UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

(Mark One)

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period

from to

Commission File Number: 000-50768

ACADIA

PHARMACEUTICALS INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

| Delaware |

|

06-1376651 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer Identification Number) |

|

|

| 11085 Torreyana Road, Suite 100

San Diego, California |

|

92121 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(858) 558-2871

Securities

registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934:

|

|

|

| Large accelerated filer x |

|

Accelerated filer ¨ |

|

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting

company) |

|

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Securities Exchange Act of 1934). Yes ¨ No x

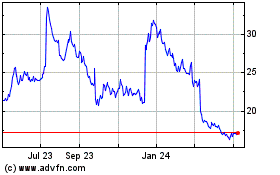

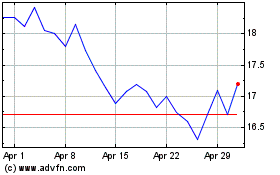

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate

market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1.4 billion, based on the closing price of the registrant’s common stock on the NASDAQ Global Select Market on June 30, 2014 of

$22.59 per share.

As of January 30, 2015, 100,171,719 shares of the registrant’s common stock, $0.0001 par value,

were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed with the Securities and Exchange Commission by April 30,

2015 are incorporated by reference into Part III of this report.

ACADIA PHARMACEUTICALS INC.

TABLE OF CONTENTS

FORM 10-K

For the Year Ended December 31, 2014

i

PART I

FORWARD-LOOKING STATEMENTS

This report and the information incorporated herein by reference contain forward-looking statements that involve a number of risks and uncertainties, as well as assumptions that, if they never materialize

or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. Although our forward-looking statements reflect the good faith judgment of our management, these statements can only

be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from results and outcomes discussed in the

forward-looking statements.

Forward-looking statements can be identified by the use of forward-looking words such as

“believes,” “expects,” “hopes,” “may,” “will,” “plans,” “intends,” “estimates,” “could,” “should,” “would,” “continue,”

“seeks,” “aims,” “projects,” “predicts,” “pro forma,” “anticipates,” “potential” or other similar words (including their use in the negative), or by discussions of future matters

such as the development of product candidates or products, technology enhancements, possible changes in legislation, and other statements that are not historical. These statements include but are not limited to statements under the captions

“Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as other sections in this report. You should be aware that the occurrence of any of

the events discussed under the caption “Risk Factors” and elsewhere in this report could substantially harm our business, results of operations and financial condition and cause our results to differ materially from those expressed or

implied by our forward-looking statements. If any of these events occurs, the trading price of our common stock could decline and you could lose all or a part of the value of your shares of our common stock.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they may

appear in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Company Overview

We are

a biopharmaceutical company focused on the development and commercialization of innovative medicines that address unmet medical needs in neurological and related central nervous system disorders. Led by our novel drug candidate NUPLAZID™

(pimavanserin) for the treatment of Parkinson’s disease psychosis, we have a portfolio of product opportunities including the following:

| |

• |

|

Parkinson’s disease psychosis (PDP). We have reported positive Phase III pivotal trial results in PDP and believe NUPLAZID has the

potential to be the first drug approved in the United States for this disorder. We are currently completing a New Drug Application, or NDA, for NUPLAZID for the treatment of PDP and related preparations to support a review of the NDA by the U.S.

Food and Drug Administration, or FDA. We plan to submit the NDA to the FDA in the first quarter of 2015. In 2014, we announced that the FDA has granted Breakthrough Therapy designation for NUPLAZID for the treatment of PDP.

|

| |

• |

|

Alzheimer’s disease psychosis (ADP). We are currently conducting a Phase II study exploring the utility of pimavanserin for the

treatment of Alzheimer’s disease psychosis, or ADP. No drug is currently approved by the FDA for the treatment of this disorder. |

| |

• |

|

Schizophrenia. We have successfully completed a Phase II study of pimavanserin in the treatment of schizophrenia where we observed

significant anti-psychotic effects when pimavanserin was co-administered with a low dose of risperidone, a generic drug currently approved for the treatment of schizophrenia. We next plan to evaluate the use of pimavanserin as a stand-alone

maintenance therapy between acute psychotic episodes in a Phase II schizophrenia study. |

1

| |

• |

|

Sleep disturbances. Pimavanserin has shown significant benefits in nighttime sleep and daytime wakefulness in studies conducted in

elderly patients with PDP. In 2015, we plan to follow up these findings with a Phase II study to further explore the potential sleep benefits of pimavanserin in Parkinson’s disease patients. |

We hold worldwide commercialization rights to pimavanserin. Our pipeline also includes clinical-stage programs for chronic pain and

glaucoma in collaboration with Allergan, Inc.

We were originally incorporated in Vermont in 1993 as Receptor Technologies,

Inc. We reincorporated in Delaware in 1997 and our headquarters are in San Diego, California. We maintain a website at www.acadia-pharm.com, to which we regularly post copies of our press releases as well as additional information about us.

Our filings with the Securities and Exchange Commission, or SEC, are available free of charge through our website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Interested persons can subscribe on

our website to email alerts that are sent automatically when we issue press releases, file our reports with the SEC or post certain other information to our website. Information contained in our website does not constitute a part of this report or

our other filings with the SEC.

We own or have rights to various trademarks, copyrights and tradenames

used in our business, including ACADIA® and NUPLAZID™. Our logos and trademarks are the property of ACADIA

Pharmaceuticals Inc. All other brand names or trademarks appearing in this report are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this report is not intended to, and

does not, imply a relationship with, or endorsement or sponsorship of us, by the trademark or trade dress owners.

Our Strategy

Our strategy is to discover, develop, and commercialize innovative small molecule drugs that address unmet medical needs

in neurological and related central nervous system disorders. We have assembled a management team with significant industry experience to lead the discovery, development, and commercialization of our product opportunities. We complement our

management team with scientific and clinical advisors, including recognized experts in the fields of Parkinson’s disease psychosis, Alzheimer’s disease psychosis, schizophrenia, and other central nervous system disorders. Key elements of

our strategy are to:

| |

• |

|

Develop and commercialize our lead product candidate, NUPLAZID, for Parkinson’s disease psychosis. We are pursuing Parkinson’s

disease psychosis as our lead indication for NUPLAZID, for which we plan to submit an NDA to the FDA in the first quarter of 2015. If approved, NUPLAZID would be the first drug approved by the FDA for the treatment of Parkinson’s disease

psychosis. If approved, we intend to commercialize NUPLAZID for this indication in the United States by establishing a specialty sales force focused primarily on neurologists and a small group of psychiatrists and long-term care physicians who are

high prescribers of antipsychotics for Parkinson’s disease psychosis patients. Outside of the United States, we may choose to commercialize NUPLAZID in selected markets by establishing one or more strategic alliances.

|

| |

• |

|

Leverage the commercial potential of pimavanserin by expanding to additional neurological and psychiatric disorders.

