UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 5, 2015

Marriott Vacations Worldwide Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35219 |

|

45-2598330 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 6649 Westwood Blvd., Orlando, FL |

|

32821 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (407) 206-6000

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 5, 2015, at the Annual Meeting of Shareholders (the “Annual Meeting”), the shareholders of Marriott Vacations Worldwide

Corporation (the “Company”) approved the Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan (the “ESPP”), including the issuance of up to 500,000 shares of the Company’s common stock thereunder. The ESPP

previously had been approved, subject to shareholder approval, by the Board of Directors of the Company.

A more detailed summary of the

material features of the ESPP is set forth in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on April 21, 2015 under the caption “Item 2 – Approval of the Marriott

Vacations Worldwide Corporation Employee Stock Purchase Plan. That summary and the foregoing description are each qualified in its entirety by reference to the text of the ESPP, which is attached to this report as Exhibit 10.1.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

At the Annual Meeting on

June 5, 2015, a total of 29,030,673 shares of the Company’s common stock (91.5% of all shares entitled to vote at the Annual Meeting) were represented, in person or by proxy. At the Annual Meeting, shareholders considered: (1) the

election of Melquiades R. Martinez and Stephen P. Weisz as Class III Directors; (2) the approval of the Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan, including the issuance of up to 500,000 shares thereunder;

(3) the ratification of the selection by the Company’s Audit Committee of Ernst & Young LLP as the Company’s independent auditors for the current fiscal year; and (4) the approval of an advisory resolution on executive

compensation. The Company’s shareholders voted as follows on these matters:

(1) The Company’s shareholders elected the three

director nominees named in the Proxy Statement as Class II directors with the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

For |

|

|

Withheld |

|

|

Broker

Non-Votes |

|

| Melquiades R. Martinez |

|

|

23,491,627 |

|

|

|

743,726 |

|

|

|

4,795,320 |

|

| Stephen P. Weisz |

|

|

24,016,724 |

|

|

|

218,629 |

|

|

|

4,795,320 |

|

(2) The Company’s shareholders approved the Marriott Vacations Worldwide Corporation Employee Stock

Purchase Plan, including the issuance of up to 500,000 shares thereunder, with the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker

Non-Votes |

|

| 24,091,549 |

|

|

81,439 |

|

|

|

62,365 |

|

|

|

4,795,320 |

|

(3) The Company’s shareholders ratified the selection by the Company’s Audit Committee of

Ernst & Young LLP as the Company’s independent auditors for the current fiscal year with the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker

Non-Votes |

|

| 28,888,546 |

|

|

100,667 |

|

|

|

41,460 |

|

|

|

— |

|

(4) The Company’s shareholders approved an advisory resolution on executive compensation with the

following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstain |

|

|

Broker

Non-Votes |

|

| 23,522,039 |

|

|

630,704 |

|

|

|

82,610 |

|

|

|

4,795,320 |

|

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit 10.1 |

|

Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MARRIOTT VACATIONS WORLDWIDE CORPORATION

(Registrant) |

|

|

|

|

| Date: June 11, 2015 |

|

|

|

By: |

|

/s/ John E. Geller, Jr. |

|

|

|

|

Name: |

|

John E. Geller, Jr. |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan. |

Exhibit 10.1

MARRIOTT VACATIONS WORLDWIDE CORPORATION

EMPLOYEE STOCK PURCHASE PLAN

1. Purpose.

Marriott

Vacations Worldwide Corporation establishes this Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan to provide eligible employees of the Participating Companies with an opportunity to become owners of the Company through the

purchase of shares of common stock of the Company. The Company intends that the Plan, and all rights granted hereunder, will meet the requirements of an “employee stock purchase plan” within the meaning of Code Section 423 and the

Plan shall be interpreted, construed and administered in all respects so as to be consistent with such requirements.

2. Definitions.

The following terms, when the initial letter is capitalized in this document, shall have the meaning set forth below:

(a) Affiliate shall mean any parent or subsidiary corporation of the Company (as determined in accordance with Code Section 424),

including any that are subsequently established.

(b) Board shall mean the Company’s Board of Directors, or any committee of

the Board to which the Board has delegated its authority hereunder, in whole or part.

