Current Report Filing (8-k)

May 21 2015 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 21, 2015

TrustCo Bank Corp NY

(Exact name of registrant as specified in its charter)

|

NEW YORK

|

0-10592

|

14-1630287

|

|

State or Other Jurisdiction of Incorporation or Organization

|

Commission File No.

|

I.R.S. Employer Identification Number

|

5 SARNOWSKI DRIVE, GLENVILLE, NEW YORK 12302

(Address of principal executive offices)

(518) 377-3311

(Registrant’s Telephone Number,

Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TrustCo Bank Corp NY

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

TrustCo Bank Corp NY (the “Company” or “TrustCo”) and Robert T. Cushing, TrustCo’s Executive Vice President and Chief Operating Officer, have decided that the effective date of Mr. Cushing’s previously announced retirement from the Company and its subsidiaries will be changed from May 31, 2015 to December 31, 2015. Mr. Cushing will continue to hold his current positions as Executive Vice President and Chief Operating Officer of TrustCo and its subsidiaries until the effective date of his retirement. In addition, TrustCo and Mr. Cushing have mutually agreed to terminate the Consulting Agreement, dated December 16, 2014, that was entered into at the time of the announcement of Mr. Cushing’s retirement.

The following materials were presented at the Annual Meeting of Shareholders held May 21, 2015. Attached is a copy of the presentation labeled as Exhibit 99(a).

| Item 9.01. |

Financial Statements and Exhibits |

| |

Reg S-K Exhibit No.

|

Description

|

| |

|

|

| |

99(a)

|

Presentation given at the Annual Meeting of Shareholders held on May 21, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Date: May 21, 2015

|

|

|

| |

|

|

| |

TrustCo Bank Corp NY

|

| |

(Registrant)

|

| |

|

|

| |

By:

|

/s/ Michael M. Ozimek

|

| |

|

Michael M. Ozimek

|

| |

|

Senior Vice President and

|

| |

|

Chief Financial Officer

|

Exhibits Index

The following exhibits are filed herewith:

|

Reg S‑K Exhibit No.

|

|

Description

|

|

Page

|

| |

|

|

|

|

|

|

|

Presentation given at the Annual Meeting of Shareholders held on May 21, 2015.

|

|

5 - 22

|

Exhibit 99(a)

Welcome to the 2015 Annual Meeting

Shareholder Assembly Agenda Balance SheetBranch Growth & Future PlansIncome Statement & Ratio AnalysisDividends & Capital GrowthStock PerformanceMarket & Regulatory EnvironmentOther Items To NoteThings To Be Proud OfQuestions and Answers

Nonperforming Loans / Loans (%)

Short-term Delinquencies* (%) *30-89 day past due loans / total loans

Number of Branches & Average Size

Investments & Cash to Assets (%)

Margin has been roughly stable and expenses flattened….. …helping to drive ROE and ROA as credit costs decline and growth continues

TrustCo vs. Peers *All public owned banking institutions covered by SNL Financial with assets of $2 to $10 billion as of December 31, 2014; peer numbers are the medians for the full year 2014. All ratios are as published by SNL Financial. TrustCo Peers* 2010 2011 2012 2013 2014 Q1/15 2014 Return on Average Equity 11.5% 11.0% 10.7% 11.2% 11.5% 10.8% 9.0% Return on Average Assets 0.77% 0.81% 0.87% 0.90% 0.97% 0.92% 0.92% Net Interest Margin 3.50% 3.40% 3.20% 3.14% 3.16% 3.07% 3.63% Nonperforming Loans/ Loans 2.07% 1.93% 2.20% 1.79% 1.39% 1.37% 1.18% 30-89 Day PD Loans / Loans 0.91% 0.48% 0.30% 0.24% 0.22% 0.22% 0.35% Efficiency Ratio 51.4% 50.0% 52.3% 52.8% 52.6% 54.2% 63.0%

Dividends & Capital Growth2000-2014 Dividends Paid: $6.79 per shareDividends Paid: $521 million totalShareholders’ Equity: Increase of 101%

3 Year Stock Performance* *December 31, 2011 to December 31, 2014, Total Return

Market & Regulatory Environment New RegulationsHeightened Regulatory ExpectationsIncreased Investment in:Systems, governance and technologyStaffing, training and developmentEnhanced operating policies, procedures, audit and risk monitoring systems Goal: To meet and exceed heightened market and regulatory expectations.

Other Items to Note Bob CushingJoe LucarelliRegulatory Environment

Things To Be Proud Of Bauer ratingRanked #12 thrift institution in nation by SNL Financial for 2014Loan portfolio exceeded $3 billion for the first timeOpened 50th branch in FloridaFinancial Services Department growthEmployee and Company support for our communities

Forward Looking Statements Safe Harbor Regarding Forward-Looking StatementsThis presentation may contain forward-looking information about TrustCo Bank Corp NY (“the Company”) that is intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Actual results and trends could differ materially from those set forth in such statements due to various risks, uncertainties and other factors. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: credit risk, the effects of and changes in, trade, monetary and fiscal policies and laws, inflation, interest rates, market and monetary fluctuations, competition, the effect of changes in financial services laws and regulations, real estate and collateral values, changes in accounting policies and practices, changes in local market areas and general business and economic trends and the matters described under the heading “Risk Factors” in our most recent annual report on Form 10-K and our other securities filings. The statements are valid only as of the date hereof and the Company disclaims any obligation to update this information except as may be required by applicable law. Note: Data in this presentation was obtained from SNL Financial and from the Company’s SEC filings. Ratios use SNL definitions and may differ from definitions used by the Company in its own SEC filings SNL definitions are available upon request.

2015 Annual Meeting Questions and Answers

2015 Annual Meeting Thank You for Attending

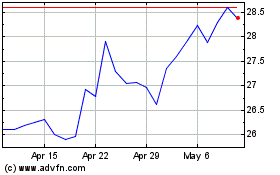

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Mar 2024 to Apr 2024

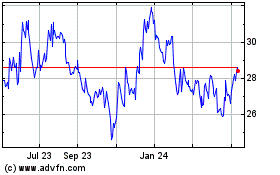

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Apr 2023 to Apr 2024