UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

For

the month of August, 2015

Commission

File Number 001-35052

Adecoagro

S.A.

(Translation

of registrant’s name into English)

Vertigo

Naos Building, 6, Rue Eugène Ruppert, L-2453, Luxembourg

R.C.S.

Luxembourg B 153 681

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.

EXPLANATORY

NOTE

This Report

of Foreign Private Issuer on Form 6-K (this “Form 6-K”) is being filed by Adecoagro S.A. (“Adecoagro”

or the “Company”) with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference

into the Company’s Registration Statement on Form F-3 filed with the SEC on December 6, 2013 (File No. 333-191325) and will

be deemed to be a part thereof from the date on which this Form 6-K is filed with the SEC, to the extent not superseded by documents

or reports subsequently filed or furnished. This Form 6-K contains, as Exhibit 99.1, Operating and Financial Review and Prospects,

which reviews Adecoagro’s results of operations and financial condition as of June 30, 2015, and for the six month periods

ended, June 30, 2015 and 2014. This report also incorporates by reference the Company’s annual report on Form 20-F filed

with the SEC on April 30, 2015 (our “Form 20-F”).

Forward

Looking Statements

This

report contains forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of

the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important

factors that could cause the registrant’s actual results to differ materially from those set forth herein and in the attached

Condensed Audited Financial Statements.

The

registrant’s forward-looking statements are based on the registrant’s current expectations, assumptions, estimates

and projections about the registrant and its industry. These forward-looking statements can be identified by words or phrases

such as “anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “is/are likely to,” “may,” “plan,” “should,” “would,”

or other similar expressions.

The

forward-looking statements included in the attached relate to, among others: (i) the registrant’s business prospects

and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the

laws, regulations and governmental policies governing the registrant’s business, including limitations on ownership of farmland

by foreign entities in certain jurisdictions in which the registrant operate, environmental laws and regulations; (iv) the

implementation of the registrant’s business strategy, including its development of the Ivinhema mill and other current projects;

(v) the registrant’s plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the

implementation of the registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the registrant’s

relationships with customers; (viii) the competitive nature of the industries in which the registrant operates; (ix) the

cost and availability of financing; (x) future demand for the commodities the registrant produces; (xi) international

prices for commodities; (xii) the condition of the registrant’s land holdings; (xiii) the development of the logistics

and infrastructure for transportation of the registrant’s products in the countries where it operates; (xiv) the performance

of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the

Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions

with the United States Securities and Exchange Commission.

These

forward-looking statements involve various risks and uncertainties. Although the registrant believes that its expectations expressed

in these forward-looking statements are reasonable, its expectations may turn out to be incorrect. The registrant’s actual

results could be materially different from its expectations. In light of the risks and uncertainties described above, the estimates

and forward-looking statements discussed in the attached might not occur, and the registrant’s future results and its performance

may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors

mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking

statements.

The

forward-looking statements made in the attached relate only to events or information as of the date on which the statements are

made in the attached. The registrant undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Adecoagro S.A. |

| |

By |

/s/ Carlos A. Boero Hughes |

| |

Name: |

Carlos A. Boero Hughes |

| |

Title: |

Chief Financial Officer and |

| |

|

Chief Accounting Officer |

| |

|

|

Date:

August 31, 2015 |

|

|

Exhibit Index

| 99.1 |

Operating

and Financial Review and Prospects

|

Exhibit

99.1

Operating

and Financial Review and Prospects

OPERATING

RESULTS

Trends

and Factors Affecting Our Results of Operations

Our

results of operations have been influenced and will continue to be influenced by the following factors:

(i)

Effects of Yield Fluctuations

The

occurrence of severe adverse weather conditions, especially droughts, hail, floods or frost, are unpredictable and may have a

potentially devastating impact on agricultural production and may otherwise adversely affect the supply and prices of the agricultural

commodities that we sell and use in our business. The effects of severe adverse weather conditions may also reduce yields at our

farms. Yields may also be affected by plague, disease or weed infection and operational problems.

The

following table sets forth our average crop, rice and sugarcane yields for the periods indicated:

| | |

| | | |

| | | |

| | |

| | |

| 2014/2015 | | |

| 2013/2014 | | |

| %

Change | |

| | |

| Harvest

Year (1) | | |

| Harvest

Year (1) | | |

| 2014/2015

-2013/2014 | |

| Corn (2) | |

| 6.1 | | |

| 6.3 | | |

| (3.2 | %) |

| Soybean | |

| 3.2 | | |

| 2.9 | | |

| 10.3 | % |

| Soybean (second harvest) | |

| 2.4 | | |

| 2.1 | | |

| 14.3 | % |

| Cotton lint | |

| 0.9 | | |

| 0.6 | | |

| 50.0 | % |

| Wheat (3) | |

| 2.3 | | |

| 2.6 | | |

| (11.5 | %) |

| Rice | |

| 5.1 | | |

| 5.7 | | |

| (10.5 | %) |

| Sugarcane | |

| 98.7 | | |

| 79.3 | | |

| 24.5 | % |

(1)

The table above reflects the presents yields in respect of harvest years as of June 30.

The portion of harvested area completed as of June 30, 2015 was 35% for corn, 100% for

soybean first harvest, 100% for wheat and 100% for rice. The portion of harvested area

completed as of June 30, 2014 was 43% for corn, 100% for soybean first harvest, 100%

for wheat and 100% for rice.

(2)

Includes sorghum

(3)

Includes barley

|

(ii)

Effects of Fluctuations in Production Costs

We

experience fluctuations in our production costs due to the fluctuation in the costs of (i) fertilizers, (ii) agrochemicals, (iii)

seeds, (iv) fuel and (v) farm leases. The use of advanced technology, however, has allowed us to increase our efficiency, in large

part mitigating the fluctuations in production costs. Some examples of how the implementation of production technology has allowed

us to increase our efficiency and reduce our costs include the use of no-till technology (also known as “direct sowing”,

which involves farming without the use of tillage, leaving plant residues on the soil to form a protective cover which positively

impacts costs, yields and the soil), crop rotation, second harvest in one year, integrated pest management, and balanced fertilization

techniques to increase the productive efficiency in our farmland. Increased mechanization of harvesting and planting operations

in our sugarcane plantations and utilization of modern, high pressure boilers in our sugar and ethanol mills has also yielded

higher rates of energy production per ton of sugarcane.

(iii)

Effects of Fluctuations in Commodities Prices

Commodity

prices have historically experienced substantial fluctuations. For example, based on Chicago Board of Trade (“CBOT”)

data, from January 1, 2015 to June 30, 2015, soybean prices increased 4.6% and corn prices increased by 6.7%. Also, between January

1, 2015 and June 30, 2015, ethanol prices decreased by 7.2%, according to Escola Superior de Agricultura “Luiz de Queiroz”

(“ESALQ”) data, and sugar prices decreased by 11.9%, according to Intercontinental Exchange of New York (“ICE-NY”)

data. Commodity price fluctuations impact our statement of income as follows:

| • | Initial

recognition and changes in the fair value of biological assets and agricultural produce

in respect of unharvested biological assets undergoing biological transformation; |

| • | Changes

in net realizable value of agricultural produce for inventory carried at its net realizable

value; and |

| • | Sales

of manufactured products and sales of agricultural produce and biological assets sold

to third parties. |

The

following graphs show the spot market price of some of our products since June 30, 2010 to June 30, 2015, highlighting the periods

January 1 to June 30, 2014 and January 1 to June 30, 2015:

(iv)

Fiscal Year and Harvest Year

Our

fiscal year begins on January 1 and ends on December 31 of each year. However, our production is based on the harvest year for

each of our crops and rice. A harvest year varies according to the crop or rice plant and to the climate in which it is grown.

