UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2015 (February 5, 2015)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-34295 |

|

38-3916511 |

(State or other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 1221 Avenue of the Americas, 36th Fl., New York, NY |

|

10020 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 584-5100

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition |

On February 5, 2015, we reported our financial

and operating results for the three months and year ended December 31, 2014. These results are discussed in the press release attached

hereto as Exhibit 99.1, which is incorporated by reference in its entirety.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

The Exhibit Index attached hereto is incorporated

herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

SIRIUS XM HOLDINGS INC. |

|

| |

|

|

|

| |

By: |

/s/ Patrick L. Donnelly |

|

| |

|

Patrick L. Donnelly |

|

| |

|

Executive Vice President, General Counsel and Secretary |

Dated: February 5, 2015

EXHIBITS

| Exhibit |

|

Description of Exhibit

|

| |

|

|

| 99.1 |

|

Press Release dated February 5, 2015 |

Exhibit 99.1

SiriusXM Reports Fourth Quarter and Full-Year

2014 Results

| · | 2014

Revenue

Climbs

10%

to

$4.18

Billion |

| · | Net

Income

Increases

31%

to

$493

Million

in

2014 |

| · | Record

Adjusted

EBITDA

of

$1.47

Billion

in

2014,

up

26% |

| · | 2014

Free

Cash

Flow

Reaches

Record

$1.16

Billion,

up

25% |

| · | $2.5

Billion

of

Stock

Repurchased

in

2014 |

NEW YORK – February 5, 2015 – SiriusXM today

announced fourth quarter and full-year 2014 operating and financial results, including record revenue of $1.09 billion and $4.18

billion for the fourth quarter and full-year, respectively, up 9% and 10% versus the prior year periods.

Net income of $143 million and $493 million in the fourth quarter

and full-year 2014, respectively, compared to $65 million and $377 million in the fourth quarter and full-year 2013. Net income

per diluted common share was $0.03 and $0.08, respectively, in the fourth quarter and full-year 2014, versus $0.01 and $0.06 in

the fourth quarter and full-year 2013. Adjusted EBITDA was $381 million and $1.47 billion, respectively, in the fourth quarter

and full-year, up 17% and 26% versus the prior year periods.

“As our results demonstrate, SiriusXM had a great year

by delivering to subscribers new and exciting music, sports, and talk programming; executing on our growth plan; and driving 36%

growth in free cash flow per diluted share, all while investing in the future of the connected car,” said Jim Meyer, Chief

Executive Officer, SiriusXM.

“We have once again set ambitious targets for 2015 to

grow our subscriber base, revenue, adjusted EBITDA, and free cash flow to new, record-high levels. I’m confident in our

ability to be creative and innovative as the leader in audio entertainment, making our superior service an even better experience

for our subscribers in 2015,” added Meyer.

FOURTH QUARTER 2014 HIGHLIGHTS

| · | Strong

fourth

quarter

net

subscriber

gains.

SiriusXM

recorded

576,689

net

new

subscribers

in

the

fourth

quarter,

marking

the

largest

fourth-quarter

increase

since

2007.

Self-pay

net

subscriber

additions

were

508,032

in

the

fourth

quarter

of

2014

compared

to

411,484

in

the

fourth

quarter

of

2013. |

| · | Record

high

fourth

quarter

adjusted

EBITDA.

Adjusted

EBITDA

of

$381

million

in

the

fourth

quarter

of

2014

was

the

highest

quarterly

amount

in

the

company’s

history,

an

increase

of

17%

over

the

fourth

quarter

2013. |

| · | Record

free

cash

flow

per

diluted

share.

Free

cash

flow

reached

a

fourth

quarter

record

of

$331

million,

while

free

cash

flow

per

diluted

share

reached

an

all-time

high

of

5.9

cents

in

the

fourth

quarter

of

2014,

up

20%

from

the

fourth

quarter

of

2013. |

FULL-YEAR 2014 HIGHLIGHTS

| · | Full-year

subscriber

gains

exceed

targets.

SiriusXM

reported

2014

total

and

self-pay

net

subscriber

additions,

respectively,

of

1,751,777

and

1,440,821,

each

ahead

of

the

company’s

original

full-year

guidance

of

1,250,000.

The

company

ended

2014

with

27.3

million

total

paying

subscribers

and

22.5

million

self-pay

subscribers,

each

up

7%

from

the

end

of

2013. |

| · | Share

buybacks

reach

$2.5

billion

in

2014.

The

company

returned

$2.5

billion

to

stockholders

by

repurchasing

739

million

shares

in

2014.

As

of

year-end,

approximately

$1.7

billion

remained

under

the

company’s

existing

$6

billion

share

repurchase

authorization. |

| · | Record-high

adjusted

EBITDA

and

margin.

Adjusted

EBITDA

grew

26%

to

a

record

$1.47

billion

in

2014

from

$1.17

billion

in

2013.

Adjusted

EBITDA

margin

grew

approximately

440

basis

points

to

a

record

high

35.0%. |

| · | Rapid

expansion

of

free

cash

flow.

SiriusXM

reported

$1.16

billion

of

free

cash

flow

in

2014,

up

25%

from

$927

million

in

2013.

The

company

reported

19.7

cents

of

free

cash

flow

per

diluted

share

in

2014,

up

36%

from

14.5

cents

per

diluted

share

in

2013. |

“Our repurchases of 739 million shares in 2014

represented approximately 12% of the shares outstanding at the beginning of last year. Even as we returned $2.5 billion to

our stockholders, SiriusXM’s leverage remained steady at about 3.1 times EBITDA, a result of rapid growth in adjusted

EBITDA and the conversion of our 7% Exchangeable Notes into equity in December. In the two years since we began our capital

return program with a special dividend, we have paid our shareholders over $4.8 billion and retired more than 1.3 billion

shares,” noted David Frear, Chief Financial Officer, SiriusXM.

