UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of June, 2015

Commission File Number 001-35052

Adecoagro S.A.

(Translation of registrant’s name into

English)

Vertigo Naos Building, 6, Rue Eugène

Ruppert, L-2453, Luxembourg

R.C.S. Luxembourg B 153 681

(Address of

principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨

No x

If “Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXPLANATORY NOTE

This Report of Foreign Private Issuer on Form 6-K (this “Form

6-K”) is being filed by Adecoagro S.A. (“Adecoagro” or the “Company”) with the Securities and Exchange

Commission (the “SEC”) and is incorporated by reference into the Company’s Registration Statement on Form F-3

filed with the SEC on December 6, 2013 (File No. 333-191325) and will be deemed to be a part thereof from the date on which this

Form 6-K is filed with the SEC, to the extent not superseded by documents or reports subsequently filed or furnished. This Form

6-K contains, as Exhibit 99.1, Operating and Financial Review and Prospects, which reviews Adecoagro’s results of operations

and financial condition as of March 31, 2015, and for the three month periods ended, March 31, 2015 and 2014. This report also

incorporates by reference the Company’s annual report on Form 20-F filed with the SEC on April 30, 2015 (our “Form

20-F”).

Forward Looking Statements

This

report contains forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of the

Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important

factors that could cause the registrant’s actual results to differ materially from those set forth herein and in the attached

Condensed Audited Financial Statements.

The

registrant’s forward-looking statements are based on the registrant’s current expectations, assumptions, estimates

and projections about the registrant and its industry. These forward-looking statements can be identified by words or phrases such

as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,”

“is/are likely to,” “may,” “plan,” “should,” “would,” or other similar

expressions.

The

forward-looking statements included in the attached relate to, among others: (i) the registrant’s business prospects

and future results of operations; (ii) weather and other natural phenomena; (iii) developments in, or changes to, the

laws, regulations and governmental policies governing the registrant’s business, including limitations on ownership of farmland

by foreign entities in certain jurisdictions in which the registrant operate, environmental laws and regulations; (iv) the

implementation of the registrant’s business strategy, including its development of the Ivinhema mill and other current projects;

(v) the registrant’s plans relating to acquisitions, joint ventures, strategic alliances or divestitures; (vi) the

implementation of the registrant’s financing strategy and capital expenditure plan; (vii) the maintenance of the registrant’s

relationships with customers; (viii) the competitive nature of the industries in which the registrant operates; (ix) the

cost and availability of financing; (x) future demand for the commodities the registrant produces; (xi) international

prices for commodities; (xii) the condition of the registrant’s land holdings; (xiii) the development of the logistics

and infrastructure for transportation of the registrant’s products in the countries where it operates; (xiv) the performance

of the South American and world economies; and (xv) the relative value of the Brazilian Real, the Argentine Peso, and the

Uruguayan Peso compared to other currencies; as well as other risks included in the registrant’s other filings and submissions

with the United States Securities and Exchange Commission.

These

forward-looking statements involve various risks and uncertainties. Although the registrant believes that its expectations expressed

in these forward-looking statements are reasonable, its expectations may turn out to be incorrect. The registrant’s actual

results could be materially different from its expectations. In light of the risks and uncertainties described above, the estimates

and forward-looking statements discussed in the attached might not occur, and the registrant’s future results and its performance

may differ materially from those expressed in these forward-looking statements due to, inclusive, but not limited to, the factors

mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking

statements.

The

forward-looking statements made in the attached relate only to events or information as of the date on which the statements are

made in the attached. The registrant undertakes no obligation to update any forward-looking statements to reflect events or circumstances

after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

|

| |

Adecoagro S.A. |

| |

|

|

| |

By |

|

/s/

Carlos A. Boero Hughes |

| |

Name: |

|

Carlos A. Boero Hughes |

| |

Title: |

|

Chief Financial Officer and |

| |

|

|

Chief Accounting Officer |

| |

|

|

|

Date:

June 9, 2015

Exhibit Index

| 99.1 |

Operating and Financial Review and Prospects |

| |

|

Exhibit

99.1

Operating and Financial Review and Prospects

OPERATING RESULTS

Trends and Factors Affecting Our Results of Operations

Our results of operations

have been influenced and will continue to be influenced by the following factors:

(i) Effects of Yield Fluctuations

The occurrence of severe adverse weather conditions,

especially droughts, hail, floods or frost, are unpredictable and may have a potentially devastating impact on agricultural production

and may otherwise adversely affect the supply and prices of the agricultural commodities that we sell and use in our business.

The effects of severe adverse weather conditions may also reduce yields at our farms. Yields may also be affected by plague, disease

or weed infection and operational problems.

The following table

sets forth our average crop, rice and sugarcane yields for the periods indicated:

| |

|

|

|

| |

|

% Change |

| |

2014/2015 |

2013/2014 |

2014/2015 -

2013/2014 |

Harvest

Year (1) |

Harvest

Year (1) |

| Corn (2) |

4.4 |

|

4.3 |

|

1.8% |

|

| Soybean |

3.8 |

|

3.3 |

|

15.9% |

|

| Soybean (second harvest) (3) |

- |

|

- |

|

- |

|

| Cotton lint (3) |

- |

|

- |

|

- |

|

| Wheat (4) |

2.3 |

|

2.6 |

|

(12.9%) |

|

| Rice |

5.2 |

|

5.8 |

|

(9.1%) |

|

| Sugarcane (3) |

- |

|

- |

|

- |

|

| |

|

|

|

(1) The

table above reflects the presents yields in respect of harvest years as of March 31. The portion of harvested area completed

as of March 31, 2015 was 16% for corn, 9% for soybean first harvest, 100% for wheat and 93% for rice. The portion of harvested

area completed as of March 31, 2014 was 19% for corn, 6% for soybean first harvest, 100% for wheat and 95% for rice.

(2) Includes sorghum

(3) None/insignificant harvest

as of March 31, 2015 and as of March 31, 2014 respectively

(4) Includes barley |

|

|

| |

|

|

(ii) Effects of Fluctuations

in Production Costs

We experience

fluctuations in our production costs due to the fluctuation in the costs of (i) fertilizers, (ii) agrochemicals, (iii) seeds,

(iv) fuel and (v) farm leases. The use of advanced technology, however, allowed us to increase our efficiency, in large part mitigating

the fluctuations in production costs. Some examples of how the implementation of production technology has allowed us to increase

our efficiency and reduce our costs include the use of no-till technology (also known as “direct sowing”, which involves

farming without the use of tillage, leaving plant residues on the soil to form a protective cover which positively impacts costs,

yields and the soil), crop rotation, second harvest in one year, integrated pest management, and balanced fertilization techniques

to increase the productive efficiency in our farmland. Increased mechanization of harvesting and planting operations in our sugarcane

plantations and utilization of modern, high pressure boilers in our sugar and ethanol mills has also yielded higher rates of energy

production per ton of sugarcane.