Due to the geographic diversity of our farms, the planting period for a given crop or rice may start earlier on one farm than

on another, causing differences for their respective harvesting periods. The presentation of production volume (tons) and production

area (hectares) in this annual report in respect of the harvest years for each of our crops and rice starts with the first day

of the planting period at the first farm to start planting in that harvest year to the last day of the harvesting period of the

crop or rice planting on the last farm to finish harvesting that harvest year.

On

the other hand, production volumes for dairy and production volume and production area for sugar, ethanol and energy business

are presented on a fiscal year basis.

The

financial results in respect of all of our products are presented on a fiscal year basis.

(v)

Effects of Fluctuations of the Production Area

Our

results of operations also depend on the size of the production area. The size of our own and leased area devoted to crop, rice

and sugarcane production fluctuates from period to period in connection with the purchase and development of new farmland, the

sale of developed farmland, the lease of new farmland and the termination of existing farmland lease agreements. Lease agreements

are usually settled following the harvest season, from July to June in crops and rice, and from May to April in sugarcane. The

length of the lease agreements are usually one year for crops, one to five years for rice and five to six years for sugarcane.

Regarding crops, the production area can be planted and harvested one or two times per year. As an example, wheat can be planted

in July and harvested in December. Right after its harvest, soybean can be planted in the same area and harvested in April. As

a result, planted and harvested area can exceed the production area during one year. The production area for sugarcane can exceed

the harvested area in one year. Grown sugarcane can be left in the fields and then harvested the following year. The following

table sets forth the fluctuations in the production area for the periods indicated:

| | |

Six-month

Period ended June

30, | |

| | |

2015 | | |

2014 | |

| | |

| Hectares | |

| Crops (1) | |

| 148,929 | | |

| 152,888 | |

| Rice | |

| 35,328 | | |

| 36,604 | |

| Sugar, Ethanol and

Energy | |

| 127,688 | | |

| 110,822 | |

(1)

Does not include second crop area.

The

decrease in crop production area in 2015 compared to 2014 was mainly driven by farm sales in 2013/2014. The increase in sugar,

ethanol and energy production area in 2015 is explained by an increase in leased hectares.

(vi)

Effect of Acquisitions and Dispositions

The

comparability of our results of operations is also affected by the completion of significant acquisitions and dispositions. Our

results of operations for earlier periods that do not include a recently completed acquisition or do include farming operations

subsequently disposed of may not be comparable to the results of a more recent period that reflects the results of such acquisition

or disposition.

(vii)

Macroeconomic Developments in Emerging Markets

We

generate nearly all of our revenue from the production of food and renewable energy in emerging markets. Therefore, our operating

results and financial condition are directly impacted by macroeconomic and fiscal developments, including fluctuations in currency

exchange rates, inflation and interest rate fluctuations, in those markets. The emerging markets where we conduct our business

(including Argentina, Brazil and Uruguay) remain subject to such fluctuations.

(viii)

Effects of Export Taxes on Our Products

Following

the economic and financial crisis experienced by Argentina in 2002, the Argentine government increased export taxes on agricultural

products, mainly on soybean and its derivatives, wheat, rice and corn. Soybean is subject to an export tax of 35.0%, wheat is

subject to an export tax of 23.0%, rough rice is subject to an export tax of 10.0%, processed rice is subject to an export tax

of 5.0%, corn is subject to an export tax of 20.0% and sunflower is subject to an export tax of 32.0%.

As

local prices are determined taking into consideration the export parity reference, any increase in export taxes would affect our

financial results.

(ix)

Effects of Foreign Currency Fluctuations

Each

of our Argentine, Brazilian and Uruguayan subsidiaries uses local currency as its functional currency. A significant portion of

our operating costs in Argentina are denominated in Argentine Pesos and most of our operating costs in Brazil are denominated

in Brazilian Reais. For each of our subsidiaries’ statements of income, foreign currency transactions are translated into

the local currency, as such subsidiaries’ functional currency, using the exchange rates prevailing as of the dates of the

relevant specific transactions. Exchange differences resulting from the settlement of such transactions and from the translation

at year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in the statement

of income under “finance income” or “finance costs,” as applicable. Our Consolidated Financial Statements

are presented in U.S. dollars, and foreign exchange differences that arise in the translation process are disclosed in the consolidated

statement of comprehensive income.

As

of June 30, 2015, the Peso-U.S. dollar exchange rate was Ps.9.09 per U.S. dollar as compared to Ps.8.13 per U.S. dollar as of

June 30, 2014. As of June 30, 2015, the Real-U.S. dollar exchange rate was R$3.10 per U.S. dollar as compared to R$2.22 per U.S.

dollar as of June 30, 2014.

The

following graph shows the Real-U.S. dollar rate of exchange for the periods since June 30, 2010 to June 30, 2015, highlighting

the periods January 1 to June 30, 2014 and January 1 to June 30, 2015:

Our

principal foreign currency fluctuation risk involves changes in the value of the Brazilian Reais relative to the U.S. dollar.

Periodically, we evaluate our exposure and consider opportunities to mitigate the effects of currency fluctuations by entering

into currency forward contracts and other hedging instruments.

(x)

Seasonality

Our

business activities are inherently seasonal. We generally harvest and sell corn, soybean, rice and sunflower between February

and August, and wheat from December to January. Cotton is unique in that while it is typically harvested from May to July, it

requires a conditioning process that takes about two to three months before being ready to be sold. Sales in other business segments,

such as in our Dairy segment, tend to be more stable. However, milk sales are generally higher during the fourth quarter, when

weather conditions are more favorable for production. The sugarcane harvesting period typically begins between April and May and

ends between November and December. As a result of the above factors, there may be significant variations in our results of operations

from one quarter to another, since planting activities may be more concentrated in one quarter whereas harvesting activities may

be more concentrated in another quarter. In addition our quarterly results may vary as a result of the effects of fluctuations

in commodity prices and production yields and costs related to the “Initial recognition and changes in fair value of biological

assets and agricultural produce” line item. See “—Critical Accounting Policies and Estimates—Biological

Assets and Agricultural Produce” included in our Form 20-F.

(xi)

Land Transformation

Our

business model includes the transformation of pasture and unproductive land into land suitable for growing various crops and the

transformation of inefficient farms into farms suitable for more efficient uses through the implementation of advanced and sustainable

agricultural practices, such as “no-till” technology and crop rotation. During approximately the first three to five

years of the land transformation process of any given parcel, we must invest heavily in transforming the land, and, accordingly,

crop yields during such period tend to be lower than crop yields once the land is completely transformed. After the transformation

process has been completed, the land requires less investment, and crop yields gradually increase. As a result, there may be variations

in our results from one season to the next according to the amount of land in the process of transformation.

Our

business model also includes the identification, acquisition, development and selective disposition of farmlands or other rural

properties that after implementing agricultural best practices and increasing crop yields we believe have the potential to appreciate

in terms of their market value. As a part of this strategy, we purchase and sell farms and other rural properties from time to

time. Please see also “Risk Factors-Risks Related to Argentina-Argentine law concerning foreign ownership of rural properties

may adversely affect our results of operations and future investments in rural properties in Argentina” and “Risk

Factors-Risks Related to Brazil- Recent changes in Brazilian rules concerning foreign investment in rural properties may adversely

affect our investments.” included in “Item 3-Risk Factors” in our Form 20-F.

