SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2015

Commission File Number: 000-30540

GIGAMEDIA

LIMITED

8F, No. 22, Lane 407, Section 2, Tiding Boulevard

Neihu District

Taipei,

Taiwan (R.O.C.)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x

Form 40-F ¨

(Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ¨

No x

(If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- .)

GIGAMEDIA LIMITED is

submitting under cover of Form 6-K:

| |

1. |

GigaMedia Announces Second-Quarter 2015 Financial Results (attached hereto as Exhibit 99.1) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GigaMedia Limited |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

| Date: |

|

August 5, 2015 |

|

|

|

By: |

|

/s/ HUANG, SHIH-CHIN |

|

|

|

|

|

|

(Signature) |

|

|

|

|

|

|

Name: |

|

HUANG, SHIH-CHIN |

|

|

|

|

|

|

Title: |

|

Head of Finance Department |

Exhibit 99.1

|

|

|

|

|

| FOR IMMEDIATE RELEASE |

|

|

|

For further information contact: |

|

|

|

|

Amanda Chang |

|

|

|

|

Investor Relations Department |

|

|

|

|

Country/City Code 8862 Tel: 2656-8080 |

|

|

|

|

amanda.chang@gigamedia.com.tw |

GigaMedia Announces Second-Quarter 2015 Financial Results

TAIPEI, Taiwan, August 5, 2015 – GigaMedia Limited (NASDAQ: GIGM) today announced its second-quarter 2015 unaudited financial results.

Message from Management

For the second quarter of 2015,

the sales revenues were $2.7 million. The contribution made by the mobile games, the social casino games and the cloud computing business accounted for about 45.7%, 28.2% and 26.5% respectively.

The mobile gaming market is getting more competitive. Started from the second quarter of 2015, the Company began to scrutinize current performance of the

mobile gaming business and try to integrate the resources of the operations in Taiwan and Hong Kong in order to streamline the business and then hopefully improve its margin by the end of this year.

In June 2015, the Company entered into partnership with World Mahjong Ltd. to organize the World Series of Mahjong 2015 and also became their exclusive online

mahjong game provider; furthermore, will host the online qualifying tournaments of the World Series of Mahjong 2015 on “ClubOne” platform. “ClubOne”, the Company’s in-house developed social casino platform, is designed also

to enable the land-based operators to consolidate resources for seizing more opportunities that navigate both online and offline markets.

Besides, in the

second quarter of 2015, the Company continued to dispose partial marketable securities and repaid the short-term borrowings for lowering its leverage ratio and meanwhile, increasing its cash position.

Management considers 2015 a turnaround year for the Company. In addition to current mobile gaming business to be streamlined and newly launched platform,

management also pursues an acquisitive growth and expects it to bring in more business value to the Company and also support its future revenue growth.

Consolidated Financial Results

GigaMedia Limited is a diversified provider of online games and cloud computing services. GigaMedia’s online games business FunTown develops and operates

a suite of games in Taiwan and Hong Kong, with focus on browser/mobile games and social casino games. GigaMedia’s cloud computing business GigaCloud was launched in early April 2013 and is focused on providing small and medium-sized enterprises

in Greater China with critical communications services and IT solutions that increase flexibility, efficiency and competitiveness.

Unaudited consolidated

results of GigaMedia are summarized in the table below.

For the Second Quarter

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GIGAMEDIA 2Q15UNAUDITED CONSOLIDATED

