F5 Networks, Inc. (NASDAQ: FFIV) today announced revenue of

$501.3 million for the fourth quarter of fiscal year 2015, up 4

percent from $483.6 million in the prior quarter and 8 percent from

$465.3 million in the fourth quarter of fiscal year 2014. For

fiscal year 2015, revenue was $1.92 billion, up 11 percent from

$1.73 billion last year.

GAAP net income for the fourth quarter was $97.0 million ($1.36

per diluted share) compared to $93.2 million ($1.29 per diluted

share) in the third quarter of 2015 and $94.0 million ($1.26 per

diluted share) in the fourth quarter a year ago. GAAP net income

for the year was $365.0 million ($5.03 per diluted share) versus

$311.2 million ($4.09 per diluted share) in fiscal year 2014.

Excluding the impact of stock-based compensation and

amortization of purchased intangible assets, non-GAAP net income

for the fourth quarter was $130.7 million ($1.84 per diluted

share), compared to $120.2 million ($1.67 per diluted share) in the

prior quarter and $116.7 million ($1.57 per diluted share) in the

fourth quarter of fiscal 2014. For fiscal year 2015, non-GAAP net

income was $480.3 million ($6.62 per diluted share) versus $413.0

million ($5.43 per diluted share) in fiscal year 2014.

A reconciliation of GAAP net income to non-GAAP net income is

included on the attached Consolidated Statements of Operations.

“Against the backdrop of a volatile macro-economy, F5 achieved a

year of solid growth and profitability,” said Manny Rivelo, F5

president and chief executive officer. “With a Q4 revenue run-rate

above two billion dollars, record annual revenue and gross margins

contributed to a 17 percent increase in GAAP net income for the

year. From a regional perspective, the United States and EMEA were

the strongest performers, with solid year over year revenue growth

in Q4, offset by weakness in Latin America, Canada and Japan.

“During the quarter, software sales continued to grow as a

percentage of our product mix, reflecting incremental demand for

our Virtual Editions and Good-Better-Best bundles and a steady ramp

in sales of our Cloud-based Silverline SaaS offerings and our other

subscription services. These trends validate our success in meeting

the growing need for hybrid solutions that can be deployed and

centrally managed on-premise and in the Cloud, and we expect to see

them continue throughout fiscal 2016.

“In addition, we believe our planned product rollouts and new

sales initiatives, combined with the strength of partner

relationships such as our recently announced partnership with

FireEye will continue to expand our addressable market and drive

products sales over the course of the year. However, we expect

their combined effect to be gradual and weighted toward the back

half of the year.

“For the past several years, we have experienced a seasonally

slower first quarter, followed by a steady ramp in sales through

the end of the fiscal year. In addition, we are factoring in a

measure of continued uncertainty in the macro environment in

shaping our outlook for Q1 of fiscal 2016.”

For the first quarter of fiscal 2016, ending December 31, the

company has set a revenue target of $480 million to $490 million

with a GAAP earnings target of $1.13 to $1.16 per diluted share.

Excluding stock-based compensation expense and amortization of

purchased intangible assets, the company’s non-GAAP earnings target

is $1.58 to $1.61 per diluted share.

A reconciliation of the company’s expected GAAP and non-GAAP

earnings is provided in the following table:

Three months ended December 31, 2015

Reconciliation of Expected Non-GAAP First Quarter Earnings

Low High Net income $ 79.8 $ 82.0 Stock-based

compensation expense $ 39.0 $ 39.0 Amortization of purchased

intangible assets $ 3.4 $ 3.4 Tax effects related to above items $

(10.7 ) $ (10.7 ) Non-GAAP net income excluding stock-based

compensation expense and amortization of purchased intangible

assets $ 111.5 $ 113.7 Net income per share - diluted

$ 1.13 $ 1.16 Non-GAAP net income per share - diluted

$ 1.58 $ 1.61

Analyst/Investor Meeting

F5 will hold a meeting for analysts and investors at the New

York Hilton Midtown, from 8:00 a.m. to 12:30 p.m. Eastern Time on

Thursday, November 12, 2015.

For more information and to register online, please visit:

https://f5.com/about-us/events/f5-networks-analyst-and-investor-meeting-2015

The meeting will also be webcast live, beginning November 12th

at 8:00 a.m. ET, and an archived version will be available through

January 20, 2016. The link for the live webcast and the archived

version is https://f5.com/about-us/investor-relations.

About F5 Networks

F5 (NASDAQ: FFIV) provides solutions for an application world.

