UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 11, 2014

ANI PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-31812 |

|

58-2301143 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

210 Main Street West

Baudette, Minnesota |

|

56623 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (218) 634-3500

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 7.01 |

Regulation FD Disclosure. |

On December 11, 2014, ANI Pharmaceuticals,

Inc. (the “Company,” “we” or “us”) announced that Arthur Przybyl, President and CEO, will present

at the Oppenheimer & Co. 25th Annual Healthcare Conference, which presentation will be webcast live at http://www.veracast.com/webcasts/opco/healthcare2014/73209130649.cfm

at 1:35 PM ET. The live webcast will be archived and available for 90 days, through March 11, 2015.

On December

11, 2014, we posted to our website our December 2014 Corporate Presentation. We may use this presentation in our communications

or at conferences. The presentation is available on our website, www.anipharmaceuticals.com, and is attached to this Current Report

on Form 8-K as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

In accordance

with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2,

shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference

into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

Certain statements contained in the presentation slides furnished

with this report contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future operations, products, financial

position, operating results, prospects, pipeline or potential markets therefor, and other statements that are not historical in

nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,”

“plans,” “potential,” “future,” “believes,” “intends,” “continue,”

other words of similar meaning, derivations of such words, and the use of future dates.

Uncertainties and risks may cause our actual results to be materially

different than those expressed in or implied by such forward-looking statements. Uncertainties and risks include, but are not limited

to, the risk that we may face with respect to importing raw materials, increased competition, delays or failure in obtaining product

approval from the U.S. Food and Drug Administration ("FDA"), general business and economic conditions, market trends,

product development, regulatory and other approvals and marketing.

More detailed information on these and additional factors that

could affect our actual results are described in our filings with the Securities and Exchange Commission, including our most recent

annual report on Form 10-K and quarterly reports on Form 10-Q, as well as our proxy statement/prospectus, filed with the Securities

and Exchange Commission on April 11, 2014. The forward-looking statements contained in this document are made only as of the date

of this document. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information,

future events or otherwise.

| Item 9.01 |

|

Financial Statements and Exhibits. |

(d) Exhibits

| No. |

|

Description |

| |

|

|

| 99.1 |

|

Press release, dated December 11, 2014, issued by ANI Pharmaceuticals, Inc. |

| |

|

|

| 99.2 |

|

ANI Pharmaceuticals, Inc. Corporate Presentation December 2014 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANI PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Charlotte C. Arnold |

| |

|

Charlotte C. Arnold |

| |

|

Vice President and Chief Financial Officer |

| Dated: December 11, 2014 |

|

ANI Pharmaceuticals Presents At Oppenheimer 25th Annual Healthcare Conference

BAUDETTE, Minn., Dec. 11, 2014 /PRNewswire/ -- ANI Pharmaceuticals, Inc. (NASDAQ: ANIP) will present today at the Oppenheimer & Co. 25th Annual Healthcare Conference at the Crowne Plaza Hotel in New York City. Arthur Przybyl, President and CEO, will present today at 1:35pm ET. The presentation will be webcast live at http://www.veracast.com/webcasts/opco/healthcare2014/73209130649.cfm. The live webcast will be archived and available through the prior link for 90 days through March 11, 2015.

About ANI

ANI Pharmaceuticals, Inc. (the "Company" or "ANI") is an integrated specialty pharmaceutical company developing, manufacturing, and

marketing branded and generic prescription pharmaceuticals. The Company's targeted areas of product development currently include narcotics, oncolytics (anti-cancers), hormones and steroids, and complex formulations involving extended release and combination products. For more information, please visit our website www.anipharmaceuticals.com.

Forward-Looking Statements

To the extent any statements made in this release deal with information that is not historical, these are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about price increases, the Company's future operations, products financial position, operating results and prospects , the Company's pipeline or potential markets therefor, and other statements that are not historical in nature,

particularly those that utilize terminology such as "anticipates," "will," "expects," "plans," "potential," "future," "believes," "intends," "continue," other words of similar meaning, derivations of such words and the use of future dates.

Uncertainties and risks may cause the Company's actual results to be materially different than those expressed in or implied by such forward-looking statements. Uncertainties and risks include, but are not limited to, the risk that the Company may face with respect to importing raw materials; increased competition; delays or failure in obtaining product approval from the U.S. Food and Drug Administration; general business and economic conditions; market trends; products development; regulatory and other approvals and marketing.