(iii) Effects of Fluctuations

in Commodities Prices

Commodity prices

have historically experienced substantial fluctuations. For example, based on Chicago Board of Trade (“CBOT”) data,

from January 1, 2015 to March 31, 2015, soybean prices decreased 2.9% and corn prices decreased by 4.9%. Also, between January

1, 2015 and March 31, 2015, ethanol prices decreased by 0.9%, according to Escola Superior de Agricultura “Luiz de Queiroz”

(“ESALQ”) data, and sugar prices decreased by 15.8%, according to Intercontinental Exchange of New York (“ICE-NY”)

data. Commodity price fluctuations impact our statement of income as follows:

| • | | Initial recognition and changes in the fair value of biological assets and agricultural

produce in respect of unharvested biological assets undergoing biological transformation; |

| • | | Changes in net realizable value of agricultural produce for inventory carried at its

net realizable value; and |

| • | | Sales of manufactured products and sales of agricultural produce and biological assets

sold to third parties. |

The following graphs

show the spot market price of some of our products since March 31, 2010 to March 31, 2015, highlighting the periods January 1 to

March 31, 2014 and January 1 to March 31, 2015:

(iv) Fiscal Year and Harvest

Year

Our fiscal year

begins on January 1 and ends on December 31 of each year. However, our production is based on the harvest year for each of our

crops and rice. A harvest year varies according to the crop or rice plant and to the climate in which it is grown. Due to the geographic

diversity of our farms, the planting period for a given crop or rice may start earlier on one farm than on another, causing differences

for their respective harvesting periods. The presentation of production volume (tons) and production area (hectares) in this annual

report in respect of the harvest years for each of our crops and rice starts with the first day of the planting period at the first

farm to start planting in that harvest year to the last day of the harvesting period of the crop or rice planting on the last farm

to finish harvesting that harvest year.

On the other hand, production volumes for dairy

and production volume and production area for sugar, ethanol and energy business are presented on a fiscal year basis.

The financial results

in respect of all of our products are presented on a fiscal year basis.

(v) Effects of Fluctuations

of the Production Area

Our results of operations

also depend on the size of the production area. The size of our own and leased area devoted to crop, rice and sugarcane production

fluctuates from period to period in connection with the purchase and development of new farmland, the sale of developed farmland,

the lease of new farmland and the termination of existing farmland lease agreements. Lease agreements are usually settled following

the harvest season, from July to June in crops and rice, and from May to April in sugarcane. The length of the lease agreements

are usually one year for crops, one to five years for rice and five to six years for sugarcane. Regarding crops, the production

area can be planted and harvested one or two times per year. As an example, wheat can be planted in July and harvested in December.

Right after its harvest, soybean can be planted in the same area and harvested in April. As a result, planted and harvested area

can exceed the production area during one year. The production area for sugarcane can exceed the harvested area in one year. Grown

sugarcane can be left in the fields and then harvested the following year. The following table sets forth the fluctuations in the

production area for the periods indicated:

| |

Three-month Period ended

March 31, |

| |

2015 |

2014 |

| |

Hectares |

| Crops (1) |

148,915 |

152,777 |

| Rice |

35,328 |

36,604 |

| Sugar, Ethanol and Energy |

126,866 |

104,897 |

(1) Does not include second

crop area.

The decrease in

crop production area in 2015 compared to 2014 was mainly driven by farm sales in 2014. The increase in sugar, ethanol and energy

production area in 2015 is explained by an increase in leased hectares.

(vi) Effect of Acquisitions

and Dispositions

The comparability

of our results of operations is also affected by the completion of significant acquisitions and dispositions. Our results of operations

for earlier periods that do not include a recently completed acquisition or do include farming operations subsequently disposed

of may not be comparable to the results of a more recent period that reflects the results of such acquisition or disposition.

(vii) Macroeconomic Developments

in Emerging Markets

We generate nearly

all of our revenue from the production of food and renewable energy in emerging markets. Therefore, our operating results and financial

condition are directly impacted by macroeconomic and fiscal developments, including fluctuations in currency exchange rates, inflation

and interest rate fluctuations, in those markets. The emerging markets where we conduct our business (including Argentina, Brazil

and Uruguay) remain subject to such fluctuations.

(viii) Effects of Export

Taxes on Our Products

Following the economic

and financial crisis experienced by Argentina in 2002, the Argentine government increased export taxes on agricultural products,

mainly on soybean and its derivatives, wheat, rice and corn. Soybean is subject to an export tax of 35.0%, wheat is subject to

an export tax of 23.0%, rough rice is subject to an export tax of 10.0%, processed rice is subject to an export tax of 5.0%, corn

is subject to an export tax of 20.0% and sunflower is subject to an export tax of 32.0%.

As local prices

are determined taking into consideration the export parity reference, any increase in export taxes would affect our financial results.

(ix) Effects of Foreign

Currency Fluctuations

Each of our Argentine,

Brazilian and Uruguayan subsidiaries uses local currency as its functional currency. A significant portion of our operating costs

in Argentina are denominated in Argentine Pesos and most of our operating costs in Brazil are denominated in Brazilian Reais. For

each of our subsidiaries’ statements of income, foreign currency transactions are translated into the local currency, as

such subsidiaries’ functional currency, using the exchange rates prevailing as of the dates of the relevant specific transactions.

Exchange differences resulting from the settlement of such transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies are recognized in the statement of income under “finance

income” or “finance costs,” as applicable. Our Consolidated Financial Statements are presented in U.S. dollars,

and foreign exchange differences that arise in the translation process are disclosed in the consolidated statement of comprehensive

income.

As of March 31,

2015, the Peso-U.S. dollar exchange rate was Ps.8.82 per U.S. dollar as compared to Ps.8.00 per U.S. dollar as of March 31, 2014.

As of March 31, 2015, the Real-U.S. dollar exchange rate was R$3.20 per U.S. dollar as compared to R$2.26 per U.S. dollar as of

March 31, 2014.

The following graph

shows the Argentine Peso-U.S. dollar rate and the Real-U.S. dollar rate of exchange for the periods since March 31, 2010 to March

31, 2015, highlighting the periods January 1 to March 31, 2014 and January 1 to March 31, 2015:

Our principal foreign

currency fluctuation risk involves changes in the value of the Brazilian Reais relative to the U.S. dollar. Periodically, we evaluate

our exposure and consider opportunities to mitigate the effects of currency fluctuations by entering into currency forward contracts

and other hedging instruments.

(x) Seasonality

Our business activities

are inherently seasonal. We generally harvest and sell corn, soybean, rice and sunflower between February and August, and wheat

from December to January. Cotton is unique in that while it is typically harvested from May to July, it requires a conditioning

process that takes about two to three months before being ready to be sold. Sales in other business segments, such as in our Dairy

segment, tend to be more stable. However, milk sales are generally higher during the fourth quarter, when weather conditions are

more favorable for production. The sugarcane harvesting period typically begins between April and May and ends between November

and December. As a result of the above factors, there may be significant variations in our results of operations from one quarter

to another, since planting activities may be more concentrated in one quarter whereas harvesting activities may be more concentrated

in another quarter. In addition our quarterly results may vary as a result of the effects of fluctuations in commodity prices and

production yields and costs related to the “Initial recognition and changes in fair value of biological assets and agricultural

produce” line item. See “—Critical Accounting Policies and Estimates—Biological Assets and Agricultural

Produce” included in our Form 20-F.