FINANCIAL RESULTS |

|

| (unaudited, all figures in US$ thousands, except per share amounts) |

|

2Q15 |

|

|

1Q15 |

|

|

Change

(%) |

|

|

2Q15 |

|

|

2Q14 |

|

|

Change

(%) |

|

|

|

|

|

|

|

|

| Revenues |

|

|

2,728 |

|

|

|

3,162 |

|

|

|

-13.7 |

% |

|

|

2,728 |

|

|

|

2,471 |

|

|

|

10.4 |

% |

|

|

|

|

|

|

|

| Gross Profit |

|

|

217 |

|

|

|

738 |

|

|

|

-70.6 |

% |

|

|

217 |

|

|

|

819 |

|

|

|

-73.5 |

% |

|

|

|

|

|

|

|

| Loss from Operations |

|

|

-3,801 |

|

|

|

-3,416 |

|

|

|

-11.3 |

% |

|

|

-3,801 |

|

|

|

-2,945 |

|

|

|

-29.1 |

% |

|

|

|

|

|

|

|

| Net Income (Loss) Attributable to GigaMedia |

|

|

1,377 |

|

|

|

5,239 |

|

|

|

-73.7 |

% |

|

|

1,377 |

|

|

|

-2,677 |

|

|

|

151.4 |

% |

|

|

|

|

|

|

|

| Net Income (Loss) Per Share Attributable to GigaMedia, Diluted |

|

|

0.02 |

|

|

|

0.09 |

|

|

|

-77.8 |

% |

|

|

0.02 |

|

|

|

-0.05 |

|

|

|

140.0 |

% |

|

|

|

|

|

|

|

| EBITDA (A) |

|

|

1,463 |

|

|

|

5,335 |

|

|

|

-72.6 |

% |

|

|

1,463 |

|

|

|

-2,448 |

|

|

|

159.8 |

% |

|

|

|

|

|

|

|

| Cash and Marketable Securities-Current |

|

|

68,305 |

|

|

|

75,575 |

|

|

|

-9.6 |

% |

|

|

68,305 |

|

|

|

63,009 |

|

|

|

8.4 |

% |

| (A) |

EBITDA (earnings before interest, taxes, depreciation, and amortization) is provided as a supplement to results provided in accordance with U.S. generally accepted accounting principles (“GAAP”). (See,

“Use of Non-GAAP Measures,” for more details.) |

Second-Quarter Financial Results

| • |

|

Consolidated revenues were $2.7 million, dropped by 13.7% quarter-on-quarter mainly due to the decrease of the new game releases, but increased by 10.4% quarter-over-quarter due to the growth of the cloud

computing business. |

| • |

|

Consolidated operating expenses were $4.0 million in 2Q15, down by 3.3% quarter-on-quarter due to an slight decrease on selling and marketing expenses, but increased by 6.7% from $3.8 million

quarter-over-quarter, resulting from an increase of selling and marketing expenses for the new games. |

| • |

|

Consolidated non-operating income was $5.1 million attributable to the capital gain on disposal of marketable securities-current. |

| • |

|

Net income was $1.4 million, up by 151.4% quarter-over-quarter mainly attributable to the gain on sales of marketable securities. |

| • |

|

Cash and marketable securities-current in 2Q15 accounted for $68.3 million, decreased by 9.6% from $75.6 million in 1Q15 resulting from a disposal of marketable securities-current and the repayment of short-term

borrowings. |

| • |

|

Investments were $6.7 million in 2Q2015, increased approximately $1.0 million quarter-on-quarter, resulting from an investment in SportsPlus Inc. (www.sportsplus.me), a new app for daily fantasy sports and

newly launched in the second quarter this year. Investments were decreased from $25.5 million in 2Q2014 to $6.7 million in 2Q2015 mainly due to a disposal of securities investment in April 2015. |

Financial Position

GigaMedia maintained its solid

financial position with cash and cash equivalents, marketable securities-current and restricted cash accounted for $69.3 million as of June 30, 2015, or approximately $1.25 per share.

Business Outlook

The following forward-looking

statements reflect GigaMedia’s expectations as of August 5, 2015. Given potential changes in economic conditions and consumer spending, the evolving nature of online games, and various other risk factors, including those discussed in the

Company’s 2014 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission as referenced below, actual results may differ materially.

In the third quarter of 2015, the Company will continue to attend the gaming events in order to promote the co-developed new games and attract overseas

publishers to license them in various countries. Meanwhile, for mobile gaming operation, the Company currently seeks for cooperation with overseas online platforms in order to better the monetization of the games.

