UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange

Act of 1934

Check the appropriate box:

| |

Preliminary Information Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| X |

Definitive Information Statement |

SMACK SPORTSWEAR, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee computed on table below per Rules 14c-5(g) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

SMACK SPORTSWEAR, INC.

20316 Gramercy Place

Torrance, CA 90501

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT OF OUR MAJORITY

STOCKHOLDERS

Dear Stockholders:

We are writing to advise you that our

Board of Directors and the holders of a majority of our outstanding common stock have approved:

• A reverse split of our

issued and outstanding shares of common stock, $0.001 par value, at a ratio of up to 1-for-3 1/3 (3.33), which ratio shall be determined

by our Board of Directors in its sole discretion, and which shall be effectuated, if at all, during the 2015 calendar year.

This action was approved on December 10,

2014 by our Board of Directors. In addition, this action was approved by a majority of our stockholders by written consent in lieu

of a special meeting effective February 4, 2015 in accordance with the relevant sections of the Nevada Revised Statutes.

WE ARE NOT ASKING YOU FOR A PROXY, AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The

accompanying Information Statement is furnished only to inform stockholders of the action taken by written consent described above

before they take effect in accordance with Rule 14c-2, promulgated under the Securities Exchange Act of 1934, as amended. The

Information Statement is first being mailed to you on or about February 20, 2015.

The Information Statement is for information

purposes only and explains the action taken by written consent. Please read the accompanying Information Statement carefully.

| February 19, 2015 |

Very truly yours, |

| |

|

| |

/s/ Douglas Samuelson |

| |

Douglas Samuelson |

| |

Interim Chief Executive Officer |

1

SMACK SPORTSWEAR, INC.

20316 Gramercy Place

Torrance, CA 90501

INFORMATION STATEMENT REGARDING ACTION TO BE TAKEN BY WRITTEN

CONSENT OF MAJORITY STOCKHOLDERS IN LIEU OF A SPECIAL MEETING

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is being sent

by first class mail to all record and beneficial owners of the common stock, $0.001 par value, of Smack Sportswear, Inc., a Nevada

corporation, which we refer to herein as “Company,” “we,” “our,” or “us.” The

mailing date of this Information Statement is on or about February 20, 2015. The Information Statement has been filed

with the Securities and Exchange Commission (the “SEC”) and is being furnished, pursuant to Section 14C of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), to notify our stockholders of an action we are taking pursuant

to written consents of a majority of our stockholders in lieu of a meeting of stockholders.

On February 4, 2015, the record date for

determining the identity of stockholders who are entitled to receive this Information Statement, we had 65,128,330 shares of common

stock issued and outstanding. The common stock constitutes the sole outstanding class of voting securities. Each

share of common stock entitles the holder thereof to one vote on all matters submitted to stockholders.

NO VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS

IS SOLICITED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED

NOT TO SEND US A PROXY.

On or around December 10, 2014, our Board

of Directors approved:

•

A reverse split of our issued and outstanding shares of common stock, $0.001 par

value, at a ratio of up to 1-for-3 1/3 (3.33), which ratio shall be determined by our Board of Directors in its sole discretion,

and which shall be effectuated, if at all, during the 2015 calendar year.

On February 4, 2015, stockholders

who beneficially own in the aggregate 34,536,000 shares, or approximately 53.03% of our issued and outstanding common stock, consented

in writing to the above action in accordance with the Nevada Revised Statutes.

The elimination of the need for a meeting

of stockholders to approve this action is made possible by Section 78.320 of the Nevada Revised Statutes, which provides that any

action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the

action, a written consent thereto is signed by stockholders holding at least a majority of the voting power. In order to eliminate

the costs involved in holding a special meeting, our Board of Directors voted to utilize the written consent of the holders of

a majority in interest of our voting securities. In the ordinary course, future issuances of shares, up to the authorized number

of shares provided for in our Articles of Incorporation, will not require the approval of our stockholders under Nevada law.

The entire cost of furnishing this Information Statement

will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries, and other like parties to forward this

Information Statement to the beneficial owners of our voting securities held of record by them, and we will reimburse such persons

for out-of-pocket expenses incurred in forwarding such material.

