UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015

Commission file number 0-30752

_______________________________

AETERNA ZENTARIS INC.

_______________________________

1405 du Parc-Technologique Boulevard

Quebec City, Québec

Canada, G1P 4P5

(Address of principal executive offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

DOCUMENTS INDEX

| |

99.1 | Aeterna Zentaris' Interim Financial Report - First Quarter 2015 (Q1) |

| |

99.2 | Certification of the Chief Executive Officer pursuant to National Instrument 52-109 |

| |

99.3 | Certification of the Chief Financial Officer pursuant to National Instrument 52-109 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | | |

| | | | |

| | AETERNA ZENTARIS INC. |

| | | |

Date: May 7, 2015 | | By: | | /s/ Dennis Turpin |

| | | | Dennis Turpin |

| | | | Senior Vice President and Chief Financial Officer |

First Quarter 2015

Management's Discussion and Analysis

of Financial Condition and Results of Operations

Company Overview

Aeterna Zentaris Inc. is a specialty biopharmaceutical company engaged in developing and commercializing novel treatments in oncology, endocrinology and women's health.

Our drug development efforts are focused currently on two lead, clinical-stage development compounds: zoptarelin doxorubicin, which has the potential to become the first United States ("US") Food and Drug Administration ("FDA")-approved medical therapy for advanced, recurrent endometrial cancer, and Macrilen™, a novel orally-active ghrelin agonist for use in evaluating adult growth hormone deficiency ("AGHD"). Additionally, our Erk inhibitors and luteinizing hormone releasing hormone ("LHRH") - Disorazol Z compounds, which are potential oncology-indication product candidates, are in pre-clinical development.

We also continue to work concurrently to pursue strategic commercial initiatives in connection with our goal to become a commercially operating specialty biopharmaceutical organization. Our vision includes in-licensing, acquiring, promoting or co-promoting additional commercial products, as well as optimizing the ultimate launch of our potential product candidates (i.e. Macrilen™ and zoptarelin doxorubicin) in certain strategic territories, including the US, Canada and the European Union, where we already have business activities. We also intend to license out certain commercial rights to licensees in territories where such out-licensing would enable the Company to ensure final development, registration and launch of our product candidates.

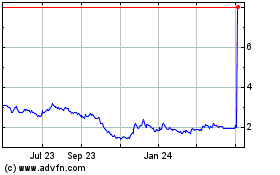

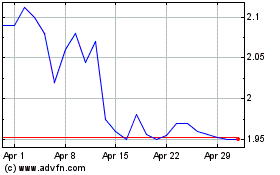

The Company's common shares are listed on both the NASDAQ Capital Market ("NASDAQ"), under the symbol "AEZS", and on the Toronto Stock Exchange ("TSX"), under the symbol "AEZ".

Introduction

This Management's Discussion and Analysis ("MD&A") provides a review of the results of operations, financial condition and cash flows of Aeterna Zentaris Inc. for the three-month period ended March 31, 2015. In this MD&A, "Aeterna Zentaris", the "Company", "we", "us", "our" and the "Group" mean Aeterna Zentaris Inc. and its subsidiaries. This discussion should be read in conjunction with the information contained in the Company's condensed interim consolidated financial statements and the accompanying notes thereto as at March 31, 2015 and for the three-month periods ended March 31, 2015 and 2014 (the "condensed interim consolidated financial statements"). Our condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") applicable to the preparation of interim financial statements, including IAS 34, Interim Financial Reporting.

All amounts in this MD&A are presented in US dollars, except for share, option and warrant data, per share and per warrant data and as otherwise noted.

About Forward-Looking Statements

This document contains forward-looking statements, which reflect our current expectations regarding future events. Forward-looking statements may include words such as "anticipate", "assume", "believe", "could", "expect", "foresee", "goal", "guidance", "intend", "may", "objective", "outlook", "plan", "seek", "should", "strive", "target" and "will".

Forward-looking statements involve risks and uncertainties, many of which are discussed in this MD&A and others of which are discussed under the caption "Key Information – Risk Factors" in our most recent Annual Report on Form 20-F filed with the relevant Canadian securities regulatory authorities in lieu of an annual information form and with the US Securities and Exchange Commission ("SEC"). Such statements include, but are not limited to, statements about the progress of our research,

First Quarter MD&A - 2015

development and clinical trials and the timing of, and prospects for, regulatory approval and commercialization of our product candidates, the timing of expected results of our studies, anticipated results of these studies, statements about the status of our efforts to establish a commercial operation and to obtain the right to promote or sell products that we did not develop and estimates regarding our capital requirements and our needs for, and our ability to obtain, additional financing. Known and unknown risks and uncertainties could cause our actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, the availability of funds and resources to pursue our research and development ("R&D") projects, the successful and timely completion of clinical studies, the degree of market acceptance once our products are approved for commercialization, our ability to take advantage of business opportunities in the pharmaceutical industry, our ability to protect our intellectual property, uncertainties related to the regulatory process and general changes in economic conditions. See also the section entitled "Risk Factors and Uncertainties" in this MD&A.

Given these uncertainties and risk factors, readers are cautioned not to place undue reliance on any forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, unless required to do so by a governmental authority or by applicable law.

About Material Information

This MD&A includes information that we believe to be material to investors after considering all circumstances, including potential market sensitivity. We consider information and disclosures to be material if they result in, or would reasonably be expected to result in, a significant change in the market price or value of our securities, or where it is likely that a reasonable investor would consider the information and disclosures to be important in making an investment decision.

The Company is a reporting issuer under the securities legislation of all of the provinces of Canada, and our securities are registered with the SEC. The Company is therefore required to file or furnish continuous disclosure information, such as interim and annual financial statements, MD&A, proxy or information circulars, annual reports on Form 20-F, material change reports and press releases with the appropriate securities regulatory authorities. Copies of these documents may be obtained free of charge upon request from the Company's Investor Relations department or on the Internet at the following addresses: www.aezsinc.com, www.sedar.com and www.sec.gov.

Key Developments

Status of Our Drug Pipeline

________________________

| |

(1) | Phase 2 in ovarian cancer completed. |

| |

(2) | Investigator-driven and sponsored. |

| |

(3) | Confirmatory Phase 3 efficacy clinical trial to be initiated before year-end. |

| |

(4) | Potential oral prostate cancer vaccine available for out-licensing. |

| |

(5) | Compound library transferred to The Medical University of South Carolina. AEZS has access to future potential development candidates. |

First Quarter MD&A - 2015

Zoptarelin Doxorubicin

Zoptarelin doxorubicin is a complex molecule that combines a synthetic peptide carrier with doxorubicin, a well-known chemotherapy agent. The synthetic peptide carrier is an LHRH agonist, a modified natural hormone with affinity for the LHRH receptor. The design of the compound allows for the specific binding and selective uptake of the cytotoxic conjugate by LHRH receptor-positive tumors. Potential benefits of this targeted approach include a better efficacy and a more favorable safety profile with lower incidence and severity of side effects as compared to doxorubicin alone.

We believe that zoptarelin doxorubicin has the potential to become the first FDA-approved medical therapy for advanced, recurrent endometrial cancer, potentially resulting in the compound's rapid adoption as a novel core therapy for patient treatment and management, representing a significant potential market opportunity for the Company. Moving forward, we will continue to develop our commercialization plans regarding zoptarelin doxorubicin in this indication. In addition, contingent on the success of the ZoptEC (Zoptarelin Doxorubicin in Endometrial Cancer) Phase 3 clinical trial, we have additional areas of interest for further therapeutic development, including ovarian, prostate and triple negative breast cancer.

