UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

December 10, 2015

Date of Report (Date of earliest event reported)

_____________________

Huron Consulting Group Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 000-50976 | 01-0666114 |

(State or other jurisdiction | (Commission | (IRS Employer |

of incorporation) | File Number) | Identification Number) |

550 West Van Buren Street

Chicago, Illinois

60607

(Address of principal executive offices)

(Zip Code)

(312) 583-8700

(Registrant’s telephone number, including area code)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

On December 10, 2015, Huron Consulting Group Inc. (the "Company") and its wholly owned subsidiaries, Huron Consulting Services LLC and Huron Consulting Group Holdings LLC, (collectively, the "Sellers"), entered into a Purchase Agreement (the "Agreement") with Consilio, Inc., a Delaware corporation (the "Buyer"), pursuant to which the Company will sell its Huron Legal practice to Buyer for minimum gross proceeds of $112 million in cash at closing, before taxes and transaction-related expenses, plus a cash post-closing payment ranging from zero to $22 million contingent upon final full year 2015 financial results, and subject to certain other adjustments set forth in the Agreement. Huron Legal provides eDiscovery services, consulting services and contract management services related to law department management, information governance and compliance, legal discovery, litigation management, and legal analytics to legal departments, law firms and companies in connection with their e-discovery, law department operations and contract and litigation management needs.

Under the terms of the Agreement, Buyer will acquire substantially all of the assets and assume certain liabilities of the Huron Legal practice, and acquire all issued and outstanding equity interests in certain entities wholly owned by the Company.

The transaction is subject to customary conditions that are to be met or waived at or prior to the closing, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvement Act of 1976, as amended. The Agreement contains customary representations, warranties, covenants, and obligations for transactions of this type. Pursuant to the Agreement, the Company and Buyer have agreed to indemnify the other party for any breach of such party's representations, warranties, and covenants contained in the Agreement, subject to varying survival periods and applicable negotiated caps, baskets, claims procedures, and other limitations.

In addition, the Company has agreed to enter into a non-competition agreement with Buyer at the closing of the transaction, under which the Company and its controlled affiliates will agree, for a period of five years, not to engage in any business which competes with the services provided by the Huron Legal practice.

The foregoing description of the Agreement and the transaction contemplated thereby does not purport to be complete and is qualified in its entirety by the full text of the Agreement, which the Company intends to file with the Securities and Exchange Commission at a later date in accordance with applicable rules and regulations.

Forward-Looking Statements

Statements in this filing, including the information incorporated by reference herein, that are not historical in nature, including with respect to the anticipated timing, completion and effects of the proposed transaction, are “forward-looking” statements as defined in Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors, including, among others, failure of the parties to consummate the transaction, failure to achieve required regulatory approval and those described under “Item 1A. Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2014, that may cause actual results to be materially different from any anticipated results expressed or implied by these forward-looking statements. The Company disclaims any obligation to update or revise any forward-looking statements as a result of new information or future events, or for any other reason.

Item 7.01. Regulation FD Disclosure.

On December 10, 2015, the Company issued a press release announcing the entry into the Agreement, the pending divestiture, and updated guidance for full year 2015.

A copy of the press release relating to the Agreement, the pending divestiture, and the updated guidance is attached hereto as Exhibit 99.1.

Item 8.01. Other Events.

On December 10, 2015, the Company announced that the Company's board of directors has authorized an increase to the current share repurchase program to $125 million inclusive of the $36.5 million remaining under the existing share repurchase program, which was extended through October 31, 2016. The amount and timing of the repurchases will be determined by management and depend on a variety of factors, including the trading price of the Company’s common stock, general market and business conditions, and applicable legal requirements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release, dated December 10, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | Huron Consulting Group Inc. |

| | | (Registrant) |

| | | |

Date: | December 10, 2015 | | /s/ C. Mark Hussey |

| | | C. Mark Hussey |

| | | Executive Vice President, Chief Operating Officer, Chief Financial Officer and Treasurer |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press release, dated December 10, 2015. |