2015 GUIDANCE

The company also reiterated its 2015 guidance, originally given

on January 7, 2015, for net subscriber additions, revenue, adjusted EBITDA, and free cash flow:

| · | Net

subscriber

additions

of

approximately

1.2

million, |

| · | Revenue

of

approximately

$4.4

billion, |

| · | Adjusted

EBITDA

of

approximately

$1.6

billion,

and |

| · | Free

cash

flow

of

approximately

$1.25

billion. |

FOURTH QUARTER AND FULL-YEAR 2014 RESULTS

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| | |

For the Three Months Ended

December 31, | | |

For the Twelve Months Ended

December 31, | |

| (in thousands, except per share data) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 922,192 | | |

$ | 852,547 | | |

$ | 3,554,302 | | |

$ | 3,284,660 | |

| Advertising revenue | |

| 27,970 | | |

| 25,402 | | |

| 100,982 | | |

| 89,288 | |

| Equipment revenue | |

| 29,938 | | |

| 25,985 | | |

| 104,661 | | |

| 80,573 | |

| Other revenue | |

| 110,852 | | |

| 96,144 | | |

| 421,150 | | |

| 344,574 | |

| Total revenue | |

| 1,090,952 | | |

| 1,000,078 | | |

| 4,181,095 | | |

| 3,799,095 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

| 210,089 | | |

| 210,625 | | |

| 810,028 | | |

| 677,642 | |

| Programming and content | |

| 77,953 | | |

| 73,010 | | |

| 297,313 | | |

| 290,323 | |

| Customer service and billing | |

| 96,411 | | |

| 83,749 | | |

| 370,585 | | |

| 320,755 | |

| Satellite and transmission | |

| 21,567 | | |

| 20,251 | | |

| 86,013 | | |

| 79,292 | |

| Cost of equipment | |

| 15,078 | | |

| 8,669 | | |

| 44,397 | | |

| 26,478 | |

| Subscriber acquisition costs | |

| 126,257 | | |

| 124,050 | | |

| 493,464 | | |

| 495,610 | |

| Sales and marketing | |

| 98,488 | | |

| 81,430 | | |

| 336,480 | | |

| 291,024 | |

| Engineering, design and development | |

| 15,107 | | |

| 15,068 | | |

| 62,784 | | |

| 57,969 | |

| General and administrative | |

| 69,943 | | |

| 77,522 | | |

| 293,938 | | |

| 262,135 | |

| Depreciation and amortization | |

| 66,402 | | |

| 60,348 | | |

| 266,423 | | |

| 253,314 | |

| Total operating expenses | |

| 797,295 | | |

| 754,722 | | |

| 3,061,425 | | |

| 2,754,542 | |

| Income from operations | |

| 293,657 | | |

| 245,356 | | |

| 1,119,670 | | |

| 1,044,553 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net of amounts capitalized | |

| (71,981 | ) | |

| (54,140 | ) | |

| (269,010 | ) | |

| (204,671 | ) |

| Loss on extinguishment of debt and credit facilities, net | |

| — | | |

| (66,229 | ) | |

| — | | |

| (190,577 | ) |

| Interest and investment income | |

| 5,910 | | |

| 3,328 | | |

| 15,498 | | |

| 6,976 | |

| Loss on change in value of derivatives | |

| — | | |

| (20,393 | ) | |

| (34,485 | ) | |

| (20,393 | ) |

| Other income (loss) | |

| 467 | | |

| 295 | | |

| (887 | ) | |

| 1,204 | |

| Total other expense | |

| (65,604 | ) | |

| (137,139 | ) | |

| (288,884 | ) | |

| (407,461 | ) |

| Income before income taxes | |

| 228,053 | | |

| 108,217 | | |

| 830,786 | | |

| 637,092 | |

| Income tax expense | |

| (84,931 | ) | |

| (43,020 | ) | |

| (337,545 | ) | |

| (259,877 | ) |

| Net income | |

$ | 143,122 | | |

$ | 65,197 | | |

$ | 493,241 | | |

$ | 377,215 | |

| Foreign currency translation adjustment, net of tax | |

| (114 | ) | |

| (136 | ) | |

| (94 | ) | |

| (428 | ) |

| Total comprehensive income | |

$ | 143,008 | | |

$ | 65,061 | | |

$ | 493,147 | | |

$ | 376,787 | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.03 | | |

$ | 0.01 | | |

$ | 0.09 | | |

$ | 0.06 | |

| Diluted | |

$ | 0.03 | | |

$ | 0.01 | | |

$ | 0.08 | | |

$ | 0.06 | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 5,577,325 | | |

| 6,113,889 | | |

| 5,788,944 | | |

| 6,227,646 | |

| Diluted | |

| 5,643,839 | | |

| 6,203,674 | | |

| 5,862,020 | | |

| 6,384,791 | |

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

As of December 31, | | |

As of December 31, | |

| (in thousands, except share and per share data) | |

2014 | | |

2013 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 147,724 | | |

$ | 134,805 | |

| Receivables, net | |

| 220,579 | | |

| 192,912 | |

| Inventory, net | |

| 19,397 | | |

| 13,863 | |

| Prepaid expenses | |

| 116,336 | | |

| 110,530 | |

| Related party current assets | |

| 4,344 | | |

| 9,145 | |

| Deferred tax asset | |

| 1,038,603 | | |

| 937,598 | |

| Other current assets | |

| 2,763 | | |

| 20,160 | |

| Total current assets | |

| 1,549,746 | | |

| 1,419,013 | |

| Property and equipment, net | |

| 1,510,112 | | |

| 1,594,574 | |

| Long-term restricted investments | |

| 5,922 | | |

| 5,718 | |

| Deferred financing fees, net | |

| 12,021 | | |

| 12,604 | |

| Intangible assets, net | |

| 2,645,046 | | |

| 2,700,062 | |

| Goodwill | |

| 2,205,107 | | |

| 2,204,553 | |

| Related party long-term assets | |

| 3,000 | | |

| 30,164 | |

| Long-term deferred tax asset | |

| 437,736 | | |

| 868,057 | |

| Other long-term assets | |

| 6,819 | | |

| 10,035 | |

| Total assets | |

$ | 8,375,509 | | |

$ | 8,844,780 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 587,755 | | |