The

results included in the Land Transformation segment are related to the acquisition and disposition of farmland businesses and

not to the physical transformation of the land. The decision to acquire and/or dispose of a farmland business depends on several

market factors that vary from period to period, rendering the results of these activities in one financial period when an acquisition

of disposition occurs not directly comparable to the results in other financial periods when no acquisitions or dispositions occurred.

(xii)

Capital Expenditures and Other Investments

Our

capital expenditures during the last three years consisted mainly of expenses related to (i) acquiring land, (ii) transforming

and increasing the productivity of our land, (iii) planting non-current sugarcane and coffee and (iv) expanding and upgrading

our production facilities. Our capital expenditures incurred in connection with such activities were $301.4 million for the year

ended December 2012, $226.6 million for the year ended December 2013 and $320.8 million for the year ended December 2014. . Capital

expenditures totaled $96.6 million for the six-month period ended June 30, 2015 in comparison with $168.1 million in the same

period in 2014. See also “-Capital Expenditure Commitments.”

(xiii)

Effects of Corporate Taxes on Our Income

We

are subject to a variety of taxes on our results of operations. The following table shows the income tax rates in effect for 2015

in each of the countries in which we operate:

| |

Tax

Rate (%) |

| Argentina |

35 |

| Brazil(1) |

34 |

| Uruguay |

25 |

| (1) | Including

the Social Contribution on Net Profit (CSLL) |

Critical

Accounting Policies and Estimates

The

Company’s critical accounting policies and estimates are consistent with those described in Note 4 to our audited consolidated

annual financial statements for the year ended December 31, 2014 included in our Form 20-F.

Operating

Segments

IFRS

8 “Operating Segments” requires an entity to report financial and descriptive information about its reportable segments,

which are operating segments or aggregations of operating segments that meet specified criteria. Operating segments are components

of an entity about which separate financial information is available that is evaluated regularly by the chief operating decision

maker (“CODM”) in deciding how to allocate resources and in assessing performance. The CODM evaluates the business

based on the differences in the nature of its operations, products and services. The amount reported for each segment item is

the measure reported to the CODM for these purposes.

We

are organized into three major lines of business, namely, Farming; Sugar, Ethanol and Energy; and Land Transformation. The Company’s

businesses are comprised of six reportable operating segments, which are organized based upon their similar economic characteristics,

the nature of products they offer, their production processes, the type of their customers and their distribution methods.

We

operate in three major lines of business, namely, Farming; Sugar, Ethanol and Energy; and Land Transformation.

| • | Our

farming business is further comprised of four reportable segments: |

| • | Our

Crops segment consists of planting, harvesting and sale of grains, oilseeds and

fibers (including wheat, corn, soybeans, cotton and sunflowers, among others), and to

a lesser extent the provision of grain warehousing/conditioning and handling and drying

services to third parties. Each underlying crop in this segment does not represent a

separate operating segment. Management seeks to maximize the use of the land through

the cultivation of one or more type of crops. Types and surface amount of crops cultivated

may vary from harvest year to harvest year depending on several factors, some of which

are out of our control. Management is focused on the long-term performance of the productive

land, and to that extent, the performance is assessed considering the aggregate combination,

if any, of crops planted in the land. A single manager is responsible for the management

of operating activity of all crops rather than for each individual crop. |

| • | Our

Rice segment consists of planting, harvesting, processing and marketing of rice; |

| • | Our

Dairy segment consists of the production and sale of raw milk and other dairy

products; |

| • | Our

All Other Segments segment consists of the combination of the remaining non-reportable

operating segments, which do not meet the quantitative thresholds for separate disclosure

and for which the Company’s management does not consider them to be of continuing

significance as from January 1, 2014, namely, Coffee and Cattle. |

| • | Our

Sugar, Ethanol and Energy segment consists of cultivating sugarcane which is processed

in owned sugar mills, transformed into ethanol, sugar and electricity and marketed; |

| • | Our

Land Transformation segment comprises the (i) identification and acquisition of

underdeveloped and undermanaged farmland businesses; and (ii) realization of value through

the strategic disposition of assets (generating profits). |

The

following table presents selected historical financial and operating data solely for the periods indicated below as it is used

for our discussion of results of operations. In respect of production data only as of June 30, 2015, we have not yet completed

the 2014/2015 harvest year crops. The Harvested tons presented corresponds to the harvest completed as of June 30, 2015.