(c) Change in Control shall have the meaning

given in the Marriott Vacations Worldwide Corporation Amended and Restated Stock and Cash Incentive Plan, as it may be amended from time to time, or any successor plan thereto.

(d) Code shall mean the Internal Revenue Code of 1986, as amended. Any reference to a particular provision of the Code shall include any

successor provisions thereto and the regulations promulgated thereunder.

(e) Common Stock shall mean the Company’s common

stock, par value $0.01 per share.

(f) Company shall mean Marriott Vacations Worldwide Corporation, a Delaware corporation, and any

corporate successor thereto.

(g) Compensation shall have the meaning determined by the Plan Administrator (or its designee) from

time to time. Specifically, the Plan Administrator (or its designee) shall have the authority to determine and approve the types of pay to be included in (or excluded from) the definition of Compensation and may change the definition on a

prospective basis.

(h) Eligible Employee shall mean any person who is employed by a Participating Company as an employee.

Notwithstanding the foregoing, the Plan Administrator may determine, in advance of any Offering Period, that the following group(s) of otherwise Eligible Employees shall be ineligible to participate in the Plan:

(i) Employees whose customary employment is twenty (20) hours of service or less per week (or such lesser number of hours as may be

specified by the Plan Administrator);

(ii) Employees who have been employed less than six (6) months (or such lesser period of

employment as may be specified by the Plan Administrator);

(iii) Employees whose customary employment is five (5) or fewer months in

any calendar year (or such lesser period of customary employment as may be specified by the Plan Administrator); and/or

(iv) Employees

who are “officers” within the meaning of Rule 16a-1(f) under the Securities Exchange Act of 1934 as may be specified by the Plan Administrator.

Notwithstanding the foregoing, employees of a Participating Company who are citizens or residents

of a foreign jurisdiction (without regard to whether they are also citizens of the United States or resident aliens within the meaning of Code Section 7701(b)(1)(A)) shall not be considered Eligible Employees for an Offering Period if

(A) the grant of a purchase right under the Plan to such citizen or resident is prohibited under the laws of such jurisdiction or (B) compliance with the laws of the foreign jurisdiction would cause the Plan or offering to violate the

requirements of Code Section 423.

(i) Entry Date shall mean the date an Eligible Employee may commence participation in an

Offering Period pursuant to Section 6. The first day of an Offering Period shall always be an Entry Date. The Plan Administrator may, in its discretion, permit other Entry Dates during an Offering Period.

(j) Fair Market Value shall mean the average of the highest and lowest quoted selling prices for the shares of Common Stock on the

applicable date (or if there were no sales on such date, the average so computed on the nearest day before the applicable date), as reported in The Wall Street Journal or a similar publication selected by the Plan Administrator.

(k) Offering Period shall mean, unless otherwise determined by the Plan Administrator, each fiscal quarter of the Company. The Plan

Administrator shall have the authority to establish additional Offering Periods, a different duration for one or more Offering Periods, and/or different commencement dates for any Offering Periods, provided that no Offering Period shall have a

duration exceeding five years.

(l) Participant shall mean an Eligible Employee who has elected to participate in the Plan in

accordance with rules established by the Plan Administrator.

(m) Participating Company shall mean, with respect to an Offering

Period, the Company and any of its Affiliates if so designated by the Plan Administrator prior to an Offering Period. If the Plan Administrator designates the Company or any of its Affiliates as a Participating Employer for an Offering Period, such

entity shall remain a Participating Employer for all subsequent Offering Periods until the Plan Administrator determines otherwise.

(n)

Plan shall mean this Marriott Vacations Worldwide Corporation Employee Stock Purchase Plan, as it may be amended from time to time.

(o) Plan Administrator shall mean a committee of the Board, which may include a committee comprised of the Chairperson of the

Compensation Policy Committee and the Chief Executive Officer of the Company, designated by the Board to administer the Plan.

(p)

Purchase Date shall mean the last business day of each Offering Period.

(q) Securities Act shall mean the Securities Act of

1933, as amended. Any reference to a particular provision of the Securities Act shall include any successor provisions thereto and any regulations promulgated thereunder.

(r) Shares shall mean shares of Common Stock.

