UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) July 22, 2015 (July 20, 2015)

STEEL DYNAMICS, INC.

(Exact name of registrant as specified in its charter)

|

Indiana |

|

0-21719 |

|

35-1929476 |

|

(State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

|

of incorporation) |

|

|

|

Identification No.) |

7575 West Jefferson Blvd, Fort Wayne, Indiana 46804

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 260-969-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On July 20, 2015, Steel Dynamics, Inc. issued a press release titled “Steel Dynamics Reports Second Quarter 2015 Results.” A copy of that press release is attached hereto as Exhibit 99.1.

The information contained in Exhibit 99.1 is furnished under this Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing thereunder or under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished with this report:

|

Exhibit Number |

|

Description |

|

|

|

|

|

99.1 |

|

A press release dated July 20, 2015, titled “Steel Dynamics Reports Second Quarter 2015 Results.” |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

|

STEEL DYNAMICS, INC. |

|

|

|

|

|

|

|

|

|

/s/Theresa E. Wagler |

|

Date: July 22, 2015 |

|

By: |

Theresa E. Wagler |

|

|

|

Title: |

Executive Vice President and Chief Financial Officer |

2

Exhibit 99.1

|

Press Release

July 20, 2015 |

|

7575 W. Jefferson Blvd.

Fort Wayne, IN 46804

Steel Dynamics Reports Second Quarter 2015 Results

FORT WAYNE, INDIANA, July 20, 2015 / PRNewswire / Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced second quarter 2015 adjusted net income of $53 million, or $0.22 per diluted share, and adjusted operating income of $120 million, which excludes the following items:

· Excluding non-controlling interests, approximately $29 million, or $0.07 per diluted share, of expenses associated with the second quarter 2015 long-term idle of company’s Minnesota Operations. These costs include non-cash inventory valuation adjustments of approximately $21 million.

· Approximately $9 million, or $0.02 per diluted share, of reduced earnings related to a planned furnace maintenance outage at Iron Dynamics that generally is required once every five years.

Including these items, the company reported second quarter 2015 net income of $32 million, or $0.13 per diluted share, on net sales of $2.0 billion.

Comparatively, prior year second quarter net income was $72 million, or $0.31 per diluted share, on net sales of $2.1 billion, and sequential first quarter 2015 net sales were $2.0 billion, with adjusted net income of $40 million, or $0.17 per diluted share, which excluded the impact of refinancing charges of $0.04 per diluted share.

“The second quarter 2015 market environment remained extremely challenging for our steel and metals recycling operations,” said Mark D. Millett, Chief Executive Officer. “The ongoing flood of steel imports continued to pressure steel product pricing to a greater degree than the benefit realized from lower scrap costs, compressing second quarter steel margins. However, due to continued solid U.S. steel demand, our second quarter steel shipments improved, which offset most of the margin compression. Steel pricing has recently stabilized and domestic steel consumption from the automotive, manufacturing and construction sectors should support a stronger domestic steel industry in the second half of the year, predicated upon the expectation of reduced levels of imported steel and sustainable lower raw material costs.

“An important barometer for domestic steel consumption is the strength of the construction industry. Historically, the construction industry has been the largest single domestic steel consuming sector, and it is continuing to strengthen this year, “continued Millett. “For the second quarter 2015, our fabrication operations achieved record profitability. Strong demand has allowed for stable product pricing, while order inquiries and bookings remain robust, confirming the positive trend in the non-residential construction market.

“Despite the import headwinds, we achieved over a 20 percent improvement in sequential second quarter 2015 adjusted operating income (excluding the idled Minnesota Operations and the Iron Dynamics outage impact), based on record fabrication performance and significantly improved metals recycling results, as scrap pricing volatility subsided in the quarter. We believe the key scrap supply factors of export activity and the strength of the U.S. dollar will continue to mute extreme scrap pricing volatility,” concluded Millett.

The company generated strong cash flow from operations of $309 million during the second quarter 2015, representing a 32 percent increase from the sequential quarter. For the first six months of 2015, the company generated $544 million of cash flow from operations, and after considering the impact of capital expenditures, generated $488 million of free cash flow, or $2.02 per common share outstanding.