On April 27, 2015, we announced that an independent Data and Safety Monitoring Board ("DSMB") for the pivotal Phase 3 ZoptEC clinical trial with zoptarelin doxorubicin in women with advanced, recurrent or metastatic endometrial cancer had completed a pre-specified first interim futility analysis. The DSMB has recommended that the Phase 3 clinical trial continue as planned. At this time, site initiation has been completed with over 120 sites in operation in North America, Europe and Israel. More than 465 patients, out of an expected total of 500, have been recruited.

Also subsequent to quarter-end, we announced that we had filed an application for a European patent on a novel method of manufacturing zoptarelin doxorubicin. Because this compound is a complex molecule, it is expensive to synthesize, and the requested patent, if granted, may make it difficult for generic manufacturers to produce zoptarelin doxorubicin on a financially feasible basis once our composition of matter patent on the compound expires. Further, the claimed manufacturing process is expected to result in a significant reduction in cost of goods sold, providing a stronger competitive position for the Company.

Macrilen™ (macimorelin)

On April 13, 2015, we announced plans to conduct a new confirmatory Phase 3 clinical trial to demonstrate the efficacy of Macrilen™, as well as a dedicated thorough QT study to evaluate the effect of Macrilen™ on myocardial repolarization. During an end-of-review meeting with the FDA on March 6, 2015, we and the FDA agreed on the general design of the confirmatory Phase 3 clinical trial of Macrilen™, as well as on evaluation criteria. The clinical trial will be conducted as a two-way crossover with the insulin tolerance test as the benchmark comparator. The clinical trial population will consist of patients with a medical history documenting risk factors for AGHD and will include a spectrum of patients from those with a low risk of having AGHD to those with a high risk of having the condition. We expect to submit a proposed final protocol of the confirmatory Phase 3 clinical trial to the FDA for approval in the near-term and to initiate it by the end of this year. Our goal is to initiate the QT study at the beginning of 2016. We currently estimate that it will take approximately 18 months to complete the trials, with a combined expenditure of between $5 million and $6 million over the same period.

Pre-clinical developments

As for our compounds in earlier stages of development, as part of our resource optimization program announced and implemented during 2014, we have decided to streamline our drug discovery activities and focus on specific projects related to our Erk inhibitors and our LHRH-disorazol Z product candidates. Regarding our Erk inhibitors program, we expect to select an optimized molecule for development during the second quarter of 2015.

On March 31, 2015, we announced the transfer of our discovery library of roughly 100,000 unique compounds to the South Carolina Center for Therapeutic Discovery and Development (the "Center") pursuant to a material transfer agreement, which represents the beginning of a long-term relationship between the Company and the Center, which in turn is part of The Medical University of South Carolina ("MUSC"). Our agreement with the Center will result in the continued use of the library for the discovery of drug development candidates for the Company in the areas of oncology, neurology, endocrinology and women's health. The Center may make the library available to all investigators in the University of South Carolina system without restriction on its use and will own any therapeutic compounds discovered outside our areas of therapeutic interest.

The Center has agreed to conduct screening and pre-clinical activities with respect to the library with a view toward submitting to us at least one development candidate per year in our areas of therapeutic interest over a ten-year period beginning in 2018.

First Quarter MD&A - 2015

We also have a right of first refusal to license any submitted development candidates. Should we decide to further develop a development candidate submitted by the Center, MUSC will license the compound candidate to us and be entitled to a royalty on the net sales of all commercialized products developed from the development candidate. However, should we decide not to further develop the development candidate submitted by the Center, MUSC is required to pay us a royalty on net sales of all commercialized products developed from the development candidate.

Commercial Developments

During the quarter, we ramped up selling efforts related to our co-promotion agreement with ASCEND Therapeutics US LLC ("ASCEND"), which we entered into in August 2014. Pursuant to that agreement, we are co-promoting ASCEND'S product, EstroGel®, a leading non-patch transdermal hormone replacement therapy product, in specific agreed-upon US territories in exchange for a sales commission that is based upon incremental sales volumes of the product that are generated over pre-established baselines.

Detailing efforts associated with EstroGel® commenced in earnest early in the first quarter of 2015, following the completion of sales force training and other knowledge-transfer activities that had been underway since late 2014. During the quarter, our contract sales representatives initiated calling on prescribing physicians in their respective territories, and overall feedback from the field has been positive. Subsequent to quarter-end, we began exceeding pre-established unit sales baseline thresholds on a total nation basis, as discussed further below.

Our commercial operations consist of a full-time sales force and a sales-management staff. We currently have 19 sales representatives in the US who provide services pursuant to our agreement with a contract sales organization.

On May 7, 2015, we announced that we had entered into a promotional services agreement with EMD Serono, Inc., the US and Canadian biopharmaceutical businesses of Merck KGaA of Darmstadt, Germany ("EMD Serono"),that will allow us to promote Saizen® [somatropin (rDNA origin) for injection] to designated medical professionals in specified US territories. Saizen® is a recombinant human growth hormone registered in the US for the treatment of growth hormone deficiency in children and adults. Under this agreement, we will detail Saizen® to designated medical professionals, representing an important incremental field promotion activity in support of the EMD Serono's product. Payment to Aeterna Zentaris will be based on new, eligible patient starts on Saizen® above an agreed-upon baseline. We have subcontracted with ASCEND, pursuant to our co-promotion agreement, to detail Saizen® in territories not covered by our contracted sales force.

Corporate Developments

Public Offering

On March 11, 2015, we completed a public offering of 59.7 million units (the "Units"), generating net proceeds of approximately $34.4 million, with each Unit consisting of either one common share or one warrant to purchase one common share ("Series C Warrant"), 0.75 of a warrant to purchase one common share ("Series A Warrant") and 0.50 of a warrant to purchase one common share ("Series B Warrant"), at a purchase price of $0.62 per Unit (the "March 2015 Offering"). The Series A Warrants are exercisable for a period of five years at an exercise price of $0.81 per share, and the Series B Warrants are exercisable for a period of 18 months at an exercise price of $0.81 per share. Both the Series A and Series B warrants are subject to certain anti-dilution provisions. The Series C Warrants are exercisable for a period of five years at an exercise price of $0.62 per share. Total gross proceeds payable to us in connection with the exercise of the Series C Warrants have been pre-paid by investors and therefore are included in the aforementioned proceeds.

The complete exercise of the Series A and Series B Warrants would result in the issuance of an aggregate of approximately 74.6 million common shares that would generate additional proceeds for an amount that would be determined based on the then adjusted exercise price. Both the Series A and Series B Warrants may at any time be exercised on a "net" or "cashless" basis. In addition to standard cashless exercise provisions, the Series B Warrants may be exercised on an alternate cashless basis. The number of common shares that would be issued pursuant to an alternative cashless exercise is not currently determinable; however, such alternative cashless exercise could result in the issuance of a substantially larger number of the Company's common shares than otherwise would be issued following a standard cash or cashless exercise of the Series B Warrants.

In connection with the March 2015 Offering, the holders of 21.1 million of the 21.9 million outstanding warrants issued in connection with previous public offerings completed in November 2013 and January 2014 each entered into an amendment

First Quarter MD&A - 2015

agreement that caused such previously issued warrants to expire and terminate in consideration for a cash payment made by us in the aggregate amount of approximately $5.7 million.