$ | 578,333 | |

| Accrued interest | |

| 80,440 | | |

| 42,085 | |

| Current portion of deferred revenue | |

| 1,632,381 | | |

| 1,586,611 | |

| Current portion of deferred credit on executory contracts | |

| 1,394 | | |

| 3,781 | |

| Current maturities of long-term debt | |

| 7,482 | | |

| 496,815 | |

| Current maturities of long-term related party debt | |

| — | | |

| 10,959 | |

| Related party current liabilities | |

| 4,340 | | |

| 20,320 | |

| Total current liabilities | |

| 2,313,792 | | |

| 2,738,904 | |

| Deferred revenue | |

| 151,901 | | |

| 149,026 | |

| Deferred credit on executory contracts | |

| — | | |

| 1,394 | |

| Long-term debt | |

| 4,493,863 | | |

| 3,093,821 | |

| Related party long-term liabilities | |

| 13,635 | | |

| 16,337 | |

| Other long-term liabilities | |

| 92,481 | | |

| 99,556 | |

| Total liabilities | |

| 7,065,672 | | |

| 6,099,038 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, undesignated, par value $0.001 (liquidation preference of $0.001 per share); 50,000,000 shares authorized and 0 shares issued and outstanding at December 31, 2014 and December 31, 2013 | |

| — | | |

| — | |

| Common stock, par value $0.001; 9,000,000,000 shares authorized; 5,653,529,403 and 6,096,220,526 shares issued; 5,646,119,122 and 6,096,220,526 outstanding at December 31, 2014 and December 31, 2013, respectively | |

| 5,653 | | |

| 6,096 | |

| Accumulated other comprehensive loss, net of tax | |

| (402 | ) | |

| (308 | ) |

| Additional paid-in capital | |

| 6,771,554 | | |

| 8,674,129 | |

| Treasury stock, at cost; 7,410,281 and 0 shares of common stock at December 31, 2014 and December 31, 2013, respectively | |

| (26,034 | ) | |

| — | |

| Accumulated deficit | |

| (5,440,934 | ) | |

| (5,934,175 | ) |

| Total stockholders’ equity | |

| 1,309,837 | | |

| 2,745,742 | |

| Total liabilities and stockholders’ equity | |

$ | 8,375,509 | | |

$ | 8,844,780 | |

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

For the Years Ended December 31, | |

| (in thousands) | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 493,241 | | |

$ | 377,215 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 266,423 | | |

| 253,314 | |

| Non-cash interest expense, net of amortization of premium | |

| 21,039 | | |

| 21,698 | |

| Provision for doubtful accounts | |

| 44,961 | | |

| 39,016 | |

| Amortization of deferred income related to equity method investment | |

| (2,776 | ) | |

| (2,776 | ) |

| Loss on extinguishment of debt and credit facilities, net | |

| — | | |

| 190,577 | |

| Gain on unconsolidated entity investments, net | |

| (5,547 | ) | |

| (5,865 | ) |

| Dividend received from unconsolidated entity investment | |

| 17,019 | | |

| 22,065 | |

| Loss on disposal of assets | |

| 220 | | |

| 351 | |

| Loss on change in value of derivatives | |

| 34,485 | | |

| 20,393 | |

| Share-based payment expense | |

| 78,212 | | |

| 68,876 | |

| Deferred income taxes | |

| 327,461 | | |

| 259,787 | |

| Other non-cash purchase price adjustments | |

| (3,781 | ) | |

| (207,854 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Receivables | |

| (72,628 | ) | |

| (15,245 | ) |

| Inventory | |

| (5,534 | ) | |

| 11,474 | |

| Related party assets | |

| (4,097 | ) | |

| 2,031 | |

| Prepaid expenses and other current assets | |

| (1,195 | ) | |

| 16,788 | |

| Other long-term assets | |

| 3,173 | | |

| 2,973 | |

| Accounts payable and accrued expenses | |

| (17,191 | ) | |

| (44,009 | ) |

| Accrued interest | |

| 38,355 | | |

| 8,131 | |

| Deferred revenue | |

| 48,645 | | |

| 73,593 | |

| Related party liabilities | |

| (206 | ) | |

| (1,991 | ) |

| Other long-term liabilities | |

| (7,035 | ) | |

| 12,290 | |

| Net cash provided by operating activities | |

| 1,253,244 | | |

| 1,102,832 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to property and equipment | |

| (121,646 | ) | |

| (173,617 | ) |

| Purchases of restricted and other investments | |

| — | | |

| (1,719 | ) |

| Acquisition of business, net of cash acquired | |

| 1,144 | | |

| (525,352 | ) |

| Return of capital from investment in unconsolidated entity | |

| 24,178 | | |

| — | |

| Net cash used in investing activities | |

| (96,324 | ) | |

| (700,688 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| 331 | | |

| 21,968 | |

| Taxes paid in lieu of shares issued for stock-based compensation | |

| (37,318 | ) | |

| (46,342 | ) |

| Proceeds from long-term borrowings and revolving credit facility, net of costs | |

| 2,406,205 | | |

| 3,156,063 | |

| Payment of premiums on redemption of debt | |

| — | | |

| (175,453 | ) |

| Repayment of long-term borrowings and revolving credit facility | |

| (1,016,420 | ) | |

| (1,782,160 | ) |

| Repayment of related party long-term borrowings | |

| — | | |

| (200,000 | ) |

| Common stock repurchased and retired | |

| (2,496,799 | ) | |

| (1,762,360 | ) |

| Net cash used in financing activities | |

| (1,144,001 | ) | |

| (788,284 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| 12,919 | | |

| (386,140 | ) |

| Cash and cash equivalents at beginning of period | |

| 134,805 | | |

| 520,945 | |

| Cash and cash equivalents at end of period | |

$ | 147,724 | | |

$ | 134,805 | |

Key Operating Metrics

The following table contains our key operating metrics for the

three and twelve months ended December 31, 2014 and 2013, respectively. Subscribers to our connected vehicle services are not