(xi) Land Transformation

Our business model

includes the transformation of pasture and unproductive land into land suitable for growing various crops and the transformation

of inefficient farms into farms suitable for more efficient uses through the implementation of advanced and sustainable agricultural

practices, such as “no-till” technology and crop rotation. During approximately the first three to five years of the

land transformation process of any given parcel, we must invest heavily in transforming the land, and, accordingly, crop yields

during such period tend to be lower than crop yields once the land is completely transformed. After the transformation process

has been completed, the land requires less investment, and crop yields gradually increase. As a result, there may be variations

in our results from one season to the next according to the amount of land in the process of transformation.

Our business model

also includes the identification, acquisition, development and selective disposition of farmlands or other rural properties that

after implementing agricultural best practices and increasing crop yields we believe have the potential to appreciate in terms

of their market value. As a part of this strategy, we purchase and sell farms and other rural properties from time to time. Please

see also “Risk Factors-Risks Related to Argentina-Argentine law concerning foreign ownership of rural properties may adversely

affect our results of operations and future investments in rural properties in Argentina” and “Risk Factors-Risks Related

to Brazil- Recent changes in Brazilian rules concerning foreign investment in rural properties may adversely affect our investments.”

included in “Item 3-Risk Factors” in our Form 20-F.

The results included

in the Land Transformation segment are related to the acquisition and disposition of farmland businesses and not to the physical

transformation of the land. The decision to acquire and/or dispose of a farmland business depends on several market factors that

vary from period to period, rendering the results of these activities in one financial period when an acquisition of disposition

occurs not directly comparable to the results in other financial periods when no acquisitions or dispositions occurred.

(xii) Capital Expenditures

and Other Investments

Our capital expenditures

during the last three years consisted mainly of expenses related to (i) acquiring land, (ii) transforming and increasing the productivity

of our land, (iii) planting non-current sugarcane and coffee and (iv) expanding and upgrading our production facilities. Our capital

expenditures incurred in connection with such activities were $335.2 million for the year ended December 2012, $232.1 million for

the year ended December 2013 and $322.9 million for the year ended December 2014. . Capital expenditures totaled $62.7 million

for the three-month period ended March 31, 2015 in comparison with $113.3 million in the same period in 2013.See also “-Capital

Expenditure Commitments.”

(xiii) Effects of Corporate

Taxes on Our Income

We are subject to

a variety of taxes on our results of operations. The following table shows the income tax rates in effect for 2015 in each of the

countries in which we operate:

| |

Tax Rate (%) |

| Argentina |

35 |

| Brazil(1) |

34 |

| Uruguay |

25 |

____________

| (1) | Including

the Social Contribution on Net Profit (CSLL) |

Critical Accounting Policies and Estimates

The Company’s critical

accounting policies and estimates are consistent with those described in Note 4 to our audited consolidated annual financial statements

for the year ended December 31, 2014 included in our Form 20-F.

Operating Segments

IFRS 8 “Operating

Segments” requires an entity to report financial and descriptive information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specified criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”)

in deciding how to allocate resources and in assessing performance. The CODM evaluates the business based on the differences in

the nature of its operations, products and services. The amount reported for each segment item is the measure reported to the CODM

for these purposes.

We are organized

into three major lines of business, namely, Farming; Sugar, Ethanol and Energy; and Land Transformation. As from January 1, 2014

the Company did not consider its Coffee and Cattle businesses to be of continuing significance as they no longer meet the quantitative

threshold for separate disclosure as reportable segments. Accordingly, the Coffee and Cattle businesses are now presented within

“Farming – All Other Segments” segment and prior year disclosures have been recast to conform to this presentation.

As a result, the Company’s businesses are comprised of six reportable operating segments, which are organized based upon

their similar economic characteristics, the nature of products they offer, their production processes, the type of their customers

and their distribution methods.

We operate in three

major lines of business, namely, Farming; Sugar, Ethanol and Energy; and Land Transformation.

| • | | Our farming business is further comprised of four reportable segments: |

| § | | Our Crops segment consists of planting, harvesting and sale of grains, oilseeds

and fibers (including wheat, corn, soybeans, cotton and sunflowers, among others), and to a lesser extent the provision of grain

warehousing/conditioning and handling and drying services to third parties. Each underlying crop in this segment does not represent

a separate operating segment. Management seeks to maximize the use of the land through the cultivation of one or more type of

crops. Types and surface amount of crops cultivated may vary from harvest year to harvest year depending on several factors, some

of which are out of our control. Management is focused on the long-term performance of the productive land, and to that extent,

the performance is assessed considering the aggregate combination, if any, of crops planted in the land. A single manager is responsible

for the management of operating activity of all crops rather than for each individual crop. |

| § | | Our Rice segment consists of planting, harvesting, processing and marketing

of rice; |

| § | | Our Dairy segment consists of the production and sale of raw milk, |

| § | | Our All Other Segments segment consists of the combination of the remaining

non-reportable operating segments, which do not meet the quantitative thresholds for separate disclosure and for which the Company’s

management does not consider them to be of continuing significance as from January 1, 2014, namely, Coffee and Cattle. |

| • | | Our Sugar, Ethanol and Energy segment consists of cultivating sugarcane which

is processed in owned sugar mills, transformed into ethanol, sugar and electricity and marketed; |

| • | | Our Land Transformation segment comprises the (i) identification and acquisition

of underdeveloped and undermanaged farmland businesses; and (ii) realization of value through the strategic disposition of assets

(generating profits). |

The following table presents

selected historical financial and operating data solely for the periods indicated below as it is used for our discussion of results

of operations. In respect of production data only as of March 31, 2015, we have not yet completed the 2014/2015 harvest year crops.

The Harvested tons presented corresponds to the harvest completed as of March 31, 2015.