| | |

Six-month

period ended June 30, | |

| | |

2015 | | |

2014 | |

| Sales | |

(In thousands

of $) | |

| Farming

Business | |

| 137,216 | | |

| 166,532 | |

| Crops | |

| 70,908 | | |

| 98,458 | |

| Soybean(1) | |

| 38,533 | | |

| 58,018 | |

| Corn (2) | |

| 14,058 | | |

| 28,983 | |

| Wheat (3) | |

| 7,542 | | |

| 6,620 | |

| Sunflower | |

| 9,046 | | |

| 3,896 | |

| Cotton | |

| 925 | | |

| 333 | |

| Other crops(4) | |

| 804 | | |

| 608 | |

| Rice(5) | |

| 48,727 | | |

| 53,343 | |

| Dairy | |

| 16,919 | | |

| 13,943 | |

| All

other segments(6) | |

| 662 | | |

| 788 | |

| | |

| | | |

| | |

| Sugar, Ethanol and

Energy Business | |

| 147,928 | | |

| 136,627 | |

| Sugar | |

| 53,303 | | |

| 43,036 | |

| Ethanol | |

| 72,941 | | |

| 74,963 | |

| Energy | |

| 21,684 | | |

| 18,628 | |

| Total Sales | |

| 285,144 | | |

| 303,159 | |

| Land Transformation

(7) | |

| - | | |

| 25,575 | |

| | |

| 2014/2015 | | |

| 2013/2014 | |

| | |

| Harvest | | |

| Harvest | |

| Production | |

| Year | | |

| Year | |

| Farming Business | |

| | | |

| | |

| Crops (tons) (8) | |

| 555,573 | | |

| 489,375 | |

| Soybean (tons) | |

| 284,263 | | |

| 213,892 | |

| Corn (tons) (2) | |

| 164,252 | | |

| 172,740 | |

| Wheat (tons) (3) | |

| 84,609 | | |

| 77,168 | |

| Sunflower (tons) | |

| 21,762 | | |

| 23,111 | |

| Cotton Lint (tons) | |

| 687 | | |

| 2,465 | |

| Rice(9) (tons) | |

| 180,149 | | |

| 205,874 | |

| | |

| | |

| |

| | |

Six-month

period ended June 30, | |

| | |

2015 | | |

2014 | |

| Processed

rice (10) (tons) | |

| 52,270 | | |

| 91,744 | |

| Dairy (11) (liters) | |

| 41,282 | | |

| 37,636 | |

| Sugar, Ethanol and

Energy Business | |

| | | |

| | |

| Sugar

(tons) | |

| 196,528 | | |

| 111,547 | |

| Ethanol

(cubic meters) | |

| 130,072 | | |

| 86,196 | |

| Energy

(MWh) | |

| 206,201 | | |

| 120,673 | |

| Land Transformation

Business (hectares traded) | |

| - | | |

| 26,299 | |

| | |

| |

| | |

| 2014/2015 | | |

| 2013/2014 | |

| | |

| | | |

| | |

| | |

| Harvest | | |

| Harvest | |

| Planted

Area | |

| Year | | |

| Year | |

| | |

| (Hectares) | |

| Farming Business

(12) | |

| | | |

| | |

| Crops | |

| 192,783 | | |

| 185,443 | |

| Soybean | |

| 96,476 | | |

| 82,980 | |

| Corn (2) | |

| 40,074 | | |

| 51,323 | |

| Wheat (3) | |

| 37,020 | | |

| 29,412 | |

| Sunflower | |

| 12,314 | | |

| 12,880 | |

| Cotton | |

| 3,160 | | |

| 6,217 | |

| Forage | |

| 3,739 | | |

| 2,631 | |

| Rice | |

| 35,328 | | |

| 36,604 | |

| Total

Planted Area | |

| 228,112 | | |

| 222,047 | |

| Second

Harvest Area | |

| 40,115 | | |

| 29,923 | |

| Leased

Area | |

| 60,086 | | |

| 55,881 | |

| Owned

Croppable Area(13) | |

| 127,911 | | |

| 136,243 | |

| | |

| | | |

| | |

| | |

| Six-month

period ended June 30, | |

| | |

| 2015 | | |

| 2014 | |

| Sugar, Ethanol and

Energy Business | |

| | | |

| | |

| | |

| | | |

| | |

| Sugarcane

plantation | |

| 127,688 | | |

| 110,822 | |

| Owned

land | |

| 9,145 | | |

| 9,145 | |

| Leased

land | |

| 118,543 | | |

| 101,677 | |

| (1) | Includes

soybean, soybean oil and soybean meal. |

| (2) | Includes sorghum and peanuts |

| (3) | Includes

barley and rapeseed. |

| (4) | Includes

seeds and farming services. |

| (5) | Sales

of processed rice including rough rice purchased from third parties and processed in

our own facilities, rice seeds and services. |

| (6) | All

other segments include our cattle business which primarly consists of leasing land to

a third party based on the price of beef. See “Item 4. Information on the Company—B.

Business Overview—Cattle Business.” in our Form 20-F. |

| (7) | Represents

capital gain from the sale of land. |

| (8) | Crop

production does not include 118,510 tons and 37,189 tons of forage produced in the 2014/2015

and 2013/2014 harvest years, respectively. |

| (9) | Expressed

in tons of rough rice produced on owned and leased farms. The rough rice we produce,

along with additional rough rice we purchase from third parties, is ultimately processed

and constitutes the product sold in respect of the rice business. |

| (10) | Includes

rough rice purchased from third parties and processed in our own facilities. Expressed

in tons of processed rice (1 ton of processed rice is approximately equivalent to 1.6

tons of rough rice). |

| (11) | Raw

milk produced at our dairy farms. |

| (12) | Includes

hectares planted in the second harvest. |

| (13) | Does

not include potential croppable areas being evaluated for transformation. |

Six-month

period ended June 30, 2015 as compared to six-month period ended June 30, 2014

The

following table sets forth certain financial information with respect to our consolidated results of operations for the periods

indicated.

| | |

Six-month

period ended

June 30, | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited) | |

| | |

(In

thousands of $) | |

| Sales of manufactured products

and services rendered | |

| 198,454 | | |

| 189,737 | |

| Cost of manufactured

products sold and services rendered | |

| (132,348 | ) | |

| (126,095 | ) |

| Gross

Profit from Manufacturing Activities | |

| 66,106 | | |

| 63,642 | |

| Sales of agricultural produce and biological

assets | |

| 86,690 | | |

| 113,422 | |

| Cost of agricultural produce sold and

direct agricultural selling expenses | |

| (86,690 | ) | |

| (113,422 | ) |

| Initial recognition and changes in fair

value of biological assets and agricultural produce | |

| 33,948 | | |

| 39,860 | |

| Changes in net

realizable value of agricultural produce after harvest | |

| 3,898 | | |

| (1,704 | ) |

| Gross

Profit from Agricultural Activities | |

| 37,846 | | |

| 38,156 | |

| Margin

on Manufacturing and Agricultural Activities Before Operating Expenses | |

| 103,952 | | |

| 101,798 | |

| General and administrative expenses | |

| (23,485 | ) | |

| (23,634 | ) |

| Selling expenses | |

| (31,032 | ) | |

| (31,393 | ) |

| Other operating income/(expense), net | |

| 15,607 | | |

| (2,384 | ) |

| Share of loss of joint ventures | |

| (1,470 | ) | |

| (231 | ) |

| Profit

from Operations Before Financing and Taxation | |

| 63,572 | | |

| 44,156 | |

| Finance income | |

| 5,670 | | |

| 4,301 | |

| Finance costs | |

| (44,604 | ) | |

| (39,180 | ) |

| Financial results,

net | |

| (38,934 | ) | |

| (34,879 | ) |

| Profit

Before Income Tax | |

| 24,638 | | |

| 9,277 | |

| Income tax expense | |

| (9,542 | ) | |

| (5,229 | ) |

| Profit

for the Period | |

| 15,096 | | |

| 4,048 | |

Sales

of Manufactured Products and Services Rendered

Six-month

period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All

Other Segments | | |

Sugar,

Ethanol and Energy | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In

thousands of $) | |

| | 2015 | | |

| 431 | | |

| 48,679 | | |

| 754 | | |

| 662 | | |

| 147,928 | | |

| 198,454 | |

| | 2014 | | |

| 117 | | |

| 51,883 | | |

| 322 | | |

| 788 | | |

| 136,627 | | |

| 189,737 | |

Sales

of manufactured products and services rendered increased 4.6%, from $189.7 million for the six month period ended June 30, 2014

to $198.5 million for the same period in 2015, primarily as a result of:

| • | a

$11.3 million increase in our Sugar, Ethanol and Energy segment, mainly due to: (i) a

40.5% increase in the volume of sugar and ethanol sold, measured in TRS(1),

from 183.1 thousand tons in the six month period ended June 30, 2014 to 257.2 thousand

tons in the same period in 2015; and (ii) a 70.9% increase in volume of energy sold,

from 120.7 thousand MWh in 2014 to 206.2 thousand MWh in 2015. The increase in volume

of sugar and ethanol sold was due to (a) a 54.2% increase in sugarcane milled, from 2.2

million tons in 2014 to 3.4 million tons in 2015; and (b) a 5.5% increase in the TRS

content in sugarcane, from 120.4 kilograms per ton in 2014 to 127.0 kilograms per ton

in 2015; partially offset by a higher inventories build-up, measured in TRS, from an

inventories sell-of of 48.4 thousand tons in 2014 compared to an inventories build-up

of 43.4 thousand tons in 2015. The increase in the volume of energy sold was mainly due

to (a) the increase in sugarcane milled; and (b) an increase in the cogeneration efficiency

ratio measured in KWh per ton of sugarcane crushed, from 54.9 in 2014 to 61.6 in 2015.

