UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): November 14, 2014

CANNAVEST CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

333-173215

(Commission File Number) |

80-0944970

(I.R.S. Employer Identification No.) |

2688 South Rainbow Boulevard, Suite B

Las Vegas, Nevada 89146

(Address

of principal executive offices)

(866) 290-2157

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a -12)

o

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 2.02 Results of Operations

and Financial Condition

The information

provided below in “Item 7.01– Regulation FD Disclosure” of this Current Report on Form 8-K is incorporated by

reference into this Item 2.02.

Item 7.01 Regulation FD Disclosure

On November 14, 2014, CannaVEST Corp. (the

“Company”) announced the release of its Third Quarter 2014 earnings. A copy of the press release issued by the Company

announcing the release of Third Quarter 2014 earnings is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information set forth under this Item

7.01, including Exhibit 99.1, is being furnished and, as a result, such information shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of such Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

| 99.1 | Press Release of CannaVEST Corp., dated November 14, 2014. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: November 24, 2014

CANNAVEST CORP.

By: /s/ Michael Mona, Jr.

Michael Mona, Jr.

President and Chief Executive Officer

Exhibit 99.1

CannaVEST Corp. Reports Third Quarter

2014 Financial Results

Las Vegas, Nevada, November 14, 2014 -

CannaVEST Corp. (“CannaVest” or the “Company”) is reporting financial results for the quarter ended September

30, 2014.

During the third quarter we terminated

our Non-Exclusive License and Distribution Agreement (the “HempMeds Agreement”) with HempMeds PX, LLC (“HempMeds”).

The HempMeds Agreement granted HempMeds a non-exclusive, worldwide license and right to promote, market, sell, distribute and service

the Company’s products and an exclusive right to online sales. The HempMeds Agreement termination resulted in a significant

revenue loss for the Company but provided an opportunity for CannaVest to better control its sales channels, brand awareness and

future profitability without having to rely on a single customer relationship. The

termination also allowed CannaVest to pursue revenue from online sales.

“Our worldwide commitment to expanding

the science, awareness and benefit of our PlusCBD™ brand of cannabidiol oil and products is gaining traction,” said

Mr. Mona. “The termination of the HempMeds Agreement required that we immediately expand our sales and marketing capability

to better control the growth trajectory of CannaVest. We have expanded our sales force, commenced e-commerce operations and have

made strategic marketing investments. Since the termination we have made great progress. In less than one month we have transitioned

from a single customer to literally hundreds of customers.” Mr. Mona continued, ”[o]ur goal is to make our product

portfolio available to the mainstream consumer market and we continue to make good progress in that direction.”

Third Quarter 2014 Operating Results

The Company’s net loss for the third

quarter of 2014 was $482,129, or $0.01 per share (basic and diluted), compared to a net loss of $810,761, or $0.08 per share (basic

and diluted) for the same period in 2013.

Selling, general and administrative expenses

for the third quarter of 2014 were $1,350,639 compared to $653,872 for the same period in 2013. The increase was related to increased

personnel in all functional areas, further investment in technology infrastructure and increased legal and marketing expense.

Research and development costs for the

third quarter of 2014 were $262,065 compared to $137,496 for the same period in 2013. This includes the cost of process development,

rental of laboratory space, personnel costs, laboratory supplies and product development and testing.

Balance Sheet Highlights

As of September 30, 2014, the Company had

cash of approximately $4.7 million. Stockholders equity amounted to approximately $21.9 as of September 30, 2014.

For further discussion of the Company’s

financial results for the period ended September 30, 2014, please refer to the Company’s consolidated financial statements

and related Management Discussion and Analysis, which can be found at www.cannavest.com or EDGAR at www.sec.gov/edgar/searchedgar/webusers.htm

in the Company’s Quarterly Report on Form 10-Q as filed with the U.S. Securities and Exchange Commission on November 11,

2014.

About CannaVEST Corp.

CannaVEST Corp. (OTCBB:CANV), based in

Las Vegas, Nevada, focuses on the procurement and wholesale of the hemp plant extract cannabidiol (CBD), and the development, marketing

and sale of end consumer products containing CBD, which is refined into its own PlusCBD Oil™ brand. CannaVEST resells

raw industrial hemp product to third parties, acquired through supply relationships in Europe. Additional information is available

from OTCMarkets.com or by visiting www.cannavest.com.

CannaVEST Corp.’s subsidiaries include

CannaVest Laboratories, LLC (www.CannaVestLabs.com), which facilitates cutting edge research and develops nutraceutical and food

products, containing cannabidiol (CBD) oil, and is the developer and manufacturer of CannaVEST’s own award winning CBD Simple™,

and US Hemp Oil, LLC (www.USHempOil.com), which provides seed procurement, cultivation, processing, and production consultation,

and equipment to support U.S. farmers, researchers and businesses to cultivate and process industrial hemp in the US. US Hemp Oil

plans to build seed-processing mills and bring hemp-based products to market.

FORWARD-LOOKING DISCLAIMER

This press release may contain certain

forward-looking statements and information, as defined within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, and is subject to the Safe Harbor created by those sections. This material contains

statements about expected future events and/or financial results that are forward-looking in nature and subject to risks and uncertainties.

Such forward-looking statements by definition involve risks, uncertainties.

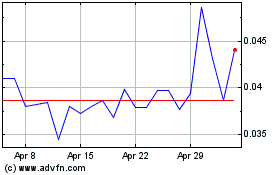

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

CV Sciences (QB) (USOTC:CVSI)

Historical Stock Chart

From Apr 2023 to Apr 2024