More detailed information on these

and additional factors that could affect the Company's actual results are described in the Company's filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as well as its proxy statement. All forward-looking statements in this news release speak only as of the date of this news release and are based on the Company's current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

For more information about ANI, please contact:

Investor Relations

(218) 634-3608

IR@anipharmaceuticals.com

A Specialty Pharmaceutical Company NASDAQ: ANIP GENERIC AND BRANDED PRESCRIPTION DRUG PRODUCTS Corporate Presentation December 2014

Forward - Looking Statements To the extent any statements made in this presentation deal with information that is not historical, these are forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about price increases, the Company’s future operations, products financial position, operating results and prospects , the Company’s pipeline or potential markets therefore, and other statements that are not historical in nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,” “plans,” “potential,” “future,” “believes,” “intends,” “continue,” other words of similar meaning, derivations of such words and the use of future dates. Uncertainties and risks may cause the Company’s actual results to be materially different than those expressed in or implied by such forward - looking statements. Uncertainties and risks include, but are not limited to, the risk that the Company may face with respect to importing raw materials; increased competition; delays or failure in obtaining product approval from the U.S. Food and Drug Administration; general business and economic conditions; market trends; products development; regulatory and other approvals and marketing. More detailed information on these and additional factors that could affect the Company’s actual results are described in the Company’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10 - K and quarterly reports on Form 10 - Q, as well as its proxy statement. All forward - looking statements in this presentation speak only as of the date of this presentation and are based on the Company’s current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise. 2

3 ANI Mission Statement ANI Pharmaceuticals is an integrated specialty pharmaceutical company developing, manufacturing and marketing branded and generic prescription pharmaceuticals. ANI’s mission is to develop, manufacture, and market niche generic pharmaceuticals, focusing on opportunities in pain management (narcotics), anti - cancer (oncolytics), women’s health (hormones and steroids), and complex formulations including extended release and combination products.

ANI Overview – Poised for Growth ANI Today ▪ Experienced management team ▪ Current business – For the nine months ended September 30, 2014: $34.9 million total net revenues □ $29.2 million ANI Rx product revenues □ $5.7 million c ontract manufacturing/services revenues □ Growth of 79% year/year ▪ Guidance for fourth quarter of 2014 (1) – Net revenues of $17 million to $18 million – Adjusted non - GAAP diluted earnings per share of $0.60 to $0.65 ▪ Potential future royalty stream from Teva’s testosterone gel ▪ 48 products in development; total current market $2.7 billion (2) (1) November 3, 2014 press release (2) Based on Company estimates, and recent IMS and NSP Audit data 4

5 ANI History and Highlights 2010 Management implements strategy to focus on ANI - labeled Rx products 2011 Expands marketed Rx portfolio to seven products 2013 Completes merger with BioSante Pharmaceuticals and obtains NASDAQ Global Market listing (NASDAQ: ANIP), June 2013 2013 Announces agreement to acquire 31 previously marketed generic products from Teva for $12.5 million and a percentage of future gross profits, December 2013 2014 Closes public offering of common shares netting $46.8 million, March 2014 2014 Acquires Vancocin ® and related assets from Shire for $11 million, August 2014 2014 Announces public offering of $125 million of convertible debt with simultaneous bond hedge and warrant transactions, December 2014 2014 Acquires Lithobid ® from Noven for $12 million, July 2014 2014 Launches Methazolamide Tablets, first product from portfolio of approved generic products acquired from Teva , November 2014

6 Sales and Marketing / Financial Overview

ANI Historical Revenue Growth 7 $s in millions 39% C ost of sales as a percentage of net revenues, excluding depreciation and amortization 42% 43% 33% 22%

ANI Current Rx Product Portfolio Generic Products Position Market Share (1) EE/MT Tablets #1 42% Fluvoxamine Tablets #1 56% HC Enema #1 85% Metoclopramide Solution #2 31% Opium Tincture #1 78% Methazolamide Tablets Launched November 2014 8 Branded Products Lithobid ® Vancocin ® C ortenema ® Reglan ® (1) Based on Company estimates, and recent IMS and NSP Audit data

ANI Contract Manufacturing Revenues 9 Current Business ▪ $5.7 million in contract manufacturing and services revenues during the nine - month period ended September 30, 2014 ▪ Four customers – Eight products and nineteen SKUs Future Opportunities ▪ Potential future royalty: Teva’s testosterone gel