F5 helps organizations seamlessly scale cloud, data center,

telecommunications, and software defined networking (SDN)

deployments to successfully deliver applications and services to

anyone, anywhere, at any time. F5 solutions broaden the reach of IT

through an open, extensible framework and a rich partner ecosystem

of leading technology and orchestration vendors. This approach lets

customers pursue the infrastructure model that best fits their

needs over time. The world’s largest businesses, service providers,

government entities, and consumer brands rely on F5 to stay ahead

of cloud, security, and mobility trends. For more information, go

to f5.com.

You can also follow @f5networks on Twitter or visit us on

LinkedIn and Facebook for more information about F5, its partners,

and technologies.

Forward-Looking Statements

This press release contains forward-looking statements

including, among other things, statements regarding the continuing

strength and momentum of F5’s business, future financial

performance, sequential growth, projected revenues including target

revenue and earnings ranges, income, earnings per share, share

amount and share price assumptions, demand for application delivery

networking, application delivery services, security, virtualization

and diameter products, expectations regarding future services and

products, expectations regarding future customers, markets and the

benefits of products, and other statements that are not historical

facts and which are forward-looking statements. These

forward-looking statements are subject to the safe harbor

provisions created by the Private Securities Litigation Reform Act

of 1995. Actual results could differ materially from those

projected in the forward-looking statements as a result of certain

risk factors. Such forward-looking statements involve risks and

uncertainties, as well as assumptions and other factors that, if

they do not fully materialize or prove correct, could cause the

actual results, performance or achievements of the company, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to: customer acceptance of our new traffic management,

security, application delivery, optimization, diameter and

virtualization offerings; the timely development, introduction and

acceptance of additional new products and features by F5 or its

competitors; competitive factors, including but not limited to

pricing pressures, industry consolidation, entry of new competitors

into F5’s markets, and new product and marketing initiatives by our

competitors; increased sales discounts; uncertain global economic

conditions which may result in reduced customer demand for our

products and services and changes in customer payment patterns;

global economic conditions and uncertainties in the geopolitical

environment; overall information technology spending; litigation

involving patents, intellectual property, shareholder and other

matters, and governmental investigations; natural catastrophic

events; a pandemic or epidemic; F5’s ability to sustain, develop

and effectively utilize distribution relationships; F5’s ability to

attract, train and retain qualified product development, marketing,

sales, professional services and customer support personnel; F5’s

ability to expand in international markets; the unpredictability of

F5’s sales cycle; F5’s share repurchase program; future prices of

F5’s common stock; and other risks and uncertainties described more

fully in our documents filed with or furnished to the Securities

and Exchange Commission, including our most recent reports on Form

10-K and Form 10-Q and current reports on Form 8-K that we may file

from time to time, which could cause actual results to vary from

expectations. The financial information contained in this release

should be read in conjunction with the consolidated financial

statements and notes thereto included in F5’s most recent reports

on Forms 10-Q and 10-K as each may be amended from time to time.

All forward-looking statements in this press release are based on

information available as of the date hereof and qualified in their

entirety by this cautionary statement. F5 assumes no obligation to

revise or update these forward-looking statements.

GAAP to non-GAAP Reconciliation

F5’s management evaluates and makes operating decisions using

various operating measures. These measures are generally based on

the revenues of its products, services operations and certain costs

of those operations, such as cost of revenues, research and

development, sales and marketing and general and administrative

expenses. One such measure is net income excluding stock-based

compensation, amortization of purchased intangible assets and

acquisition-related charges, net of taxes, which is a non-GAAP

financial measure under Section 101 of Regulation G under the

Securities Exchange Act of 1934, as amended. This measure consists

of GAAP net income excluding, as applicable, stock-based

compensation, amortization of purchased intangible assets and

acquisition-related charges. This measure of non-GAAP net income is

adjusted by the amount of additional taxes or tax benefit that the

company would accrue if it used non-GAAP results instead of GAAP

results to calculate the company’s tax liability. Stock-based

compensation is a non-cash expense that F5 has accounted for since

July 1, 2005 in accordance with the fair value recognition

provisions of Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) Topic 718

Compensation—Stock Compensation (“FASB ASC Topic 718”).

Amortization of intangible assets is a non-cash expense. Investors

should note that the use of intangible assets contribute to

revenues earned during the periods presented and will contribute to

revenues in future periods. Acquisition-related expenses consist of

professional services fees incurred in connection with

acquisitions.

