UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

December 2, 2014

Date of report (Date of earliest event reported)

Universal

Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission

file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Boulevard, Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

On December 2, 2014, Universal Insurance Holdings, Inc.

(“Company”) entered into a letter agreement pursuant to which the Company sold 1.0 million shares of its common stock, par value $0.01 per share, to the investor named therein (“Transaction”) pursuant to the Company’s

shelf registration statement on Form S-3 (File No. 333-185484). An announcement of the Transaction, a copy of which is attached hereto as Exhibit 99.1, is incorporated herein by reference.

In connection with the Transaction, the Company is filing an opinion of its counsel, K&L Gates LLP, regarding the legality of the shares

of common stock being sold, which opinion is attached as Exhibit 5.1 to this Current Report on Form 8-K.

| ITEM 9.01 |

Financial Statements and Exhibits |

(d) Exhibits:

| 5.1 |

Opinion of K&L Gates LLP |

| 23.1 |

Consent of K&L Gates LLP (included in Exhibit 5.1) |

| 99.1 |

Press Release dated December 2, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: December 2, 2014 |

|

|

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

|

|

|

|

|

|

/s/ Jon W. Springer |

|

|

|

|

|

|

Jon W. Springer |

|

|

|

|

|

|

Executive Vice President and Chief Operating Officer |

Exhibit 5.1

Opinion of K&L Gates LLP

December 2,

2014

Universal Insurance Holdings, Inc.

1110 West

Commercial Boulevard

Fort Lauderdale, Florida 33309

Ladies

and Gentlemen:

We have acted as counsel to Universal Insurance Holdings, Inc., a Delaware corporation (the “Company”), in

connection with the issuance and sale by the Company of 1,000,000 shares (the “Shares”) of the Company’s common stock, $0.01 par value per share (the “Common Stock”). The Shares are being offered, issued and sold in a

registered direct offering pursuant to a letter agreement (the “Letter Agreement”) by and among the Company and the investor named therein (the “Investor”). The Shares are being offered and sold pursuant to the Registration

Statement (Registration No. 333-185484) on Form S-3 (the “Registration Statement”), filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the

“Act”). This opinion is being delivered at your request in accordance with the requirements of Section 7(a), and paragraph 29 of Schedule A, of the Act.

In connection with this opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of:

(i) the Registration Statement;

(ii) the Amended and Restated Certificate of Incorporation of the Company, as amended and supplemented, and as certified by the Secretary of

the Company;

(iii) the Bylaws of the Company, as currently in effect, and as certified by the Secretary of the Company (the

“Bylaws”);

(iv) the Letter Agreement;

(v) the corporate actions of the Company that provide for the adoption of the Registration Statement and the sale of the Shares to the

Investor, including relevant resolutions of the Company’s Board of Directors; and

(vi) a specimen certificate representing the

Common Stock.

We have also examined and relied upon certificates of public officials and as to certain matters of fact that are material

to our opinion, certificates of officers or other representatives of the Company. We have not independently established any of the facts on which we have so relied.

Universal Insurance Holdings, Inc.

December 2, 2014

Page 2

For purposes of our opinions, we have assumed the legal capacity of all natural persons, the genuineness of all signatures, the authenticity

of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified, conformed or photostatic copies, and the authenticity of the originals of such copies. In

making our examination of executed documents or documents to be executed, we have assumed that the parties thereto, other than the Company, had or will have the power, corporate or other, to enter into and perform all obligations thereunder and have

also assumed the due authorization by all requisite action, corporate or other, and the execution and delivery by such parties of such documents, and the validity and binding effect thereof on such parties.

Our opinions set forth herein are based on the facts in existence and the laws in effect on the date hereof and are limited to the Delaware

General Corporation Law. We do not express any opinion with respect to any other law or as to the effect of any other law on the opinions herein stated.

Based upon and subject to the foregoing and to the limitations, qualifications, exceptions and assumptions set forth herein, we are of the

opinion that the Shares have been duly authorized by the Company for issuance and sale to the Investor pursuant to the Letter Agreement and, when issued and delivered by the Company pursuant to the Letter Agreement against payment of the

consideration set forth therein, will be validly issued, fully paid and non-assessable.

We hereby consent to the filing of this opinion

with the Commission as an exhibit to the Registration Statement. We also hereby consent to the use of our name under the heading “Legal Matters” in the prospectus which forms a part of the Registration Statement. In giving this consent, we

do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ K&L Gates LLP

Exhibit 99.1

FOR IMMEDIATE RELEASE

Universal Insurance Holdings Inc. Announces Sale of 1,000,000 Treasury Shares

Fort Lauderdale, FL, December 2, 2014 - Universal Insurance Holdings, Inc. (NYSE: UVE) (or the “Company”) today announced that it has

sold 1 million registered shares (“Purchased Shares”) of UVE common stock at a price of $19.00 per share, in a privately negotiated transaction, to Ananke Catastrophe Investments Ltd., an affiliate of Nephila Capital Ltd. (Nephila), a

leading specialist investment manager focused on investing in natural catastrophe reinsurance and weather risk.

The Purchased Shares will be the

subject of a registration statement filed with the U.S. Securities and Exchange Commission.

“This investment by Nephila, the premier investment

manager within the global property reinsurance space, underscores the strength of our longstanding partnership and their confidence in Universal,” said Sean P. Downes, the Company’s Chairman, President and Chief Executive Officer. “By

using shares held in treasury from prior repurchases, this transaction will immediately increase our book value per share by 7%. The transaction will also allow the Company to use the proceeds to accelerate its organic growth strategy through the

combination of continued geographic expansion outside of Florida and further quota share reduction. We are uniquely positioned in that a complete quota share reduction would allow us to retain an additional $230M of our own organically grown

business.”

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of

insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed

and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts, Maryland and Delaware. American Platinum Property and Casualty Insurance Company, also a wholly-owned subsidiary, currently writes homeowners

multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not targeted through its affiliate UPCIC. For additional information on the Company, please visit our investor relations website at

www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words

“believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or

quantified. Future results could differ

Page 2

materially from those described and the Company undertakes no obligation to correct or update any forward-looking

statements. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including the Form 10-K for the

year ended December 31, 2013 and the Form 10-Q for the quarter ended September 30, 2014.

Investor Contact:

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer

Katcher

212-355-4449

- ### -

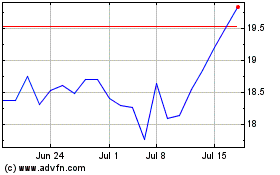

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

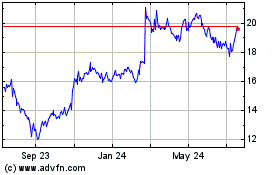

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024