FOR IMMEDIATE RELEASE

December 10, 2015

Huron Consulting Group Announces Definitive Agreement to

Divest Huron Legal Business

CHICAGO - December 10, 2015 - Huron Consulting Group Inc. (NASDAQ: HURN), a leading provider of business consulting services, today announced a definitive agreement to divest its Huron Legal practice to Consilio, Inc., a global leader in eDiscovery and document review services, for minimum gross proceeds of $112 million in cash upon closing, plus a cash post-closing payment contingent upon final full year 2015 financial results and subject to certain other adjustments set forth in the agreement. The sale is expected to close in the fourth quarter of 2015 following the satisfaction of regulatory requirements and other customary closing conditions. In connection with the anticipated sale, Huron’s board of directors has increased the Company’s current share repurchase authorization to $125 million inclusive of the $36.5 million remaining on the existing share repurchase authorization.

“With its highly experienced team and exceptional focus on client service, Huron Legal has achieved a leading reputation in the industry,” said James H. Roth, president and chief executive officer, Huron Consulting Group. “Combining Consilio’s global focus and Huron Legal’s strong domestic presence will provide the scale and expertise necessary to support the complex issues facing corporate law departments and law firms around the world. We have tremendous respect for the Consilio team, and we believe the combined business will provide a compelling set of offerings to meet the needs of its multinational clients and users of complex legal services.”

“Huron Legal provides a highly complementary platform to our business in terms of both service line and geographic presence, but, more importantly, shares our commitment to delivering high-value, quality service to clients,” added Andy Macdonald, chief executive officer of Consilio. “We are excited to have Huron Legal join the Consilio team.”

After the close of the transaction, Huron will concentrate its resources and investments in the Company’s Healthcare, Education and Life Sciences and Business Advisory segments to drive future growth and generate long-term value for its shareholders.

“As Huron looks to the future, we remain excited by the dynamic markets we serve, our incredible team of professionals, and our ability to enhance our focus and resources to accelerate growth within our businesses,” continued Roth.

Share Repurchase Authorization

In connection with the transaction, the Company’s board of directors authorized an increase to the current share repurchase program to $125 million inclusive of the $36.5 million remaining under the existing share repurchase program, which was extended through October 31, 2016. The amount and timing of the repurchases will be determined by management and depend on a variety of factors, including the trading price of the Company’s common stock, general market and business conditions, and applicable legal requirements.

“We believe Huron is well positioned to sustain growth through its solid cash flow generated by a portfolio of service offerings that meet the changing needs of our growing client base,” said C. Mark Hussey, chief operating officer and chief financial officer, Huron Consulting Group. “With the anticipated sale of our Legal practice, we continue to maintain a strong and flexible balance sheet that allows us to continue to invest in our businesses, while returning excess cash to shareholders through share repurchases.”

Transaction Overview

Under the terms of the definitive agreement, Huron will receive minimum gross proceeds of $112 million in cash at closing, before taxes and transaction-related expenses, plus a cash post-closing payment contingent upon final full year 2015 financial results. The Company expects net proceeds at closing after taxes and transaction-related expenses to be approximately $90 million before the contingent post-closing payment, if any. The Company intends to use the net proceeds from the transaction primarily to purchase shares under the increased share repurchase authorization.

The transaction is expected to close in the fourth quarter of 2015, and is subject to clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and other customary closing conditions.

William Blair & Company acted as financial advisor and Skadden, Arps, Slate, Meagher & Flom, LLP served as legal advisor to the Company.

Further information regarding the material terms and conditions contained in the definitive agreement will be included in Huron’s forthcoming Current Report on Form 8-K in connection with the closing of the transaction.