2

The action approved by our shareholders is as follows:

Reverse Stock Split

On February 4, 2015, the shareholders

of the Company authorized our Board of Directors to effectuate a reverse stock split, in such Board’s discretion (the “Reverse

Stock Split”), if at all. The Reverse Stock Split would cause up to three and one-third (3.33) issued and outstanding shares

of the Company’s Common Stock to be changed and converted into one (1) share of Common Stock in the Board’s absolute

discretion—to be effectuated, if at all, during the 2015 calendar year.

If the Reverse Split is effected by the

Board of Directors, then the Company will continue to have 70,000,000 shares of Common Stock authorized for issuance but the number

of outstanding shares of the Company’s Common Stock will be reduced from 65,128,330 shares to as few as approximately 21,709,491

shares. Each shareholder entitled to a fractional share of the Company’s Common Stock as a result of the Reverse Split will

receive a whole share of the Company’s Common Stock in lieu of the fractional share. Once the Company effectuates the Reverse

Split, the Company will have up to approximately 48,290,509 authorized but unissued shares of Common Stock available for issuance.

The authorized but unissued shares of

Common Stock will be available for issuance from time to time as may be deemed advisable by the Board of Directors for various

purposes including, but not limited to, the issuance of Common Stock in connection with the exercise of outstanding warrants or

other convertible or derivative securities that have been or may be issued by the Company, the issuance of Common Stock in financing

or acquisition transactions and the issuance of Common Stock to consultants, contractors or employees. The Board of Directors will

be able to authorize the issuance of Common Stock for these transactions without the necessity, and related costs and delays, of

either calling a special shareholders’ meeting or waiting for the regularly scheduled annual meeting of shareholders in order

to increase the authorized capital.

The Reverse Stock Split is not intended

to have an anti-takeover effect and is not part of any series of anti-takeover measures included in the Articles of Incorporation

or the bylaws of the Company in effect on the date of this Information Statement. However, the additional authorized and unissued

shares of Common Stock could be issued to make any attempt to gain control of the Company or the Board of Directors more difficult

or time consuming and to make it more difficult to remove management. (See “Effect of Reverse Split and Potential Anti-Takeover

Effect” below).

Criteria for Determining the Split Ratio

The Board shall determine the split ratio

based upon a review of the capital structure of the Company, including shares and convertible instruments outstanding, share price,

general market conditions and the potential benefits that may result from the Reverse Split.

The Reverse Stock Split

The following table reflects the number

of shares of Common Stock that would be outstanding as a result of the Reverse Split and the approximate percentage reduction in

the number of outstanding shares based on approximately 65,128,330 shares of Common Stock that are anticipated to be outstanding

on the date of the Reverse Split.

|

Proposed

Reverse

Split Ratio |

|

Percentage

Reduction |

|

Approximate Shares

of Common Stock

to be Outstanding

After the Reverse Split |

| 1-for-3.33 reverse split |

|

66.67% |

|

21,709,441 |

3

Effectiveness of the Reverse Stock Split and Mechanism for Share Exchange

The Reverse Split will become effective

with the approval by the Board of Directors and the completion of all necessary filings with the Nevada Secretary of State, as

required by the Nevada Revised Statutes (the “Split Effective Date”). The Board of Directors may abandon the Reverse

Split if it determines that it is in the best interests of the Company and our shareholders to do so. The Company must effectuate

the Reverse Split before January 1, 2016. If the Company fails to do so before that date, the authority will lapse.

On the Split Effective Date, each three

and one-third (3.33) shares of the Company’s Common Stock issued and outstanding or held as unissued immediately prior to

the Split Effective Date will automatically, without any action on the part of the holder thereof, be reclassified and changed

into one (1) share of Common Stock which the Company will be authorized to issue immediately following the Split Effective Date.

If any conversion would create a fractional share, the fractional share will be disregarded and the number of shares of Common

Stock issuable upon the conversion, in the aggregate, will be rounded up to the nearest whole number of shares of Common Stock.

