Current Report Filing (8-k)

January 13 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 12, 2015

Date of Report (Date of earliest event reported)

|

|

JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Ireland | | 001-33500 | | 98-1032470 |

(State or other jurisdiction of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

|

|

Fourth Floor, Connaught House, 1 Burlington Road, Dublin 4, Ireland |

(Address of principal executive offices, including zip code) |

011-353-1-634-7800

|

|

(Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On January 12, 2015, at the J.P. Morgan Healthcare Conference in San Francisco, California, Jazz Pharmaceuticals plc (the “Company”) presented a corporate overview and financial update, which presentation included the Company’s current expectations with respect to certain operating results for the year ended December 31, 2014. The presentation was announced by a widely disseminated press release and was made available to the public via audio webcast, and the slides that accompanied the presentation were made available to the public through the Company’s website. A transcript of the relevant portion of the presentation relating to the aforementioned financial update is attached hereto as Exhibit 99.1, along with a copy of the relevant slides containing such information.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 to this current report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 to this current report shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

Exhibits

|

| | |

Exhibit Number | | Description |

99.1 | | Portion of transcript and related slides of presentation by Jazz Pharmaceuticals plc on January 12, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY |

| | |

| By: | /s/ Matthew P. Young |

| | Matthew P. Young |

| | Senior Vice President and Chief Financial Officer |

Date: January 12, 2015

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Portion of transcript and related slides of presentation by Jazz Pharmaceuticals plc on January 12, 2015 |

Exhibit 99.1

Relevant portion of the transcript of the oral presentation by Jazz Pharmaceuticals plc at the J.P. Morgan Healthcare Conference in San Francisco, California on January 12, 2015:

Bruce C. Cozadd, Chairman & CEO, Jazz Pharmaceuticals plc

. . .

I will make forward-looking statements. Of course, those are subject to risks and uncertainties that we detail in our SEC filings.

...

And last when I give financial guidance in today's presentation, that's the guidance we disclosed on November 4 on our third quarter earnings call and it's as of that date, unless I specifically update it, which I will do for certain items, okay.

. . .

Good execution of our strategy has resulted in nice top-line growth. I'm pleased to tell you today that we do expect our total revenues for 2014 will come in at the upper end of our previously provided guidance, and I'll remind you that our revenue run rate coming out of the third quarter was in excess of $1.2 billion. This would represent about 30% to 35% growth on the top line. And you can see that most of our revenues are coming from our core products, as highlighted in the pie chart on the right.

. . .

We've had continued strong performance on Xyrem and once again, I am pleased to announce that we do expect our 2014 Xyrem sales will come in at toward the upper end of our previously provided guidance. And remember, our third quarter revenues for Xyrem annualized at a run rate of $800 million -- a little north of $800 million. You'll also see on the slide that we did achieve 10% volume growth rate for Xyrem 2014 over 2013 and this in part reflects a very strong fourth quarter performance with 14% volume growth over the fourth quarter in the prior year. Now, I will say we instituted a change to refill eligibility during the fourth quarter to allow for earlier refills and some of the patients did take us up on that. We did that to ensure that we reduced the risk of any Xyrem patient going out without medications in the event of any service slowdown at our central pharmacy, which we did see in the first quarter of last year. If we back out the effect of that change, fourth quarter growth on volume would have been 11%.

. . .

I'm also pleased to say that we expect that our 2014 net sales of Erwinaze will be at the upper end of our previously given guidance, which was $190 million to $200 million and we think there is substantial growth opportunity for Erwinaze.

. . .

After acquiring this product in January and launching it in Europe in March, I'm pleased to say that once again, we expect our net sales to come in at the upper end of our previously-provided guidance. We would report $65 million to $70 million of those sales, of course pro forma for that small period at the beginning of the year where we didn't own the product yet, total revenues on a pro forma basis would be slightly higher.

. . .

So when I presented last year at this conference, I gave you a snapshot of what we expected in terms of 2014 accomplishments and I'm pleased to say it was fairly accurate.

. . .

Relevant slides from Jazz Pharmaceuticals plc's presentation at the J.P. Morgan Healthcare Conference in San Francisco, California on January 12, 2015:

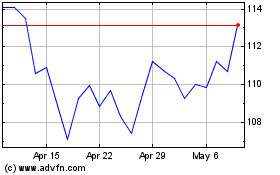

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

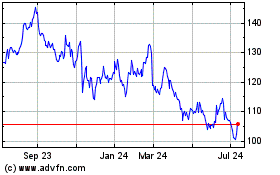

Jazz Pharmaceuticals (NASDAQ:JAZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024