Labor SMART, Inc. Reports Full Year 2014 Revenue Growth of 45 Percent

January 07 2015 - 8:00AM

Access Wire

Full Year 2014 Revenue of $24

Million

Targeting Debt-Free of

Convertible Notes by Mid-2015

ATLANTA, GA / ACCESSWIRE / January 7, 2015 /

Labor SMART, Inc. (LTNC) (the "Company"), a leader in providing

on-demand blue collar staffing primarily in the southeastern United

States, is pleased to announce full year 2014 revenue growth of 45

percent to $24 million, compared to $16.6 million for all of 2013.

Please note there may be some minor year-end adjustments due to the

Company's fiscal year end changing to December 26.

Ryan Schadel, Chairman and Chief Executive Officer of Labor

SMART, stated, "2014 proved to be another record year for our young

company. So much has been accomplished and I believe we are well

positioned in our market segment for continued growth through 2015

and beyond. Our current debt reduction and cash flow strategy is

working well and the Company is not actively seeking new

convertible debt to grow its business. We continue to reach out to

larger shareholders for market support and are seeking a preferred

equity solution to refinancing the convertible debt to a much less

dilutive security. Additionally, I will continue to add to my

personal position in the open market. With the share price

continuing to show weakness, we may very well need to increase our

authorized shares again to accommodate the reserve requirement of

the remaining convertible debt."

2014 Highlights:

- Became substantially self-insured

- Expanded our branch footprint to 30 locations

- Successfully completed 2 acquisitions

- Successfully transitioned away from lower margin, higher risk

business

- Expanded our management team with the hiring of COO Kimberly

Thompson

- Implemented a number of key initiatives in the fourth quarter

aimed at boosting cash flow and profitability in 2015

2015 Expectations:

- Expecting a dramatic cash gain in first

half of 2015 which will be used to clean up remaining

debt and potentially buy back shares

in the float as needed

- New branch openings for 2015 will be very limited, footprint

growth for 2015 expected to come from acquisitions versus new

branch openings

- Seeking up to $40 million in additional revenue from

acquisitions

- Anticipate increasing our current line of credit to $4 million in

Q1 2015

- Expecting adjusted EBITDA of $2-3 million for fiscal year

2015

- Exploring licensing or franchising arrangements

As of December 29, 2014, Labor SMART had an approximate balance

of $2.66 million in Convertible Notes Payable on its balance sheet.

The shares outstanding as of December 29, 2014 stood at 191

million.

About Labor SMART, Inc.

Labor SMART, Inc. provides On-Demand temporary labor to a

variety of industries. The Company's clients range from small

businesses to Fortune 100 companies. Labor SMART was founded to

provide reliable, dependable and flexible resources for on-demand

personnel to small and large businesses in areas that include

construction, manufacturing, hospitality, event-staffing,

restoration, warehousing, retailing, disaster relief and cleanup,

demolition and landscaping. Labor SMART believes it can make a

positive contribution each and every day for the benefit of its

clients and temporary employees. The Company's mission is to be the

provider of choice to its growing portfolio of customers with a

service-focused approach that enables Labor SMART to be seen as a

resource and partner to its clients.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These statements appear in a number of places

in this release and include all statements that are not statements

of historical fact regarding the intent, belief or current

expectations of Labor SMART, Inc., its directors or its officers

with respect to, among other things: (i) financing plans; (ii)

trends affecting its financial condition or results of operations;

(iii) growth strategy and operating strategy. The words "may",

"would", "will", "expect", "estimate", "can", "believe",

"potential", and similar expressions and variations thereof are

intended to identify forward-looking statements. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties, many of which are beyond Labor SMART, Inc.'s ability

to control, and that actual results may differ materially from

those projected in the forward-looking statements as a result of

various factors. More information about the potential factors that

could affect the business and financial results is and will be

included in Labor SMART, Inc.'s filings with the U.S. Securities

and Exchange Commission.

Contacts:

Hayden IR

917-658-7878

hart@haydenir.com

SOURCE: Labor SMART, Inc.

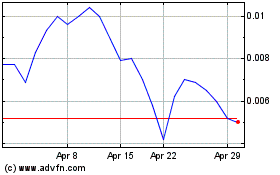

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Labor Smart (PK) (USOTC:LTNC)

Historical Stock Chart

From Sep 2023 to Sep 2024