3. Administration of the Plan.

The Plan Administrator shall have the sole and discretionary authority to administer the Plan, including, without limitation, the authority

to: (a) construe, interpret, and apply the provisions of the Plan, and, in connection therewith, to make factual determinations; (b) establish the policies, interpretations, practices, and procedures of this Plan (provided that they are

compliant with Code Section 423); (c) prescribe and require the use of appropriate forms (including electronic forms); (d) prepare all reports, notices, and any other documents relating to the Plan which may be required by law;

(e) hire all persons providing services to the Plan; and (f) delegate to one or more individuals such duties and functions relating to the operation and administration of the Plan as the Plan Administrator so determines, except to the

extent prohibited by applicable law.

Decisions of the Plan Administrator shall be final and binding on all parties having an interest in

the Plan.

2

4. Stock Subject to Plan.

(a) General. The stock purchasable under the Plan shall be authorized but unissued or reacquired Shares and/or Shares purchased on the

open market, as determined by the Plan Administrator. Subject to Article 4(b) below, the maximum number of shares of Common Stock which may be purchased in the aggregate under the Plan shall be 500,000 Shares.

(b) Changes to Common Stock. Should any change be made to the Common Stock by reason of any stock split, stock dividend,

recapitalization, combination of shares, exchange of shares or other change affecting the outstanding Common Stock as a class without the Company’s receipt of consideration, the Plan Administrator shall make equitable adjustments, in order to

prevent the dilution or enlargement of benefits hereunder, to the following: (i) the maximum number and class of securities issuable in the aggregate under the Plan, (ii) the maximum number and class of securities purchasable per

Participant and in the aggregate on any one Purchase Date, and (iii) the number and class of securities and the price per share in effect under each outstanding purchase right.

5. Offering Periods.

(a) General. Shares shall be offered for purchase under the Plan through a series of successive Offering Periods, the first of

which shall begin on July 1, 2015 or such other date as the Plan Administrator may designate. The Plan Administrator shall designate the commencement date of subsequent Offering Periods.

(b) Separate Offerings. Unless otherwise specified by the Plan Administrator, each offering to Eligible Employees shall be deemed a

separate offering, even if the dates and other terms of the applicable Offering Periods of each such offering are identical, and the provisions of the Plan will separately apply to each offering. To the extent permitted by Treasury Regulations

Section 1.423-2(a)(1), the terms of each separate offering need not be identical, provided that the terms of the Plan and an offering together satisfy Treasury Regulations Sections 1.423-2(a)(2) and (a)(3).

6. Eligibility and Participation.

(a) Eligibility. Each individual who is an Eligible Employee and who is enrolled on the first day of an Offering Period shall

participate in the Offering Period.

(b) Participation. To participate in the Plan, an Eligible Employee must complete the

enrollment forms prescribed by the Plan Administrator or its designee (which may include a stock purchase agreement and/or, to the extent applicable, a payroll deduction authorization) by the deadline established by the Plan Administrator, and

follow any other procedures for enrollment in the Plan as may be established by the Plan Administrator (or its designee) on or before the deadline established by the Plan Administrator for that Entry Date. Unless otherwise determined by the Plan

Administrator, once an Eligible Employee has enrolled in an Offering Period, his or her enrollment will remain in effect through subsequent Offering Periods on the terms then in effect unless the Eligible Employee voluntarily ceases payroll

deductions pursuant to Section 8(a), withdraws from an Offering Period pursuant to Section 8(b) hereof or ceases to be an Eligible Employee.

(c) Rights and Privileges. Except for differences that are required in order to comply with the laws of a foreign jurisdiction or are

otherwise consistent with Code Section 423(b)(5), all Eligible Employees who participate in the Plan shall have the same rights and privileges under the Plan.

7. Payroll Deductions.

(a) General. Except as otherwise provided by the Plan Administrator prior to the commencement of an Offering Period, an Eligible

Employee may authorize, for purposes of acquiring shares during an Offering Period, payroll deductions of either a flat dollar amount per pay period or any multiple of one percent (1%) of the Eligible Employee’s Compensation during such

Offering Period, up to a maximum established by the Plan Administrator for the Offering Period.