Management believes that non-GAAP net income per share provides

useful supplemental information to management and investors

regarding the performance of the company’s core business operations

and facilitates comparisons to the company’s historical operating

results. Although F5’s management finds this non-GAAP measure to be

useful in evaluating the performance of the core business,

management’s reliance on this measure is limited because items

excluded from such measures could have a material effect on F5’s

earnings and earnings per share calculated in accordance with GAAP.

Therefore, F5’s management will use its non-GAAP earnings and

earnings per share measures, in conjunction with GAAP earnings and

earnings per share measures, to address these limitations when

evaluating the performance of the company’s core business.

Investors should consider these non-GAAP measures in addition to,

and not as a substitute for, financial performance measures in

accordance with GAAP.

F5 believes that presenting its non-GAAP measure of earnings and

earnings per share provides investors with an additional tool for

evaluating the performance of the company’s core business and which

management uses in its own evaluation of the company’s performance.

Investors are encouraged to look at GAAP results as the best

measure of financial performance. However, while the GAAP results

are more complete, the company provides investors this supplemental

measure since, with reconciliation to GAAP, it may provide

additional insight into the company’s operational performance and

financial results.

For reconciliation of this non-GAAP financial measure to the

most directly comparable GAAP financial measure, please see the

section in our Consolidated Statements of Operations entitled

“Non-GAAP Financial Measures.”

F5 Networks, Inc. Consolidated

Balance Sheets

(unaudited, in thousands)

September 30, September 30, 2015

2014 Assets Current assets Cash and cash

equivalents $ 390,460 $ 281,502 Short-term investments 383,882

363,877 Accounts receivable, net of allowances of $1,979 and $4,958

279,434 242,242 Inventories 33,717 24,471 Deferred tax assets

50,128 42,290 Other current assets 50,519 44,466

Total current assets 1,188,140 998,848

Property and equipment, net 95,909 66,791 Long-term investments

397,656 482,917 Deferred tax assets 6,492 4,434 Goodwill 555,965

556,957 Other assets, net 68,128 75,003 Total assets

$ 2,312,290 $ 2,184,950

Liabilities and Shareholders’

Equity Current liabilities Accounts payable $ 50,814 $ 43,772

Accrued liabilities 130,401 108,772 Deferred revenue 573,908

484,437 Total current liabilities 755,123

636,981 Other long-term liabilities 30,136 22,718 Deferred

revenue, long-term 209,402 152,312 Deferred tax liabilities

901 3,629 Total long-term liabilities 240,439

178,659 Commitments and contingencies Shareholders’

equity Preferred stock, no par value; 10,000 shares authorized, no

shares outstanding - -

Common stock, no par value; 200,000 shares

authorized, 70,138 and 73,390 shares issued and outstanding

10,159 15,753 Accumulated other comprehensive loss (15,288) (9,584)

Retained earnings 1,321,857 1,363,141 Total

shareholders' equity 1,316,728 1,369,310 Total

liabilities and shareholders' equity $ 2,312,290 $ 2,184,950

F5 Networks, Inc.

Consolidated Statements of Operations (unaudited, in

thousands, except per share amounts) Three

Months Ended Twelve Months Ended September 30,

September 30, 2015 2014

2015 2014

Net revenues Products $ 257,719 $ 255,461 $ 991,539 $ 936,130

Services 243,582 209,805 928,284

795,916 Total 501,301 465,266 1,919,823

1,732,046 Cost of net revenues (1)(2) Products 44,505 43,351

174,225 158,788 Services 40,153 38,601

158,036 151,171 Total 84,658

81,952 332,261 309,959

Gross Profit 416,643 383,314 1,587,562 1,422,087

Operating expenses (1)(2) Sales and marketing 151,653 143,284

602,540 558,284 Research and development 77,665 65,401 296,583

263,792 General and administrative 39,726

27,148 135,540 106,454 Total

269,044 235,833 1,034,663

928,530 Income from operations 147,599 147,481

552,899 493,557 Other income, net 1,865 2,323

8,445 3,785 Income before income

taxes 149,464 149,804 561,344 497,342 Provision for income taxes

52,427 55,783 196,330

186,159 Net Income $ 97,037 $ 94,021 $

365,014 $ 311,183 Net income per share

- basic $ 1.37 $ 1.27 $ 5.07 $ 4.13

Weighted average shares - basic 70,679 73,817

71,944 75,395 Net income

per share - diluted $ 1.36 $ 1.26 $ 5.03 $

4.09 Weighted average shares - diluted 71,098

74,366 72,547 76,092

Non-GAAP Financial Measures Net income

as reported $ 97,037 $ 94,021 $ 365,014 $ 311,183 Stock-based

compensation expense (3) 41,634 25,159 145,553 127,156 Amortization

of purchased intangible assets 3,409 3,147 13,231 9,488 Tax effects

related to above items (11,414 ) (5,585 ) (43,461 ) (34,859 )