Outlook for 2015(1)

As a result of the pending transaction, the Huron Legal business will be treated as a discontinued operation for 2015, and Huron updates its full year 2015 guidance to reflect this change. Based on currently available information, the Company updates guidance for full year 2015 revenues before reimbursable expenses from continuing operations to a range of $695 million to $699 million. The Company also updates its earnings guidance to reflect continuing operations and now expects EBITDA from continuing operations in a range of $134 million to $137 million, Adjusted EBITDA from continuing operations in a range of $138 million to $141 million, GAAP diluted earnings per share from continuing operations in a range of $1.91 to $1.95, and non-GAAP Adjusted diluted earnings per share from continuing operations in a range of $2.96 to $3.00.

In connection with the sale, the Company expects to reduce its corporate costs by approximately $11 million to more closely align to a level required to support the ongoing scale of its continuing operations. In addition, Huron expects to incur restructuring charges for certain costs not assumed by the purchaser. The amount and timing of the restructuring charges have not yet been determined and are expected to primarily relate to reductions in office facilities and other costs of separating the divested business.

Management will provide a more detailed discussion of the transaction and its 2015 outlook during the Company’s investor webcast.

The Company expects to announce its 2016 earnings guidance in conjunction with the release of its fourth quarter and full year 2015 earnings results, which is currently scheduled to occur on February 22, 2016.

Investor Webcast

The Company will host a conference call and webcast today, December 10, 2015, at 6:00pm Eastern Time (5:00pm Central Time). The conference call is being webcast by NASDAQ OMX and can be

accessed at Huron Consulting Group’s website at http://ir.huronconsultinggroup.com. To participate by telephone, the dial-in number is (855) 789-8162 with passcode 3236844. A replay of the webcast will be available approximately two hours after the conclusion of the call and for 90 days thereafter.

A supplemental presentation that will be discussed on the conference call and webcast will be made available in the Investor Relations section of the Company’s website at

http://ir.huronconsultinggroup.com prior to the conference call, and will be available for 90 days thereafter.

Investor Day 2016

The Company will host an investor day in Chicago on Wednesday, February 24, 2016 at 10:00am Eastern Time (9:00am Central Time) with presentations given by James H. Roth, president and chief executive officer, and members of executive and practice management. The presentations will include a question and answer session.

Use of Non-GAAP Financial Measures(1)

In evaluating the Company’s financial performance and outlook, management uses EBITDA, Adjusted EBITDA, Adjusted EBITDA as a percentage of revenues, Adjusted net income, and Adjusted diluted earnings per share, which are non-GAAP measures. Management believes that such measures, as supplements to operating income, net income, and diluted earnings per share, and other GAAP measures, are useful indicators for investors. These useful indicators can help readers gain a meaningful understanding of the Company's core operating results and future prospects. Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States.

About Huron Consulting Group

Huron Consulting Group helps clients in diverse industries improve performance, transform the enterprise, reduce costs, leverage technology, process and review large amounts of complex data, address regulatory changes, recover from distress and stimulate growth. Our professionals employ their expertise in finance, operations, strategy, analytics, and technology to provide our clients with specialized analyses and customized advice and solutions that are tailored to address each client's particular challenges and opportunities to deliver sustainable and measurable results. The Company provides consulting services to a wide variety of both financially sound and distressed organizations, including healthcare organizations, leading academic institutions, Fortune 500 companies, governmental entities and law firms. Huron has worked with more than 450 health systems, hospitals, and academic medical centers; more than 400 corporate general counsel; and more than 400 universities and research institutions. Learn more at www.huronconsultinggroup.com.

