UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January 2016

Commission File Number 0-28584

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

|

|

(Translation of registrant's name into English)

5 Ha’solelim Street, Tel Aviv, Israel

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

|

INVESTOR CONTACT:

|

MEDIA CONTACT:

|

|

Kip E. Meintzer

|

Jason Stolarczyk

|

|

Check Point Software Technologies

|

Check Point Software Technologies

|

|

+1.650.628.2040

|

+1.650.628.2127

|

|

ir@checkpoint.com

|

press@checkpoint.com

|

CHECK POINT SOFTWARE TECHNOLOGIES REPORTS 2015 FOURTH QUARTER AND

FULL YEAR FINANCIAL RESULTS

SAN CARLOS, CA – January 28, 2016 — Check Point® Software Technologies Ltd. (NASDAQ: CHKP), the largest pure-play security vendor globally, today announced its financial results for the fourth quarter and full-year ended December 31, 2015.

Fourth Quarter 2015:

|

|

·

|

Total Revenue: $458 million, representing a 9 percent increase year over year

|

|

|

·

|

Non-GAAP Operating Income: $262 million, representing 57 percent of revenues

|

|

|

·

|

Non-GAAP EPS: $1.20, representing a 12 percent increase year over year

|

|

|

·

|

Deferred Revenues: $906 million, representing a 16 percent increase year over year

|

Full Year 2015:

|

|

·

|

Total Revenue: $1,630 million, representing a 9 percent increase year over year

|

|

|

·

|

Non-GAAP Operating Income: $927 million, representing 57 percent of revenues

|

|

|

·

|

Non-GAAP EPS: $4.17, representing a 12 percent increase year over year

|

“We completed 2015 with revenues in the upper half of our range and earnings that exceeded our projections. Subscription revenues grew 22 percent during the quarter, driven primarily by customer demand for advanced threat prevention technologies including SandBlast zero-day malware protection,” said Gil Shwed, founder and chief executive officer of Check Point Software Technologies, “We’re pleased to see that our investment in advanced threat prevention and mobile security are producing results.”

Financial Highlights for the Fourth Quarter of 2015:

|

·

|

Total Revenue: $458 million compared to $421 million in the fourth quarter of 2014.

|

|

·

|

GAAP Operating Income: $239 million compared to $229 million in the fourth quarter of 2014.

|

|

·

|

Non-GAAP Operating Income: $262 million compared to $247 million in the fourth quarter of 2014.

|

|

·

|

GAAP Net Income and Earnings per Diluted Share: GAAP net income was $195 million compared to $186 million in the fourth quarter of 2014. GAAP earnings per diluted share were $1.08 compared to $0.98 in the fourth quarter of 2014.

|

|

·

|

Non-GAAP Net Income: Non-GAAP net income was $216 million compared to $203 million in the fourth quarter of 2014.

|

|

·

|

Non-GAAP Earnings per Diluted Share: $1.20 compared to $1.07 in the fourth quarter of 2014.

|

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 2

|

·

|

Deferred Revenues: As of December 31, 2015, deferred revenues were $906 million compared to $784 million as of December 31, 2014.

|

|

·

|

Cash Flow: Cash flow from operations of $212 million compared to $210 million in the fourth quarter of 2014.

|

|

·

|

Share Repurchase Program: During the fourth quarter of 2015, the company repurchased 3 million shares at a total cost of $249 million.

|

|

·

|

Cash Balances, Marketable Securities and Short Term Deposits: $3,615 million as of December 31, 2015, compared to $3,683 million as of December 31, 2014.

|

Financial Highlights for the Year Ended December 31, 2015

|

·

|

Total Revenues: $1,630 million compared to $1,496 million in 2014.

|

|

·

|

GAAP Operating Income: $840 million compared to $801 million in 2014.

|

|

·

|

Non-GAAP Operating Income: $927 million compared to $866 million in 2014.