Net income excluding stock-based

compensation and amortization of purchased intangible assets

(non-GAAP) - diluted

$ 130,666 $ 116,742 $

480,337 $ 412,968 Net income per share

excluding stock-based compensation and amortization of purchased

intangible assets (non-GAAP) - diluted $ 1.84 $ 1.57

$ 6.62 $ 5.43 Weighted average shares -

diluted 71,098 74,366 72,547

76,092 (1) Includes stock-based

compensation as follows: Cost of net revenues $ 3,723 $ 2,591 $

14,220 $ 13,985 Sales and marketing 13,992 9,521 56,754 50,091

Research and development 11,629 9,029 46,129 43,633 General and

administrative 12,290 4,018

28,450 19,447 $ 41,634 $ 25,159

$ 145,553 $ 127,156 (2) Includes amortization

of purchased intangible assets as follows: Cost of net revenues $

2,682 $ 2,651 $ 10,650 $ 7,890 Sales and marketing 487 496 1,946

1,598 General and administrative 240 -

635 - $ 3,409 $ 3,147 $

13,231 $ 9,488 (3) Stock-based compensation is

accounted for in accordance with the fair value recognition

provisions of Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) Topic 718, Compensation –

Stock Compensation (“FASB ASC Topic 718”)

F5 Networks, Inc. Consolidated Statements of Cash

Flows (unaudited, in thousands) Years

Ended September 30, 2015

2014 Operating activities Net income $

365,014 $ 311,183 Adjustments to reconcile net income to net cash

provided by operating activities: Realized loss (gain) on

disposition of assets and investments 282 (195 ) Stock-based

compensation 145,553 127,156 Provisions for doubtful accounts and

sales returns 1,488 2,870 Depreciation and amortization 52,583

46,121 Deferred income taxes (12,571 ) (3,090 ) Changes in

operating assets and liabilities, net of amounts acquired:

Accounts receivable

(38,680 ) (40,895 ) Inventories (9,246 ) (5,445 ) Other current

assets (6,533 ) (9,828 ) Other assets 569 (2,502 ) Accounts payable

and accrued liabilities 39,521 18,339 Deferred revenue

146,561 105,278 Net cash provided by operating

activities 684,541 548,992

Investing activities Purchases of investments (609,875 )

(515,737 ) Maturities of investments 461,327 523,983 Sales of

investments 205,292 214,493 (Increase) decrease in restricted cash

(357 ) 59 Acquisition of intangible assets (6,779 ) - Acquisition

of businesses, net of cash acquired - (49,439 ) Purchases of

property and equipment (60,307 ) (22,718 ) Net cash

(used in) provided by investing activities (10,699 )

150,641

Financing activities Excess tax

benefit from stock-based compensation 9,517 10,283

Proceeds from the exercise of stock

options and purchases of stock under employee stock purchase

plan

40,439 35,299 Repurchase of common stock (606,858 )

(650,542 ) Net cash used in financing activities (556,902 )

(604,960 ) Net increase in cash and cash equivalents

116,940 94,673 Effect of exchange rate changes on cash and cash

equivalents (7,982 ) (2,864 ) Cash and cash equivalents, beginning

of period 281,502 189,693 Cash and cash

equivalents, end of period $ 390,460 $ 281,502

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151028006637/en/

F5 Networks, Inc.Investor RelationsJohn Eldridge,

206-272-6571j.eldridge@f5.comorPublic

RelationsNathan Misner,

206-272-7494n.misner@f5.com

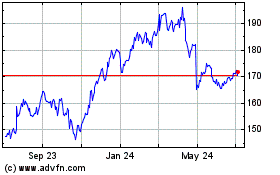

F5 (NASDAQ:FFIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

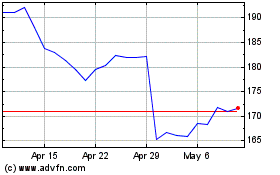

F5 (NASDAQ:FFIV)

Historical Stock Chart

From Apr 2023 to Apr 2024