UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act Of 1934

Date of report (Date of earliest event reported): December 16, 2014 (December 16, 2014)

TrustCo Bank Corp NY

(Exact Name of Registrant as Specified in Charter)

|

New York

|

0-10592

|

14-1630287

|

|

State of Other Jurisdiction or Incorporation

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

5 Sarnowski Drive

Glenville, New York 12302

(Address of Principal Executive Offices)

(518) 377-3311

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Retirement of Executive Officer.

On December 16, 2014, TrustCo Bank Corp NY (the “Company” or “TrustCo”) announced that Robert T. Cushing, TrustCo’s Executive Vice President and Chief Financial Officer, will retire from the Company and its subsidiaries, including Trustco Bank, effective May 31, 2015. Effective December 16, 2014, Mr. Cushing’s officer title and responsibilities changed, with Mr. Cushing becoming Executive Vice President and Chief Operating Officer of TrustCo and its subsidiaries. He will hold these positions until the effective date of his retirement.

As part of Mr. Cushing’s retirement, on December 16, 2014, the Board of Directors of the Company approved entering into a Consulting Agreement (the “Consulting Agreement”) with Mr. Cushing. Under the Consulting Agreement, after the effective date of his retirement, Mr. Cushing will render consulting services and advice to TrustCo and its affiliates on an as-needed basis. TrustCo will pay Mr. Cushing a monthly fee in the amount of $20,000 and provide to him in-kind benefits consisting of office facilities, a personal secretary, use of a vehicle, club memberships and estate planning services. Also under the Consulting Agreement, Mr. Cushing agreed, subject to certain exceptions, that he will not (a) own, have any interest in or act as an officer, director, partner, principal, employee, agent, representative, consultant to or independent contractor of a TrustCo competitor, (b) divert or attempt to divert to a competitor any client, customer or account of TrustCo or an affiliate or (c) hire, or solicit to hire, for or on behalf of a competitor, any current or former employee of TrustCo or its affiliate. The term of Mr. Cushing’s engagement under the Consulting Agreement will commence on June 1, 2015 and will continue through December 31, 2015, unless sooner terminated. TrustCo may terminate the Consulting Agreement upon not less than 90 days’ prior written notice to Mr. Cushing. The foregoing description of the Consulting Agreement is qualified in its entirety by reference to the text of the Consulting Agreement, which is attached hereto as Exhibit 10.1.

Appointment of Executive Officer.

On December 16, 2014, the TrustCo Board of Directors appointed Michael M. Ozimek, age 40, to serve as Senior Vice President and Chief Financial Officer of the Company and Trustco Bank. Mr. Ozimek has served as Administrative Vice President, Accounting/Finance, of TrustCo and Trustco Bank since June 30, 2010 and prior to then had been Vice President, Finance, since 2004. Before joining TrustCo, Mr. Ozimek had been with the audit, tax and advisory firm of KPMG LLP. The Compensation Committee of TrustCo’s Board of Directors determined that Mr. Ozimek’s base salary for 2015 will be $225,000 and has approved his participation for 2015 in the Company’s Executive Officer Incentive Plan.

Item 9.01 Financial Statements and Exhibits

(c) Exhibits

| Exhibit No. |

Description of Exhibit |

| 10.1 |

Consulting Agreement, dated December 16, 2014 between TrustCo Bank Corp NY and Robert T. Cushing |

| 99.1 |

Press release, dated December 16, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRUSTCO BANK CORP NY

|

|

| |

|

|

|

| |

By:

|

/s/ Michael M. Ozimek

|

|

| |

Name:

|

Michael M. Ozimek

|

|

| |

Title:

|

Senior Vice President and

|

|

| |

|

Chief Financial Officer

|

|

Date: December 16, 2014

Exhibits Index

| Exhibit No. |

Description of Exhibit |

| 10.1 |

Consulting Agreement, dated December 16, 2014 between TrustCo Bank Corp NY and Robert T. Cushing |

| 99.1 |

Press release, dated December 16, 2014 |

Exhibit 10.1

CONSULTING AGREEMENT BETWEEN

TRUSTCO BANK CORP NY AND ROBERT T. CUSHING

THIS CONSULTING AGREEMENT (“Agreement”) is entered into as of the 16th day of December 2014 by and between TrustCo Bank Corp NY, a New York corporation (“TrustCo”), and Robert T. Cushing (“Cushing”). In consideration of the mutual covenants herein contained, the parties agree as follows:

1. Term and Duties.

(a) The term of Cushing’s engagement under this Agreement will commence on June 1, 2015 and will continue through December 31, 2015, unless sooner terminated pursuant to Section 2 or Section 5 (the “Term”).