Condensed Interim Consolidated Statements of Comprehensive Loss Information

|

| | | | | | |

| | Three months ended March 31, |

(in thousands, except share and per share data) | | 2015 | | 2014 |

| | $ | | $ |

Revenues | | | | |

License fees | | 73 |

| | — |

|

Operating expenses | | | | |

Research and development costs | | 4,466 |

| | 5,830 |

|

Selling, general and administrative expenses | | 5,143 |

| | 2,365 |

|

| | 9,609 |

| | 8,195 |

|

Loss from operations | | (9,536 | ) | | (8,195 | ) |

Finance income | | 1,374 |

| | 4,919 |

|

Finance costs | | (1,474 | ) | | (1,028 | ) |

Net finance (costs) income | | (100 | ) | | 3,891 |

|

Net loss from continuing operations | | (9,636 | ) | | (4,304 | ) |

Net loss from discontinued operations | | (100 | ) | | (52 | ) |

Net loss | | (9,736 | ) | | (4,356 | ) |

Other comprehensive income (loss): | | | | |

Items that may be reclassified subsequently to profit or loss: | | | | |

Foreign currency translation adjustments | | 1,775 |

| | 23 |

|

Items that will not be reclassified to profit or loss: | | | | |

Actuarial loss on defined benefit plans | | (1,301 | ) | | (959 | ) |

Comprehensive loss | | (9,262 | ) | | (5,292 | ) |

Net loss per share (basic and diluted) from continuing operations | | (0.13 | ) | | (0.08 | ) |

Net loss per share (basic and diluted) from discontinued operations | | — |

| | — |

|

Net loss (basic and diluted) per share | | (0.13 | ) | | (0.08 | ) |

Weighted average number of shares outstanding: | | | | |

Basic | | 71,653,626 |

| | 54,921,459 |

|

Diluted | | 71,653,626 |

| | 54,921,459 |

|

First Quarter MD&A - 2015

Revenues

Revenues recorded during the three months ended March 31, 2015 resulted predominantly from the amortization of a one-time, non-refundable payment made to us in 2014 in connection with a master collaboration agreement, a technology transfer and technical assistance agreement and a license agreement we entered into with Sinopharm A-Think Pharmaceuticals Co., Ltd. ("Sinopharm"), which is related to zoptarelin doxorubicin.

We expect revenues during the second quarter of 2015 to be higher than those recorded during the first quarter of 2015 due to sales commission revenue that we expect to begin generating in connection with our sales efforts related to EstroGel®, pursuant to the co-promotion services agreement entered into with ASCEND.

As discussed above, following the completion of sales force training and other knowledge-transfer activities, detailing efforts commenced in earnest early in the first quarter of 2015. During that period, our contract sales representatives initiated calling on prescribing physicians in their respective territories, and overall feedback from the field has been positive. Subsequent to quarter-end, we began exceeding pre-established unit sales baseline thresholds on a total nation basis. As such, we expect to commence recognizing sales commissions revenue in the second and subsequent quarters of 2015.

Operating Expenses

R&D costs were $4.5 million for the three-month period ended March 31, 2015, compared to $5.8 million for the same period in 2014.

The decrease for the three-month period ended March 31, 2015, as compared to the same period in 2014, is attributable to lower comparative employee compensation and benefits costs, facilities rent and maintenance as well as other costs. A substantial portion of this decrease is due to the realization of cost savings in connection with our aforementioned global resource optimization program as well as the lower comparative exchange rate of the EUR against the US dollar. This decrease was partly compensated by higher third-party costs, as described below.

The following table summarizes our R&D costs by nature of expense:

|

| | | | | | |

| | Three months ended March 31, |

(in thousands) | | 2015 | | 2014 |

| | $ | | $ |

Third-party costs | | 3,173 |

| | 2,543 |

|

Employee compensation and benefits | | 1,041 |

| | 2,450 |

|

Facilities rent and maintenance | | 335 |

| | 448 |

|

Other costs* | | 191 |

| | 389 |

|

Gain on disposal of equipment | | (274 | ) | | — |

|

| | 4,466 |

| | 5,830 |

|

_________________________

* Includes depreciation, amortization, reversal of impairment charges and of unused provision as well as operating foreign exchange losses.

First Quarter MD&A - 2015

The following table summarizes primary third-party R&D costs, by product candidate, incurred by the Company during the three-month periods ended March 31, 2015 and 2014.

|

| | | | | | | | | | | | |

(in thousands, except percentages) | | Three months ended March 31, | | Three months ended March 31, |

Product Candidate | | 2015 | | 2014 |

| | $ | | % | | $ | | % |

Zoptarelin doxorubicin | | 2,803 |

| | 88.3 |

| | 1,879 |

| | 73.9 |

|

Erk inhibitors | | 216 |

| | 6.8 |

| | 202 |

| | 7.9 |

|

Macrilen™, macimorelin | | 82 |

| | 2.6 |

| | 42 |

| | 1.7 |

|

LHRH-Disorazol Z | | 47 |

| | 1.5 |

| | 143 |

| | 5.6 |

|

Other | | 25 |

| | 0.8 |

| | 277 |

| | 10.9 |

|

| | 3,173 |

| | 100.0 |

| | 2,543 |

| | 100.0 |

|

As shown above, a substantial portion of the quarter-to-date third-party R&D costs relates to development initiatives associated with zoptarelin doxorubicin, and in particular with our Phase 3 ZoptEC clinical trial initiated in 2013 with Ergomed Clinical Research Ltd. ("Ergomed"), the contract clinical development organization with which, in April 2013, we entered into a co-development and profit sharing agreement. Third-party costs attributable to zoptarelin doxorubicin increased by $0.9 million during the three-month period ended March 31, 2015, as compared to the same period in 2014, mainly due to a higher comparative number of patients enrolled in the clinical trial.

During the three-month period ended March 31, 2015, ongoing services provided by Ergomed included the conducting of monitoring visits at various clinical sites, screening and enrolment initiatives, investigation-related management and analysis and regulatory support. ZoptEC-related efforts are progressing in accordance with pre-established timelines. As we continue to closely monitor all initiatives supported by Ergomed, we may decide to revise some of the trial's parameters or expand the scope of work performed by Ergomed and, consequently, total estimated costs in connection with the co-development and revenue sharing agreement may be adjusted. To date, our arrangement with Ergomed has been revised following our decision to open additional clinical sites and to perform additional sub-studies, resulting in overall, cumulative cost increases of approximately $1.8 million, as compared to our original expectations.

Excluding the impact of foreign exchange rate fluctuations, we expect R&D costs to increase in the second quarter of 2015, as compared to the first quarter of 2015, mainly due to slightly higher third-party R&D costs in connection with our Phase 3 ZoptEC clinical trial and to the recording in the first quarter of 2015 of a non-recurring gain on disposal of certain R&D equipment, reversal of impairment charges and unused provision. Based on currently available information and forecasts, excluding the impact of foreign exchange rate fluctuations, we continue to expect that we will incur R&D costs of between $21 million and $23 million for the year ended December 31, 2015, including the expected initiation of our confirmatory Phase 3 clinical trial for Macrilen™.

Selling, general and administrative ("SG&A") expenses were $5.1 million for the three-month period ended March 31, 2015, as compared to $2.4 million for the same period in 2014.

The quarter-over-quarter increase is attributable to our increased selling activities, associated with the co-promotion efforts related to EstroGel®, with $1.1 million of first quarter 2015 expenses being related to higher costs associated with our contracted sales force and our own sales and marketing staff. Additionally, approximately $0.8 million of the quarter-over-quarter increase is attributable to transaction costs incurred in connection with the completion of the March 2015 Offering. Other increases are attributable in large part to lower comparative foreign exchange gains.

