LiveWorld, Inc. (OTC Markets: LVWD), today announced the audited

financial results for the full years 2014. Total revenues were

approximately $13.8 million for 2014 as compared to the

approximately $14.5 million in total revenues reported for

2013.

The Company reported net loss for 2014 of approximately $0.4

million, or 3% of total revenues. This compares to the net income

of approximately $0.8 million, or 7% of total revenues, reported

for 2013. The loss per share on a fully diluted basis was $0.01

while the earnings per share was $0.02 for 2014 and 2013,

respectively.

The company ended 2014 with approximately $4.4 million in cash

and cash equivalents. The Company reported a positive working

capital balance of approximately $3.8 million as of December 31,

2014.

“In 2014 we saw the company begin to transition our development,

sales, and marketing efforts as we put greater emphasis on bringing

new and compelling products to market,” states David Houston, Chief

Financial Officer of LiveWorld. “We will remain focused on the

long-term goals of the company which means making meaningful

investments for our future growth.”

Detailed financial information may be downloaded at

www.liveworld.com/investor-relations or at www.otcmarkets.com.

About LiveWorld

LiveWorld is a social media solutions company that provides

services and software for human engagement at scale to help brands

develop deeper relationships with customers. LiveWorld delivers a

full range of social media solutions to improve relationship

marketing, customer support, and market learning. Our solutions

include social & content strategy, campaign management,

customer support, moderation & engagement, listening &

Insights and measurement and reporting. Our clients include the #1

brands in retail, CPG, pharma, and financial services who use our

solutions to engage their customers in a way that’s social,

personal, and direct, yet affordable and sustainable on a large

scale. LiveWorld is headquartered in San Jose California, with

additional offices in New York City and Austin. Learn more at

www.liveworld.com and @LiveWorld.

“Safe Harbor" Statement Under The

Private Securities Litigation Reform Act

This press release may contain forward-looking information

concerning LiveWorld's plans, objectives, future expectations,

forecasts and prospects. These statements may include those

regarding LiveWorld’s current or future financial performance

including but not limited to lists of clients, revenue and profit,

use of cash, investments, relationships and the actual or potential

impact of stock option expense, and the results of its product

development efforts. Actual results may differ materially from

those expressed in the forward looking statements made as a result

of, among other things, final accounting adjustments and results,

LiveWorld’s ability to attract new clients and preserve or expand

its relationship with existing clients, LiveWorld’s ability to

retain and attract high quality employees, including its management

staff, the ability to deliver new innovative products in a timely

manner, changing accounting treatments, and other risks applicable

to the Company. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date hereof, and the Company undertakes no obligation to update

these forward-looking statements to reflect subsequent events or

circumstances.

LIVEWORLD, INC. BALANCE SHEETS (In

thousands, except share data) December 31,

December 31, 2014

2013 ASSETS Current assets Cash and cash

equivalent $ 4,386 $ 4,413 Accounts receivable 535 488 Prepaid

expenses 397 336

Total current assets

5,318 5,237 Property and equipment, net 144 257 Other assets

18 18 Total assets $ 5,480 $

5,512

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Accounts payable $ 99 $ 159 Accrued employee expenses

597 576 Other accrued liabilities 54 6 Deferred revenue 714

665 Total current liabilities 1,464

1,406 Stockholders' equity Common

stock: $0.001 par value, 100,000,000 shares authorized 33,388,545

and 33,321,634 issued and outstanding as of December 31, 2014 and

December 31, 2013 respectively 34 33 Additional paid-in capital

141,735 141,448 Accumulated deficit (137,753 )

(137,375 ) Total stockholders' equity 4,016

4,106 Total liabilities and stockholders' equity $ 5,480

$ 5,512

LIVEWORLD, INC. STATEMENTS

OF OPERATIONS (In thousands, except share and per share

data) Twelve Months Ended December 31,

2014 2013 Total revenues

$ 13,803 $ 14,523 Cost of revenues 5,756 5,262

Gross margin 8,047 9,261 Operating expenses Product development

3,424 3,725 Sales and marketing 2,104 1,875 General and

administrative 2,896 2,840 Total operating

expenses 8,424 8,440 Income (loss) from

operations (377 ) 821 Other income ---- 6

Income (loss) before tax (377 ) 827 Provision for income taxes

1 15 Net income (loss) (378 )

812 Basic net income (loss) per share $ (0.01 ) $ 0.02

Shares used in computing basic net income (loss) per share

33,353,526 33,259,634 Diluted net income (loss) per share $ (0.01 )

$ 0.02 Shares used in computing diluted income (loss) per

share 33,353,526 41,291,384 Departmental allocation of

stock-based compensation: Cost of goods sold $ 57 $ 31 Product

development 72 70 Sales and marketing 55 32 General and

administrative 98 66 Total stock-based

compensation $ 282 $ 199

LIVEWORLD, INC.

STATEMENTS OF CASH FLOWS (In thousands)

Twelve Months Ended December 31, 2014

2013 Cash flows from operating

activities: Net income (loss) $ (378 ) $ 812 Adjustments to

reconcile net income (loss) to net cash provided by operating

activities: Depreciation 155 134 Stock-based compensation 282 199

Changes in operating assets and liabilities: Accounts receivable

(47 ) 29 Prepaid expenses and other assets (61 ) (61 ) Accounts

payable (60 ) (76 ) Accrued liabilities 69 61 Deferred revenue

49 84 Net cash provided by (used in)

operating activities 9 1,182 Cash flows

from investing activities: Purchase of property and equipment

(42 ) (157 ) Net cash (used in) investing activities

(42 ) (157 ) Cash flows from financing activities:

Proceeds from exercise of stock options 6 6

Net cash provided by financing activities 6

6 Change in cash and cash equivalents (27 ) 1,031

Cash and cash equivalents, beginning of year 4,413

3,382 Cash and cash equivalents, end of year $ 4,386

$ 4,413 Supplemental cash flow information:

Income taxes paid $ 12 $ 4

LiveWorldIR Contact:David Houston,

408-615-8496dhouston@liveworld.comorPR Contact:TallGrass Public

RelationsSeth Menacker,

201-638-7561Seth.Menacker@tallgrasspr.com

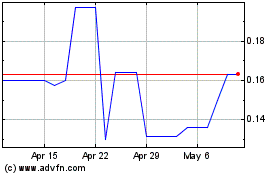

LiveWorld (PK) (USOTC:LVWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

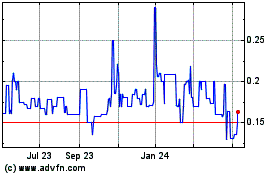

LiveWorld (PK) (USOTC:LVWD)

Historical Stock Chart

From Apr 2023 to Apr 2024