Current Report Filing (8-k)

December 24 2014 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 18, 2014

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

|

|

|

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

1000 First Avenue South, Suite 100, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

◻Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

◻Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

◻Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

◻Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On December 18, 2014, as amended and restated on December 22, 2014, Jones Soda Co. (the “Company”) entered into an amendment (the “Amendment”) to its existing revolving secured credit facility (the “Loan Facility”) with CapitalSource Business Finance Group, a dba of BFI Business Finance (the “Lender”).

The primary purpose of the Amendment is to provide for a minimum annual cumulative amount of interest of $30,000 to be paid to the Lender under the Loan Facility. The Amendment is effective as of December 27, 2014, with the renewal of the Loan Facility.

The foregoing description of the material terms of the Amendment is qualified in its entirety by reference to the Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., Jones Soda (Canada) Inc., and Lender, a copy of which is attached as Exhibit 10.1 to this Current Report and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

10.1

|

Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., JONES SODA (CANADA) Inc., and CapitalSource Business Finance Group, a dba of BFI Business Finance.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

JONES SODA CO.

(Registrant)

|

|

|

|

|

|

|

December 23, 2014

|

|

By:

|

/s/ Mark Miyata

|

|

|

|

|

|

Mark Miyata, Vice President of Finance

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Amendment & Restatement of First Modification to Loan and Security Agreement dated as of December 22, 2014, by and among Jones Soda Co. (USA) Inc., JONES SODA (CANADA) Inc., and CapitalSource Business Finance Group, a dba of BFI Business Finance.

|

Exhibit 10.1

Amendment & Restatement of First Modification to Loan and Security Agreement

This Amendment & Restatement of First Modification to Loan and Security Agreement (this “Modification”) is entered into by and between Jones Soda Co. (USA) Inc., a(n) Washington corporation and JONES SODA (CANADA) INC. a Canadian corporation (each individually and collectively, “Borrower”) and CapitalSource Business Finance Group, a dba of BFI Business Finance, a California corporation (“Lender”) as of this 22nd day of December, 2014, at Campbell, California.

RECITALS

|

A.

Lender and Borrower have previously entered into or are concurrently herewith entering into a Loan and Security Agreement (the “Agreement”) dated December 27, 2013. |

|

B.

Lender and Borrower may have previously executed one or more Modifications to Loan and Security Agreement (the "Previous Modification(s)"). |

|

C.

Borrower has requested, and Lender has agreed, to modify the Agreement as set forth below. |

AGREEMENT

For good and valuable consideration, the parties agree as set forth below:

|

1.

Incorporation by Reference. The Agreement and the Previous Modification(s), if any, as modified hereby and the Recitals are incorporated herein by this reference. |

|

2.

Effective Date. The terms of this Modification shall be in full force and effect as of December 27, 2014. |

|

3.

Modification to Agreement. The Agreement is hereby modified as follows: |

a. The following Section(s) is(are) hereby amended and restated in its(their) entirety as set forth below:

6.Advances hereunder shall bear interest, on the average daily outstanding balance, at the rate (the “Rate”) of two percentage point(s) (2.00%) per annum (in the case of Advances against the Domestic A/R Borrowing Base or the Canadian A/R Borrowing Base), and two percentage point(s) (2.00%) per annum (in the case of Advances against the Inventory Borrowing Base) over and above the rate announced as the “prime” rate in the Western Edition of the Wall Street Journal which is in effect from time to time (the “Prime Rate”); provided that the Prime Rate shall at all times be deemed to be not less than four percent (4.00%) per annum (the “Deemed Prime Rate”) and provided that the cumulative minimum annual amount of interest payable together with the Administrative Fee (as defined in Paragraph 9) shall in no event be less than Thirty Thousand and 00/100 Dollars ($30,000.00) annually (the “Cumulative Minimum Annual Interest Payment”) and, (i) in the event that accrued interest together with the Administrative Fee (collectively, “Accrued Interest”) is less than $2,500 during any month of such annual period (commencing January 2015) (for any applicable month, a “Shortfall”), Borrower shall pay such Accrued Interest together with the Shortfall amount for such month, and, (ii) if the aggregate Accrued Interest and Shorfall payments exceed the Cumulative Minimum Annual Interest Payment at any time during such applicable annual period, Borrower shall not be required to make any further Shortfall payments during such annual period and shall only be required to make a payment of any such Accrued Interest during the month that it accrues. In the event that the Prime Rate is changed, the adjustment in the Rate charged shall be made on the day such change occurs. Interest shall be computed on the basis of a 360-day year for the actual number of days elapsed. Interest shall be due and payable monthly on the first day of each month, and if not so paid, shall bear interest at the