With regard to social casino game platform, the Company continues the cooperation talk with overseas operators in

order to license “ClubOne” not only in China but also in South East Asia by the end of 2015.

As for cloud computing business, the Company will

continue to provide customized and integrated services to the corporate customers. Management also expects it to improve its margin while the sales revenues are increasing.

Use of Non-GAAP Measures

To supplement GigaMedia’s

consolidated financial statements presented in accordance with US GAAP, the company uses the following measure defined as non-GAAP by the SEC: EBITDA. Management believes that EBITDA (earnings before interest, taxes, depreciation, and

amortization) is a useful supplemental measure of performance because it excludes certain non-cash items such as depreciation and amortization and that EBITDA is a measure of performance used by some investors, equity analysts and others to make

informed investment decisions. EBITDA is not a recognized earnings measure under GAAP and does not have a standardized meaning. Non-GAAP measures such as EBITDA should be considered in addition to results prepared in accordance with GAAP, but should

not be considered a substitute for, or superior to, other financial measures prepared in accordance with GAAP. A limitation of using EBITDA is that it does not include all items that impact the company’s net income for the period.

Reconciliations to the GAAP equivalents of the non-GAAP financial measures are provided on the attached unaudited financial statements.

About the

Numbers in This Release

Quarterly results

All quarterly results referred to in the text, tables and attachments to this release are unaudited. The financial statements from which the financial results

reported in this press release are derived have been prepared in accordance with U.S. GAAP, unless otherwise noted as “non-GAAP,” and are presented in U.S. dollars.

Webcast Schedule

For Q&A regarding the second

quarter 2015 performance upon the release, investors may send the questions via email to IR@gigamedia.com.tw by August 10th, and the responses will be replied in the webcast. Webcast

will be available on the company’s official website www.gigamedia.com on August 14th.

About GigaMedia

Headquartered in Taipei, Taiwan, GigaMedia Limited (Singapore registration number: 199905474H) is a diversified provider of online games and cloud computing

services. GigaMedia’s online games business develops and operates a suite of games in Taiwan and Hong Kong, with focus on browser/mobile games and social casino games. The company’s cloud computing business is focused on providing SMEs in

Greater China with critical communications services and IT solutions that increase flexibility, efficiency and competitiveness. More information on GigaMedia can be obtained from www.gigamedia.com.

The statements included above and elsewhere in this press release that are not historical in nature are “forward-looking statements” within the

meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding expected financial performance (as described without limitation in the

“Business Outlook” section and in quotations from management in this press release) and GigaMedia’s strategic and operational plans. These statements are based on management’s current expectations and are subject to risks and

uncertainties and changes in circumstances. There are important factors that could cause actual results to differ materially from those anticipated in the forward looking statements, including but not limited to, our ability to license, develop or

acquire additional online games that are appealing to users, our ability to retain existing online game players and attract new players, and our ability to launch online games in a timely manner and pursuant to our anticipated schedule. Further

information on risks or other factors that could cause results to differ is detailed in GigaMedia’s Annual Report on Form 20-F filed in April 2013 and its other filings with the United States Securities and Exchange Commission.

# # #

(Tables to follow)

GIGAMEDIA LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

6/30/2015 |

|

|

3/31/2015 |

|

|

6/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

| Operating revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Asian online game and service revenues |

|

|

2,014,922 |

|

|

|

2,718,393 |

|

|

|

2,180,171 |

|

| Other revenues |

|

|

712,646 |

|

|

|

443,692 |

|

|

|

290,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,727,568 |

|

|

|

3,162,085 |

|

|

|

2,470,798 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Asian online game and service revenues |

|

|

1,777,811 |

|

|

|

1,966,164 |

|

|

|

1,291,889 |

|

| Cost of other revenues |

|

|

732,775 |

|

|

|

457,520 |

|

|

|

360,349 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,510,586 |

|

|

|

2,423,684 |

|

|

|

1,652,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

216,982 |

|

|

|

738,401 |

|

|

|

818,560 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Product development and engineering expenses |