| |

|

Three-month period ended March 31, |

| |

|

2015 |

2014 |

|

| Sales |

|

( In thousands of $) |

| Farming Business |

|

58,687 |

46,084 |

|

| Crops |

|

21,829 |

22,181 |

|

| Soybean(1) |

|

5,217 |

2,185 |

|

| Corn (2) |

|

4,149 |

11,914 |

|

| Wheat (3) |

|

6,851 |

5,373 |

|

| Sunflower |

|

4,637 |

2,000 |

|

| Cotton |

|

713 |

333 |

|

| Other crops(4) |

|

262 |

377 |

|

| Rice(5) |

|

28,488 |

16,486 |

|

| Dairy |

|

8,060 |

7,075 |

|

| All other segments(6) |

|

310 |

342 |

|

| Sugar, Ethanol and Energy Business |

|

55,531 |

53,045 |

|

| Sugar |

|

13,955 |

13,069 |

|

| Ethanol |

|

39,647 |

36,482 |

|

| Energy |

|

1,929 |

3,494 |

|

| Total |

|

114,218 |

99,129 |

|

| | |

|

|

| | |

2014/2015 |

2013/2014 |

| | |

Harvest |

Harvest |

| Production | |

Year |

Year |

| Farming Business | |

| |

| Crops (tons) (7) | |

216,886 |

175,811 |

| Soybean (tons) | |

22,665 |

11,774 |

| Corn (tons) (2) | |

89,496 |

68,317 |

| Wheat (tons) (3) | |

84,606 |

77,168 |

| Sunflower (tons) | |

20,119 |

18,552 |

| Cotton Lint (tons) | |

- |

- |

| Rice(8) (tons) | |

171,197 |

198,343 |

| | |

|

|

| |

Three-month period ended March 31, |

| |

|

| |

| 2015 |

2014 |

| Processed rice (9) (tons) |

| 37,565 |

40,253 |

| Dairy (10) (liters) |

| 20,260 |

19,256 |

| Sugar, Ethanol and Energy Business |

| |

| Sugar (tons) |

| 22,468 |

- |

| Ethanol (cubic meters) |

| 16,596 |

2,103 |

| Energy (MWh) |

| 17,890 |

15,527 |

| Land Transformation Business (hectares traded) |

| - |

- |

| |

|

|

|

| |

|

2014/2015 |

2013/2014 |

| |

|

Harvest |

Harvest |

| Planted Area |

|

Year |

Year |

| |

|

(Hectares) |

|

| Farming Business (11) |

|

|

|

| Crops |

|

192,772 |

185,333 |

| Soybean |

|

96,604 |

82,981 |

| Corn (2) |

|

39,935 |

51,212 |

| Wheat (3) |

|

37,020 |

29,412 |

| Sunflower |

|

12,314 |

12,880 |

| Cotton |

|

3,160 |

6,217 |

| Forage |

|

3,739 |

2,631 |

| Rice |

|

35,328 |

36,604 |

| Total Planted Area |

|

228,101 |

221,937 |

| Second Harvest Area |

|

40,118 |

29,923 |

| Leased Area |

|

60,205 |

55,797 |

| Owned Croppable Area(12) |

|

127,778 |

136,216 |

| |

|

|

|

| |

|

Three-month period

ended March 31, |

| |

|

2015 |

2014 |

| Sugar, Ethanol and Energy Business |

|

|

|

| Sugarcane plantation |

|

126,866 |

104,897 |

| Owned land |

|

9,145 |

9,145 |

| Leased land |

|

117,721 |

95,752 |

| (1) | Includes

soybean, soybean oil and soybean meal. |

| (2) | Includes

sorghum and peanuts |

| (3) | Includes

barley and rapeseed. |

| (4) | Includes

seeds and farming services. |

| (5) | Sales

of processed rice including rough rice purchased from third parties and processed in

our own facilities, rice seeds and services. |

| (6) | All other

segments include our cattle business which primarly consists of leasing land to a third

party based on the price of beef. See “Item 4. Information on the Company—B.

Business Overview—Cattle Business.” in our Form 20-F. |

| (7) | Crop production

does not include 61,889 tons and 26,234 tons of forage produced in the 2014/2015 and

2013/2014 harvest years, respectively. |

| (8) | Expressed

in tons of rough rice produced on owned and leased farms. The rough rice we produce,

along with additional rough rice we purchase from third parties, is ultimately processed

and constitutes the product sold in respect of the rice business. |

| (9) | Includes

rough rice purchased from third parties and processed in our own facilities. Expressed

in tons of processed rice (1 ton of processed rice is approximately equivalent to 1.6

tons of rough rice). |

| (10) | Raw milk

produced at our dairy farms. |

| (11) | Includes

hectares planted in the second harvest. |

| (12) | Does

not include potential croppable areas being evaluated for transformation. |

Three-month period ended March 31, 2015 as compared to three-month

period ended March 31, 2014

The following table

sets forth certain financial information with respect to our consolidated results of operations for the periods indicated.

| |

Three-month period

ended March 31, |

| |

2015 |

|

2014 |

| |

(Unaudited) |

| |

|

(In thousands of $) |

| |

Sales of manufactured products and services rendered |

84,480 |

|

68,811 |

| |

Cost of manufactured products sold and services rendered |

(60,234) |

|

(46,340) |

| |

Gross Profit from Manufacturing Activities |

24,246 |

|

22,471 |

| |

Sales of agricultural produce and biological assets |

29,738 |

|

30,318 |

| |

Cost of agricultural produce sold and direct agricultural selling expenses |

(29,738) |

|

(30,318) |

| |

Initial recognition and changes in fair value of biological assets and agricultural produce |

23,666 |

|

38,945 |

| |

Changes in net realizable value of agricultural produce after harvest |

(162) |

|

861 |

| |

Gross Profit from Agricultural Activities |

23,504 |

|

39,806 |

| |

Margin on Manufacturing and Agricultural Activities Before Operating Expenses |

47,750 |

|

62,277 |

| |

General and administrative expenses |

(12,018) |

|

(10,780) |

| |

Selling expenses |

(13,255) |

|

(11,636) |

| |

Other operating income/(expense), net |

21,625 |

|

(13,570) |

| |

Share of loss of joint ventures |

(878) |

|

(255) |

| |

Profit from Operations Before Financing and Taxation |

43,224 |

|

26,066 |

| |

Finance income |

3,291 |

|

2,165 |

| |

Finance costs |

(27,783) |

|

(18,338) |

| |

Financial results, net |

(24,492) |

|

(16,173) |

| |

Profit Before Income Tax |

18,732 |

|

9,893 |

| |

Income tax expense |

(4,971) |

|

(7,297) |

| |

Profit for the Period |

13,761 |

|

2,596 |

| |

|

|

|

|

Sales of Manufactured Products and Services Rendered

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

77 |

|

28,479 |

|

83 |

|

310 |

|

55,531 |

|

84,480 |

| 2014 |

|

84 |

|

15,340 |

|

- |

|

342 |

|

53,045 |

|

68,811 |

Sales of manufactured

products and services rendered increased 22.8%, from $68.8 million for the three month period ended March 31, 2014 to $84.5 million

for the same period in 2015, primarily as a result of:

| • | a $13.1 million increase in our Rice segment, mainly due to: (i) a 124.4% increase in the volume

of white rice sold measured in tons of rough rice, from 19.5 thousand tons in the three month period ended March 31, 2014 to 43.8

thousand tons in the same period in 2015, mainly explained by a lower inventories build-up from 148.0 thousand tons in 2014 to

114.0 thousand tons in 2015; and (ii) an increase of 3.8% in the price, from $575.4 in 2014 to $597.3 per ton of rough rice equivalent

in 2015. These increases were partially offset by a 56.0% decrease in the sales of by-products, from $5.2 million in 2014 to $2.3

million in 2015 due to a decrease a in volume sold, from 37.4 thousand tons expressed in rough rice during 2014 to 22.8 thousand

tons expressed in rough rice in 2015. |

| | | |

| • | a $2.5 million increase in our Sugar, Ethanol and Energy segment, mainly due to: (i) a 28% increase

in the volume of sugar and ethanol sold, measured in TRS(1), from 135 thousand tons in the three month period ended