3

(b) Duration and Use. Payroll deductions shall begin on the first pay day following the

Eligible Employee’s Entry Date and shall continue through the pay day ending coincident with or immediately prior to the Purchase Date (unless sooner terminated pursuant to Section 8 hereof). The amounts so collected shall be credited to a

bookkeeping account established for the Participant under the Plan. No interest shall be paid on the balance credited in the Participant’s account, unless payment of interest is required under applicable law. The amounts so collected may be

commingled with the general assets of the Company and used for general corporate purposes and shall not be required to be held in a trust fund or in any segregated account, unless segregation is otherwise required under applicable law.

(c) Modifications. Except as provided in Section 8, an Eligible Employee may not change his or her payroll deduction election

during an Offering Period.

(d) Alternative Forms. Notwithstanding any other provisions of the Plan to the contrary, in locations

where the laws of a foreign jurisdiction prohibit payroll deductions, an Eligible Employee may elect to participate through contributions to his or her account under the Plan in a form acceptable to the Plan Administrator (or its designee).

8. Termination of Participation.

(a) Voluntary Cessation of Contributions. A Participant may, at any time and for any reason, voluntarily cease contributions to the

Plan during an Offering Period by notification delivered to the Plan Administrator (or its designee). Payroll deductions shall cease as soon as practicable after the Plan Administrator (or its designee) receives such notice. If a Participant elects

to cease contributions during an Offering Period, then (i) the Participant may not re-start payroll deductions for the remainder of the Offering Period and (ii) the balance in the Participant’s account determined as of the effective

date of the cessation shall be used at the next Purchase Date to purchase Shares under the Plan in accordance with the terms hereof. A Participant’s cessation of contributions to the Plan during an Offering Period shall have no effect on his or

her eligibility to participate in any subsequent Offering Period, provided the individual continues to qualify as an Eligible Employee. In order to resume participation in a subsequent Offering Period, such individual must re-enroll in the Plan (by

timely completing the required enrollment forms) by the deadline established by the Plan Administrator for the Entry Date for that next Offering Period.

(b) Withdrawal from Plan. A Participant (including a Participant who previously elected to have contributions cease in accordance with

Section 8(a)), may, at any time and for any reason, voluntarily withdraw from participation in the Plan for an Offering Period by notification of withdrawal delivered to the Plan Administrator (or its designee). If a Participant elects to

withdraw from participation during an Offering Period, then (i) payroll deductions for the remainder of the Offering Period shall cease (and may not be restarted for the remainder of the Offering Period), (ii) participation in the Plan for

that Offering Period shall terminate, (iii) the balance in the Participant’s account determined as of the effective date of his withdrawal shall be paid to the Participant in cash as soon as practicable following the effective date of the

withdrawal, and (iv) no Shares will be purchased on behalf of the Participant for the Offering Period in which the withdrawal occurs. A Participant’s withdrawal from the Plan during an Offering Period shall have no effect on his or her

eligibility to participate in any subsequent Offering Period, provided the individual continues to qualify as an Eligible Employee. In order to resume participation in a subsequent Offering Period, such individual must re-enroll in the Plan (by

timely completing the required enrollment forms) on or before his or her scheduled Entry Date for that next Offering Period.

(c)

Cessation of Eligibility. Participation in the Plan shall be automatically terminated if a Participant ceases to be an Eligible Employee for any reason (including termination of employment, death, or change in status) while his or her

purchase right remains outstanding. In such case, the balance in the Participant’s Plan account determined on the date such Participant no longer qualifies as an Eligible Employee shall be paid in cash to the Participant (or, in the case of

death, to the Participant’s heirs or estate) as soon as practicable following such date and no Shares will be purchased on behalf of the Participant for the Offering Period in which such termination occurs.

4

(d) Leaves of Absence. The Plan Administrator may also establish policies and procedures

for determining when leaves of absence or changes of employment status will be considered to be a termination of employment for purposes of Section 8(c); provided that such procedures do not conflict with Code Section 423.