We intend to pursue the development and commercialization of pimavanserin in additional neurological and psychiatric indications that are underserved by currently available antipsychotics and represent large unmet medical needs. Currently, we are in

Phase II development with pimavanserin as a treatment for Alzheimer’s disease psychosis. In addition, we have completed a Phase II study in schizophrenia and we are planning additional studies for this indication. We have also observed

significant sleep benefits of pimavanserin in studies conducted in elderly patients with Parkinson’s disease psychosis and plan to further explore these benefits in a Phase II study in Parkinson’s disease patients. We plan to retain

commercialization rights in therapeutic areas where we feel pimavanserin can be sold by a specialty sales force that calls on a focused group of physicians. In therapeutic areas that require large specialty or primary care sales forces, we may elect

to conduct commercialization through, or in collaboration with, partners. |

2

| |

• |

|

Seek to in-license or acquire complementary products or product candidates. Although all of the product candidates currently in our

pipeline emanate from internal discoveries, in the future we may in-license or acquire assets, which could include clinical-stage product candidates or commercial-stage products, to leverage the sales force that we intend to establish.

|

| |

• |

|

Continue to develop our other product candidates for the treatment of central nervous system and related disorders. We plan to continue

developing our other product candidates, including our collaborative programs with Allergan. While our resources are currently focused on the development and commercialization of pimavanserin, we may pursue additional product candidates in the

future. These may be directed at neurological and related central nervous system disorders and may be developed independently or in partnerships. We believe that a diversified portfolio will mitigate risks inherent in drug development and increase

the likelihood of our success. |

Our Product Opportunities

Our pipeline of product opportunities addresses diseases that are not well served by currently available therapies and that represent

large potential commercial market opportunities. We believe our product opportunities offer innovative therapeutic approaches and may provide significant advantages relative to current therapies. Our pipeline consists of the following programs:

NUPLAZID (Pimavanserin)

Pimavanserin is a new chemical entity that we discovered and that has successfully completed Phase III development,

potentially positioning it to be the first drug approved in the United States for the treatment of Parkinson’s disease psychosis. During 2014, the FDA provisionally accepted NUPLAZID as the trade name for pimavanserin. NUPLAZID (pimavanserin)

selectively blocks the activity of the 5-HT2A receptor, a key

serotonin receptor that plays an important role in psychosis. We hold worldwide commercialization rights to NUPLAZID (pimavanserin) for all indications and have established a broad patent portfolio, which includes numerous issued patents in the

United States, Europe, and several additional countries.

We are pursuing Parkinson’s disease psychosis as our lead

indication for NUPLAZID. We have completed a successful pivotal Phase III trial with NUPLAZID in patients with Parkinson’s disease psychosis, the -020 Study. Following this study, we met with the FDA in 2013, and announced that the agency

agreed that the data from the -020 Study, together with supportive data from our other studies with NUPLAZID, are sufficient to support the filing of an NDA for the treatment of Parkinson’s disease psychosis. In 2014, the FDA granted

Breakthrough Therapy designation for NUPLAZID for the treatment of Parkinson’s disease psychosis. The Breakthrough Therapy designation was created by the FDA to expedite the development and review of drugs that are intended to treat serious or

life-threatening conditions. If approved, we intend to commercialize NUPLAZID for Parkinson’s disease psychosis in the United States by establishing a specialty sales force focused primarily on neurologists and a small group of psychiatrists

and long-term care physicians who are high prescribers of antipsychotics for Parkinson’s disease psychosis patients. Starting in the second half of 2013, we began to hire

3

the senior leadership of our commercial organization. Our preparations are underway for the planned future launch of NUPLAZID and we plan to hire a commercial sales force to coincide

approximately with a NUPLAZID approval, if any. In addition to building our commercial capabilities, we are expanding our existing infrastructure to support the planned launch and commercialization of NUPLAZID, including adding to our commercial

level manufacturing, medical affairs, quality control and compliance capabilities. As was the case with the -020 Study and our other clinical trials, if approved, NUPLAZID will be administered in two 17 mg tablets taken together once a day.

We believe that pimavanserin also has the potential to address other neurological and psychiatric disorders, including

Alzheimer’s disease psychosis and schizophrenia. We are currently conducting a Phase II study to examine the efficacy and safety of pimavanserin as a treatment for Alzheimer’s disease psychosis. We have completed a successful Phase II

trial with pimavanserin as a co-therapy for schizophrenia and we are currently planning additional studies of pimavanserin as a stand-alone maintenance therapy to treat schizophrenia between acute psychotic episodes.

NUPLAZID as a Treatment for Parkinson’s Disease Psychosis

Parkinson’s disease is the second most common neurodegenerative disorder after Alzheimer’s disease. According to the National

Parkinson Foundation, about one million people in the United States and from four to six million people worldwide suffer from this disease. Parkinson’s disease is more common in people over 60 years of age and the prevalence of this

disease is expected to increase significantly as the population ages.

Parkinson’s disease psychosis is a debilitating

disorder commonly characterized by visual hallucinations and delusions that occurs in an estimated 40 percent of Parkinson’s disease patients. The development of psychosis in patients with Parkinson’s disease substantially contributes to

the burden of Parkinson’s disease and deeply affects their quality of life. Parkinson’s disease psychosis is associated with increased caregiver stress and burden, nursing home placement, and increased morbidity and mortality.

The FDA has not approved any drug to treat Parkinson’s disease psychosis. Therefore, despite substantial limitations, physicians

frequently resort to off-label use of currently marketed antipsychotic drugs, including Seroquel and clozapine, to treat patients with Parkinson’s disease psychosis. These drugs are associated with a number of side effects, which can be

especially problematic for elderly patients with Parkinson’s disease. In addition, all current antipsychotic drugs have a black box warning for use in elderly patients with dementia-related psychosis due to increased mortality and morbidity.

The only currently marketed antipsychotic drug that has demonstrated efficacy in reducing psychosis in

patients with Parkinson’s disease without further impairing motor function is clozapine when given at low doses. Studies suggest that this unique clinical utility of low-dose clozapine arises from its potent blocking of a key serotonin

receptor, a protein that responds to the neurotransmitter serotonin, known as the 5-HT2A receptor. The use of low-dose clozapine has been approved in Europe, but not in the United States, for the treatment of psychotic disorders in Parkinson’s disease. However, routine use of clozapine

is limited by safety concerns, including its potential to cause a rare, and potentially fatal, blood disorder that necessitates stringent blood monitoring. Currently, there is a large unmet medical need for new therapies that will effectively treat

psychosis in patients with Parkinson’s disease without compromising motor control or causing other serious side effects in this elderly and fragile patient population.

NUPLAZID provides an innovative, non-dopaminergic approach and, we believe, has the potential to be the first safe and effective drug that will treat Parkinson’s disease psychosis without

compromising motor control, thereby significantly improving the quality of life for patients with Parkinson’s disease.

In November 2012, we announced successful top-line results from our pivotal Phase III -020 Study, evaluating the efficacy, tolerability,

and safety of NUPLAZID in patients with Parkinson’s disease psychosis.