Additional Second Quarter 2015 Comments

While steel import levels remained high, continued strength in U.S. steel consumption resulted in increased steel and metals recycling shipments. Second quarter 2015 operating income for the company’s steel operations decreased 3 percent to $110 million, due to metal spread compression, which was largely offset by a 15 percent increase in steel shipments. Steel metal spread contracted in the second quarter 2015 as a function of the excessive import levels,

which caused steel product pricing to decline more rapidly than scrap raw material costs. The average product selling price for the company’s steel operations decreased $101 to $662 per ton. The average ferrous scrap cost per ton melted decreased $57 to $255 per ton.

Second quarter 2015 operating income attributable to the company’s sheet products decreased 15 percent when compared to the sequential quarter. Although the company’s flat roll shipments increased 24 percent, metal spread contracted meaningfully, as flat roll products were the most negatively impacted by high import volumes and existing customer inventory levels. Operating income from long products increased ten percent, as construction-related and rail volumes improved. Driven by stronger flat roll volume, the company’s steel production utilization rate significantly recovered to 87 percent for the second quarter 2015, which is higher than both the average U.S. domestic steel mill utilization rate and the company’s first quarter 2015 utilization rate of 73 percent.

The company’s metals recycling operations recorded second quarter 2015 operating income of $12.3 million compared to a slight operating loss in the first quarter 2015, based on both increased ferrous shipments and margins as steel mill utilization improved and scrap price volatility subsided.

The company’s fabrication operations continued to achieve record financial performance. Second quarter 2015 operating income of $27.7 million surpassed the fourth quarter 2014 previous record by 27 percent. Sustained strong demand combined with lower raw material steel costs, supported metal spread expansion.

As discussed in the company’s May 26, 2015, press release, management and the board of directors elected to idle the Minnesota Operations for an initial twenty-four month period given the significant and sustained decline in pig iron pricing, which resulted in the cost of iron nugget production being meaningfully higher than product selling values. The strength of the U.S. dollar and world iron ore supply support lower pig iron prices for the foreseeable future. Given the company’s Minnesota Operations were intended to serve as a hedge against high priced pig iron and scrap, the indefinite idle was a prudent and necessary response to the prevailing market environment. While the lower raw material cost environment advantages the company’s steel operations, it has resulted in an uneconomic situation for its Minnesota iron production operations.

Year-to-Date Comparison

For the first six months ended June 30, 2015, net income was $62 million, or $0.26 per diluted share, on net sales of $4.1 billion, as compared to net income of $111 million, or $0.48 per diluted share, on net sales of $3.9 billion for the six months ended June 30, 2014. Year-to-date consolidated net sales increased four percent, primarily as a result of the acquisition of the Columbus flat roll steel mill in September 2014, resulting in higher first half 2015 steel shipments that more than offset the 26 percent decline in metals recycling revenue. Year-to-date consolidated operating income decreased $36 million, or 17 percent, as the result of both decreased steel prices and the additional costs incurred in the second quarter 2015 from the company’s iron production facilities. Excluding the impact from idling the Minnesota iron production facilities and the Iron Dynamics maintenance outage, year-to-date adjusted consolidated operating income improved three percent, to $220 million, based on improved fabrication results. The average selling price for the company’s steel operations decreased $125 per ton. The average ferrous scrap cost per ton melted decreased $91 per ton.

Outlook

“Based on an expected reduction in steel import volume and sustained lower scrap costs, we anticipate improved financial results in the second half of 2015,” said Millett. “We continue to strengthen our financial position through strong cash flow generation, and the execution of our long-term strategy. We are well-positioned for additional growth. The recently announced paint line addition at our Columbus Flat Roll Division is an example of an investment that provides an excellent financial return, further diversifying our product capabilities into higher margin market segments at this facility. Customer focus, coupled with our market diversification and low-cost operating platforms, support our ability to maintain our best-in-class performance. We believe we are poised to capitalize on meaningful growth opportunities, both near-term and in the future, that will benefit our customers, shareholders, employees and communities,” concluded Millett.