March 31, 2014 to 172 thousand tons in the same period in 2015; (ii) a 12.6% increase in volume of energy sold, from 15.3 thousand

MWh in 2014 to 17.2 thousand MWh in 2015; and (iii) a 4.5% increase in the price of sugar, from $381.6 in 2014 to $398.8 per ton

in 2015. The increase in volume of sugar and ethanol sold was due to (a) a 918.4% increase in sugarcane milled, from 45.2 thousand

tons in 2014 to 460.1 thousand tons in 2015; (b) a 14.5% increase in the TRS content in sugarcane, from 103.0 kilograms per ton

in 2014 to 117.9 kilograms per ton in 2015; and (c) an increase in the commercialization of sugar from third parties; partially

offset by a lower inventories sell-off, measured in TRS, of 127.2 tons in 2014 compared to an inventories sell-off of 82.3 tons

in 2015. The increase in the volume of energy sold was mainly due to the increase in sugarcane milled; partially offset by the

lower stockpile of bagasse that was carried from previous year to be burned during the off-season. The increase in the sugarcane

milled is sustained by (i) an increase in the harvesting area from 0.7 thousand hectares in 2014 to 6.2 thousand hectares in 2015

due to the earlier start of the crushing season and (ii) a 41.3% increase in sugarcane yields from 64.2 tons per hectare in 2014

to 90.7 tons per hectare in 2015. The increases in volumes sold and sugar prices were partially offset by: (i) a 51.0% decrease

in energy price, from $229.0 per MWh in 2014 to $112.3 per MWh in 2015; and (ii) a 20.7% decrease in the price of ethanol, from

$629.3 per cubic meter in 2014 to $499.2 per cubic meter in 2015. |

| | The following figure sets forth the variables that determine our Sugar and Ethanol sales: |

| (1) | On average, one metric ton of

sugarcane contains 140 kilograms of TRS (Total Recoverable Sugar). While a mill can produce

either sugar or ethanol, the TRS input requirements differ between these two products.

On average, 1.045 kilograms of TRS equivalent are required to produce 1.0 kilogram of

sugar, while the amount of TRS required to produce 1 liter of ethanol is 1.691 kilograms |

The following

figure sets forth the variables that determine our Energy sales:

The following

table sets forth the breakdown of sales of manufactured products for the periods indicated.

| |

Three-month period ended March 31, |

|

Three-month period ended March 31, |

|

Three-month period ended March 31, |

| |

2015 |

|

2014 |

|

Chg % |

|

2015 |

|

2014 |

|

Chg % |

|

2015 |

|

2014 |

|

Chg % |

| |

(in million of $) |

|

|

|

(in thousand units) |

|

|

|

(in dollars per unit) |

|

|

| Ethanol (M3) |

39.6 |

|

36.5 |

|

8.7% |

|

79.4 |

|

58.0 |

|

37.0% |

|

499.2 |

|

629.3 |

|

(20.7%) |

| Sugar (tons) |

14.0 |

|

13.1 |

|

6.8% |

|

35.0 |

|

34.2 |

|

2.2% |

|

398.8 |

|

381.6 |

|

4.5% |

| Energy (MWh) |

1.9 |

|

3.5 |

|

(44.8%) |

|

17.2 |

|

15.3 |

|

12.6% |

|

112.3 |

|

229.0 |

|

(51.0%) |

| TOTAL |

55.5 |

|

53.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Manufactured Products Sold and

Services Rendered

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other

Segments |

|

Sugar, Ethanol

and Energy |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

- |

|

(23,156) |

|

(168) |

|

(186) |

|

(36,724) |

|

(60,234) |

| 2014 |

|

- |

|

(11,767) |

|

- |

|

(18) |

|

(34,555) |

|

(46,340) |

Cost of manufactured

products sold and services rendered increased 30.0%, from $46.3 million three month period ended in March 31, 2014 to $60.2 million

in the same period in 2015. This increase was primarily due to:

| • | a $11.4 million increase in our Rice segment mainly due to: (i) the increase in volume sold; and

(ii) a 68.2% increase in the unitary cost of product sold from $206.8 per ton of rough rice in 2014 to $347.8 per ton of rough

rice in 2015 due to the 22.6% depreciation of the Argentine peso during the three-month period ended March 31 2014, in comparison

to the 4.2% depreciation during the same period of 2015. |

| | | |

| • | a $2.2 million increase in our Sugar, Ethanol and Energy segment mainly due to increase in the

volume of sugar and ethanol sold measured in TRS; partially offset by a lower unitary cost of product sold due to a 20.3% depreciation

of the Brazilean Real during 1Q 2015. |

Sales and Cost of Agricultural Produce and Biological

Assets

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other

Segments |

|

Sugar, Ethanol

and Energy |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

21,752 |

|

9 |

|

7,977 |

|

- |

|

- |

|

29,738 |

| 2014 |

|

22,097 |

|

1,146 |

|

7,075 |

|

- |

|

- |

|

30,318 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Sales of agricultural

produce and biological assets decreased 1.9%, from $30.3 million in 2014, to $29.7 million in 2015, primarily as a result of:

| • | A $1.1 million decrease in our Rice segment was mainly driven by a lower volume of rough rice sold

to third parties in the three-month period ended March 31, 2015. The sales reported in 2014 were exceptional on account of the

delivery of 4.0 thousand tons at a price of $275.6 per ton. |

| • | A $0.3 million decrease in our Crops segment mainly driven by the general decrease in the price

of grains sold. Soybean prices decreased 10.3%, from $332.4 per ton in the three-month period ended March 31, 2014 to $298.3 per

ton in the same period of 2015. Corn prices decreased 24.8%, from $200.7 per ton in the three-month period ended March 31, 2014

to $151.0 per ton in the same period of 2015. Wheat prices decreased 5.1%, from $235.6 per ton in the three-month period ended

March 31, 2014 to $223.7 per ton in the same period of 2015. The decrease in prices was partially offset by an increase in the

proportion of soybean and wheat sold, mainly due to (i) an increase in production harvested from 11.7 thousand tons in the three-month

period ended March 31, 2014 to 22.7 thousand tons in the same period of 2015 and from 77.1 thousand tons in 2014 to 84.6 thousand

ton in 2015 for soybean and wheat respectively; and (ii) lower soybean inventories build-up from 97.3 tons in 2014 to 4.6 tons

in 2015. |

The following table sets forth the breakdown

of sales for the periods indicated.