4

Results from the -020 Study were presented at the American Academy of Neurology Meeting in March 2013, and published in The Lancet, a peer-reviewed medical journal, in November 2013. The -020

Study was a multi-center, double-blind, placebo-controlled clinical trial. A total of 199 patients were enrolled in the study and randomized on a one-to-one basis to receive either 34 mg of NUPLAZID (the equivalent of 40mg of pimavanserin tartrate)

or placebo once-daily for six weeks, following a two-week screening period that included brief psycho-social therapy. Patients also received stable doses of their existing anti-Parkinson’s therapy throughout the study.

NUPLAZID met the primary endpoint in the -020 Study by demonstrating a highly significant reduction in psychosis (p=0.001) as measured

using the SAPS-PD, a scale consisting of nine items from the hallucinations and delusions domains of the Scale for the Assessment of Positive Symptoms. NUPLAZID also met the key secondary endpoint for motoric tolerability as measured using Parts II

and III of the Unified Parkinson’s Disease Rating Scale, or UPDRS. These results were further supported by highly significant improvements in all secondary efficacy measures, including the Clinical Global Impression Severity, or CGI-S, scale

(p<0.001), the Clinical Global Impression Improvement, or CGI-I, scale (p=0.001), and a CGI-I responder analyses (p=0.002). In addition, statistically significant benefits were observed in exploratory efficacy measures of nighttime sleep, daytime

wakefulness and caregiver burden. Consistent with previous studies, NUPLAZID was safe and well tolerated in this Phase III trial.

Following our successful -020 Study, in April 2013 we met with the FDA and announced that the agency agreed that the data from our -020 Study, together with supportive data from our other studies with

NUPLAZID, are sufficient to support the filing of an NDA for the treatment of Parkinson’s disease psychosis. In September 2014, we announced that the FDA has granted Breakthrough Therapy designation for NUPLAZID for the treatment of

Parkinson’s disease psychosis. The Breakthrough Therapy designation was created by the FDA to expedite the development and review of drugs that are intended to treat serious or life-threatening conditions.

We also are continuing to conduct our open-label safety extension study, referred to as the -015 Study, involving patients with

Parkinson’s disease psychosis who have completed the -020 Study and our earlier Phase III studies. The -015 Study, together with a similar extension study from our earlier Phase II Parkinson’s disease psychosis trial, has generated a

considerable amount of long-term safety data on NUPLAZID. A total of over 250 patients have been treated with NUPLAZID for at least one year, and of those at least 100 patients have been treated for at least two years. Our longest

single-patient exposure is greater than nine years. We believe that our experience to date suggests that long-term administration of NUPLAZID is generally safe and well tolerated in this elderly and fragile patient population.

During 2014, we conducted foundational access and reimbursement research with key decision makers for payers covering 168 million

lives, of which approximately one-third are covered by commercial healthcare payers, one-third covered by Medicare Part D Standard, and one-third covered by Medicare Part D Low Income Subsidy.

While the FDA has agreed to review an NDA for NUPLAZID on the basis of our positive pivotal -020 Study data, along with supportive

efficacy and safety data from other NUPLAZID studies, the NDA will be subject to FDA review to determine whether the filing package is adequate to support approval for Parkinson’s disease psychosis.

Pimavanserin as a Treatment for Alzheimer’s Disease Psychosis

According to the Alzheimer’s Association, an estimated 5.2 million people in the United States have Alzheimer’s disease and

it is currently the fifth leading cause of death for people age 65 and older. Studies have suggested that approximately 25 to 50 percent of Alzheimer’s disease patients may develop psychosis, commonly consisting of hallucinations and delusions.

The diagnosis of Alzheimer’s disease psychosis is associated with more rapid cognitive and functional decline and increased institutionalization.

5

The FDA has not approved any drug to treat Alzheimer’s disease psychosis. As symptoms

progress and become more severe, physicians often resort to off-label use of antipsychotic medications in these patients. Current antipsychotic drugs may exacerbate the cognitive disturbances associated with Alzheimer’s disease. Current

antipsychotic drugs also have a black box warning for use in elderly patients with dementia-related psychosis due to increased mortality and morbidity. There is a large unmet medical need for a safe and effective therapy to treat the psychosis in

patients with Alzheimer’s disease.

We are in Phase II development with pimavanserin as a potential new treatment for

Alzheimer’s disease psychosis. Patients with Alzheimer’s disease psychosis and Parkinson’s disease psychosis share many characteristics and often exhibit similar psychiatric symptoms associated with their respective underlying

neurodegenerative disease. We have shown that pimavanserin attenuates psychosis-related behaviors in preclinical models of Alzheimer’s disease psychosis. In preclinical models, pimavanserin also has been shown to positively interact with

cholinesterase inhibitors to enhance their pro-cognitive effect. Because of its selective mechanism of action and its efficacy and safety profile observed to date in studies conducted in elderly patients with Parkinson’s disease psychosis, we

believe that pimavanserin also may be ideally suited to address the need for a new treatment for Alzheimer’s disease psychosis that is safe, effective, and well tolerated.

In November 2013, we initiated a Phase II trial, referred to as the -019 Study, to examine the efficacy and safety of pimavanserin as a

treatment for Alzheimer’s disease psychosis. The -019 Study is a randomized, double-blind, placebo-controlled study designed to enroll 200 patients with Alzheimer’s disease psychosis. Following a screening period that includes brief

psycho-social therapy, patients are randomized on a one-to-one basis to receive either 34 mg of pimavanserin (the equivalent of 40mg of pimavanserin tartrate) or placebo once-daily for twelve weeks. The -019 study will assess several key efficacy

endpoints, including use of the Neuropsychiatric Inventory—Nursing Home scale to measure psychosis and other behavioral disorders. Key efficacy endpoints will be based on the change at week 6 from baseline. The study will also assess additional

exploratory endpoints, including the cognitive status of patients and the durability of response to pimavanserin, through twelve weeks of therapy. We plan to complete enrollment in the -019 Study by the end of 2015.

Pimavanserin as a Treatment for Schizophrenia

Schizophrenia is a severe chronic mental illness that involves disturbances in cognition, perception, emotion, and other aspects of behavior. The positive symptoms of schizophrenia include hallucinations

and delusions, while the negative symptoms may manifest as loss of interest and emotional withdrawal. Schizophrenia is associated with persistent impairment of a patient’s social functioning and productivity. Cognitive disturbances often

prevent patients with schizophrenia from readjusting to society. As a result, patients with schizophrenia are normally required to be under medical care for their entire lives.

According to the National Institute of Mental Health, approximately one percent of the U.S. population suffers from schizophrenia.

Antipsychotic drugs increasingly have been used by physicians to address a range of disorders in addition to schizophrenia, including bipolar disorder and a variety of psychoses and related conditions in elderly patients. Despite their commercial

success, current antipsychotic drugs have substantial limitations, including inadequate efficacy and severe side effects.

