UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

FORM

10-K

(Mark One)

| [X] |

ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JUNE 30, 2015 OR |

| |

|

| [ ] |

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _____________ TO _____________ |

Commission

file number: 000-27791

Wincash

Apolo Gold & Energy, Inc.

(Exact

name of small business issuer in its charter)

| Nevada |

|

98-0412805 |

| State

or other jurisdiction of |

|

I.R.S.

Employer |

| incorporation

or organization |

|

Identification

No. |

| 9/F,

Kam Chung Commercial Building |

|

|

| 19-21

Hennessy Road, Wanchai, Hong Kong |

|

- |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Issuer’s

telephone number: (852) 3111 7718

Securities

Registered Under Section 12(b) of the Exchange Act: None

Securities

Registered Under Section 12(g) of the Exchange Act:

Common

Stock, 0.001 par value

(Title

of class)

Indicate

by check mark if the registrant is well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [X] No [ ]

Check whether

the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ]

No [ ]

Check if

there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure

will be contained, to the best of the issuer’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. Seethe definitions of “large accelerated filer”, “accelerated filer”, and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer [ ] |

Accelerated

filer [ ] |

| Non-accelerated

filer (Do not check if a smaller reporting company) [ ] |

Smaller

reporting company [X] |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State

issuer’s revenues for most recent fiscal year: Nil

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates. As of June 30, 2015, the aggregate

market value of the voting and non-voting common equity held by non-affiliates is based on 3,664,974 shares and the average bid

and asked price of 0.15 per share is 549,746.

State

the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 21,872,118

shares of Common Stock as of July 27, 2015.

Documents

Incorporated by Reference: None

NOTE

REGARDING FORWARD LOOKING STATEMENTS

Except

for statements of historical fact, certain information contained herein constitutes “forward-looking statements,”

including without limitation statements containing the words “believes,” “anticipates,” “intends,”

“expects” and words of similar import, as well as all projections of future results. Such forward-looking statements

involve known and unknown risks, uncertainties and other factors which may cause the actual results or achievements of the Company

to be materially different from any future results or achievements of the Company expressed or implied by such forward-looking

statements. Such factors include, but are not limited to the following: the Company’s lack of an operating history, the

Company’s minimal level of revenues and unpredictability of future revenues; the Company’s future capital requirements

to develop additional property within the defined claim; the risks associated with rapidly changing technology; the risks associated

with governmental regulations and legal uncertainties; and the other risks and uncertainties described under “Description

of Business - Risk Factors” in this Form 10-KSB. Certain of the Forward-looking statements contained in this annual report

are identified with cross-references to this section and/or to specific risks identified under “Description of Business

- Risk Factors”.

PART

I

ITEM

1. DESCRIPTION OF BUSINESS

History

Apolo

Gold & Energy Inc, (the “Company”) was incorporated in March 1997 under the laws of the State of Nevada as Apolo

Gold Inc., for the purpose of financing and operating precious metals concessions. In May 2005, the Company amended its articles

of incorporation to change the name of the Company from Apolo Gold Inc. to Apolo Gold & Energy Inc.

After

incorporation in 1997 the Company focused on precious metals opportunities in Latin and South America. Shortly thereafter the

Company formed a subsidiary, Compania Minera Apologold, C.A. a corporation, and on May 18, 1999 the Venezuela subsidiary entered

into an agreement with Empresa Proyectos Mineros Goldma, C.A. in Caracas Venezuela, to acquire the diamond and gold mining concession

in Southern Venezuela known as Codsa 13, located in the Gran Sabana Autonomous Municipality, State of Bolivar, Venezuela. This

project was subsequently cancelled in August 2001 because of poor testing results. The subsidiary company in Venezuela has been

dormant since 2001 and will not be reactivated.

On

April 16, 2002, the Company executed an agreement with Pt. Metro Astatama, of Jakarta, Indonesia, for the mining rights to a property

known as Nepal Umbar Picung (“NUP”), which is located west of Bandar Lampung, on the island of Sumatra, Indonesia.

NUP has a KP, Number KW. 098PP325, which is a mineral tenement license for both Exploration and Exploitation. All KP’s must

be held by an Indonesian entity.

The

“NUP” is 733.9 hectares in size and Apolo had an 80% interest. These claims are owned privately by citizens of Indonesia

and are not crown granted claims. Apolo was entitled to recover all of its development costs on the “NUP” including

property payments before the partner with 20% can participate.

The

total purchase price for “NUP” was $375,000, of which payments amounting to $250,000 had been made. After various

exploration programs including different drilling programs failed to yield sufficient positive results, the Company discussed

various options with the property owner and decided to terminate its agreement with the NUP property and return all exploration

rights to the property owners.

On

December 11, 2013, the Company acquired 70% interest in three gold exploration claims located in China’s Xinjiang Province

from Yinfu Gold Corp. (“Yinfu”). The Company issued six million shares of restricted common stocks for the claims.

On

December 23, 2013, the Company acquired 24% equity interest in Jiangxi Everenergy New Material Co., Ltd. (“Everenergy”).

The consideration was settled by the issuance of eight-million restricted common stocks at a deemed price of $0.375 per share,

plus $1-million in cash. Additionally, on February 19, 2014, the Company acquired an additional 29% equity interest in Everenergy.

The consideration was settled with the issuance of 11-million restricted common stock at a deemed price of $0.45 per share.

On

September 17, 2014, the Company cancelled both transactions with Everenergy and had requested return of the $1-million payment

and all the shares. The 11-million shares issued were effectively cancelled on October 21, 2014. The remaining 8-million shares

issued are in the process of cancellation and the $1 million paid for the acquisition was written off as investment loss.

On

January 19, 2015, the Company and Yinfu reached a mutual agreement to terminate the acquisition of the 70% interest in the three

gold exploration claims in the PRC. On February 3, 2015, all six million shares of restricted common stock had been returned by

the wholly owned subsidiary of Yinfu and cancelled by the Company.

On

February 13, 2015, the Company disposed its 100% equity interest in Apolo Gold Direct Limited (formerly known as Apolo Gold &

Energy Asia Limited) to (i) Mr. Kelvin Chak Wai Man, the Chief Executive Officer (“CEO”) and director of the Company,

who acquired 40% equity interest, (ii) Mr. Tsap Wai Ping, a relative of the CEO of the Company, who acquired 50% equity interest,

and (iii) China Yi Gao Gold Trader Co., Limited, a company incorporated in Hong Kong, which acquired the remaining 10% equity

interest, for a consideration of $100.

On

June 18, 2015, the Company filed an Amendment to its Articles of Incorporation with the Nevada Secretary of State to change its

name from Apolo Gold & Energy, Inc. to Wincash Apolo Gold & Energy, Inc.