| |

Three-month Period ended

March 31, |

|

Three-month Period ended

March 31, |

Three-month Period ended

March 31, |

| |

2015 |

2014 |

% Chg |

|

2015 |

2014 |

% Chg |

|

2015 |

2014 |

% Chg |

| |

|

|

|

|

|

|

|

|

| |

(In thousands of $) |

|

|

(In thousands of tons) |

|

|

(In $ per ton) |

|

| Soybean |

5,217 |

2,185 |

138.8% |

|

17,488 |

6,573 |

166.1% |

|

298.3 |

332.4 |

(10.3%) |

| Corn (1) |

4,149 |

11,914 |

(65.2%) |

|

27,477 |

59,352 |

(53.7%) |

|

151.0 |

200.7 |

(24.8%) |

| Cotton lint |

713 |

333 |

114.3% |

|

588 |

201 |

192.5% |

|

1,211.8 |

1,654.4 |

(26.8%) |

| Wheat (2) |

6,851 |

5,373 |

27.5% |

|

30,629 |

22,801 |

34.3% |

|

223.7 |

235.6 |

(5.1%) |

| Sunflower |

4,637 |

2,000 |

131.9% |

|

10,514 |

5,843 |

79.9% |

|

441.0 |

342.2 |

28.9% |

| Others |

185 |

292 |

(36.6%) |

|

|

|

|

|

|

|

|

| Total |

21,752 |

22,097 |

(1.6%) |

|

|

|

|

|

|

|

|

____________

Partially offset by:

| • | A 12.7% increase in our Dairy segment, from $7.1 million in the three-month period ended

March 31, 2014 to $8.0 million in the three-month period ended March 31, 2015. This increase is explained by (i) an

increase in the amount of liters of fluid milk sold, from 18.1 million liters in the three-month period ended March 31, 2014

to 19.8 million liters in the same period of 2015; and (ii) a 1.9% increase in milk prices from $0.366 per liter in 2014 to

$0.373 per liter in 2015. The increase in the amount of liters sold is attributable to (a) a 2.3% increase in our milking cow

herd driven by enhanced reproduction efficiencies at our two free-stall dairy facilities from an average of 6,396 heads in

the three month period ended March 31st, 2014 to an average of 6,544 heads in the same period of 2015; and (b) by

a 2.8% increase in cow productivity, from 33.5 liters per day per cow in 2014 to 34.4 liters per day per cow in 2015 due to

enhanced operating efficiencies. |

While we receive

cash or consideration upon the sale of our inventory of agricultural produce to third parties, we do not record any additional

profit related to that sale, as that gain or loss had already been recognized under the line items “Initial recognition and

changes in fair value of biological assets and agricultural produce” and “Changes in net realizable value of agricultural

produce after harvest.” Please see “—Critical Accounting Policies and Estimates—Biological Assets and Agricultural

Produce” above for a discussion of the accounting treatment, financial statement presentation and disclosure related to our

agricultural activity.

Initial Recognition and Changes in Fair

Value of Biological Assets and Agricultural Produce

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

9,004 |

|

4,717 |

|

1,955 |

|

(1) |

|

7,991 |

|

23,666 |

| 2014 |

|

34,089 |

|

12,515 |

|

1,932 |

|

(278) |

|

(9,313) |

|

38,945 |

Initial recognition

and changes in fair value of biological assets and agricultural produce decreased 39.2%, from $38.9 million in the three-month

period ended March 31, 2014 to $23.7 million in the same period for 2015. The decrease was mainly due to:

• a

$25.1 million decrease in our Crops segment mainly due to:

| - | a $21.1 million decrease in the recognition at fair value less cost to sell for non-harvested crops,

from a gain of $25.3 million in the three-month period ended March 31, 2014 to a gain of $4.1 million in the same period of 2015,

mainly due to (i) a general decrease in prices; and (ii) a lower area with significant biological growth. |

| | | |

| - | The recognition at fair value less cost to sell of crops at the point of harvest, remained essentially

unchanched from $4.1 million in the three-month period ended March 31, 2014 to $3.8 million in the same period in 2015. |

| | | |

| - | Of the $9.0 million gain of initial recognition and changes in fair value of biological assets

and agricultural produce for the three-month period ended March 31, 2015, $8.0 million gain represents the unrealized portion,

as compared to the $29.4 million unrealized gain of the $34.1 million gain of initial recognition and changes in fair value of

biological assets and agricultural produce in 2014. |

| | | |

| • | A $7.8 million decrease in our Rice segment, as a result of: |

| | | |

| - | the recognition at fair value less cost to sell for non-harvested crops remained essentially

unchancged as most of the area was already harvested, from 95% in 2014 to 93% in 2015. |

| | | |

| - | a $7.8 million decrease in the recognition at fair value less cost to sell of rice at the point

of harvest, from a gain of $12.5 million in the three-month period ended March 31, 2014 to a gain of $4.7 million in the same period

in 2015 mainly due to (i) a 9.1% decrease in yields from 5.8 tons per hectare in 2014 to 5.2 tons per hectare in 2015 due to above

average rains and cloudy days during the development of the crops; and (ii) a 3.5% decrease in the area under production. |

| - | Of the $4.7 million gain of initial recognition and changes in fair value of biological

assets and agricultural produce for the three-month period ended March 31, 2015, $1.6 million gain represents the realized portion,

as compared to the $2.2 million gain realized portion of the $12.5 million gain of initial recognition and changes in fair value

of biological assets and agricultural produce for the same period in 2014. |

| | | |

Partially offset

by:

| • | A $17.3 million increase in our Sugar, Ethanol and Energy segment, mainly due to: |

| | | |

| - | a $15.7 million increase in the recognition at fair value less cost to sell of non-harvested sugarcane,

from a loss of $3.4 million in the three-month period ended March 31, 2014 to a gain of $12.3 million in the same period for 2015,

mainly generated by a decrease in sugarcane yield estimates in 2014 as a result of a dry period during November 2013 to January

2014 which affected the normal development of the sugarcane. |

| | | |

| - | The changes in the recognition at fair value less cost to sell of sugarcane at the point of harvest

increased from a loss of $5.9 million in the three-month period ended March 31, 2014 to a loss of $4.3 million in the same period

for 2015 due to higher harvested area as a results of the earlier start of the season. |

| | | |

| - | Of the $8.0 million gain of initial recognition and changes in fair value of biological assets

and agricultural produce for the three-month period ended March 31, 2015, $9.0 million gain represents the unrealized portion,

as compared to the $10.8 million loss unrealized portion of the $9.3 million loss of initial recognition and changes in fair value

of biological assets and agricultural produce in the same period for 2014. |

| | | |

Changes in Net Realizable Value of Agricultural Produce after

Harvest

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

(162) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(162) |

| 2014 |

|

861 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

861 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Changes in net realizable

value of agricultural produce after harvest is mainly composed by: (i) profit or loss from commodity price fluctuations during

the period of time the agricultural produce is in inventory, which impacts its fair value; (ii) profit or loss from the valuation

of forward contracts related to agricultural produce in inventory; and (iii) profit from direct exports. Changes in net realizable

value of agricultural produce after harvest decreased from $0.9 million gain in the three-month period ended March 31, 2014 to

$0.1 million loss in the same period for 2015. This decrease is mainly explained by the decrease in commodity prices that impacted

in higher inventories of corn.

General and Administrative Expenses

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

(1,403) |

|

(1,087) |

|

(370) |

|

(19) |

|

(4,421) |

|

(4,718) |

|

(12,018) |

| 2014 |

|

(980) |

|

(812) |

|

(394) |

|

(35) |

|

(3,710) |

|

(4,849) |

|

(10,780) |

Our general and

administrative expenses increased 11.5%, from $10.8 million in the three-month period ended March 31, 2014 to $12.0 million in

the same period for 2015. This increase is explained by a $0.7 million increase in our Sugar, Ethanol and Energy segment due to

higher average headcount as a result of the expansion in milling activities.