|

|

·

|

GAAP Net Income and Earnings per Diluted Share: GAAP net income was $686 million compared to $660 million in 2014. GAAP earnings per diluted share were $3.74 compared to $3.43 in 2014.

|

|

·

|

Non-GAAP Net Income and Earnings per Diluted Share: Non-GAAP net income was $766 million compared to $715 million in 2014. Non-GAAP earnings per diluted share were $4.17 compared to $3.72 in 2014.

|

|

·

|

Cash Flow: Cash flow from operations of $917 million compared to $753 million in 2014. Net of the tax settlement payment made to the Israeli Tax Authorities in 2014 and the payments made in 2015 related to acquisitions, cash flow from operations in 2015 was $951 million compared to $865 million in 2014.

|

|

·

|

Share Repurchase Program: In 2015, the company repurchased approximately 12 million shares at a total cost of $986 million, which represented an average repurchase per quarter of $246 million.

|

For information regarding the non-GAAP financial measures discussed in this release, as well as a reconciliation of such non-GAAP financial measures to the most directly comparable GAAP financial measures, please see “Use of Non-GAAP Financial Information” and “Reconciliation of GAAP to Non-GAAP Financial Information.”

“Our unique focus remains on attack prevention, not merely detecting attacks after the damage is done. In 2016, we will continue to provide threat prevention solutions and technologies that will enable more customers to stay one step ahead of the threats on their network, mobile and cloud environments,” concluded Shwed.

Business Highlights

Product, technology & acquisition announcements during 2015:

February - Hyperwise Acquisition: Unique CPU-Level threat prevention technology.

March - Threat Extraction Technology: Providing zero malware protection in zero seconds.

April - Lacoon Mobile Security Acquisition: Advanced threat prevention for mobile devices.

May - 1200R SCADA Appliance: Securing industrial control systems and critical infrastructure.

July - Check Point vSEC: Private cloud security solution for VMware NSX environments.

July - ZoneAlarm 2016: Consumer endpoint security software.

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 3

August - Check Point Protect: Mobile Threat Prevention Solution for smartphones.

September - SandBlast: New Threat Prevention Solution.

This week we’ve also made the following product introduction:

January 2016 - 15000 & 23000 Data Center Appliances: Next generation threat prevention securing of SSL/TLS encrypted traffic.

Check Point Security research & security vulnerability discoveries during 2015:

Volatile Cedar: Campaign allowing attackers to monitor a victim’s actions and steal data.

2015 Check Point Security Report: Report revealed that 96 percent of organizations are using high-risk applications and that there was an increase in security incidents across all categories. The report is available at http://www.checkpoint.com/securityreport.

Magento eCommerce Platform: Critical RCE (remote code execution) vulnerability in eBay’s Magento web ecommerce platform, affecting nearly 200,000 online shops.

WhatsApp Web Vulnerabilities: Vulnerabilities that exploit the WhatsApp Web logic put up to 200 million users at risk.

Certifi-gate Vulnerability in Android: Allows applications to gain illegitimate privileged access rights and exists in hundreds of millions of devices.

BrainTest related Mobile Malware: Malware, packaged within an Android game app called BrainTest, affected between 200,000 and one million users.

EZCast Vulnerability: HDMI dongle-based TV streamer that converts non-connected TVs into smart TVs allowing hacker’s ability to gain unauthorized access to an EZCast subscriber’s home network.

Rocket Kitten: Strategic malware attacks supported by persistent spear phishing campaigns.

During 2015 we received the following Industry Accolades:

Gartner

Number One Worldwide Firewall Equipment Market Share 2014

Leader Enterprise Network Firewall Market Quadrant 2015

Leader Unified Threat Management Magic Quadrant 2015

Leader Mobile Data Protection Magic Quadrant 2015

Number One Worldwide Firewall Equipment Market Share 2015 1st. 2nd, 3rd Quarter

IDC

Top Position Worldwide Combined Firewall & UTM Appliance Market 2014

Top Position Worldwide Combined Firewall and UTM Appliance Market 2015 1st. 2nd, 3rd Quarter

NSS Breach Detection Systems Results: Check Point’s Next Generation Threat Prevention Solution received a “recommended” rating in the NSS Labs Breach Detection Systems (BDS) group test. Check Point received a 100 percent catch rate of HTTP, 100 percent catch rate for email and 100 percent catch rate for drive by malware.

