UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 23, 2015

Date of Report (Date of Earliest Event Reported)

AMES NATIONAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

IOWA |

|

0-32637 |

|

42-1039071 |

|

(State or Other Jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

| Incorporation or Organization) |

|

|

|

Identification No.) |

405 FIFTH STREET

AMES, IOWA 50010

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (515) 232-6251

NOT APPLICABLE

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

● |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

● |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

● |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

● |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

Item 7.01 Regulation FD Disclosure

The following information is furnished pursuant to Items 2.02 and 7.01:

On January 23, 2015, Ames National Corporation issued a News Release announcing financial results for the three and twelve months ended December 31, 2014. A copy of the News Release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibit is furnished as part of this Report:

Exhibit No. Description

99.1 News Release dated January 23, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AMES NATIONAL CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 23, 2015 |

By: |

/s/ Thomas H. Pohlman |

|

|

|

|

Thomas H. Pohlman, Chief Executive Officer and President |

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No. |

Description |

| |

|

| 99.1 |

News Release dated January 23, 2015 |

EXHIBIT 99.1

|

NEWS RELEASE |

|

|

|

|

|

|

|

FOR IMMEDIATE RELEASE |

CONTACT: |

THOMAS H. POHLMAN |

|

|

|

CHIEF EXECUTIVE OFFICER AND PRESIDENT |

|

JANUARY 23, 2015 |

|

(515) 232-6251 |

AMES NATIONAL CORPORATION

ANNOUNCES 2014 FOURTH QUARTER EARNINGS RESULTS

Fourth Quarter 2014 Results:

For the quarter ended December 31, 2014, net income for Ames National Corporation (the Company) totaled $3,139,000 or $0.34 per share, compared to $3,377,000 or $0.36 per share earned in 2013, a decrease of 7%. The lower earnings were a result of impairment write downs on other real estate owned, offset in part by increases in net interest income and securities gains.

As previously announced, the Company’s largest subsidiary bank, First National Bank (FNB), acquired First Bank located in West Des Moines, Iowa on August 29, 2014 (the “Acquisition”). The acquired assets totaled approximately $89 million. First Bank’s legacy core processing and computer networking functions were successfully converted to those of the Company’s in the fourth quarter. Retention of loan and deposit customers from the Acquisition has been favorable. The impact of the Acquisition on the Company’s quarterly net income was not significant.

Fourth quarter net interest income totaled $10,778,000, an increase of $873,000, or 8.8%, compared to the same quarter a year ago, due primarily to growth in the real estate loan portfolio. The increase in net interest income led to an improvement in the Company’s net interest margin to 3.39% for the quarter ended December 31, 2014 as compared to 3.25% for the quarter ended December 31, 2013.

A provision for loan losses of $299,000 was recognized in the fourth quarter of 2014 as compared to $620,000 in the fourth quarter of 2013. Net loan recoveries were $9,000 for the quarter ended December 31, 2014 compared to net loan recoveries of $49,000 for the quarter ended December 31, 2013.

Noninterest income for the fourth quarter of 2014 totaled $2,744,000 as compared to $1,966,000 for the same period in 2013. The increase in noninterest income is primarily due to increases in realized securities gains. Exclusive of realized securities gains, noninterest income was 15% higher in the fourth quarter of 2014 compared to the same period in 2013, primarily due to higher merchant and card fees and increased wealth management income.

Noninterest expense for the fourth quarter of 2014 totaled $7,969,000 compared to $5,491,000 recorded in 2013, an increase of 45.1%. The increase in noninterest expense was primarily due to increases in other real estate owned expenses and salaries and benefits. The increase in other real estate owned expenses was due to an impairment write down on two properties. The increase in salaries and benefits was mainly the result of additional payroll costs attributed to the Acquisition. The efficiency ratio for the fourth quarter of 2014 was 64.11%, compared to 51.69% in 2013.

Year 2014 Results:

For the year ended December 31, 2014, net income for the Company totaled $15,251,000, or $1.64 per share, compared to $13,954,000, or $1.50 per share in 2013, a 9.3% increase. Net income increased primarily due to increases in net interest income gain on the sale of bank premises and equipment and wealth management income, offset in part by increases in salaries and benefits and other real estate owned expenses.

