Additional Proxy Soliciting Materials (definitive) (defa14a)

March 27 2015 - 9:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

|

|

(Name of Registrant as Specified in Its Charter)

|

| |

|

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Biglari Holdings Inc. (“Biglari Holdings”) has made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying BLUE proxy card to be used to solicit votes for the election of Biglari Holdings’ director nominees at its 2015 annual meeting of shareholders.

On March 26, 2015, Biglari Holdings issued the following press release:

Leading Proxy Advisory Firm ISS Rejects Groveland’s Attempt to Take Control of Biglari Holdings Board

– ISS Recommends that Shareholders vote Biglari Holdings’ BLUE Proxy Card –

– ISS Recommends NOT to Vote for Any of Groveland’s Six Nominees –

San Antonio, TX, March 26, 2015 – Biglari Holdings Inc. (NYSE: BH) (“Biglari Holdings” or the “Company”) today announced that Institutional Shareholder Services ("ISS"), a leading independent proxy voting advisory firm, has recommended that Biglari Holdings’ shareholders vote on the Company’s BLUE proxy card and affirmatively reject Groveland Capital’s attempt to gain control of the Biglari Holdings Board of Directors.

In its report, ISS states that the dissident slate is “uncompelling, given a paucity of relevant operating or public board experience; an inadequately detailed plan for seamlessly managing the transition and minimizing unintended consequences should they succeed in ousting all incumbent directors, including the CEO; and a lead dissident who would be overboarded should he win election to this board.”

Biglari Holdings strongly urges shareholders to ensure that Groveland’s nominees do not gain Board control by submitting their voting instructions on the BLUE proxy card "FOR ALL" of the Company's nominees to the Board.

If you have any questions, require assistance with voting your BLUE proxy card,

or need additional copies of the proxy materials, please contact our proxy solicitor:

OKAPI PARTNERS LLC

437 Madison Avenue, 28th Floor

New York, NY 10022

(212) 297-0720

Shareholders Call Toll-Free at: (877) 279-2311

E-mail: info@okapipartners.com

About Biglari Holdings Inc.

Biglari Holdings Inc. is a holding company owning subsidiaries engaged in a number of diverse business activities, including media, property and casualty insurance, as well as restaurants. The Company’s largest operating subsidiaries are involved in the franchising and operating of restaurants. All major operating, investment, and capital allocation decisions are made for the Company and its subsidiaries by Sardar Biglari, Chairman and Chief Executive Officer.

Media Contact:

Sloane & Company

Elliot Sloane, 212-446-1860 / Dan Zacchei, 212-446-1882

esloane@sloanepr.com / dzacchei@sloanepr.com

Risks Associated with Forward-Looking Statements

This news release may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements which may concern anticipated future results are based on current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ markedly from those projected or discussed here. Biglari Holdings cautions readers not to place undue reliance upon any such forward-looking statements, for actual results may differ materially from expectations. Biglari Holdings does not update publicly or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. Further information on the types of factors that could affect Biglari Holdings and its business can be found in the company's filings with the SEC.

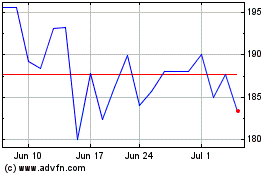

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

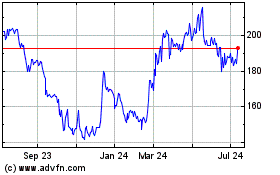

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024