CRN Channel Chief Award: Check Point President, Amnon Bar-Lev, was named one of CRN’s 2015 Channel Chiefs.

Common Criteria Certification: Check Point was awarded Common Criteria (CC) certification for R77.30, following a rigorous third-party evaluation and testing process.

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 4

Best Product of 2015: Check Point SandBlast was named ‘Coolest Security Product of 2015’ by CRN Magazine.

First Quarter Investor Conference Participation Schedule:

|

|

·

|

Goldman Sachs Technology & Internet Conference 2016

|

|

|

February 11, 2016 –San Francisco, CA

|

|

|

·

|

JMP Technology Conference

|

|

|

February 29, 2016 –San Francisco, CA

|

|

|

·

|

Raymond James 37th Annual Institutional Investor Conference

|

|

|

March 7, 2016 – Orlando, FL

|

Members of Check Point's management team are expected to present at these conferences and discuss the latest company strategies and initiatives. Check Point’s conference presentations are expected to be available via webcast on the company's web site. To view these presentations and access the most updated information please visit the company's web site at www.checkpoint.com/ir. The schedule is subject to change.

Conference Call and Webcast Information

Check Point will host a conference call with the investment community on January 28, 2016 at 8:30 AM ET/5:30 AM PT. To listen to the live webcast, please visit the website at: www.checkpoint.com/ir. A replay of the conference call will be available through February 4, 2016 on the company's website or by telephone at +1.201.612.7415, replay ID number 13628376.

About Check Point Software Technologies Ltd.

Check Point Software Technologies Ltd. (www.checkpoint.com) is the largest pure-play security vendor globally, providing industry-leading solutions and protecting customers from cyberattacks with an unmatched catch rate of malware and other types of threats. Check Point offers a complete security architecture defending enterprises – from networks to mobile devices – in addition to the most comprehensive and intuitive security management. Check Point protects over 100,000 organizations of all sizes. At Check Point, we secure the future.

©2016 Check Point Software Technologies Ltd. All rights reserved

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this press release include, but are not limited to, statements related to our expectations regarding our continued focus on providing threat prevention solutions and technologies for customers in 2016 and our participation in investor conferences during the first quarter of 2016. Our expectations and beliefs regarding these matters may not materialize, and actual results or events in the future are subject to risks and uncertainties that could cause actual results or events to differ materially from those projected. These risks include our ability to continue to develop platform capabilities and solutions; customer acceptance and purchase of our existing solutions and new solutions; the market for IT security continuing to develop; competition from other products and services; and general market, political, economic and business conditions. The forward-looking statements contained in this press release are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission, including our Annual Report on Form 20-F filed with the Securities and Exchange Commission on April 24, 2015. The forward-looking statements in this press release are based on information available to Check Point as of the date hereof, and Check Point disclaims any obligation to update any forward-looking statements, except as required by law.

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 5

Use of Non-GAAP Financial Information

In addition to reporting financial results in accordance with generally accepted accounting principles, or GAAP, Check Point uses non-GAAP measures of net income, operating income, operating margin and earnings per diluted share, which are adjustments from results based on GAAP to exclude stock-based compensation charges, amortization of intangible assets and acquisition related expenses and the related tax affects. Check Point’s management believes the non-GAAP financial information provided in this release is useful to investors’ understanding and assessment of Check Point’s ongoing core operations and prospects for the future. Historically, Check Point has also publicly presented these supplemental non-GAAP financial measures in order to assist the investment community to see the Company “through the eyes of management,” and thereby enhance understanding of its operating performance. The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures discussed in this press release to the most directly comparable GAAP financial measures is included with the financial statements contained in this press release. Management uses both GAAP and non-GAAP information in evaluating and operating business internally and as such has determined that it is important to provide this information to investors.

