Report of Foreign Issuer (6-k)

December 08 2014 - 11:47AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2014

Commission File Number: 001-34454

Shanda Games Limited

(Translation of registrant’s name into English)

No. 1 Office Building

No. 690 Bibo Road

Pudong New Area

Shanghai 201203

People’s Republic of China

(8621) 5050-4740

(Address of principal executive office)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

|

| |

|

Form 20-F x Form 40-F ¨

|

| |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

|

| |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

|

| |

|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

|

| |

|

Yes ¨ No x

|

|

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____________

|

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Shanda Games Limited

|

|

| |

|

|

|

|

Date: December 8, 2014

|

By:

|

/s/ Yingfeng Zhang

|

|

| |

|

Name: Yingfeng Zhang

|

|

| |

|

Title: Acting Chief Executive Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

| |

|

|

|

Exhibit 99.1

|

|

Press Release

|

Exhibit 99.1

Formation of a New Consortium to Acquire Shanda Games

HONG KONG, December 8, 2014 /PRNewswire/ -- Shanda Games Limited (NASDAQ: GAME, “Shanda Games” or the “Company”), a leading online game developer, operator and publisher in China, has been informed that Yili Shengda Investment Holdings (Hong Kong) Company Limited (“Yili”), a company formed under the laws of Hong Kong and an affiliate of the Company’s acting CEO, Mr. Yingfeng Zhang, and certain of Yili’s affiliates filed a statement on Schedule 13D (the “13D Statement”) with respect to Shanda Games on December 5, 2014. According to the 13D Statement, Ningxia Yilida Capital Investment Limited Partnership (“Ningxia Yilida”), a limited partnership organized under the laws of the People’s Republic of China and the sole shareholder of Yili, and Ningxia Zhongyincashmere International Group Co., Ltd. (“Ningxia” and, together with Ningxia Yilida, the “Consortium”), a company formed under the laws of the People’s Republic of China, entered into a consortium agreement on December 5, 2014 pursuant to which they have agreed to form a consortium to acquire the Company in a “going private” transaction (the “Proposed Transaction”). As previously announced, the board of directors (the “Board”) of the Company received a preliminary non-binding proposal letter (the “SNDA Proposal”) dated January 27, 2014 from a consortium (the “SNDA Consortium”) then consisting of Shanda Interactive Entertainment Limited (“Shanda Interactive”), the then-controlling shareholder of the Company, and certain other parties. According to the SNDA Proposal, the SNDA Consortium proposed to acquire the Company in a “going private” transaction for US$3.45 per Class A Share or Class B Share, or US$6.90 per ADS (the “SNDA Proposal”). Subsequently, (i) the Board formed a special committee (the “Special Committee”) of independent directors which is authorized to consider the SNDA Proposal and other alternative proposals or competing offers and make recommendations to the Board; and (ii) Shanda Interactive sold all ordinary shares of the Company held by it to various parties, including Ningxia and its affiliates and Yili, and informed the Company that it did not intend to remain a member of the SNDA Consortium. Currently, (i) Ningxia and its affiliates collectively own Class A Shares and Class B Shares representing approximately 24.1% of the Company’s issued and outstanding ordinary shares as of October 20, 2014 and approximately 40.1% of the total number of votes represented by the Company’s issued and outstanding ordinary shares as of October 20, 2014; and (ii) Yili owns Class B Shares representing approximately 9.1% of the Company’s issued and outstanding ordinary shares as of October 20, 2014 and approximately 34.5% of the total number of votes represented by the Company’s issued and outstanding ordinary shares as of October 20, 2014.

The Special Committee has not set a definitive timetable for the completion of its evaluation of the Proposed Transaction or any other alternative transaction (if any) and does not currently intend to announce developments unless and until an agreement has been reached. The Company cautions its shareholders and others considering trading its securities that there can be no assurance that any definitive agreement will be executed relating to the Proposed Transaction, or that the Proposed Transaction or any other transaction will be approved or consummated.

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements in this press release that are not historical facts represent only the Company’s current expectations, assumptions,

estimates and projections and are forward-looking statements. These forward-looking statements involve inherent risks and uncertainties. Important risks and uncertainties that could cause the Company’s actual results to be materially different from expectations include, but are not limited to, the risks set forth in the Company’s filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F. The Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the issuer or selling security holder and that will contain detailed information about the issuer and its management, as well as financial statements.

About Shanda Games

Shanda Games Limited (NASDAQ: GAME) is a leading online game developer, operator and publisher in China. Shanda Games offers a diversified game portfolio, which includes some of the most popular massively multiplayer online (MMO) games and mobile games in China and in overseas markets, targeting a large and diverse community of users. Shanda Games manages and operates online games that are developed in-house, co-developed with world-leading game developers, acquired through investments or licensed from third parties. For more information about Shanda Games, please visit http://www.ShandaGames.com.

Contact

Shanda Games Limited:

Ellen Chiu, Investor Relations Director

Maggie Zhou, Investor Relations Associate Director

Phone: +86-21-5050-4740 (Shanghai)

Email: IR@ShandaGames.com

Christensen:

Christian Arnell

Phone: +86-10-5900-1548 (China)

Email: carnell@ChristensenIR.com

Linda Bergkamp

Phone: +1-480-614-3004 (U.S.A.)

Email: lbergkamp@ChristensenIR.com

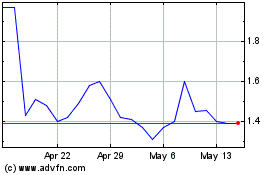

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Mar 2024 to Apr 2024

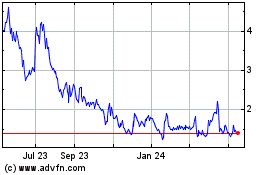

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Apr 2023 to Apr 2024