Excluding the impact of foreign exchange rate fluctuations, we expect SG&A expenses to decrease in the second quarter of 2015, as compared to the first quarter of 2015, due to the recording in the first quarter of non-recurring transaction costs related to the March 2015 Offering. Based on currently available information and forecasts, excluding the impact of foreign exchange rate fluctuations, we now expect that our SG&A expenses will increase for the year ended December 31, 2015, as compared to the year ended December 31, 2014, mainly due to the aforementioned recording of transaction costs in connection with the completion of the March 2015 Offering.

First Quarter MD&A - 2015

Net finance income decreased by $4.0 million for the three-month period ended March 31, 2015, as compared to the same period in 2014.

While finance costs, which increased by $0.4 million for the three-month period ended March 31, 2015 as compared to the same period in 2014, are attributable entirely to losses associated with foreign currency fluctuations, finance income for the three-month period ended March 31, 2015 was $1.3 million, as compared to $4.9 million for the same period in 2014. This decrease is almost entirely attributable to the change in fair value recorded in connection with our warrant liability. Such change in fair value results from the periodic "mark-to-market" revaluation, via the application of the Black-Scholes option pricing model, of currently outstanding share purchase warrants. The "mark-to-market" warrant valuation most notably has been impacted by the fair value calculated at the issuance of 74.6 million additional share purchase warrants and by the closing price of our common shares, which, on the NASDAQ, fluctuated from $0.51 to $0.84 during the three-month period ended March 31, 2015.

Net loss for the three-month period ended March 31, 2015 was $9.7 million, or $0.13 per basic and diluted share, compared to $4.4 million, or $0.08 per basic and diluted share, for the same period in 2014.

The increase in net loss for the three-month period ended March 31, 2015, as compared to the same period in 2014, is due largely to higher comparative SG&A expenses and to higher comparative net finance costs, partially offset by lower comparative R&D costs, as presented above.

Quarterly Consolidated Results of Operations Information

|

| | | | | | | | | | | | |

(in thousands, except for per share data) | | Three months ended |

| | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 |

| | $ | | $ | | $ | | $ |

Revenues | | 73 |

| | 11 |

| | — |

| | — |

|

Loss from operations | | (9,536 | ) | | (10,947 | ) | | (9,843 | ) | | (8,410 | ) |

Net (loss) income from continuing operations | | (9,636 | ) | | 3,995 |

| | (11,629 | ) | | (5,249 | ) |

Net (loss) income | | (9,736 | ) | | 4,153 |

| | (11,337 | ) | | (5,024 | ) |

Net (loss) income per share from continuing operations (basic and diluted)* | | (0.13 | ) | | 0.06 |

| | (0.20 | ) | | (0.09 | ) |

Net (loss) income per share (basic and diluted)* | | (0.13 | ) | | 0.06 |

| | (0.20 | ) | | (0.09 | ) |

|

| | | | | | | | | | | | |

(in thousands, except for per share data) | | Three months ended |

| | March 31, 2014 | | December 31, 2013 | | September 30, 2013 | | June 30, 2013 |

| | $ | | $ | | $ | | $ |

Revenues | | — |

| | — |

| | 17 |

| | 96 |

|

Loss from operations | | (8,195 | ) | | (7,972 | ) | | (8,648 | ) | | (9,693 | ) |

Net loss from continuing operations | | (4,304 | ) | | (10,596 | ) | | (7,799 | ) | | (9,848 | ) |

Net (loss) income | | (4,356 | ) | | (8,243 | ) | | 3,842 |

| | 9,330 |

|

Net loss per share from continuing operations (basic and diluted)* | | (0.08 | ) | | (0.28 | ) | | (0.26 | ) | | (0.39 | ) |

Net (loss) income per share (basic and diluted)* | | (0.08 | ) | | (0.22 | ) | | 0.13 |

| | 0.37 |

|

_________________________

| |

* | Net (loss) income per share is based on the weighted average number of shares outstanding during each reporting period, which may differ on a quarter-to-quarter basis. As such, the sum of the quarterly net (loss) income per share amounts may not equal year-to-date net (loss) income per share. |

First Quarter MD&A - 2015

Historical quarterly results of operations and net income (loss) from continuing operations cannot be taken as reflective of recurring revenue or expenditure patterns or of predictable trends, largely given the unpredictable quarterly variations attributable to our net finance income (costs), which in turn are comprised of the impact of the periodic "mark-to-market" revaluation of our warrant liability and of foreign exchange gains and losses. Additionally, our R&D costs historically have varied on a quarter-over-quarter basis due to the ramping up or winding down of potential product candidate activities, which in turn are dependent upon a number of factors that often do not occur on a linear or predictable basis.

More recently, our SG&A expenses have increased on a quarter-over-quarter basis due to the ramping up of pre-commercialization activities associated with Macrilen™ (prior to the receipt of a Complete Response Letter from the FDA in November 2014) and to the deployment of our contracted sales force related to our co-promotion activities associated with EstroGel®.

In addition to the items referred to above, our net income (loss) also has been impacted by net variations attributable to our discontinued operations related to the manufacturing of Cetrotide® and related activities.

Condensed Interim Consolidated Statement of Financial Position Information

|

| | | | | | |

| | As at March 31, | | As at December 31, |

| | 2015 | | 2014 |

| | $ | | $ |

Cash and cash equivalents1 | | 53,259 |

| | 34,931 |

|

Trade and other receivables and other current assets | | 2,292 |

| | 1,286 |

|

Restricted cash equivalents | | 674 |

| | 760 |

|

Property, plant and equipment | | 529 |

| | 797 |

|

Other non-current assets | | 8,520 |

| | 9,661 |

|

Total assets | | 65,274 |

| | 47,435 |

|

Payables and other current liabilities2 | | 6,078 |

| | 7,304 |

|

Current portion of deferred revenues | | 239 |

| | 270 |

|

Warrant liability | | 22,151 |

| | 8,225 |

|

Non-financial non-current liabilities3 | | 16,425 |

| | 17,152 |

|

Total liabilities | | 44,893 |

| | 32,951 |

|

Shareholders' equity | | 20,381 |

| | 14,484 |

|

Total liabilities and shareholders' equity | | 65,274 |

| | 47,435 |

|

_________________________

1 Of which approximately $2.4 million was denominated in EUR as at March 31, 2015 ($3.6 million as at December 31, 2014)

| |

2 | Of which approximately $0.5 million is related to our provision for restructuring costs as at March 31, 2015 ($1.5 million as at |

December 31, 2014).

3 Comprised mainly of employee future benefits and provisions for onerous contracts.

The increase in cash and cash equivalents as at March 31, 2015, as compared to December 31, 2014, is due to the receipt of net proceeds of $34.4 million in connection with the March 2015 Offering, by variations in components of our working capital and by recurring disbursements, as well as by the effect of exchange rate fluctuations.

The increase in trade and other receivables and other current assets as at March 31, 2015, as compared to December 31, 2014, is mainly due to higher trade accounts receivable, due in connection with the disposal of certain R&D equipment.

The decrease in other non-current assets as at March 31, 2015, as compared to December 31, 2014, is primarily due to the lower comparative exchange rate of the EUR against the US dollar, which weakened by 11.4% from December 31, 2014 to March 31, 2015.

First Quarter MD&A - 2015

The decrease in payables and other current liabilities as at March 31, 2015, as compared to December 31, 2014, is mainly explained by the decrease of our provision for restructuring costs, following severance payments made during the first quarter of 2015, as well as by the lower comparative exchange rate of the EUR against the US dollar.

Our warrant liability increased from December 31, 2014 to March 31, 2015 predominantly due to the issuance of 74.6 million additional share purchase warrants in connection with the March 2015 Offering, as discussed above. This increase was partly offset by a $5.9 million reduction resulting from the early expiry and derecognition of 21.1 million warrants previously issued in connection with offerings completed in November 2013 and January 2014 and by net fair value gains of $1.2 million, which were recorded pursuant to our periodic "mark-to-market" revaluation of the underlying outstanding share purchase warrants.