Most schizophrenia patients in the United States today are treated with second-generation, or atypical, antipsychotics, which induce fewer motor disturbances than typical, or first-generation,

antipsychotics, but still fail to address most of the negative symptoms of schizophrenia. In addition, currently prescribed treatments do not effectively address or may exacerbate cognitive disturbances associated with schizophrenia. It is believed

that the efficacy of atypical antipsychotics is due to their interactions with dopamine and 5-HT2A receptors. The side effects induced by the atypical agents may include weight gain, non-insulin dependent (type II) diabetes, cardiovascular side effects, sleep disturbances, and motor disturbances. We

believe that these side effects generally arise either from non-essential receptor interactions or from excessive dopamine blockade.

6

The limitations of currently available antipsychotics result in poor patient compliance. A

study conducted by the National Institute of Mental Health, which was published in The New England Journal of Medicine in September 2005, found that 74 percent of patients taking typical or atypical antipsychotics discontinued treatment

within 18 months because of side effects or lack of efficacy. We believe there is a large unmet medical need for new therapies that have improved side effect and efficacy profiles.

Pimavanserin’s selective blockade of the 5-HT2A receptor may enable it to be used in two different treatment approaches to improve the therapy for patients with

schizophrenia. First, we are planning to evaluate the use of pimavanserin between acute psychotic episodes in a Phase II schizophrenia study. In this maintenance phase of schizophrenia therapy, we believe that pimavanserin may be desirable to use as

a treatment that selectively blocks the 5-HT2A receptor and

avoids interaction with dopamine receptors, which may be associated with many of the side effects caused by existing antipsychotic drugs. We believe that pimavanserin has the potential to be used as a stand-alone treatment to provide a

well-tolerated maintenance therapy for schizophrenia patients that results in better compliance compared to existing antipsychotic drugs.

Second, we believe that pimavanserin may be effective as a co-therapy, together with low doses of existing atypical antipsychotic drugs such as risperidone, to obtain a more optimal balance between

5-HT2A receptor blockade and partial dopamine receptor

blockade. This co-therapy approach has the potential to result in enhanced efficacy and fewer side effects relative to existing treatments. We published results in 2012 from an earlier multi-center, double-blind, placebo-controlled Phase II trial

designed to evaluate pimavanserin as a co-therapy in patients with schizophrenia. The trial results showed several advantages of co-therapy with pimavanserin and a 2 mg, or low, dose of risperidone in patients

with schizophrenia. These advantages included efficacy comparable to that of a 6 mg, or standard, dose of risperidone, combined with a faster onset of antipsychotic action and an improved side effect profile, including significantly less weight

gain, compared to the standard dose of risperidone.

Sleep Benefits of Pimavanserin

Although Parkinson’s disease is typically characterized by motor dysfunction, non-motor problems are also common and can

significantly impair function and quality of life. In studies of Parkinson’s disease patients, the prevalence of sleep disturbances, including daytime wakefulness, has been reported to be almost 100 percent. Sleep disorders are a major cause of

disability in Parkinson’s disease and are associated with other symptoms including falls, psychosis, dementia, and depression, which have a substantial impact on quality of life.

Sleep-related problems in Parkinson’s disease can be divided into disturbances of nocturnal sleep and disturbances of daytime

wakefulness. Studies suggest that nighttime sleep disturbances occur in almost 70 percent of Parkinson’s disease patients. These disturbances include insomnia, restless legs syndrome, periodic leg movements of sleep, rapid eye movement

sleep behavior disorder, and sleep apnea. Impaired nighttime sleep has been associated with increased daytime sleepiness, depression, fatigue, and cognitive impairment.

Clinical benefits of pimavanserin were observed in an exploratory efficacy measure of sleep during our -020 Study. Sleep was assessed using the SCOPA-sleep scale, which was designed to enable the

investigator to evaluate nighttime sleep and daytime wakefulness in Parkinson’s disease patients. Pimavanserin demonstrated significant improvements on both nighttime sleep (p=0.045) and daytime wakefulness (p=0.012) on SCOPA. We plan to follow

up these findings with a Phase II study to further explore the potential sleep benefits of pimavanserin in Parkinson’s disease patients.

Adrenergic and Muscarinic Programs

In collaboration with Allergan, we have discovered small molecule product candidates for the treatment of chronic pain. Chronic pain is a common form of persistent pain that may be related to a number of

medical

7

conditions and is often resistant to treatment. Our novel alpha adrenergic agonists provide pain relief in a range of preclinical models, without the side effects of current pain therapies,

including sedation and cardiovascular and respiratory effects. Allergan has conducted several Phase II trials in this program and has reported preliminary results, including positive proof-of-concept in a visceral pain trial in patients that had

hypersensitivity of the esophagus, and efficacy signals in two chronic pain trials in the areas of fibromyalgia and irritable bowel syndrome. Allergan has announced that it is seeking a partner for the further development of this program and for

commercialization in areas predominantly served by general practitioners.

We have discovered and, in collaboration with

Allergan, are developing small molecule product candidates for the treatment of glaucoma. Glaucoma is a chronic eye disease and is the second leading cause of blindness in the world. We identified a subtype of the muscarinic receptors that controls

intraocular pressure and discovered lead compounds that selectively activate this target. In preclinical models, our product candidates have demonstrated a promising preclinical profile, including robust efficacy and a long duration of action. This

program has reached Phase I development.

In November 2014, Allergan announced it entered into an agreement with Actavis plc

under which Actavis will acquire Allergan. If this acquisition is completed, we do not know what impact, if any, it will have on our programs with Allergan or Allergan’s performance thereunder.

Competition

We face,

and will continue to face, intense competition from pharmaceutical and biotechnology companies, as well as numerous academic and research institutions and governmental agencies, both in the United States and abroad. We compete, or will compete, with

existing and new products being developed by our competitors. Some of these competitors are pursuing the development of pharmaceuticals that target the same diseases and conditions that our research and development programs target.

Even if we are successful in developing pimavanserin and gaining FDA approval of NUPLAZID, it would compete with a variety of established

drugs in the areas of Parkinson’s disease psychosis, Alzheimer’s disease psychosis, and schizophrenia. For example, NUPLAZID for the treatment of Parkinson’s disease psychosis would compete with off-label use of antipsychotic drugs,

including Seroquel, marketed by Astra-Zeneca PLC, and clozapine, a generic drug.

Pimavanserin for Alzheimer’s disease

psychosis would compete with off-label use of antipsychotic drugs. Pimavanserin for the treatment of schizophrenia would compete with Latuda, marketed by Sunovion Pharmaceuticals Inc., Zyprexa, marketed by Eli Lilly and Company, Risperdal,

marketed by Johnson & Johnson, Abilify, marketed jointly by Bristol-Myers Squibb Company and Otsuka Pharmaceutical Co., Ltd., Seroquel, and clozapine. Zyprexa (olanzapine), Risperdal (risperidone), Seroquel (quetiapine) and clozapine

(clozaril) are all now generic in the United States.

Our potential products for the treatment of chronic pain would compete

with Lyrica, marketed by Pfizer Inc., and Cymbalta, marketed by Eli Lilly, as well as with a variety of generic or proprietary opioids, and other drugs. Currently, the leading drugs approved for chronic pain indications include Lyrica, the successor

to Neurontin (gabapentin, now a generic drug), and Cymbalta, now generic in the United States.