Net interest income for the year ended December 31, 2014 totaled $36,417,000, an increase of $3,058,000, or 9.2%, compared to the same period a year ago, and was due primarily to an increase in the volume of real estate loans, higher yields on taxable securities available-for-sale and lower cost of funds on certificates of deposits. This improvement in interest income led to an improvement in the Company’s net interest margin to 3.31% for the year ended December 31, 2014 as compared to 3.18% for the year ended December 31, 2013.

A provision for loan losses of $429,000 was recognized in the year ended December 31, 2014 as compared to $786,000 for the year ended December 31, 2013. Net loan charge-offs were $162,000 for the year ended December 31, 2014 compared to net loan recoveries of $13,000 for the year ended December 31, 2013.

Noninterest income for the year ended December 31, 2014 totaled $9,252,000 as compared to $7,718,000 for the same period in 2013, a 19.9% increase. The increase in noninterest income is primarily due to the gain on the sale of bank premise and equipment (University office) and an increase in wealth management income, which were offset in part by a decrease in the level of gains realized on the sale of loans held for sale. The Company sold its office location near Iowa State University in Ames, Iowa (University office) and has purchased another office location near the campus which will be opened in 2015.

Noninterest expense for the year ended December 31, 2014 totaled $24,373,000 compared to $21,679,000 recorded in 2013. The increase of 12.4% in noninterest expense was primarily due to salaries and benefits and other real estate owned expense. The higher salaries and benefits relate to normal salary increases, incremental payroll costs associated with the Acquisition and higher incentive pay. Other real estate owned expenses were higher due to $1,744,000 of impairment write downs in 2014 as compared to a $670,000 impairment write down in 2013. The efficiency ratio for the year ended December 31, 2014 was 53.37%, as compared to 52.78% in 2013.

Balance Sheet Review:

As of December 31, 2014, total assets were $1,301,031,000, a $67,947,000 increase compared to December 31, 2013. The increase in assets, primarily loans, was due to the Acquisition of the First Bank branches and growth at the affiliate banks.

Securities available-for-sale as of December 31, 2014 declined to $542,502,000, from $580,039,000 as of December 31, 2013. The decrease in securities available-for-sale is primarily due to pay downs of U.S. government mortgage-backed securities and maturities of state and political subdivision bonds.

Net loans as of December 31, 2014 increased 16.7% to $658,441,000 as compared to $564,502,000 as of December 31, 2013. The growth was primarily due to the Acquisition, but also improved 2014 growth at the affiliate banks. This growth primarily resulted in increases in the commercial real estate, 1-4 family real estate and construction real estate portfolios. The allowance for loan losses on December 31, 2014 totaled $8,838,000, or 1.32% of gross loans, compared to $8,572,000 or 1.50% of gross loans as of December 31, 2013. The decrease in the percentage of allowance for loan losses to gross loans can be primarily attributed to the Acquisition, as the purchased loan portfolio is initially recorded without an allowance for loan loss and credit quality improvements. Impaired loans as of December 31, 2014, were $2,070,000, or 0.31% of gross loans, compared to $2,244,000, or .39% of gross loans as of December 31, 2013.

Other real estate owned was $8,436,000 and $8,861,000 as of December 31, 2014 and 2013, respectively. The decrease in the other real estate owned was primarily due to impairment write downs, offset in part by two properties received as a result of the Acquisition. Due to potential changes in the real estate markets, it is at least reasonably possible that management’s assessments of fair value will change in the near term and that such changes could materially affect the amounts reported in the Company’s financial statements.

Deposits totaled $1,052,123,000 on December 31, 2014, a 4.0% increase from the $1,011,803,000 recorded at December 31, 2013. The increase in deposits was primarily due to the Acquisition, offset in part by a reduction in deposits due to a customer transferring funds from a commercial checking account to a daily repurchase agreement.

Securities sold under agreements to repurchase and federal funds purchased totaled $51,265,000 on December 31, 2014, a 29.4% increase from the $39,617,000 recorded at December 31, 2013. The increase was primarily related to a commercial customer transferring funds to a daily repurchase account from a commercial checking account.