included in our subscriber count:

| | |

Unaudited | |

| | |

For the Three Months Ended December 31, | | |

For the Twelve Months Ended December 31, | |

| (in thousands, except subscriber, per subscriber and per installation amounts) | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Self-pay subscribers | |

| 22,522,638 | | |

| 21,081,817 | | |

| 22,522,638 | | |

| 21,081,817 | |

| Paid promotional subscribers | |

| 4,788,449 | | |

| 4,477,493 | | |

| 4,788,449 | | |

| 4,477,493 | |

| Ending subscribers | |

| 27,311,087 | | |

| 25,559,310 | | |

| 27,311,087 | | |

| 25,559,310 | |

| | |

| | | |

| | | |

| | | |

| | |

| Self-pay subscribers | |

| 508,032 | | |

| 411,484 | | |

| 1,440,821 | | |

| 1,511,543 | |

| Paid promotional subscribers | |

| 68,657 | | |

| (434,240 | ) | |

| 310,956 | | |

| 147,431 | |

| Net additions | |

| 576,689 | | |

| (22,756 | ) | |

| 1,751,777 | | |

| 1,658,974 | |

| | |

| | | |

| | | |

| | | |

| | |

| Daily weighted average number of subscribers | |

| 27,021,501 | | |

| 25,596,580 | | |

| 26,283,785 | | |

| 24,886,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| Average self-pay monthly churn | |

| 1.8 | % | |

| 1.9 | % | |

| 1.9 | % | |

| 1.8 | % |

| | |

| | | |

| | | |

| | | |

| | |

| New vehicle consumer conversion rate | |

| 40 | % | |

| 42 | % | |

| 41 | % | |

| 44 | % |

| | |

| | | |

| | | |

| | | |

| | |

| ARPU | |

$ | 12.49 | | |

$ | 12.31 | | |

$ | 12.38 | | |

$ | 12.23 | |

| SAC, per installation | |

$ | 33 | | |

$ | 34 | | |

$ | 34 | | |

$ | 43 | |

| Customer service and billing expenses, per average subscriber | |

$ | 1.07 | | |

$ | 1.04 | | |

$ | 1.07 | | |

$ | 1.06 | |

| Free cash flow | |

$ | 330,674 | | |

$ | 303,193 | | |

$ | 1,155,776 | | |

$ | 927,496 | |

| Adjusted EBITDA | |

$ | 381,306 | | |

$ | 325,551 | | |

$ | 1,467,775 | | |

$ | 1,166,140 | |

Glossary

Adjusted EBITDA - EBITDA is defined as net income

before interest and investment income (loss); interest expense, net of amounts capitalized; income tax expense and depreciation

and amortization. We adjust EBITDA to exclude the impact of other income and expense, loss on extinguishment of debt, loss on

change in value of derivatives as well as certain other charges discussed below. This measure is one of the primary Non-GAAP financial

measures on which we (i) evaluate the performance of our businesses, (ii) base our internal budgets and (iii) compensate management.

Adjusted EBITDA is a Non-GAAP financial performance measure that excludes (if applicable): (i) certain adjustments as a result

of the purchase price accounting for the merger of Sirius and XM, (ii) depreciation and amortization and (iii) share-based payment

expense. The purchase price accounting adjustments include: (i) the elimination of deferred revenue associated with the investment

in XM Canada, (ii) recognition of deferred subscriber revenues not recognized in purchase price accounting, and (iii) elimination

of the benefit of deferred credits on executory contracts, which are primarily attributable to third party arrangements with an

OEM and programming providers. We believe adjusted EBITDA is a useful measure of the underlying trend of our operating performance,

which provides useful information about our business apart from the costs associated with our physical plant, capital structure

and purchase price accounting. We believe investors find this Non-GAAP financial measure useful when analyzing our results and

comparing our operating performance to the performance of other communications, entertainment and media companies. We believe

investors use current and projected adjusted EBITDA to estimate our current and prospective enterprise value and to make investment

decisions. Because we fund and build-out our satellite radio system through the periodic raising and expenditure of large amounts

of capital, our results of operations reflect significant charges for depreciation expense. The exclusion of depreciation and

amortization expense is useful given significant variation in depreciation and amortization expense that can result from the potential

variations in estimated useful lives, all of which can vary widely across different industries or among companies within the same

industry. We also believe the exclusion of share-based payment expense is useful given share-based payment expense is not directly

related to the operational conditions of our business.

Adjusted EBITDA has certain limitations in that it does not

take into account the impact to our statements of comprehensive income of certain expenses, including share-based payment expense

and certain purchase price accounting for the merger of Sirius and XM. We endeavor to compensate for the limitations of the Non-GAAP

measure presented by also providing the comparable GAAP measure with equal or greater prominence and descriptions of the reconciling

items, including quantifying such items, to derive the Non-GAAP measure. Investors that wish to compare and evaluate our operating

results after giving effect for these costs, should refer to net

income as disclosed in our consolidated statements of comprehensive

income. Since adjusted EBITDA is a Non-GAAP financial performance measure, our calculation of adjusted EBITDA may be susceptible

to varying calculations; may not be comparable to other similarly titled measures of other companies; and should not be considered

in isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with GAAP. The reconciliation

of net income to the adjusted EBITDA is calculated as follows (in thousands):