Our potential products for the

treatment of glaucoma would compete with Xalatan, marketed by Pfizer, and Lumigan and Alphagan, marketed by Allergan. Xalatan (latanoprost) is now generic.

In addition, the companies described above and other competitors may have a variety of drugs in development or awaiting FDA approval that could reach the market and become established before we have a

8

product to sell. Our competitors may also develop alternative therapies that could further limit the market for any drugs that we may develop. Many of our competitors are using technologies or

methods different or similar to ours to identify and validate drug targets and to discover novel small molecule drugs. Many of our competitors and their collaborators have significantly greater experience than we do in the following:

| |

• |

|

identifying and validating targets; |

| |

• |

|

screening compounds against targets; |

| |

• |

|

preclinical and clinical trials of potential pharmaceutical products; and |

| |

• |

|

obtaining FDA and other regulatory clearances. |

In addition, many of our competitors and their collaborators have substantially greater advantages in the following areas:

| |

• |

|

research and development resources; |

| |

• |

|

manufacturing capabilities; and |

Smaller companies also may prove to be significant competitors, particularly through proprietary research discoveries and collaborative arrangements with large pharmaceutical and established biotechnology

companies. Many of our competitors have products that have been approved or are in advanced development. We face competition from other companies, academic institutions, governmental agencies and other public and private research organizations for

collaborative arrangements with pharmaceutical and biotechnology companies, in recruiting and retaining highly qualified scientific, sales and marketing, and management personnel and for licenses to additional technologies. Our competitors, either

alone or with their collaborators, may succeed in developing technologies or drugs that are more effective, safer, and more affordable or more easily administered than ours and may achieve patent protection or commercialize drugs sooner than us.

Developments by others may render our product candidates or our technologies obsolete. Our failure to compete effectively could have a material adverse effect on our business.

Intellectual Property

We currently hold 49 issued U.S. patents and 244

issued foreign patents. All of these patents originated from discoveries made by us. In addition, we have 15 provisional and utility U.S. patent applications and 52 foreign patent applications.

Patents or other proprietary rights are an essential element of our business. Our strategy is to file patent applications in the United

States and any other country that represents an important potential commercial market to us. In addition, we seek to protect our technology, inventions and improvements to inventions that are important to the development of our business. Our patent

applications claim proprietary technology, including methods of screening and chemical synthetic methods, novel drug targets and novel compounds identified using our technology.

We also rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be

used to identify and develop novel drugs. We protect our trade secrets in part through confidentiality and proprietary information agreements. We have entered into a license agreement, dated as of November 30, 2006, for certain intellectual

property rights from the Ipsen Group in order to expand and strengthen the intellectual property portfolio for our serotonin platform, including pimavanserin. In connection with a successful filing of the NDA for NUPLAZID, we would pay a $2.5

million milestone payment to Ipsen and, if approved, would pay an additional $8.0 million milestone payment to Ipsen, each pursuant to the terms of

9

the 2006 license agreement. In addition, if we are able to successfully market and sell NUPLAZID, we would pay to Ipsen royalties of up to two percent of net product sales pursuant to the

agreement. We are a party to various other license agreements that give us rights to use certain technologies in our research and development.

Pimavanserin

Twenty U.S. patents have been issued to us that provide protection for pimavanserin, including two that cover the compound generically and

12 that specifically cover pimavanserin, polymorphs thereof, the use thereof for treating Parkinson’s disease psychosis, Alzheimer’s disease psychosis, schizophrenia, bipolar disorder, Lewy body disease, sleep disorders, and other methods

of treatment. These patents also provide protection for certain methods of producing pimavanserin. The pimavanserin-specific patent and the Parkinson’s disease psychosis treatment patent provide protection until June 2027 and 2026,

respectively. The patent that covers polymorphs of pimavanserin provides protection until June 2028. The patents that cover pimavanserin generically expire in 2021. Our estimation of the above patent terms includes patent term adjustments made by

the U.S. Patent and Trademark Office. These patent terms may be subject to change based on new interpretations of the law. We have 56 issued foreign patents that specifically cover pimavanserin, including patents in 38 European countries, Australia,

Canada, China, Hong Kong, India, Japan, Mexico, New Zealand, Russia, Singapore and South Africa, which provide patent protection until 2024. We also have 48 issued foreign patents that cover polymorphs of pimavanserin and provide patent protection

until 2025. We continue to prosecute patent applications directed to pimavanserin and to methods of treating various diseases using pimavanserin, either alone or in combination with other agents, worldwide.

Alpha Adrenergic Program

We have not been issued, and are not pursuing, patents covering the compounds being pursued by Allergan under this collaboration as the compounds are covered by Allergan patents.

Muscarinic Program

We have two U.S. patents that have been issued to us providing coverage for the compounds covered by our collaboration with Allergan for

the treatment of glaucoma. These U.S. patents will expire in 2023. We have 48 issued foreign patents and 14 pending foreign applications that cover these compounds. The issued foreign patents for this program will expire in 2022 and 2025.

Collaboration Agreements

Historically, we have been a party to various collaboration agreements with Allergan and other parties to leverage our drug discovery platform and related assets, and to advance development of and

commercialize selected product candidates. These collaborations have typically included upfront payments at initiation of the collaboration, research support during the research term, if applicable, milestone payments upon successful completion of

specified development objectives, and royalties based upon future sales, if any, of drugs developed under the collaboration. Our current agreements are as follows:

In July 1999, we entered into a collaboration agreement with Allergan to discover, develop and commercialize selective muscarinic drugs for the treatment of glaucoma. Under this agreement, we provided our

chemistry and discovery expertise to enable Allergan to select two compounds for development. We granted Allergan exclusive worldwide rights to commercialize products based on these two compounds for the treatment of ocular disease. As of

December 31, 2014, we had received an aggregate of $9.9 million in payments under the agreement, consisting of upfront fees, research funding and milestone payments. We are eligible to receive up to an aggregate of $15.0 million in

additional payments per product upon the achievement of development and regulatory milestones as well as royalties on future net product sales worldwide, if any. Allergan may terminate this agreement upon 90 days’ notice. However, if

terminated, Allergan’s rights to the selected compounds would revert to us.

10

In September 1997, we entered into a collaboration agreement with Allergan focused primarily

on the discovery and development of new therapeutics for pain and ophthalmic indications. This agreement, as amended, provides for the continued development of product candidates for one target area. We are restricted from conducting competing

research in that target area. Pursuant to the agreement, we granted Allergan exclusive worldwide rights to commercialize products resulting from the collaboration. We had received an aggregate of $10.5 million in payments, consisting of research

funding and milestone payments, through December 31, 2014 under this agreement. We are eligible to receive additional milestone payments of up to $10.0 million in the aggregate upon the achievement of development and regulatory milestones as

well as royalties on future net product sales worldwide, if any. In connection with the execution of the collaboration agreement in 1997, Allergan made a $6.0 million equity investment in us.