The increase in shareholders' equity as at March 31, 2015, as compared to December 31, 2014, is mainly attributable to the increase in our share capital and pre-funded warrants following the issuance of units discussed above and to the increase in our accumulated other comprehensive income due to foreign currency translation adjustments, partly offset by the increase in our deficit due to the recording of our net loss and an actuarial loss on our pension-related employee benefit obligation.

Financial Liabilities, Obligations and Commitments

We have certain contractual lease obligation commitments. The following table summarizes future cash requirements with respect to these obligations.

Expected future minimum lease payments and future minimum sublease receipts under non-cancellable operating leases (subleases) are as follows:

|

| | | | | | |

| | As at March 31, 2015 |

(in thousands) | | Minimum lease payments | | Sublease income |

| | $ | | $ |

Less than 1 year | | 1,543 |

| | (375 | ) |

1 – 3 years | | 1,024 |

| | (432 | ) |

4 – 5 years | | 242 |

| | — |

|

Total | | 2,809 |

| | (807 | ) |

With regard to our lease arrangement in Germany for laboratory, office and storage space, we expect not to renew our existing agreement beyond the end of its original term (expiry of March 2016). As such, the minimum lease payments presented above exclude any lease payments for our German subsidiary beyond March 2016. However, in the near-term, we expect to enter into a new lease agreement, which will reflect reduced space requirements as compared to our current arrangement.

Outstanding Share Data

As at May 7, 2015, we had 95,894,654 common shares issued and outstanding 29,629,355 pre-funded warrants, as well as 3,856,986 stock options outstanding. Non-pre-funded warrants outstanding as at May 7, 2015 represented a total of 81,815,298 equivalent common shares.

Capital Disclosures

Our objective in managing capital, consisting of shareholders' equity, with cash and cash equivalents and restricted cash equivalents being its primary components, is to ensure sufficient liquidity to fund R&D activities, selling, general and administrative expenses and working capital.

Over the past several years, we have increasingly raised capital via public equity offerings and drawdowns under various ATM sales programs as our primary source of liquidity.

Our capital management objective remains the same as that in previous periods. The policy on dividends is to retain cash to keep funds available to finance the activities required to advance our product development portfolio and to pursue appropriate commercial opportunities as they may arise.

First Quarter MD&A - 2015

We are not subject to any capital requirements imposed by any regulators or by any other external source.

Liquidity, Cash Flows and Capital Resources

Our operations and capital expenditures have been financed through certain transactions impacting our cash flows from operating activities, public equity offerings, as well as from the drawdowns under various ATM programs.

Based on our assessment, which took into account current cash levels, as well as our strategic plan and corresponding budgets and forecasts, we believe that we have sufficient liquidity and financial resources to fund planned expenditures and other working capital needs for at least, but not limited to, the 12-month period following the statement of financial position date of March 31, 2015.

We may endeavour to secure additional financing, as required, through strategic alliance arrangements or through other activities, as well as via the issuance of new share capital or other securities.

The variations in our liquidity by activity are explained below.

|

| | | | | | |

(in thousands) | | Three months ended March 31, |

| | 2015 | | 2014 |

| | $ | | $ |

Cash and cash equivalents - Beginning of period | | 34,931 |

| | 43,202 |

|

Cash flows from operating activities: | | | | |

Cash used in operating activities from continuing operations | | (9,871 | ) | | (9,216 | ) |

Cash used in operating activities from discontinued operations | | (314 | ) | | (357 | ) |

| | (10,185 | ) | | (9,573 | ) |

Cash flows from financing activities: | | | | |

Net cash provided by financing activities | | 28,737 |

| | 12,446 |

|

| | 28,737 |

| | 12,446 |

|

| | | | |

Cash flows from investing activities: | | | | |

Net cash provided by investing activities | | 492 |

| | (7 | ) |

| | 492 |

| | (7 | ) |

Effect of exchange rate changes on cash and cash equivalents | | (716 | ) | | (316 | ) |

Cash and cash equivalents - End of period | | 53,259 |

| | 45,752 |

|

Operating Activities

Cash used in operating activities totalled $10.2 million for the three-month period ended March 31, 2015, compared to $9.6 million for the same period in 2014.

We expect net cash used in operating activities to decrease in the second quarter of 2015, as compared to the first quarter of 2015, mainly as we expect that our net disbursements associated with our operating assets and liabilities will be lower. This guidance may vary significantly in future periods, most notably in light of ongoing business development initiatives, as discussed further below.

Financing Activities

Cash flows provided by financing activities were $28.7 million for the three-month period ended March 31, 2015, compared to $12.4 million for the same period in 2014. The increase for the three-month period ended March 31, 2015, as compared to the same period in 2014 is due to higher net proceeds received from the issuance of common shares and warrants.

First Quarter MD&A - 2015

Critical Accounting Policies, Estimates and Judgments

The preparation of consolidated financial statements in accordance with IFRS requires management to make judgments, estimates and assumptions that affect the reported amounts of our assets, liabilities, revenues, expenses and related disclosures. Judgments, estimates and assumptions are based on historical experience, expectations, current trends and other factors that management believes to be relevant at the time at which our consolidated financial statements are prepared.

Management reviews, on a regular basis, the Company's accounting policies, assumptions, estimates and judgments in order to ensure that our consolidated financial statements are presented fairly and in accordance with IFRS. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Critical accounting estimates and assumptions, as well as critical judgments used in applying accounting policies in the preparation of our condensed interim consolidated financial statements were the same as those that applied to our annual consolidated financial statements as at December 31, 2014 and December 31, 2013 and for the years ended December 31, 2014, 2013 and 2012, except as pertaining to the valuation of the fair value attributable to the Series A and Series B Warrants and our accrued pension benefit obligation, to which we applied an adjusted discount rate assumption as at March 31, 2015.

Recent Accounting Pronouncements

Not yet adopted

The final version of IFRS 9, Financial instruments ("IFRS 9"), was issued by the IASB in July 2014 and will replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 introduces a model for classification and measurement, a single, forward-looking expected loss impairment model and a substantially reformed approach to hedge accounting. IFRS 9, which is to be applied retrospectively, is effective for annual periods beginning on or after January 1, 2018 and is available for early adoption. We are currently assessing the impact, if any, that this new standard will have on our consolidated financial statements.

In May 2014, the IASB issued IFRS 15, Revenue from Contracts with Customers. The objective of this new standard is to provide a single, comprehensive revenue recognition framework for all contracts with customers to improve comparability of financial statements of companies globally. The underlying principle is that an entity will recognize revenue to depict the transfer of goods or services to customers at an amount that the entity expects to be entitled to in exchange for those goods or services. This new standard is effective for annual periods beginning on or after January 1, 2017. We are currently assessing the impact that this new standard may have on our consolidated financial statements.

Outlook for the remainder of 2015

Commercial Development

EstroGel®

Our selling efforts associated with EstroGel® are expected to continue to become more focused, and ongoing activities by our contract sales force are expected to result in our exceeding pre-established unit sales baseline thresholds on a total nation basis, as discussed above.

Saizen®

We will commence selling and related activities that will allow us to promote Saizen® subsequent to our having very recently entered into a co-promotion agreement with EMD Serono.

Expansion of our Commercial Portfolio

With our focus to become a growth-oriented, commercially operating specialty biopharmaceutical organization, and in addition to our commitment to developing key product candidates in our existing pipeline, we expect to continue to evaluate potential in-licensing and/or acquisition opportunities, as well as additional promotional or co-promotional arrangements related to targeted commercial products.

