UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) May 22, 2015

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

| | |

Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

|

| | |

| | |

3001 Ocean Drive, Suite 201 Vero Beach, Florida | | 32963 |

(Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.02. Termination of a Material Definitive Agreement.

On May 22, 2015, ARMOUR Residential REIT, Inc. (the “Company”) gave notice of termination of that certain Equity Distribution Agreement by and between the Company and Citadel Securities LLC (“Citadel”) dated as of July 27, 2012 (the “Agreement”). The Agreement is terminable at will by the Company upon giving ten days written notice to Citadel with no penalty. As a result of the May 22, 2015 notice, the Agreement will terminate effective as of the close of business on June 1, 2015. The Agreement established an “at-the-market” (“ATM”) offering program through which the Company had the right to sell, from time to time, through Citadel, as the Company’s agent, or to Citadel for resale, up to 22,500,000 shares of its common stock, par value $0.001 per share (the “Common Stock”) and up to 2,000,000 shares of its 8.250% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”). The Company sold 4,250,000 shares of Common Stock and no shares of Series A Preferred Stock under the Agreement.

Item 8.01. Other Events.

As previously disclosed, the Company has had an ongoing ATM offering of shares of its Common Stock, pursuant to an Equity Distribution Agreement dated October 11, 2011 (the “Distribution Agreement”) with Deutsche Bank Securities Inc., JMP Securities LLC and Ladenburg Thalmann & Co. Inc. (collectively, the “Agents”). Under the terms of the Distribution Agreement, the Company may offer and sell, from time to time, through the Agents, as the Company’s agents, or to the Agents for resale, up to 40,000,000 shares of the Company’s Common Stock. The Company has sold 15,500,000 shares of its Common Stock under the Distribution Agreement as of the date of this Current Report on Form 8-K.

Also as previously disclosed, the Company has had an ongoing ATM offering of its Series A Preferred Stock, pursuant to an At Market Issuance Sales Agreement dated July 13, 2012 (the “Sales Agreement”) with MLV & Co LLC (“MLV”). Under the terms of the Sales Agreement, the Company may offer and sell, from time to time, through MLV, as the Company’s agent, or to MLV for resale, up to 6,000,000 shares of the Company’s Series A Preferred Stock. The Company has sold 780,572 shares of its Series A Preferred Stock under the Sales Agreement as of the date of this Current Report on Form 8-K.

Under the requirements of the rules and regulations of the Securities and Exchange Commission (the “Commission”), public companies are required to file new registration statements for ongoing offerings every three years. On May 1, 2015, the Company filed a new automatic shelf registration statement on Form S-3 (No. 333-203813) (the “Registration Statement”) covering its Common Stock, preferred stock, warrants, depository shares and debt securities, which may be offered from time to time. The Registration Statement was declared effective immediately. On May 22, 2015, the Company filed (1) a prospectus supplement covering the sale of the 24,500,000 unsold shares of Common Stock (the “Unsold Common Stock”) from its previously registered 40,000,000 share ATM offering of Common Stock (the “Common Stock ATM Prospectus Supplement”), and (2) a prospectus supplement covering the sale of the 5,219,428 unsold shares of Series A Preferred Stock (the “Unsold Preferred Stock”) from its previously registered 6,000,000 share ATM offering of Series A Preferred Stock (the “Preferred Stock ATM Prospectus Supplement”).

The offering of the Unsold Common Stock and the offering of the Unsold Preferred Stock will be made pursuant to (a) the Registration Statement, (b) the Prospectus, dated May 1, 2015, filed as a portion of the Registration Statement, and (c) the Common Stock ATM Prospectus Supplement with respect to the Unsold Common Stock and the Preferred Stock ATM Prospectus Supplement with respect to the Unsold Preferred Stock, and will continue to be governed by the terms of the Distribution Agreement and Sales Agreement, respectively. The Distribution Agreement as described in the Company's Current Report on Form 8-K filed with the Commission on October 12, 2011 and the Sales Agreement as described in the Company's Current Report on Form 8-K filed with the Commission on July 13, 2012, do not purport to be complete and are qualified in their entirety by reference to the Distribution Agreement and Sales Agreement filed as exhibits, respectively, to such Current Reports on Form 8-K.