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 6

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products and licenses

|

|

$ |

173,993 |

|

|

$ |

162,002 |

|

|

$ |

555,792 |

|

|

$ |

520,312 |

|

|

Software Blades subscriptions

|

|

|

88,026 |

|

|

|

72,357 |

|

|

|

318,624 |

|

|

|

265,021 |

|

|

Total revenues from products and software blades

|

|

|

262,019 |

|

|

|

234,359 |

|

|

|

874,416 |

|

|

|

785,333 |

|

|

Software updates and maintenance

|

|

|

196,053 |

|

|

|

186,283 |

|

|

|

755,422 |

|

|

|

710,483 |

|

|

Total revenues

|

|

|

458,072 |

|

|

|

420,642 |

|

|

|

1,629,838 |

|

|

|

1,495,816 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products and licenses

|

|

|

31,825 |

|

|

|

29,379 |

|

|

|

101,158 |

|

|

|

95,868 |

|

|

Cost of software blades subscriptions

|

|

|

1,961 |

|

|

|

1,755 |

|

|

|

7,623 |

|

|

|

5,626 |

|

|

Total cost of products and software blades

|

|

|

33,786 |

|

|

|

31,134 |

|

|

|

108,781 |

|

|

|

101,494 |

|

|

Cost of Software updates and maintenance

|

|

|

20,388 |

|

|

|

20,729 |

|

|

|

78,468 |

|

|

|

74,807 |

|

|

Amortization of technology

|

|

|

546 |

|

|

|

60 |

|

|

|

1,808 |

|

|

|

240 |

|

|

Total cost of revenues

|

|

|

54,720 |

|

|

|

51,923 |

|

|

|

189,057 |

|

|

|

176,541 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

40,030 |

|

|

|

34,278 |

|

|

|

149,279 |

|

|

|

133,300 |

|

|

Selling and marketing

|

|

|

101,198 |

|

|

|

83,187 |

|

|

|

359,804 |

|

|

|

306,363 |

|

|

General and administrative

|

|

|

23,134 |

|

|

|

22,000 |

|

|

|

91,981 |

|

|

|

78,558 |

|

|

Total operating expenses

|

|

|

219,082 |

|

|

|

191,388 |

|

|

|

790,121 |

|

|

|

694,762 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

238,990 |

|

|

|

229,254 |

|

|

|

839,717 |

|

|

|

801,054 |

|

|

Financial income, net

|

|

|

9,168 |

|

|

|

7,002 |

|

|

|

34,073 |

|

|

|

28,762 |

|

|

Income before taxes on income

|

|

|

248,158 |

|

|

|

236,256 |

|

|

|

873,790 |

|

|

|

829,816 |

|

|

Taxes on income

|

|

|

53,554 |

|

|

|

50,473 |

|

|

|

187,924 |

|

|

|

170,245 |

|

|

Net income

|

|

$ |

194,604 |

|

|

$ |

185,783 |

|

|

$ |

685,866 |

|

|

$ |

659,571 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$ |

1.11 |

|

|

$ |

1.01 |

|

|

$ |

3.83 |

|

|

$ |

3.50 |

|

|

Number of shares used in computing basic earnings per share

|

|

|

175,907 |

|

|

|

184,781 |

|

|

|

179,218 |

|

|

|

188,487 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

1.08 |

|

|

$ |

0.98 |

|

|

$ |

3.74 |

|

|

$ |

3.43 |

|

|

Number of shares used in computing diluted earnings per share

|

|

|

179,975 |

|

|

|

189,160 |

|

|

|

183,619 |

|

|

|

192,300 |

|

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 7

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

RECONCILIATION OF GAAP TO NON GAAP FINANCIAL INFORMATION

(In thousands, except per share amounts)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating income