First Quarter MD&A - 2015

Resource Optimization

We expect to substantially complete implementation of our global resource optimization program to streamline R&D activities, increase commercial activities and overall workforce flexibility by August 31, 2015.

Zoptarelin doxorubicin

With regard to our ZoptEC Phase 3 clinical trial in collaboration with Ergomed, we will continue to monitor patient enrollment in North America, Europe and Israel, such that we are able to secure a second interim analysis before year-end. We also expect to complete patient recruitment for this trial in the near-term.

Macrilen™

We plan to conduct a new confirmatory Phase 3 clinical trial to demonstrate the efficacy of Macrilen™, as well as a dedicated thorough QT study to evaluate the effect of Macrilen™ on myocardial repolarization. We expect to submit a proposed final protocol of the confirmatory Phase 3 clinical trial to the FDA for approval in the near-term and to initiate it by the end of this year. Our goal is to initiate the QT study at the beginning of 2016. We currently estimate that it will take approximately 18 months to complete the trials, with a combined expenditure of between $5 million and $6 million over the same period.

Erk Inhibitor Development

We expect to select an optimized molecule for development in the second quarter of 2015.

Summary of key expectations for revenues, operating expenditures and cash flows

As noted above, we expect to commence generating sales commission revenues in subsequent quarters and for the full-year ended December 31, 2015 in connection with our co-promotion agreement with ASCEND. However, given the relatively early stage of our selling initiatives, we are not yet able to provide an estimate as to overall commissions revenue. As more historical data and trend analysis are made available, we may be in a position to provide more detailed guidance on this component of our revenue stream in future quarters. As for license fee revenues, we will continue to recognize the amortization of deferred revenues related to the agreements we entered into with Sinopharm in 2014, as mentioned above.

As discussed above, excluding the impact of foreign exchange rate fluctuations, we continue to expect that we will incur R&D costs of between $21 million and $23 million for the year ended December 31, 2015, including the initiation of our confirmatory Phase 3 clinical trial for Macrilen™ later this year.

As noted above, our main focus for R&D efforts will be on our later-stage compounds, zoptarelin doxorubicin and its Phase 3 ZoptEC clinical trial as well as Macrilen™ and its confirmatory Phase 3 clinical trial, where we continue to anticipate substantial investment to fund ongoing development initiatives.

Excluding the impact of foreign exchange rate fluctuations, we now expect that our SG&A expenses will increase for the year ended December 31, 2015, as compared to the year ended December 31, 2014, mainly due to the aforementioned recording of transaction costs in connection with the completion of the March 2015 Offering.

Excluding any foreign exchange impacts, we continue to expect that our overall operating burn in 2015 will range from $33 million to $35 million as we continue to fund ongoing operating activities and working capital requirements.

The preceding summary with regard to our revenue, operating expenditure and cash flow expectations excludes any consideration of any potential strategic commercial initiatives that may be consummated in connection with our efforts to expand our commercial operations in the US or elsewhere. As such, the guidance presented in this MD&A is subject to revision based on new information that is not currently known or available.

First Quarter MD&A - 2015

Financial Risk Factors and Other Instruments

Fair value risk

As noted above, the change in our warrant liability, which is measured at fair value through profit or loss, results from the periodic "mark-to-market" revaluation, via the application of the Black-Scholes option pricing model, of currently outstanding share purchase warrants. The Black-Scholes valuation is impacted, among other inputs, by the market price of our common shares. As a result, the change in fair value of the warrant liability, which is reported as finance income (cost) in our consolidated statements of comprehensive loss, has been and may continue in future periods to be materially affected by changes in our common share closing price, which has ranged from $0.51 to $0.84 on the NASDAQ during the three-month period ended March 31, 2015.

If variations in the market price of our common shares of -10% and +10% were to occur, the impact on our net loss for the warrant liability held at March 31, 2015 would be as follows:

|

| | | | | | | | | |

(in thousands) | | Carrying

amount | | -10% | | +10% |

| | $ | | $ | | $ |

Warrant liability | | 22,151 |

| | 3,027 |

| | (3,117 | ) |

Total impact on net loss – decrease / (increase) | | | | 3,027 |

| | (3,117 | ) |

Liquidity risk

Liquidity risk is the risk that we will not be able to meet our financial obligations as they become due. We manage this risk through the management of our capital structure and by continuously monitoring actual and projected cash flows. Our Board of Directors reviews and approves our operating and capital budgets, as well as any material transactions out of the ordinary course of business. We have adopted an investment policy in respect of the safety and preservation of our capital to ensure our liquidity needs are met. The instruments are selected with regard to the expected timing of expenditures and prevailing interest rates.

We believe that we have sufficient funds to pay our ongoing general and administrative expenses, to pursue our R&D activities and to meet our obligations and existing commitments as they fall due at least through March 31, 2016. In making this assessment, we took into account all available information about the future, which is at least, but not limited to, twelve months from the end of the most recent reporting period. We expect to continue to incur operating losses and may require significant capital to fulfill our future obligations. Our ability to continue future operations beyond March 31, 2016 and to fund our activities is dependent on our ability to secure additional funding, which may be completed in a number of ways, including but not limited to licensing arrangements, partnerships, share and other security issuances and other financing activities. We will pursue such additional sources of financing when required, and while we have been successful in securing financing in the past, there can be no assurance we will be able to do so in the future or that these sources of funding or initiatives will be available for the Company or that they will be available on terms which are acceptable to us.

Credit risk

Credit risk is the risk of an unexpected loss if a customer or counterparty to a financial instrument fails to meet its contractual obligations. We regularly monitor credit risk exposure and take steps to mitigate the likelihood of this exposure resulting in losses. Our exposure to credit risk currently relates to cash and cash equivalents, to trade and other receivables and to restricted cash equivalents. We invest our available cash in amounts that are readily convertible to known amounts of cash and deposit our cash balances with financial institutions that are rated the equivalent of "Baa1" and above. This information is supplied by independent rating agencies where available and, if not available, we use publicly available financial information to ensure that we invest our cash in creditworthy and reputable financial institutions.

As at March 31, 2015, trade accounts receivable for an amount of approximately $1.0 million were with three counterparties.

As at March 31, 2015, no trade accounts receivable were past due or impaired.

First Quarter MD&A - 2015

Generally, we do not require collateral or other security from customers for trade accounts receivable; however, credit is extended following an evaluation of creditworthiness. In addition, we perform ongoing credit reviews of all our customers and establish an allowance for doubtful accounts when accounts are determined to be uncollectible.

The maximum exposure to credit risk approximates the amount recognized on our condensed interim consolidated statement of financial position.

Related Party Transactions and Off-Balance Sheet Arrangements

In addition to recurring payments made to members of our key management team, during the three-month periods ended March 31, 2015 and 2014, we incurred nil and $35,000, respectively, in professional fees for services rendered by one of the members of the Company's Board of Directors in connection with special tasks mandated by our Nominating, Corporate Governance and Compensation Committee.

As at March 31, 2015, we did not have any interests in special purpose entities or any other off-balance sheet arrangements.