Selling Expenses

Three-month period

ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

| |

|

(In thousands of $) |

| 2015 |

|

(802) |

|

(4,291) |

|

(165) |

|

(7) |

|

(7,506) |

|

(484) |

|

(13,255) |

| 2014 |

|

(722) |

|

(3,383) |

|

(155) |

|

(4) |

|

(7,155) |

|

(217) |

|

(11,636) |

Selling expenses

increased 13.9%, from $11.6 million in the three-month period ended March 31, 2014 to $13.3 million in the same period for 2015,

mainly driven by a $0.9 million increase in our Rice segment, primarily due to an increase in sales volume.

Other Operating Income, Net

| Three-month period ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Land

Transformation |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

| (In thousands of $) |

| 2015 |

|

8,962 |

|

479 |

|

(28) |

|

2 |

|

12,205 |

|

- |

|

5 |

|

21,625 |

| 2014 |

|

(12,503) |

|

183 |

|

19 |

|

(1) |

|

(1,366) |

|

- |

|

98 |

|

(13,570) |

Other operating

income increased $35.2 million, from a $13.6 million loss in the three-month period ended March 31, 2014 to $21.6 million gain

in the same period for 2015, primarily due to:

| • | a $21.5 million increase in our Crops segment due to the mark-to-market effect of outstanding hedge

positions of our soybean and corn derivatives; |

| | | |

| • | a $13.6 million increase in our Sugar, Ethanol & Energy segment due to the mark-to-market effect

of outstanding hedge positions. |

Other operating income, net of our Rice,

Dairy, All other segments, Land Transformation and Corporate segments remained essentially unchanged.

Share of Loss of Joint Ventures and Investment

Results

| Three-month period ended March 31, |

|

Crops |

|

Rice |

|

Dairy |

|

All Other Segments |

|

Sugar, Ethanol

and Energy |

|

Land

Transformation |

|

Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

| (In thousands of $) |

| 2015 |

|

(878) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(878) |

| 2014 |

|

(225) |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(225) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our share of loss of Joint Ventures increased

slightly from a loss of $0.2 million in the three-month period ended March 31, 2014 to a loss of $0.9 million in the same period

for 2015. This result is explained by the 50% interest that we hold in CHS AGRO, a joint venture with CHS Inc., dedicated to the

processing of confectionary sunflower. The negative result is mainly due to interest expenses and the negative impact of the depreciation

of Argentine peso on the dollar denominated debt.

Financial Results, Net

Our financial results,

net decreased from a loss of $16.2 in the three month period ended March 31, 2014 to a loss of $24.5 million in the same period

of 2015, primarily due to: a $13.7 million mainly non-cash loss in 2015, compared to a $3.7 million non-cash loss in 2014, mostly

generated by the impact of foreign exchange fluctuation on our dollar denominated debt issued by subsidiaries.

The following table

sets forth the breakdown of financial results for the periods indicated.

| |

|

Three-month period ended March 31, |

| |

|

2015 |

2014 |

|

| |

|

(Unaudited) |

|

| |

|

(In $ thousand) |

% Change |

| Interest income |

|

2,568 |

1,477 |

73.9% |

| Interest expense |

|

(12,715) |

(12,693) |

0.2% |

| Foreign exchange losses, net |

|

(13,694) |

(3,702) |

269.9% |

| Cash flow hedge – transfer from equity |

|

464 |

(245) |

(289.4%) |

| Gain/(Loss) from interest rate /foreign exchange rate derivative financial instruments |

|

226 |

592 |

(61.8%) |

| Taxes |

|

(705) |

(743) |

(5.1%) |

| Other Income/(Expenses) |

|

(636) |

(859) |

(26.0%) |

| Total Financial Results |

|

(24,492) |

(16,173) |

51.4% |

| |

|

|

|

|

|

Income Tax expense

Current income tax charge

totaled $5.0 million for the three-month period ended March 31, 2015, which equates to a consolidated effective tax rate of 26.5%.

For the same period in 2014 we registered a loss of income tax of $7.3 million, which equates to a consolidated effective tax rate

of 73.8%.

As of March 31, 2015, the

income tax rate in Uruguay was 25%. However, in Uruguay the income tax rate applicable to derivative activities is 0.75%. During

the three-month period ended March 31, 2015, we recognized a gain in the line item Other operating income, net, of $6.0 million

which was subject to the 0.75% rate. As result of these effects our consolidated effective income tax rate decreased from 73.8%

for the three-month period ended March 31, 2014 to 26.5% for the same period in 2015.

Profit for the period

As a result of the foregoing,

our net income for the three-month period ended March 31, 2015 increased $11.2 million, from a gain of $2.6 million in 2014 to

a profit of $13.7 million in 2015.

LIQUIDITY AND

CAPITAL RESOURCES

Our liquidity and capital

resources are and will be influenced by a variety of factors, including:

| • | our ability to generate cash flows from our operations; |

| | | |

| • | the level of our outstanding indebtedness and the interest that we are obligated to pay on such

outstanding indebtedness; |

| | | |

| • | our capital expenditure requirements, which consist primarily of investments in new farmland, in

our operations, in equipment and plant facilities and maintenance costs; and |

| | | |

| • | our working capital requirements. |

| | | |

Our principal sources of

liquidity have traditionally consisted of shareholders’ contributions, short and long term borrowings and proceeds received

from the disposition of transformed farmland or subsidiaries.

We believe that our working

capital will be sufficient during the next 12 months to meet our liquidity requirements.

Three-month period ended March 31, 2015 and 2014

The table below reflects

our statements of Cash Flow for the three-month period ended March 31, 2015 and 2014.

| |

Three-month period |

| |

2015 |

2014 |

| |

(Unaudited, in thousands of $) |

| Cash and cash equivalent at the beginning of the period |

113,795 |

232,147 |

| Net cash generated from operating activities |

41,803 |

40,915 |

| Net cash used in investing activities |

(60,613) |

(112,958) |

| Net cash generated by financial activities |

125,879 |

75,561 |

| Effect of exchange rate changes on cash and cash equivalent |

(22,585) |

11,766 |

| Cash and cash equivalent at the end of the period |

198,279 |

247,431 |

| |

|

|

Operating Activities

Period ended March 31, 2015

Net cash generated by operating

activities was $41.8 million for the three-month period ended March 31, 2015. During this period, we generated a net profit of

$13.8 million that included non-cash charges relating primarily to losses from foreign exchange, net of $13.7 million, $10.8 million

interest and other expense, net, $5.0 million of income tax and $4.9 million of depreciation and amortization. All these effects

were partially offset by a gain from derivate financial instruments and forward contracts of $21.3 million and the unrealized portion

of the “Initial recognition and changes in fair value of biological assets and agricultural produce” of $20.1 million.