The general terms of our collaboration agreements with Allergan continue until the later of the expiration of the last to expire patent

covering a product licensed under the collaboration and at least 10 years from the date of first commercial sale of a product. In addition, each of our Allergan collaboration agreements includes a research term that is shorter but may be renewed if

agreed to by the parties.

In November 2014, Allergan announced it entered into an agreement with Actavis under which Actavis

will acquire Allergan. If this acquisition is completed, we do not know what impact, if any, it will have on our agreements with Allergan or Allergan’s performance thereunder.

Government Regulation

Our business activities, including the manufacturing

and marketing of our potential products and our ongoing research and development activities are subject to extensive regulation by numerous governmental authorities in the United States and other countries. Before marketing in the United States, any

new drug developed by us must undergo rigorous preclinical testing, clinical trials and an extensive regulatory clearance process implemented by the FDA under the federal Food, Drug, and Cosmetic Act, as amended. The FDA regulates, among other

things, the development, testing, manufacture, safety, efficacy, record keeping, labeling, storage, approval, advertising, promotion, import, export, sale and distribution of biopharmaceutical products. None of our product candidates has been

approved for sale in the United States or any foreign market. The regulatory review and approval process, which includes preclinical testing and clinical trials of each product candidate, is lengthy, expensive and uncertain. Moreover, if our product

candidates are approved by the FDA, government coverage and reimbursement policies will both directly and indirectly impact our ability to successfully commercialize our products, and such coverage and reimbursement policies will be impacted by

recently enacted and any applicable future healthcare reform measures. In addition, we are subject to state and federal laws, including, among others, anti-kickback laws, false claims laws, data privacy and security laws, and transparency laws that

restrict certain business practices in the pharmaceutical industry.

In the United States, drug product candidates intended

for human use undergo laboratory and animal testing until adequate proof of safety is established. Clinical trials for new product candidates are then typically conducted in humans in three sequential phases that may overlap. Phase I trials

involve the initial introduction of the product candidate into healthy human volunteers. The emphasis of Phase I trials is on testing for safety or adverse effects, dosage, tolerance, metabolism, distribution, excretion and clinical pharmacology.

Phase II involves studies in a limited patient population to determine the initial efficacy of the compound for specific targeted indications, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety

risks. Once a compound shows evidence of effectiveness and is found to have an acceptable safety profile in Phase II evaluations, Phase III trials are undertaken to more fully evaluate clinical outcomes. Before commencing clinical investigations in

humans, we or our collaborators must submit an Investigational New Drug Application, or IND, to the FDA.

11

Regulatory authorities may require additional data before allowing the clinical studies to

commence or proceed from one phase to another, and could demand that the studies be discontinued or suspended at any time if there are significant safety issues. We have in the past and may in the future rely on some of our collaborators to file

INDs and generally direct the regulatory approval process for our potential products. Clinical testing must also meet requirements for clinical trial registration, institutional review board oversight, informed consent, health information privacy,

and good clinical practices, or GCPs. Additionally, the manufacture of our drug product, must be done in accordance with current good manufacturing practices, or GMPs.

To establish a new product candidate’s safety and efficacy, the FDA requires companies seeking approval to market a drug product to submit extensive preclinical and clinical data, along with other

information, for each indication for which the product will be labeled. The data and information are submitted to the FDA in the form of a New Drug Application, or NDA. Generating the required data and information for an NDA takes many years and

requires the expenditure of substantial resources. Information generated in this process is susceptible to varying interpretations that could delay, limit or prevent regulatory approval at any stage of the process. The failure to demonstrate

adequately the quality, safety and efficacy of a product candidate under development would delay or prevent regulatory approval of the product candidate. We cannot assure you that, even if clinical trials are completed, either our collaborators or

we will submit applications for required authorizations to manufacture and/or market potential products or that any such application will be reviewed and approved by the appropriate regulatory authorities in a timely manner, if at all. Under

applicable laws and FDA regulations, each NDA submitted for FDA approval is given an internal administrative review within 60 days following submission of the NDA. If deemed sufficiently complete to permit a substantive review, the FDA will

“file” the NDA. The FDA can refuse to file any NDA that it deems incomplete or not properly reviewable. The FDA has established internal goals of eight months from submission for priority review of NDAs that cover product candidates that

offer major advances in treatment or provide a treatment where no adequate therapy exists, and 12 months from submission for the standard review of NDAs. However, the FDA is not legally required to complete its review within these periods, these

performance goals may change over time and the review is often extended by FDA requests for additional information or clarification. Moreover, the outcome of the review, even if generally favorable, may not be an actual approval but a “complete

response letter” that describes additional work that must be done before the NDA can be approved. Before approving an NDA, the FDA can choose to inspect the facilities at which the product is manufactured and will not approve the product unless

the manufacturing facility complies with GMPs. The FDA may also audit sites at which clinical trials have been conducted to determine compliance with GCPs and data integrity. The FDA’s review of an NDA may also involve review and

recommendations by an independent FDA advisory committee, particularly for novel indications, such as Parkinson’s disease psychosis. The FDA is not bound by the recommendation of an advisory committee.

In addition, delays or rejections may be encountered based upon changes in regulatory policy, regulations or statutes governing product

approval during the period of product development and regulatory agency review.

Before receiving FDA approval to market a

potential product, we or our collaborators must demonstrate through adequate and well-controlled clinical studies that the potential product is safe and effective in the patient population that will be treated. If regulatory approval of a potential

product is granted, this approval will be limited to those disease states and conditions for which the product is approved. Marketing or promoting a drug for an unapproved indication is generally prohibited. Furthermore, FDA approval may entail

ongoing requirements for risk management, including post-marketing studies. Even if approval is obtained, a marketed product, its manufacturer and its manufacturing facilities are subject to payment of significant annual fees and continuing review

and periodic inspections by the FDA. Discovery of previously unknown problems with a product, manufacturer or facility may result in restrictions on the product or manufacturer, including labeling changes, warning letters, costly recalls or

withdrawal of the product from the market.

Any drug is likely to produce some toxicities or undesirable side effects in

animals and in humans when administered at sufficiently high doses and/or for sufficiently long periods of time. Unacceptable toxicities or

12

side effects may occur at any dose level at any time in the course of studies in animals designed to identify unacceptable effects of a product candidate, known as toxicological studies, or

during clinical trials of our potential products. The appearance of any unacceptable toxicity or side effect could cause us or regulatory authorities to interrupt, limit, delay or abort the development of any of our product candidates. Further, such

unacceptable toxicity or side effects could ultimately prevent a potential product’s approval by the FDA or foreign regulatory authorities for any or all targeted indications or limit any labeling claims, even if the product is approved.