Risk Factors and Uncertainties

Risks Associated with Operations

| |

• | Our product candidates are currently at the development stage. It is impossible to ensure that the R&D activities related to these product candidates will result in the creation of profitable operations. |

| |

• | We are currently developing our product candidates based on R&D activities, preclinical testing and clinical trials conducted to date, and we may not be successful in developing or introducing to the market these or any other new products or technology. If we fail to develop and deploy new products successfully and on a timely basis, we may become non-competitive and unable to recover the R&D and other expenses we incur to develop and test new products. Additionally, if we are unable to successfully complete our clinical trial programs, or if such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely affected. |

| |

• | Even if our products are approved for commercialization, they may not be successful in the marketplace. Market acceptance of any of our products will depend on a number of factors including, but not limited to: demonstration of clinical efficacy and safety; the prevalence and severity of any adverse side effects; limitations or warnings contained in the product's approved labeling; availability of alternative treatments for the indications we target; the advantages and disadvantages of our products relative to current or alternative treatments; the availability of acceptable pricing and adequate third-party reimbursement; and the effectiveness of marketing and distribution methods for the products. If our products do not gain market acceptance among physicians, patients, healthcare payers and others in the medical community, who may not accept or utilize our products, our ability to generate significant revenues from our products would be limited and our financial condition could be materially adversely affected. In addition, if we fail to penetrate our core markets and existing geographic markets or successfully expand our business into new markets, the growth in sales of our products, along with our operating results, could be negatively impacted. |

| |

• | We rely heavily on our proprietary information in developing and manufacturing our product candidates, and our success will depend, in large part, on our ability to protect our competitive position through patents, trade secrets, trademarks and other intellectual property rights. We may not obtain adequate protection for our products through our intellectual property, despite efforts to protect our proprietary rights from unauthorized use or disclosure. If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected. In addition to patent protection, we may rely on other protections provided in the United States or elsewhere, such as new chemical entity or new formulation exclusivity, to provide market exclusivity for a product candidate. We cannot provide any assurance that zoptarelin doxorubicin or any of our drug candidates will obtain any market exclusivity, and, as a result, the absence of market exclusivity may have an adverse impact on our operating results, financial position and cash flows. |

First Quarter MD&A - 2015

| |

• | We are currently dependent on certain strategic relationships with third parties and may enter into future collaborations for the research and development of our product candidates. Our arrangements with these third parties may not provide us with the benefits we expect and may expose us to a number of risks. We are dependent on, and rely upon, third parties to perform various functions related to our business, including, but not limited to, the research and development of some of our product candidates. Our reliance on these relationships poses a number of risks. We may not realize the contemplated benefits of such agreements nor can we be certain that any of these parties will fulfill their obligations in a manner which maximizes our revenue. These arrangements may also require us to transfer certain material rights or issue our equity, voting or other securities to collaborators, licensees and others. Any license or sublicense of our commercial rights may reduce our product revenue. |

| |

• | We expect to rely on third parties to manufacture and supply marketed products. We also have or may have certain supply obligations vis-à-vis our existing and potential licensees, who are or will be responsible for the marketing of the products. To be successful, our products have to be manufactured in commercial quantities in compliance with quality controls and regulatory requirements. Even though it is our objective to minimize such risk by introducing alternative suppliers to ensure a constant supply at all times, we cannot guarantee that we will not experience supply shortfalls and, in such event, we may not be able to perform our obligations under contracts with our licensees. |

| |

• | We have incurred, and expect to continue to incur, substantial expenses in our efforts to develop and market products. Consequently, we have incurred operating losses historically and in each of the last several years, and our operating losses have adversely impacted, and will continue to adversely impact, our working capital, total assets, operating cash flows and shareholders' equity. We do not expect to reach operating profitability in the immediate future, and our operating expenses are likely to continue to represent a significant component of our overall cost profile as we continue our R&D and clinical study programs, seek regulatory approval for our product candidates and carry out commercial activities. Even if we succeed in developing, acquiring or in-licensing new commercial products, we could incur additional operating losses for at least the next several years. If we do not ultimately generate sufficient revenue from commercialized products and achieve or maintain operating profitability, an investment in our company could result in a significant or total loss. |

| |

• | In connection with our strategy to further transform the Company into a commercially operating specialty biopharmaceutical organization, we may enter into commercial arrangements with third parties, including but not limited to promotion, co-promotion, acquisition or in-licensing agreements, in efforts to establish and expand our commercial revenue base. We can provide no assurance that we will be able to identify potential product candidates or strategic commercial partners or, if we identify such product candidates or partners, that any related commercial arrangements will be consummated on terms that are favorable to us. To the extent that we are successful in entering into any strategic commercial arrangements or acquisition or in-licensing agreements with third parties, we cannot provide any assurance that any resulting initiatives or activities will be successful. To the extent that any related investments in such arrangements do not yield the expected benefits, our business, financial condition and results of operations may be materially adversely affected. |

| |

• | Future acquisitions or in-licensed products may not be successfully integrated. The failure to successfully integrate the personnel and operations of businesses that we may acquire or of products that we may in-license in the future with our existing operations, business and products could have a material adverse effect on our operations and results. |

Risks Related to Our Financial Condition, Capital Requirements and Going Concern

| |

• | We will require significant additional financing, and we may not have access to sufficient capital. We may require additional capital to pursue planned clinical trials, regulatory approvals, as well as further R&D and marketing efforts for our product candidates and potential products. We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or from other sources. Additional funding may not be available on terms which are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable or exercisable for equity securities, the issuance of those securities could result in dilution to our shareholders. Moreover, the incurrence of debt financing or the issuance of dividend-paying preferred shares could result in a substantial portion of our future cash flows, if any, being dedicated to the payment of principal and interest on such indebtedness or the payment of dividends on such preferred shares and could impose restrictions on our |

First Quarter MD&A - 2015

operations and on our ability to make certain expenditures and/or incur additional indebtedness. This could render us more vulnerable to competitive pressures and economic downturns.

Risks Associated with Regulatory Matters

| |

• | We will only receive regulatory approval for a product candidate if we can demonstrate in carefully designed and conducted clinical trials that the product candidate is both safe and effective. None of our current product candidates have to date received regulatory approval for their intended commercial sale. In general, significant R&D and clinical studies are required to demonstrate the safety and efficacy of our product candidates before we can submit regulatory applications. Though we may engage a contract research organization with experience in conducting regulatory trials, errors in the conduct, monitoring and/or auditing could invalidate the results from a regulatory perspective. Even if a product candidate is approved by the FDA, Health Canada's Therapeutic Products Directorate or any other regulatory authority, we may not obtain approval for an indication whose market is large enough to recover our investment in that product candidate. In addition, there can be no assurance that we will ever obtain all or any required regulatory approvals for any of our product candidates. Further, even if we receive marketing approval for our product candidates, such product approvals could be subject to restrictions or withdrawals. Regulatory requirements are subject to change. |

| |

• | We have limited experience in filing a new drug application ("NDA"), or similar application for approval in the US or in any country for our current product candidates, which may result in a delay in, or the rejection of, our filing of an NDA or similar application. During the drug development process, regulatory agencies will typically ask questions of drug sponsors. While we endeavor to answer all such questions in a timely fashion, some questions may not be answered in time to prevent the delay of acceptance of an NDA or the rejection of the NDA. |