The table below illustrates, as of the

date of this Information Statement, the number of shares of Common Stock that are issued and outstanding, the number of shares

of Common Stock available for issuance and the number of shares of Common Stock that are authorized.

|

Number of Shares

Outstanding |

|

Number of Shares Available for Issuance |

|

Number of Shares

Authorized |

| 65,128,330 |

|

4,871,670 |

|

70,000,000 |

Giving effect to the Reverse Split and

assuming no change to the number of shares of Common Stock that are issued and outstanding on the date of this Information Statement,

the table below illustrates the number of shares of Common Stock that will be issued and outstanding, the number of shares of Common

Stock that will be available for issuance and the number of shares of Common Stock.

|

Number of Shares

Outstanding |

|

Number of Shares Available for Issuance |

|

Number of Shares

Authorized |

| 21,709,491 |

|

48,290,509 |

|

70,000,000 |

Effect of Reverse Split and Potential Anti-Takeover Effect

Management does not anticipate that our

financial condition, the percentage ownership of the Company’s Common Stock by management, the number of our shareholders,

or any aspect of our business will materially change as a result of the Reverse Split. Because the Reverse Split will apply to

all issued and outstanding shares of Common Stock and outstanding rights to purchase Common Stock or to convert other securities

into Common Stock, the proposed Reverse Split will not alter the relative rights and preferences of existing shareholders. However,

as noted above, the number of authorized shares of Common Stock will remain at 70,000,000, but the number of shares of Common Stock

outstanding will be decreased. As a result, we could potentially issue a total of up to approximately 48,290,509 additional shares

of Common Stock, as opposed to a total of approximately 4,871,670 additional shares of Common Stock that would have been available

to issue had the Reverse Split not occurred.

4

The increase in our authorized shares

will not be used by management to make it more difficult or to discourage a future merger, tender offer or proxy contest or the

removal of incumbent management. This proposal is not the result of management’s knowledge of an effort to accumulate our

securities or to obtain control of the Company by means of a merger, tender offer, solicitation or otherwise.

Neither our Articles of Incorporation

nor our bylaws presently contain any provisions having anti-takeover effects and this proposal is not a plan by management to adopt

a series of amendments to our Articles of Incorporation or bylaws to institute anti-takeover provisions. We do not presently have

any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

There are no rules or practices on any

stock exchange that permit such exchange to reserve the right to refuse to list or to de-list any stock which completes a reverse

stock split.

Advantages and Disadvantages of the Reverse Split

Management believes that the Reverse Split

may result in an increase to the trading price of the Company’s Common Stock and enhance its marketability to the financial

community. The potential increases in the trading price and greater interest from the financial community could ultimately improve

the trading liquidity of the Company’s Common Stock.

A potential disadvantage to the Reverse

Stock Split is that we may issue the additional shares of Common Stock, which could substantially dilute the Common Stock holdings

of our existing shareholders.

5

FORWARD-LOOKING INFORMATION

This Information Statement and other reports

that we file with the SEC contain certain forward-looking statements relating to future events performance. In some

cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,”

“expect,” “intend,” “plan,” “anticipate,” “believe, ” “estimate,”

“predict,” “potential,” “continue,” or similar terms, variations of such terms or the negative

of such terms. These statements are only predictions and involve known and unknown risks, uncertainties and other factors,

including those risks discussed elsewhere herein. Although forward-looking statements, and any assumptions upon which

they are based, are made in good faith and reflect our current judgment, actual results could differ materially from those anticipated

in such statements. Except as required by applicable law, including the securities laws of the United States, we do

not intend to update any of the forward-looking statements to conform these statements to actual results.

OUTSTANDING VOTING SECURITIES

AND CONSENTING STOCKHOLDERS

As of the date of the consent by the majority stockholders

on February 4, 2015 we had issued and outstanding 65,128,330 shares of common stock and had not issued any preferred stock. Each

share of common stock is entitled to one vote on matters submitted for stockholder approval.

On February 4, 2015, the holders of 34,536,000

shares (or approximately 53.03% of the shares of common stock then outstanding) executed and delivered to the Board of Directors

written consents approving the action. Because the action was approved by stockholders holding a majority of our outstanding

shares, no proxies are being solicited with this Information Statement.