| | |

Unaudited | |

| | |

For the Three Months Ended

December 31, | | |

For the Twelve Months Ended

December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (GAAP): | |

$ | 143,122 | | |

$ | 65,197 | | |

$ | 493,241 | | |

$ | 377,215 | |

| Add back items excluded from Adjusted EBITDA: | |

| | | |

| | | |

| | | |

| | |

| Purchase price accounting adjustments: | |

| | | |

| | | |

| | | |

| | |

| Revenues | |

| 1,813 | | |

| 1,813 | | |

| 7,251 | | |

| 7,251 | |

| Operating expenses | |

| (946 | ) | |

| (1,068 | ) | |

| (3,781 | ) | |

| (207,854 | ) |

| Share-based payment expense (GAAP) | |

| 20,380 | | |

| 19,102 | | |

| 78,212 | | |

| 68,876 | |

| Depreciation and amortization (GAAP) | |

| 66,402 | | |

| 60,348 | | |

| 266,423 | | |

| 253,314 | |

| Interest expense, net of amounts capitalized (GAAP) | |

| 71,981 | | |

| 54,140 | | |

| 269,010 | | |

| 204,671 | |

| Loss on extinguishment of debt and credit facilities, net (GAAP) | |

| — | | |

| 66,229 | | |

| — | | |

| 190,577 | |

| Interest and investment income (GAAP) | |

| (5,910 | ) | |

| (3,328 | ) | |

| (15,498 | ) | |

| (6,976 | ) |

| Loss on change in value of derivatives (GAAP) | |

| — | | |

| 20,393 | | |

| 34,485 | | |

| 20,393 | |

| Other (income) loss (GAAP) | |

| (467 | ) | |

| (295 | ) | |

| 887 | | |

| (1,204 | ) |

| Income tax expense (GAAP) | |

| 84,931 | | |

| 43,020 | | |

| 337,545 | | |

| 259,877 | |

| Adjusted EBITDA | |

$ | 381,306 | | |

$ | 325,551 | | |

$ | 1,467,775 | | |

$ | 1,166,140 | |

Adjusted Revenues and Operating Expenses - We define

this Non-GAAP financial measure as our actual revenues and operating expenses adjusted to exclude the impact of certain purchase

price accounting adjustments from the merger of Sirius and XM and share-based payment expense. We use this Non-GAAP financial

measure to manage our business, to set operational goals and as a basis for determining performance-based compensation for our

employees. The following tables reconcile our actual revenues and operating expenses to our adjusted revenues and operating expenses

for the three and twelve months ended December 31, 2014 and 2013:

| | |

Unaudited For the Three Months Ended December 31, 2014 | |

| (in thousands) | |

As Reported | | |

Purchase Price

Accounting

Adjustments | | |

Allocation of

Share-based

Payment Expense | | |

Adjusted | |

| | |

| | | |

| | | |

| | | |

| | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 922,192 | | |

$ | — | | |

$ | — | | |

$ | 922,192 | |

| Advertising revenue | |

| 27,970 | | |

| — | | |

| — | | |

| 27,970 | |

| Equipment revenue | |

| 29,938 | | |

| — | | |

| — | | |

| 29,938 | |

| Other revenue | |

| 110,852 | | |

| 1,813 | | |

| — | | |

| 112,665 | |

| Total revenue | |

$ | 1,090,952 | | |

$ | 1,813 | | |

$ | — | | |

$ | 1,092,765 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 210,089 | | |

$ | — | | |

$ | — | | |

$ | 210,089 | |

| Programming and content | |

| 77,953 | | |

| 946 | | |

| (2,277 | ) | |

| 76,622 | |

| Customer service and billing | |

| 96,411 | | |

| — | | |

| (748 | ) | |

| 95,663 | |

| Satellite and transmission | |

| 21,567 | | |

| — | | |

| (1,004 | ) | |

| 20,563 | |

| Cost of equipment | |

| 15,078 | | |

| — | | |

| — | | |

| 15,078 | |

| Subscriber acquisition costs | |

| 126,257 | | |

| — | | |

| — | | |

| 126,257 | |

| Sales and marketing | |

| 98,488 | | |

| — | | |

| (4,216 | ) | |

| 94,272 | |

| Engineering, design and development | |

| 15,107 | | |

| — | | |

| (2,253 | ) | |

| 12,854 | |

| General and administrative | |

| 69,943 | | |

| — | | |

| (9,882 | ) | |

| 60,061 | |

| Depreciation and amortization (a) | |

| 66,402 | | |

| — | | |

| — | | |

| 66,402 | |

| Share-based payment expense | |

| — | | |

| — | | |

| 20,380 | | |

| 20,380 | |

| Total operating expenses | |

$ | 797,295 | | |

$ | 946 | | |

$ | — | | |

$ | 798,241 | |

(a) Purchase price accounting adjustments included above exclude

the incremental depreciation and amortization associated with the $785,000 stepped up basis in property, equipment and intangible

assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the three months ended December

31, 2014 was $9,000.

| | |

Unaudited For the Three Months Ended December 31, 2013 | |

| (in thousands) | |

As Reported | | |

Purchase Price

Accounting

Adjustments | | |

Allocation of

Share-based

Payment Expense | | |

Adjusted | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 852,547 | | |

$ | — | | |

$ | — | | |

$ | 852,547 | |

| Advertising revenue | |

| 25,402 | | |

| — | | |

| — | | |

| 25,402 | |

| Equipment revenue | |

| 25,985 | | |

| — | | |

| — | | |

| 25,985 | |

| Other revenue | |

| 96,144 | | |

| 1,813 | | |

| — | | |

| 97,957 | |

| Total revenue | |

$ | 1,000,078 | | |

$ | 1,813 | | |

$ | — | | |

$ | 1,001,891 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 210,625 | | |