|

|

164,085 |

|

|

|

181,708 |

|

|

|

227,509 |

|

| Selling and marketing expenses |

|

|

2,262,207 |

|

|

|

2,687,116 |

|

|

|

1,677,455 |

|

| General and administrative expenses |

|

|

1,265,399 |

|

|

|

1,285,835 |

|

|

|

1,858,949 |

|

| Other |

|

|

326,594 |

|

|

|

0 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,018,285 |

|

|

|

4,154,659 |

|

|

|

3,763,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(3,801,303 |

) |

|

|

(3,416,258 |

) |

|

|

(2,945,353 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

106,324 |

|

|

|

102,529 |

|

|

|

174,559 |

|

| Gain on sales of marketable securities |

|

|

4,703,500 |

|

|

|

9,473,063 |

|

|

|

162,051 |

|

| Interest expense |

|

|

(48,224 |

) |

|

|

(82,113 |

) |

|

|

(68,399 |

) |

| Foreign exchange (loss) gain - net |

|

|

(17,655 |

) |

|

|

(16,242 |

) |

|

|

115,438 |

|

| Equity in net earnings (loss) on equity method investments |

|

|

22,954 |

|

|

|

40,100 |

|

|

|

(244,775 |

) |

| Changes in the fair value of an instrument recognized at fair value |

|

|

879,472 |

|

|

|

(951,660 |

) |

|

|

0 |

|

| Other |

|

|

(508,926 |

) |

|

|

18,373 |

|

|

|

18,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,137,445 |

|

|

|

8,584,050 |

|

|

|

157,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations before income taxes |

|

|

1,336,142 |

|

|

|

5,167,792 |

|

|

|

(2,788,077 |

) |

| Income tax benefit |

|

|

170 |

|

|

|

13,351 |

|

|

|

60,849 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

|

1,336,312 |

|

|

|

5,181,143 |

|

|

|

(2,727,228 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

1,336,312 |

|

|

|

5,181,143 |

|

|

|

(2,727,228 |

) |

| Less: Net loss attributable to noncontrolling interest |

|

|

40,525 |

|

|

|

58,130 |

|

|

|

50,537 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to shareholders of GigaMedia |

|

|

1,376,837 |

|

|

|

5,239,273 |

|

|

|

(2,676,691 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per share attributable to GigaMedia |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

|

0.02 |

|

|

|

0.09 |

|

|

|

(0.05 |

) |

| Loss from discontinued operations |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.02 |

|

|

|

0.09 |

|

|

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

|

0.02 |

|

|

|

0.09 |

|

|

|

(0.05 |

) |

| Loss from discontinued operations |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.02 |

