Equipment

6. Vehicles

7, Office Equipment and Software

8. Accumulated Depreciation from Blue and Co Report

9. Accounts Receivable at closing

5

Schedule B

Assumed Liabilities

1). Accounts Payable Trade Buyer will keep Accounts AP trade

liability.

6

Schedule C

Excluded Liabilities

1. All accounts payable due and owing to Dilling Group Inc.

and its affiliated entities.

2. Claims Resource Group claim to recover GTAT bankruptcy

claims purchased 11-24-2014.

3. All AP trade related to legal fees for the Alabama Lawsuit

litigation and bankruptcy case,

7

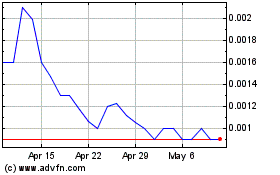

Ameritek Ventures (PK) (USOTC:ATVK)

Historical Stock Chart

From Aug 2024 to Sep 2024

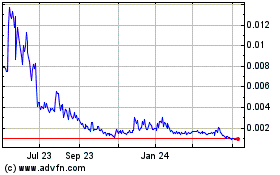

Ameritek Ventures (PK) (USOTC:ATVK)

Historical Stock Chart

From Sep 2023 to Sep 2024