UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 7, 2015

GALENA BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 001-33958 | | 20-8099512 |

(State or other jurisdiction of incorporation or organization) | | (Commission

File Number)

| | (I.R.S. Employer

Identification No.) |

| | | | |

| | 4640 S.W. Macadam Avenue Suite 270 Portland, Oregon 97239 | | |

| | (Address of Principal Executive Offices) (Zip Code)

| | |

| | | | |

Registrant’s telephone number, including area code: (855) 855-4253

|

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On May 7, 2015, Galena Biopharma, Inc. (“we,” “us,” “our” and the “company”) issued a press release announcing our financial results for the first quarter ended March 31, 2015 and providing an update on recent business developments. A copy of the press release is attached to this Report as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this Item 2.02, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed to be incorporated by reference in any previous or subsequent filing by the company under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | |

| | |

Exhibit No. | | Description |

| |

99.1 |

| | Press Release of Galena Biopharma, Inc. dated May 7, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | |

| | | | | | | | |

| | | | GALENA BIOPHARMA, INC. |

| | | | |

Date: | | May 7, 2015 | | | | By: | | /s/ Mark W. Schwartz |

| | | | | | | | Mark W. Schwartz Ph.D. President and Chief Executive Officer |

Galena Biopharma Reports First Quarter 2015 Financial Results

| |

• | Completed enrollment in the NeuVax Phase 3 PRESENT breast cancer immunotherapy clinical trial |

| |

• | Commercial programs continue on track |

| |

• | Abstral® (fentanyl) Sublingual Tablets achieve net revenue of $2.8 million; full year 2015 net revenue guidance reiterated at $15-$18 million |

| |

• | Zuplenz® (ondansetron) Oral Soluble Film product launch targeted for July |

| |

• | Webcast and conference call scheduled for today at 2:00 p.m. P.T. / 5:00 p.m. E.T. |

Portland, Oregon, May 7, 2015 - Galena Biopharma, Inc. (NASDAQ: GALE), a biopharmaceutical company developing and commercializing innovative, targeted oncology therapeutics that address major medical needs across the full spectrum of cancer care, today reported its financial results for the quarter ended March 31, 2015 and provided a business update.

“We achieved two critical milestones thus far this year with completion of enrollment in our Phase 3 PRESENT trial and the closing of a public offering to solidify our balance sheet,” said Mark W. Schwartz, Ph.D., President and Chief Executive Officer. “Together, these events demonstrate Galena’s near-term and longer-range value proposition as we continue to advance the Company’s development and commercial operations to capitalize on significant treatment opportunities within the oncology setting.”

Dr. Schwartz continued, “Completing enrollment and over-enrolling our PRESENT trial is a major accomplishment for Galena. We are now focused on treating and monitoring the 758 patients in this Phase 3 trial as we progress towards our event-driven, interim analysis at the end of this year or in the first quarter of 2016. The ongoing advancement of our NeuVax and GALE-301 programs showcase the significant potential of our cancer immunotherapy programs that are designed to harness the power of the immune system to prevent a patient’s cancer from returning. To do this effectively, we are treating women in the adjuvant setting whose immune systems have returned to a healthy status after having received their cancer treatments, giving NeuVax and GALE-301 the best opportunity to make a difference.”

Dr. Schwartz concluded, “Dovetailing the clinical successes during the quarter, the financing that we secured in March was an important achievement for Galena as it provides us the flexibility to advance our development programs and to strengthen our commercial efforts. Our immunotherapy platform has multiple clinical trials ongoing and we look forward to key data readouts from these trials over the next year. Meanwhile, on the commercial front, Abstral sales remain on target, our oncology presence continues to grow, and we reiterate our full year guidance of $15-$18 million for 2015. Additionally, we are now preparing to launch Zuplenz in July, adding a second, supportive care commercial product to our oncology-focused sales portfolio. In total, we have established a strong foundation with our development programs supported by our commercial franchise, and we remain committed to the growth of our company.”

Galena will host a webcast and conference call today at 2:00 p.m. P.T./5:00 p.m. E.T. to discuss financial and business results. The live webcast will include slides that can be accessed on the Company's website under the Investors section/Events and Presentations: http://investors.galenabiopharma.com/events.cfm. The conference call can be accessed by dialing (844) 825-4413 toll-free in the U.S., or (973) 638-3403 for participants outside the U.S. The Conference ID number is: 33786642. The archived webcast replay will be available on the Company's website for 90 days.

FINANCIAL HIGHLIGHTS AND GUIDANCE

We recognize revenue from the sale of Abstral to wholesale pharmaceutical distributors, net of product-related discounts, allowances, product returns, rebates, chargebacks, and patient assistance benefits, as applicable. Net revenue was $2.8 million in the first quarter of 2015, a 28% increase compared to $2.2 million for the same period a year ago.