9. Purchase Rights.

(a)

Grant of Purchase Right. A Participant shall be granted a separate purchase right for each Offering Period in which he or she participates. The purchase right shall be granted on the Participant’s Entry Date into the Offering Period and

shall provide the Participant with the right to purchase shares of Common Stock over the course or at the end of such Offering Period, upon the terms set forth in this Section 9. The Plan Administrator may require the Participant to execute a

stock purchase agreement embodying such terms and such other provisions (not inconsistent with the Plan) as the Plan Administrator (or its designee) prescribes.

(b) Exercise of Purchase Right and Delivery of Shares. Each purchase right shall be automatically exercised on the Purchase Date for

the Offering Period. On such date, Shares shall be purchased on behalf of each Participant (other than Participants whose payroll deductions have been previously refunded pursuant to Section 8 hereof). The purchase shall be effected by applying

the Participant’s payroll deductions for the Offering Period to the purchase of whole Shares at the purchase price in effect for the Participant for that Purchase Date. As soon as reasonably practicable after each Purchase Date, the Company

will arrange for delivery to each Participant of the Shares purchased on his behalf in the form (which may include book entry) determined by the Plan Administrator (in its sole discretion) and pursuant to the rules established by the Plan

Administrator. The Company may permit or require that Shares be deposited directly with a broker designated by the Company or to a designated agent of the Company, and the Company may utilize electronic or automated methods of share transfer. The

Company may require that Shares be retained with such broker or agent for a designated period of time and/or may establish procedures to permit tracking of disposition of such Shares.

(c) Purchase Price. The purchase price per share at which Common Stock will be purchased on the Participant’s behalf on each

Purchase Date shall be established by the Plan Administrator prior to the beginning of an Offering Period; provided however, that such purchase price shall not be less than ninety-five percent (95%) of the Fair Market Value per share of Common

Stock on that Purchase Date.

(d) Number of Purchasable Shares. The number of Shares purchasable by a Participant on each Purchase

Date shall be the number of whole Shares obtained by dividing the Participant’s payroll deductions during the Offering Period by the purchase price in effect for that Purchase Date. However, the Plan Administrator may prescribe, prior to the

commencement of an Offering Period, a maximum number of Shares purchasable per Participant and/or a maximum number of Shares purchasable in the aggregate by all Participants on any Purchase Date, each subject to periodic adjustments in the event of

certain changes in the Company’s capitalization. Should the total number of Shares to be purchased by all Participants exceed the maximum limitation established by the Plan Administrator, the Plan Administrator shall make a pro-rata allocation

of the available Shares on a uniform and nondiscriminatory basis.

(e) Excess Payroll Deductions. Any payroll deductions not

applied to the purchase of Shares on any Purchase Date will be promptly refunded to the Participant following the last day of the Offering Period; provided that any amount representing a fractional share shall be carried forward and applied for the

next Offering Period.

(f) Proration of Purchase Rights. Should the total number of Shares to be purchased on any particular

Purchase Date exceed the number of Shares then available for issuance under the Plan, the Plan Administrator shall make a pro-rata allocation of the available Shares on a uniform and nondiscriminatory basis, and the payroll deductions of each

Participant, to the extent in excess of the aggregate purchase price payable for the Shares allocated to such individual, shall be refunded.

(g) Limitations on Purchase Rights. Notwithstanding anything herein to the contrary,

(i) no Participant shall be granted purchase rights under the Plan if such individual would, immediately after the grant, own (within the

meaning of Code Section 424(d)) or hold outstanding options or other rights to purchase, stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or any Affiliate; and

5

(ii) no Participant shall be entitled to accrue rights to acquire Common Stock pursuant to any

purchase right outstanding under this Plan if and to the extent such accrual, when aggregated with (A) rights to purchase Common Stock accrued under any other purchase right granted under this Plan and (B) similar rights accrued under

other employee stock purchase plans (within the meaning of Code Section 423) of the Company or any Affiliate, would permit such Participant to purchase more than Twenty-Five Thousand Dollars ($25,000) worth of Common Stock or stock of any

Affiliate (determined on the basis of the Fair Market Value per share on the date or dates such rights are treated as granted under Code Section 423) for each calendar year such rights are at any time outstanding. If by reason of such accrual

limitation, the purchase right of a Participant does not accrue for a particular Offering Period, then the Participant’s payroll deductions shall automatically be discontinued and shall resume at the same rate at the beginning of the first

offering period in the next calendar year (if the Participant is then an Eligible Employee).