The

Company will continue to anticipate potential mineral property exploration and other energy related investments.

Government

Regulation

The

Company was aware of environmental requirements in the operation of a concession. The Company is comfortable with the requirements

and regulations and will abide by them.

ITEM

1A. Risk Factors

1. The

Company has no record of earnings. It is also subject to all the risks inherent in a developing business enterprise including

lack of cash flow, and no assurance of recovery of precious metals.

2. The

Company’s success and possible growth will depend on its ability to develop or acquire new business operations. It continues

to explore opportunities but has yet to secure an opportunity that is acceptable.

3. Liquidity

and need for additional financing is a concern for the Company. At the present time, the Company does not have sufficient cash

to finance its operations. The Company is dependent on the ability of its management team to obtain the necessary working capital

to operate successfully. There is no assurance that the Company will be able to obtain additional capital as required or if the

capital is available, to obtain it on terms favorable to the Company. The Company may suffer from a lack of liquidity in the future

that could impair its production efforts and adversely affect its results of operations.

4. Competition

is more in the area of ability to sell at world prices that the Company cannot control, and the Company competes for access to

the world markets with its products.

5. The

Company is wholly dependent at the present upon the personal efforts and abilities of its Officers and Directors, who exercise

control over the day-to-day affairs of the Company.

6. There

are currently 29,872,118 common shares outstanding at July 27, 2015 out of a total authorized capital of 300,000,000 shares. This

is after giving effect of the cancellation issuance of 11,000,000 common shares for the acquisition of 29% interest in Everenergy;

cancellation issuance of 6,000,000 common shares for the three mineral properties; issuance of 1,040,000 common shares as debt

settlement; issuance of 6,400,000 common shares as consulting services provided. The Board of Directors has the power to issue

such shares, subject to Shareholder approval, in some instances.

7. There are no dividends anticipated by the Company.

Company’s

Office

The

Company’s office is at 9/F, Kam Chung Commercial Building, 19-21 Hennessy Road, Wanchai, Hong Kong. Its telephone

number is 852-3111-7718.

ITEM

1B. Unresolved Staff Comments

Not

applicable

ITEM

2. Description of Property

None

ITEM

3. Legal Proceedings

The

Company is not a party to any pending or threatened litigation and to its knowledge, no action, suit or proceedings has been threatened

against its officers and its directors.

ITEM

4. Mine Safety Disclosures

None

PART

II

ITEM

5. Market for Common Equity and Related Stockholder Matters

The

Company’s common stock has been quoted on the National Association of Securities Dealers’ Over-the-Counter market

since May 17, 2000. There is no other public trading market for the Company’s equity securities.

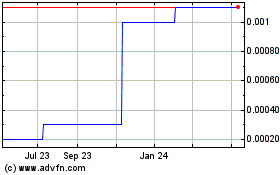

The

following table summarizes trading in the Company’s common stock, as provided by quotations published by the OTC Bulletin

Board for the periods as indicated. The quotations reflect inter-dealer prices without retail mark-up, markdown or commission,

and may not represent actual transactions.

| Quarter Ended | |

High Bid | | |

Low Bid | |

| | |

| | |

| |

| Sep 30, 2014 | |

$ | 0.11 | | |

$ | 0.11 | |

| Dec 31, 2014 | |

$ | 0.10 | | |

$ | 0.10 | |

| Mar 31, 2015 | |

$ | 0.13 | | |

$ | 0.11 | |

| Jun 30, 2015 | |

$ | 0.25 | | |

$ | 0.18 | |

The

common shares were consolidated 20:1 as a result of shareholder approval on October 29, 2010. The consolidation was effective

November 29, 2010. Quotations for September 30, 2010 are based on pricing prior to consolidation of shares.

As

of July 27, 2015, there were 207 holders of record of the Company’s common stock. That does not include the number of beneficial

holders whose stock is held in the name of broker-dealers or banks.

The

Company has not paid, and, in the foreseeable future, the Company does not intend to pay any dividends.

Equity

Compensation Plan Information

The

Company has no existing Equity Compensation Plan and all options granted under previous plans have been exercised, expired or

cancelled.

ITEM

6. Selected Financial Data

As

a smaller business issuer, the Company is not required to include this Item.

ITEM

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations/Plan of Operation

General

Overview

Apolo

Gold & Energy Inc. (“Company”) was incorporated in March 1997 under the laws of the State of Nevada. Its objective

was to pursue mineral properties in South America, Central America, North America and Asia. The Company incorporated a subsidiary

- Compania Minera Apologold, C.A in Venezuela to develop a gold/diamond mining concession in Southeastern Venezuela. Project was

terminated in August 2001, due to poor testing results and the property abandoned. This subsidiary company has been inactive since

2001 and will not be reactivated.

On

April 16, 2002, the Company announced the acquisition of the mining rights to a property known as the Napal Gold Property, (“NUP”).

This property is located 48 km south-west of Bandar Lampung, Sumatra, Indonesia. The property consisted of 733.9 hectares and

possessed a Production Permit (a KP) # KW. 098PP325.

The

terms of the Napal Gold Property called for a total payment of $375,000 US over a six-year period of which a total of $250,000

have been made to date. Company paid $250,000 over the past 5 years and subsequent to the year ending June 30, 2008 the Company

terminated its agreement on the NUP property and returned all exploration rights to the owner.

On

December 11, 2013, the Company acquired 70% interest in three gold exploration claims located in China’s Xinjiang Province

from Yinfu Gold Corp. (“Yinfu”). The Company issued 6,000,000 shares of restricted common stock for the claims at

$0.20 per share for the consideration of $1,200,000. On January 19, 2015, the Company and Yinfu reached a mutual agreement to

terminate the acquisition at the current market value of $0.10 per share and therefore an investment loss of $600,000 was resulted.

On February 3, 2015, all 6,000,000 shares of restricted common stock were returned and effectively cancelled.

On

December 23, 2013, the Company acquired 24% interest in Jiangxi Everenergy New Material Co., Ltd. (“Everenergy”) for

a consideration of $4,000,000. The consideration was settled with the issuance of 8,000,000 shares of restricted common stock

at a deemed price of $0.375 per share, plus $1,000,000 in cash.

On

February 19, 2014, the Company acquired an additional 29% interest in Everenergy for a consideration of $4,950,000. The consideration

was settled with the issuance of 11,000,000 shares of restricted common stock at a deemed price of $0.45 per share.

On

September 17, 2014, the Company cancelled both transactions with Everenergy at the current market value of $0.12 per share and

requested the return of $1,000,000 cash payment. The 11,000,000 shares were effectively cancelled on October 21, 2014and the remaining

8,000,000 shares are to be cancelled as of June 30, 2015. For the year ended June 30, 2015, the Company could not recover the

$1,000,000 cash payment and therefore a total investment loss of $6,670,000 was resulted.