|

|

$ |

238,990 |

|

|

$ |

229,254 |

|

|

$ |

839,717 |

|

|

$ |

801,054 |

|

|

Stock-based compensation (1)

|

|

|

19,768 |

|

|

|

17,132 |

|

|

|

76,302 |

|

|

|

63,169 |

|

|

Amortization of intangible assets and acquisition related expenses (2)

|

|

|

3,309 |

|

|

|

518 |

|

|

|

11,221 |

|

|

|

2,106 |

|

|

Non-GAAP operating income

|

|

$ |

262,067 |

|

|

$ |

246,904 |

|

|

$ |

927,240 |

|

|

$ |

866,329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income

|

|

$ |

194,604 |

|

|

$ |

185,783 |

|

|

$ |

685,866 |

|

|

$ |

659,571 |

|

|

Stock-based compensation (1)

|

|

|

19,768 |

|

|

|

17,132 |

|

|

|

76,302 |

|

|

|

63,169 |

|

|

Amortization of intangible assets and acquisition related expenses (2)

|

|

|

3,309 |

|

|

|

518 |

|

|

|

11,221 |

|

|

|

2,106 |

|

|

Taxes on the above items (3)

|

|

|

(1,682 |

) |

|

|

(874 |

) |

|

|

(7,186 |

) |

|

|

(9,493 |

) |

|

Non-GAAP net income

|

|

$ |

215,999 |

|

|

$ |

202,559 |

|

|

$ |

766,203 |

|

|

$ |

715,353 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted GAAP Earnings per share

|

|

$ |

1.08 |

|

|

$ |

0.98 |

|

|

$ |

3.74 |

|

|

$ |

3.43 |

|

|

Stock-based compensation (1)

|

|

|

0.11 |

|

|

|

0.09 |

|

|

|

0.41 |

|

|

|

0.33 |

|

|

Amortization of intangible assets and acquisition related expenses (2)

|

|

|

0.02 |

|

|

|

- |

|

|

|

0.06 |

|

|

|

0.01 |

|

|

Taxes on the above items (3)

|

|

|

(0.01 |

) |

|

|

- |

|

|

|

(0.04 |

) |

|

|

(0.05 |

) |

|

Diluted Non-GAAP Earnings per share

|

|

$ |

1.20 |

|

|

$ |

1.07 |

|

|

$ |

4.17 |

|

|

$ |

3.72 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares used in computing diluted Non-GAAP earnings per share

|

|

|

179,975 |

|

|

|

189,160 |

|

|

|

183,619 |

|

|

|

192,300 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Stock-based compensation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products and licenses

|

|

$ |

18 |

|

|

$ |

14 |

|

|

$ |

65 |

|

|

$ |

66 |

|

|

Cost of software updates and maintenance

|

|

|

410 |

|

|

|

306 |

|

|

|

1,520 |

|

|

|

1,024 |

|

|

Research and development

|

|

|

3,008 |

|

|

|

2,289 |

|

|

|

11,544 |

|

|

|

9,284 |

|

|

Selling and marketing

|

|

|

4,238 |

|

|

|

3,611 |

|

|

|

16,351 |

|

|

|

13,339 |

|

|

General and administrative

|

|

|

12,094 |

|

|

|

10,912 |

|

|

|

46,822 |

|

|

|

39,456 |

|

| |

|

|

19,768 |

|

|

|

17,132 |

|

|

|

76,302 |

|

|

|

63,169 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Amortization of intangible assets and acquisition related expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of technology-cost of revenues

|

|

|

546 |

|

|

|

60 |

|

|

|

1,808 |

|

|

|

240 |

|

|

Research and development

|

|

|

1,897 |

|

|

|

- |

|

|

|

6,146 |

|

|

|

- |

|

|

Selling and marketing

|

|

|

866 |

|

|

|

458 |

|

|

|

3,267 |

|

|

|

1,866 |

|

| |

|

|

3,309 |

|

|

|

518 |

|

|

|

11,221 |

|

|

|

2,106 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Taxes on the above items