Page 1 of 1 Initial Here MM

Rate. Borrower hereby instructs and authorizes Lender (until such time as such instructions are revoked in writing) to charge accrued interest as an Advance under this Agreement. Notwithstanding anything to the contrary contained in this Agreement, no payment made by check or any other means shall be deemed made until three (3) business days after receipt thereof by Lender, to allow for and subject to, clearance of funds.

b. Section 43 is hereby partially amended and restated by replacing the last sentence thereof with the following (with the remainder of such section to remain unchanged):

Borrower agrees to indemnify the Lender Parties against, and hold each of them harmless from, any liability of any kind or nature, including attorneys’ fees and Lender’s Expenses which may be imposed upon, incurred by, or asserted against any of the Lender Parties, in any way relating to or arising out of this Agreement or the transactions contemplated hereby, except to the extent of any liability caused by any of the Lender Parties’ gross negligence or willful misconduct, with the foregoing indemnity and hold harmless agreement by Borrower in favor of Lender to survive the termination of this Agreement and payment and performance of the Obligations, and continue thereafter.

|

4.

Fee. At the time of execution of the Modification, Borrower agrees to pay a one-time fee in the amount of ----------N/A---------- and 00/100 Dollars ($----------n/a----------). |

|

5.

Legal Effect. Except as specifically set forth in this Modification, all of the terms and conditions of the Agreement remain in full force and effect. |

|

6.

Counterparts. This Modification may be executed in any number of counterparts, each of which shall be deemed an original but all of which taken together shall constitute a single original. |

|

7.

Electronic Signature. This Modification, or a signature page thereto intended to be attached to a copy of this Modification, signed and transmitted by facsimile machine, telecopier or other electronic means (including via transmittal of a “pdf” file) shall be deemed and treated as an original document. The signature of any person thereon, for purposes hereof, is to be considered as an original signature, and the document transmitted is to be considered to have the same binding effect as an original signature on an original document. At the request of any party hereto, any facsimile, telecopy or other electronic document is to be re-executed in original form by the persons who executed the facsimile, telecopy of other electronic document. No party hereto may raise the use of a facsimile machine, telecopier or other electronic means or the fact that any signature was transmitted through the use of a facsimile machine, telecopier or other electronic means as a defense to the enforcement of this Modification. |

|

8.

Integration. This is an integrated Modification and supersedes all prior negotiations and agreements regarding the subject matter hereof. All amendments hereto must be in writing and signed by the parties. |

IN WITNESS WHEREOF, the parties have executed this Amendment & Restatement of First Modification to Loan and Security Agreement as of the date first set forth above.

|

|

|

|

Jones Soda Co. (USA) Inc.

|

JONES SODA (CANADA) INC.

|

|

|

|

|

/s/ Jennifer L. Cue

|

/s/ Mark Miyata

|

|

By: Jennifer L. Cue

|

By: Mark Miyata

|

|

Its: President & CEO

|

Its: VP of Finance

|

|

|

|

|

|

|

|

CapitalSource Business Finance Group,

a dba of BFI Business Finance

|

|

|

|

|

|

/s/ Colleen M. Gonia

|

|

|

By: Colleen M. Gonia

|

|

|

Its: Vice President

|

|

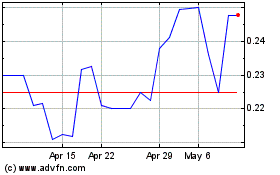

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

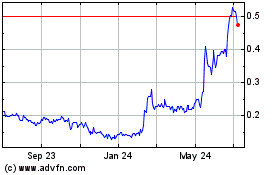

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024