The increase in the sugarcane milled is sustained by (i) an increase in the harvesting

area from 25.5 thousand hectares in 2014 to 33.0 thousand hectares in 2015 due to the

earlier start of the crushing season; (ii) a 24.5% increase in sugarcane yields from

79.3 tons per hectare in 2014 to 98.7 tons per hectare in 2015; and (iii) a 27.1% increase

in sugarcane crushed per day as a result of the expansion of nominal crushing capacity

coupled with enhanced agricultural and industrial efficiencies. The increases in volume

sold were partially offset by: (i) a 31.9% decrease in energy price, from $154.4 per

MWh in 2014 to $105.2 per MWh in 2015; (ii) a 25.3% decrease in the price of ethanol,

from $625.9 per cubic meter in 2014 to $467.6 per cubic meter in 2015; and (iii) a 13.8%

decrease in the sugar price from $393.1 per ton in 2014 to $338.8 per ton in 2015 |

| | The

following figure sets forth the variables that determine our Sugar and Ethanol sales: |

On

average, one metric ton of sugarcane contains 140 kilograms of TRS (Total Recoverable Sugar). While a mill can produce either

sugar or ethanol, the TRS input requirements differ between these two products. On average, 1.045 kilograms of TRS equivalent

are required to produce 1.0 kilogram of sugar, while the amount of TRS required to produce 1 liter of ethanol is 1.691 kilograms

The

following figure sets forth the variables that determine our Energy sales:

The

following table sets forth the breakdown of sales of manufactured products for the periods indicated.

| | |

Six-month

period ended June 30, | | |

Six-month

period ended June 30, | | |

Six-month

period ended June 30, | |

| | |

2015 | | |

2014 | | |

Chg

% | | |

2015 | | |

2014 | | |

Chg

% | | |

2015 | | |

2014 | | |

Chg

% | |

| | |

(in

million of $) | | |

| | |

(in

thousand units) | | |

| | |

(in

dollars per unit) | | |

| |

| Ethanol (M3) | |

| 72.9 | | |

| 75.0 | | |

| (2.8 | %) | |

| 156.0 | | |

| 119.8 | | |

| 30.2 | % | |

| 467.6 | | |

| 625.9 | | |

| (25.3 | %) |

| Sugar (tons) | |

| 53.3 | | |

| 43.0 | | |

| 23.9 | % | |

| 157.3 | | |

| 109.5 | | |

| 43.7 | % | |

| 338.8 | | |

| 393.1 | | |

| (13.8 | %) |

| Energy (MWh) | |

| 21.7 | | |

| 18.6 | | |

| 16.7 | % | |

| 206.2 | | |

| 120.7 | | |

| 70.9 | % | |

| 105.2 | | |

| 154.4 | | |

| (31.9 | %) |

| TOTAL | |

| 147.9 | | |

| 136.6 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| • | a

$0.4 million increase in our Dairy segment due to a 190.4% increase in the volume of

milk powder sold, from 75 tons in the six month period ended June 30, 2014 to 218 tons

in the same period in 2015; partially offset by a decrease of 19.5% in the price, from

$4.3 thousand per ton in 2014 to $3.5 thousand per ton in 2015 |

partially

offset by;

| • | a

$3.2 million decrease in our Rice segment, mainly due to: (i) a 5.4% decrease in the

volume of white rice sold measured in tons of rough rice, from 119.8 thousand tons in

the six month period ended June 30, 2014 to 113.3 thousand tons in the same period in

2015, mainly explained by a higher inventories build-up from 82.8 thousand tons in 2014

to 116.8 thousand tons in 2015; and (ii) a 49.7% decrease in the sale of by-products,

from $10.6 million in 2014 to $5.3 million in 2015. These decreases were partially offset

by an increase of 7.5% in the price, from $356 in 2014 to $383 per ton of rough rice

equivalent in 2015. |

Cost

of Manufactured Products Sold and Services Rendered

| Six-month

period ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All

Other

Segments | | |

Sugar,

Ethanol

and Energy | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In

thousands of $) | |

| | 2015 | | |

| (262 | ) | |

| (40,193 | ) | |

| (884 | ) | |

| (331 | ) | |

| (90,678 | ) | |

| (132,348 | ) |

| | 2014 | | |

| - | | |

| (39,328 | ) | |

| (322 | ) | |

| (33 | ) | |

| (86,412 | ) | |

| (126,095 | ) |

Cost

of manufactured products sold and services rendered increased 5.0%, from $126.1 million in the six month period ended in June

30, 2014 to $132.3 million in the same period in 2015. This increase was primarily due to:

| • | a

$4.3 million increase in our Sugar, Ethanol and Energy segment mainly due to increase

in the volume of sugar and ethanol sold measured in TRS; partially offset by a lower

unitary cost of product sold due to a 16.7% depreciation of the Brazilean Real during

the six month period ended June 30, 2015. |

| • | a

$0.9 million increase in our Rice segment mainly due to a 8.1% increase in the unitary

cost of product sold due to the 24.7% depreciation of the Argentine peso during the six-month

period ended June 30 2014, in comparison to the 7.4% depreciation during the same period

of 2015; partially offset by the increase in volume sold. |

| • | a

$0.6 million increase in our Dairy segment mainly due to the increase in the volume of

milk powder sold. |

Sales

and Cost of Agricultural Produce and Biological Assets

Six-month

period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All

Other

Segments | | |

Sugar,

Ethanol and Energy | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In

thousands of $) | |

| | 2015 | | |

| 70,477 | | |

| 48 | | |

| 16,165 | | |

| - | | |

| - | | |

| 86,690 | |

| | 2014 | | |

| 98,341 | | |

| 1,460 | | |

| 13,621 | | |

| - | | |

| - | | |

| 113,422 | |

Sales

of agricultural produce and biological assets decreased 23.6%, from $113.4 million in 2014, to $86.7 million in 2015, primarily

as a result of:

| • | A

$27.9 million decrease in our Crops segment mainly driven by (i) the general decrease

in the price of grains sold: soybean prices decreased 27.2%, from $366.3 per ton in the

six-month period ended June 30, 2014 to $266.6 per ton in the same period of 2015, and

corn prices decreased 22.8%, from $201.2 per ton in the six-month period ended June 30,

2014 to $155.4 per ton in the same period of 2015; (ii) a 8.7% decrease in soybean tons

sold due to a higher inventories build-up from 83.0 thousand tons of inventories build-up

in the six month period ended June 30, 2014 to 137.2 thousand tons in the same period

of 2015; and (iii) a 37.2% decrease in tons of corn sold from 114.0 thousand tons in

2014 to 90.4 thousand tons in 2015 due to a decrease in harvested area as of June 30,

from 43% in 2014 to 35% in 2015. Thes decreases were partially offset by higher soybean

yields from 2.9 tons per hectare in 2014 to 3.2 in 2015 for soybean first crop and from

2.9 in 2014 to 3.2 in 2015 for soybean second crop. |

The

following table sets forth the breakdown of sales for the periods indicated.

| | |

Six-month

Period ended June

30, | | |

Six-month

Period ended June

30, | | |

Six-month

Period ended June

30, | |

| | |

2015 | | |

2014 | | |

%

Chg | | |

2015 | | |

2014 | | |

%

Chg | | |

2015 | | |

2014 | | |

%

Chg | |

| | |

(In

thousands of $) | | |

| | |

(In

thousands of tons) | | |

| | |

(In

$ per ton) | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Soybean | |

| 38,533 | | |

| 58,018 | | |

| (33.6 | %) | |

| 144,553 | | |

| 158,412 | | |

| (8.7 | %) | |

| 266.6 | | |

| 366.3 | | |

| (27.2 | %) |

| Corn (1) | |

| 14,058 | | |

| 28,983 | | |

| (51.5 | %) | |

| 90,446 | | |

| 144,023 | | |

| (37.2 | %) | |

| 155.4 | | |

| 201.2 | | |

| (22.8 | %) |

| Cotton lint | |

| 925 | | |

| 333 | | |

| 178.0 | % | |

| 770 | | |

| 201 | | |

| 282.7 | % | |

| 1,201.7 | | |

| 1,654.4 | | |

| (27.4 | %) |

| Wheat (2) | |

| 7,542 | | |

| 6,620 | | |

| 13.9 | % | |

| 35,462 | | |

| 28,014 | | |

| 26.6 | % | |

| 212.7 | | |

| 236.3 | | |

| (10.0 | %) |

| Sunflower | |

| 9,046 | | |

| 3,896 | | |

| 132.2 | % | |

| 19,313 | | |

| 10,985 | | |

| 75.8 | % | |

| 468.4 | | |

| 354.7 | | |

| 32.1 | % |

| Others | |

| 373 | | |

| 491 | | |

| (24.0 | %) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

| 70,477 | | |

| 98,341 | | |

| (28.3 | %) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| • | A

$1.4 million decrease in our Rice segment was mainly driven by a lower volume of rough

rice sold to third parties in the six-month period ended June 30, 2015. The sales reported

in 2014 were exceptional, as we normally process all of our rough rice. During the six month period ended June 30, 2014, we

sold 4.0

thousand

tons

of rough rice at a

price of

$275.6

per

ton. |

Partially

offset by:

| • | A

18.7% increase in our Dairy segment, from $13.6 million in the six-month period ended