|

|

|

(1,682 |

) |

|

|

(874 |

) |

|

|

(7,186 |

) |

|

|

(9,493 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total, net

|

|

$ |

21,395 |

|

|

$ |

16,776 |

|

|

$ |

80,337 |

|

|

$ |

55,782 |

|

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 8

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

ASSETS

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

192,312 |

|

|

$ |

261,970 |

|

|

Marketable securities and short-term deposits

|

|

|

1,091,915 |

|

|

|

1,050,492 |

|

|

Trade receivables, net

|

|

|

410,763 |

|

|

|

366,700 |

|

|

Prepaid expenses and other current assets

|

|

|

85,762 |

|

|

|

68,673 |

|

|

Total current assets

|

|

|

1,780,752 |

|

|

|

1,747,835 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term assets:

|

|

|

|

|

|

|

|

|

|

Marketable securities

|

|

|

2,331,187 |

|

|

|

2,370,471 |

|

|

Property and equipment, net

|

|

|

48,692 |

|

|

|

41,549 |

|

|

Severance pay fund

|

|

|

5,262 |

|

|

|

5,491 |

|

|

Deferred tax asset, net

|

|

|

20,793 |

|

|

|

14,368 |

|

|

Goodwill and other intangible assets, net

|

|

|

838,020 |

|

|

|

741,960 |

|

|

Other assets

|

|

|

45,174 |

|

|

|

27,144 |

|

|

Total long-term assets

|

|

|

3,289,128 |

|

|

|

3,200,983 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

5,069,880 |

|

|

$ |

4,948,818 |

|

LIABILITIES AND

SHAREHOLDERS’ EQUITY

|

Current liabilities:

|

|

|

|

|

|

|

|

Deferred revenues

|

|

$ |

717,528 |

|

|

$ |

651,281 |

|

|

Trade payables and other accrued liabilities

|

|

|

339,325 |

|

|

|

281,554 |

|

|

Total current liabilities

|

|

|

1,056,853 |

|

|

|

932,835 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Long-term deferred revenues

|

|

|

188,255 |

|

|

|

132,732 |

|

|

Income tax accrual

|

|

|

283,215 |

|

|

|

235,705 |

|

|

Deferred tax liability, net

|

|

|

240 |

|

|

|

504 |

|

|

Accrued severance pay

|

|

|

9,451 |

|

|

|

9,483 |

|

| |

|

|

481,161 |

|

|

|

378,424 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

1,538,014 |

|

|

|

1,311,259 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

774 |

|

|

|

774 |

|

|

Additional paid-in capital

|

|

|

987,331 |

|

|

|

859,124 |

|

|

Treasury shares at cost

|

|

|

(4,043,271 |

) |

|

|

(3,126,685 |

) |

|

Accumulated other comprehensive loss

|

|

|

(4,250 |

) |

|

|

(1,070 |

) |

|

Retained earnings

|

|

|

6,591,282 |

|

|

|

5,905,416 |

|

|

Total shareholders’ equity

|

|

|

3,531,866 |

|

|

|

3,637,559 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity

|

|

$ |

5,069,880 |

|

|

$ |

4,948,818 |

|

|

Total cash and cash equivalents, marketable securities and short-term deposits

|

|

$ |

3,615,414 |

|

|

$ |

3,682,933 |

|

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 9

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

SELECTED CONSOLIDATED CASH FLOW DATA

(In thousands)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Cash flow from operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