In addition, other changes

in operating assets and liability balances resulted in a net increase in cash of $33.6 million,primarily due to an decrease of

$24.4 million in trade and other receivables, a decrease of $11.3 million in derivate financial instruments, and a decrease of

$11.3 million in biological assets, partially offset by a increase of $13.0 million in trade and other payables.

Period ended March 31, 2014

Net cash generated by operating

activities was $40.9 million for the three-month period ended March 31, 2014. During this period, we generated a net profit of

$2.6 million that included non-cash charges relating primarily to a loss from derivative financial instruments of $13.3 million,

$12.1 million of interest and other expenses, net, $5.3 million of depreciation and amortization, $7.3 million income tax, $3.7

million of foreign exchange gains, net and $2.1 million of provisions and allowances. All of these effects were partially offset

by unrealized portion of the “Initial recognition and changes in fair value of biological assets and agricultural produce”

of $28.8 million.

In addition, other changes

in operating asset and liability balances resulted in a net increase in cash of $22.2 million, primarily due to an decrease of

$18.3 million in biological assets, mainly due to the harvest of rice and crops, and a decrease of $6.9 million in trade and other

receivables, partially offset by a increase of $3.7 million in inventories.

Investing Activities

Period ended March 31, 2015

Net cash used in investing

activities totaled $60.6 million in the three-month period ended March 31, 2015, primarily due to the purchases of property, plant

and equipment (mainly acquisitions of machinery, buildings and facilities for the finalization of the construction of the second

phase of Ivinhema mill), totaling $51.3 million; and $11.3 million in biological assets related mainly to the expansion of our

sugarcane plantation area in Mato Grosso do Sul.

Period ended March 31, 2014

Net cash used in investing

activities totaled $113.0 million in the three-month period ended March 31, 2014, primarily due to the purchases of property, plant

and equipment (mainly acquisitions of machinery, buildings and facilities for the construction of the second phase of Ivinhema

mill), totaling $88.0 million; and $25.1 million in biological assets related mainly to the expansion of our sugarcane plantation

area in Mato Grosso do Sul.

Financing Activities

Period ended March 31, 2015

Net cash provided by financing

activities was $125.9 million in the Period ended March 31, 2015, primarily derived from the incurrence of new long and short term

loans in the amounts of $160.7 million and $5.2 million, respectively, mainly for our Brazilian operations related to the Sugar

and Ethanol cluster development. This effect was partially offset by a net payments of short and long term borrowings in the amounts

$19.8 million and $11.2 million, respectively. During this period, interest paid totaled $9.7 million.

Period ended March 31, 2014

Net cash provided by financing

activities was $75.6 million in the Period ended March 31, 2014, primarily derived from the incurrence of new long and short term

loans in the amounts of $120.8 million and $19.0 million, respectively, mainly for our Brazilian operations related to the Sugar

and Ethanol cluster development. This effect was partially offset by net payments on short and long term borrowings in the amounts

of $30.2 million and $11.2 million, respectively, and $12.9 million of purchase of own shares. During this period, interest paid

totaled $10.2 million

Cash and Cash Equivalents

Historically, since our

cash flows from operations were insufficient to fund our working capital needs and investment plans, we funded our operations with

proceeds from short-term and long-term indebtedness and capital contributions from existing and new private investors. In 2011

we obtained $421.8 million from the IPO and the sale of shares in a concurrent private placement (See “Item 4. Information

on the Company—A. History and Development of the Company” in our Form 20-F). As of March 31, 2015, our cash and cash

equivalents amounted to $198.3 million.

However, we may need additional

cash resources in the future to continue our investment plans. Also, we may need additional cash if we experience a change in business

conditions or other developments. We also might need additional cash resources in the future if we find and wish to pursue opportunities

for investment, acquisitions, strategic alliances or other similar investments. If we ever determine that our cash requirements

exceed our amounts of cash and cash equivalents on hand, we might seek to issue debt or additional equity securities or obtain

additional credit facilities or realize the disposition of transformed farmland and/or subsidiaries. Any issuance of equity securities

could cause dilution for our shareholders. Any incurrence of additional indebtedness could increase our debt service obligations

and cause us to become subject to additional restrictive operating and financial covenants, and could require that we pledge collateral

to secure those borrowings, if permitted to do so. It is possible that, when we need additional cash resources, financing will

not be available to us in amounts or on terms that would be acceptable to us or at all.

Projected Sources and Uses of Cash

We anticipate that we will

generate cash from the following sources:

| • | the dispositions of transformed farmland and/or subsidiaries; and |

| | | |

| • | debt or equity offerings. |

| | | |

We anticipate

that we will use our cash:

| • | for other working capital purposes; |

| | | |

| • | to meet our budgeted capital expenditures; |

| | | |

| • | to make investment in new projects related to our business; and |

| | | |

| • | to refinance our current debts. |

| | | |

Indebtedness and Financial Instruments

The table below illustrates

the maturity of our indebtedness (excluding obligations under finance leases) and our exposure to fixed and variable interest rates:

| |

March 31,

2015 |

|

December 31, 2014 |

| |

(unaudited) |

|

|

| Fixed rate: |

|

|

|

| Less than 1 year |

94,680 |

|

95,524 |

| Between 1 and 2 years |

42,394 |

|

45,518 |

| Between 2 and 3 years |

31,831 |

|

41,685 |

| Between 3 and 4 years |

30,282 |

|

25,809 |

| Between 4 and 5 years |

26,580 |

|

39,992 |

| More than 5 years |

59,704 |

|

87,219 |

| |

285,471 |

|

335,747 |

| Variable rate: |

|

|

|

| Less than 1 year |

98,207 |

|

111,371 |

| Between 1 and 2 years |

173,344 |

|

130,426 |

| Between 2 and 3 years |

133,418 |

|

80,199 |

| Between 3 and 4 years |

63,158 |

|

13,154 |

| Between 4 and 5 years |

6,323 |

|

7,346 |

| More than 5 years |

17,477 |

|

19,683 |

| |

491,927 |

|

362,179 |

| |

777,398 |

|

697,926 |

| |

|

|

|

| (1) | The

Company plans to partially rollover its short term debt using new available lines of

credit, or on using operating cash flow to cancel such debt. |

During 2015 and

2014 the Company was in compliance with all financial covenants.

Short-term Debt.

As of March 31,

2015, our short term debt totaled $193.1 million.

We maintain lines

of credit with several banks in order to finance our working capital requirements. We believe that we will continue to be able

to obtain additional credit to finance our working capital needs in the future based on our past track record and current market

conditions.

Capital Expenditure Commitments

During the three-month

Period ended March 31, 2015, our capital expenditures totaled $62.7 million. Our capital expenditures consisted mainly of equipment,

machinery and construction costs related to the finalization of the construction of the Ivinhema sugar and ethanol mill in Brazil.

We expect continuous capital expenditures for the foreseeable future

as we expand and consolidate each of our business segments.

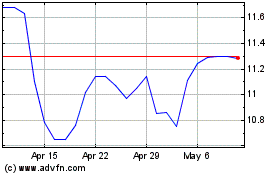

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Sep 2023 to Sep 2024