In addition, as a condition of approval, the FDA may require an applicant to develop a risk evaluation and mitigation

strategy, or REMS. REMS use risk minimization strategies beyond the professional labeling to ensure that the benefits of the product outweigh the potential risks. To determine whether a REMS is needed, the FDA will consider the size of the

population likely to use the product, seriousness of the disease, expected benefit of the product, expected duration of treatment, seriousness of known or potential adverse events, and whether the product is a new molecular entity. REMS can include

medication guides, physician communication plans for healthcare professionals, and elements to assure safe use, or ETASU. ETASU may include, but are not limited to, special training or certification for prescribing or dispensing, dispensing only

under certain circumstances, special monitoring, and the use of patient registries. The FDA may require a REMS before approval or post-approval if it becomes aware of a serious risk associated with use of the product. The requirement for a REMS can

materially affect the potential market and profitability of a product.

Any trade name that we intend to use for a potential

product must be approved by the FDA irrespective of whether we have secured a formal trademark registration from the U.S. Patent and Trademark Office. The FDA conducts a rigorous review of proposed product names, and may reject a product name if it

believes that the name inappropriately implies medical claims or if it poses the potential for confusion with other product names. The FDA will not approve a trade name until the NDA for a product is approved. If the FDA determines that the trade

names of other products that are approved prior to the approval of our potential products may present a risk of confusion with our proposed trade name, the FDA may elect to not approve our proposed trade name. If our trade name is rejected, we will

lose the benefit of any brand equity that may already have been developed for this trade name, as well as the benefit of our existing trademark applications for this trade name. If the FDA does not approve our proposed trade name, we may be required

to launch a potential product candidate without a brand name, and our efforts to build a successful brand identity for, and commercialize, this product candidate may be adversely impacted.

We and our collaborators and contract manufacturers also are required to comply with the applicable FDA current good manufacturing

practice regulations. Good manufacturing practice regulations include requirements relating to quality control and quality assurance as well as the corresponding maintenance of records and documentation. Manufacturing facilities are subject to

inspection by the FDA. These facilities must be approved before we can use them in commercial manufacturing of our potential products. The FDA may conclude that we or our collaborators or contract manufacturers are not in compliance with applicable

good manufacturing practice requirements and other FDA regulatory requirements, which may result in delay or failure to approve applications, warning letters, product recalls and/or imposition of fines or penalties.

If the product is approved, we must also comply with post-marketing requirements, including, but not limited to, compliance with

advertising and promotion laws enforced by various government agencies, including the FDA’s Office of Prescription Drug Promotion, through such laws as the Prescription Drug Marketing Act, federal and state anti-fraud and abuse laws, including

anti-kickback and false claims laws, healthcare information privacy and security laws, post-marketing safety surveillance, and disclosure of payments or other transfers of value to healthcare professionals and entities. In addition, we are subject

to other federal and state regulation including, for example, the implementation of corporate compliance programs.

Outside of

the United States, our ability to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical

13

trials, marketing authorization, pricing and reimbursement vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within

the European Community, or EC, registration procedures are available to companies wishing to market a product in more than one EC member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficacy has been

presented, marketing authorization will be granted. This foreign regulatory approval process involves all of the risks associated with FDA marketing approval discussed above. In addition, foreign regulations may include applicable post-marketing

requirements, including safety surveillance, anti-fraud and abuse laws, and implementation of corporate compliance programs and reporting of payments or other transfers of value to healthcare professionals and entities.

Drugs for Serious or Life-Threatening Illnesses

In 2012, Congress enacted the Food and Drug Administration Safety and Innovation Act, or FDASIA. This law established a new regulatory scheme allowing for expedited review of products designated as

“breakthrough therapies”. A product may be designated as a breakthrough therapy if it is intended, either alone or in combination with one or more other drugs, to treat a serious or life-threatening disease or condition and preliminary

clinical evidence indicates that the product may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. The FDA may

take certain actions with respect to breakthrough therapies, including holding meetings with the sponsor throughout the development process, providing timely advice to the product sponsor regarding development and approval, involving more senior

staff in the review process, assigning a cross-disciplinary project lead for the review team, and taking other steps to design the clinical trials in an efficient manner. FDA regulations also provide certain mechanisms to expedite approval of

potential products intended to treat serious or life-threatening illnesses which have been studied for safety and effectiveness and which demonstrate the potential to address unmet medical needs. Under accelerated approval regulations, NDAs may be

approved on the basis of valid surrogate markers of product effectiveness, thus accelerating the normal approval process. Certain of our product candidates might qualify for accelerated approval. Even if the FDA agrees that these potential products

qualify for accelerated approval procedures or breakthrough therapy designation, the FDA may deny approval of our drugs or may require that additional studies be required before approval. The FDA may also require us to perform post-approval, or

Phase IV, studies as a condition of approval. In addition, the FDA may impose restrictions on distribution and/or promotion in connection with any accelerated approval, and may withdraw approval if post-approval studies do not confirm the intended

clinical benefit or safety of the potential product.

Coverage and Reimbursement

Market acceptance and sales of any product candidates for which we may receive regulatory approval will depend, in part, upon the

availability of coverage and adequate reimbursement from third-party payors. Third-party payors such as government health programs (including Medicare and Medicaid in the United States), managed care organizations, private health insurers, and other

organizations generally decide which drugs they will pay for and establish reimbursement levels for health care. Coverage decisions may depend upon various clinical and economic factors that potentially disfavor new drug products when more

established or lower cost therapeutic alternatives are available. Even if coverage is made available by a third-party payor, the reimbursement rates paid for covered products might not be adequate. The marketability of any products for which we may

receive regulatory approval for commercial sale may suffer if the government and other third-party payors fail to provide coverage and adequate reimbursement to allow us to sell such products on a competitive and profitable basis. For example, under

these circumstances, physicians may limit how much or under what circumstances they will prescribe or administer such products, and patients may decline to purchase them. This, in turn, could affect our ability to successfully commercialize our

products and impact our profitability, results of operations, financial condition, and future success.

In the United States

and other potentially significant markets for our product candidates, government authorities and other third party payors are increasingly attempting to limit or regulate the price of medical

14

products and services, particularly for new and innovative products and therapies. Such pressure, along with the increased emphasis on managed healthcare in the United States and on country and

regional pricing and reimbursement controls in other countries, will likely put additional downward pressure on product pricing, reimbursement and usage, which may adversely affect any future product sales and our results of operations. The market

for any product candidates for which we may receive regulatory approval will depend significantly on the degree to which these products are listed on third-party payors’ drug formularies, or lists of medications for which third-party payors

provide coverage and reimbursement, to the extent products for which we may receive regulatory approval are covered under a pharmacy benefit or are otherwise subject to a formulary. The industry competition to be included on such formularies often

leads to downward pricing pressures on pharmaceutical companies. Also, third-party payors may refuse to include a particular branded drug on their formularies or otherwise restrict patient access to a branded drug when a less costly generic

equivalent or other therapeutic alternative is available. In addition, because each third-party payor individually approves coverage and reimbursement levels, obtaining coverage and adequate reimbursement is a time-consuming and costly process. We

may be required to provide scientific and clinical support for the use of any product to each third-party payor separately with no assurance that approval would be obtained, and we may need to conduct expensive pharmacoeconomic studies in order to

demonstrate the cost-effectiveness of our products. We cannot be certain that our product candidates will be considered cost-effective. This process could delay the market acceptance of any product candidates for which we may receive approval and

could have a negative effect on our future revenues and operating results.