On

February 13, 2015, the Company disposed its 100% equity interest in Apolo Gold Direct Limited (formerly known as Apolo Gold &

Energy Asia Limited) to (i) Mr. Kelvin Chak Wai Man, the Chief Executive Officer (“CEO”) and director of the Company,

who acquired 40% equity interest, (ii) Mr. Tsap Wai Ping, a relative of the CEO of the Company, who acquired 50% equity interest,

and (iii) China Yi Gao Gold Trader Co., Limited, a company incorporated in Hong Kong, which acquired the remaining 10% equity

interest, for a consideration of $100.

On

June 18, 2015, the Company filed an Amendment to its Articles of Incorporation with the Nevada Secretary of State to change its

name from Apolo Gold & Energy, Inc. to Wincash Apolo Gold & Energy, Inc.

The

Company continues to pursue opportunities in the natural resource industry and will consider the acquisition of any other business

opportunity in order to enhance its value.

Results

of Operations - Year ended June 30, 2015 compared to year ended June 30, 2014

REVENUES:

The Company had no revenues in the past fiscal years.

EXPENSES:

During

the fiscal year ending June 30, 2015 and June 30, 2014, the Company had no exploration costs. Total expenses for the year amounted

to $7,549,476 compared to $210,554 in the year ending June 30, 2014, an increase of $7,338,922. The increase is mainly attributable

to the investment loss of $7,270,000 which resulted from the termination of the acquisition of (i) 70% interest in gold exploration

claims in Mainland China and (ii) an aggregate 53% equity interest in Jiangxi Everenergy New Material Co., Ltd. These transactions

details are stated in the note 4 and 5 to the Notes to the Consolidated Financial Statements in this Annual Reporting.

Consulting

and professional fees amounted to $237,597 compared to $179,724 for the year ending June 30, 2014. Among the consulting and professional

fees, approximately $122,300 and $51,700 were settled by stock based compensation for the year ended June 30, 2015 and 2014, respectively.

There

were no additional or extraordinary expenses incurred in the current year ending June 30, 2015 as the Company focused its efforts

in seeking out a resource project that would be beneficial to shareholders.

The

Company continues to carefully control its expenses, and intends to seek additional financing both for potential business opportunities

it may develop. There is no assurance that the Company will be successful in its attempts to raise additional capital.

The

Company has no employees in its head office at the present time other than its Officers and Directors, and engages personnel through

consulting agreements where necessary as well as outside attorneys, accountants and technical consultants.

Cash

and cash equivalents at June 30, 2015 was $14,403 compared to $7,439 in 2014 and the Company recognizes it may not have sufficient

funds to conduct its affairs. It fully intends to seek financing by way of loans, private placements or a combination of both

in the coming months. The Company is dependent on its directors to provide necessary funding when required.

LIQUIDITY

AND CAPITAL RESOURCES

Cash

Used in Operating Activities

Net

cash used in operating activities for the year ended June 30, 2015 was $142,531 as compared to $144,847 for the comparable year

ended in 2014. The cash used in operating activities are mainly attributed from the net loss of $7,549,476 for the year ended

June 30, 2015 and off set by the investment loss of $7,270,000 and stock based compensation of $122,333.

Cash

Used in Investing Activities

Net

cash used in investing activities for the year ended June 30, 2015 and 2014 was $0 and $1,000,000, respectively. The cash used

in investing activities for the year ended June 30, 2014 was for the acquisition of equity interest of Jiangxi Everenergy New

Material Co. Limited.

Cash

Provided by Financing Activities

Net

cash provided by financing activities for the year ended June 30, 2015 and 2014 was $146,482 and $1,150,000, respectively. The

cash provided by financing activities for the year ended June 30, 2015 was advances from a director and comparable to the same

period in 2014 was the sale of common stocks.

The

Company has financed its development to date by way of sale of common stock and with loans from directors/shareholders of the

Company. At July 27, 2015, the Company had 21,872,118 shares of common stock outstanding, and has raised total capital since inception

in excess of $7,500,000.

The

Company has limited financial resources at June 30, 2015 with cash and cash equivalents of $14,403 and $7,439 as of June 30, 2015

and 2014, respectively.

Other

payables and accrued liabilities as of June 30, 2015 amounted to $24,691 compared to $10,079 as of June 30, 2014. The other payables

and accrued liabilities as of June 30, 2015 include amounts owing for professional fees, and sundry amounts owing to former suppliers.

As

of June 30, 2015, the amount due to a director was $10,000. As of June 30, 2014, the amount due from a director was $15,482. The

amounts were unsecured, interest free and have no fixed terms of repayment.

While

the Company continues to seek out additional capital, there is no assurance that they will be successful in completing this necessary

financing. The Company recognizes that it is dependent on the ability of its management team to obtain the necessary working capital

required.

While

in the pursuit of additional working capital, the Company is also very active in reviewing other resource development opportunities

and will continue with these endeavors.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements, financings or other relationships.

Contractual

Obligations and Commitments

As

of June 30, 2015, we did not have any contractual obligations and commitments.

Critical

Accounting Policies

Our

significant accounting policies are described in the notes to our consolidated financial statements for the year ended June 30,

2015, and are included elsewhere in this annual report on Form 10-K.

INFLATION

Inflation

has not been a factor during the fiscal year ending June 30, 2015. While inflationary forces are showing some signs of increasing

in the next year, it is not considered a factor in capital expenditures or production activities.

REPORT

OF MANAGEMENT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our

management is responsible for establishing and maintaining adequate internal control over financial reporting for the company.

Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of our financial

reporting for external purposes in accordance with accounting principles generally accepted in the United States of America. Internal

control over financial reporting includes maintaining records that in reasonable detail accurately and fairly reflect our transactions;

providing reasonable assurance that transactions are recorded as necessary for preparation of our financial statements; providing

reasonable assurance that receipts and expenditures of company assets are made in accordance with management authorization; and

providing reasonable assurance that unauthorized acquisition, use or disposition of company assets that could have a material

effect on our financial statements would be prevented or detected on a timely basis. Because of its inherent limitations, internal

control over financial reporting is not intended to provide absolute assurance that a misstatement of our financial statements

would be prevented or detected.

In

connection with the preparation of this Annual Report on Form 10-K for the year ended June 30, 2015, Management on Internal Control

over Financial Reporting is under the supervision of the principal executive officer who is the chief executive officer of the

Company. Under his direction, the Company has evaluated the effectiveness of its disclosure controls and procedures as required

by Exchange Act Rule 13a-15(b) as of June 30, 2015. Based on that evaluation, the Principal Executive Officer concluded that Disclosures

Controls and Procedures were not effective as of June 30, 2015. Due to limited financial resources available, there is a lack

of segregation of duties in financial reporting although the Principal Executive Officer, who also serves as Principal Financial

Officer, is an experienced financial executive and professional with professional accreditation.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

The

Company does not have any market risk sensitive financial instruments for trading or other purposes. All Company cash is held

in insured deposit accounts.