The Company’s stockholders’ equity represented 11.9% of total assets as of December 31, 2014 with all of the Company’s five affiliate banks considered well-capitalized as defined by federal capital regulations. Total stockholders’ equity was $154,674,000 as of December 31, 2014, and $142,106,000 as of December 31, 2013. The increase in stockholders’ equity was primarily the result of net income and higher fair value on the securities available-for-sale which is reflected as an increase in accumulated other comprehensive income, offset in part by dividends.

Shareholder Information:

Return on average assets was 0.96% for the quarter ended December 31, 2014, compared to 1.09% for the same period in 2013. Return on average equity was 8.07% for the quarter ended December 31, 2014, compared to the 9.45% in 2013. Return on average assets was 1.21% for the year ended December 31, 2014, compared to 1.14% for the same period in 2013. Return on average equity was 10.09% for the year ended December 31, 2014, compared to the 9.76% in 2013.

The Company’s stock, which is listed on the NASDAQ Capital Market under the symbol ATLO, closed at $25.94 on December 31, 2014. During the fourth quarter of 2014, the price ranged from $21.63 to $26.87.

On November 12, 2014, the Company declared a quarterly cash dividend on its common stock, payable on February 13, 2015 to stockholders of record as of January 30, 2015, equal to $0.18 per share.

Ames National Corporation affiliate Iowa banks are First National Bank, Ames; Boone Bank & Trust Co., Boone; State Bank & Trust Co., Nevada; Reliance State Bank, Story City; and United Bank & Trust, Marshalltown.

The Private Securities Litigation Reform Act of 1995 provides the Company with the opportunity to make cautionary statements regarding forward-looking statements contained in this News Release, including forward-looking statements concerning the Company’s future financial performance and asset quality. Any forward-looking statement contained in this News Release is based on management’s current beliefs, assumptions and expectations of the Company’s future performance, taking into account all information currently available to management. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to management. If a change occurs, the Company’s business, financial condition, liquidity, results of operations, asset quality, plans and objectives may vary materially from those expressed in the forward-looking statements. The risks and uncertainties that may affect the actual results of the Company include, but are not limited to, the following: economic conditions, particularly in the concentrated geographic area in which the Company and its affiliate banks operate; competitive products and pricing available in the marketplace; changes in credit and other risks posed by the Company’s loan and investment portfolios, including declines in commercial or residential real estate values or changes in the allowance for loan losses dictated by new market conditions or regulatory requirements; fiscal and monetary policies of the U.S. government; changes in governmental regulations affecting financial institutions (including regulatory fees and capital requirements); changes in prevailing interest rates; credit risk management and asset/liability management; the financial and securities markets; the availability of and cost associated with sources of liquidity; and other risks and uncertainties inherent in the Company’s business, including those discussed under the heading “Risk Factors” in the Company’s annual report on Form 10-K. Management intends to identify forward-looking statements when using words such as “believe”, “expect”, “intend”, “anticipate”, “estimate”, “should”, “forecasting” or similar expressions. Undue reliance should not be placed on these forward-looking statements. The Company undertakes no obligation to revise or update such forward-looking statements to reflect current events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

AMES NATIONAL CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

December 31, 2014 and 2013

(unaudited)