June 30, 2014 to $16.2 million in the six-month period ended June 30, 2015. This increase

is explained by an increase in the amount of liters of fluid milk sold, from 33.6 million

liters in the six-month period ended June 30, 2014 to 39.4 million liters in the same

period of 2015 as a result of: (a) a 3.6% increase in our milking cow herd driven by

enhanced reproduction efficiencies at our two free-stall dairy facilities from an average

of 6,346 heads in the six month period ended June 30,2014 to an average of 6,577 heads

in the same period of 2015; and (b) by a 5.8% increase in cow productivity, from 32.8

liters per day per cow in 2014 to 34.7 liters per day per cow in 2015 due to enhanced

operating efficiencies. The increase in the amount of liters sold was partially offset

by a 1.1% decrease in milk prices from $0.373 per liter in 2014 to $0.369 per liter in

2015. |

While

we receive cash or consideration upon the sale of our inventory of agricultural produce to third parties, we do not record any

additional profit related to that sale, as that gain or loss had already been recognized under the line items “Initial recognition

and changes in fair value of biological assets and agricultural produce” and “Changes in net realizable value of agricultural

produce after harvest.” Please see “—Critical Accounting Policies and Estimates—Biological Assets and

Agricultural Produce” above for a discussion of the accounting treatment, financial statement presentation and disclosure

related to our agricultural activity.

Initial

Recognition and Changes in Fair Value of Biological Assets and Agricultural Produce

Six-month

period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All

Other

Segments | | |

Sugar,

Ethanol

and Energy | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In

thousands of $) | |

| | 2015 | | |

| 15,473 | | |

| 3,755 | | |

| 4,178 | | |

| (2 | ) | |

| 10,544 | | |

| 33,948 | |

| | 2014 | | |

| 42,871 | | |

| 11,557 | | |

| 3,890 | | |

| (386 | ) | |

| (18,072 | ) | |

| 39,860 | |

Initial

recognition and changes in fair value of biological assets and agricultural produce decreased 14.8%, from $39.9 million in the

six-month period ended June 30, 2014 to $33.9 million in the same period for 2015. The decrease was mainly due to:

| • | a

$27.4 million decrease in our Crops segment mainly due to: |

| - | a

$26.6 million decrease in the recognition at fair value less cost to sell of crops at

the point of harvest mainly due to a decrease in commodity prices, partially offset by

the higher yields. |

| - | a

$0.8 million decrease in the recognition at fair value less cost to sell for non-harvested

crops, from a gain of $0.8 million in the six-month period ended June 30, 2014 to nill

in the same period of 2015, mainly due to (i) a general decrease in prices; and (ii)

a lower production with significant growth at the end of the period. |

| - | Of

the $15.5 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce for the six-month period ended June 30, 2015, $8.0 million

gain represents the realized portion, as compared to the $27.4 million realized gain

of the $42.9 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce in 2014. |

| • | A

$7.8 million decrease in our Rice segment, as a result of: |

| - | a

$7.8 million decrease in the recognition at fair value less cost to sell of rice at the

point of harvest, from a gain of $11.6 million in the six-month period ended June 30,

2014 to a gain of $3.8 million in the same period in 2015 mainly due to (i) a 10.0% decrease

in yields from 5.7 tons per hectare in 2014 to 5.1 tons per hectare in 2015 due to above

average rains and cloudy days during the development of the crops; and (ii) a 3.5% decrease

in the area under production. |

| - | Of

the $3.8 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce for the six-month period ended June 30, 2015, $1.0 million

gain represents the realized portion, as compared to the $5.5 million gain realized portion

of the $11.6 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce for the same period in 2014. |

partially

offset by:

| • | A

$28.6 million increase in our Sugar, Ethanol and Energy segment, mainly due to: |

| - | a

$21.5 million increase in the recognition at fair value less cost to sell of non-harvested

sugarcane, from a loss of $3.3 million in the six-month period ended June 30, 2014 to

a gain of $18.1 million in the same period for 2015, mainly generated by an increase

in sugarcane yield estimates due to enhancements in our agricultural operation. |

| - | The

changes in the recognition at fair value less cost to sell of sugarcane at the point

of harvest increased from a loss of $14.7 million in the six-month period ended June

30, 2014 to a loss of $7.6 million in the same period for 2015 due to an increase in

yields. |

| - | Of

the $10.5 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce for the six-month period ended June 30, 2015, $14.5 million

gain represents the unrealized portion, as compared to the $10.4 million loss unrealized

portion of the $18.1 million loss of initial recognition and changes in fair value of

biological assets and agricultural produce in the same period for 2014. |

Changes

in Net Realizable Value of Agricultural Produce after Harvest

Six-month

period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All

Other

Segments | |

Sugar,

Ethanol and Energy | |

Corporate | | |

Total | |

| | | |

| | |

| | |

| | |

| |

| |

| | |

| |

| | | |

(Unaudited) | |

| | | |

(In

thousands of $) | |

| | 2015 | | |

| 3,898 | | |

| N/A | | |

| N/A | | |

N/A | |

N/A | |

| N/A | | |

| 3,898 | |

| | 2014 | | |

| (1,704 | ) | |

| N/A | | |

| N/A | | |

N/A | |

N/A | |

| N/A | | |

| (1,704 | ) |

Changes

in net realizable value of agricultural produce after harvest is mainly composed by: (i) profit or loss from commodity price fluctuations

during the period of time the agricultural produce is in inventory, which impacts its fair value; (ii) profit or loss from the

valuation of forward contracts related to agricultural produce in inventory; and (iii) profit from direct exports. Changes in

net realizable value of agricultural produce after harvest increased from $1.7 million loss in the six-month period ended June

30, 2014 to $3.9 million gain in the same period for 2015. This increase is mainly explained by the increase in gain from forward

contracts.

General

and Administrative Expenses

Six-month period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All Other Segments | | |

Sugar, Ethanol and Energy

| | |

Corporate | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In thousands of $) | |

| | 2015 | | |

| (1,792 | ) | |

| (1,618 | ) | |

| (747 | ) | |

| (41 | ) | |

| (10,152 | ) | |

| (9,135 | ) | |

| (23,485 | ) |

| | 2014 | | |

| (2,083 | ) | |

| (1,602 | ) | |

| (777 | ) | |

| (84 | ) | |

| (10,132 | ) | |

| (8,956 | ) | |

| (23,634 | ) |

Our

general and administrative expenses remained essentially unchanged, from $23.6 million in the six-month period ended June 30,

2014 to $23.5 million in the same period for 2015.