Item

8. Financial Statements and Supplementary Data.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Board of Directors and Stockholders,

Wincash

Apolo Gold & Energy, Inc.

We

have audited the accompanying consolidated balance sheets of Wincash Apolo Gold & Energy, Inc. (an Exploration Stage Company)

as of June 30, 2015 and the related consolidated statements of operations and comprehensive loss, consolidated statement of stockholders’

equity and consolidated statements of cash flows for the years ended June 30, 2015 and 2014. These consolidated financial statements

are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial

statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States of

America). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the consolidated

financial statements are free of material misstatement. An audit includes examining on a test basis, evidence supporting the

amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles

used and significant estimates made by management, as well as evaluating the overall consolidated financial statement

presentation. We believe that our audits provide a reasonable basis for my opinion.

In

our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated

financial position of the Company as of June 30, 2015 and 2014 and the results of its operations and its consolidated cash flows

for the years ended June 30, 2015 and 2014 in conformity with accounting principles generally accepted in the United States of

America.

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

As discussed in Note 2 to the consolidated financial statements, the Company has incurred substantial losses, which raises substantial

doubt about its ability to continue as a going concern. Management’s plans in regard to their planned financing and other

matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from

the outcome of this uncertainty.

| /s/

WELD ASIA ASSOCIATES |

|

| WELD

ASIA ASSOCIATES |

|

| |

|

| Date:

August 27, 2015 |

|

| Kuala

Lumpur, Malaysia |

|

WINCASH

APOLO GOLD & ENERGY, INC.

CONSOLIDATED

BALANCE SHEETS

AS

OF JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

| | |

As of June 30, | |

| | |

2015 | | |

2014 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 14,403 | | |

$ | 7,439 | |

| Amount due from a director | |

| - | | |

| 15,482 | |

| | |

| | | |

| | |

| Total current assets | |

| 14,403 | | |

| 22,921 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Mineral property interests | |

| - | | |

| 1,200,000 | |

| Investments | |

| - | | |

| 8,950,000 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 14,403 | | |

$ | 10,172,921 | |

| | |

| | | |

| | |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Other payables and accrued liabilities | |

$ | 24,691 | | |

$ | 10,079 | |

| Amount due to a director | |

| 10,000 | | |

| - | |

| | |

| | | |

| | |

| Total liabilities | |

| 34,691 | | |

| 10,079 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.001 par value; 25,000,000 shares authorized; None issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 300,000,000 shares authorized; 21,872,118 and 39,432,118 shares issued and outstanding as of June 30, 2015 and 2014, respectively | |

| 21,872 | | |

| 41,316 | |

| Additional paid-in capital | |

| 15,939,279 | | |

| 18,038,835 | |

| Deferred compensation | |

| (550,000 | ) | |

| (32,333 | ) |

| Accumulated other comprehensive income | |

| 4,882 | | |

| 1,869 | |

| Accumulated deficit | |

| (15,436,321 | ) | |

| (7,886,845 | ) |

| Total stockholders’ (deficit) equity | |

| (20,288 | ) | |

| 10,162,842 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 14,403 | | |

$ | 10,172,921 | |

See

accompanying notes to the consolidated financial statements.

WINCASH

APOLO GOLD & ENERGY, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

| | |

For the years ended June 30, | |

| | |

2015 | | |

2014 | |

| | |

| | | |

| | |

| Revenues | |

$ | - | | |

$ | - | |

| Operating expenses | |

| | | |

| | |

| Stock based compensation | |

| 122,333 | | |

| 51,667 | |

| General and administrative expenses | |

| 157,143 | | |

| 158,887 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 279,476 | | |

| 210,554 | |

| | |

| | | |

| | |

| Loss before income tax | |

| (279,476 | ) | |

| (210,554 | ) |

| | |

| | | |

| | |

| Other expense: | |

| | | |

| | |

| Investment loss | |

| (7,270,000 | ) | |

| - | |

| | |

| | | |

| | |

| Loss before income tax | |

| (7,549,476 | ) | |

| (210,554 | ) |

| Income tax expense | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net loss | |

$ | (7,549,476 | ) | |

$ | (210,554 | ) |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| - Foreign currency translation income | |

| 3,013 | | |

| 1,869 | |

| Comprehensive loss | |

$ | (7,546,463 | ) | |

| (208,685 | ) |

| | |

| | | |

| | |

| Net loss per share – Basic and diluted | |

$ | (0.31 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average common stock outstanding – Basic and diluted | |

| 24,599,570 | | |

| 22,298,569 | |

See

accompanying notes to the consolidated financial statements.

WINCASH

APOLO GOLD & ENERGY, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Curreny

expressed in United States Dollars (“US$”))

| | |

For the years ended June 30, | |

| | |

2015 | | |

2014 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (7,549,476 | ) | |

$ | (210,554 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Investment loss | |

| 7,270,000 | | |

| - | |

| Stock based compensation | |

| 122,333 | | |

| 51,667 | |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Other payables and accrued expenses | |

| 14,612 | | |

| (14,843 | ) |

| Amount due to related parties | |

| - | | |

| 28,883 | |

| Net cash used in operating activities | |

| (142,531 | ) | |

| (144,847 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Investment in Jiangxi Everenergy New Material Co., Limited | |

| - | | |

| (1,000,000 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| - | | |

| (1,000,000 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Amount due to a director | |

| 146,482 | | |

| - | |

| Proceeds from sale of common stock | |

| - | | |

| 1,150,000 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 146,482 | | |

| 1,150,000 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 3,013 | | |

| 1,869 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | |

| 6,964 | | |

| 7,022 | |

| Cash and cash equivalents, beginning of year | |

| 7,439 | | |

| 417 | |

| | |

| | | |

| | |

| Cash and cash equivalents, end of year | |

$ | 14,403 | | |

$ | 7,439 | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOWS INFORMATION | |

| | | |

| | |

| Income taxes paid | |

$ | - | | |

$ | - | |

| Interest paid | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| NON-CASH INVESTING & FINANCING ACTIVITIES: | |

| | | |

| | |

| Cancellation of shares issued for mineral property interests | |

| 600,000 | | |

| - | |

| Cancellation of shares issued for investments in Jiangxi Everenergy New Material Co., Limited | |

| 2,280,000 | | |

| - | |

| Shares issued for debt settlement | |

| 121,000 | | |

| 130,764 | |

| Shares issued for mineral property interests | |

| - | | |

| 1,200,000 | |

| Shares issued for investments in Jiangxi Everenergy New Material Co., Limited | |

| - | | |

| 7,950,000 | |

See

accompanying notes to the consolidated financial statements.