The requirements set forth under this

provision will be interpreted and applied to comply with current requirements under Code Section 423. In the event there is any conflict between the provisions of this Section and one or more provisions of the Plan or any instrument issued

thereunder, the provisions of this Section shall be controlling.

10. Change in Control.

In the event of a Change in Control, the Board may provide for any of, or a combination of any of, the following: (a) each purchase right

shall be assumed or an equivalent purchase right shall be substituted by the successor entity or parent or subsidiary of such successor entity, (b) a date selected by the Board on or before the date of consummation of such Change in Control

shall be treated as a Purchase Date and all outstanding purchase rights shall be exercised on such date, (c) all outstanding purchase rights shall terminate and the accumulated payroll deductions will be refunded to each Participant upon or

immediately prior to the Change in Control, or (d) outstanding purchase rights shall continue unchanged.

11. Effective Date;

Compliance with Laws; Plan Term.

(a) Effective Date. The Plan is effective on July 1, 2015, provided the Company’s

shareholders have approved the Plan prior to such effective date. Notwithstanding the foregoing, the Plan Administrator may, prior to the Plan’s effective date, permit Eligible Employees to enroll in the Plan so that the first Offering Period

may commence on July 1, 2015, provided that such enrollment is contingent on shareholder approval of the Plan.

(b) Compliance

with Laws. The inability of the Company to obtain from any regulatory body having jurisdiction and the authority, if any, deemed by the Company’s legal counsel to be necessary for the lawful issuance and sale of any shares under the Plan

shall relieve the Company of any liability in respect of the failure to issue or sell such shares as to which such requisite authority shall not have been obtained. As a condition to the exercise of a purchase right, the Company may require the

Participant to satisfy any qualifications that may be necessary or appropriate, to evidence compliance with any applicable law or regulation, and to make any representation or warranty with respect thereto as may be requested by the Company.

(c) Plan Term. The Plan shall terminate upon the earlier of (i) the date on which all shares available for issuance under the Plan

shall have been sold pursuant to purchase rights exercised under the Plan, or (ii) the date determined by the Board in its sole discretion. Following the Plan’s termination, no further purchase rights shall be granted or exercised, and no

further payroll deductions shall be collected. If the Plan is terminated by the Board pursuant to clause (ii) hereof, then all outstanding purchase rights shall terminate and the accumulated payroll deductions will be refunded to each

Participant upon or immediately prior to the termination date established by the Board.

6

12. Amendment.

(a) General. The Board or the Plan Administrator may alter, amend, or suspend the Plan at any time. If the Board or the Plan

Administrator suspends the Plan, then all outstanding purchase rights shall terminate and the accumulated payroll deductions will be refunded to each Participant upon or immediately prior to the suspension date established by the Board or Plan

Administrator.

(b) Shareholder Approval. To the extent necessary to comply with Code Section 423 (or any successor rule or

provision or any other applicable law, regulation or stock exchange rule), the Company shall obtain shareholder approval for any amendment to the Plan in such a manner and to such a degree as required.

13. Rules for Foreign Jurisdictions.

The Board or Plan Administrator may adopt rules or procedures relating to the operation and administration of the Plan to accommodate the

specific requirements of the laws and procedures of a foreign jurisdiction. Without limiting the generality of the foregoing, the Plan Administrator is specifically authorized to adopt rules and procedures regarding handling of payroll deductions or

other contributions by Participants, establishment of accounts to hold payroll deductions or other contributions, payment of interest, conversion of local currency, payroll tax, withholding procedures and handling of share certificates which vary

according to local requirements; however, to the extent any such varying provisions are not in accordance with the provisions of Code Section 423(b), including but not limited to the requirements of Code Section 423(b)(5) that all purchase

rights granted under the Plan shall provide the same rights and privileges unless otherwise provided under the Code, the individuals affected by such varying provisions shall be deemed not to be Eligible Employees.

