UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2015

Astrotech Corporation

(Exact name of registrant as specified in its charter)

|

| | | | |

Washington | | 001-34426 | | 91-1273737 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

401 Congress Ave. Suite 1650, Austin, Texas | | 78701 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(512) 485-9530

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

c | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

c | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

c | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

c | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.07 Submission of Matters to a Vote of Security Holders

On December 4, 2015, Astrotech Corporation (“Astrotech,”the “Company”) held its annual meeting of shareholders, pursuant to notice duly given, at 401 Congress Avenue, Suite 1600, Austin, Texas 78701. Of the 20,700,673 shares of common stock entitled to vote at such meeting, 18,666,528 shares, or 90.17% of the Company’s common stock, were present in person or by proxy. The matters voted upon at the meeting and the results of such voting are set forth below:

Proposal 1 – Election of Directors

By the votes reflected below, our shareholders elected the following individuals to serve as directors to serve for the respective terms prescribed by the Company’s bylaws:

|

| | | | | | |

Nominee | | Votes For | | Votes Withheld | | Broker Non-Votes |

Thomas B. Pickens III | | 10,672,853 | | 156,461 | | 7,837,214 |

Mark Adams | | 10,665,928 | | 163,386 | | 7,837,214 |

John A. Oliva | | 10,641,884 | | 187,430 | | 7,837,214 |

William F. Readdy | | 10,643,739 | | 185,575 | | 7,837,214 |

Sha-Chelle Manning | | 10,667,861 | | 161,453 | | 7,837,214 |

Daniel T. Russler, Jr. | | 10,667,870 | | 161,444 | | 7,837,214 |

Ronald W. Cantwell | | 10,674,760 | | 154,554 | | 7,837,214 |

Michael R. Humphrey | | 10,676,315 | | 152,999 | | 7,837,214 |

Proposal 2 – Ratification of Selection of Independent Registered Public Accounting Firm

By the votes reflected below, our shareholders ratified the appointment of BDO, LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2016:

|

| | | | | | |

Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

18,414,774 | | 37,506 | | 214,248 | | — |

Proposal 3 - Say-On-Pay Advisory Vote on the Compensation of Our Named Executive Officers

By the votes reflected below, our shareholders approved an advisory, non-binding resolution approving the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement filed with the Securities and Exchange Commission on October 19, 2015:

|

| | | | | | |

Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

9,651,441 | | 925,744 | | 252,129 | | 7,837,214 |

Item 8.01 Other Events

On December 3, 2015, Astrotech's Board of Directors approved an extension of the share repurchase program authorizing the company to repurchase up to $5.0 million of the Company's common stock through December 31, 2016. To date, the Company has repurchased 188 thousand shares at a cost of $492 thousand.

Repurchases under the share repurchase program may be made from time to time through open market transactions, privately negotiated transactions or otherwise, as determined by the Company depending on market conditions and business needs. The share repurchase program does not obligate the Company to purchase any particular amount of common shares, and it may be suspended, discontinued, or modified at any time at the Company’s discretion and without prior notice.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

Exhibit No. | | Description |

99.1 | | Press release announcing the share repurchase program extension originally issued by Astrotech Corporation on December 16, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | ASTROTECH CORPORATION |

| | | |

Date: December 9, 2015 | | By: | /s/ Thomas B. Pickens III |

| | | Name: Thomas B. Pickens III |

| | | Title: Chairman of the Board and Chief Executive Officer |

| | | |

| | | |

| | | |

| | | |

|

| | |

| | Astrotech Corporation |

| 401 Congress, Suite 1650 |

| Austin, Texas |

| 512.485.9530 |

| fax: 512.485.9531 |

| www.astrotechcorp.com |

Astrotech Board of Directors Extends Repurchase of Up to $5 Million

of the Company's Outstanding Common Stock

Austin, TX (December 9, 2015) - Astrotech Corporation (NASDAQ: ASTC) announced its Board of Directors extended the share repurchase plan that was originally announced on December 16, 2014, for another 12 months, to December 31, 2016.

“Our strong balance sheet supports our commitment to return capital to shareholders while we simultaneously invest in emerging disruptive technologies,” said Thomas B. Pickens III, Chairman and CEO. “Extending our share repurchase program highlights our confidence in our financial strength and our ability to increase shareholder value, particularly as we extract the unrecognized value of each of our businesses.”

The terms remain in place. Repurchases under the share repurchase program may be made from time to time through open market transactions, privately negotiated transactions or otherwise, as determined by the Company depending on market conditions and business needs. The share repurchase program does not obligate the Company to purchase any particular amount of common shares, and it may be suspended, discontinued, or modified at any time at the Company’s discretion and without prior notice.

To date, Astrotech repurchased 188 thousand shares at a cost of $492 thousand. Astrotech had approximately 20,700,673 shares of common stock outstanding as of December 9, 2015.

About Astrotech Corporation

Astrotech Corporation (NASDAQ: ASTC) identifies and commercializes emerging disruptive technologies through its closely held subsidiaries. Management sources investment opportunities from various government laboratories, agencies, universities, and corporations, as well as through its own internal research. Sourced from Oak Ridge Laboratory’s chemical analyzer research, 1st Detect develops, manufactures, and sells chemical analyzers that streamline processes for industrial use in the airport security, food and beverage, semiconductor, pharmaceutical, research and environmental markets, and the military. Sourced from decades of image research from the laboratories of IBM and Kodak combined with classified satellite technology from government laboratories, Astral Images sells film to digital image enhancement, defect removal and color correction software and post processing services providing economically feasible conversion of television and feature 35mm and 16mm films to the new 4K ultra-high definition (UHD), high-dynamic range (HDR) format necessary for the new generation of digital distribution. Sourced from NASA’s extensive microgravity research, Astrogenetix is applying a fast-track on-orbit discovery platform using the International Space Station to develop vaccines and other therapeutics. Demonstrating its entrepreneurial strategy, Astrotech management sold its state-of-the-art satellite servicing operations to Lockheed Martin in August 2014. Astrotech has operations throughout Texas and is headquartered in Austin. For information please visit www.astrotechcorp.com

This press release contains forward-looking statements that are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, trends, and uncertainties that could cause actual results to be materially different from the forward-looking statement. These factors include, but are not limited to, continued government support and funding for key space programs, product performance and market acceptance of products and services, as well as other risk factors and business considerations described in the Company’s Securities and Exchange Commission filings including the annual report on Form 10-K. Any forward-looking statements in this document should be evaluated in light of these important risk factors. The Company assumes no obligation to update these forward-looking statements.

IR Contact

Cathy Mattison and Kirsten Chapman

LHA

+1 (415) 433-3777ir@astrotechcorp.com

###

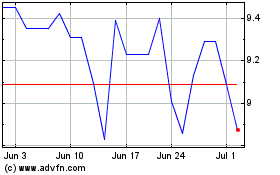

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Sep 2023 to Sep 2024