ANI Financial Highlights 10 YTD Results – 2014 ($ in millions) Nine months ended Sept 30, 2014 Sept 30, 2013 % Growth Net revenues $34.9 $19.6 79% Adjusted non - GAAP EBITDA (1) $14.5 $3.6 306% (1) Please see pages 18 and 19 for US GAAP reconciliations (2) November 3, 2014 press release Fourth Quarter Guidance – 2014 (2) ($ in millions, except earnings per share) Net revenues $17.0 to $18.0 Adjusted non - GAAP EBITDA $9.75 to $10.25 Adjusted non - GAAP earnings per share $0.60 to $0.65

11 Product Development / Business Development Overview

12 ANI Product Development Pipeline Development Pipeline: 48 p roducts in development ▪ Nine filed products – One ANDA granted expedited review – Development collaborations: Ricon, Sofgen, Sterling ▪ Total combined current market: $2.7 billion (1) (1) Based on Company estimates, and recent IMS and NSP Audit data Products ANI Partnered Total At FDA 6 3 9 Development 4 5 9 Acquired Products 30 - 30 Totals 40 8 48

13 ANI Business Development Highlights Acquired Vancocin ® and related assets from Shire, August 2014 Acquired Lithobid ® from Noven, July 2014 Acquired 31 generic products from Teva, December 2013 Product development partnership with Sofgen, August 2013; expanded, April 2014 Acquired royalty arrangement with Teva, June 2013 Product development partnership with Ricon, June 2011 Acquired Reglan ® tablets, June 2011 Business Development Focus In - licensing/acquisitions/alliances for development stage ANDAs, revenue generating products Enhancing generic product pipeline through development partnerships Company acquisitions

14 Manufacturing Overview

15 ANI Manufacturing – Main Street Facility Location: Baudette , Minnesota ▪ 52,000 square feet of manufacturing , packaging, and warehouse facilities ▪ Rx solutions , suspensions , topicals , tablets , and capsules ▪ DEA - licensed for Schedule II controlled substances ▪ 17,000 square feet of laboratory space for product development and analytical testing

16 ANI Manufacturing – IDC Road Facility Location: Baudette, Minnesota ▪ Fully - contained h igh potency facility with capabilities to manufacture h ormone , steroid , and oncolytic products ▪ 47,000 square feet of manufacturing and packaging, and warehouse facilities ▪ 100 nano - gram per eight - hour weighted average maximum exposure limit to ensure employee safety ▪ DEA Schedule IIIN capability

ANI Summary ANI is an integrated specialty generic pharmaceutical firm with: ▪ Profitable base business generating organic growth – Fourth quarter 2014 guidance (1) □ Net revenues of $17 million to $18 million □ Adjusted non - GAAP EBITDA of $9.75 million to $10.25 million □ Adjusted non - GAAP EPS of $0.60 to $0.65 ▪ Well capitalized balance sheet with $160 million in cash ▪ Experienced management team ANI is focused on: ▪ Internal product development ▪ Partnerships/strategic alliances ▪ Accretive acquisitions 17 (1) November 3, 2014 press release

U.S. GAAP Reconciliations 18 2014 2013 2014 2013 Operating (Loss)/Income $8,199 $810 $9,234 ($2,562) Add back Depreciation and amortization 1,187 382 2,596 673 Add back Stock-based compensation 692 3 2,719 3 Merger-related expenses, not already added back Adjusted EBITDA $10,078 $1,696 $14,549 $3,582 5,468 - 501 - ANI Pharmaceuticals, Inc. and Subsidiary Adjusted non-GAAP EBITDA Calculation and US GAAP to Non-GAAP Reconciliation (unaudited, in thousands) Three months ended September 30, Nine months ended September 30,

U.S. GAAP Reconciliations 19 Three months ended September 30, 2014 Net Income 6,746 Add back Stock-based compensation 692 Adjusted Net Income Used in Calculating Adjusted non-GAAP Diluted Earnings Per Share 7,438$ Diluted Weighted-Average Shares Outstanding 11,302 Adjusted non-GAAP Diluted Earnings Per Share 0.66$ ANI Pharmaceuticals, Inc. and Subsidiary Adjusted non-GAAP Diluted Earnings Per Share Reconciliation (unaudited, in thousands, except per share amounts)

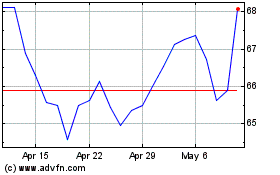

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Apr 2023 to Apr 2024