Supplemental Quarterly Information

|

|

|

Second Quarter |

|

Year to Date |

|

|

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

1Q 2015 |

|

|

|

|

(Dollars in thousands) |

|

|

External Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Steel |

|

$ |

1,375,677 |

|

$ |

1,265,104 |

|

$ |

2,761,096 |

|

$ |

2,382,702 |

|

$ |

1,385,419 |

|

|

Fabrication |

|

154,513 |

|

134,852 |

|

315,536 |

|

250,713 |

|

161,023 |

|

|

Metals Recycling |

|

391,210 |

|

580,509 |

|

816,806 |

|

1,103,633 |

|

425,596 |

|

|

Ferrous Resources |

|

70,423 |

|

64,707 |

|

123,541 |

|

117,357 |

|

53,118 |

|

|

Other |

|

13,184 |

|

24,589 |

|

35,463 |

|

45,438 |

|

22,279 |

|

|

Consolidated |

|

$ |

2,005,007 |

|

$ |

2,069,761 |

|

$ |

4,052,442 |

|

$ |

3,899,843 |

|

$ |

2,047,435 |

|

|

Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

Steel |

|

$ |

109,961 |

|

$ |

158,083 |

|

$ |

223,532 |

|

$ |

265,859 |

|

$ |

113,571 |

|

|

Fabrication |

|

27,660 |

|

7,590 |

|

49,021 |

|

10,716 |

|

21,361 |

|

|

Metals Recycling |

|

12,300 |

|

18,398 |

|

11,820 |

|

27,947 |

|

(480 |

) |

|

Ferrous Resources |

|

(43,465 |

) |

(19,915 |

) |

(56,032 |

) |

(40,445 |

) |

(12,567 |

) |

|

Operations |

|

106,456 |

|

164,156 |

|

228,341 |

|

264,077 |

|

121,885 |

|

|

Non-cash Amortization of Intangible Assets |

|

(6,493 |

) |

(6,934 |

) |

(12,816 |

) |

(13,869 |

) |

(6,323 |

) |

|

Profit Sharing Expense |

|

(5,031 |

) |

(10,469 |

) |

(9,629 |

) |

(15,864 |

) |

(4,598 |

) |

|

Non-segment Operations |

|

(17,373 |

) |

(14,848 |

) |

(28,566 |

) |

(21,507 |

) |

(11,193 |

) |

|

Consolidated Operating Income |

|

77,559 |

|

131,905 |

|

177,330 |

|

212,837 |

|

99,771 |

|

|

Minnesota Idle Charges (Including Minority Interests) |

|

33,167 |

|

— |

|

33,167 |

|

— |

|

— |

|

|

Iron Dynamics Outage Impact |

|

9,403 |

|

— |

|

9,403 |

|

— |

|

— |

|

|

Adjusted Operating Income (1) |

|

$ |

120,129 |

|

$ |

131,905 |

|

$ |

219,900 |

|

$ |

212,837 |

|

$ |

99,771 |

|

|

External Shipments |

|

|

|

|

|

|

|

|

|

|

|

|

Steel (In tons) |

|

2,078,685 |

|

1,518,882 |

|

3,895,056 |

|

2,857,455 |

|

1,816,371 |

|

|

Steel Shipped to Internal Locations |

|

163,723 |

|

158,884 |

|

296,372 |

|

271,043 |

|

132,649 |

|

|

Fabrication (In tons) |

|

109,662 |

|

105,188 |

|

222,391 |

|

199,855 |

|

112,729 |

|

|

Metals Recycling |

|

|

|

|

|

|

|

|

|

|

|

|

Nonferrous (In 000’s of pounds) |

|

253,273 |

|

270,271 |

|

494,853 |

|

521,859 |

|

241,580 |

|

|

Ferrous (In gross tons) |

|

626,264 |

|

769,046 |

|

1,268,344 |

|

1,418,598 |

|

642,080 |

|

|

Ferrous Scrap Shipped to Internal Steel Mills |

|

731,491 |

|

653,651 |

|

1,322,412 |

|

1,368,632 |

|

590,921 |

|

|

Other Operating Information |

|

|

|

|

|

|

|

|

|

|

|

|

Steel |

|

|

|

|

|

|

|

|

