Report of Foreign Issuer (6-k)

January 12 2016 - 7:06AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of January 2016

Commission File Number: 000-13345

CALEDONIA MINING CORPORATION

(Translation of registrant's name into English)

Suite 1000

36 Toronto Street

Toronto, ON, M5C 2C5

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F x Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ______

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ______

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Caledonia Mining Corporation

(Registrant)

By: /s/ Steve Curtis

|

|

Dated: January 12, 2016

|

Name: Steve Curtis

Title: CEO and Director

|

|

Exhibit

|

Description

|

|

|

|

|

|

Caledonia Mining Corporation: Long Term Incentive Awards

|

Caledonia Mining Corporation

(TSX: CAL, OTCQX: CALVF, AIM: CMCL)

Long Term Incentive Awards

January 12, 2016: Caledonia Mining Corporation ("Caledonia" or the "Company") announces that the company's Compensation Committee (the "Committee") has granted long term incentives to Messrs. Curtis, Learmonth, Mangezi and Roets (the "Participants"). The awards are made pursuant to the approval of the Omnibus Equity Incentive Plan (the "Plan") by shareholders at the annual shareholder meeting held on May 14, 2015.

The Compensation Committee worked with external consultants to ensure that the Plan is consistent with international best practice in terms of structure and quantum.

LTIP Awards

The Long Term Incentive Plan ("LTIP") awards are made in the form of Restricted Share Units ("RSU's") and Performance Share Units ("PSU's"). Due to the Committee's wish to avoid equity dilution for shareholders, RSU's and PSU's will be settled in cash, reflecting the prevailing Caledonia share price at the maturity of the award. No shares will be issued as a result of the LTIP awards.

The number of PSU's and RSU's awarded is equal to the monetary value of the award divided by the Fair Market Value of the Company's shares, being the greater of (i) the volume-weighted average trading price of Caledonia's shares on the Toronto Stock Exchange for the five days preceding the date of the award or (ii) the closing price on the TSX on the trading day immediately prior to the grant date, converted to the U.S. dollar equivalent based on the CAD/USD exchange rate for the 90 days immediately preceding the valuation date, i.e. 62 US cents.

Each RSU entitles the Participant to receive the cash equivalent of the Fair Market Value of one Caledonia common share on the maturity of the award. 20 per cent of the total value of the LTIP award for each participant in the plan is made up of RSU's.

The awards are intended to create a high degree of alignment between the remuneration of Caledonia's senior management team and the interests of shareholders. Accordingly, 80% of the award value for each Participant is made up of PSU's. The final number of PSU's which vest on maturity of the award will be adjusted to reflect the actual performance of the Company in terms of three criteria: progress on the sinking of the Central Shaft; gold production and production costs. In the case of all three criteria, if actual performance is less than 70% of target, no PSU's will vest; if actual performance is greater than 70% of target, the number of vesting PSU's will be adjusted pro rata on a linear basis. In the case of Central Shaft progress, adjustment will be to a maximum of 100% of target whereas adjustments with respect to gold production and costs will increase on a linear pro rata basis reflecting the extent to which actual performance exceeds target, subject to a maximum of 200% of the initial target.

The total annual LTIP award for Messrs. Learmonth, Mangezi and Roets is 20% of basic salary; the total annual LTIP award for Mr Curtis is 30% of his basic salary.

For Messrs. Curtis, Mangezi and Roets, an immediate award has been made covering the 3 years 2016 to 2018; further PSU awards relating to 2019 and 2020 will be made on the third and fourth anniversaries of the initial grants at which time new performance criteria will be established. Mr Learmonth has received a one year award covering 2016 only; a further award relating to 2017 and 2018 will be made pending clarification of his residence status which depends on the outcome of the proposal to re-domicile Caledonia from Canada to Jersey, Chanel Islands and is subject to a shareholder vote. Mr. Learmonth will also receive additional PSU awards relating to 2019 and 2020. In all cases, RSUs and PSUs will vest on the third anniversary of the respective awards grant dates.

The LTIP awards by Participant are set out below

| |

|

LTIP

Annual

Target %

|

|

|

5 Year

LTIP Grant

Value

|

|

|

Initial

Award

|

|

|

Grant

Value of

Initial

RSUs

|

|

|

Grant

Value of

Initial

PSUs

|

|

|

Grant

Value of

Tranche

4 PSUs

|

|

|

Grant

Value of

Tranche

5 PSUs

|

|

|

Curtis

Roets

Mangezi

|

|

|

30

20

20

|

%

%

%

|

|

$

$

$

|

650,000

425,000

350,000

|

|

|

$

$

$

|

390,000

255,000

210,000

|

|

|

$

$

$

|

78,000

51,000

42,000

|

|

|

$

$

$

|

312,000

204,000

168,000

|

|

|

$

$

$

|

130,000

85,000

70,000

|

|

|

$

$

$

|

130,000

85,000

70,000

|

|

|

Learmonth

|

|

|

20

|

%

|

|

|

n/a

|

|

|

$

|

85,000

|

|

|

$

|

17,000

|

|

|

$

|

68,000

|

|

|

|

n/a

|

|

|

|

n/a

|

|

|

All monetary amounts are in US$

|

|

All bonus payments, including those pursuant to LTIP's will be reported in the ordinary course of events in Caledonia's annual audited financial statements; the basis and quantum of LTIP awards will be set out in Caledonia's 20-F filing which will be made on or before March 31, 2016.

Commenting on the introduction of the Plan, Leigh Wilson, Caledonia's Chairman said:

"Caledonia has set in place an objective and transparent incentivisation system for its senior management team which closely aligns the interests of shareholders and the performance of management.

"Management is now clearly incentivised to deliver on the core aspects of the Revised Investment Plan which we announced to the market in November 2014 – these core aspects being gold production, cost control and progress on sinking the Central Shaft."

For further information please contact:

|

Caledonia Mining Corporation

Mark Learmonth

Tel: +27 11 447 2499

marklearmonth@caledoniamining.com

|

WH Ireland

Adrian Hadden/Nick Prowting

Tel: +44 20 7220 1751

|

| |

|

|

Blytheweigh

Tim Blythe/Camilla Horsfall/Megan Ray

Tel: +44 20 7138 3204

|

|

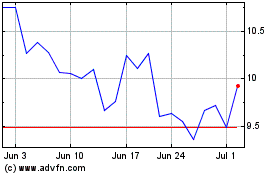

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Aug 2024 to Sep 2024

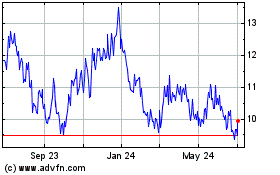

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Sep 2023 to Sep 2024