WINCASH

APOLO GOLD & ENERGY, INC.

CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

| | |

Common Stock | | |

Additional | | |

| | |

Accumulated other | | |

| | |

Total | |

| | |

Number of shares | | |

Amount | | |

paid-in capital | | |

Deferred compensation | | |

comprehensive income | | |

Accumulated deficit | | |

stockholders’ equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of July 1, 2013 | |

| 6,503,295 | | |

$ | 6,503 | | |

$ | 7,558,884 | | |

$ | - | | |

$ | - | | |

$ | (7,676,291 | ) | |

$ | (110,904 | ) |

| Shares issued for working capital of $0.08 per share | |

| 1,875,000 | | |

| 1,875 | | |

| 148,125 | | |

| - | | |

| - | | |

| - | | |

| 150,000 | |

| Shares issued for stock based compensation | |

| 1,053,823 | | |

| 1,054 | | |

| 213,710 | | |

| (32,333 | ) | |

| - | | |

| - | | |

| 182,431 | |

| Shares issued at a price of $0.20 per share | |

| 5,000,000 | | |

| 5,000 | | |

| 995,000 | | |

| - | | |

| - | | |

| - | | |

| 1,000,000 | |

| Shares issued for purchase of gold exploration claims at $0.20 per share | |

| 6,000,000 | | |

| 6,000 | | |

| 1,194,000 | | |

| - | | |

| - | | |

| - | | |

| 1,200,000 | |

| Shares issued for investment in in Jiangxi Everenergy New Material Co., Limited at $0.375 per share | |

| 8,000,000 | | |

| 8,000 | | |

| 2,992,000 | | |

| - | | |

| - | | |

| - | | |

| 3,000,000 | |

| Shares issued for investment in Jiangxi Everenergy New Material Co., Limited at $0.45 per share | |

| 11,000,000 | | |

| 11,000 | | |

| 4,939,000 | | |

| - | | |

| - | | |

| - | | |

| 4,950,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (210,554 | ) | |

| (210,554 | ) |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,869 | | |

| - | | |

| 1,869 | |

| Balance as of June 30, 2014 | |

| 39,432,118 | | |

| 39,432 | | |

| 18,040,719 | | |

| (32,333 | ) | |

| 1,869 | | |

| (7,886,845 | ) | |

| 10,162,842 | |

| Cancellation of shares issued for investment in Jiangxi Everenergy New Material Co., Limited | |

| (11,000,000 | ) | |

| (11,000 | ) | |

| (1,309,000 | ) | |

| - | | |

| - | | |

| - | | |

| (1,320,000 | ) |

| Cancellation of shares issued for purchase of gold exploration claims | |

| (6,000,000 | ) | |

| (6,000 | ) | |

| (594,000 | ) | |

| - | | |

| - | | |

| - | | |

| (600,000 | ) |

| Shares issued for debt settlement at $0.10 per share | |

| 700,000 | | |

| 700 | | |

| | | |

| 69,300 | | |

| | | |

| - | | |

| 70,000 | |

| Shares issued for stock based compensation at $0.10 per share | |

| 6,400,000 | | |

| 6,400 | | |

| 633,600 | | |

| (550,000 | ) | |

| - | | |

| - | | |

| 90,000 | |

| Shares to be issued for debt settlement at $0.15 per share | |

| 340,000 | | |

| 340 | | |

| 50,660 | | |

| - | | |

| - | | |

| - | | |

| 51,000 | |

| Shares to be cancelled for termination of investments | |

| (8,000,000 | ) | |

| (8,000 | ) | |

| (952,000 | ) | |

| - | | |

| - | | |

| - | | |

| (960,000 | ) |

| Amortization of deferred compensation | |

| - | | |

| - | | |

| - | | |

| 32,333 | | |

| - | | |

| - | | |

| 32,333 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,549,476 | ) | |

| (7,549,476 | ) |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,013 | | |

| - | | |

| 3,013 | |

| | |

| 21,872,118 | | |

$ | 21,872 | | |

$ | 15,939,279 | | |

$ | (550,000 | ) | |

$ | 4,882 | | |

$ | (15,436,321 | ) | |

$ | (20,288 | ) |

See

accompanying notes to the consolidated financial statements.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Wincash

Apolo Gold & Energy, Inc.(“the Company”) was incorporated in March of 1997 under the laws of the State of Nevada

primarily for the purpose of acquiring and developing mineral properties. The Company conducts operations primarily from its administrative

offices in Vancouver, British Columbia, Canada.

On

December 11, 2013, the Company entered into a sale agreement with Yinfu Gold Corp. (“Yinfu”) to acquire 70% interest

in three gold exploration claims located in Xinjian Province, the People’s Republic of China (the “PRC”). The

Company issued 6,000,000 shares of restricted common stock of the Company at $0.20 per share for the consideration of $1,200,000.

On January 19, 2015, the Company and Yinfu reached a mutual agreement to terminate the acquisition at the current market value

of $0.10 per share and an investment loss of $600,000 was resulted.

On

December 23, 2013, the Company entered into an Asset Sale & Purchase Agreement with Mr. Tang Wenbo (“Mr. Tang”)

to acquire Mr. Tang’s 24% equity interest and assets in Jiangxi Everenergy New Material Co., Ltd. (“Everenergy”).

The Company issued 8,000,000 shares of restricted common stock of the Company at $0.375 per share and paid $1,000,000 for the

aggregate consideration of $4,000,000.

On

February 19, 2014, the Company entered into an Asset Sale & Purchase Agreement with Mr. Hu Qinjian (“Mr. Hu”)

to acquire Mr. Hu’s 29% equity interest and assets in Everenergy. The Company issued 11,000,000 shares of restricted common

stock of the Company at $0.45 per share for the consideration of $4,950,000.

On

September 17, 2014, the Company terminated the Asset Sale & Purchase Agreements with Mr. Tang and Mr. Hu for the acquisition

of 24% and 29% equity interest and assets in Everenergy, respectively due to neither Mr. Tang, Mr. Hu or Everenergy had complied

various terms and conditions of the Asset Sale & Purchase Agreement. On the same day, the Board of Directors approved the

cancellation of the total 19,000,000 shares of restricted common stock at the current market value of $0.12 per share. On October

21, 2014, 11,000,000 shares were returned and effectively cancelled and the remaining 8,000,000 shares are to be cancelled on

June 30, 2015. For the year ended June 30, 2015, the Company could not recover the $1,000,000 cash payment and a total investment

loss of $6,670,000 was resulted.