Statements in this press release that are not historical in nature, including those concerning the Company’s current expectations about its future requirements and needs, are “forward-looking” statements as defined in Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by words such as “may,” “should,” “expects,” “provides,” “anticipates,” “assumes,” “can,” “will,” “meets,” “could,” “likely,” “intends,” “might,” “predicts,” “seeks,” “would,” “believes,” “estimates,” “plans,” or “continues.” These forward-looking statements reflect our current expectations about our future requirements and needs, results, levels of activity, performance, or achievements. Some of the factors that could cause actual results to differ materially from the forward-looking statements contained herein include, without limitation: failure to achieve expected utilization rates, billing rates and the number of revenue-generating professionals; inability to expand or adjust our service offerings in response to market demands; our dependence on renewal of client-based services; dependence on new business and retention of current

clients and qualified personnel; failure to maintain third-party provider relationships and strategic alliances; inability to license technology to and from third parties; the impairment of goodwill; various factors related to income and other taxes; difficulties in successfully integrating the businesses we acquire and achieving expected benefits from such acquisitions; risks relating to privacy, information security, and related laws and standards; and a general downturn in market conditions. With respect to our proposed sale of Huron Legal, additional factors that could cause actual results to differ materially from those indicated or implied by the forward-looking statements include, among others: the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement we entered into in connection with the proposed sale, the ability to satisfy all conditions to closing, including obtaining clearances under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, and complete the proposed sale, the disruption of management’s attention from our ongoing business operations due to the proposed sale and the failure to achieve projected corporate cost savings. These forward-looking statements involve known and unknown risks, uncertainties and other factors, including, among others, those described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014, that may cause actual results, levels of activity, performance or achievements to be materially different from any anticipated results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. We disclaim any obligation to update or revise any forward-looking statements as a result of new information or future events, or for any other reason.

Media Contact:

Jenna Nichols

312-880-5693

jnichols@huronconsultinggroup.com

Investor Contact:

C. Mark Hussey

or

John Kelly

312-583-8722

investor@huronconsultinggroup.com

HURON CONSULTING GROUP INC.

RECONCILIATION OF NON-GAAP MEASURES FOR FULL YEAR 2015 OUTLOOK

RECONCILIATION OF NET INCOME TO

ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (1)

(In millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| | Guidance Ranges For the Year Ending December 31, 2015 |

| |

| | Continuing Operations | | Discontinued Operations | | Total Company |

| | | |

| | Low | High | | Low | High | | Low | High |

Projected revenues - GAAP | | $ | 695.0 |

| $ | 699.0 |

| | $ | 140.0 |

| $ | 142.0 |

| | $ | 835.0 |

| $ | 841.0 |

|

Projected net income (loss) - GAAP | | $ | 42.0 |

| $ | 44.0 |

| | $ | (10.0 | ) | $ | (9.0 | ) | | $ | 32.0 |

| $ | 35.0 |

|

Add back: | | | | | | | | | |

Income tax expense | | 31.0 |

| 32.0 |

| | 3.0 |

| 3.0 |

| | 34.0 |

| 35.0 |

|

Interest and other expenses | | 19.0 |

| 19.0 |

| | 1.0 |

| 1.0 |

| | 20.0 |

| 20.0 |

|

Depreciation and amortization | | 42.0 |

| 42.0 |

| | 9.0 |

| 9.0 |

| | 51.0 |

| 51.0 |

|

Projected earnings before interest, taxes, depreciation and amortization (EBITDA)(1) | | 134.0 |

| 137.0 |

| | 3.0 |

| 4.0 |

| | 137.0 |

| 141.0 |

|

Add back: | | | | | | | | | |

Loss on sale of Huron Legal, net of taxes | | — |

| — |

| | 17.0 |

| 17.0 |

| | 17.0 |

| 17.0 |

|

Transaction expenses related to sale of Huron Legal | | — |

| — |

| | 8.0 |

| 8.0 |

| | 8.0 |

| 8.0 |

|

Restructuring charges | | 3.0 |

| 3.0 |

| | 1.0 |

| 1.0 |

| | 4.0 |

| 4.0 |

|

Litigation and other (gains) losses | | 1.0 |

| 1.0 |

| | — |

| — |

| | 1.0 |

| 1.0 |

|

Projected adjusted EBITDA(1) | | $ | 138.0 |

| $ | 141.0 |

| | $ | 29.0 |

| $ | 30.0 |

| | $ | 167.0 |

| $ | 171.0 |

|

Projected adjusted EBITDA as a percentage of projected revenues(1) | | 19.8 | % | 20.2 | % | | 20.7 | % | 21.1 | % | | 20.0 | % | 20.4 | % |