Operating loss for the first quarter of 2015 was $11.1 million, including $0.6 million in stock based compensation, compared to an operating loss of $11.8 million, including $1.7 million in stock-based compensation for the same period in 2014. The decrease in net operating loss year-over-year is primarily the result of the completion of enrollment in our Phase 3 PRESENT trial for NeuVax, as well as the decrease in stock based compensation.

Other income or expenses include non-cash charges related to changes in the fair value estimates of the company’s warrant liabilities and contingent purchase price liability, and the realized gain from the sale of marketable securities. The non-cash benefit related to the changes in the value of our warrant liability for the first quarter of 2015 was $1.2 million for the three months ended March 31, 2015, versus a non-cash benefit of $9.8 million for the same period in 2014, respectively.

Net loss for the first quarter of 2015 was $10.5 million, including $1.2 million in a non-cash benefit described above, or $0.08 per basic and diluted share. Net loss for the first quarter of 2014 was $2.5 million, including a $9.8 million non-cash benefit described above, or $0.02 per basic and diluted share.

On March 18, 2015, we announced the closing of our underwritten public offering of 24,358,974 shares of common stock and 12,179,487 warrants to purchase our common stock at an exercise price of $2.08. The underwriters also exercised their over-allotment option to purchase warrants to purchase an aggregate of 1,826,923 shares of our common stock. On April 10, 2015 the underwriters exercised their option to purchase an additional 3,653,846 shares of common stock for additional net proceeds of $5.4 million. The total net proceeds to us from the March 2015 offering were approximately $40.8 million. Also, during January and February of 2015 we raised $6.6 million under the Lincoln Park and ATM agreements, resulting in a total cash raise of $47.4 million during the first quarter of 2015 and through today.

As of March 31, 2015, Galena had cash and cash equivalents of $52.9 million, compared with $23.7 million as of December 31, 2014. The $29.2 million increase in cash during the first quarter represents the aforementioned cash raised from issuance of common stock (excluding the April overallotment exercise), partially offset by $11.6 million used in operating activities, $0.5 million milestone payment for Zuplenz, and $0.9 million in debt service payments.

FIRST QUARTER AND RECENT HIGHLIGHTS

NeuVax™ (nelipepimut-S) achieves critical milestone with completion of over-enrollment in its Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer with Low to Intermediate HER2 Expression with NeuVax Treatment) clinical trial. NeuVax is a first-in-class, HER2-directed cancer immunotherapy under evaluation to prevent cancer recurrence after standard of care treatment in the adjuvant setting in breast and gastric cancers. Galena over-enrolled the trial by 7.7% with a total of 758 patients now in the intent-to-treat (ITT) population. The protocol for the PRESENT trial, being conducted under an FDA approved Special Protocol Assessment (SPA), called for 700 patients; and, the Company expects this higher number of ITT patients will increase the confidence in the timing, the statistics and the final outcome of the trial. The primary endpoint is currently expected to be reached in 2018, after the last patient dosed reaches her 36th month of follow-up, or a total of 141 events (recurrence or death) occur, whichever comes later. PRESENT is a randomized, double blind, placebo controlled, international, Phase 3 trial and is being conducted in 13 countries at more than 140 sites.

Expanded the patient population in the Phase 2 clinical trial with NeuVax in combination with trastuzumab in HER2 1+/2+ patients to include Human Leukocyte Antigen (HLA) A24 or A26 Positive Patients. The trial evaluates node positive, triple negative, and high-risk node negative breast cancer patients with immunohistochemistry (IHC) HER2 1+/2+ expressing tumors who are disease-free after standard of care therapy. To date, NeuVax has been tested in trials with patients who are HLA-A2+ or A3+, representing more than 60% of the North American, European and Chinese populations. NeuVax has also been shown to bind to HLA-A24 and A26, which represents an additional 10-15% of the population in the U.S., but more importantly, represents up to approximately 70% of the population in Japan.

CORPORATE HIGHLIGHTS

Hired Joseph Lasaga as Vice President, Business Development and Alliance Management. Mr. Lasaga brings more than 17 years of experience in the biotechnology and pharmaceutical industry in the areas of research and development, business development, alliance management and product strategy. Prior to joining Galena, Mr. Lasaga spent four years at Nektar Therapeutics, most recently as Senior Director, Business Development where he led the successful execution of several transactions for the company and managed several key partnerships. Between 1998-2010, Mr. Lasaga worked at Rigel Pharmaceuticals where he led and participated in many buy-side and sell-side asset transactions adding significant value to the organization during his tenure there. Mr. Lasaga received his Masters of Business Administration in Marketing from San Francisco State University and his Bachelor of Science in Molecular Biology with a minor in Chemistry from San Jose State University.

Enhanced the balance sheet with the closing of a public offering of common stock, receiving gross proceeds of $43.7 million. With the closing of the over-allotment, total net proceeds to Galena from the offering were approximately $40.8 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by Galena. Galena intends to use the net proceeds from the offering to fund its operations, including the ongoing commercialization of Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film, its ongoing Phase 3 PRESENT study and other clinical trials of its product candidates, and for other working capital and general corporate purposes.