This Current Report on Form 8-K does not constitute offers to sell or the solicitation of offers to buy nor shall there be any sales of Unsold Common Stock or Unsold Preferred Stock in any state in which such offers, solicitations or sales would be unlawful prior to registration or qualification under the securities laws of any such state.

Exhibits 5.1 and 23.1, and Exhibits 5.2 and 23.2, to this Current Report on Form 8-K are filed herewith in connection with the Company’s Common Stock ATM Prospectus Supplement and Preferred Stock ATM Prospectus Supplement, respectively, and are incorporated therein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit No. | Description |

| |

5.1 | | Opinion of Akerman LLP (Common Stock ATM Prospectus Supplement) |

5.2 | | Opinion of Akerman LLP (Preferred Stock ATM Prospectus Supplement) |

23.1 | | Consent of Akerman LLP (Common Stock ATM Prospectus Supplement) (included in Ex. 5.1) |

23.2 | | Consent of Akerman LLP (Preferred Stock ATM Prospectus Supplement) (included in Ex. 5.2) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 22, 2015

ARMOUR RESIDENTIAL REIT, INC.

By: /s/ James R. Mountain

Name: James R. Mountain

Title: Chief Financial Officer

Exhibit Index

|

| | |

Exhibit No. | Description |

| |

5.1 | | Opinion of Akerman LLP (Cosmmon Stock ATM Prospectus Supplement) |

5.2 | | Opinion of Akerman LLP (Preferred Stock ATM Prospectus Supplement) |

23.1 | | Consent of Akerman LLP (Common Stock ATM Prospectus Supplement) (included in Ex. 5.1) |

23.2 | | Consent of Akerman LLP (Preferred Stock ATM Prospectus Supplement) (included in Ex. 5.2) |

[Akerman Letterhead]

May 22, 2015

ARMOUR Residential REIT, Inc.

3001 Ocean Drive, Suite 201

Vero Beach, Florida 32963

Re: Common Stock registered under Registration Statement on Form S-3

Ladies and Gentlemen:

Reference is made to our opinion dated May 1, 2015 and included as Exhibit 5.1 to the Registration Statement on Form S-3 ASR (Registration No. 333-203813) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on May 1, 2015 by ARMOUR Residential REIT, Inc. (the “Company”) pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”). We are rendering this supplemental opinion in connection with the prospectus supplement (the “Prospectus Supplement”) dated May 22, 2015. The Prospectus Supplement relates to the at-the-market offering by the Company of up to 24,500,000 shares of the Company's common stock, par value $0.001 per share (the “Shares”), which Shares are covered by the Registration Statement. We understand that the Shares are to be offered and sold in the manner set forth in the Registration Statement and the Prospectus Supplement.

We have acted as your counsel in connection with the preparation of the Registration Statement and the Prospectus Supplement. We are familiar with the proceedings taken by the Board of Directors of the Company in connection with the authorization, issuance and sale of the Preferred Shares. We have examined all such documents as we have considered necessary in order to enable us to render this opinion, including, but not limited to, (i) the Registration Statement, (ii) the Prospectus dated May 1, 2015 included with the Registration Statement (the “Prospectus”), (iii) the Prospectus Supplement, (iv) the Company's Articles of Incorporation, as amended, (v) the Company's Amended and Restated By-laws, (vi) certain resolutions of the Board of Directors of the Company and of the Pricing Committee thereof, (vii) corporate records and instruments, (viii) a specimen certificate representing the Shares, and (ix) such laws and regulations as we have deemed necessary for the purposes of rendering the opinions set forth herein. In our examination, we have assumed the legal capacity of all natural persons, the authenticity of originals of such documents that have been presented to us as photostatic copies, and that the Preferred Shares will be issued against payment of valid consideration under applicable law. As to any facts material to the opinions expressed herein, which were not independently established or verified, we have relied upon statements and representations of officers of the Company.

ARMOUR Residential REIT, Inc.