|

|

|

|

Average External Sales Price (Per ton shipped) |

|

$ |

662 |

|

$ |

833 |

|

$ |

709 |

|

$ |

834 |

|

$ |

763 |

|

|

Average Ferrous Cost (Per ton melted) |

|

$ |

255 |

|

$ |

364 |

|

$ |

280 |

|

$ |

371 |

|

$ |

312 |

|

|

Flat Roll Shipments |

|

|

|

|

|

|

|

|

|

|

|

|

Butler Division |

|

721,115 |

|

778,220 |

|

1,300,608 |

|

1,419,740 |

|

579,493 |

|

|

Columbus Division (Acquired Sept 2014) |

|

693,772 |

|

— |

|

1,258,013 |

|

— |

|

564,241 |

|

|

The Techs |

|

182,239 |

|

191,934 |

|

328,173 |

|

345,171 |

|

145,934 |

|

|

Long Product Shipments |

|

|

|

|

|

|

|

|

|

|

|

|

Structural and Rail Division-Structural |

|

227,338 |

|

282,681 |

|

464,982 |

|

531,061 |

|

237,644 |

|

|

Structural and Rail Division-Rail |

|

74,912 |

|

53,699 |

|

141,620 |

|

97,635 |

|

66,708 |

|

|

Engineered Bar Products Division |

|

120,559 |

|

152,768 |

|

276,925 |

|

297,071 |

|

156,366 |

|

|

Roanoke Bar Division |

|

140,795 |

|

143,583 |

|

265,918 |

|

287,365 |

|

125,123 |

|

|

Steel of West Virginia-Specialty Shapes |

|

81,678 |

|

74,881 |

|

155,189 |

|

150,455 |

|

73,511 |

|

|

Total Steel Shipments (In tons) |

|

2,242,408 |

|

1,677,766 |

|

4,191,428 |

|

3,128,498 |

|

1,949,020 |

|

|

Steel Production (In tons) |

|

2,344,895 |

|

1,708,252 |

|

4,294,158 |

|

3,227,818 |

|

1,949,263 |

|

|

Fabrication |

|

|

|

|

|

|

|

|

|

|

|

|

Average External Sales Price (Per ton shipped) |

|

$ |

1,409 |

|

$ |

1,282 |

|

$ |

1,419 |

|

$ |

1,254 |

|

$ |

1,428 |

|

|

Consolidated EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Before Taxes |

|

$ |

41,608 |

|

$ |

103,610 |

|

$ |

82,100 |

|

$ |

154,604 |

|

$ |

40,492 |

|

|

Net Interest Expense |

|

36,890 |

|

29,860 |

|

79,764 |

|

60,207 |

|

42,874 |

|

|

Depreciation |

|

66,281 |

|

49,970 |

|

131,141 |

|

98,916 |

|

64,860 |

|

|

Amortization |

|

6,493 |

|

6,934 |

|

12,816 |

|

13,869 |

|

6,323 |

|

|

Noncontrolling Interest |

|

6,225 |

|

5,962 |

|

10,032 |

|

10,843 |

|

3,807 |

|

|

EBITDA |

|

157,497 |

|

196,336 |

|

315,853 |

|

338,439 |

|

158,356 |

|

|

Unrealized Hedging (Gain) Loss |

|

(1,808 |

) |

2,500 |

|

1,407 |

|

(1,567 |

) |

3,215 |

|

|

Inventory Valuation |

|

18,075 |

|

1,596 |

|

23,065 |

|

2,234 |

|

4,990 |

|

|

Equity Based Compensation |

|

6,356 |

|

4,700 |

|

13,555 |

|

9,389 |

|

7,199 |

|

|

Non-Cash Financing Expenses |

|

— |

|

— |

|

3,326 |

|

— |

|

3,326 |

|

|

Adjusted EBITDA |

|

$ |

180,120 |

|

$ |

205,132 |

|

$ |

357,206 |

|

$ |

348,495 |

|

$ |

177,086 |

|

(1) Amount excludes 2Q 2015 expenses associated with the idled Minnesota Operations (amount includes non-controlling interests of approximately $4 million) and the impact from the Q2 2015 Iron Dynamics planned furnace maintenance outage that generally is required once every 5 years.