(b) During the Term, Cushing shall serve as a consultant to TrustCo and to each of its affiliates, rendering to TrustCo and such affiliates consulting services and advice on an as-needed basis with respect to matters pertaining to TrustCo and its affiliates. The services rendered shall be advisory only, and Cushing’s services as a consultant shall be rendered, during his lifetime, at such times and places as may be mutually convenient to TrustCo and its affiliates and Cushing. Cushing acknowledges that he will be an independent contractor only, and shall not for any purpose hereunder be considered to be an employee of TrustCo or any of its affiliates. The parties reasonably anticipate that Cushing’s level of service for TrustCo and its affiliates during the term of this Agreement will be less than eight hours per week, which is less than 20% of the average level of service provided by Cushing to TrustCo and its affiliates as Executive Vice President and Chief Financial Officer during the last 36 months of his employment by TrustCo and its affiliates.

(c) Compensation. In full compensation for the services to be rendered by Cushing hereunder during the Term and for the noncompetition agreement set forth in Section 3 herein, TrustCo (a) will pay Cushing a monthly fee in the amount of $20,000, to be paid in cash on the first business day of each month during the Term and (b) will provide, at no cost, to Cushing in-kind benefits consisting of office facilities, a personal secretary, use of a vehicle, club memberships and estate planning services, each as provided by TrustCo to Cushing during the last 36 months of his employment by TrustCo and its affiliates. In the event of Cushing’s death or disability (as hereafter defined) during the Term, TrustCo’s obligations under this Section 2 shall terminate, provided that TrustCo shall be obligated to pay to Cushing’s estate or other designated beneficiary the full amount of the monthly fee, if such fee had not previously been paid, for the month in which such death or disability occurred. In no event will Cushing or his estate have the right to designate the taxable year of such payment. For purposes of this Section 2, the term “disability” means (i) Cushing is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expect to last for a continuous period of not less than 12 months or (ii) Cushing is, by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than 3 months under an accident and health plan covering employees of TrustCo. Cushing also will be deemed to have a “disability” if determined to be totally disabled by the Social Security Administration. In addition, Cushing will be deemed to have a “disability” if determined to be disabled in accordance with a disability insurance program accepted by TrustCo, provided that the definition of disability applied under such disability insurance program complies with the requirements of this Section. To the extent that any right to reimbursement of expenses or payment of any in-kind benefit under this Agreement constitutes nonqualified deferred compensation (within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended), (i) any such expense reimbursement shall be made by TrustCo no later than the last day of the taxable year following the taxable year in which such expense was incurred by Cushing, (ii) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit and (iii) the amount of expenses eligible for reimbursement or in-kind benefits provided during any taxable year shall not affect the expenses eligible for reimbursement or in-kind benefits to be provided in any other taxable year; provided that the foregoing clause shall not be violated with regard to expenses reimbursed under any arrangement covered by Section 105(b) of the Code solely because such expenses are subject to a limit related to the period the arrangement is in effect

2. Noncompetition. Cushing acknowledges that he has provided special, unique and extraordinary services to TrustCo and its affiliates during his employment with TrustCo and its bank subsidiary. Cushing agrees that he will not, during the Term, directly or indirectly, without the written consent of TrustCo:

(a) Own, have any interest in or act as an officer, director, partner, principal, employee, agent, representative, consultant to or independent contractor of a Competitor if Cushing in any such capacity performs services in an aspect of Competitor’ business which is competitive with TrustCo or an affiliate; provided, however, Cushing may invest in no more than 5% of the stock of any publicly-traded company that is a Competitor without violating this covenant;

(b) Divert or attempt to divert to a Competitor any client, customer or account of TrustCo or an affiliate (which is a client, customer or account during the Term); or

(c) Hire, or solicit to hire, for or on behalf of a Competitor, any employee of TrustCo or an affiliate (who is an employee of TrustCo or an affiliate as of the time of such hire or solicitation to hire) or any former employee of TrustCo or an affiliate (who was employed by TrustCo or an affiliate within the 12-month period immediately preceding the date of such hire or solicitation to hire).

(d) For purposes of this Section 3, capitalized terms are defined as follows:

Competitor. “Competitor” shall mean any person, firm, corporation, partnership, limited liability company or any other entity doing business in the Geographic Market which, during the Term, is engaged in competition in a substantial manner with TrustCo or an affiliate of TrustCo.

Geographic Market. “Geographic Market shall mean the area within a radius of 25 miles of the location of the headquarters or any branch office of TrustCo or an affiliate.

3. Scope of Noncompetition Provisions. If it shall be finally determined by any court of competent jurisdiction that any limitation contained in Section 3 is too extensive to be legally enforceable and must be reduced, then the parties hereby agree that such reduced limitation shall be deemed to be the maximum scope or duration which shall be legally enforceable, and Cushing hereby consents to the enforcement of such reduced limitation.

4. Termination of Contract. TrustCo may terminate this Agreement upon not less than 90 days’ prior written notice to Cushing. Upon the effective date of such termination, the parties’ obligations under this Agreement shall cease.