$ | — | | |

$ | — | | |

$ | 210,625 | |

| Programming and content | |

| 73,010 | | |

| 1,068 | | |

| (2,071 | ) | |

| 72,007 | |

| Customer service and billing | |

| 83,749 | | |

| — | | |

| (591 | ) | |

| 83,158 | |

| Satellite and transmission | |

| 20,251 | | |

| — | | |

| (961 | ) | |

| 19,290 | |

| Cost of equipment | |

| 8,669 | | |

| — | | |

| — | | |

| 8,669 | |

| Subscriber acquisition costs | |

| 124,050 | | |

| — | | |

| — | | |

| 124,050 | |

| Sales and marketing | |

| 81,430 | | |

| — | | |

| (4,678 | ) | |

| 76,752 | |

| Engineering, design and development | |

| 15,068 | | |

| — | | |

| (1,947 | ) | |

| 13,121 | |

| General and administrative | |

| 77,522 | | |

| — | | |

| (8,854 | ) | |

| 68,668 | |

| Depreciation and amortization (a) | |

| 60,348 | | |

| — | | |

| — | | |

| 60,348 | |

| Share-based payment expense | |

| — | | |

| — | | |

| 19,102 | | |

| 19,102 | |

| Total operating expenses | |

$ | 754,722 | | |

$ | 1,068 | | |

$ | — | | |

$ | 755,790 | |

(a) Purchase price accounting adjustments included above exclude

the incremental depreciation and amortization associated with the $785,000 stepped up basis in property, equipment and intangible

assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the three months ended December

31, 2013 was $10,000.

| | |

Unaudited For the Twelve Months Ended December 31, 2014 | |

| (in thousands) | |

As Reported | | |

Purchase Price Accounting Adjustments | | |

Allocation of Share-based Payment Expense | | |

Adjusted | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 3,554,302 | | |

$ | — | | |

$ | — | | |

$ | 3,554,302 | |

| Advertising revenue | |

| 100,982 | | |

| — | | |

| — | | |

| 100,982 | |

| Equipment revenue | |

| 104,661 | | |

| — | | |

| — | | |

| 104,661 | |

| Other revenue | |

| 421,150 | | |

| 7,251 | | |

| — | | |

| 428,401 | |

| Total revenue | |

$ | 4,181,095 | | |

$ | 7,251 | | |

$ | — | | |

$ | 4,188,346 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 810,028 | | |

$ | — | | |

$ | — | | |

$ | 810,028 | |

| Programming and content | |

| 297,313 | | |

| 3,781 | | |

| (9,180 | ) | |

| 291,914 | |

| Customer service and billing | |

| 370,585 | | |

| — | | |

| (2,780 | ) | |

| 367,805 | |

| Satellite and transmission | |

| 86,013 | | |

| — | | |

| (4,091 | ) | |

| 81,922 | |

| Cost of equipment | |

| 44,397 | | |

| — | | |

| — | | |

| 44,397 | |

| Subscriber acquisition costs | |

| 493,464 | | |

| — | | |

| — | | |

| 493,464 | |

| Sales and marketing | |

| 336,480 | | |

| — | | |

| (15,454 | ) | |

| 321,026 | |

| Engineering, design and development | |

| 62,784 | | |

| — | | |

| (8,675 | ) | |

| 54,109 | |

| General and administrative | |

| 293,938 | | |

| — | | |

| (38,032 | ) | |

| 255,906 | |

| Depreciation and amortization (a) | |

| 266,423 | | |

| — | | |

| — | | |

| 266,423 | |

| Share-based payment expense | |

| — | | |

| — | | |

| 78,212 | | |

| 78,212 | |

| Total operating expenses | |

$ | 3,061,425 | | |

$ | 3,781 | | |

$ | — | | |

$ | 3,065,206 | |

(a) Purchase price accounting adjustments

included above exclude the incremental depreciation and amortization associated with the $785,000 stepped up basis in property,

equipment and intangible assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the

year ended December 31, 2014 was $39,000.

| | |

Unaudited For the Twelve Months Ended December 31, 2013 | |

| (in thousands) | |

As Reported | | |

Purchase Price Accounting Adjustments | | |

Allocation of Share-based Payment Expense | | |

Adjusted | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 3,284,660 | | |

$ | — | | |

$ | — | | |

$ | 3,284,660 | |

| Advertising revenue | |

| 89,288 | | |

| — | | |

| — | | |

| 89,288 | |

| Equipment revenue | |

| 80,573 | | |

| — | | |

| — | | |

| 80,573 | |

| Other revenue | |

| 344,574 | | |

| 7,251 | | |

| — | | |

| 351,825 | |

| Total revenue | |

$ | 3,799,095 | | |

$ | 7,251 | | |

$ | — | | |

$ | 3,806,346 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 677,642 | | |

$ | 122,534 | | |

$ | — | | |

$ | 800,176 | |

| Programming and content | |

| 290,323 | | |

| 8,033 | | |

| (7,584 | ) | |

| 290,772 | |

| Customer service and billing | |

| 320,755 | | |

| — | | |

| (2,219 | ) | |

| 318,536 | |

| Satellite and transmission | |

| 79,292 | | |

| — | | |

| (3,714 | ) | |

| 75,578 | |

| Cost of equipment | |

| 26,478 | | |

| — | | |

| — | | |

| 26,478 | |

| Subscriber acquisition costs | |

| 495,610 | | |

| 64,365 | | |

| — | | |

| 559,975 | |

| Sales and marketing | |

| 291,024 | | |

| 12,922 | | |

| (14,792 | ) | |

| 289,154 | |

| Engineering, design and development | |

| 57,969 | | |

| — | | |

| (7,405 | ) | |

| 50,564 | |

| General and administrative | |

| 262,135 | | |

| — | | |

| (33,162 | ) | |

| 228,973 | |

| Depreciation and amortization (a) | |

| 253,314 | | |

| — | | |

| — | | |

| 253,314 | |

| Share-based payment expense | |

| — | | |

| — | | |

| 68,876 | | |

| 68,876 | |

| Total operating expenses | |

$ | 2,754,542 | | |

$ | 207,854 | | |

$ | — | | |

$ | 2,962,396 | |

(a) Purchase price accounting adjustments

included above exclude the incremental depreciation and amortization associated with the $785,000 stepped up basis in property,

equipment and intangible assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the

year ended December 31, 2013 was $47,000.