Conference Call and Webcast

Steel Dynamics, Inc. will hold a conference call to discuss second quarter 2015 operating and financial results on Tuesday, July 21, 2015, at 10:00 a.m. Eastern Time. You may access the call and find dial-in information on the Investor Relations section of the company’s website at www.steeldynamics.com. A replay of the call will be available on our website until 11:59 p.m. Eastern Time on July 28, 2015.

About Steel Dynamics, Inc.

Steel Dynamics, Inc. is one of the largest domestic steel producers and metals recyclers in the United States based on estimated annual steelmaking and metals recycling capability, with annual sales of $8.8 billion in 2014, approximately 7,600 employees, and manufacturing facilities primarily located throughout the United States (including six steel mills, eight steel coating facilities, an iron production facility, approximately 90 metals recycling locations and six steel fabrication plants).

Note Regarding Non-GAAP Financial Measures

The company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Management believes that EBITDA and Adjusted EBITDA, non-GAAP financial measures, provide additional meaningful information regarding the company’s performance and financial strength. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the company’s reported results prepared in accordance with GAAP. In addition, because not all companies use identical calculations, EBITDA included in this release may not be comparable to similarly titled measures of other companies.

Forward-Looking Statement

This press release contains some predictive statements about future events, including statements related to conditions in the steel and metallic scrap markets, Steel Dynamics’ revenues, costs of purchased materials, future profitability and earnings, and the operation of new or existing facilities. These statements are intended to be made as “forward-looking,” subject to many risks and uncertainties, within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. These statements speak only as of this date and are based upon information and assumptions, which we consider reasonable as of this date, concerning our businesses and the environments in which they operate. Such predictive statements are not guarantees of future performance, and we undertake no duty to update or revise any such statements. Some factors that could cause such forward-looking statements to turn out differently than anticipated include: (1) the effects of uncertain economic conditions; (2) cyclical and changing industrial demand; (3) changes in conditions in any of the steel or scrap-consuming sectors of the economy which affect demand for our products, including the strength of the non-residential and residential construction, automotive, appliance, pipe and tube, and other steel-consuming industries; (4) fluctuations in the cost of key raw materials (including steel scrap, iron units, and energy costs) and our ability to pass-on any cost increases; (5) the impact of domestic and foreign import price competition; (6) unanticipated difficulties in integrating or starting up new or acquired businesses; (7) risks and uncertainties involving product and/or technology development; and (8) occurrences of unexpected plant outages or equipment failures.

More specifically, we refer you to SDI’s more detailed explanation of these and other factors and risks that may cause such predictive statements to turn out differently, as set forth in our most recent Annual Report on Form 10-K, in our quarterly reports on Form 10-Q or in other reports which we from time to time file with the Securities and Exchange Commission. These are available publicly on the SEC website, www.sec.gov, and on the Steel Dynamics website, www.steeldynamics.com.

Contact: Marlene Owen, Director Investor Relations —+1.260.969.3500

Steel Dynamics, Inc.

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(Dollars in thousands, except per share data)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

Three Months

Ended |

|

|

|

|

June 30, |

|

June 30, |

|

March 31, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

2,005,007 |

|

$ |

2,069,761 |

|

$ |

4,052,442 |

|

$ |

3,899,843 |

|

$ |

2,047,435 |

|

|

Costs of goods sold |

|

1,833,264 |

|

1,846,990 |

|

3,693,657 |

|

3,513,768 |

|

1,860,393 |

|

|

Gross profit |

|

171,743 |

|

222,771 |

|

358,785 |

|

386,075 |

|

187,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

82,660 |

|

73,463 |

|

159,010 |

|

143,505 |

|

76,350 |

|

|

Profit sharing |

|

5,031 |

|

10,469 |

|

9,629 |

|

15,864 |

|

4,598 |

|

|

Amortization of intangible assets |

|

6,493 |

|

6,934 |

|

12,816 |

|

13,869 |

|

6,323 |

|

|

Operating income |

|

77,559 |

|

131,905 |

|

177,330 |

|

212,837 |

|

99,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of capitalized interest |