|

|

|

0.09 |

|

|

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

55,261,661 |

|

|

|

55,261,661 |

|

|

|

53,901,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

55,262,036 |

|

|

|

55,261,926 |

|

|

|

53,901,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GIGAMEDIA LIMITED

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

6/30/2015 |

|

|

3/31/2015 |

|

|

6/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

68,299,828 |

|

|

|

53,856,429 |

|

|

|

40,660,576 |

|

| Marketable securities - current |

|

|

5,307 |

|

|

|

21,718,274 |

|

|

|

22,348,693 |

|

| Accounts receivable - net |

|

|

1,675,561 |

|

|

|

2,031,966 |

|

|

|

1,352,875 |

|

| Prepaid expenses |

|

|

1,019,249 |

|

|

|

671,116 |

|

|

|

648,190 |

|

| Restricted cash |

|

|

1,000,000 |

|

|

|

9,034,062 |

|

|

|

8,924,513 |

|

| Other receivables |

|

|

186,994 |

|

|

|

3,105,223 |

|

|

|

273,032 |

|

| Other current assets |

|

|

273,500 |

|

|

|

490,835 |

|

|

|

143,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

72,460,439 |

|

|

|

90,907,905 |

|

|

|

74,351,344 |

|

|

|

|

|

| Marketable securities - noncurrent |

|

|

4,744,000 |

|

|

|

4,744,000 |

|

|

|

9,214,270 |

|

| Investments |

|

|

6,740,252 |

|

|

|

5,724,346 |

|

|

|

25,476,917 |

|

| Property, plant & equipment - net |

|

|

1,675,312 |

|

|

|

1,719,799 |

|

|

|

1,695,953 |

|

| Intangible assets - net |

|

|

206,780 |

|

|

|

263,811 |

|

|

|

884,979 |

|

| Prepaid licensing and royalty fees |

|

|

5,026,779 |

|

|

|

5,144,947 |

|

|

|

4,843,848 |

|

| Other assets |

|

|

369,685 |

|

|

|

356,274 |

|

|

|

329,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

91,223,247 |

|

|

|

108,861,082 |

|

|

|

116,796,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

|

4,536,617 |

|

|

|

19,808,307 |

|

|

|

19,755,567 |

|

| Accounts payable |

|

|

557,599 |

|

|

|

652,708 |

|

|

|

332,166 |

|

| Accrued compensation |

|

|

464,384 |

|

|

|

363,480 |

|

|

|

785,562 |

|

| Accrued expenses |

|

|

3,739,583 |

|

|

|

3,439,764 |

|

|

|

2,717,972 |

|

| Unearned revenue |

|

|

1,673,170 |

|

|

|

1,947,176 |

|

|

|

2,289,599 |

|

| Other current liabilities |

|

|

1,800,582 |

|

|

|

1,985,012 |

|

|

|

3,810,015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

12,771,935 |

|

|

|

28,196,447 |

|

|

|

29,690,881 |

|

| Other liabilities |

|

|

1,933,173 |

|

|

|

1,935,620 |

|

|

|

182,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

14,705,108 |

|

|

|

30,132,067 |

|

|

|

29,873,031 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GigaMedia’s shareholders’ equity |

|

|

76,607,057 |

|

|

|

78,776,989 |

|

|

|

86,825,311 |

|

| Noncontrolling interest |

|

|

(88,918 |

) |

|

|

(47,974 |

) |

|

|

98,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

76,518,139 |

|

|

|

78,729,015 |

|

|

|

86,923,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

91,223,247 |

|

|

|

108,861,082 |

|

|

|

116,796,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GIGAMEDIA LIMITED

Reconciliations of Non-GAAP Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

6/30/2015 |

|

|

3/31/2015 |

|

|

6/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

| Reconciliation of Net Income (Loss) to EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to GigaMedia |

|

|

1,376,837 |

|

|

|

5,239,273 |

|

|

|

(2,676,691 |

) |

| Depreciation |

|

|

80,296 |

|

|

|

74,212 |

|

|

|

75,599 |

|

| Amortization |

|

|

64,129 |

|

|

|

55,316 |

|

|

|

319,683 |

|

| Interest income |

|

|

(106,302 |

) |

|

|

(102,529 |

) |

|

|

(174,362 |

) |

| Interest expense |

|

|

47,975 |

|

|

|

82,102 |

|

|

|

68,399 |

|

| Income tax (benefit) expense |

|

|

(170 |

) |

|

|

(13,351 |

) |

|

|

(60,849 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

1,462,765 |

|

|

|

5,335,023 |

|

|

|

(2,448,221 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

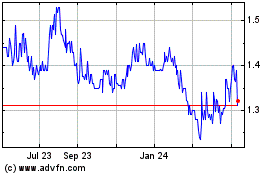

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Aug 2024 to Sep 2024

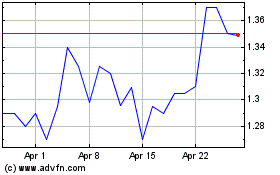

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Sep 2023 to Sep 2024