UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): January 27, 2015

PERVASIP CORP.

(Exact name of registrant as specified in its

charter)

| New York |

000-04465 |

13-2511270 |

|

(State or other

jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

430 North Street

White Plains, NY 10605

(Address of principal

executive offices)

(914)

750-9339

(Registrant’s telephone

number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13-4(e) under the Exchange Act (17 CFR 240.13e-4(c))21723200

SECTION 1 – REGISTRANT’S

BUSINESS AND OPERATIONS

Item 1.01. Entry into a Material Definitive Agreement.

On January 27, 2014,

Pervasip Corp. (the “Company”) executed debt modification agreements (the “Agreements”) with 112359 Factor

Fund, its senior lender (the “Lender”), pursuant to which the Lender agreed to reduce the principal balance due from

Pervasip under each outstanding debenture owed to the Lender.

Debenture number

PVSP – 59FF005, with an original issuance date of June 19, 2013, in the amount of $665,000, and filed as Exhibit 4.1 to the

Company’s Quarterly Report on Form 10-Q for the quarterly period ended May 31, 2013, was reduced from an outstanding balance

of $634,600 to $250,000.

Debenture number

PVSP – 59FF001, with an original issuance date of November 30, 2005, in the amount of $1,000,000, and filed as Exhibit 10.2

to the Company’s Current Report on Form 8-K dated February 15, 2013, was reduced from an outstanding balance of $280,190

to $250,000.

Debenture number

PVSP – 59FF002, with an original issuance date of May 31, 2006, in the amount of $1,000,000, and filed as Exhibit 10.3 to

the Company’s Current Report on Form 8-K dated February 15, 2013, was modified to reduce the outstanding balance of $1,000,000

to $0, upon the completion of the payments required to retire the $250,000 debenture number PVSP – 59FF001.

SECTION 8 – OTHER EVENTS

Item 8.01 Other Events.

On January 27, 2015 the Company issued a press

release announcing the Agreements. A copy of the press release is attached hereto as Exhibit 99.1.

SECTION 9 – FINANCIAL STATEMENT AND

EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits.

Number Documents

99.1 Press release of Pervasip Corp. dated January

27, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

PERVASIP CORP. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: February 4, 2015 |

|

By: |

/s/ Paul H. Riss |

|

| |

|

|

|

Name: Paul H. Riss |

|

| |

|

|

|

Title: Chief Executive Officer |

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

Pervasip Executes

Debt Modification Agreements to Reduce Debt By $1.4 Million

WHITE PLAINS, NEW YORK – January

27, 2015 – Pervasip Corp. (USOTC: PVSP) (“Pervasip” or the “Company”) today announced its execution

of agreements to eliminate an additional $1.4 million in debt.

The new agreements bring the Company's balance sheet improvement to more than $3.3 million when taken with the Company's previously

announced $1.9 million debt settlement with the Pension Benefit Guarantee Corporation.

"We are pleased to have the support of our creditors as we implement our restructuring and acquisition plans," said

Paul Riss, Pervasip’s chief executive officer. “We still intend to eliminate additional debt but the completed transactions

have paved the way for us to meet the balance sheet requirements of our targeted acquisitions, which we now hope to complete this

quarter."

About Pervasip Corp.

Pervasip delivers mobile VoIP and video telephone service anywhere in the world that has a stable broadband connection. In addition

to international telephone numbers from 57 countries for mobile phone users, with unlimited inbound calling, it offers several

international outbound calling plans, including some of the lowest rates to international mobile phones.

Forward Looking Statements

The information contained herein includes

forward-looking statements. These statements relate to future events or to our future financial performance, and involve known

and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements

to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these

forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which are, in some cases, beyond our control and which could, and likely will, materially

affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects our current views

with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations,

results of operations, growth strategy and liquidity. We assume no obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future.

Additional

Information

Pervasip Corp.

Paul H. Riss,

CEO

phriss@pervasip.com

914-750-9339

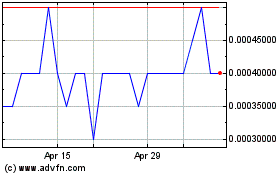

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Apr 2024 to May 2024

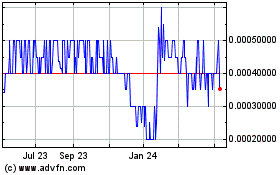

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From May 2023 to May 2024