|

37,163 |

|

30,050 |

|

80,250 |

|

60,619 |

|

43,087 |

|

|

Other expense (income), net |

|

(1,212 |

) |

(1,754 |

) |

14,980 |

|

(2,385 |

) |

16,192 |

|

|

Income before income taxes |

|

41,608 |

|

103,609 |

|

82,100 |

|

154,603 |

|

40,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

16,283 |

|

37,268 |

|

29,821 |

|

54,564 |

|

13,538 |

|

|

Net income |

|

25,325 |

|

66,341 |

|

52,279 |

|

100,039 |

|

26,954 |

|

|

Net loss attributable to noncontrolling interests |

|

6,225 |

|

5,962 |

|

10,032 |

|

10,843 |

|

3,807 |

|

|

Net income attributable to Steel Dynamics, Inc. |

|

$ |

31,550 |

|

$ |

72,303 |

|

$ |

62,311 |

|

$ |

110,882 |

|

$ |

30,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share attributable to Steel Dynamics, Inc. stockholders |

|

$ |

0.13 |

|

$ |

0.32 |

|

$ |

0.26 |

|

$ |

0.49 |

|

$ |

0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares |

|

241,900 |

|

226,220 |

|

241,718 |

|

224,615 |

|

241,535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share attributable to Steel Dynamics, Inc. stockholders, including the effect of assumed conversions when dilutive |

|

$ |

0.13 |

|

$ |

0.31 |

|

$ |

0.26 |

|

$ |

0.48 |

|

$ |

0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares and equivalents |

|

243,491 |

|

242,048 |

|

243,179 |

|

241,721 |

|

242,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

0.1375 |

|

$ |

0.115 |

|

$ |

0.2750 |

|

$ |

0.230 |

|

$ |

0.1375 |

|

Steel Dynamics, Inc.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

|

|

|

June 30,

2015 |

|

December 31,

2014 |

|

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and equivalents |

|

$ |

419,401 |

|

$ |

361,363 |

|

|

Accounts receivable, net |

|

816,522 |

|

902,825 |

|

|

Inventories |

|

1,292,069 |

|

1,618,419 |

|

|

Deferred income taxes |

|

31,396 |

|

35,503 |

|

|

Other current assets |

|

32,004 |

|

55,655 |

|

|

Total current assets |

|

2,591,392 |

|

2,973,765 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

3,047,401 |

|

3,123,906 |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

19,571 |

|

19,312 |

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

358,402 |

|

370,669 |

|

|

|

|

|

|

|

|

|

Goodwill |

|

741,898 |

|

745,158 |

|

|

|

|

|

|

|

|

|

Other assets |

|

68,099 |

|

78,217 |

|

|

Total assets |

|

$ |

6,826,763 |

|

$ |

7,311,027 |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

446,698 |

|

$ |

511,056 |

|

|

Income taxes payable |

|

2,411 |

|

6,086 |

|

|

Accrued expenses |

|

214,404 |

|

286,980 |

|

|

Current maturities of long-term debt |

|

35,075 |

|

46,460 |

|

|

Total current liabilities |

|

698,588 |

|

850,582 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

|

|

|

|

Senior term loan |

|

231,250 |

|

237,500 |

|

|

Senior notes |

|

2,350,000 |

|

2,700,000 |

|

|

Other long-term debt |

|

38,324 |

|

40,206 |

|

|

Total long-term debt |

|

2,619,574 |

|

2,977,706 |

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

567,754 |

|

542,033 |

|

|

Other liabilities |

|

16,147 |

|

18,839 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests |

|

125,972 |

|

126,340 |

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Common stock |

|

636 |

|

635 |

|

|

Treasury stock, at cost |

|

(396,491 |

) |

(398,898 |

) |

|

Additional paid-in capital |

|

1,099,669 |

|

1,083,435 |

|

|

Retained earnings |

|

2,223,599 |

|

2,227,843 |

|

|

Total Steel Dynamics, Inc. equity |

|

2,927,413 |

|

2,913,015 |

|

|

Non-controlling interests |

|

(128,685 |

) |

(117,488 |

) |

|

Total equity |

|

2,798,728 |

|

2,795,527 |

|

|

Total liabilities and equity |

|

$ |

6,826,763 |

|

$ |

7,311,027 |

|

Steel Dynamics, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Dollars in thousands)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

