Current Report Filing (8-k)

May 15 2015 - 12:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 15, 2015

TrustCo Bank Corp NY

(Exact name of registrant as specified in its charter)

|

NEW YORK

|

0-10592

|

14-1630287

|

|

State or Other Jurisdiction of Incorporation or Organization

|

Commission File No.

|

I.R.S. Employer Identification Number

|

5 SARNOWSKI DRIVE, GLENVILLE, NEW YORK 12302

(Address of principal executive offices)

(518) 377-3311

(Registrant's Telephone Number,

Including Area Code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TrustCo Bank Corp NY

A press release was issued on May 15, 2015 announcing that SNL Financial ranked TrustCo Bank Corp NY as one of its top 100 public thrifts for 2014. Attached is a copy of the press release labeled as Exhibit 99(a).

| Item 9.01. |

Financial Statements and Exhibits |

| |

Reg S-K Exhibit No. |

Description |

|

99(a) |

Press release dated May 15, 2015 announcing that SNL Financial ranked TrustCo Bank Corp NY as one of its top 100 public thrifts for 2014. |

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: May 15, 2015

|

|

TrustCo Bank Corp NY

|

|

|

(Registrant)

|

| |

|

|

|

|

|

By:

|

/s/ Michael M. Ozimek

|

|

|

|

|

Michael M. Ozimek

|

|

| |

|

Senior Vice President and

|

|

| |

|

Chief Financial Officer

|

|

-3-

The following exhibits are filed herewith:

|

Reg S-K Exhibit No.

|

|

Description

|

|

|

|

Press release dated May 15, 2015 announcing that SNL Financial ranked TrustCo Bank Corp NY as one of its top 100 public thrifts for 2014.

|

-4-

Exhibit 99(a)

5 Sarnowski Drive, Glenville, New York, 12302

(518) 377-3311 Fax: (518) 381-3668

|

Subsidiary: Trustco Bank

|

NASDAQ -- TRST

|

|

Contact:

|

Kevin T. Timmons

|

Vice President/Treasurer

(518) 381-3607

FOR IMMEDIATE RELEASE:

TrustCo Recognized as One of

America's Top Thrifts

Glenville, New York – May 15, 2015

SNL Financial once again named TrustCo Bank Corp NY (TrustCo, Nasdaq: TRST) as one of America's top banking institutions. SNL recently released its 2014 ranking of the top performers from the largest 100 institutions in the thrift industry. TrustCo ranked 12th based on an objective analysis of profitability, capital strength and asset quality. President and Chief Executive Officer Robert J. McCormick noted, "We are pleased that this independent analysis of TrustCo's financial performance and condition affirms that our business model continues to produce results that rank among the best in the industry."

TrustCo has ranked in the top twenty on this study every year since 2005. The study rates thrifts based on six financial performance metrics including, return on average assets, return on average equity, the growth rate in tangible book value, the efficiency ratio, nonperforming loans as a percentage of total loans and net charge-offs as a percentage of average loans.

TrustCo Bank Corp NY is a $4.7 billion bank holding company and through its subsidiary, Trustco Bank, operates 145 offices in New York, Florida, Massachusetts, New Jersey and Vermont.

In addition, the Bank's Financial Services Department offers a full range of investment services, retirement planning and trust and estate administration services. The common shares of TrustCo are traded on the NASDAQ Global Select Market under the symbol TRST.

Safe Harbor Statement

All statements in this news release that are not historical are forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our expectations for our performance during 2015 and for the growth of loans and deposits throughout our branch network and our ability to capitalize on economic changes in the areas in which we operate. Such forward-looking statements are subject to factors that could cause actual results to differ materially for TrustCo from those discussed. TrustCo wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The following important factors, among others, in some cases have affected and in the future could affect TrustCo's actual results and could cause TrustCo's actual financial performance to differ materially from that expressed in any forward-looking statement: our ability to continue to originate a significant volume of one-to-four family mortgage loans in our market areas; our ability to continue to maintain noninterest expense and other overhead costs at reasonable levels relative to income; the future earnings and capital levels of Trustco Bank and the continued ability of Trustco Bank under regulatory rules to distribute capital to TrustCo, which could affect our ability to pay dividends; our ability to make accurate assumptions and judgments regarding the credit risks associated with lending and investing activities; the effect of changes in financial services laws and regulations and the impact of other governmental initiatives affecting the financial services industry; results of examinations of Trustco Bank and TrustCo by our respective regulators; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board, inflation, interest rates, market and monetary fluctuations; the perceived overall value of our products and services by users, including in comparison to competitors' products and services and the willingness of current and prospective customers to substitute competitors' products and services for our products and services; real estate and collateral values; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the FASB or PCAOB; changes in local market areas and general business and economic trends, as well as changes in consumer spending and saving habits; our success at managing the risks involved in the foregoing and managing our business; and other risks and uncertainties under the heading "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2014, as amended, and, if any, in our subsequent quarterly reports on Form 10-Q or other securities filings.

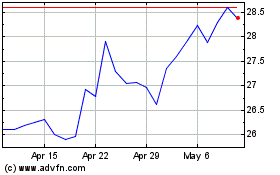

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Aug 2024 to Sep 2024

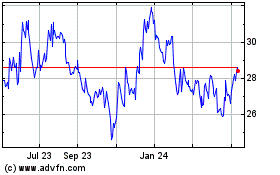

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Sep 2023 to Sep 2024