RECONCILIATION OF NET INCOME TO ADJUSTED NET INCOME (1)

(In millions)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| | Guidance Ranges For the Year Ending December 31, 2015 |

| |

| | Continuing Operations | | Discontinued Operations | | Total Company |

| | | |

| | Low | High | | Low | High | | Low | High |

Projected net income (loss) - GAAP | | $ | 42.0 |

| $ | 44.0 |

| | $ | (10.0 | ) | $ | (9.0 | ) | | $ | 32.0 |

| $ | 35.0 |

|

Projected diluted earnings (loss) per share - GAAP | | $ | 1.91 |

| $ | 1.95 |

| | $ | (0.45 | ) | $ | (0.43 | ) | | $ | 1.46 |

| $ | 1.52 |

|

Add back: | | | | | | | | | |

Loss on sale of Huron Legal, net of taxes | | — |

| — |

| | 17.0 |

| 17.0 |

| | 17.0 |

| 17.0 |

|

Transaction expenses related to sale of Huron Legal | | — |

| — |

| | 8.0 |

| 8.0 |

| | 8.0 |

| 8.0 |

|

Amortization of intangible assets | | 29.0 |

| 29.0 |

| | 1.0 |

| 1.0 |

| | 30.0 |

| 30.0 |

|

Restructuring charges | | 3.0 |

| 3.0 |

| | 1.0 |

| 1.0 |

| | 4.0 |

| 4.0 |

|

Litigation and other (gains) losses | | 1.0 |

| 1.0 |

| | — |

| — |

| | 1.0 |

| 1.0 |

|

Non-cash interest on convertible notes | | 7.0 |

| 7.0 |

| | — |

| — |

| | 7.0 |

| 7.0 |

|

Tax effect | | (16.0 | ) | (16.0 | ) | | (5.0 | ) | (5.0 | ) | | (21.0 | ) | (21.0 | ) |

Total adjustments, net of tax | | 24.0 |

| 24.0 |

| | 22.0 |

| 22.0 |

| | 46.0 |

| 46.0 |

|

Projected adjusted net income(1) | | 66.0 |

| 68.0 |

| | 12.0 |

| 13.0 |

| | 78.0 |

| 81.0 |

|

Projected adjusted diluted earnings per share(1) | | $ | 2.96 |

| $ | 3.00 |

| | $ | 0.58 |

| $ | 0.60 |

| | $ | 3.54 |

| $ | 3.60 |

|

| |

(1) | In evaluating the Company’s outlook, management uses Projected EBITDA, Projected adjusted EBITDA, Projected adjusted EBITDA as a percentage of revenues, Projected adjusted net income, and Projected adjusted diluted earnings per share, which are non-GAAP measures. Management believes that the use of such measures, as supplements to Projected net income and Projected diluted earnings per share, and other GAAP measures, are useful indicators for investors. These useful indicators can help readers gain a meaningful understanding of the Company’s core operating results and future prospects without the effect of non-cash or other one-time items. Investors should recognize that these non-GAAP measures might not be comparable to similarly titled measures of other companies. These measures should be considered in addition to, and not as a substitute for or superior to, any measure of performance, cash flows or liquidity prepared in accordance with accounting principles generally accepted in the United States. |

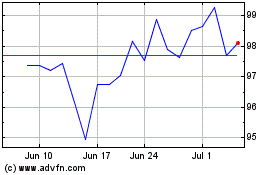

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

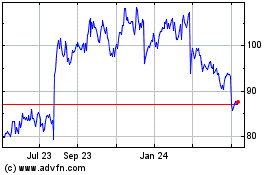

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Apr 2023 to Apr 2024