In the United States, the Medicare Part D program

provides a voluntary outpatient drug benefit to Medicare beneficiaries for certain products. We expect NUPLAZID, if approved, will be available for coverage under Medicare Part D, but the extent to which the individual Part D plans may offer

coverage may be subject to various factors such as those described above. In addition, while Medicare Part D has historically required Medicare Part D plans to include “all or substantially all” drugs in the following designated classes of

“clinical concern” on their formularies: anticonvulsants, antidepressants, antineoplastics, antipsychotics, antiretrovirals, and immunosuppressants, the Centers for Medicare and Medicaid Services, or CMS, recently proposed, but did not

adopt, changes to this policy for coverage year 2015. If this policy is changed in the future and if CMS no longer considers the antipsychotic class to be of “critical concern”, Medicare Part D plans would have significantly more

discretion to reduce the number of products covered in that class. Furthermore, private payors often follow Medicare coverage policies and payment limitations in setting their own coverage policies.

Coverage policies, third-party reimbursement rates, and product pricing regulation may change at any time. Even if favorable coverage and

reimbursement status is attained for one or more products that receive regulatory approval, less favorable coverage policies and reimbursement rates may be implemented in the future.

“Fraud and Abuse”, Data Privacy, and Security Laws and Regulations

In addition to FDA restrictions on marketing of pharmaceutical products, federal and state fraud and abuse laws restrict business practices in the pharmaceutical industry. These laws include, among

others, anti-kickback and false claims laws, data privacy and security laws, and transparency laws. The federal Anti-Kickback Statute prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration to

induce or in return for purchasing, leasing, ordering or arranging for or recommending the purchase, lease or order of any good, facility, item or service reimbursable under Medicare, Medicaid or other federal healthcare programs. The term

“remuneration” has been broadly interpreted to include anything of value, and thus the Anti-Kickback Statute could potentially restrict certain arrangements between pharmaceutical manufacturers and

customers that are common or even potentially beneficial in other industries. Although there are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution, the exceptions and safe harbors are

limited in scope. The Patient Protection and Affordable Care Act of 2010, as amended by the Health Care and Education Reconciliation Act of 2010, or collectively the ACA, among other things, amended the intent requirement of the federal

Anti-Kickback Statute to state that a person or entity need not have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

15

Where “one purpose” of an arrangement involving remuneration is to induce referrals of a federal healthcare covered business, the Anti-Kickback Statute may have been violated, and

enforcement will depend on the relevant facts and circumstances.

The federal False Claims Act prohibits any person or entity

from knowingly presenting, or causing to be presented, a false claim for payment to the federal government or knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim to the federal

government. A claim includes “any request or demand” for money or property presented to the U.S. government. In addition, the ACA specified that a claim including items or services resulting from a violation of the federal Anti-Kickback

Statute constitutes a false or fraudulent claim for purposes of the civil False Claims Act. The federal False Claims Act has been the basis for numerous enforcement actions and settlements by pharmaceutical and other healthcare companies in

connection with various alleged financial relationships with customers. In addition, a number of pharmaceutical companies have reached substantial financial settlements in connection with, for example, allegedly causing false claims to be submitted

because of their marketing of products for unapproved, and thus non-reimbursable, uses.

Additionally, other federal and state

false claims and false statements laws exist that restrict business activities in the pharmaceutical industry. For example, a federal criminal law enacted as part of the Health Insurance Portability and Accountability Act of 1996, or HIPAA,

prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private third party payors, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false,

fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. In addition, the federal civil monetary penalties statute imposes penalties against any person or entity that, among other

things, is determined to have presented or caused to be presented a claim to a federal health program that the person knows or should know is for an item or service that was not provided as claimed or is false or fraudulent. Also, many states have

similar fraud and abuse statutes or regulations, including, without limitation, laws analogous to the federal Anti-Kickback Statute and the federal False Claims Act, that apply to items and services reimbursed under Medicaid and other state

programs, or, in several states, apply regardless of the payor.

We may be subject to data privacy and security regulation by

both the federal government and the states in which we conduct our business. HIPAA, as amended by the Health Information Technology and Clinical Health Act, or HITECH, and their respective implementing regulations, impose specified requirements

relating to the privacy, security, and transmission of certain individually identifiable health information. Among other things, HIPAA’s privacy and security standards are now directly applicable to “business associates”, which is

defined as independent contractors or agents of covered entities that create, receive, maintain, or transmit protected health information in connection with providing a service for or on behalf of a covered entity. In addition to possible civil and

criminal penalties for violations, state attorneys general are authorized to file civil actions for damages or injunctions in federal courts to enforce HIPAA and seek attorney’s fees and costs associated with pursuing federal civil actions. In

addition, state laws govern the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect, which further complicates compliance efforts.

In addition, a federal requirement created under the ACA mandates that pharmaceutical companies track and annually report to the federal

government certain payments and other transfers of value made to physicians and other healthcare professionals and teaching hospitals and ownership or investment interests held by physicians and their immediate family members. CMS disclosed certain

reported information for the first reporting period on a publicly available website in September 2014. There are also an increasing number of state “sunshine” laws that require pharmaceutical companies to make reports to states on pricing

and marketing information. Several states have enacted legislation requiring pharmaceutical companies to, among other things, establish marketing compliance programs, file periodic reports with the state, and make periodic public disclosures on

sales and marketing activities, and prohibiting certain other sales and marketing practices. These laws may adversely affect our sales, marketing, and other activities with respect to any product candidate for which we receive approval to

16

market in the United States by imposing administrative and compliance burdens on us. If we fail to track and report as required by these laws or otherwise fail to comply with these laws, we could

be subject to the penalty provisions of the pertinent state and federal authorities.

Because of the breadth of these laws and

the narrowness of available statutory and regulatory exceptions, it is possible that some of our business activities, particularly any sales and marketing activities after a product candidate has been approved for marketing in the United States,

could be subject to legal challenge and enforcement actions. If our operations are found to be in violation of any of the federal and state laws described above or any other governmental regulations that apply to us, we may be subject to significant

civil, criminal, and administrative penalties, including, without limitation, damages, fines, imprisonment, exclusion from participation in government healthcare programs, and the curtailment or restructuring of our operations, any of which could

adversely affect our ability to operate our business and our results of operations. To the extent that any of our product candidates receive approval and are sold in a foreign country, we may be subject to similar foreign laws and regulations, which

may include, for instance, applicable post-marketing requirements, including safety surveillance, anti-fraud and abuse laws, and implementation of corporate compliance programs, as well as laws and regulations requiring transparency of pricing and

marketing information and governing the privacy and security of health information, such as the European Union’s Directive 95/46/EC on the protection of individuals with regard to the processing of personal data.

Impact of Healthcare Reform on Coverage, Reimbursement, and Pricing