Risks Related to Our Organizational Structure and Key Personnel

| |

• | Aeterna Zentaris Inc. is a holding company, and a substantial portion of our non-cash assets is the share capital of our subsidiaries. Because Aeterna Zentaris Inc. is a holding company, our obligations to our creditors are structurally subordinated to all existing and future liabilities of our subsidiaries. Our rights and the rights of our creditors to participate in any distribution of the assets of any subsidiary in the event that such a subsidiary were to be liquidated or reorganized or in the event of any bankruptcy or insolvency proceeding relating to or involving such a subsidiary, and therefore the rights of the holders of our shares to participate in those assets, are subject to the prior claims of such subsidiary's creditors. To the extent that we may be a creditor with recognized claims against any such subsidiary, our claims would still be subject to the prior claims of our subsidiary's creditors to the extent that they are secured or senior to those held by us. Accordingly, in the event of any foreclosure, dissolution, winding-up, liquidation or reorganization, or a bankruptcy or insolvency proceeding relating to us or our property, or any subsidiary, there can be no assurance as to the value, if any, that would be available to holders of our shares. |

| |

• | We are subject to intense competition for our skilled personnel, and the loss of key personnel or the inability to attract additional personnel could impair our ability to conduct our operations. We are highly dependent on our management and our clinical, regulatory and scientific staff, the loss of whose services might adversely impact our ability to achieve our objectives. Recruiting and retaining qualified management and clinical, scientific and regulatory personnel is critical to our success. Reductions in our staffing levels have eliminated redundancies in key capabilities and skill sets among our full-time staff and required us to rely more heavily on outside consultants and third parties. The competition for qualified personnel in the biopharmaceutical field is intense, and if we are not able to continue to attract and retain qualified personnel and/or maintain positive relationships with our outside consultants, we may not be able to achieve our strategic and operational objectives. |

Risks Related to Our Listing on the NASDAQ and the TSX

| |

• | There can be no assurance that our common shares will remain listed on the NASDAQ. If we fail to meet any of the NASDAQ's continued listing requirements, our common shares may be delisted. On December 19, 2014, we received a notice from the NASDAQ regarding our failure to comply with the NASDAQ's $1.00 minimum bid price requirement. We have until June 16, 2015 to regain compliance with the minimum bid price requirement. There can be no assurance that we will be able to maintain our listing on the NASDAQ. Any delisting of our common shares may adversely affect a shareholder's ability to dispose, or obtain quotations as to the market value, of such shares. |

First Quarter MD&A - 2015

| |

• | The market price of our common shares is subject to potentially significant fluctuations due to numerous developments directly affecting our business and by developments out of our control or unrelated to us. The stock market generally, and the biopharmaceutical sector in particular, are vulnerable to abrupt changes in investor sentiment. Prices of shares and trading volume of companies in the biopharmaceutical industry can swing dramatically in ways unrelated to, or that bear a disproportionate relationship to, operating performance. Our share price and trading volume may fluctuate based on a number of factors including, but not limited to: clinical and regulatory developments regarding our product candidates; delays in our anticipated development or commercialization timelines; developments regarding current or future third-party collaborators; other announcements by us regarding technological, product development or other matters; arrivals or departures of key personnel; governmental or regulatory action affecting our product candidates and our competitors' products in the US, Canada and other countries; developments or disputes concerning patent or proprietary rights; actual or anticipated fluctuations in our revenues or expenses; general market conditions and fluctuations for the emerging growth and biopharmaceutical market sectors; and economic conditions in the US, Canada or abroad. |

| |

• | Our listing on both the NASDAQ and the TSX may increase price volatility due to various factors, including different ability to buy or sell our common shares, different market conditions in different capital markets and different trading volumes. In addition, low trading volume may increase the price volatility of our common shares. A thin trading market could cause the price of our common shares to fluctuate significantly more than the stock market as a whole. |

Risk Associated with a Class Action Lawsuit

| |

• | The Company and certain of its current and former officers are defendants in several purported class-action lawsuits pending in the United States District Court for the District of New Jersey, brought on behalf of shareholders of the Company. |

| |

• | The lawsuits, the first of which was filed on November 11, 2014, have been consolidated, and the plaintiffs have filed an amended consolidated complaint. The amended complaint alleges violations of the Securities Exchange Act of 1934 in connection with allegedly false and misleading statements made by the defendants between August 30, 2011 and November 6, 2014 (the "Class Period"), regarding the safety and efficacy of Macrilen™, a product that the we developed for use in the diagnosis of adult growth hormone deficiency, and the prospects for the approval of our NDA for the product by the FDA. The plaintiffs seek to represent a class comprised of purchasers of our common shares during the Class Period and seek unspecified damages, costs and expenses and such other relief as determined by the court. On April 10, 2015, the lead plaintiff in the lawsuit filed an amended and restated complaint. |

| |

• | Our directors' and officers' insurance policies ("D&O Insurance") provide for reimbursement of costs and expenses incurred in connection with this lawsuit, including legal and professional fees, as well as potential damages awarded, if any, subject to certain policy exclusions, restrictions, limits, deductibles and other terms. We believes that the D&O Insurance covers the purported lawsuit; however, the insurers have reserved their rights to raise all of the rights, entitlements and defenses available to them under the D&O Insurance. If the D&O Insurance does cover the lawsuit, we will be required to pay legal and professional fees, as well as potential damages awarded in an amount equal to a substantial self-insured retention. Legal and professional fees are expensed as incurred and no reserve is established for them. |

| |

• | While we believe that we have meritorious defenses and intend to defend this purported lawsuit vigorously, we cannot currently predict the outcome of this suit or reasonably estimate potential loss, if any, from this suit. Accordingly, we have not recorded any liability related to the lawsuit. No assurance can be given with respect to the ultimate outcome of such proceedings, and the amount of any damages, settlement or judgment in such lawsuit could have a material impact on our financial condition, results of operations or cash flows. |

First Quarter MD&A - 2015

A more comprehensive list of the risks and uncertainties affecting us can be found in our most recent Annual Report on Form 20-F filed with the relevant Canadian securities regulatory authorities in lieu of an annual information form at www.sedar.com and with the SEC at www.sec.gov, and investors are urged to consult such risk factors.

Changes in Internal Controls over Financial Reporting

There have been no changes in our internal control over financial reporting during the three-month period ended March 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

The design of any system of controls and procedures is based in part upon certain assumptions about the likelihood of certain events. There can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, including conditions that are remote.

On behalf of management,

/s/ Dennis Turpin

Dennis Turpin, CPA, CA

Senior Vice President and Chief Financial Officer

May 7, 2015

Condensed Interim Consolidated Financial Statements

(Unaudited)

Aeterna Zentaris Inc.

As at March 31, 2015 and for the three-month periods ended

March 31, 2015 and 2014

(presented in thousands of US dollars)

|

| | |

Aeterna Zentaris Inc. |

Condensed Interim Consolidated Financial Statements |

(Unaudited) |

As at March 31, 2015 and for the three-month periods ended March 31, 2015 and 2014 |

|

| | |

Aeterna Zentaris Inc. |

Condensed Interim Consolidated Statements of Financial Position |

(in thousands of US dollars) |

|

| | | | | | |

(Unaudited) | | March 31, 2015 | | December 31, 2014 |

| | $ | | $ |

ASSETS | | | | |

Current assets | | | | |

Cash and cash equivalents (note 4) | | 53,259 |

| | 34,931 |

|

Trade and other receivables | | 1,562 |

| | 867 |

|

Prepaid expenses and other current assets | | 730 |

| | 419 |

|

| | 55,551 |

| | 36,217 |

|

Restricted cash equivalents | | 674 |

| | 760 |

|

Property, plant and equipment | | 529 |

| | 797 |

|

Other non-current assets | | 528 |

| | 622 |

|

Identifiable intangible assets | | 292 |

| | 352 |

|

Goodwill | | 7,700 |

| | 8,687 |

|

| | 65,274 |

| | 47,435 |

|

LIABILITIES | | | | |

Current liabilities | | | | |

Payables and accrued liabilities (note 5) | | 5,556 |

| | 5,799 |

|

Provision for restructuring costs (note 6) | | 522 |

| | 1,505 |

|

Deferred revenues | | 239 |

| | 270 |

|

| | 6,317 |

| | 7,574 |

|

Deferred revenues | | 658 |

| | 809 |

|

Warrant liability (note 7) | | 22,151 |

| | 8,225 |

|