14. Miscellaneous.

(a)

Compliance with Applicable Laws; Limits on Issuance. Notwithstanding any other provision of the Plan, the Company shall have no liability to deliver any Shares under the Plan unless such delivery or distribution would comply with all

applicable laws, including, without limitation, the requirements of the Securities Act, and the applicable requirements of any securities exchange or similar entity on which the Common Stock is listed. Prior to the issuance of any Shares under the

Plan, the Company may require a written statement that the recipient is acquiring the Shares for investment and not for the purpose or with the intention of distributing the Shares and will not dispose of them in violation of the registration

requirements of the Securities Act. All Shares acquired pursuant to purchase rights granted hereunder shall be subject to any applicable restrictions contained in the Company’s by-laws. In addition, the Plan Administrator may impose such

restrictions on any Shares acquired pursuant to the exercise of purchase rights hereunder as it may deem advisable, including, without limitation, restrictions under applicable securities laws, under the requirements of any stock exchange or market

upon which such Shares are then listed and/or traded, and restrictions under any blue sky or state securities laws applicable to such Shares.

(b) Transferability. A purchase right granted under the Plan may be exercised during a Participant’s lifetime only by the

Participant. Neither the right of a Participant to purchase Shares hereunder, nor his Plan account balance, may be transferred, pledged, assigned, or otherwise disposed of in any way other than by will or the laws of descent and distribution, and

any such attempted transfer, pledge, assignment, or other disposition shall be null and void and without effect. If a Participant in any manner attempts to transfer, assign, or otherwise encumber his or her rights or interests under the Plan, other

than by will or the laws of descent and distribution or as permitted by the Code, the Plan Administrator may treat such act as an election by the Participant to discontinue participation in the Plan pursuant to Section 8(b).

(c) Withholding. Each Participating Company shall have the right to withhold all applicable taxes with respect to the exercise of a

purchase right hereunder, or the subsequent sale of any Shares acquired hereunder, from any amounts owed to the Participant, or may require a Participant, as a condition to the exercise of the purchase right or the sale of such Shares to remit such

taxes to the Participating Company or make other arrangements satisfactory to the Participating Company with respect thereto, which may include, at the Plan Administrator’s discretion, electing to have any Shares issued under the Plan withheld

or to surrender to the Company or the Participating Company Shares already owned by the Participant to fulfill any tax withholding obligation; provided, however, in no event shall the fair market value of the number of Shares so withheld (or

accepted) exceed the amount necessary to meet the minimum Federal, state and local marginal tax rates then in effect that are applicable to the Participant and to the particular transaction.

7

(d) Limitation of Implied Rights. The Plan does not constitute a contract of employment or

continued service and participation in the Plan will not give any employee the right to be retained in the employ of any Participating Company or any right or claim to any benefit under the Plan unless such right or claim has specifically accrued

under the terms of the Plan. Participation in the Plan by a Participant shall not create any rights in such Participant as a shareholder of the Company until Shares are registered in the name of the Participant.

(e) Gender and Number. Where the context admits, words in one gender shall include the other gender, words in the singular shall

include the plural and the plural shall include the singular.

(f) Governing Law; Limitations on Actions. The Plan shall be

construed in accordance with and governed by the laws of the State of Delaware, without reference to any conflict of law principles thereof. Any legal action or proceeding with respect to this Plan must be brought within one year (365 days) after

the day the complaining party first knew or should have known of the events giving rise to the complaint.

(g) Severability. If any

provision of the Plan (i) is or becomes or is deemed to be invalid, illegal or unenforceable in any jurisdiction, or as to any person or purchase right, or (ii) would disqualify the Plan under any law deemed applicable by the Board or the

Plan Administrator, including Code Section 423, then such provision shall be construed or deemed amended to conform to applicable laws, or if it cannot be so construed or deemed amended without, in the determination of the Board or the Plan

Administrator, materially altering the intent of the Plan, then such provision shall be stricken as to such jurisdiction, person or purchase right, and the remainder of the Plan shall remain in full force and effect.

8

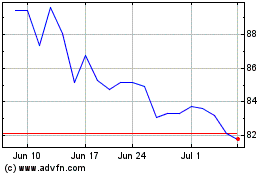

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

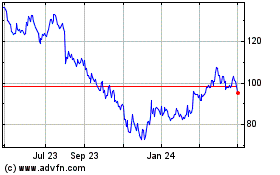

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Apr 2023 to Apr 2024