25,325 |

|

$ |

66,341 |

|

$ |

52,279 |

|

$ |

100,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

74,273 |

|

58,441 |

|

147,095 |

|

116,009 |

|

|

Equity-based compensation |

|

6,357 |

|

4,700 |

|

14,900 |

|

10,468 |

|

|

Deferred income taxes |

|

16,367 |

|

(280 |

) |

33,084 |

|

(4,371 |

) |

|

Changes in certain assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

(47,149 |

) |

(99,696 |

) |

85,935 |

|

(188,646 |

) |

|

Inventories |

|

161,174 |

|

11,230 |

|

326,173 |

|

(6,124 |

) |

|

Accounts payable |

|

62,735 |

|

13,385 |

|

(64,318 |

) |

18,426 |

|

|

Income taxes receivable / payable |

|

(6,844 |

) |

(4,964 |

) |

9,421 |

|

14,429 |

|

|

Other assets and liabilities |

|

16,974 |

|

26,857 |

|

(60,650 |

) |

(11,463 |

) |

|

Net cash provided by operating activities |

|

309,212 |

|

76,014 |

|

543,919 |

|

48,767 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

(22,821 |

) |

(33,534 |

) |

(56,172 |

) |

(58,375 |

) |

|

Other investing activities |

|

806 |

|

2,314 |

|

2,469 |

|

31,198 |

|

|

Net cash used in investing activities |

|

(22,015 |

) |

(31,220 |

) |

(53,703 |

) |

(27,177 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

Issuance of current and long-term debt |

|

60,941 |

|

63,945 |

|

111,034 |

|

107,398 |

|

|

Repayment of current and long-term debt |

|

(60,557 |

) |

(76,412 |

) |

(488,008 |

) |

(132,658 |

) |

|

Exercise of stock option proceeds, including related tax effect |

|

5,206 |

|

8,516 |

|

6,959 |

|

11,421 |

|

|

Contributions from noncontrolling investors, net |

|

(1,135 |

) |

(606 |

) |

(1,164 |

) |

4,764 |

|

|

Dividends paid |

|

(33,233 |

) |

(25,666 |

) |

(60,999 |

) |

(50,181 |

) |

|

Net cash used in financing activities |

|

(28,778 |

) |

(30,223 |

) |

(432,178 |

) |

(59,256 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and equivalents |

|

258,419 |

|

14,571 |

|

58,038 |

|

(37,666 |

) |

|

Cash and equivalents at beginning of period |

|

160,982 |

|

342,919 |

|

361,363 |

|

395,156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and equivalents at end of period |

|

$ |

419,401 |

|

$ |

357,490 |

|

$ |

419,401 |

|

$ |

357,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure information: |

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

48,550 |

|

$ |

20,838 |

|

$ |

88,644 |

|

$ |

60,501 |

|

|

Cash paid (received) for federal and state income taxes, net |

|

$ |

7,046 |

|

$ |

43,008 |

|

$ |

(11,493 |

) |

$ |

45,151 |

|

Steel Dynamics (NASDAQ:STLD)

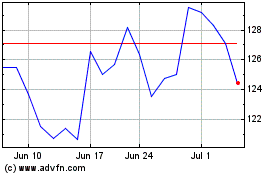

Historical Stock Chart

From Apr 2024 to May 2024

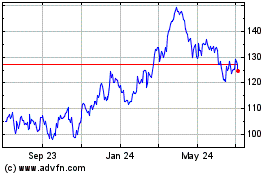

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From May 2023 to May 2024