On

February 13, 2015, the Company disposed its 100% equity interest in Apolo Gold Direct Limited (formerly known as Apolo Gold &

Energy Asia Limited) to Mr. Kelvin Chak, the Chief Executive Officer (“CEO”) and director of the Company, Mr. Tsap

Wai Ping, the brother of the CEO and China Yi Gao Gold Trader Co., Limited, a company incorporated in Hong Kong, for a consideration

of $100. For the year ended June, 30, 2015, there was no gain or loss recognized on the disposal of a subsidiary.

On

June 18, 2015, the Company filed an Amendment to its Articles of Incorporation with the Nevada Secretary of State to change its

name from Apolo Gold & Energy, Inc. to Wincash Apolo Gold & Energy, Inc.

The

Company will continue to anticipate potential mineral property exploration and other energy related investments. As of June 30,

2015, the Company does not hold any mineral property exploration claims.

NOTE

2 – GOING CONCERN UNCERTAINTIES

The

accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.

As of June 30, 2015, the Company suffered an accumulated deficit of $15,436,321 and the Company had generated limited revenue

and had no committed sources of capital or financing for the reporting period.

These

consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates

the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future.

As

of June 30, 2015, the Company suffered the accumulated deficits of $15,436,321 from prior years and suffered from a working capital

deficit of $20,288. The continuation of the Company as a going concern is dependent upon the continuing financial support from

its stockholders or external financing. Management believes the existing stockholders will provide the additional cash to meet

with the Company’s obligations as they become due. However, there can be no assurance that the Company will be able to obtain

sufficient funds to meet its obligations.

These

factors raise substantial doubt about the Company’s ability to continue as a going concern. These consolidated financial

statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets

or the amounts and classification of liabilities that may result in the Company not being able to continue as a going concern.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of presentation

The

accompanying consolidated financial statements are prepared in accordance with generally accepted accounting principles in the

United States of America (“US GAAP”).

Basis

of consolidation

The

consolidated financial statements include the accounts of the Company and its subsidiary. All inter-company accounts and transactions

have been eliminated in consolidation.

On

February 13, 2015, the Company disposed of its 100% equity interest in Apolo Gold Direct Limited (formerly known as Apolo Gold

& Energy Asia Limited), a company incorporated in Hong Kong, to Mr. Kelvin Chak, the Chief Executive Officer (“CEO”)

and director of the Company, Mr. Tsap Wai Ping, the brother of the CEO and China Yi Gao Gold Trader Co., Limited, a company incorporated

in Hong Kong, for a consideration of $100. For the year ended June 30, 2015, there was no gain or loss recognized on the disposal

of a subsidiary.

Estimates

Management

uses estimates and assumptions in preparing these financial statements in accordance with US GAAP. Those estimates and assumptions

affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities in the balance sheet,

and the reported revenue and expenses during the periods reported. Actual results may differ from these estimates.

Cash

and cash equivalents

Cash

and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions

and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Investments

Affiliated

companies, in which the Company has significant influence, but no control, are accounted for investment. Investment adjustments

include the Company’s proportionate share of investee income or loss, gains or losses resulting from investee capital transactions,

adjustments to recognize certain differences between the Company’s carrying value and the Company’s equity in net

assets of the investee at the date of investment, impairments, and other adjustments required by the equity method. Gain or losses

are realized when such investments are sold.

Stock-based

compensation

The

Company adopts FASB Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“ASC Topic

718”) using the fair value method. Under ASC Topic 718, the stock-based compensation is measured using the Black-Scholes

Option-Pricing model on the date of grant under the modified prospective method. The fair value of stock-based compensation that

are expected to vest are recognized using the straight-line method over the requisite service period.

Income

taxes

Income

taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”).

Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax

assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the periods in which

those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change

in tax rates is recognized in income in the period that includes the enactment date.

ASC

740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclose in their financial statements

uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized

in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities.

Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50%

likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant

facts.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

Net

loss per share

The

Company calculates net loss per share in accordance with ASC Topic 260, “Earnings per Share.” Basic loss per

share is computed by dividing the net loss by the weighted-average number of common shares outstanding during the period. Diluted

income per share is computed similar to basic loss per share except that the denominator is increased to include the number of

additional common shares that would have been outstanding if the potential common stock equivalents had been issued and if the

additional common shares were dilutive.

Comprehensive

income

ASC

Topic 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components

and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources.

Accumulated other comprehensive income, as presented in the accompanying consolidated statement of stockholders’ equity,

consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included

in the computation of income tax expense or benefit.

Related

parties

Parties,

which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly,

to control the other party or exercise significant influence over the other party in making financial and operating decisions.

Companies are also considered to be related if they are subject to common control or common significant influence.

Fair

value of financial instruments

The

carrying value of the Company’s financial instruments: cash and cash equivalents, subscription receivable, notes receivable,

accounts payable and loans from related parties approximate at their fair values because of the short-term nature of these financial

instruments.

The

Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”),

with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value

hierarchy that prioritizes the inputs used in measuring fair value as follows:

Level

1: Observable inputs such as quoted prices in active markets;

Level

2: Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level

3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

Foreign

currency translation

Transactions

denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates

prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional

currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting

exchange differences are recorded in the statement of operations.

The

reporting currency of the Company is United States Dollars (“US$”) and the accompanying financial statements have

been expressed in US$. In addition, the Company’s former subsidiary in Hong Kong maintains its books and record in its local

currency, Hong Kong Dollars (“HK$”), which is functional currency as being the primary currency of the economic environment

in which the entity operates.

In

general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated

into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the

balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting

from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive

income within the statement of stockholders’ equity. The gains and losses are recorded as a separate component of accumulated

other comprehensive income within the statement of stockholders’ equity.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

Translation

of amounts from HK$ into US$1 has been made at the following exchange rates for the respective periods:

| | |

June

30, | |

| | |

2015 | | |

2014 | |

| Year-end

HK$ : US$1 exchange rate | |

| 7.7550 | | |

| 7.7511 | |

| Year-average

HK$ : US$1 exchange rate | |

| 7.7533 | | |

| 7.7528 | |

Recent

accounting pronouncements

FASB

issues various Accounting Standards Updates relating to the treatment and recording of certain accounting transactions. On June

10, 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-10,Development Stage Entities

(Topic 915) - Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance

in Topic 810, Consolidation, which eliminates the concept of a development stage entity (DSE) entirely from current accounting

guidance. The Company has elected adoption of this standard, which eliminates the designation of DSEs and the requirement to disclose

results of operations and cash flows since inception.