5. Entire Agreement; Amendment; Governing Law. This Agreement constitutes the entire Agreement between TrustCo and Cushing and all prior understandings and agreements between them, if any, concerning the same subject matter are merged herein and thus extinguished. This Agreement may not be modified except by a writing signed by both parties. This Agreement is made under, and shall be construed in accordance with the laws of the State of New York.

6. Separability. If any provision hereof is declared void and unenforceable by any court of competent jurisdiction, the remaining provisions hereof shall remain in full force and effect.

7. Binding Effect. This Agreement shall be binding on the parties hereto and their respective successors, heirs and assigns upon full execution by all parties.

[signature page follows]

IN WITNESS WHEREOF, TrustCo and Cushing have executed this Agreement as of the date first above written.

| |

TRUSTCO BANK CORP NY

|

|

| |

|

|

|

| |

By:

|

/s/ Robert J. McCormick

|

|

| |

Name:

|

Robert J. McCormick

|

|

| |

Title:

|

President and Chief Executive Officer

|

| |

|

|

|

| |

/s/ Robert T. Cushing

|

|

| |

Robert T. Cushing

|

|

5 of 5

Exhibit 99.1

|

|

News Release

|

|

5 Sarnowski Drive, Glenville, New York, 12302

|

|

|

Subsidiary: Trustco Bank

|

NASDAQ -- TRST

|

| Contact: |

Kevin T. Timmons |

Vice President/Treasurer

(518) 381-3607

FOR IMMEDIATE RELEASE

TrustCo Announces CFO Transition

Glenville, New York – December 16, 2014

Robert J. McCormick, President and Chief Executive Officer of TrustCo Bank Corp NY (TrustCo) (Nasdaq:TRST) announced today that Executive Vice President and Chief Financial Officer Robert T. Cushing is retiring from the Company on May 31, 2015. Mr. Cushing has assumed the new role of Chief Operating Officer and will assist his successor in the orderly transition of the CFO responsibilities through his retirement in May.

“Bob has been integral part of the Company for over 20 years. His leadership of the Company's financial operation as CFO has been a key component in the growth and success at TrustCo,” said Robert McCormick. “We wish him the best of luck in his retirement and he will be missed.”

Robert McCormick also announced today that Michael M. Ozimek, has been named Senior Vice President and CFO. Mike has been with TrustCo for twelve years and is a graduate of Siena College. Prior to joining TrustCo Mike worked at the accounting firm KPMG. Mr. McCormick noted “Bob and Mike have worked together for a number of years and I am confident that the transition will go very smoothly. We are pleased to have an individual of Mike's caliber assume the role of CFO.”

TrustCo Bank Corp NY is a $4.6 billion savings and loan holding company. Its subsidiary, Trustco Bank, operates 143 offices in New York, Florida, Massachusetts, New Jersey and Vermont.

In addition, the Bank’s Financial Services Department offers a full range of investment services, retirement planning and trust and estate administration services.

The common shares of TrustCo are traded on The NASDAQ Global Select Market under the symbol TRST.

Safe Harbor Statement

All statements in this news release that are not historical are forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our expectations for our performance during the remainder of 2014 and for the growth of loans and deposits throughout our branch network and our ability to capitalize on economic changes in the areas in which we operate. Such forward-looking statements are subject to factors that could cause actual results to differ materially for TrustCo from those discussed. TrustCo wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The following important factors, among others, in some cases have affected and in the future could affect TrustCo’s actual results and could cause TrustCo’s actual financial performance to differ materially from that expressed in any forward-looking statement: our ability to continue to originate a significant volume of one-to-four family mortgage loans in our market areas; our ability to continue to maintain noninterest expense and other overhead costs at reasonable levels relative to income; the future earnings and capital levels of Trustco Bank and the continued ability of Trustco Bank under regulatory rules to distribute capital to TrustCo, which could affect our ability to pay dividends; our ability to make accurate assumptions and judgments regarding the credit risks associated with lending and investing activities; the effect of changes in financial services laws and regulations and the impact of other governmental initiatives affecting the financial services industry; results of examinations of Trustco Bank and TrustCo by our respective regulators; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board, inflation, interest rates, market and monetary fluctuations; the perceived overall value of our products and services by users, including in comparison to competitors’ products and services and the willingness of current and prospective customers to substitute competitors’ products and services for our products and services; real estate and collateral values; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the FASB or PCAOB; changes in local market areas and general business and economic trends, as well as changes in consumer spending and saving habits; our success at managing the risks involved in the foregoing and managing our business; and other risks and uncertainties under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2013, as amended, and, if any, in our subsequent quarterly reports on Form 10-Q or other securities filings.

2

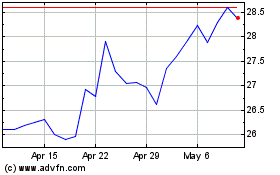

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Mar 2024 to Apr 2024

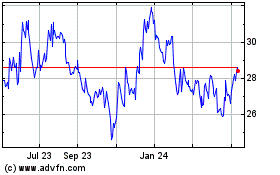

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Apr 2023 to Apr 2024