|

ASSETS |

|

2014 |

|

|

2013 |

|

|

Cash and due from banks |

|

$ |

23,730,257 |

|

|

$ |

24,270,031 |

|

|

Federal funds sold |

|

|

6,000 |

|

|

|

- |

|

|

Interest bearing deposits in financial institutions |

|

|

31,463,382 |

|

|

|

23,628,117 |

|

|

Securities available-for-sale |

|

|

542,502,381 |

|

|

|

580,039,080 |

|

|

Loans receivable, net |

|

|

658,440,998 |

|

|

|

564,501,547 |

|

|

Loans held for sale |

|

|

704,850 |

|

|

|

295,618 |

|

|

Bank premises and equipment, net |

|

|

15,956,989 |

|

|

|

11,892,329 |

|

|

Accrued income receivable |

|

|

7,471,023 |

|

|

|

7,437,673 |

|

|

Other real estate owned |

|

|

8,435,885 |

|

|

|

8,861,107 |

|

|

Deferred income taxes |

|

|

2,633,177 |

|

|

|

5,027,103 |

|

|

Core deposit intangible, net |

|

|

1,730,231 |

|

|

|

1,029,564 |

|

|

Goodwill |

|

|

6,732,216 |

|

|

|

5,600,749 |

|

|

Other assets |

|

|

1,223,328 |

|

|

|

501,242 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,301,030,717 |

|

|

$ |

1,233,084,160 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

Demand, noninterest bearing |

|

$ |

188,725,609 |

|

|

$ |

179,946,472 |

|

|

NOW accounts |

|

|

298,581,556 |

|

|

|

299,788,852 |

|

|

Savings and money market |

|

|

321,700,422 |

|

|

|

289,307,102 |

|

|

Time, $100,000 and over |

|

|

93,808,027 |

|

|

|

97,077,717 |

|

|

Other time |

|

|

149,307,643 |

|

|

|

145,683,035 |

|

|

Total deposits |

|

|

1,052,123,257 |

|

|

|

1,011,803,178 |

|

| |

|

|

|

|

|

|

|

|

|

Securities sold under agreements to repurchase and federal funds purchased |

|

|

51,265,011 |

|

|

|

39,616,644 |

|

|

Federal Home Loan Bank advances and other borrowings |

|

|

37,467,737 |

|

|

|

34,540,526 |

|

|

Dividend payable |

|

|

1,675,964 |

|

|

|

1,489,746 |

|

|

Accrued expenses and other liabilities |

|

|

3,824,330 |

|

|

|

3,527,882 |

|

|

Total liabilities |

|

|

1,146,356,299 |

|

|

|

1,090,977,976 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Common stock, $2 par value, authorized 18,000,000 shares; issued 9,310,913 shares as of December 31, 2014 and 9,432,915 shares as of December 31, 2013; outstanding 9,310,913 shares as of December 31, 2014 and 2013 |

|

|

18,621,826 |

|

|

|

18,865,830 |

|

|

Additional paid-in capital |

|

|

20,878,728 |

|

|

|

22,651,222 |

|

|

Retained earnings |

|

|

110,701,847 |

|

|

|

102,154,498 |

|

|

Accumulated other comprehensive income-net unrealized income on securities available-for-sale |

|

|

4,472,017 |

|

|

|

451,132 |

|

|

Treasury stock, at cost; 122,002 shares as of December 31, 2013 |

|

|

- |

|

|

|

(2,016,498 |

) |

|

Total stockholders' equity |

|

|

154,674,418 |

|

|

|

142,106,184 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

1,301,030,717 |

|

|

$ |

1,233,084,160 |

|

AMES NATIONAL CORPORATION AND SUBSIDIARIES

Consolidated Statements of Income

(unaudited)

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

7,488,669 |

|

|

$ |

6,559,671 |

|

|

$ |

27,196,859 |

|

|

$ |

25,433,950 |

|

|

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

1,697,406 |

|

|

|

1,606,890 |

|

|

|

7,104,563 |

|

|

|

5,744,321 |

|

|

Tax-exempt |

|

|

1,496,414 |

|

|

|

1,652,450 |

|

|

|

6,354,147 |

|

|

|

6,864,948 |

|

|

Interest bearing deposits and federal funds sold |

|

|

95,523 |

|

|

|

86,422 |

|

|

|

308,782 |

|

|

|

390,594 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest income |

|

|

10,778,012 |

|

|

|

9,905,433 |

|

|

|

40,964,351 |

|

|

|

38,433,813 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

827,300 |

|

|

|

942,053 |

|

|

|

3,385,099 |

|

|

|

3,861,713 |

|

|

Other borrowed funds |

|

|

264,221 |

|

|

|

307,084 |

|

|

|

1,162,002 |

|

|

|

1,213,050 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest expense |

|

|

1,091,521 |

|

|

|

1,249,137 |

|

|

|

4,547,101 |

|

|

|

5,074,763 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

9,686,491 |

|

|

|

8,656,296 |

|

|

|

36,417,250 |

|

|

|

33,359,050 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for loan losses |

|

|

299,120 |

|

|

|

620,428 |

|

|

|

429,140 |

|

|

|

786,390 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision for loan losses |