The consenting stockholders are set forth below:

| |

Name |

Number of Shares |

Percent |

| |

|

|

|

| Bill Sigler |

21,643,500 |

33.23% |

|

| Fox Chase |

5,000,000 |

7.68% |

|

| Carlos Gonzalez |

3,000,000 |

4.61% |

|

| Christopher Jenks |

2,900,000 |

4.45% |

|

| William Kruse |

1,992,500 |

3.06% |

|

| |

|

|

|

| |

Total |

34,536,000 |

53.03% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

6

SECURITIES OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain

information as of February 4, 2015 with respect to the beneficial ownership of our common stock:

• each

stockholder believed to be the beneficial owner of more than 5% of our common stock;

• by

each of our directors and executive officers; and

• all

of our directors and executive officers as a group.

Beneficial ownership is determined in

accordance with the rules of the SEC. A person is deemed to be the beneficial owner of securities that can be acquired

by such a person within 60 days, including but not limited to the right to acquire through the exercise of options, warrants or

convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants and

convertible securities that are held by such a person (but not those held by any other person) and are exercisable within 60 days

have been exercised.

Unless otherwise indicated, the persons

and entities named in the table have sole voting and sole investment power with respect to the shares set forth opposite the stockholder’s

name.

The percentage of class beneficially owned set forth

below is based on 65,128,330 shares of common stock outstanding on February 4, 2015.

| Name and Address |

|

Number of Shares

of Common Stock

Beneficially Owned |

|

|

|

Percent of Class (1) |

| |

|

|

|

|

|

|

| Directors and Executive Officers: |

|

|

|

|

|

|

| Bill Sigler, Director (2) |

|

21,643,500 |

|

|

|

33.23% |

|

Chris Jenks, Director (2)

|

|

2,900,000 |

|

|

|

4.45% |

| Doug Samuelson, Interim Chief Executive Officer and Chief Financial Officer (3) |

|

175,000 |

|

|

|

.27% |

| |

|

|

|

|

|

|

| All directors and officers as a group (3 persons) |

|

24,718,500 |

|

|

|

37.95% |

| |

|

|

|

|

|

|

| 5% Stockholders: |

|

|

|

|

|

|

| Bill Sigler (2) |

|

21,643,500 |

|

|

|

33.23% |

| Fox Chase (4) |

|

5,000,000 |

|

|

|

7.68% |

(1)

The percent of class is based on 59,628,330 shares of our common stock issued

and outstanding as of December 18, 2014.

(2)

The address for these persons is 20316 Gramercy Place, Torrance, CA 90501.

(3)

The address for this person is 6025 Macadma Ct., Agoura Hills, CA 91301.

(4)

The address for this person is P.O. Box 233, Redondo Beach, CA 90277.

7

DISSENTERS’ RIGHTS

There is no provision in the Nevada Revised

Statutes or in our Articles of Incorporation or By-laws, providing our shareholders with dissenters' rights of appraisal to demand

payment in cash for their shares of common stock in connection with the implementation of any of the actions described in this

Information Statement.

DELIVERY OF DOCUMENTS TO

SECURITY HOLDERS SHARING AN ADDRESS

Only one Information Statement will be

delivered to multiple stockholders sharing an address, unless contrary instructions are received from one or more of such stockholders.

Upon receipt of a written request at the address noted above, the Company will deliver a single copy of this Information Statement

and future stockholders communication documents to any stockholders sharing an address to which multiple copies are now delivered.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current

reports and other information with the SEC that contain additional information about Novint. You can inspect and copy these

materials at the public reference facilities of the SEC’s office located at 100 F Street, NE, Washington, D.C. 20549 and

on its web site at http://www.sec.gov. You may also obtain copies of the documents at prescribed rates by writing to the Public

Reference Section. Those persons in the United States may also call 1-202-551-8090 for further information.

8

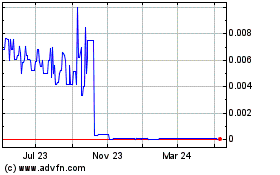

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Aug 2024 to Sep 2024

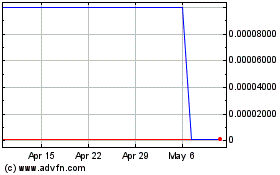

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Sep 2023 to Sep 2024