The

Company has reviewed all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption

of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE

4 – MINERAL PROPERTY INTERESTS

On

December 11, 2013, the Company entered into a sale agreement with Yinfu Gold Corp. (“Yinfu”) to acquire 70% interest

in three gold exploration claims located in Xinjian Province, the PRC. The Company issued 6,000,000 shares of restricted common

stock at $0.20 per share to the wholly owned subsidiary of Yinfu in payment of $1,200,000 for the acquisition.

On

January 19, 2015, the Company and Yinfu reached a mutual agreement to terminate the acquisition of the 70% interest in the three

gold exploration claims in the PRC. All 6,000,000 shares of restricted common stock were returned and cancelled at the current

market value of $0.10 per share and an investment loss of $600,000 was resulted.

As

of June 30, 2015, the Company does not hold any mineral property exploration claims.

NOTE

5 – INVESTMENTS

On

December 23, 2013, the Company entered into an Asset Sale & Purchase Agreement with Mr. Tang Wenbo (“Mr. Tang”)

to acquire Mr. Tang’s 24% equity interest and assets in Jiangxi Everenergy New Material Co., Ltd. (“Everenergy”).

The Company issued 8,000,000 shares of restricted common stock of the Company at $0.375 per share and paid $1,000,000 for the

aggregate payment of $4,000,000 for the acquisition.

On

February 19, 2014, the Company entered into an Asset Sale & Purchase Agreement with Mr. Hu Qinjian (“Mr. Hu”)

to acquire Mr. Hu’s 29% equity interest and assets in Everenergy. The Company issued 11,000,000 shares of restricted common

stock of the Company at $0.45 per share for the consideration of $4,950,000 for the acquisition.

On

September 17, 2014, the Company terminated the Asset Sale & Purchase Agreements with Mr. Tang and Mr. Hu for the acquisition

of 24% and 29% equity interest and assets in Everenergy, respectively due to neither Mr. Tang, Mr. Hu and Everenergy had complied

various terms and conditions of the Asset Sale & Purchase Agreement. On the same day, the Board of Directors approved the

cancellation of all 19,000,000 shares of restricted common stock at a current market value of $0.12 per share. On October 21,

2014, 11,000,000 shares of restricted common stock were returned and effectively cancelled and the remaining 8,000,000 shares

are to be cancelled as of June 30, 2015. For the year ended June 30, 2015, the Company could not recover the $1,000,000 cash payment

and a total investment loss of $6,670,000 was resulted.

As

of June 30, 2015, the Company does not hold any investments.

NOTE

6 – AMOUNT DUE TO A DIRECTOR

As

of June 30, 2015, the director of the Company has advanced $10,000 for the payment of administrative expenses., The amount is

unsecured, bears no interest and is payable upon demand.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

7 – COMMON STOCK

On

September 30, 2013, the Company issued 1,875,000 shares of restricted common stock at $0.08 per share for a private placement

of $150,000.

On

December 1, 2013, the Company issued 200,000 shares of restricted common stock at $0.08 per share for the rendering of business

consulting services of $16,000. As of December 1, 2013, the current value was $0.23 per share.

On

December 1, 2013, the Company issued 100,000 shares of restricted common stock at $0.23 per share for the rendering of business

consulting services of $23,000. As of December 1, 2013, the current market value was $0.23 per share.

On

December 4, 2013, the Company issued 5,000,000 shares of restricted common stock at $0.20 per share for a private placement of

$1,000,000.

On

December 11, 2013, the Company issued 6,000,000 shares of restricted common stock at $0.20 per share in lieu of $1,200,000 consideration

for the acquisition of 70% interest in three gold exploration claims in the PRC. As of December 11, 2013, the current market value

was $0.25 per share. On January 19, 2015, the Company and Yinfu mutually agreed to terminate the acquisition and cancel all 6,000,000

shares at the current market value of $0.10 per share.

On

December 23, 2013, the Company issued 8,000,000 shares of restricted common stock at $0.375 per share plus $1,000,000 in cash

for the acquisition of 24% equity interest in Everenergy with an aggregated consideration of $4,000,000. As of December 23, 2013,

the current market value was $0.33 per share.

On

February 11, 2014, the Company issued 100,000 shares of restricted common stock at $0.45 per share for the rendering of business

consulting services of $45,000. As of February 11, 2014, the current market value was $0.45 per share.

On

February 19, 2014, the Company issued 11,000,000 shares of restricted common stock at $0.45 per share for the acquisition of additional

29% equity interest in Everenergy in a consideration of $4,950,000. As of February 19, 2014, the current market value was $0.35

per share.

On

June 16, 2014, the Company issued 653,823 shares of restricted common stock at $0.20 per share to settle a debt of $130,764 owed

to the Chief Executive Officer and director of the Company. As of June 16, 2014, the current market value was $0.15 per share.

On

September 17, 2014, the Board of Directors approved the cancellation of the total 19,000,000 shares of restricted common stocks

issued for the acquisition of equity interest in Everenergy at a current market value of $0.12 per share. The 11,000,000 shares

issued to Mr. Hu were effectively cancelled on October 21, 2014 and the remaining 8,000,000 shares issued to Mr. Tang are to be

cancelled as of June 30, 2015.

On

February 12, 2015, the Company issued 700,000 shares of restricted common stock at $0.10 per share to settle a debt of $70,000

owed to the Chief Executive Officer and director of the Company. As of February 12, 2015, the current market value was $0.10 per

share.

On

June 4, 2015, the Company issued 6,000,000 shares of restricted common stock at $0.10 per share for the rendering of business

and strategic consulting services of $600,000 in a service period of twelve months commencing from June 2015. For the year ended

June 30, 2015, the Company amortized $50,000 to the operations using the straight-line method. As of June 30, 2015, the deferred

expenditure is recorded as $550,000.

On

June 9, 2015, the Company issued 400,000 shares of restricted common stock at $0.10 per share for the rendering of administrative

consulting services of $40,000. As of June 9, 2015, the current market value was $0.10 per share.

On

June 26, 2015, the Board of Directors of the Company approved to issue 340,000 shares of restricted common stock at $0.15 per

share to settle a debt of $51,000 owed to the Chief Executive Officer and director of the Company. All 340,000 shares were issued

subsequently on July 2, 2015. As of June 26, 2015, the current market value was $0.16 per share.

There

were no stock options, warrants or other potentially dilutive securities outstanding as at June 30, 2015 and 2014.

As

of June 30, 2015 there are 21,872,118 shares of common stock issued and outstanding.

WINCASH

APOLO GOLD & ENERGY, INC.