|

|

9,387,371 |

|

|

|

8,035,868 |

|

|

|

35,988,110 |

|

|

|

32,572,660 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wealth Management Income |

|

|

640,469 |

|

|

|

568,319 |

|

|

|

2,748,619 |

|

|

|

2,199,797 |

|

|

Service fees |

|

|

454,307 |

|

|

|

400,922 |

|

|

|

1,649,169 |

|

|

|

1,580,811 |

|

|

Securities gains, net |

|

|

896,371 |

|

|

|

364,941 |

|

|

|

1,110,953 |

|

|

|

1,002,920 |

|

|

Gain on sale of loans held for sale |

|

|

230,318 |

|

|

|

230,824 |

|

|

|

704,051 |

|

|

|

1,200,402 |

|

|

Merchant and card fees |

|

|

358,098 |

|

|

|

257,444 |

|

|

|

1,189,503 |

|

|

|

1,142,027 |

|

|

Gain (loss) on sale of premises and equipment, net |

|

|

(2,628 |

) |

|

|

- |

|

|

|

1,239,581 |

|

|

|

- |

|

|

Other noninterest income |

|

|

166,698 |

|

|

|

143,607 |

|

|

|

610,203 |

|

|

|

591,821 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest income |

|

|

2,743,633 |

|

|

|

1,966,057 |

|

|

|

9,252,079 |

|

|

|

7,717,778 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

3,894,393 |

|

|

|

3,395,400 |

|

|

|

14,129,956 |

|

|

|

13,131,556 |

|

|

Data processing |

|

|

785,550 |

|

|

|

633,412 |

|

|

|

2,609,185 |

|

|

|

2,414,564 |

|

|

Occupancy expenses, net |

|

|

495,285 |

|

|

|

368,058 |

|

|

|

1,680,351 |

|

|

|

1,471,978 |

|

|

FDIC insurance assessments |

|

|

155,766 |

|

|

|

154,498 |

|

|

|

645,997 |

|

|

|

661,127 |

|

|

Professional fees |

|

|

310,235 |

|

|

|

274,464 |

|

|

|

1,274,111 |

|

|

|

1,127,666 |

|

|

Business development |

|

|

377,420 |

|

|

|

308,419 |

|

|

|

1,103,923 |

|

|

|

957,702 |

|

|

Other real estate owned expense, net |

|

|

1,502,606 |

|

|

|

(1,901 |

) |

|

|

1,502,408 |

|

|

|

651,401 |

|

|

Core deposit intangible amortization |

|

|

113,626 |

|

|

|

65,751 |

|

|

|

317,333 |

|

|

|

273,700 |

|

|

Other operating expenses, net |

|

|

333,951 |

|

|

|

292,983 |

|

|

|

1,110,199 |

|

|

|

989,178 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total noninterest expense |

|

|

7,968,832 |

|

|

|

5,491,084 |

|

|

|

24,373,463 |

|

|

|

21,678,872 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

4,162,172 |

|

|

|

4,510,841 |

|

|

|

20,866,726 |

|

|

|

18,611,566 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

1,023,465 |

|

|

|

1,133,894 |

|

|

|

5,615,519 |

|

|

|

4,657,922 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,138,707 |

|

|

$ |

3,376,947 |

|

|

$ |

15,251,207 |

|

|

$ |

13,953,644 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per share |

|

$ |

0.34 |

|

|

$ |

0.36 |

|

|

$ |

1.64 |

|

|

$ |

1.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declared dividends per share |

|

$ |

0.18 |

|

|

$ |

0.16 |

|

|

$ |

0.72 |

|

|

$ |

0.64 |

|

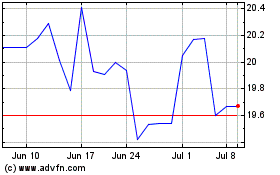

Ames National (NASDAQ:ATLO)

Historical Stock Chart

From Aug 2024 to Sep 2024

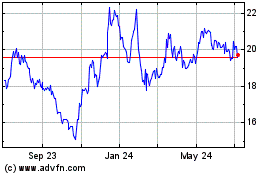

Ames National (NASDAQ:ATLO)

Historical Stock Chart

From Sep 2023 to Sep 2024