Selling

Expenses

Six-month

period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All Other Segments | | |

Sugar, Ethanol and Energy

| | |

Corporate | | |

Total | |

| | | |

(Unaudited) | |

| | | |

(In thousands of $)

| |

| | 2015 | | |

| (2,751 | ) | |

| (6,763 | ) | |

| (346 | ) | |

| (13 | ) | |

| (20,663 | ) | |

| (526 | ) | |

| (31,032 | ) |

| | 2014 | | |

| (2,029 | ) | |

| (9,126 | ) | |

| (272 | ) | |

| (13 | ) | |

| (19,225 | ) | |

| (728 | ) | |

| (31,393 | ) |

Selling

expenses remained essentially unchanged, from $31.4 million in the six-month period ended June 30, 2014 to $31.0 million in the

same period for 2015. The $2.4 million decrease in selling expenses in our Rice segment due to lower tons of white rice sold was

offset by (i) a 7.5% increase in our Sugar, Ethanol and Energy segment from $19.2 million in 2014 to $20.6 million in 2015 due

to higher tons of sugar and ethanol sold expressed in TRS; and (ii) a $0.7 million increase in our Crops segment due to lower

selling costs from exports as of June 30, 2014 that wer booked in July 2015.

Other

Operating Income, Net

Six-month

period ended

June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All Other Segments | | |

Sugar, Ethanol

and Energy | | |

Land Transformation | | |

Corporate | | |

Total | |

| (Unaudited) | |

| (In thousands of $) | |

| | 2015 | | |

| 1,480 | | |

| 601 | | |

| (306 | ) | |

| 1 | | |

| 13,609 | | |

| - | | |

| 222 | | |

| 15,607 | |

| | 2014 | | |

| (5,245 | ) | |

| 235 | | |

| 20 | | |

| (15 | ) | |

| 2,484 | | |

| - | | |

| 137 | | |

| (2,384 | ) |

Other

operating income increased $18.0 million, from a $2.4 million loss in the six-month period ended June 30, 2014 to $15.6 million

gain in the same period for 2015, primarily due to:

| • | a

$11.1 million increase in our Sugar, Ethanol & Energy segment due to the mark-to-market

effect of outstanding hedge positions. |

| • | a

$6.7 million increase in our Crops segment due to the mark-to-market effect of outstanding

hedge positions; |

Other

operating income, net of our Rice, Dairy, All other segments, Land Transformation and Corporate segments remained essentially

unchanged.

Share

of Loss of Joint Ventures and Investment Results

Six-month period

ended June 30, | | |

Crops | | |

Rice | | |

Dairy | | |

All Other Segments | | |

Sugar, Ethanol and Energy

| | |

Land Transformation | | |

Corporate | | |

Total | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (Unaudited) | |

| (In thousands of $)

| |

| | 2015 | | |

| (1,470 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,470 | ) |

| | 2014 | | |

| (231 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (231 | ) |

Our

share of loss of Joint Ventures increased from a loss of $0.2 million in the three-month period ended June 30, 2014 to a loss

of $1.5 million in the same period for 2015. This result is explained by the 50% interest that we hold in CHS AGRO, a joint venture

with CHS Inc., dedicated to the processing of confectionary sunflower. The negative result is mainly due to the decrease in commodity

prices, interest expense and the negative impact of the depreciation of Argentine peso on its dollar denominated debt.

Financial

Results, Net

Our

financial results, net decreased from a loss of $34.9 in the six month period ended June 30, 2014 to a loss of $38.9 million in

the same period of 2015, primarily due to: a $9.7 million mainly non-cash loss in 2015, compared to a $3.3 million non-cash loss

in 2014, mostly generated by the impact of foreign exchange fluctuation on our dollar denominated debt

The

following table sets forth the breakdown of financial results for the periods indicated.

| | |

Six-month period ended June 30, |

|

|

|

| |

| | |

2015 | | |

2014 | | |

| |

| | |

(Unaudited) | | |

| | |

| |

| | |

| (In

$ thousand) | | |

| | | |

| %

Change | |

| Interest income | |

| 4,906 | | |

| 3,393 | | |

| 44.6 | % |

| Interest expense | |

| (24,151 | ) | |

| (27,809 | ) | |

| (13.2 | %) |

| Foreign exchange losses, net | |

| (9,653 | ) | |

| (3,268 | ) | |

| 195.4 | % |

| Cash flow hedge – transfer from equity | |

| (7,754 | ) | |

| (4,609 | ) | |

| 68.2 | % |

| Gain from interest rate /foreign exchange rate derivative financial instruments | |

| 570 | | |

| 720 | | |

| (20.8 | %) |

| Taxes | |

| (1,457 | ) | |

| (1,954 | ) | |

| (25.4 | %) |

| Other Expenses | |

| (1,395 | ) | |

| (1,352 | ) | |

| 3.2 | % |

| Total Financial Results | |

| (38,934 | ) | |

| (34,879 | ) | |

| 11.6 | % |

Income

Tax expense

Current

income tax charge totaled $9.5 million for the six-month period ended June 30, 2015, which equates to a consolidated effective

tax rate of 38.7%. For the same period in 2014 we registered a loss of income tax of $5.2 million, which equates to a consolidated

effective tax rate of 56.4%.

As

of June 30, 2015, the income tax rate in Uruguay was 25%. However, in Uruguay the income tax rate applicable to derivative activities

is 0.75%. During the six-month period ended June 30, 2015, we recognized a gain in the line item Other operating income, net,

of $2.1 million which was subject to the 0.75% rate. As result of these effects our consolidated effective income tax rate decreased

from 56.4% for the six-month period ended June 30, 2014 to 38.7% for the same period in 2015.

Profit

for the period

As

a result of the foregoing, our net income for the six-month period ended June 30, 2015 increased $11.0 million, from a gain of

$4.0 million in 2014 to a profit of $15.1 million in 2015.

LIQUIDITY

AND CAPITAL RESOURCES

Our

liquidity and capital resources are and will be influenced by a variety of factors, including:

| • | our

ability to generate cash flows from our operations; |

| • | the

level of our outstanding indebtedness and the interest that we are obligated to pay on

such outstanding indebtedness; |

| • | our

capital expenditure requirements, which consist primarily of investments in new farmland,

in our operations, in equipment and plant facilities and maintenance costs; and |

| • | our

working capital requirements. |

Our

principal sources of liquidity have traditionally consisted of shareholders’ contributions, short and long term borrowings

and proceeds received from the disposition of transformed farmland or subsidiaries.

We

believe that our working capital will be sufficient during the next 12 months to meet our liquidity requirements.

Six-month

period ended June 30, 2015 and 2014

The

table below reflects our statements of Cash Flow for the six-month period ended June 30, 2015 and 2014.

| | |

Six-month

period | |

| | |

2015 | | |

2014 | |

| | |

(Unaudited, in thousands

of $) | |

| Cash and cash equivalent at the beginning of the period | |

| 113,795 | | |

| 232,147 | |

| Net cash generated from operating activities | |

| 47,489 | | |

| 26,559 | |

| Net cash used in investing activities | |

| (99,142 | ) | |

| (166,372 | ) |

| Net cash generated from financial activities | |

| 116,556 | | |

| 82,581 | |

| Effect of exchange rate changes on cash and cash equivalent | |

| (15,232 | ) | |

| 24,412 | |

| Cash and cash equivalent at the end of the period | |

| 163,466 | | |

| 199,327 | |

Operating

Activities

Period

ended June 30, 2015

Net

cash generated by operating activities was $47.5 million for the six-month period ended June 30, 2015. During this period, we

generated a net profit of $15.1 million that included non-cash charges relating primarily to losses from foreign exchange, net

of $9.7 million, $20.6 million interest and other expense, net, $9.5 million of income tax and $30.0 million of depreciation and

amortization. All these effects were partially offset by a gain from derivate financial instruments and forward contracts of $15.3

million and the unrealized portion of the “Initial recognition and changes in fair value of biological assets and agricultural

produce” of $24.7 million.