Adjusted Cash Operating Expenses - We define

this Non-GAAP financial measure as our actual operating expenses adjusted to exclude the impact of certain purchase price

accounting adjustments from the merger of Sirius and XM, depreciation and amortization expense, and share-based payment

expense. The following table reconciles our actual operating expenses to our adjusted cash operating expenses for the three

and twelve months ended December 31, 2014 and 2013:

| | |

Unaudited | |

| | |

For the Three Months Ended December 31, | | |

For the Twelve Months Ended December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses (GAAP): | |

$ | 797,295 | | |

$ | 754,722 | | |

$ | 3,061,425 | | |

$ | 2,754,542 | |

| Items excluded from adjusted cash operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Purchase price accounting adjustments | |

| 946 | | |

| 1,068 | | |

| 3,781 | | |

| 207,854 | |

| Share-based payment expense (GAAP) | |

| (20,380 | ) | |

| (19,102 | ) | |

| (78,212 | ) | |

| (68,876 | ) |

| Depreciation and amortization (GAAP) | |

| (66,402 | ) | |

| (60,348 | ) | |

| (266,423 | ) | |

| (253,314 | ) |

| Adjusted cash operating expenses | |

$ | 711,459 | | |

$ | 676,340 | | |

$ | 2,720,571 | | |

$ | 2,640,206 | |

ARPU - is derived from total earned subscriber

revenue, advertising revenue and other subscription-related revenue, excluding revenue associated with our connected vehicle business,

net of purchase price accounting adjustments, divided by the number of months in the period, divided by the daily weighted average

number of subscribers for the period. Other subscription-related revenue includes the U.S. Music Royalty Fee. ARPU is calculated

as follows (in thousands, except for subscriber and per subscriber amounts):

| | |

Unaudited | |

| | |

For the Three Months Ended December 31, | | |

For the Twelve Months Ended December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Subscriber revenue, excluding connected vehicle (GAAP) | |

$ | 897,308 | | |

$ | 840,605 | | |

$ | 3,466,050 | | |

$ | 3,272,718 | |

| Add: advertising revenue (GAAP) | |

| 27,970 | | |

| 25,402 | | |

| 100,982 | | |

| 89,288 | |

| Add: other subscription-related revenue (GAAP) | |

| 87,270 | | |

| 79,111 | | |

| 336,408 | | |

| 290,895 | |

| | |

$ | 1,012,548 | | |

$ | 945,118 | | |

$ | 3,903,440 | | |

$ | 3,652,901 | |

| | |

| | | |

| | | |

| | | |

| | |

| Daily weighted average number of subscribers | |

| 27,021,501 | | |

| 25,596,580 | | |

| 26,283,785 | | |

| 24,886,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| ARPU | |

$ | 12.49 | | |

$ | 12.31 | | |

$ | 12.38 | | |

$ | 12.23 | |

Average self-pay monthly churn - is defined as

the monthly average of self-pay deactivations for the period divided by the average number of self-pay subscribers for the period.

Customer service and billing expenses, per average subscriber

- is derived from total customer service and billing expenses, excluding connected vehicle customer service and billing expenses

and share-based payment expense, divided by the number of months in the period, divided by the daily weighted average number of

subscribers for the period. We believe the exclusion of share-based payment expense in our calculation of customer service and

billing expenses, per average subscriber, is useful as share-based payment expense is not directly related to the operational conditions

that give rise to variations in the components of our customer service and billing expenses. Customer service and billing expenses,

per average subscriber, is calculated as follows (in thousands, except for subscriber and per subscriber amounts):

| | |

Unaudited | |

| | |

For the Three Months Ended December 31, | | |

For the Twelve Months Ended December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Customer service and billing expenses, excluding connected vehicle (GAAP) | |

$ | 87,417 | | |

$ | 80,826 | | |

$ | 340,094 | | |

$ | 317,832 | |

| Less: share-based payment expense (GAAP) | |

| (748 | ) | |

| (591 | ) | |

| (2,780 | ) | |

| (2,219 | ) |

| | |

$ | 86,669 | | |

$ | 80,235 | | |

$ | 337,314 | | |

$ | 315,613 | |

| | |

| | | |

| | | |

| | | |

| | |

| Daily weighted average number of subscribers | |

| 27,021,501 | | |

| 25,596,580 | | |

| 26,283,785 | | |

| 24,886,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| Customer service and billing expenses, per average subscriber | |

$ | 1.07 | | |

$ | 1.04 | | |

$ | 1.07 | | |

$ | 1.06 | |

Free cash flow and free cash flow per diluted share

- are derived from cash flow provided by operating activities, capital expenditures and restricted and other investment activity.

The calculation for free cash flow and free cash flow per diluted share are as follows (in thousands, except share and per share

data):

| | |

Unaudited | |

| | |

For the Three Months Ended December 31, | | |

For the Twelve Months Ended December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Cash Flow information | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operating activities | |