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(Amounts in thousands, except share and per share data)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Net revenue | $ | 2,750 |

| | $ | 2,173 |

|

Costs and expenses: | | | |

Cost of revenue (excluding amortization of certain acquired intangible assets) | 393 |

| | 331 |

|

Research and development | 5,910 |

| | 6,770 |

|

Selling, general, and administrative | 7,427 |

| | 6,830 |

|

Amortization of certain acquired intangible assets | 146 |

| | 91 |

|

Total costs and expenses | 13,876 |

| | 14,022 |

|

Operating loss | (11,126 | ) | | (11,849 | ) |

Non-operating income (expense): | | | |

Change in fair value of warrants potentially settleable in cash

| 1,152 |

| | 9,792 |

|

Interest expense, net | (242 | ) | | (314 | ) |

Other expense | (321 | ) | | (165 | ) |

Total non-operating income, net | 589 |

| | 9,313 |

|

Net loss | $ | (10,537 | ) | | $ | (2,536 | ) |

Net loss per common share: | | | |

Basic and diluted net loss per share | $ | (0.08 | ) | | $ | (0.02 | ) |

Weighted average common shares outstanding: basic and diluted | 136,054,864 |

| | 116,244,209 |

|

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(Amounts in thousands)

|

| | | | | | | |

| March 31, 2015 | | December 31, 2014 (1) |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 52,860 |

| | $ | 23,650 |

|

Restricted cash | 200 |

| | 200 |

|

Accounts receivable | 1,060 |

| | 1,839 |

|

Inventory | 637 |

| | 655 |

|

Prepaid expenses and other current assets | 2,564 |

| | 2,680 |

|

Total current assets | 57,321 |

| | 29,024 |

|

Equipment and furnishings, net | 528 |

| | 555 |

|

In-process research and development | 12,864 |

| | 12,864 |

|

Abstral rights | 14,387 |

| | 14,533 |

|

Zuplenz Rights | 8,101 |

| | 8,101 |

|

GALE-401 rights | 9,255 |

| | 9,255 |

|

Goodwill | 6,069 |

| | 6,069 |

|

Deposits | 82 |

| | 87 |

|

Total assets | $ | 108,607 |

| | $ | 80,488 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 3,293 |

| | $ | 2,271 |

|

Accrued expense and other current liabilities | 12,149 |

| | 15,669 |

|

Fair value of warrants potentially settleable in cash | 14,528 |

| | 5,383 |

|

Current portion of long-term debt | 3,994 |

| | 3,910 |

|

Total current liabilities | 33,964 |

| | 27,233 |

|

Deferred tax liability, non-current | 5,053 |

| | 5,053 |

|

Contingent purchase price consideration, net of current portion | 6,972 |

| | 6,651 |

|

Long-term debt, net of current portion | 3,534 |

| | 4,492 |

|

Total liabilities | 49,523 |

| | 43,429 |

|

Stockholders’ equity: | 59,084 |

| | 37,059 |

|

Total liabilities and stockholders’ equity | 108,607 |

| | 80,488 |

|

(1) Derived from the audited consolidated financial statements as of December 31, 2014.

About Galena Biopharma

Galena Biopharma, Inc. (NASDAQ: GALE) is a biopharmaceutical company developing and commercializing innovative, targeted oncology therapeutics that address major medical needs across the full spectrum of cancer care. Galena’s development portfolio ranges from mid- to late-stage clinical assets, including a robust immunotherapy program led by NeuVax™ (nelipepimut-S) currently in an international, Phase 3 clinical trial. The Company’s commercial drugs include Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film. Collectively, Galena’s clinical and commercial strategy focuses on identifying and advancing therapeutic opportunities to improve cancer care, from direct treatment of the disease to the reduction of its debilitating side-effects. For more information visit www.galenabiopharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our 2014 revenue from the sale of Abstral®, our planned launch of Zuplenz®, the issuance of patents, and the progress of development of Galena’s product candidates, including patient enrollment in our clinical trials. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in Galena’s Annual Report on Form 10-K for the year ended December 31, 2014 and most recent Quarterly Reports on Form 10-Q filed with the SEC. Actual results may differ materially from those contemplated by these forward-looking statements. Galena does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this press release.

NeuVax™ and Abstral® are trademarks of Galena Biopharma, Inc. All other trademarks are the property of their respective owners.

Contact:

Remy Bernarda

SVP, Investor Relations & Corporate Communications

(503) 405-8258

rbernarda@galenabiopharma.com

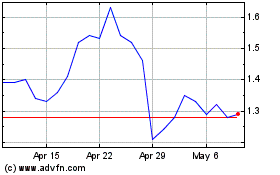

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Aug 2024 to Sep 2024

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Sep 2023 to Sep 2024