In

addition, other changes in operating assets and liability balances resulted in a net decrease in cash of $7.3 million, primarily

due to an decrease of $7.4 million in trade and other receivables, a decrease of $25.8 million in derivate financial instruments,

and a decrease of $37.3 million in biological assets, partially offset by a increase of $52.6 million in inventories and a decrease

of 27.0 in trade and other payables.

Period

ended June 30, 2014

Net

cash generated by operating activities was $26.6 million for the period ended June 30, 2014. During this period, we generated

a net gain of $4.1 million that included non-cash charges relating primarily to depreciation and amortization of $34.4 million,

$25.8 million of interest expense, net, and $5.2 million of income tax benefit. All these effects were partially offset by unrealized

portion of the initial recognition and changes in fair value of non-harvested biological assets of $11.2 million.

In

addition, other changes in operating asset and liability balances resulted in a net decrease in cash of $45.7 million, primarily

due to an increase of $49.3 million in inventories, $23.7 million of trade and other receivables and a decrease of $13.6 million

in trade and other payables, partially offset by a decrease of $45.1 in biological assets due to the harvest of rice, crops, and

sugarcane.

Investing

Activities

Period

ended June 30, 2015

Net

cash used in investing activities totaled $99.1 million in the six-month period ended June 30, 2015, primarily due to the purchases

of property, plant and equipment (mainly acquisitions of machinery, buildings and facilities for the finalization of the construction

of the second phase of Ivinhema mill), totaling $69.9 million; and $25.9 million in biological assets related mainly to the expansion

of our sugarcane plantation area in Mato Grosso do Sul.

Period

ended June 30, 2014

Net

cash used in investing activities totaled $166.4 million in the six-month period ended June 30, 2014, primarily due to the purchases

of property, plant and equipment (mainly acquisitions of machinery, buildings and facilities for the construction of the Ivinhema

mill), totaling $113.1 million; $54.4 million in biological assets related mainly to the expansion of our sugarcane plantation

area in Mato Grosso do Sul.

Financing

Activities

Period

ended June 30, 2015

Net

cash provided by financing activities was $116.5 million in the period ended June 30, 2015, primarily derived from the incurrence

of new long and short term loans in the amounts of $166.9 million and $37.4 million, respectively, mainly for our Brazilian operations

related to the Sugar and Ethanol cluster development. This effect was partially offset by a net payments of short and long term

borrowings in the amounts $19.7 million and $48.9 million, respectively. During this period, interest paid totaled $20.3 million.

Period

ended June 30, 2014

Net

cash provided by financing activities was $82.6 million in the period ended June 30, 2014, primarily derived from the incurrence

of new long and short term loans in the amounts of $159.1 million and $42.4 million, respectively, mainly for our Brazilian operations

related to the Sugar and Ethanol cluster development, and from the sale of minority interest in subsidiaries for $49.4 million.

All these effects were partially offset by payments of short and long term borrowings in the amounts $59.5 million and $71.2 million,

respectively. During this period, interest paid totaled $25.2 million.

Cash

and Cash Equivalents

Historically,

since our cash flows from operations were insufficient to fund our working capital needs and investment plans, we funded our operations

with proceeds from short-term and long-term indebtedness and capital contributions from existing and new private investors. In

2011 we obtained $421.8 million from the IPO and the sale of shares in a concurrent private placement (See “Item 4. Information

on the Company—A. History and Development of the Company” in our Form 20-F). As of June 30, 2015, our cash and cash

equivalents amounted to $198.3 million.

However,

we may need additional cash resources in the future to continue our investment plans. Also, we may need additional cash if we

experience a change in business conditions or other developments. We also might need additional cash resources in the future if

we find and wish to pursue opportunities for investment, acquisitions, strategic alliances or other similar investments. If we

ever determine that our cash requirements exceed our amounts of cash and cash equivalents on hand, we might seek to issue debt

or additional equity securities or obtain additional credit facilities or realize the disposition of transformed farmland and/or

subsidiaries. Any issuance of equity securities could cause dilution for our shareholders. Any incurrence of additional indebtedness

could increase our debt service obligations and cause us to become subject to additional restrictive operating and financial covenants,

and could require that we pledge collateral to secure those borrowings, if permitted to do so. It is possible that, when we need

additional cash resources, financing will not be available to us in amounts or on terms that would be acceptable to us or at all.

Projected

Sources and Uses of Cash

We

anticipate that we will generate cash from the following sources:

| • | the

dispositions of transformed farmland and/or subsidiaries; and |

| • | debt

or equity offerings. |

We

anticipate that we will use our cash:

| • | for

other working capital purposes; |

| • | to

meet our budgeted capital expenditures; |

| • | to

make investment in new projects related to our business; and |

| • | to

refinance our current debts. |

Indebtedness

and Financial Instruments

The

table below illustrates the maturity of our indebtedness (excluding obligations under finance leases) and our exposure to fixed

and variable interest rates:

| | |

June

30, 2015 | | |

December

31, 2014 | |

| | |

(unaudited) | | |

| |

| Fixed rate: | |

| | | |

| | |

| Less than 1 year | |

| 114,204 | | |

| 95,524 | |

| Between 1 and 2 years | |

| 40,350 | | |

| 45,518 | |

| Between 2 and 3 years | |

| 32,697 | | |

| 41,685 | |

| Between 3 and 4 years | |

| 29,009 | | |

| 25,809 | |

| Between 4 and 5 years | |

| 27,641 | | |

| 39,992 | |

| More than 5 years | |

| 54,543 | | |

| 87,219 | |

| | |

| 298,444 | | |

| 335,747 | |

| Variable rate: | |

| | | |

| | |

| Less than 1 year | |

| 115,923 | | |

| 111,371 | |

| Between 1 and 2 years | |

| 162,487 | | |

| 130,426 | |

| Between 2 and 3 years | |

| 126,871 | | |

| 80,199 | |

| Between 3 and 4 years | |

| 58,536 | | |

| 13,154 | |

| Between 4 and 5 years | |

| 6,959 | | |

| 7,346 | |

| More than 5 years | |

| 15,368 | | |

| 19,683 | |

| | |

| 486,144 | | |

| 362,179 | |

| | |

| 784,588 | | |

| 697,926 | |

| (1) | The

Company plans to partially rollover its short term debt using new available lines of

credit, or on using operating cash flow to cancel such debt. |

During

2015 and 2014 the Company was in compliance with all financial covenants.

Short-term

Debt.

As

of June 30, 2015, our short term debt totaled $230.4 million.

We

maintain lines of credit with several banks in order to finance our working capital requirements. We believe that we will continue

to be able to obtain additional credit to finance our working capital needs in the future based on our past track record and current

market conditions.

Capital

Expenditure Commitments

During

the six-month Period ended June 30, 2015, our capital expenditures totaled $96.6 million. Our capital expenditures consisted mainly

of equipment, machinery and construction costs related to the finalization of the construction of the Ivinhema sugar and ethanol

mill in Brazil.

We expect

continuous capital expenditures for the foreseeable future as we expand and consolidate each of our business segments.

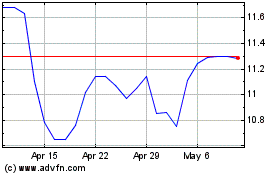

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Sep 2023 to Sep 2024