$ | 365,076 | | |

$ | 358,575 | | |

$ | 1,253,244 | | |

$ | 1,102,832 | |

| Net cash used in investing activities | |

$ | (34,402 | ) | |

$ | (580,734 | ) | |

$ | (96,324 | ) | |

$ | (700,688 | ) |

| Net cash used in financing activities | |

$ | (286,535 | ) | |

$ | (359,820 | ) | |

$ | (1,144,001 | ) | |

$ | (788,284 | ) |

| Free Cash Flow | |

| | | |

| | | |

| | | |

| | |

| Net cash provided by operating activities | |

$ | 365,076 | | |

$ | 358,575 | | |

$ | 1,253,244 | | |

$ | 1,102,832 | |

| Additions to property and equipment | |

| (34,402 | ) | |

| (55,382 | ) | |

| (121,646 | ) | |

| (173,617 | ) |

| Purchases of restricted and other investments | |

| — | | |

| — | | |

| — | | |

| (1,719 | ) |

| Return of capital from investment in unconsolidated entity | |

| — | | |

| — | | |

| 24,178 | | |

| — | |

| Free cash flow | |

$ | 330,674 | | |

$ | 303,193 | | |

$ | 1,155,776 | | |

$ | 927,496 | |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted weighted average common shares outstanding | |

| 5,643,839 | | |

| 6,203,674 | | |

| 5,862,020 | | |

| 6,384,791 | |

| | |

| | | |

| | | |

| | | |

| | |

| Free cash flow per diluted share | |

$ | 0.059 | | |

$ | 0.049 | | |

$ | 0.197 | | |

$ | 0.145 | |

New vehicle consumer conversion rate - is defined

as the percentage of owners and lessees of new vehicles that receive our satellite radio service and convert to become self-paying

subscribers after the initial promotion period. At the time satellite radio enabled vehicles are sold or leased, the owners or

lessees generally receive trial subscriptions ranging from three to twelve months. We measure conversion rate three months after

the period in which the trial service ends. The metric excludes rental and fleet vehicles.

Subscriber acquisition cost, per installation -

or SAC, per installation, is derived from subscriber acquisition costs and margins from the sale of radios and accessories, excluding

purchase price accounting adjustments, divided by the number of satellite radio installations in new vehicles and shipments of

aftermarket radios for the period. Purchase price accounting adjustments associated with the merger of Sirius and XM include the

elimination of the benefit of amortization of deferred credits on executory contracts recognized at the merger date attributable

to an OEM. SAC, per installation, is calculated as follows (in thousands, except for installation amounts):

| | |

Unaudited | |

| | |

For the Three Months Ended

December 31, | | |

For the Twelve Months Ended

December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Subscriber acquisition costs (GAAP) | |

$ | 126,257 | | |

$ | 124,050 | | |

$ | 493,464 | | |

$ | 495,610 | |

| Less: margin from direct sales of radios and accessories (GAAP) | |

| (14,860 | ) | |

| (17,316 | ) | |

| (60,264 | ) | |

| (54,095 | ) |

| Add: purchase price accounting adjustments | |

| — | | |

| — | | |

| — | | |

| 64,365 | |

| | |

$ | 111,397 | | |

$ | 106,734 | | |

$ | 433,200 | | |

$ | 505,880 | |

| | |

| | | |

| | | |

| | | |

| | |

| Installations | |

| 3,391,422 | | |

| 3,107,237 | | |

| 12,787,537 | | |

| 11,765,078 | |

| | |

| | | |

| | | |

| | | |

| | |

| SAC, per installation | |

$ | 33 | | |

$ | 34 | | |

$ | 34 | | |

$ | 43 | |

###

About SiriusXM

Sirius XM Holdings Inc. (NASDAQ: SIRI) is the world’s

largest radio broadcaster measured by revenue and has 27.3 million subscribers. SiriusXM creates and broadcasts commercial-free

music; premier sports talk and live events; comedy; news; exclusive talk and entertainment; and the most comprehensive Latin music,

sports and talk programming in radio. SiriusXM is available in vehicles from every major car company in the U.S. and from retailers

nationwide as well as at shop.siriusxm.com. SiriusXM programming is available through the SiriusXM Internet Radio

App for smartphones and other connected devices as well as online at siriusxm.com. SiriusXM also provides premium traffic,

weather, data and information services for subscribers in cars, trucks, RVs, boats and aircraft through SiriusXM Traffic™,

SiriusXM Travel Link, NavTraffic®, NavWeather™, SiriusXM Aviation, SiriusXM Marine™, Sirius Marine Weather, XMWX

Aviation™, and XMWX Marine™. SiriusXM holds a minority interest in SiriusXM Canada which has more than 2 million

subscribers.

On social media, join the SiriusXM community on Facebook,

Twitter, Instagram, and YouTube.

This communication contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to

future operations, products and services; and other statements identified by words such as “will likely result,” “are

expected to,” “will continue,” “is anticipated,” “estimated,” “believe,”

“intend,” “plan,” “projection,” “outlook” or words of similar meaning. Such

forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to

significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally

beyond our control. Actual results may differ materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results

to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: our

competitive position versus other radio and audio entertainment providers; our ability to attract and retain subscribers, which

is uncertain; our dependence upon the auto industry; general economic conditions; failure of our satellites, which, in most cases,

are not insured; the interruption or failure of our information and communications systems; the security of the personal information

about our customers; royalties we pay for music rights, which increase over time; the unfavorable outcome of pending or future

litigation; our failure to realize benefits of acquisitions; rapid technological and industry change; failure of third parties

to perform; changes in consumer protection laws and their enforcement; failure to comply with FCC requirements and other government

regulations; and our indebtedness. Additional factors that could cause our results to differ materially from those described

in the forward-looking statements can be found in our Annual Report on Form 10-K for the year ended December 31, 2013, which is

filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s Internet site (http://www.sec.gov).

The information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any

forward looking statements as a result of developments occurring after the date of this communication.

E - SIRI

Contact Information for Investors and Financial Media:

Investors:

Hooper Stevens

212 901 6718

hooper.stevens@siriusxm.com

Media:

Patrick Reilly

212 901 6646

patrick.reilly@siriusxm.com

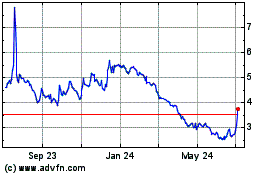

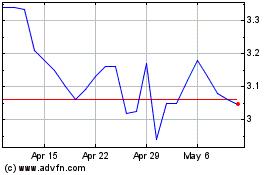

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Sep 2023 to Sep 2024