May 22, 2015

Page 2

Based upon the foregoing, we are of the opinion that the Shares have been duly authorized and, when issued and delivered by the Company against payment therefor as set forth in the Prospectus Supplement, will be validly issued, fully paid and non-assessable.

We assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact that may change the opinion expressed herein after the date hereof.

We hereby consent to the filing of this opinion as part of the Registration Statement and to the reference of our firm under the caption “Legal Matters” in the Prospectus Supplement. In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

Very truly yours,

/s/ Akerman LLP

[Akerman Letterhead]

May 22, 2015

ARMOUR Residential REIT, Inc.

3001 Ocean Drive, Suite 201

Vero Beach, Florida 32963

Re: Preferred Stock registered under Registration Statement on Form S-3

Ladies and Gentlemen:

Reference is made to our opinion dated May 1, 2015 and included as Exhibit 5.1 to the Registration Statement on Form S-3 ASR (Registration No. 333-203813) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on May 1, 2015 by ARMOUR Residential REIT, Inc. (the “Company”) pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”). We are rendering this supplemental opinion in connection with the prospectus supplement (the “Prospectus Supplement”) dated May 22, 2015. The Prospectus Supplement relates to the at-the-market offering by the Company of up to 5,219,428 shares (the “Preferred Shares”) of the Company's 8.250% Series A Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share, $0.001 par value per share, (the “Series A Preferred Stock”), which Preferred Shares are covered by the Registration Statement. The Prospectus Supplement also relates to the potential issuance of up to 37,495,849 shares (the “Common Shares”) of the Company's common stock, par value $0.001 per share, upon the conversion of the Preferred Shares pursuant to the Articles Supplementary governing the Preferred Shares, subject to adjustment as provided therein. We understand that the Preferred Shares and the Common Shares are to be offered and sold in the manner set forth in the Registration Statement and the Prospectus Supplement.

We have acted as your counsel in connection with the preparation of the Registration Statement and the Prospectus Supplement. We are familiar with the proceedings taken by the Board of Directors of the Company in connection with the authorization, issuance and sale of the Preferred Shares. We have examined all such documents as we have considered necessary in order to enable us to render this opinion, including, but not limited to, (i) the Registration Statement, (ii) the Prospectus dated May 1, 2015 included with the Registration Statement (the “Prospectus”), (iii) the Prospectus Supplement, (iv) the Company's Articles of Incorporation, as amended, (v) the Company's Amended and Restated By-laws, (vi) the Articles Supplementary for the Series A Preferred Stock, as certified by the Secretary of the Company, (vii) certain resolutions of the Board of Directors of the Company and of the Pricing Committee thereof, (viii) corporate records and instruments, (ix) a specimen certificate representing the Preferred

ARMOUR Residential REIT, Inc.

May 22, 2015

Page 2

Shares and the Common Shares, and (x) such laws and regulations as we have deemed necessary for the purposes of rendering the opinions set forth herein. In our examination, we have assumed the legal capacity of all natural persons, the authenticity of originals of such documents that have been presented to us as photostatic copies, and that the Preferred Shares will be issued against payment of valid consideration under applicable law. As to any facts material to the opinions expressed herein, which were not independently established or verified, we have relied upon statements and representations of officers of the Company.

Based upon the foregoing, we are of the opinion that the Preferred Shares and the Common Shares have been duly authorized and, when issued and delivered by the Company against payment therefor as set forth in the Prospectus Supplement, will be validly issued, fully paid and non-assessable.

We assume no obligation to supplement this opinion if any applicable law changes after the date hereof or if we become aware of any fact that may change the opinion expressed herein after the date hereof.

We hereby consent to the filing of this opinion as part of the Registration Statement and to the reference of our firm under the caption “Legal Matters” in the Prospectus Supplement. In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

Very truly yours,

/s/ Akerman LLP

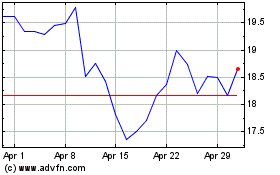

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Aug 2024 to Sep 2024

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Sep 2023 to Sep 2024