NOTES

TO CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

(Currency

expressed in United States Dollars (“US$”), except for number of shares)

NOTE

8 – INCOME TAX

For

the years ended June 30, 2015 and 2014, the local (United States) and foreign components of loss before income taxes were comprised

of the following:

| | |

For the years ended June 30, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Tax jurisdictions from: | |

| | | |

| | |

| - Local | |

$ | (7,521,068 | ) | |

$ | (120,320 | ) |

| - Foreign | |

| (28,408 | ) | |

| (90,234 | ) |

| | |

| | | |

| | |

| Loss before income tax | |

$ | (7,549,476 | ) | |

$ | (210,554 | ) |

The

provision for income taxes consisted of the following:

| | |

| For the years ended June 30, | |

| | |

| 2015 | | |

| 2014 | |

| | |

| | | |

| | |

| Current: | |

| | | |

| | |

| - Local | |

$ | - | | |

$ | - | |

| - Foreign | |

| - | | |

| - | |

| | |

| | | |

| | |

| Deferred: | |

| | | |

| | |

| - Local | |

| - | | |

| - | |

| - Foreign | |

| - | | |

| - | |

| | |

$ | - | | |

$ | - | |

The

Company is registered in the State of Nevada and is subject to the tax laws of the United States of America. As of June 30, 2015,

the operations in the United States of America incurred $15,436,319 of cumulative net operating losses which can be carried forward

to offset future taxable income. The net operating loss carryforwards begin to expire in the year 2017 through 2034, if unutilized.

The Company has provided for a full valuation allowance of $3,859,080 against the deferred tax assets on the expected future tax

benefits from the net operating loss carryforwards as the management believes it is more likely than not that these assets will

not be realized in the future.

NOTE

9 – RELATED PARTY TRANSACTIONS

During

the year ended June 30, 2015, Mr. Kelvin Chak, the CEO and director of the Company paid a total of $50,596 for general expenses

and management fees of $25,482 and $25,114, respectively.

On

February 12, 2015, the Company issued 700,000 shares of restricted common stocks at $0.10 per share to settle a debt of $70,000

owed to the CEO and director of the Company at the current market value of $0.10 per share.

On

February 13, 2015, the Company disposed its 100% equity interest in Apolo Gold Direct Limited (formerly known as Apolo Gold &

Energy Asia Limited) to (i) Mr. Kelvin Chak Wai Man, the Chief Executive Officer (“CEO”) and director of the Company,

who acquired 40% equity interest, (ii) Mr. Tsap Wai Ping, the brother of the CEO of the Company, who acquired 50% equity interest,

and (iii) China Yi Gao Gold Trader Co., Limited, a company incorporated in Hong Kong, which acquired the remaining 10% equity

interest, for a consideration of $100.

On

June 4, 2015, the Company issued 2,000,000 shares of restricted common stocks at $0.10 per share for the rendering of business

consulting services provided by the brother of the CEO and director of the Company at the current market value of $0.11 per share.

On

June 9, 2015, the Company issued 200,000 shares of restricted common stocks at $0.10 per share for the rendering of administrative

consulting services provided by the Chief Financial Officer of the Company at the current market value of $0.22 per share.

On

June 26, 2015, the Board of Directors of the Company approved to issue 340,000 shares of restricted common stock at $0.15 per

share to settle a debt of $51,000 owed to the CEO and director of the Company at the current market value of $0.16 per share.

All 340,000 shares were issued subsequently on July 2, 2015.

NOTE

10 – COMMITMENTS AND CONTINGENCIES

As

of June 30, 2015, the Company has no commitments or contingencies involved.

NOTE

11 – SUBSEQUENT EVENTS

In

accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure

of events that occur after the balance sheet date but before financial statements are issued, the Company has evaluated all events

or transactions that occurred after June 30, 2015 up through the date the Company issued the audited consolidated financial statements.

There were no subsequent events that required recognition or disclosure.

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None

ITEM

9A. CONTROLS AND PROCEDURES

Disclosure

Controls and Procedures

We

carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e)

and 15d-15(e)) as of June 30, 2015 (the “Evaluation Date”). This evaluation was carried out under the supervision

and with the participation of our Chief Executive Officer and Chief Financial Officer. Based upon that evaluation, our Chief Executive

Officer and Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of the Evaluation

Date as a result of the material weaknesses in internal control over financial reporting discussed below.

Disclosure

controls and procedures are those controls and procedures that are designed to ensure that information required to be disclosed

in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods

specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures

designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated

to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required

disclosure.

Notwithstanding

the assessment that our internal control over financial reporting was not effective and that there were material weaknesses as

identified in this report, we believe that our financial statements contained in our Annual Report on Form 10-K for the year ended

June 30, 2015 fairly present our financial condition, results of operations and cash flows in all material respects.

Management’s

Annual Report on Internal Control Over Financial Reporting

Our

management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is

defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act, for the Company.

Internal

control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that,

in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance

that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted

accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of its management

and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use

or disposition of our assets that could have a material effect on the financial statements.

Management

recognizes that there are inherent limitations in the effectiveness of any system of internal control, and accordingly, even effective

internal control can provide only reasonable assurance with respect to financial statement preparation and may not prevent or

detect material misstatements. In addition, effective internal control at a point in time may become ineffective in future periods

because of changes in conditions or due to deterioration in the degree of compliance with our established policies and procedures.

A

material weakness is a significant deficiency, or combination of significant deficiencies, that results in there being a more

than remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected.

Under

the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, management conducted an

evaluation of the effectiveness of our internal control over financial reporting, as of the Evaluation Date, based on the framework

set forth in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission

(COSO). Based on its evaluation under this framework, management concluded that our internal control over financial reporting

was not effective as of the Evaluation Date.

Management

assessed the effectiveness of the Company’s internal control over financial reporting as of Evaluation Date and identified

the following material weaknesses:

Inadequate

Segregation of Duties: We have an inadequate number of personnel to properly implement control procedures.

Insufficient

Written Policies & Procedures: We have insufficient written policies and procedures for accounting and financial reporting.

Inadequate

Financial Statement Closing Process: We have an inadequate financial statement closing process.

Lack

of Audit Committee: The lack of a functioning audit committee and lack of a majority of outside directors on the Company’s

Board of Directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures.

Management

is committed to improving its internal controls and will (1) continue to use third party specialists to address shortfalls in

staffing and to assist the Company with accounting and finance responsibilities, (2) increase the frequency of independent reconciliations

of significant accounts which will mitigate the lack of segregation of duties until there are sufficient personnel and (3) prepare

and implement sufficient written policies and checklists for financial reporting and closing processes and (4) may consider appointing

outside directors and audit committee members in the future.

Management,

including our Chief Executive Officer and the Chief Financial Officer, has discussed the material weakness noted above with our

independent registered public accounting firm. Due to the nature of this material weakness, there is a more than remote likelihood

that misstatements which could be material to the annual or interim financial statements could occur that would not be prevented

or detected.

This