Additional Proxy Soliciting Materials (definitive) (defa14a)

April 22 2015 - 2:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| | | | |

Filed by the Registrant | x | | Filed by a Party other than the Registrant | o |

Check the appropriate box:

|

| | |

o | | Preliminary Proxy Statement |

|

| | |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| | |

o | | Definitive Proxy Statement |

|

| | |

x | | Definitive Additional Materials |

|

| | |

o | | Soliciting Material under §240.14a-12 |

CNO FINANCIAL GROUP, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| |

(1) | Title of each class of securities to which the transaction applies: |

| |

|

| |

(2) | Aggregate number of securities to which the transaction applies: |

| |

|

| |

(3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

| |

(4) | Proposed maximum aggregate value of the transaction: |

| |

|

| | |

o | | Fee paid previously with preliminary materials. |

|

| | |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

(1) | Amount Previously Paid: |

| |

|

| |

(2) | Form, Schedule or Registration Statement No.: |

| |

CNO Financial Group, Inc.

11825 North Pennsylvania Street

Carmel, Indiana 46032

SUPPLEMENT TO THE

PROXY STATEMENT DATED MARCH 26, 2015

FOR THE

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 6, 2015

April 22, 2015

To the Shareholders of CNO Financial Group, Inc.:

On or about March 27, 2015, CNO Financial Group, Inc. (the “Company”) distributed a proxy statement to its Shareholders describing the matters to be voted on at the annual meeting to be held on May 6, 2015 (the “Annual Meeting”), including the approval of the adoption of the Amended and Restated Section 382 Shareholder Rights Plan (the “Second Amended Rights Plan”) to preserve the value of the Company’s net operating losses. Among other changes, the Second Amended Rights Plan extended the expiration date of the rights plan from December 6, 2014 to December 31, 2017. The Company was subsequently informed by Institutional Shareholder Services Inc. (“ISS”) that it recommends a vote against the Second Amended Rights Plan because the term of the Second Amended Rights Plan is more than three years.

On April 22, 2015, the Company and American Stock Transfer and Trust Company, LLC entered into an amendment which revised the definition of “Final Expiration Date” in the Second Amended Rights Plan to change the expiration date from December 31, 2017 to November 13, 2017, which is three years after the Second Amended Rights Plan became effective. There were no other changes to the Second Amended Rights Plan as set forth in Annex A to the Proxy Statement. The definition of “Final Expiration Date” in the Second Amended Rights Plan, as amended, is set forth below:

“Final Expiration Date” shall mean the earliest to occur of (i) the Close of Business on November 13, 2017, (ii) the Close of Business on November 13, 2015 if stockholder approval of this Rights Agreement has not been received by or on such date, (iii) the adjournment of the first annual meeting of the stockholders of the Company following the date hereof if stockholder approval of this Rights Agreement has not been received prior to such time, (iv) the repeal of Section 382 or any successor statute if the Board of Directors determines that this Rights Agreement is no longer necessary for the preservation of Tax Benefits or (v) the beginning of a taxable year of the Company to which the Board of Directors determines that no Tax Benefits may be carried forward.

The Second Amended Rights Plan, as amended above, will be presented for Shareholder approval at the Company’s Annual Meeting of Shareholders to be held on Wednesday, May 6, 2015.

If a Shareholder returns a proxy card or votes via the Internet or by telephone at any time (either prior to or after the date of this supplement) indicating a vote in favor of the adoption of the Amended and Restated Section 382 Shareholder Rights Plan, such vote will constitute a vote in favor of the Second Amended Rights Plan, as amended. If any Shareholder has already returned a properly executed proxy card or voted via the Internet or by telephone and would like to change such vote on any matter, such Shareholder may revoke their proxy before it is voted at the Annual Meeting of Shareholders by submission of a proxy bearing a later date via the Internet, by telephone, by mail or by attending the Annual Meeting in person and casting a ballot.

If any Shareholder would like a new proxy or has any questions, please contact Karl W. Kindig, Senior Vice President and Secretary, 11825 N. Pennsylvania Street, Carmel, IN 46032, at (317) 817-2893.

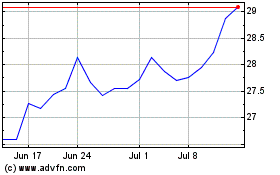

CNO Financial (NYSE:CNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

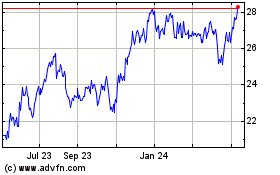

CNO Financial (NYSE:CNO)

Historical Stock Chart

From Apr 2023 to Apr 2024