194,604 |

|

|

$ |

185,783 |

|

|

$ |

685,866 |

|

|

$ |

659,571 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property and equipment

|

|

|

2,817 |

|

|

|

2,495 |

|

|

|

10,358 |

|

|

|

9,178 |

|

|

Amortization of intangible assets

|

|

|

990 |

|

|

|

518 |

|

|

|

3,612 |

|

|

|

2,106 |

|

|

Stock-based compensation

|

|

|

19,768 |

|

|

|

17,132 |

|

|

|

76,302 |

|

|

|

63,169 |

|

|

Realized loss (gain) on marketable securities

|

|

|

(113 |

) |

|

|

18 |

|

|

|

(16 |

) |

|

|

(289 |

) |

|

Decrease (increase) in trade and other receivables, net

|

|

|

(188,964 |

) |

|

|

(147,846 |

) |

|

|

(64,788 |

) |

|

|

4,337 |

|

|

Increase in deferred revenues, trade payables and other accrued liabilities

|

|

|

208,911 |

|

|

|

167,336 |

|

|

|

241,009 |

|

|

|

38,749 |

|

|

Excess tax benefit from stock-based compensation

|

|

|

(13,303 |

) |

|

|

(8,843 |

) |

|

|

(19,376 |

) |

|

|

(11,669 |

) |

|

Deferred income taxes, net

|

|

|

(12,731 |

) |

|

|

(6,224 |

) |

|

|

(15,847 |

) |

|

|

(12,292 |

) |

|

Net cash provided by operating activities

|

|

|

211,979 |

|

|

|

210,369 |

|

|

|

917,120 |

|

|

|

752,860 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid in conjunction with acquisitions, net of acquired cash

|

|

|

- |

|

|

|

- |

|

|

|

(96,544 |

) |

|

|

- |

|

|

Investment in property and equipment

|

|

|

(7,142 |

) |

|

|

(4,621 |

) |

|

|

(17,348 |

) |

|

|

(12,736 |

) |

|

Net cash used in investing activities

|

|

|

(7,142 |

) |

|

|

(4,621 |

) |

|

|

(113,892 |

) |

|

|

(12,736 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of shares upon exercise of options

|

|

|

48,763 |

|

|

|

8,781 |

|

|

|

102,852 |

|

|

|

70,266 |

|

|

Purchase of treasury shares

|

|

|

(249,290 |

) |

|

|

(194,905 |

) |

|

|

(985,735 |

) |

|

|

(768,176 |

) |

|

Excess tax benefit from stock-based compensation

|

|

|

13,303 |

|

|

|

8,843 |

|

|

|

19,376 |

|

|

|

11,669 |

|

|

Net cash used in financing activities

|

|

|

(187,224 |

) |

|

|

(177,281 |

) |

|

|

(863,507 |

) |

|

|

(686,241 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on marketable securities, net

|

|

|

(14,501 |

) |

|

|

(1,486 |

) |

|

|

(7,240 |

) |

|

|

(874 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents, marketable securities and short term deposits

|

|

|

3,112 |

|

|

|

26,981 |

|

|

|

(67,519 |

) |

|

|

53,009 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, marketable securities and short term deposits at the beginning of the period

|

|

|

3,612,302 |

|

|

|

3,655,952 |

|

|

|

3,682,933 |

|

|

|

3,629,924 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, marketable securities and short term deposits at the end of the period

|

|

$ |

3,615,414 |

|

|

$ |

3,682,933 |

|

|

$ |

3,615,414 |

|

|

$ |

3,682,933 |

|

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 10

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

|

|

| |

|

|

|

|

|

By:

|

/s/ Tal Payne

|

|

|

|

|

Tal Payne

|

|

| |

|

Chief Financial Officer &

Chief Operating Officer

|

|

January 28, 2016

©2016 Check Point Software Technologies Ltd. All rights reserved | P. 11

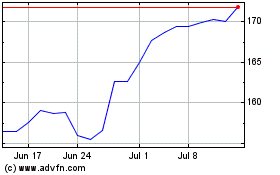

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Mar 2024 to Apr 2024

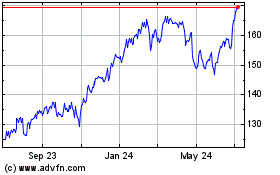

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Apr 2023 to Apr 2024